Stagnation or Growth? Algeria’s development pathway to 2040

Summary

- Poor governance—i.e. inefficient bureaucracy, corruption and cronyism—is one of the biggest challenges to Algeria’s progress. Jump to Governance and the deep state

- Reform of Algeria’s economic system is long overdue as the country missed the opportunity to diversify during its oil revenue boom. Jump to Economy

- The status quo and hyper-regulation of the business environment hamper Algeria’s economic potential.

- The extensive subsidy system is unsustainable and has created an inflexible and cumbersome economy of dependence. Jump to Achievements and the problem of subsidies

- There is a mismatch between the skills of the Algerian labour force and the needs of the market. Jump to Education

- The country’s large working-age population does not translate into rapid growth and it is not leveraging the potential of trade with its neighbours, instead remaining dependent upon trade with the European Union. Jump to Trade

- Algeria relies heavily on food imports, which are volatile and susceptible to international supply chain disruptions and price fluctuations. This is especially important in light of declining foreign exchange reserves. Jump to Trade

- The impact of climate change will strain water supplies and agricultural productivity. Jump to Agriculture, climate change and access to water

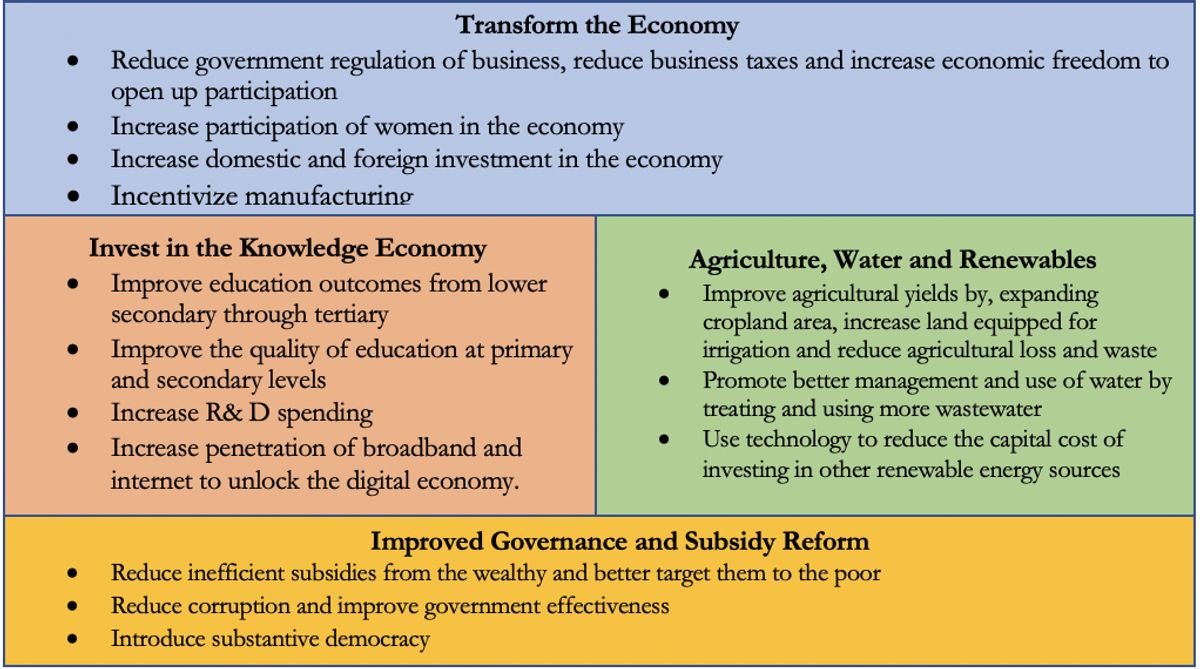

Recommendations. Jump to Conclusion

The government of Algeria should:

- promote good governance, i.e. transparency and accountability, and greater inclusivity in a more democratic society.

