15 Energy

15 Energy

Feedback welcome

Our aim is to use the best data to inform our analysis. See our About page for information on the IFs forecasting platform. We appreciate your help and references for improvements via our feedback form.

This theme on Africa’s Energy Futures explores the challenges and feasibility of Africa's transition to renewable energies as well as the energy requirements for rapid, sustainable development. It presents Africa’s energy demand and production in the Current Path (business-as-usual) forecast to 2063. Based on an analysis of the continent's energy landscape, it also motivates and develops an African Energy Policy scenario across nine types of energy combined with additional adaptive and mitigative measures. After examining the impact of the Africa Energy Policy scenario we explore its impact as part of the high-growth Combined scenario modelled elsewhere on this website. It is evident that an additional global effort is required to constrain carbon emissions and provide room for the inevitable increase in emissions from Africa given its current energy poverty, development needs and growing population. To this end we add the Differentiated global carbon tax scenario from the Climate theme to the Combined scenario to create a new scenario, the Sustainable Africa scenario. The Sustainable Africa scenario presents a low-carbon, high-growth development pathway for Africa that provides room for increased emissions from the continent even as it rapidly transitions to renewables. For more information about the International Futures modelling platform (IFs) that is used for scenario development, please see About this Site.

Summary

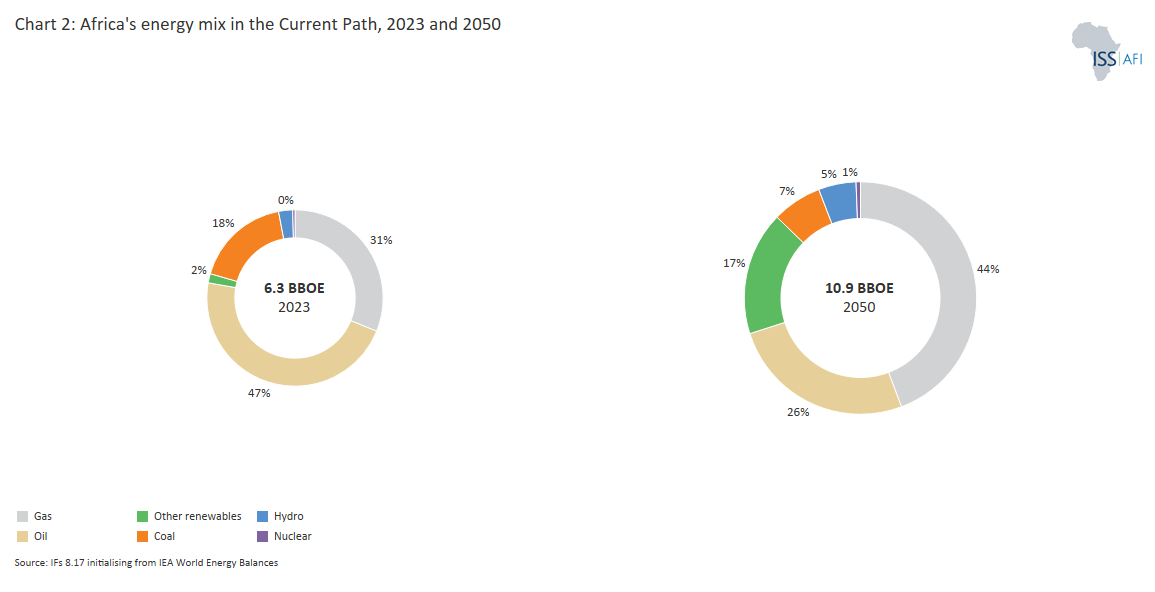

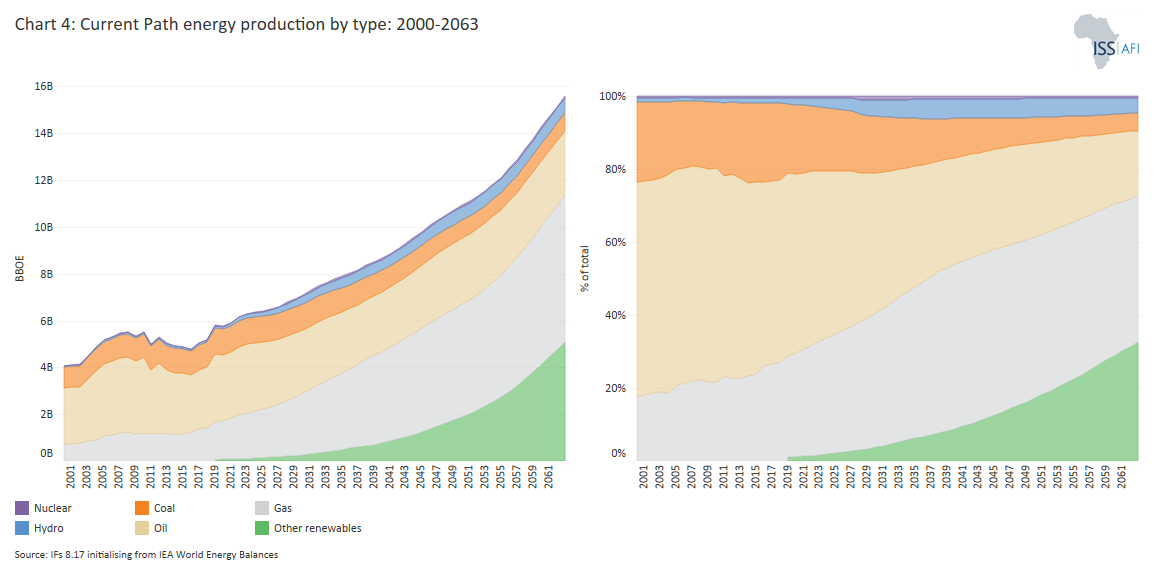

This theme starts with a brief history and the prospects of the world’s energy future, reflecting on the minimum energy requirement for rapid development and the associated energy deficit in most African countries. This section includes an energy supply and demand forecast for 2050 and sometimes 2063 as well as the associated carbon emissions from fossil fuels. The analysis is grounded in the Current Path and identifies the minimum energy level for rapid development. Energy demand and production are quantified in millions or billions of barrels of oil equivalent (MBOE or BBOE) per year facilitating a direct comparison among different sources such as oil vs nuclear.

The second section provides a high-level overview of Africa’s energy landscape and the extent to which the continent's poorly developed electricity grid is a key factor in associated inefficiencies. In spite of the huge energy potential from wind, solar, hydropower and geothermal sources, energy production and demand in Africa is low. Less than 5% of Africa’s modest energy production in 2023 came from renewable sources while domestic use is characterised by high levels of reliance on fossil fuels. We also examine the situation regarding energy exports and imports

The next session develops a viable Africa Energy Policy scenario, proceeding in three steps. The first step consists of a rapid increase in renewable energy production and a decrease in energy from fossil fuels, building upon the analysis presented in the preceding section on Africa's energy landscape. A second step considers the contribution of greater energy efficiency and carbon sequestration before finally listing the key elements that constitute a viable Africa Energy Policy scenario in step three.

We then briefly compare the energy production and demand of the Africa Energy Policy scenario with the Current Path before examining its impact as part of the high-growth Combined scenario. Energy demand for 2050 in the Combined scenario is 26% above the 2050 Current Path and energy production increases by 29% above the 2050 Current Path. The result is a small improvement in Africa's import dependence and a large increase in per capita energy demand. Growing domestic demand means that energy imports will increase in spite of aggressive increases in production. The shift away from fossil fuels in favour of cleaner energy sources is evident, with the share from oil, coal and nuclear declining, while that from solar, wind and hydro expand significantly.

By 2050, Africa will emit 10.4% of the world’s carbon emissions from fossil fuels, 342 million tons of CO2 more than in the Current Path. While carbon emissions from fossil fuel use in the rest of the world are set to plateau and then decline from 2037/8, emissions from Africa will steadily increase beyond 2063 in both the Current Path and the Combined scenario.

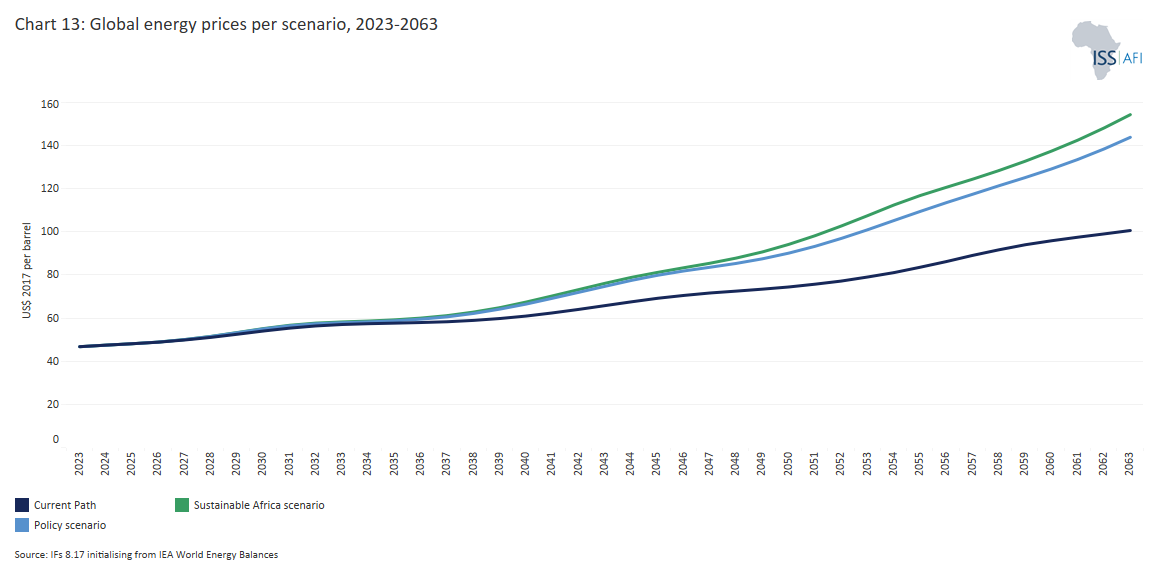

We therefore incorporate the Differentiated Pay global carbon tax scenario (developed and explained in the Climate theme) into the Combined scenario and examine its impact. We term this the Sustainable Africa scenario which reduces carbon emissions from fossil fuels in the world by 14% (or 4.5 billion tons of CO2 equivalent) in 2050, accelerating therafter.

The concluding section outlines key policy recommendations, including a global carbon tax, renewable energy expansion, and the integration of Africa’s electricity grid through the Continental Power System Masterplan (CMP). The transition from fossil fuels will be gradual but essential, with North Africa lagging behind Sub-Saharan Africa. However, given Africa’s ongoing reliance on oil and gas, managing the risks of stranded fossil fuel assets is critical.

This transition has major implications for carbon-intensive economies like South Africa and oil exporters such as Nigeria. Expanding nuclear and hydropower, alongside energy storage and waste-to-energy solutions, will be vital. Small modular reactors (SMNRs) and circular economy initiatives can further support sustainability efforts. Financing remains a major challenge, requiring multilateral support, private investment, and climate finance mechanisms. Debt relief initiatives like Climate Resilient Debt Clauses (CRDCs) and debt-for-nature swaps could ease financial constraints and enable a just energy transition. Without such support, Africa risks prolonged fossil fuel dependency and economic vulnerabilities.

