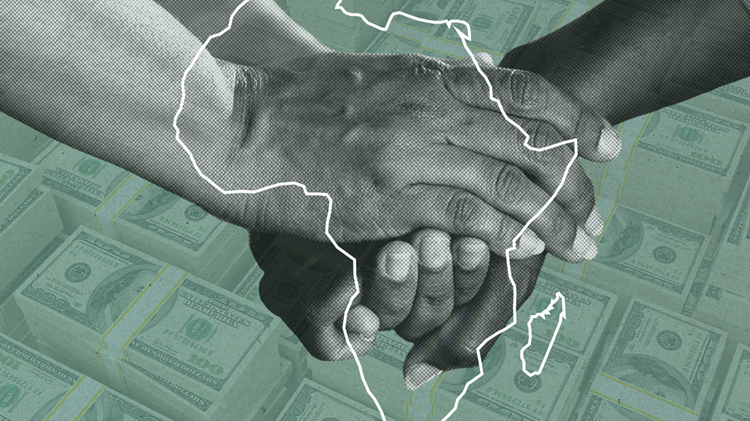

Unlocking Africa’s manufacturing potential

Energy, transport and reforms are strategic priorities for Africa’s industrialisation.

Africa’s manufacturing sector has long been touted as a key driver of the continent’s economic transformation. However, its actual contribution remains modest, accounting for less than 15% of GDP in most countries as of 2023, with many countries experiencing premature deindustrialisation since the 1990s. Africa also contributes less to world manufacturing. The continent’s share of global manufacturing has declined from approximately 3% in the 1970s to less than 2% in 2023, placing Africa at the bottom of the global manufacturing value chain. This stagnation persists despite the continent’s vast endowment of raw materials and large youthful labour force, factors that should ideally serve as competitive advantages.

Within Africa, North Africa accounts for the largest share of manufacturing value added (MVA), underpinned by relatively well-developed industrial bases in countries such as Egypt and Morocco, where manufacturing spans automotive assembly, textiles and agro-processing. Central and West Africa follow, with both regions recording notable progress over the past decade, driven partly by Nigeria’s nascent agro-processing sector and Cameroon’s growth in light manufacturing. In contrast, Southern Africa’s share of MVA has declined steadily, largely reflecting South Africa’s deindustrialisation trend amid energy constraints, global dynamics and industrial competitiveness challenges. East Africa continues to register the lowest manufacturing contribution on the continent, although countries like Ethiopia have made recent strides in textile and apparel manufacturing through targeted industrial park strategies. These divergent patterns underscore the need for region-specific industrial policies that address unique constraints and leverage existing comparative advantages.

The United Nations Industrial Development Organisation (UNIDO)’s industrial development goals highlight that manufacturing must contribute at least 20% of GDP to drive structural transformation meaningfully. Achieving this threshold is crucial for sustaining industrial growth and advancing towards upper-middle-income status for Africa's 46 lower-middle-income countries. As of 2023, only Eswatini had surpassed this benchmark, with MVA accounting for 27% of its GDP, driven partly by thriving textiles and sugar processing industries, supported by preferential access to the US market under the African Growth and Opportunity Act (AGOA). In contrast, even Africa’s largest economies remain below the target: South Africa, despite being the continent’s most industrialised in absolute terms and an upper-middle-income country, registered just 12%, while Nigeria and Egypt reached approximately 14% and 17%, respectively.

Unlike successful industrialised economies in the Global North, the Asian Tigers and more recently China, Africa’s structural transformation has largely bypassed the manufacturing sector, particularly among lower-middle-income countries. Instead, many countries have transitioned directly from agriculture into low-value services (Figure 2). This atypical trajectory constrains the continent’s ability to harness the productivity gains and employment benefits typically associated with manufacturing-led industrialisation, thereby impeding progress toward upper-income status.

According to the recent AFI-ISS study on the state of industrialisation in Africa, the continent’s increasing dependence on low-value, service-led growth and its continued trend of premature deindustrialisation stems largely from critical infrastructure deficits, particularly chronic power shortages and transport bottlenecks. These challenges are compounded by various structural impediments, including skills and technological gaps, inconsistent implementation of industrial policy, limited access to finance and complex business environments. Together, these factors undermine the continent’s capacity to sustain manufacturing-led growth and meaningful structural economic transformation.

Persistent power and transport gaps are driving Africa’s shift to low-value, service-led growth and accelerating premature deindustrialisation

The World Bank estimates suggest that sub-Saharan Africa’s infrastructure deficit reduces annual economic growth by roughly two percentage points and that it lowers business productivity by up to 40% in some countries. Reliable power supply and efficient transport networks are not merely infrastructure issues; they are central to any viable industrialisation strategy. Yet, many African manufacturers continue to grapple with chronic electricity shortages and logistical bottlenecks, severely limiting their competitiveness and growth potential.

In Nigeria, for example, approximately 90% of manufacturers depend on diesel generators due to the chronic instability of the national power grid. The government estimates that its manufacturers lose approximately US$27 billion annually due to power outages, an economic burden that significantly hampers industrial growth. Consequently, Nigeria's manufacturing sector has stagnated, contributing around 13% to GDP since 2020.