- reform the economy to allow greater economic freedom, inclusivity, competition, economic diversification and a conducive investment climate—key among these reforms are lowering investment barriers and promoting merit and efficiency.

- create an environment favourable to the private sector and entrepreneurship to boost creativity, competition and job creation.

- take advantage of its technological potential to promote a digital economy.

- do more to reduce subsidies that benefit the wealthy while promoting better-targeted social safety net programmes that effectively help the poor.

- boost domestic agricultural production to promote food security and reduce dependence on food imports.

- leverage its potential for regional trade and economic integration.

- improve the quality of education to ensure a better skills match with the needs of the market and allow greater flexibility in the language of instruction.

- ensure better management of strained resources like water and implement a sustainable shift to renewable energy.

All charts for Stagnation or Growth? Algeria’s development pathway to 2040

- Chart 2: Algeria vs OLMICs and UMICs on IFs governance triangle in 2020

- Chart 3: Algeria vs Africa country groups on Polity IV index for 2017

- Chart 4: Government-to-household welfare transfers (% GDP)

- Chart 5: Population history and forecast, 1960–2070

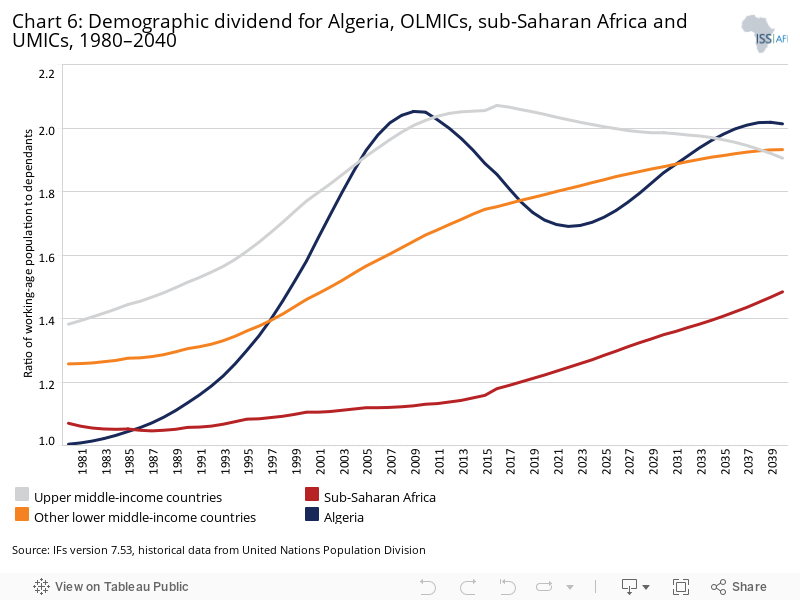

- Chart 6: Demographic dividend for Algeria, OLMICs, sub-Saharan Africa and UMICs, 1980–2040