Ultimately, Africa’s energy future depends on bold policies, investment in renewables, and regional energy cooperation. A well-managed transition can position the continent as a leader in sustainable energy, balancing economic growth, climate resilience, and global decarbonization efforts.

All charts for Theme 15

- Chart 1: Energy production by type and CO₂ equivalent emissions, 2000-2063

- Chart 2: Africa's electricity grid and power pools

- Chart 3: Energy exports and imports, 2020-2063

- Chart 4: Africa's energy facilities and pipelines

- Chart 5: Energy production by type: Current Path vs Energy Policy scenario, 2000-2063

- Chart 6: Energy demand vs production: Current Path vs Combined scenario, 2020-2063

- Chart 7: Energy exports and imports: Current Path vs Combined scenario, 2020-2063

- Chart 8: Energy demand: Current Path vs Combined scenario, 2020-2063

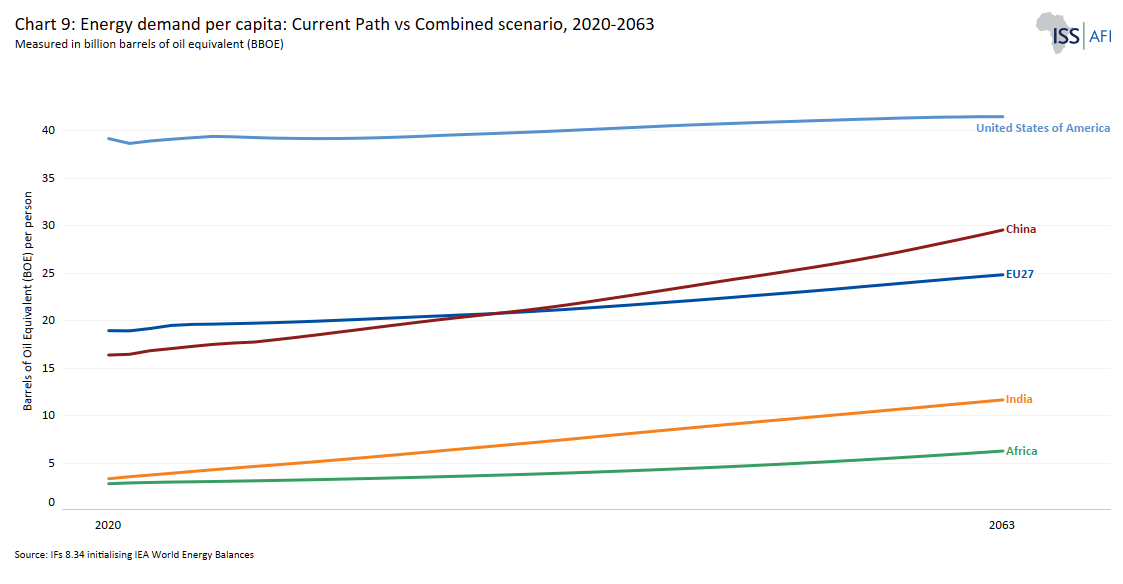

- Chart 9: Energy demand per capita: Current Path vs Combined scenario, 2020-2063

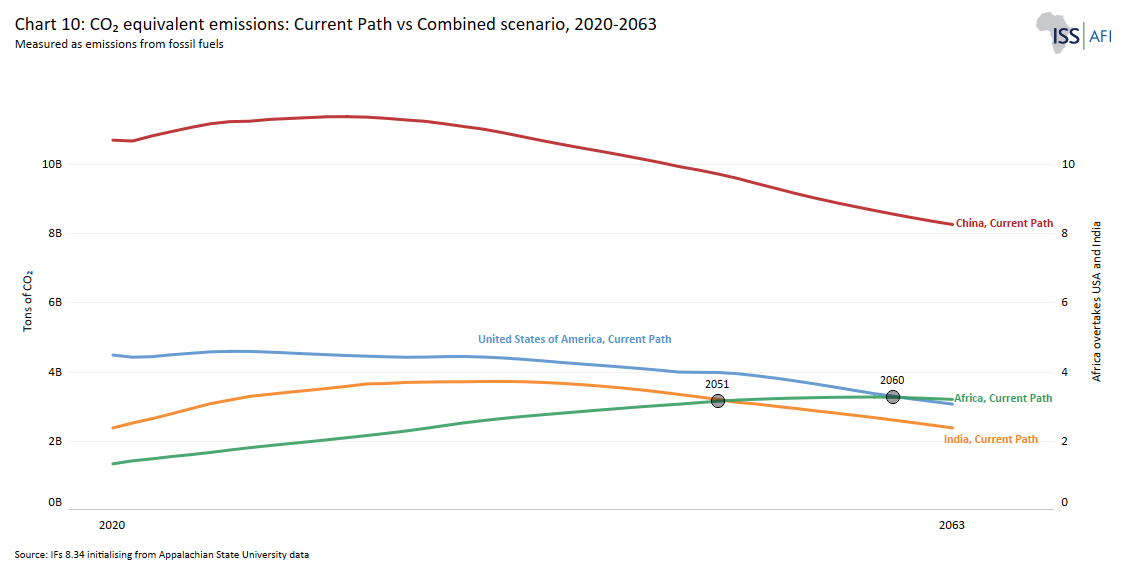

- Chart 10: CO₂ equivalent emissions: Current Path vs Combined scenario, 2020-263

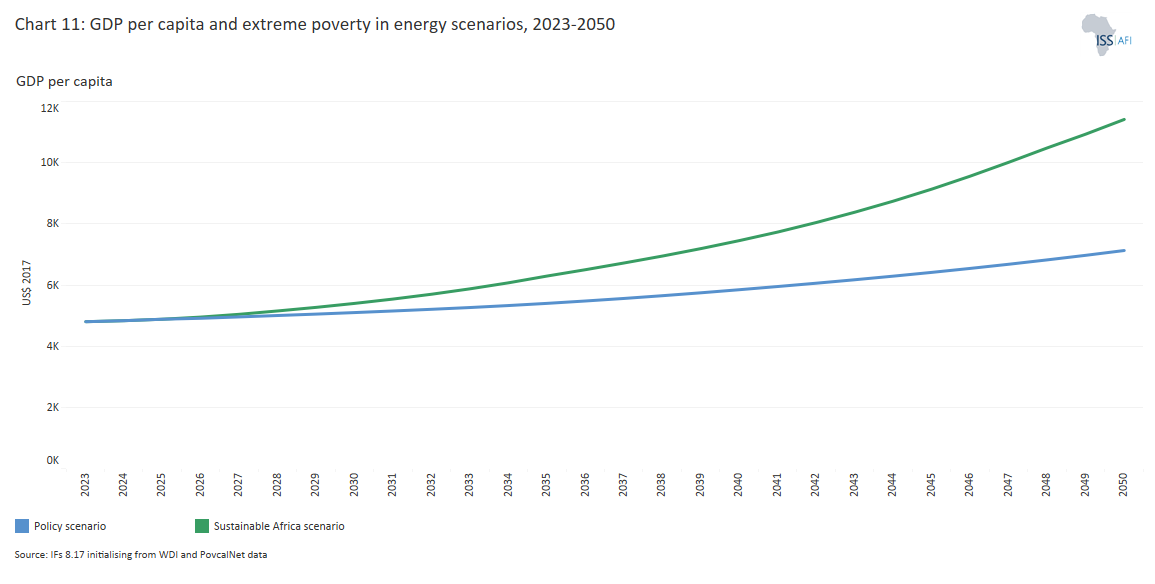

- Chart 11: CO₂ equivalent emissions: Current Path, Combined and Sustainable Africa scenario, 2020-2063

- Chart 12: Energy demand vs production: Current Path, Combined and Sustainable Africa scenario, 2020-2063

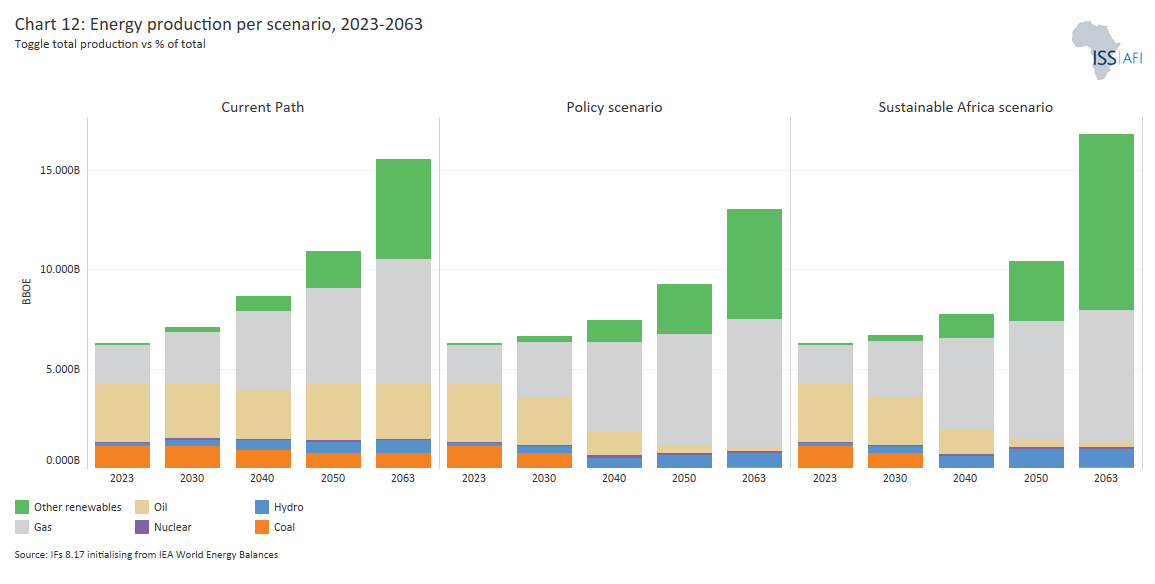

- Chart 13: Energy production by type: Current Path, Combined and Sustainable Africa scenario, 2020-2063

- Chart 14: Recommendations

Human development is inextricably linked to energy consumption - a trend that is expected to persist. The world’s population is set to increase from 8.1 billion in 2023 to 9.8 billion in 2050. Yet, the 21% increase in population is overshadowed by the associated 39% energy demand[1Excluding biomass. Demand consists of consumption and unmet demand.] increase from 94.6 billion barrels of oil equivalent (BBOE) to 131 BBOE. The much higher increase in energy demand affirms the strong relationship between energy and development. Total energy demand continues to grow globally due to population growth and the development demands of middle-income countries. Also, instead of a reduction in energy use in high-income countries, the energy demand for more data centres, artificial intelligence (AI) and cryptocurrency is expected to double by 2026 from 2% of global demand in 2022.

Using the work of Vaclav Smil, the Human Development Index (HDI) posits a minimum energy level of 8.62 barrels of oil per person per year (equivalent to 100 gigajoules) for rapid development. Diminishing returns become evident at higher levels of use and, above 16.34 BOE, there is no statistically significant relationship as a saturation effect sets in. Then other factors, such as the economy's structure (including, for example, the size of the manufacturing sector), institutional quality and social capital, increase in importance to fuel human development. Eventually, the effect of these differences in the development trajectory of high-income countries is large. Thus the energy demand of Norway is 25% lower than the US even though its GDP per capita is 3% higher.