Similarly, in South Africa, load-shedding (rolling blackouts) by utility Eskom has forced regular plant shutdowns from late 2007 to early 2024, undercutting manufacturing output. Between 2007 and 2019, load-shedding cost the South African economy nearly R35 billion, with the manufacturing sector alone accounting for nearly 40% of this cost, by far the largest share among other sectors. The worst year on record was 2023, with 25 000 gigawatt hours (GWh) shed over 287 days.

This crippling energy deficit, whether Nigeria’s chronic outages or South Africa’s load-shedding, is an insurmountable barrier to scaling up manufacturing. It slashes output, dents investor confidence, erodes competitiveness as factories endure higher costs and lower productivity, resulting in steady deindustrialisation.

Inadequate transport infrastructure is another significant obstacle to industrial development in Africa, driving up logistics costs and causing long lead times. The continent’s roads, railways and ports have failed to keep pace with growing economic demands, making the movement of goods both slow and expensive. In 2018, sub-Saharan Africa, despite comprising 17% of the world’s land mass, accounted for just 6% of global road networks, starkly contrasting to South Asia’s 17% share. According to the Africa Finance Corporation’s 2024 report, Africa’s total paved road network spans only about 680 000 kilometres, roughly one-sixth the size of India’s, despite the two regions having roughly equal population sizes. Africa is, of course, more than nine times the size of India, meaning that its few roads have to service much larger geographic areas. This infrastructure gap leaves vast areas poorly connected, creating severe logistical challenges for manufacturers across the continent.

Policy priorities to unlock Africa’s industrial potential

Rapidly industrialising countries like Vietnam overcame power deficits by investing heavily in energy infrastructure, implying that closing Africa’s energy gap is non-negotiable for industrialisation. Governments must prioritise power generation, transmission and distribution projects to ensure reliable, affordable electricity for industry. This means upgrading grids, reducing losses and expanding generation through various sources, including renewables, nuclear, geothermal and natural gas. Crucially, African countries should leverage public-private partnerships and lean on independent power producers to inject capital and expertise into the energy sector. To do that requires robust regulatory frameworks, clear public-private partnership legislation and cost-reflective tariffs that make projects viable. At a regional level, expanding power pools for cross-border electricity trade, such as the Southern African Power Pool, can help stabilise supply in SADC and beyond.

African governments and regional blocs (ECOWAS, EAC, SADC, COMESA, etc.) should double down on moving ahead with the strategic corridors planned as part of the Programme for Infrastructure Development in Africa (PIDA PAP 2), focusing on those linking industrial hubs to markets. This could involve new highway segments to connect missing links, for example, completing the Trans-West African Coastal Highway, rehabilitating rail lines for freight, and improving port efficiency with better management or concessions. Streamlining customs and border procedures under the African Continental Free Trade Area (AfCFTA) is vital. Studies show that transport and logistics pose a greater challenge to African trade than tariffs. Investment in inland logistics hubs, warehouses and cold chains will help manufacturers get inputs and deliver goods reliably.

Successful industrialisers overcame power shortages and transport bottlenecks first, hence closing Africa’s energy and transport gaps is non-negotiable for industrialisation

While substantial investment in energy and transport infrastructure is essential, it must go hand in hand with reforms to the business environment and the adoption of coherent, manufacturing-oriented policies. Such policies should aim to build foundational industrial capabilities, encourage beneficiation, drive technological advancement and lay the groundwork for sustainable structural transformation. A transparent and predictable regulatory framework, supported by consistent and credible industrial strategies, will ease capital constraints. They are crucial requirements for attracting long-term foreign investment, unlocking multilateral development financing, stimulating the growth of domestic enterprises and mobilising domestic resources.

The AFI-ISS study demonstrates that significantly scaling up investment in manufacturing, complemented by business environment regulatory reforms, increased support for research and development (R&D) and higher labour force participation, can deliver transformative economic gains for Africa by 2043. Forecasted outcomes include an additional US$167.2 billion in manufacturing output (Figure 3), 34.6 million new jobs, a US$283.5 billion boost to overall economic output, US$83.2 billion in additional government revenues, a US$190 increase in per capita income and 20.1 million more people lifted out of poverty. Moreover, manufacturing functions as a catalytic sector, much like yeast in a cake, expanding the overall size of the economy by generating strong positive spillover effects across other sectors, particularly agriculture and services.

In support of industrial growth, African governments need to invest in technical and vocational education and training (TVET) aligned with industry needs. Additionally, policies to promote technology adoption in manufacturing can help leapfrog constraints. This could include tax incentives or grants for firms to invest in modern equipment, supporting tech hubs and incubation centres for manufacturing startups and encouraging both South-South and North-South technology transfer. Partnerships with countries that are rapidly industrialising, such as China, India, Turkey, Vietnam and more, can facilitate knowledge exchange, such as through training programs or joint ventures that bring in new production techniques.

A transparent and predictable regulatory framework, supported by consistent and credible industrial strategies, can, in itself, ease capital constraints

African countries can eliminate the obstacles that have hindered their manufacturing sectors. While not every nation will become an industrial powerhouse, consistent implementation of the policies listed here will create an environment where factories can thrive. Encouragingly, some countries are already making progress in this direction. For instance, Ghana and Côte d’Ivoire have improved their power supply and cocoa processing, Senegal is streamlining business regulations while developing a new industrial park in Diamniadio, and Mauritius has utilised business environment reforms to expand its textile and apparel industry. These positive examples demonstrate that progress is possible with the right policy mix.

Image: AFI/Canva

Read the full, recently updated theme on Manufacturing here.