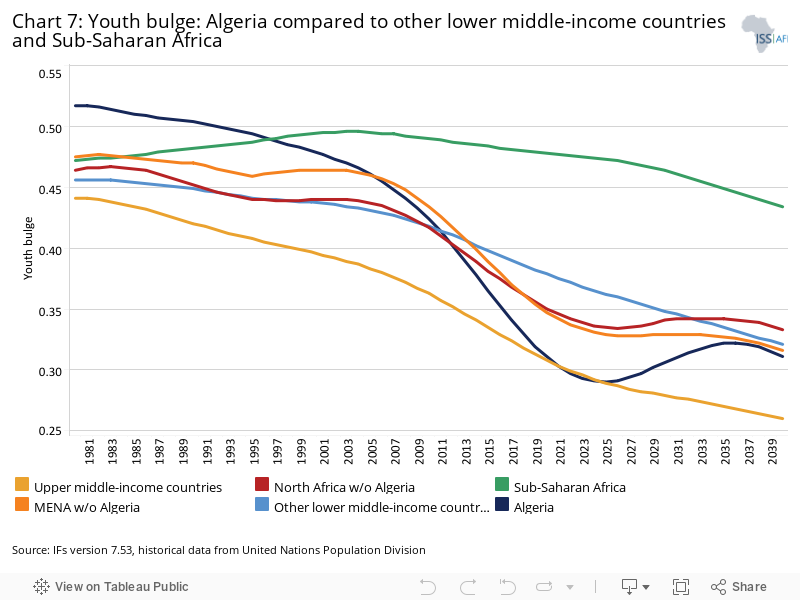

- Chart 7: Youth bulge: Algeria compared to OLMICs and sub-Saharan Africa

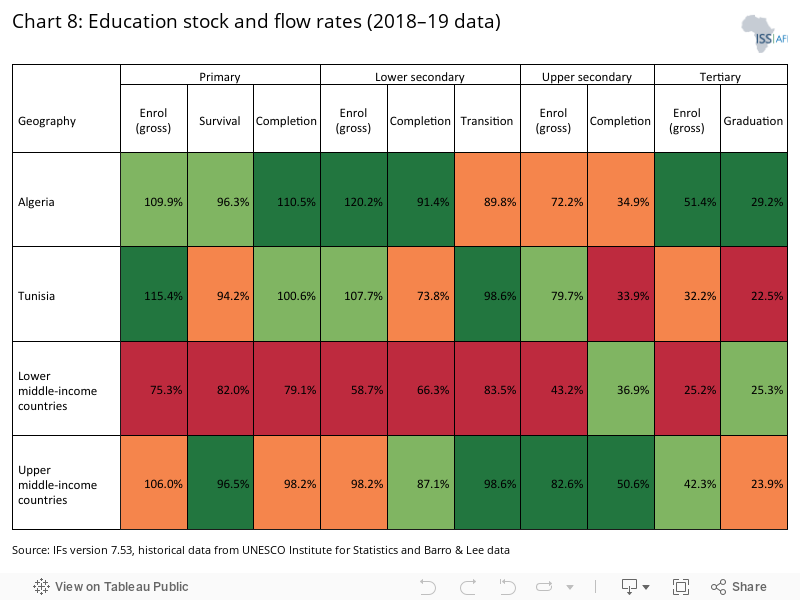

- Chart 8: Education stock and flow rates (2018–19 data)

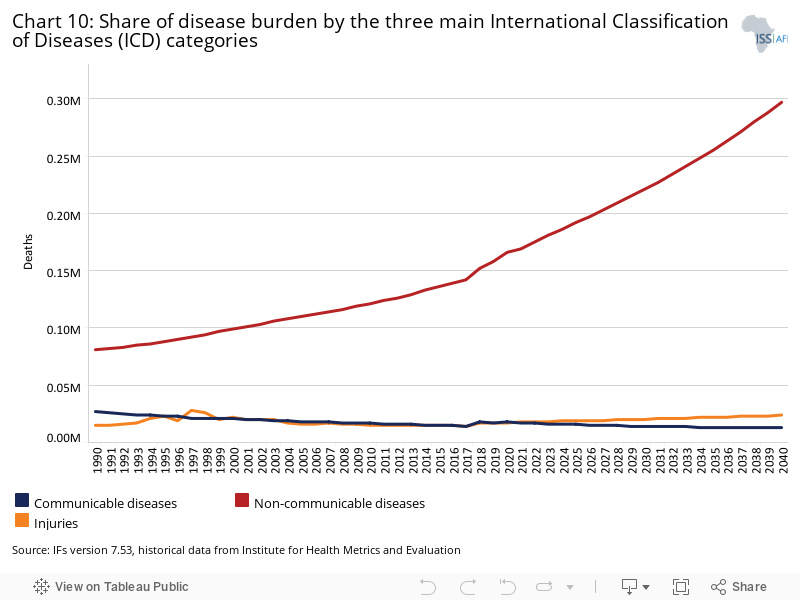

- Chart 10: Share of disease burden by the three main International Classification of Diseases categories