The sources from which we obtain our energy have evolved over time. Until the mid-19th century, most energy came from traditional biomass—burning wood, crop waste, or charcoal. With the Industrial Revolution came the rise of peat, coal, and, later, oil and gas. Hydropower gained momentum at the turn of the 20th century. Today, China is the leader in hydropower globally, generating four times more than Canada and Brazil, which ranked second and third.

Renewable energy sources, such as solar and wind, only emerged in the 1980s but are now driven by the imperatives to curb global warming and climate change. Advances in technology and falling costs have positioned solar power as the lowest-cost electricity source, particularly in Africa, where high solar radiation levels provide exceptional generation potential. The result is that solar is considered the renewable energy source likely to ramp up most rapidly given the low costs of installation and improvements in efficiency. Wind energy, too, has evolved into a global industry, with modern turbines now producing up to 14 MW—roughly 700 times more than early models in the 1970s.

According to the IEA, a confluence of factors—including cost reductions, climate commitments, and industrial policies such as the US Inflation Reduction Act—has accelerated clean energy investment. While renewables receive much attention, the IEA estimates the value of consumer-facing fossil fuel subsidies at US$620 billion, which is still several times more than financing for consumer-facing renewable energies.

For several years, investment in global exploration and production of fossil fuels (upstream oil and gas investment) declined after it peaked in 2015, but is again increasing. Russia’s invasion of Ukraine provided new incentives to increase the search for additional oil and gas demand as European countries scrambled for alternative sources to reduce the need to import gas from Russia. In response, the US ramped up its liquefied natural gas (LNG) exports, a move expedited by former President Trump's decision in 2025 to lift restrictions on LNG infrastructure development. While this expansion will take time to impact supply, it underscores ongoing reliance on fossil fuels despite decarbonisation efforts.

Since the 1960s, more countries have begun using nuclear power. Presently the United States, China, France, Russia and South Korea leading in installed capacity. A resurgence in nuclear energy is currently underway with the development of a new generation of small modular reactors (SMRs). These reactors, designed for prefabrication and modular assembly, provide potential scalable, low-carbon baseload power. Micro, small and medium-scale modular reactors (MMRs, and SMRs) that are factory-built and standardised could eventually benefit from economies of scale, with simplified design, fuel efficiency, reduced nuclear waste management costs and hence faster deployments and lower construction costs with the potential to be ratcheted up or down to help balance the grid alongside surging renewable output in a decade or so. Thus, at the 2023 UN COP28 climate summit in Dubai, more than 20 countries agreed to triple global nuclear power capacity by 2050. China now accounts for 16% of global nuclear generation, and Russia’s influence in the sector is growing, with the two countries providing the technology for 70% of the reactors under construction.

Africa is also exploring SMRs as part of its energy transition strategy. In January 2025, Ghana inaugurated the NuScale Energy Exploration (E2) Center at the Graduate School of Nuclear and Allied Sciences in Accra, the first such facility in sub-Saharan Africa. South Africa, meanwhile, is prioritising SMRs as part of its long-term energy mix, with government officials reiterating nuclear power’s role in securing energy stability. In August 2024, Rwanda formalised a partnership with NANO Nuclear Energy Inc. to integrate SMRs and micro reactors, including the ZEUS solid-core battery reactor and ODIN low-pressure coolant reactor. These initiatives indicate that nuclear power could play an important role in Africa’s decarbonisation efforts.

Many challenges in the energy sector remain. The use of solid fuels (biomass, coal and charcoal) as a household energy source is still used every day by more than 3 billion people globally but is declining with more citizens accessing electricity to cook, heat and cool. Many of these households are in Africa, such as Ethiopia, DR Congo, Tanzania, Nigeria and Mozambique, where most citizens in rural areas continue to use traditional biomass for cooking and heating. Solid fuel use, particularly indoors, is associated with increased mortality from pneumonia and other acute lower respiratory diseases among children, as well as increased mortality from chronic obstructive pulmonary disease, cerebrovascular and ischaemic heart diseases, and lung cancer among adults. Household air pollution caused more than 3.2 million premature deaths in 2022.

In advanced economies, biomass is being integrated into renewable energy strategies, supporting decentralised energy production at household and municipal levels. The transition to renewable sources, coupled with advancements in battery storage and distributed energy grids, could enable more resilient, self-sustaining energy systems. However, large-scale bioenergy deployment remains constrained by land and water use concerns.

Because of the large volumes of feedstock that are required to produce energy from biomass, energy production is generally produced near the source of the feedstock. By contrast, fossil fuels such as coal, oil and gas can be transported in their original form between countries by rail, road or sea. Natural gas, oil and hydrogen can be transported by pipelines, but other means, such as by long-distance transport by ship, require that natural gas and hydrogen be refrigerated and compressed (or converted into ammonia in the case of hydrogen) which are expensive and energy intensive. The result is a complex system in which energy sources are connected and transported across national boundaries either in unrefined or final form. In this manner, production in one country feeds demand in another and shortages reverberate across regions and countries that are increasingly interdependent.

Using a common yardstick to measure energy production, in this instance billion barrels of oil equivalent (BBOE), only about 1.3% of the global energy production came from solar, 1.5% from wind and less than 1% from geothermal in 2023. Global energy production remains heavily reliant on fossil fuels: oil (32%), gas (26%) and coal (30%), with nuclear and hydro accounting for 5.2% and 2.9%, respectively. While fossil fuels continue to dominate (remaining above 80% in the last two decades), coal production is expected to peak by 2033, while global oil output is already in decline. Peak gas production is projected to occur before mid-century.

Fossil fuel producers continue to exert significant influence. For example, for several decades towards the end of the 20th century, large energy producers, mainly in the Middle East, established a cartel, the Organization of the Petroleum Exporting Countries (OPEC), that effectively controlled petroleum prices globally. OPEC market dominance was subsequently disrupted, particularly by large-scale oil and gas fracking in the US, to the extent that, together with an increase in energy efficiency and renewable energy, the US has emerged as the largest oil and gas producer globally. It became energy-independent in 2019, now exporting large amounts of natural gas to others. Today, China, too, is actively pursuing energy self-sufficiency but has yet to satisfy domestic demand for its national resources. It has replaced the US as the largest market for oil and gas with sources generally imported from the Middle East and recently from Russia.

Emerging markets, particularly in Asia, will play a growing role in shaping future energy demand.

Chart 1 presents the current path of energy production used in our forecasts and modelling from IFs. The user can also view the associated CO2 emissions from fossil fuels.

The war in Ukraine temporarily created a tight LNG market, resulting in record-high prices in 2022 and a European rush for imports, although 2023 prices were significantly lower. In time, a significant gas supply will come to the market due to the European scramble for alternative supply and the steady increased US production, potentially creating an oversupply towards the end of the decade. Gas is less carbon intensive than coal or oil so this is potentially good news although it is important to recognize that low gas prices may delay the shift to renewables.

Because energy demand and carbon emissions from China are the highest globally, it will play an outsized role in shaping global energy and emission trends. In the last decade, China accounted for almost two-thirds of the rise in global oil use, and nearly one-third of the increase in natural gas, and has been the dominant player in coal markets. Yet, China has emerged as a powerhouse in renewables, accounting for around half of wind and solar additions and over half of global electric vehicle (EV) sales. In 2023, China surpassed the rest of the world's collective 2022 solar PV installations while its wind power additions increased by 66% from 2022 to 2023. As a result, China is likely to achieve its 2030 target for wind and solar PV installations in 2024, six years ahead of schedule. According to the IEA, two-thirds of global wind manufacturing expansions planned for 2025 will occur in China, primarily for its domestic market. Hence, the view that China will drive global renewable energy deployment to global benefit. However, the IEA forecast of China’s economic growth at just below 4% per annum to 2030 is conservative. China may grow more rapidly which will release substantially more carbon into the atmosphere.

While things are also changing rapidly in the US, given its volatile presidential politics, its model is quite different. In 2023, fossil fuels (natural gas, petroleum and coal) accounted for 84% of US primary energy production, nuclear for 8% and renewables including hydro also at 8%. Total energy production in the US has exceeded annual energy consumption since 2019—a remarkable turnaround for a country previously dependent on oil from the Middle East. Instead of debating energy import dependence, policymakers are seized with decisions regarding investments in LNG terminals to export its surplus of natural gas—with newly re-elected President Donald Trump rapidly overturning the pause on LNG export licence approvals imposed by the Biden administration.

While many high-income countries have enacted policies and laws specific to renewable energy, only half of least developed countries (LDCs) and a third of small island and developing states (so-called SIDS) have done so, finds UNCTAD. Efforts to develop comprehensive legal and regulatory frameworks to advance clean energy technologies are limited mainly to developed and large emerging economies. Instead, countries like Gabon, Tanzania, Liberia, Kenya, Zambia and Angola engage with carbon credit arrangements with debatable impacts on emission reductions. Through a carbon credit scheme, a polluter can buy a carbon credit typically worth one metric ton of carbon dioxide (CO2), with the money paid then used for carbon-lowering projects such as protecting natural ecosystems and wildlife resources, planting trees and generating renewable electricity. The intention is to create a financial incentive for companies to reduce emissions.

Roughly 24% of global emissions are now covered by some form of carbon credit pricing, with the newly established Africa Carbon Markets Initiative (ACMI) aiming to unlock US$6 billion in revenue to create 30 million jobs by 2030. These forecasts need to be treated with care, however, since verification is complex. For example, the UAE-based Blue Carbon, the company leading most efforts, was, in 2023, barely a year old without any track record in the area.

With limited state resources and amidst competing demands, poor countries struggle to invest in the efforts required to unlock a different pathway to the fossil-fueled example set by others. These findings underpin UNCTAD's calls for the international community to help developing countries urgently attract sufficient investment to transition to clean energy. The associated estimate is that the world needs to invest US$1.5 trillion annually to triple renewable power and double energy efficiency by 2030 as critical steps towards keeping the 1.5oC Paris goal alive.

The 41st Ordinary Session of the Executive Council adopted the African Common Position on Energy Access and Just Transition, on the 15th of July 2022, a comprehensive approach that charts Africa’s short-, medium- and long-term energy development pathways to accelerate universal energy access and transition without compromising its development imperatives. The Common Position stipulates that Africa will continue to deploy all forms of its abundant energy resources including renewable and non-renewable energy to address energy demand. In terms of the Common Vision natural gas, green and low-carbon hydrogen and nuclear energy will play a crucial role in expanding modern energy access in the short to medium term while enhancing the uptake of renewables in the long term for low-carbon and climate-resilient trajectory.

