How will Africa navigate its future energy transition?

How can Africa balance its development with global carbon emission goals?

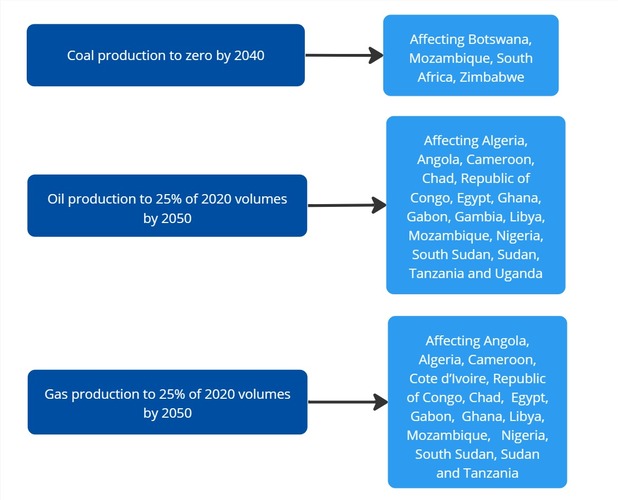

The 2023 UN Environmental Programme (UNEP) Production Gap Report recommends that the world aim to phase out coal production and use by 2040, as well as reduce oil and gas production to a quarter of the 2020 levels by 2050.

The UNEP goals are set to keep the ambition of the Paris Agreement to limit global average temperatures to 1.5°C above pre-industrial levels alive.

These recommendations are ambitious. On a business-as-usual trajectory, coal will still account for 18% of global energy production in 2040. By 2050, oil will account for 22% of production and gas for 29%. These figures are a far cry from the transition proposed by the Production Gap Report, which requires that 63% of global energy production shift from coal, oil and gas to other energy sources by 2050.

Africa’s energy production landscape depends heavily on fossil fuels – the contribution from renewables is very low at 1.7% of total energy production. Oil contributes 46.6% of Africa’s total energy production, with gas at 31.2%, and coal at 17.6%. Renewable energy from wind and solar will take several years to gain momentum and a decade or more to ramp up to the point that they offer viable alternatives to fossil fuels.

Across Africa, implementing the UNEP recommendations would require countries to pay US$231.3 billion more for energy imports in 2050, while energy export earnings would decline by US$214.4 billion.

While the rest of the world is moving away from fossil fuels, Africa’s demand for energy is increasing as its population grows and it develops. The UNEP recommendations’ effects would, of course, disproportionately affect the 20 African countries producing fossil fuels, but the eventual result is a more productive and diversified economic structure unaffected by the ills associated with single-commodity dependence.

We modelled the UNEP recommendations. Our scenarios assess the impact of quadrupling Africa’s energy production from renewables by 2030. This represents the most ambitious forecasts by the International Renewable Energy Agency (IRENA). Most of the oil and gas from Africa is exported to Europe, China, and India, and the refined products are imported at a higher cost.

Our modelling concludes that it will not be possible for Africa to close the subsequent energy production gap, even with the most optimistic increases in energy production from hydro, solar, wind, hydrogen, and nuclear. Nor will Africa be able to source sufficient energy through imports (the continent is currently a net exporter of fossil fuels) since pursuing the UNEP targets globally will likely result in competition for cleaner energy sources.

Africa could end coal production by 2040 and constrain oil production to the UNEP-recommended levels. However, the continent would need time and space to exploit its natural gas endowment while making every effort to constrain carbon emissions.

While the rest of the world is moving away from fossil fuels, Africa’s demand for energy is increasing as it develops

Africa’s growing population is energy-poor, particularly regarding access to electricity. Only 57% of Africa’s population has electricity, meaning 596 million people lack access to the most basic household resource for heating, cooling, cooking, reading and home education. For comparison, 98% of people outside of Africa have access to electricity. Energy poverty is particularly evident in the Central African Republic, Chad and South Sudan.

Should the continent proceed on the same fossil fuel development pathway as today’s richer economies, Africa will be associated with significant increases in energy demand and related carbon emissions.

By 2065, Africa will release more carbon from fossil fuels than China as its energy demand grows. In the longer term, constraining carbon emissions globally may depend on what happens with Africa’s energy future.

Rather than constraining all fossil fuel production, Africa’s most significant contribution to a sustainable future is its potential to act as a carbon sink through policies on reforestation, improved land management and associated measures.

Momentum is growing among wealthy countries to stop new investments in oil and gas ventures. At the same time, Africa’s high levels of indebtedness and punitive risk premiums mean that the continent struggles to attract investment in the best circumstances.

Africa would need lots of support to realise a viable carbon emissions pathway

With an unreformed global financial system and capital mainly in the hands of the risk-averse private sector, the ability of African countries to borrow at affordable interest rates is limited. The large sums of money promised to help the green transition under the auspices of the so-called Just Energy Transition Partnerships have not materialised, and the result is that polluting coal plants stay open.

Africa would need lots of support to realise a viable carbon emissions pathway. The obvious response would be to introduce a carbon tax on countries with high per capita emissions and those that have historically benefitted from a high carbon growth path. The associated funds could be used to finance Africa's energy transition, which we modelled separately.

In addition to debt relief and suspension, multilateral development banks need to implement Climate Resilient Debt Clauses (CRDCs) and debt-for-nature or debt-for-climate swaps to strengthen recipient countries. This would allow them to repay their debts by investing in nature regeneration and climate action.

Africa needs vast amounts of energy. Most analyses argue that the variability of solar and wind means that they cannot meet the base-load requirements for industry and other energy-intensive sectors, without a technological breakthrough in energy storage.

That leaves only nuclear or hydro. But scaling up solar production in North Africa could power all of Europe, while the associated manufacturing requirements could massively boost North Africa's economies. Instead, Germany chose gas from Russia and closed its nuclear energy plants until the war in Ukraine ignited demand for gas from America instead of solar energy from the Sahara.

These examples point to the need for ‘out of the box thinking’ – such as green hydrogen from Grand Inga and Namibia and bulk solar from the Sahara since the costs associated with hydro, hydrogen and nuclear energy appear to limit the feasibility of other options. Also, in addition to gas, wind, solar, geothermal, green hydrogen, and other renewables, Africa must explore local solutions such as repurposing solid waste and making efforts towards a circular economy.