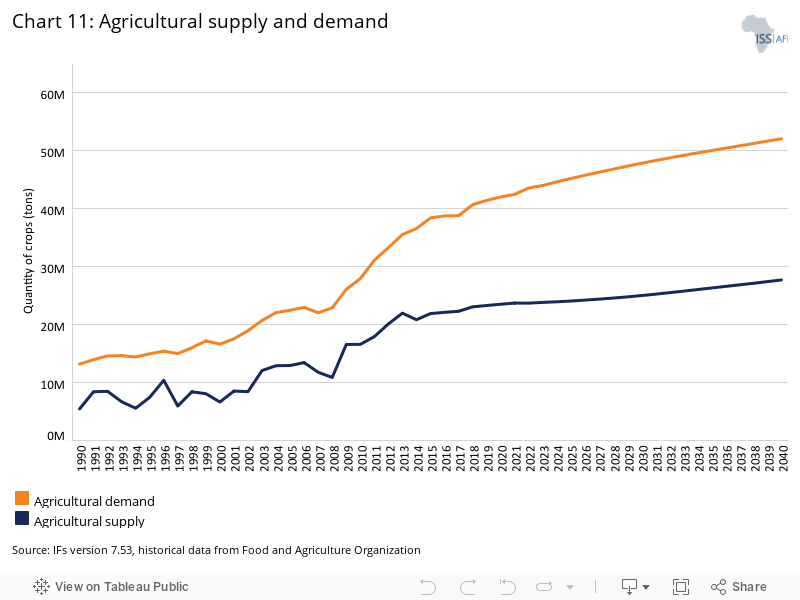

- Chart 11: Agricultural supply and demand

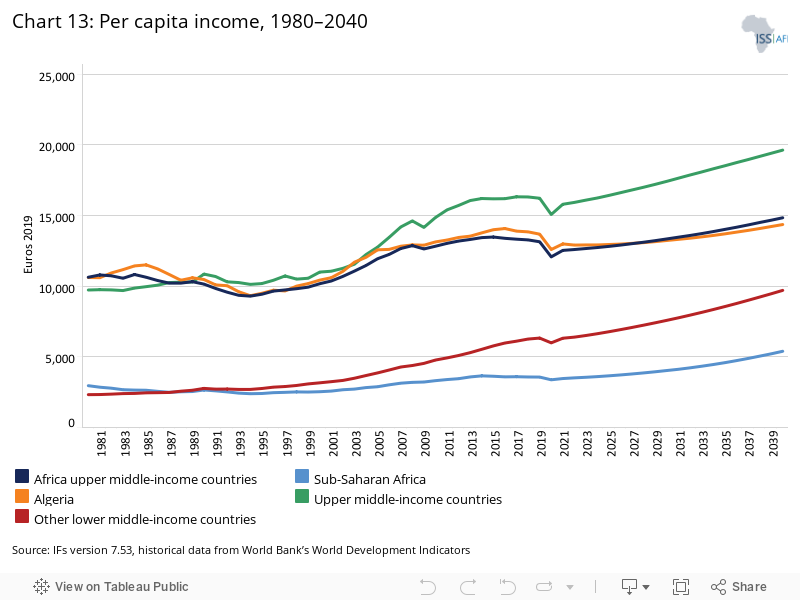

- Chart 13: Per capita income, 1980–2040

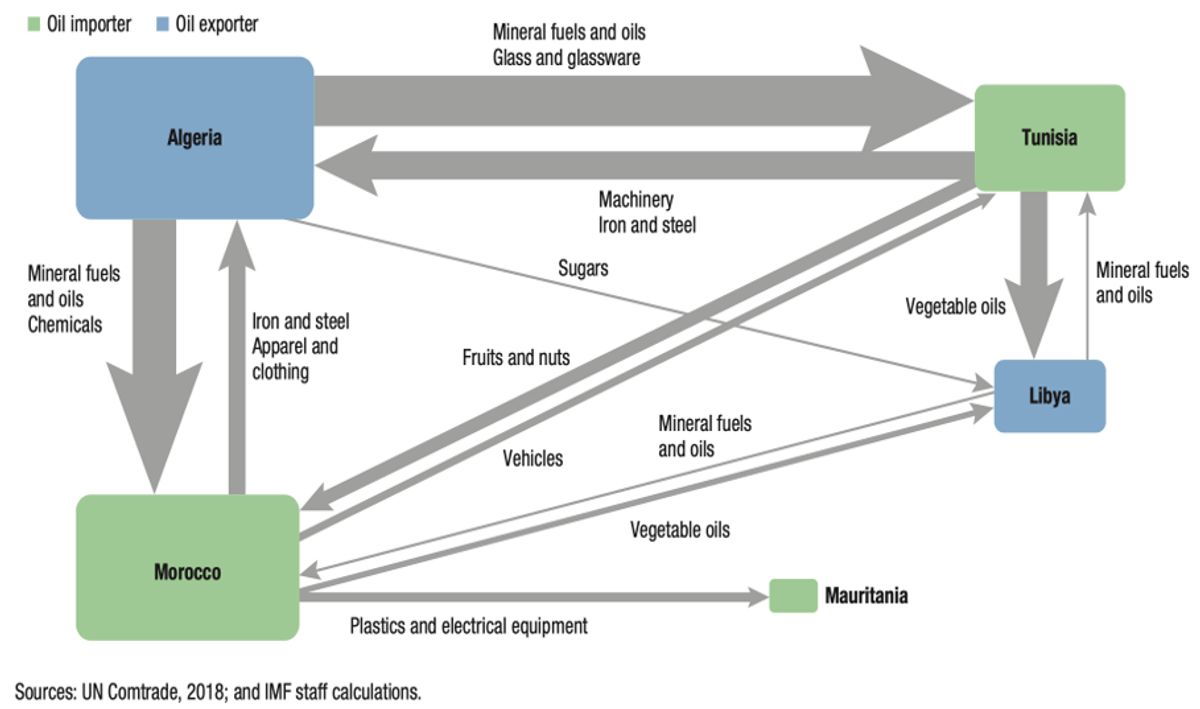