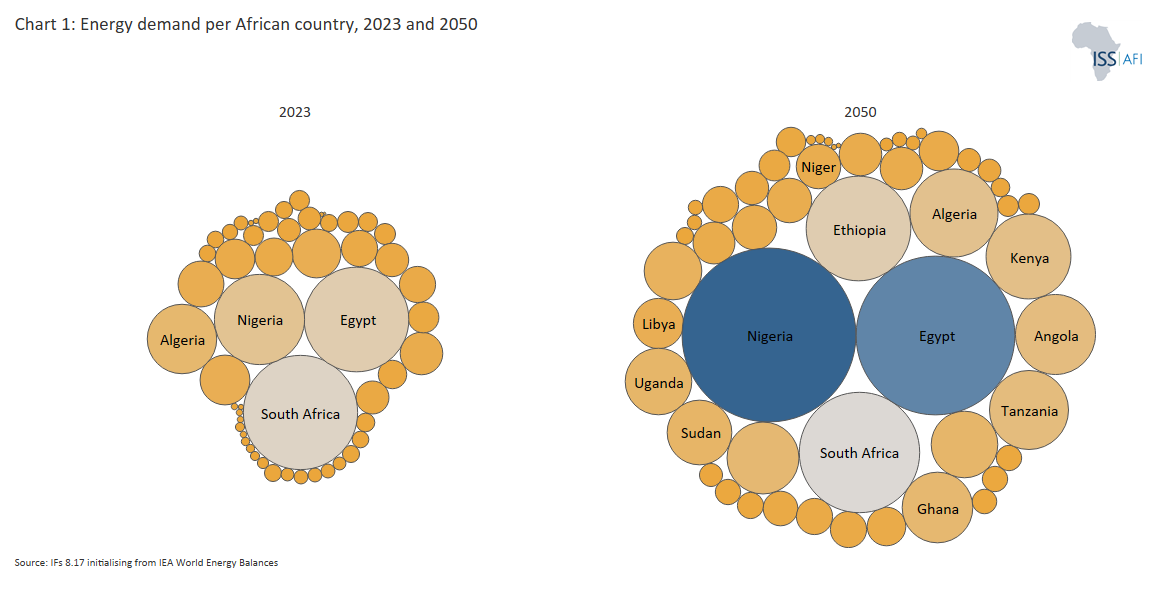

Africa produces little energy compared to other regions. In 2023, Africa produced only 5.7% of world energy, which would increase to 6.8% in 2050—a portion vastly out of balance with its large and growing population and development needs. In its 2025 Outlook Report, the African Energy Chamber provides the following summary:

In general, electrification has been hindered by high grid connection costs, low disposable income levels, poor local distribution infrastructure and sluggish power demand. The economic strain on consumers leads to lower overall power consumption, as individuals and businesses may limit their usage to reduce costs. This disparity underscores the need for investment and infrastructure development to bridge the gap and improve living conditions across the continent. Increasing electricity access is crucial for boosting economic opportunities and overall quality of life in Africa.

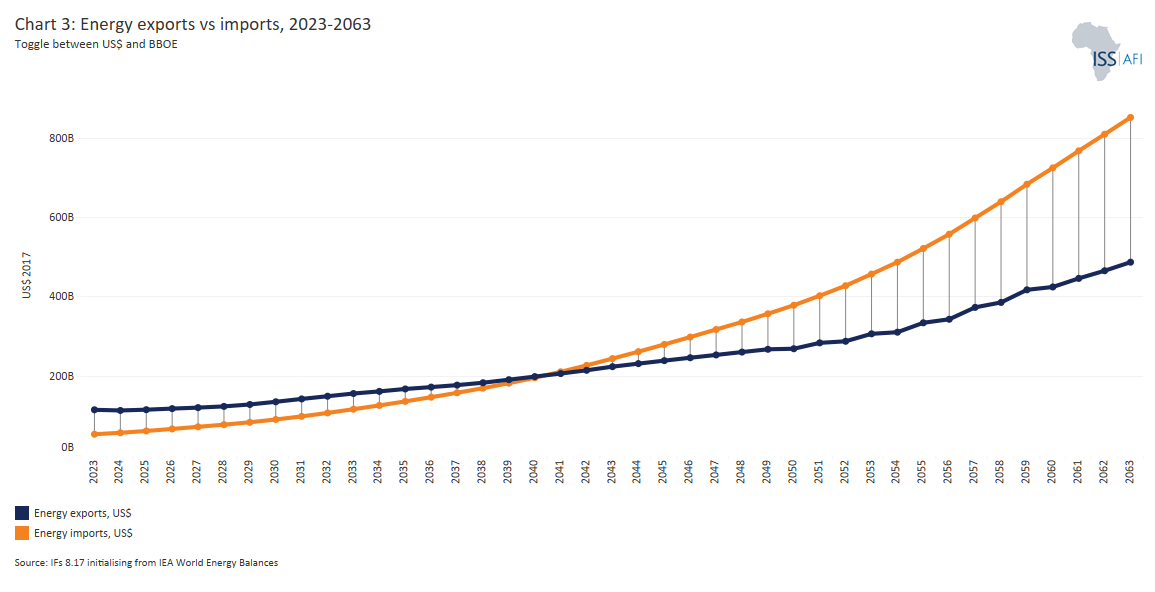

Africa's energy demand is also low, at less than 5% of the world’s in 2023, and that year the continent exported energy to the value of US$87 billion generally consisting of coal, oil and gas..

In discussions on energy, the focus is often on electricity since Africa’s residential sector is the largest consumer of energy. The electricity share of total energy use in Africa is, however, only 13%—ranging from 30% in Mauritius to 1.8% in Burundi. These are amongst the lowest shares globally. The rest is used for transport (primarily petroleum products), industry (which together with transport uses the bulk of energy), agriculture and services. Similar to the situation globally, the services sector dominates African economies, but much of it consists of low-end services, often as part of the informal economy, with limited energy demand. The informal economy in Africa is also large, on average contributing more than 26% to GDP and employing 58% of labour. While the informal sector also requires energy, cost recovery is low. Finally, because of low levels of mechanisation and the use of traditional farming methods, the agricultural sector in Africa consumes a relatively small amount of energy compared to other regions.

Energy in Africa is expensive and, because of poor infrastructure, much of it is wasted. For example, Africa requires 65% more energy per thousand dollars of gross domestic product (GDP) than the global average, reflecting the potential for rapid improvement in energy efficiency. Much of Africa’s energy, petrol and diesel, is transported by road. The World Bank has developed an impressive map of Africa’s electricity grid which is presented as Chart 2. It reflects the limited grid development in many Central African countries and in the Sahel. Among many other measures, improvements in connections within and between countries and Africa’s five power pools (or regional networks) will significantly improve electricity access and reduce inefficiencies. An essential step in this regard occurred in June 2021 when the African Union launched the Africa Single Electricity Market (AfSEM) to be supported by the Continental Power System Master Plan currently being developed by the African Union Development Agency (AUDA-NEPAD).

Grids are more than connections between energy producers and consumers. They allow a surplus or deficit in one area to complement or draw upon excess supply or feed demand elsewhere. Electricity grids enable a more efficient electricity market and the evolution of smart grids even allows households to sell excess electricity supply, such as from solar, into a grid for use by others.

Africa’s poorly developed electricity grid means that the region loses a larger portion of electricity during transmission than any other region globally with Central, West and East Africa doing particularly badly. Regions with developed grids, such as Europe and North America, lose around 5% of electricity during transmission while electricity loss in Central, West and East Africa is between 15 and 20%.

In addition to the aggressive development of electricity grid networks, there are numerous additional commitments and plans to improve energy efficiencies, particularly championed by the International Renewable Energy Agency (IRENA) which argues for an aggressive energy efficiency strategy as a critical component towards emission reduction. Additional savings could come from implementing stricter building codes and energy standards as well as greater industrial efficiencies such as in cement, steel and chemicals. The African Development Bank (ADB) estimates these measures could save up to 10% of the continent’s total energy consumption by 2030. The IEA estimates that efficiencies in existing vehicles and promoting fuel-efficient modes of transport could contribute to a 5-10% reduction in total energy demand by 2030.

At COP28, countries agreed to double the average annual rate of energy efficiency improvements to four per cent by 2030 and reduce methane emissions.

Chart 3 presents the Current Path of total energy imports versus exports for each African country, with numbers expressed in BBOE or US$ values (the user can choose). Libya, Nigeria, Algeria, Angola, Egypt, South Sudan, the Republic of Congo, Uganda, Gabon Chad, Sudan and Equatorial Guinea have much of Africa’s oil. Most gas reserves are found in Nigeria, Algeria, Mozambique, Egypt and Libya, while South Africa and Zimbabwe dominate in coal reserves. Much of these resources are exported (US$486.7 billion in 2023) making Africa a net energy exporter since energy imports, mostly refined petroleum, amounted to US$50 billion. With the recent commissioning of the Dangote refinery, Nigeria has the largest oil refining capacity in Africa, followed by Egypt, Algeria, Libya, South Africa, Angola, Gabon and the Republic of Congo.

Rapid population growth, urbanisation and rising incomes will significantly increase energy consumption in Africa in the coming decades. While the continent has traditionally been a net energy exporter—largely due to oil and gas exports from countries like Nigeria, Algeria, Libya and Angola—this trend is set to reverse. As domestic demand surges, the availability of exportable energy will decline. By 2033, the total value of Africa’s energy exports will fall below the value of its imports, signalling a fundamental shift in the continent’s energy trade balance. This transition is driven by a combination of factors: rising consumption, limited refining capacity in many oil-producing nations, and the growing need to import refined petroleum products and electricity. As demand continues to grow faster than domestic supply and processing capacity, the trade deficit in energy will expand at a continental level, although with large country-to-country variations.

In fact, 28 African countries were already net energy importers prior to 2023, relying heavily on external sources to meet their domestic needs. Without substantial investment in local refining, natural gas processing and renewable energy infrastructure, this reliance is expected to deepen.

Several African countries are dependent upon energy imports for more than 50% of their domestic demand, including Morocco (for 90% of its demand), Benin, Mauritania, Senegal, Eritrea, Uganda, Mali, Mauritius, Togo and Tunisia (at 57%). By 2050, 31 African countries will import more than 50% of their demand reflecting the urgency of moving rapidly towards domestic renewable resources such as wind, solar, geothermal and biomass. Being dependent on fossil fuel energy imports makes these countries vulnerable to price fluctuations (such as the effect on gas prices that followed Russia’s invasion of Ukraine) and supply disruptions in international markets (such as the attacks on commercial vehicles in the Red Sea early in 2024). It also points to the large potential with the development of Africa’s five electricity trading entities or pools where electricity demand in one country can be offset by production in another. These are the Southern African Power Pool (SAPP), Eastern African Power Pool (EAPP), Central African Power Pool (CAPP), West African Power Pool (WAPP) and the North African Power Pool (NAPP). To this end, the African Union (AU) has articulated a vision for a continent-wide interconnected power system, the Africa Single Electricity Market (AfSEM), that is intended to be fully operational by 2040. Among the steps towards the realisation of AfSEM is the development of a Continental Power System Master Plan (CMP) to eventually allow countries to trade electricity across borders. The ambition is to achieve 100% access to electricity in the continent by 2030 in line with the AU Agenda 2063 and the UN Sustainable Development Goal (SDG) Number 7. However, in a business-as-usual forecast average electricity access would likely then extend to only 62% of Africa's population, reflecting the huge challenges that remain.

In the meanwhile, and in spite of its massive wind, solar, hydro, biomass and geothermal potential, Africa’s people are energy-poor. In 2023 only 58% of Africa’s population has electricity, meaning 626 million people lack access to the most basic household resource for heating, cooling, cooking, reading and home education—a number that will increase to 657 million in 2030 (62% of population) in the Current Path. Energy is much more than electricity but the data highlights the stark contrast between the continent’s energy potential and widespread energy poverty.

In addition to limited access to electricity, a fundamental requirement for a decent quality of life, Africans generally lack energy for transportation, industry, agriculture, construction and services to enable economic growth. This energy paradox is particularly evident in countries such as the Central African Republic, Chad and South Sudan, where abundant energy resources such as oil and gas do not translate to electricity access.

In 2023, only 3.3% of Africa’s total energy production came from renewables, compared to 12.8% in South America and 5.9% in South Asia. The Africa Energy Chamber in its 2025 Outlook report notes that, currently, nearly 80% of Africa’s solar and wind-based capacity is installed in North Africa, South Africa, Kenya, Ethiopia, Angola and Senegal. South Africa accounts for a major chunk of Africa’s solar PV and wind capacity, with a share of 41% and 34%, respectively. Solar PV and wind deployment are increasing rapidly. It grew by over 500% over the last decade, with solar PV growing from nearly 1.6 GW in 2014 to over 17 GW in 2023, while wind grew from 2.4 GW to over 10 GW. The result is that Africa is home to some of the largest solar PV installations globally such as Egypt's Benban complex and the 540 MW Kenhardt solar-storage hybrid power plant in South Africa. Egypt also hosts Africa's largest wind power facilities.

Africa boasts 60% of the world's best solar resources, utilising only 1% of its installed solar PV capacity. According to a support study undertaken for the CSP, solar radiation on only 200 000 km2—approximately the size of Senegal—could satisfy all of Africa's projected power needs by 2040. Today solar power is the cheapest electricity amongst the various alternatives and its capacity factor improves as technologies advance. The modularity and versatility of solar technology enable it to be developed close to end users and within short timeframes. Solar offers both centralised and decentralised solutions—and is particularly well-suited to provide electricity access to remote areas. Several large-scale solar projects are already operational or under construction. Morocco’s Noor Solar Complex, one of the largest Concentrated Solar Power (CSP) plants globally, has been operational for 8 years, with a capacity of over 500 MW. Egypt’s Benban Solar Park, a massive photovoltaic (PV) solar farm with 1.65 GW capacity, has been running for 5 years. The newly constructed Kenhardt Solar Facility in South Africa, one of the world’s largest hybrid solar and battery storage projects, sets a new standard in combining renewable energy with energy storage.

Africa is set to expand its solar energy. The Desert to Power initiative aims to provide electricity to 250 million people across the Sahel region, generating 10 GW of solar power. Tunisia’s TuNur Solar Project, still under development, targets 4.5 GW, with the goal of exporting energy to Europe. Nigeria, in a recent deal, set a target of 5 GW of installed solar capacity by 2030, with a 1 GW solar plant already under development.

Grid interconnection from East to West across the vast African continent could also allow for extended hours every day with less need for energy storage capacity.

Large parts of Africa also have excellent wind resources, particularly in coastal areas and the Great Rift Valley. The potential is such that continental Africa possesses an onshore wind potential of almost 180 000 Terawatts-hours (TWh) per annum, enough to satisfy the entire continent's electricity demand 250 times over. An analysis by the IDC and Everoze states that 27 African countries on their own each have sufficient wind potential to theoretically supply all of Africa with electricity.

Africa also sits on top of numerous active geothermal hot spots, particularly along the Great Rift Valley in East Africa—but the potential for geothermal energy generation extends across the continent. Geothermal has been part of energy systems for more than a century, widely used in many North European countries to provide heating, and now emerging technologies such as horizontal drilling and hydraulic fracking honed through oil and gas developments in North America could enable access to previously untapped resources. On average, the temperature in the Earth's crust increases by 25-30oC per kilometre of depth, although unevenly distributed and strongly linked to tectonic conditions. New drilling technologies exploring resources at depths beyond 3 km imply temperatures greater than 90oC and open a potential for geothermal in nearly all countries in the world. Going deeper (such as to 8 km) potentially delivers exponential improvements. Geothermal can provide around-the-clock electricity generation, heat production and storage with an average utilisation rate of over 75% in 2023, compared with less than 30% for wind power and less than 15% for solar PV. In Africa, Kenya is most active in pursuit of geothermal energy as a technology that provides a secure base-load but its potential is ubiquitous. A study by the IEA finds that costs for next-generation geothermal could fall by 80% by 2035 at which point new projects could deliver electricity on par or below hydro, nuclear and bioenergy, and potentially compete with solar PV and wind paired with battery storage.

It is therefore ironic that, in 2023, less than 2% of Africa’s energy production came from sources such as geothermal (0.7%), nuclear (0.34%), solar (0.43%) or wind (0.36%). Energy from hydro contributed less than 3%. Africa's energy production landscape is heavily fossil-fuel dependent (North and Southern Africa in particular) and is primarily composed of oil at 43.5%, gas at 32% and coal at 19%, much of which is exported. East and West Africa have a more balanced and cleaner power generation mix, particularly from hydropower and geothermal.

While the MENA region, including North Africa, holds around 60% of the world’s proven oil reserves, most countries in sub-Saharan Africa (SSA) import much of their refined fuel requirements from elsewhere. SSA only has 2 to 3% of the world’s refining capacity and is thus vulnerable to oil price shocks and regional fuel shortages. The region relies heavily on liquid fuels for primary energy consumption, particularly diesel, which accounts for most of transportation fuel consumption, baseload and backup electricity generation. For example, up to 90% of Senegal’s electricity is generated via diesel and heavy fuel oil.

Improving local liquid fuel production is particularly challenging in the region due to underdeveloped infrastructure and unreliable transportation networks. Apart from Kenya and South Africa, which have pipelines to transport liquid fuels, petroleum products are generally transported by road and truck. Chart 4 from the Global Energy Monitor presents the location of energy projects and the few pipelines in Africa.

Several African countries have expressed interest in developing nuclear power as a means to enhance energy security, diversify electricity generation and support industrial growth. Currently, only South Africa has a commercial nuclear power plant, the Koeberg station near Cape Town, that accounts for around 6% of the nation’s electricity production, with a capacity of 1 940 MW. The first unit was synchronised to the grid in 1984 and was scheduled for decommissioning in 2024, but its lifespan has now been extended to 2044. Recognising the need for additional nuclear capacity, the National Energy Regulator of South Africa (NERSA) approved plans in 2021 for South Africa to procure an additional 2 500 MW of nuclear power.

Apart from South Africa, Egypt has taken the most significant steps toward nuclear power expansion. The country has embarked on a large-scale nuclear development program, awarding a US$25 billion contract to Russia’s Rosatom for the construction of the El-Dabaa Nuclear Power Plant, located along the Mediterranean coast. The plant will have a total capacity of 4.8 GW, with the first reactor expected to come online in 2028, followed by full operational capacity across all four units by 2030.

Several other African nations, including Ghana, Morocco, Uganda, Burkina Faso, Kenya and Rwanda, have expressed interest in nuclear power and are in various stages of feasibility studies, regulatory planning and capacity building. However, none of these countries has begun construction of nuclear facilities. Challenges such as financing, regulatory frameworks, public acceptance and technical expertise remain significant barriers to nuclear development in the region.

In addition to its abundant renewable energy resources, Africa has the most significant untapped hydropower potential of any region globally, but hydro only constituted 2.8% of total energy production in 2023. The continent has many rivers and waterfalls, making it a prime candidate for hydropower generation. On the Current Path, hydro will contribute 6.1% of the continent's production in 2050, and several large hydroelectric schemes are currently under construction. For example, Ethiopia recently completed the US$5 billion Grand Ethiopian Renaissance Dam (GERD) on the upper reaches of the Blue Nile close to its border with Sudan. GERD is the third-largest hydroelectric facility in the world in terms of installed capacity, capable of generating almost 6.5 GW in peak operating conditions. With the completion of GERD, Ethiopia is now the largest source of hydroelectric power in Africa, having overtaken DR Congo.

Other hydroelectric projects include the Julius Nyerere Hydropower Plant and Dam in the Rufiji River basin in Tanzania, which would each deliver 2.1 GW. In DR Congo, the first two dams of the Grand Inga scheme, Inga l and ll, are built, and Inga lll is imminent. But the larger Grand Inga Dam (of which Inga lll would only be a first phase) has been in planning since the 1950s, held back by poor planning, inefficiencies and corruption—and the need to lay transmission lines over several thousand kilometres to the large South African and Nigerian markets.

Towards a Viable Africa Energy Policy

Download to pdfThe Climate theme presents the implications for Africa of the current trajectory of carbon emissions and the associated effects such as warming, changes in precipitation and climate volatility. Because of their limited ability to adapt to the effects of climate change, Africans will likely suffer more than any other region despite having contributed little to the cause of this problem. Therefore, the first step towards the development of a viable African Energy Policy scenario must consist of a rapid increase in non-fossil energy production and a decrease in energy from fossil fuels, building upon the analysis presented in the preceding section, which presented the continent’s potential in this regard. A second step is to consider the contribution of greater energy efficiency and carbon sequestration before listing the key elements that constitute a viable Africa Energy Policy scenario.

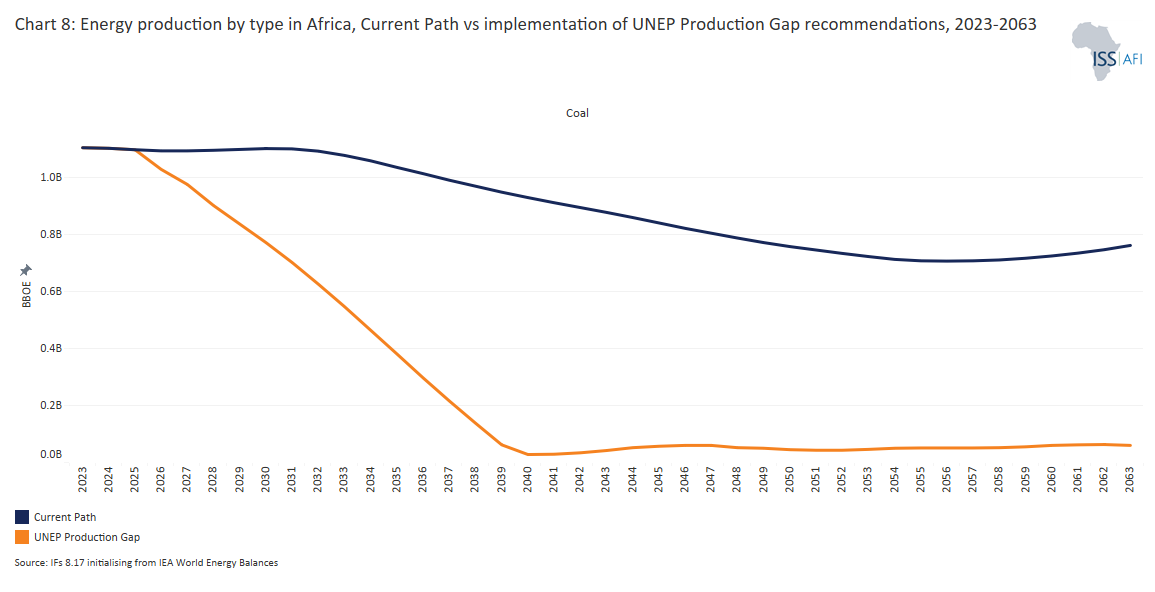

The UNEP 2023 Production Gap Report “Phasing down or phasing up?” highlights that under the current government plans and projections, a global ‘Production Gap’ (the gap between planned fossil fuel production and the levels consistent with limiting global warming) is likely to widen to 2050. UNEP’s analysis shows that governments plan to produce around 110% more fossil fuels in 2030 than would be consistent with limiting global warming to the ambitious 1.5oC target. This means that fossil fuel production is projected to generate 69% more emissions than would be compatible with limiting warming to 2°C, concluding that the world only had a 14% chance of limiting warming to 1.5oC. To keep the 1.5oC ambition alive at all, fossil fuel use must decline dramatically and other key mitigation and sequestration efforts must increase exponentially. Based on the full implementation of the national commitments would put the world on track to 2.9oC.

There is a large gap, the authors warn, between the fossil fuel production that is being planned and pursued and the Paris Agreement’s global warming limits, pointing to the need of drastic change. The 2023 Production Gap report recommends that the world aim for a near-total phase-out of coal production and use by 2040 and reduce oil and gas by three-quarters by 2050 compared to 2020 volumes. UNEP’s subsequent Emissions Gap Report 2024 noted that greenhouse gas emissions need to be cut by 42% (2030) and by 57% (2035) to get on track for 1.5oC.

The obvious challenge is that Africa will require significantly more energy in the future and the related energy sector (mining, oil and gas) attracts the bulk of Africa’s FDI, implying that pressure to avoid these sectors amongst foreign investors could have a significant detrimental impact on a continent in dire need of capital. We examine the associated trends in the theme on Financial Flows.

According to a 2023 report from the IEA, a tripling of energy production from renewables by 2030 is ‘technically and economically feasible’, but requires significant policy and investment changes.[2 In 2022 (the base year from which the IEA forecast), renewables accounted 4.2% of Africa’s energy production, equivalent to 232 million BOE. For Africa to triple its renewables could mean 11.2% or 696 million BOE from renewables. On the Current Path, the portion of Africa’s energy from other renewables will more than double to 7.8% (579 million BOE) in 2030. In the Current Path forecast, renewable energy production would increase to 20.9% or 2.38 BBOE in 2050.] These ambitions were affirmed at COP28 later that year which agreed to triple renewable energy capacity to at least 11 000 GW by 2030, which is now within reach with more rapid progress in China. African governments have already more than tripled public investment in renewable electricity, up to US$47.0 billion from US$13.4 billion the previous decade. Many African countries have also set ambitious targets for renewable energy development, typically 30% in 2030, although often from a shallow base. Some, such as Kenya and Cabo Verde, aspire to 100%. Others, such as Mozambique, Rwanda and Eswatini, aspire to around 60%.

The reasoning for more rapid decreases in the costs of other renewables follows findings from IRENA that renewable energy costs have steadily fallen for years. Between 2021 and 2022, for example, the global weighted average cost of electricity from new onshore wind projects dropped by 5% and solar PV by 3%. These trends will likely continue, driven by technological advancements, economies of scale and competitive market dynamics. IRENA projects that by 2050, the cost of electricity from utility-scale solar PV could fall by as much as 80% compared to 2020 levels, while onshore wind could see a cost decline of 50%.

The IEA Africa Energy Outlook 2022 report projects that under ambitious policy interventions and significant investments, Africa could see over 80% of new power generation capacity coming from renewables by 2030. In their World Renewables Outlook 2023 report, IRENA estimates that Africa could achieve a renewable energy capacity of 750 GW by 2030, representing a four-fold increase from the current capacity of roughly 180 GW. However, the increase comes from a shallow base since, in 2023, the contribution from renewables only constituted 106 MBOE (or 1.7% of total energy production) and was set to increase to 266 MBOE in 2030, i.e. by a factor of 2.5.

Nuclear will likely also play an important role in Africa's energy future. For the first time since the annual climate summits commenced in 1995, the 198 signatory countries to the UN Framework Convention on Climate Change (UNFCCC) officially included nuclear energy to help achieve deep and rapid decarbonisation at the COP28 meeting in Dubai in December 2023. The inclusion of nuclear and a separate declaration by more than 22 countries to advance the aspirational goal of tripling nuclear power capacity by 2050, on top of statements by the IAEA and the nuclear industry, underscored a new momentum for this sector and its potential contribution to clean energy.

In addition to nuclear, Africa also has to invest in more energy from hydropower—although the associated projects are often capital intensive and require significant lead-in times. In a meeting of the International Hydropower Association in Abuja in May 2024, participants called for the refurbishment of Africa's ageing hydro facilities and for African governments to 'recognise and champion sustainable hydropower as a clean, green, modern and affordable solution to provision of secure electricity supply...' That said, the increased variations in seasonal rainfall that are associated with climate change are making hydropower less reliable with each passing year. Thus, in February 2024, Zambia extended its national disaster to include a provision to import and ration electricity as a devastating drought affected hydropower generation from the Kariba Dam, its main source of energy. The effect is being felt globally. According to the IEA, droughts were an important contributing factor to higher world energy demand in 2023, worsened by the El Nino weather pattern that warms the Pacific Ocean. To compensate, fossil fuel power plants were used instead, releasing about 170 million tons of additional CO2.

Africa will undoubtedly require significantly more energy in the future and it is also important to recognize the opportunity that fossil fuel exploration projects offer to a continent that otherwise attracts limited foreign direct investment. Although trends are changing, the resource extraction sector (mining, oil and gas), attracts the bulk of Africa’s FDI, implying that pressure to avoid these sectors amongst foreign investors could have a significant detrimental impact on a continent in dire need of capital.

In addition to the use of different renewable sources of energy, fossil fuel dependence can also be reduced by improving the efficiency with which the fuel is used. Currently, Africa requires 70% more energy per unit of GDP than the global average, reflecting the potential for rapid improvement, particularly through investment in grid capacity as discussed previously, and reflected in Chart 2.

In the Africa Energy Outlook 2022, the IEA projects that with vital policy interventions and significant investments, Africa could achieve a 30% reduction in electricity demand through energy and material efficiency measures by 2030. However, in 2023, the electricity share of energy use in Africa averaged only 13% and is forecast to decline to 11% in 2050, meaning the reductions in electricity demand would have little impact on total energy demand, particularly given energy poverty. Additional savings could come from implementing stricter building codes and energy standards, greater industrial efficiencies such as in cement, steel and chemicals (the ADB estimates this could save up to 10% of the continent’s total energy consumption by 2030), and efficiencies in existing vehicles and promoting fuel-efficient modes of transport, which the IEA estimates could contribute a 5-10% reduction in total energy demand by 2030.

Because it relies upon fossil fuels (mostly diesel) that are transported by road (and not by rail or pipeline), often for use in numerous small generators, the potential for greater energy efficiencies in Africa with fossil fuel use is significant.

The Current Path that is presented in Chart 1 is already aggressive in ramping up renewable energy production in Africa. Our further interventions for an Energy Policy scenario on energy production, exports, transmission loss and electricity access that stem from the preceding sections mean that Africa will produce 12.5% more energy in 2050 than in the Current Path consisting of the following (reflected in Chart 5):

- A 7.1% reduction in energy exports (US$7.65 billion lower export earnings from energy exports),

- An increase of 175 million tons of carbon sequestration (through forest protection and regeneration),

- A 19% increase in nuclear energy production,

- A 42% increase in solar energy production,

- A 36% increase in wind energy investment and production,

- A 29% increase in hydro energy production,

- A 25% increase in geothermal energy production,

- A 3% increase in energy production from gas,

- A 28% increase in energy production from other renewables,

- A 5% reduction in energy production from oil,

- A 12% decrease in energy production from coal.

The interventions reduce the number of Africans without electricity access by 184 million of which 69 million are in urban areas and 112 million in rural areas. Also, instead of losing 12% of electricity production, Africa will only lose 10.8% due to grid extension and efficiency improvements.

With respect to carbon sequestration, our Agriculture scenario includes a reasonable forest protection multiplier to constrain the expansion of cropland. This multiplier is included in the Energy Policy scenario over a 40-year period in 17 African countries.[3Congo, Zambia, Angola, CAR, Nigeria, São Tomé, Senegal, Sierra Leone, Ghana, Benin, Eswatini, Gambia, Guinea, Malawi, Burkina Faso, Togo, Madagascar.] However, the positive increase in production needs to be placed in context because, in the high-growth Combined scenario, Africa’s energy demand is 26% higher (15.2 instead of 12.1 BBOE) in 2050 than in the Current Path (Chart 5).

The interventions listed above are included in the Combined scenario, to which we turn below.

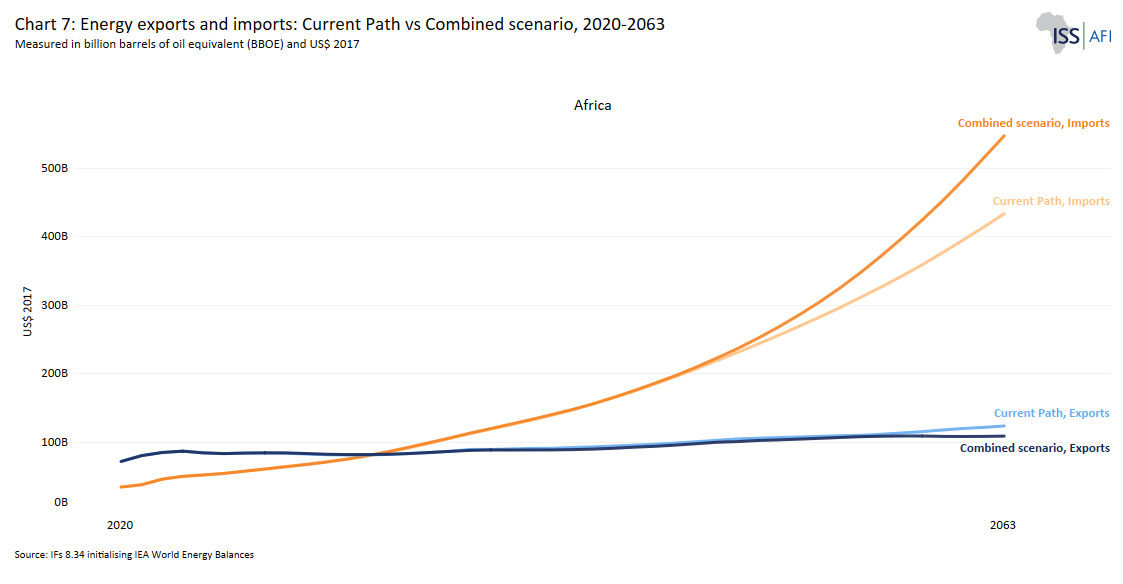

With more rapid economic growth in the Combined scenario compared to the Current Path, African countries' total energy demand will increase. Energy demand for 2050 in the Combined scenario is 26% above the 2050 Current Path (Chart 6) and 48% higher in 2063. Despite a 29% increase in energy production above the 2050 Current Path, energy imports will increase.

The increase in demand is partly offset by the 29% increase in production by 2050 when comparing the Combined scenario with the Current Path. Production in the Combined scenario is 11.55 BBOE in 2050 compared to the Current Path of 8.95 BBOE in 2050.

Because we intervene in the Combined scenario to constrain energy exports as a policy initiative to improve domestic energy security, exports decline compared to the Current Path. Instead of energy exports of US$104.6 billion in 2050, African countries would only earn US$100.7 billion. In 2023 (a record year for energy exports from Africa due to Europe’s energy crisis with the war in Ukraine), African countries earned US$83.7 billion.

In 2023, African countries imported energy products to the value of US$50 billion. Because of the constraint on exports in the Combined scenario, import value is largely similar in the Current Path and Combined scenario in 2050 despite the fact that total energy production in the Combined scenario is 29% above the Current Path. Generally, Africa’s import dependence slightly improves (i.e. energy import minus exports relative to demand is lower in the Combined scenario compared to the Current Path).

Population growth and welfare improvements are the reasons for the increase in Africa’s future energy demand. In 2023, Africa’s population surpassed that of India and China. By 2063, Africa (at 3.1 billion people) will have almost double the population of India (at 1.67 billion). India will, in turn, have a much larger population than China (then at 1.1 billion). GDP per capita, a good general indicator of improvements in well-being, will increase by 48% above the 2050 Current Path in the Combined scenario.

Contrary to the situation with India and China, Africa’s population will continue to increase beyond the end of the century. As prosperity increases, so will Africa’s energy demand and associated carbon emissions unless the continent embarks upon a different energy future than its current trajectory, which imitates the fossil-dependent pathway of richer regions and countries.

It is evident that Africa has an energy mountain to climb. Only seven African countries (South Africa, Algeria, Mauritius, Libya, Seychelles, Botswana and Equatorial Guinea) had per capita demand above the threshold of 8.62 BOE in 2023, the minimum level required for rapid human development gains. The average energy demand per person in Africa in 2023 was much lower, at only 3 BOE, and will only modestly increase to 4.6 BOE in 2050 on the Current Path. Even the Combined scenario only increases energy demand to 6.2 BOE per person in 2050 at which point 16 countries would meet or exceed the 8.62 BOE development requirement. That is in spite of the fact that in the high growth Combined scenario, Africa’s energy demand is 26% above the 2050 Current Path.

It is therefore no surprise to find that Africa’s energy demand per person is lower than South America and South Asia, the two other developing regions against which we typically benchmark Africa. The Current Path is that Africa’s relative energy poverty (demand per person compared to these two regions) will increase over time as energy production in South America and South Asia ramps up more rapidly than in Africa although the gap stabilises in the Combined scenario.

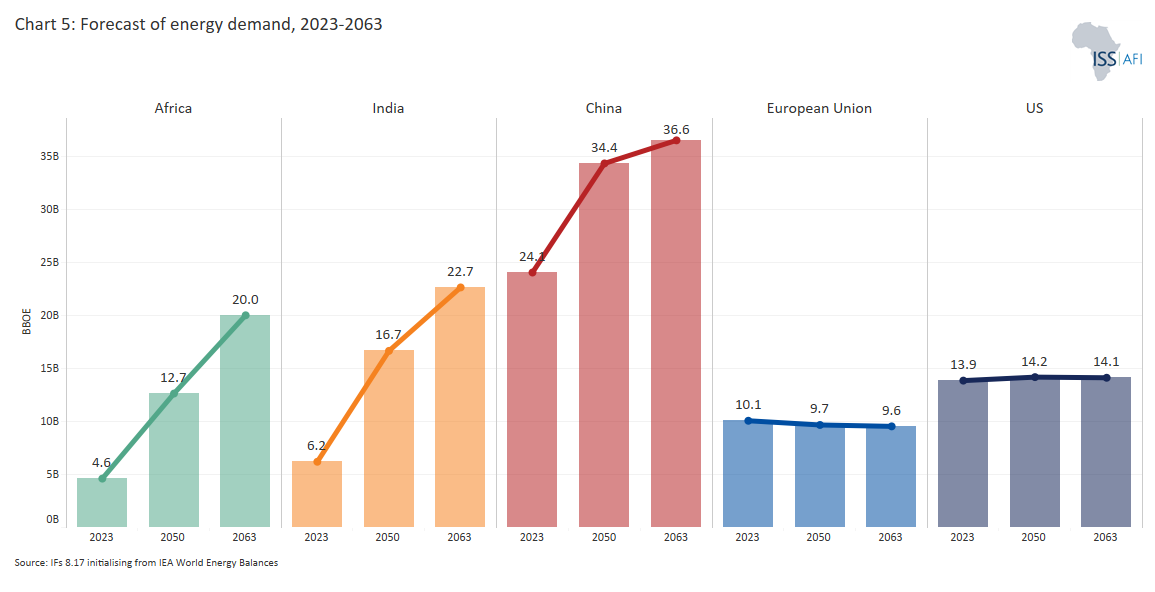

Chart 7 compares Africa’s total energy demand in 2023, 2050 and 2063 with that in India, China, the European Union and the US. The data is in BBOE and the user can also select to show the forecast for South America and South Asia, as well as the impact of the Combined scenario on Africa’s energy demand.

Total energy demand from China (with its large population and rapid economic growth) is the largest, although demand growth starts to taper off towards the end of the forecast period. On the Current Path, total energy demand from Africa overtakes that of India in 2062. Demand in the EU and the US increases marginally.

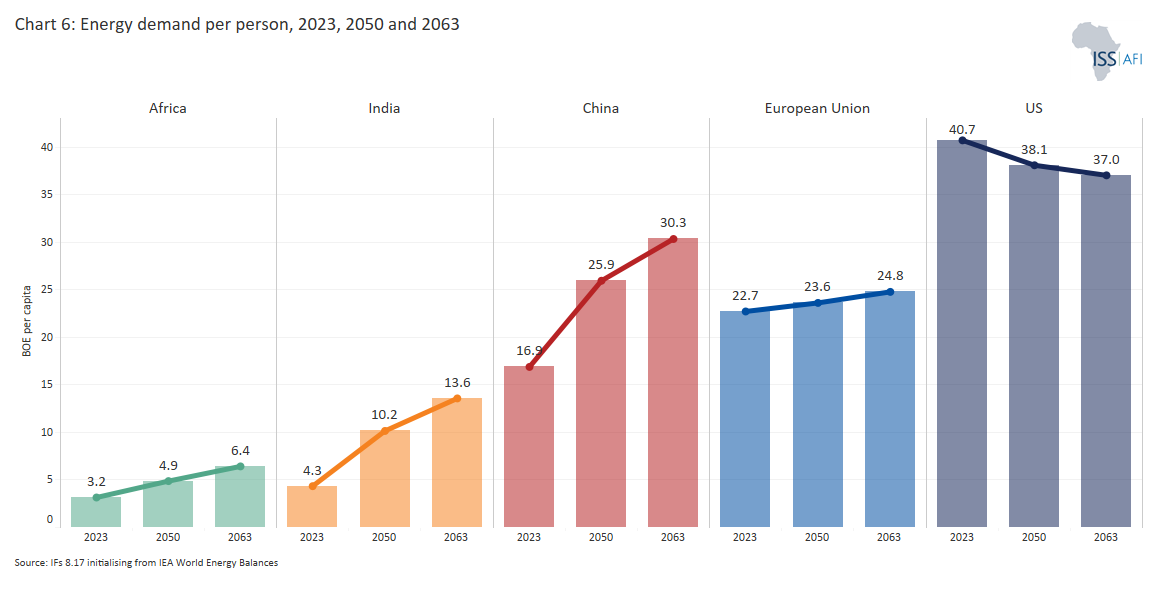

Chart 9 compares demand per person and shows the extent to which the energy demand from the average American was much higher than any other: 39.1 BOE equivalent in 2023, compared to 3 BOE in Africa and 3.9 BOE in India. Looking to the future, China’s per capita demand will overtake the EU in 2040.

By 2050, the average US demand will be at 40.7 BOE per person, reflecting the extent to which the demands from AI, bitcoin and other services require more energy in advanced economies. This overturns the expectation that the energy intensity of high-income countries could eventually decline. By 2063, almost four decades into the future, Africa’s average energy demand per person will be a quarter of the demand in the US in the Combined scenario compared to only 15% of US demand in the Current Path.

Despite its slow per capita energy demand growth, Africa’s growing population, expanding economy and low energy efficiencies imply that the continent’s portion of the world's energy demand will increase from 4.7% in 2023 to 12.9% by 2063 (Current Path) and to 18.1% in the Combined scenario, pointing to the need for additional efforts to unlock a less carbon-intensive future in its own, and global, interest.

With rapid population growth, urbanisation and economic expansion driving a surge in energy demand, the continent must navigate a complex path to secure its energy future. The Combined scenario demonstrates that while energy production can significantly increase—particularly through renewables like solar, wind, and hydro—demand will still outpace supply, reinforcing Africa’s dependence on energy imports.

The shift away from fossil fuels in favour of cleaner energy sources is evident, with oil, coal and nuclear power declining as a share of total production, while solar, wind and hydro expand significantly. However, the transition is happening against a backdrop of persistent energy poverty. By 2050, even under the high-growth Combined scenario, Africa’s average per capita energy demand will remain far below global benchmarks, underscoring the urgency of scaling up investment in energy infrastructure, grid expansion and renewable capacity.

In the Current Path (Chart 1), fossil fuels would still account for 61% of world energy production in 2050, consisting of 21% from coal,16% from oil and 23% from gas. The preceding analysis has already presented the 2050 percentages of total energy production for fossil fuels in Africa (see Chart 5) which are as follows:

- Oil: 17.45% in the Current Path and 13.8% in the Combined scenario,

- Gas: 40.7% in the Current Path and 36% in the Combined scenario,

- Coal: 6.9% in the Current Path and 4.7% in the Combined scenario.

Africa cannot develop without adequate energy and it is inevitable that its development will be accompanied by increased energy demand. Appropriate action is required to ensure that carbon emissions are as low as possible.

Africa’s energy transition is rapid even as emissions grow. In 2023, 95% of Africa’s energy came from coal, oil and gas. On the 2050 Current Path, it would be 65%, and only 54% in the Combined scenario—a difference of eleven percentage points.

When considering these differences, it is important to remember that the size of the African economy in the Combined scenario is much larger than in the Current Path, meaning that the actual transition away from fossil fuels is more rapid than reflected in the eleven percentage point difference.

Another way of presenting this is to consider Africa’s CO2-equivalent emissions from fossil fuels in global terms (see Chart 7):

- In 2023, CO2 equivalent emissions from fossil fuels in Africa constituted 4.5% of the world total.

- However, global CO2 emissions from fossil fuels will peak around 2037/8, after which they start to decline. By 2050, global CO2-equivalent emissions from fossil fuels will be 5% below their 2023 emissions (a difference of 1.69 billion tons of CO2 equivalent).

- According to the Current Path, by 2050, Africa will emit 9.4% of the world’s CO2-equivalent emissions from fossil fuel use.

- In the Combined scenario, by 2050, Africa will emit 10.4% of the world’s carbon emissions from fossil fuel use. The difference is equivalent to 342 million tons of CO2.

On the one hand Africa’s need for more energy and associated growth in carbon emissions from fossil fuel will be offset by the forecast of a decline in global emissions from fossil fuel use. But since the latter is incompatible with the lower emissions required to keep the Paris goals alive, more is required globally, and from Africa.

However, the remarkable transition to renewables that has been modelled thus far does not reduce Africa’s carbon emissions, pointing to the need for additional interventions.

Our Climate theme explores the impact of four alternative global carbon taxes ranging from a universal tax (Everyone Pays scenario) to a tax on high emitters only (Polluters Pay scenario). The scenario that has the largest effect on reducing emissions is the Differentiated Pay scenario in which a country's income classification determines the associated carbon tax. In this scenario, high-income countries pay US$100 per ton of carbon equivalent (1 ton of carbon equates to 3.57 tons of CO2) while upper-middle-income countries pay US$75/ton, which is phased in over ten years. Lower-middle-income countries pay US$50/ton, and low-income countries pay US$25/ton, both of which are then phased in over 15 years. In 2024, Africa had one high-income country, eight upper-middle-income countries, 23 lower-middle-income countries and 22 low-income countries.

At a global level, the Differentiated Pay scenario reduces carbon emission from fossil fuels by 14% (or 4.57 billion tons of CO2 equivalent) and by 26% (by 6.7 billion tons) in 2063 compared to the Current Path. The most significant reductions are by China, the US, India, Russia, Canada, Japan, Nigeria, Mexico, Brazil and Turkey, given their ranking among the world's top polluters. However, implementing such a differentiated carbon tax requires careful management due to its varying impacts. The impact on each country under a carbon tax regime hinges on its ability to navigate the transition effectively, invest in clean energy alternatives and implement policies that foster economic resilience and sustainability.

In a final scenario, the Sustainable Africa scenario, we now add the Differentiated global carbon tax to the Combined scenario. Chart 8 presents carbon emissions from fossil fuels for Africa on the Current Path, the Combined scenario and the Sustainable Africa scenario. The impact is to reduce carbon dioxide in the atmosphere in 2063 by 3%. Africa’s carbon emissions from fossil fuels in the Sustainable Africa scenario are actually below the Current Path in spite of the fact that the African economy is much larger—an amazing testimony to the potential impact of a reasonable carbon tax.

By 2050, much will have changed compared to 2023. On the Current Path, Africa would have 2.6 billion people but only 2.4 billion in the Combined or Sustainable Africa scenarios given the reductions in fertility rates associated with greater prosperity. Instead of GDP per capita at US$9 872 on the Current Path, GDP per capita could be US$18 620 and only 139 million Africans would still be living in extreme poverty compared to 351 million on the Current Path.

The progress is reflected in the degree to which Africa will achieve almost total electricity access by 2050, although a handful of countries—DR Congo, Guinea Bissau, Malawi, Burundi, Central African Republic, Chad and South Sudan—still have less than 60% access, making rapid progress.

The fulfilment of the Sustainable Africa scenario would see a 2050 African economy that is 58% larger than the Current Path. GDP per capita would be 45% higher. African countries would, on average, grow about two percentage points more than in the Current Path to 2050.

Chart 9 compares Africa’s total energy demand with production and allows the user to select the data for any African group or country from the drop-down menu to compare the Current Path with the Combined and/or Sustainable Africa scenario. Because the Sustainable Africa scenario reduces demand and production globally, demand and production for Africa is below the Combined scenario.

In addition to a rapid transition to renewables, thus constraining emissions from fossil fuel use, Africa can make a significant contribution to a sustainable future as a carbon sink through the application of policies on reforestation, improved land management and associated measures, discussed in more detail as part of the Climate theme. This could serve as an essential incentive for investment and the purchase of carbon credits. In the Current Path, global carbon emissions from deforestation will decline from 278 million tons in 2023 to 15 million tons in 2050. In the Sustainable Africa scenario, global reforestation increases carbon absorption to 227 million tons.

Our findings in this theme highlight the complex nature of Africa's transition away from fossil fuels. Contrary to the rapid shifts proposed by UNEP and others, our analysis suggests a more gradual phasing out in Africa, starting with coal, then oil and only impacting on gas as from around 2040. That transition is moving fast in many advanced economies such as Europe, North America, Japan and China. It is much slower in developing countries, particularly in Africa, which requires substantial support from wealthier nations to establish a feasible transition to renewables and carbon emission pathways. For Africa, climate finance is the critical enabler of its energy transition and must be at the top of the COP agenda.

Although it will not be easy, Africa can embark upon a sustainable growth path to its own and global benefit—but only if it has the room to exploit its gas resources to avoid an energy and development crisis, reflecting a more modest scaling back on fossil fuel use compared to the UNEP recommendations. Instead, Africa should be recognised (and compensated) for its role in acting as a carbon sink and through the proceedings of a global carbon tax, investments should flow to renewables development on the continent.

In 2023, Africa only produced 4.8% of its energy from renewables, with North Africa doing particularly poorly. The other two comparable developing regions, South Asia and South America, produced 8.3% and 15.4%, respectively. On a Current Path, by 2050, Africa will produce around 34.8% of its energy from renewables, still significantly less than either comparable region and trailing even further behind. As a portion of total energy production, South Asia and South America also produce more nuclear and hydro power than Africa.

Our modelling underlines the importance of a global carbon tax as key to reduced emissions. With or without such a tax, we estimate that Africa would need a 2050 emissions budget of 10% of global emissions from fossil fuel use, increasing to 14% by 2053. Although the percentage is the same, Africa's required carbon budget from fossil fuel production in the Combined scenario would be 0.6 billion tons of CO2 larger than in the Sustainable Africa scenario.

Considering these numbers, the reader is reminded that Africa's 2050 population will constitute 25% of the world's total and 28% by 2063. Currently, Africa constitutes 18% of the world's population. Therefore, Africa's required share of carbon emissions from fossil fuels is significantly below its share of the global population, even on a high-growth forecast. Africa’s 2050 population is, of course, 172 million smaller in the Combined scenario and 369 million less in 2063, given the reductions in fertility rates that accompany improvements in well-being.

The role that hydrogen could play in Africa's energy future is currently unclear. Energy from hydrogen has regularly attracted hype and disillusionment, and its journey towards becoming a ubiquitous fuel is bumpy at best, given the challenges of production, transportation and use. The most straightforward use of large-scale hydrogen is in hard-to-decarbonise areas of the economy, such as heavy industry, with limited application in Africa, given the low demand from these sectors. It is, instead, the potential for export as ammonia that is then converted back to hydrogen at the destination that attracts attention. Thus, with promises of US$10.8 billion investments from Germany, Namibia has the most ambitious plans to produce green hydrogen from its abundant solar and wind resources, turn it into ammonia, and then ship it to Europe.

With clear policies and determined leadership, many African countries can embark on an early transition to reduce fossil fuel use to global benefit. Large fossil fuel producers South Africa, Egypt, Algeria and Nigeria will be most affected. The future carbon emissions from a handful of African countries are globally significant, particularly Nigeria, Egypt, South Africa, Algeria, Ethiopia and Tanzania. These are countries with rapidly growing populations and a large fossil fuel emission footprint. Their success in rapidly transitioning to renewables and reducing their carbon footprint will be critical in determining Africa's contribution to global warming and a sustainable global future.

Amongst Africa’s coal producers, South Africa faces the most significant challenge. In 2023, it depended on coal for 95% of total energy production and is one of the largest coal exporters in the world and Africa’s largest carbon emitter. In the Current Path, South Africa depends on coal for 55% of its total energy production in 2050 while still exporting large amounts. It is only 36% in the Sustainable Africa scenario.

The transition from coal will also be painful for Zimbabwe, Mozambique and Botswana. The latter sourced 50% of its energy production from coal in 2023—Zimbabwe was 63% and Mozambique at 40%. On the Current Path, coal production in Botswana will remain at its current levels until 2050, while production in Zimbabwe is set to increase, implying that it could continue mining coal for domestic energy production given the size of its known coal reserves. All three will have to forego export earnings related to their coal assets in the Sustainable Africa scenario.

Africa's oil exporters, such as Angola and Libya, will also need help reducing production in line with the UNEP target. Nigeria, Africa's largest oil producer, will be challenged the most, as well as Algeria, the second-largest producer. Oil accounts for over 80% of Nigeria’s exports and roughly 50% of the government budget, although production has steadily declined from its peak in 2005. Investments in exploration have also gone down. Many of the larger foreign oil companies such as Shell, TotalEnergies, Chevron, ExxonMobil, Eni and Equinor have either left, are in the process of doing so, or are shifting their investments into offshore waters given high levels of onshore insecurity, particularly in the Niger Delta that harbours most of that country’s onshore and shallow-water oil rigs. With the largest gas reserves in Africa, Nigeria will inevitably pivot from oil to natural gas, which currently accounts for just 10% of Nigeria's exports. Increasing its gas exports would require significantly expanding the facilities to cool and liquefy gas.

In thinking about energy, African governments are primarily concerned about cost and speed and less about the choice of technology (such as nuclear or geothermal). In this context, SMRs could significantly contribute to meeting Africa's energy requirement in high-demand nodes, but so could geothermal as a source of dispatchable low-emissions electricity and heat. Baseload electricity supply can be produced close to high-demand areas using SMRs and geothermal technologies. Examples are the provision of energy for industrial or mining demand such as cement and fertiliser production, iron ore smelters, large data centres, and chemical and steel plants, with project-specific additions from other energy sources to meet peaking demand. Africa will, however, not invest in technology demonstrators (first of a kind) SMRs, implying that the most likely successful approach could either come later in the SMR development path (once demonstrator units are operating effectively elsewhere) or for SMR developers presenting a fleet option to several countries as a package option that resolves energy requirements across a host of higher demand nodes. The challenge with new geothermal is similar since the associated expertise is located in the fracking industrial ecosystem in the US.

Africa has set a path towards industrialisation and regional trade integration. These two ambitions inevitably release more carbon than the other six sectors modelled on this website and are included in the Sustainable Africa scenario. Therefore, it is important that industrial development, such as building fertiliser and cement plants, proceed with the appropriate technologies that keep carbon emissions to a minimum.

But perhaps the most important initiative to advance energy security in Africa is to fully operationalise the Africa Single Electricity Market (AfSEM) to harmonise regulatory frameworks for Africa's underdeveloped and fragmented electricity market and to connect electricity grids within and across regions. A much expanded and enhanced grid with greater interconnectivity is essential for the future. To this end, Renewable Energy Solutions for Africa (RES4Africa) launched Grids4Africa to raise awareness about the importance of grid infrastructure and the associated challenges that could bring additional private sector resources to transmission and distribution.

The Continental Power System Master Plan (CMP) needs to be updated and implemented to create a single, integrated grid for the continent from the five power pools that would allow for the optimisation of renewables. The advantages are manifold, allowing production in one country to supply demand in another and extending the period when solar produces energy given Africa's large East-West expanse.

Given the fear of stranded assets, the inevitable question is: How and who will finance Africa’s exploration and production of gas and for which market—for domestic consumption or export? Africa would need lots of support from multilateral funding institutions, private sector partners, development agencies and bilateral support from high-income countries to realise a viable carbon emissions pathway, including for selected exploration and production of gas. The call is not new and was prominently made as part of the Bujumbura Declaration in August 2021 that urged the World Bank to scale up investments in energy cooperation in Africa, including the financing of gas-to-power projects beyond 2025. Yet, momentum is growing among wealthy countries to stop new investments in oil and gas ventures, and the risk of stranded investments looms large. The World Bank stopped financing upstream oil and gas projects in 2019 and the African Development Bank no longer puts money into fossil fuel projects—although some of this may change with Donald Trump as US president. In response, a coalition of oil-producing African countries intends to launch an "energy bank" to fund fossil fuel initiatives.

Africa’s high levels of indebtedness and punitive risk premiums mean that the continent struggles to attract investment in the best circumstances. Even if Africa were to get a reprieve on gas projects, the negative perceptions associated with investments in fossil fuels imply a high level of risk to private or public sector investors. Mozambique is an example of a country that has entered into complex arrangements with private actors to develop its gas resources with only limited revenues flowing to the government towards the end of the project life cycle once the investors have recouped the return on their investment. At the same time, the large sums of money promised to help the green transition under the auspices of the so-called Just Energy Transition Partnerships have not materialised, and the result is that polluting coal plants stay open.