- Chart 14: Intra-regional trade flows

- Chart 15: Scenario components

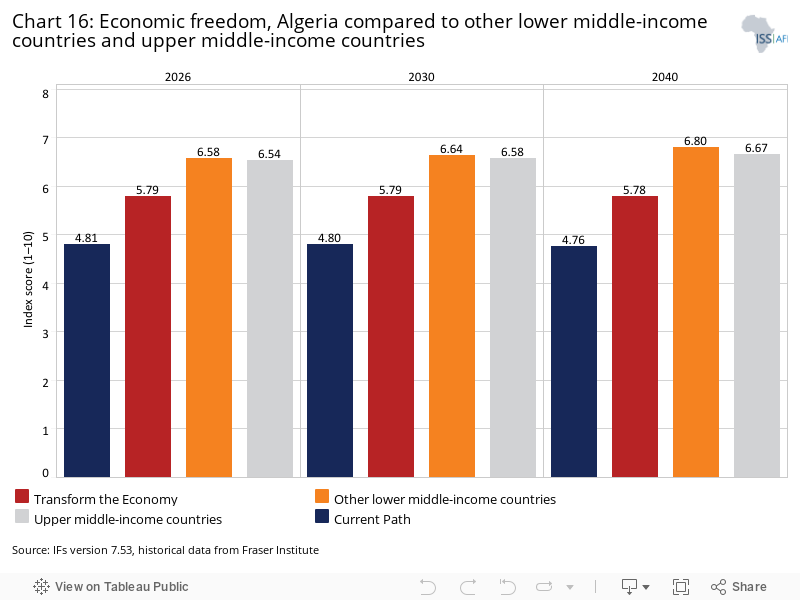

- Chart 16: Economic freedom, Algeria compared to OLMICs and UMICs

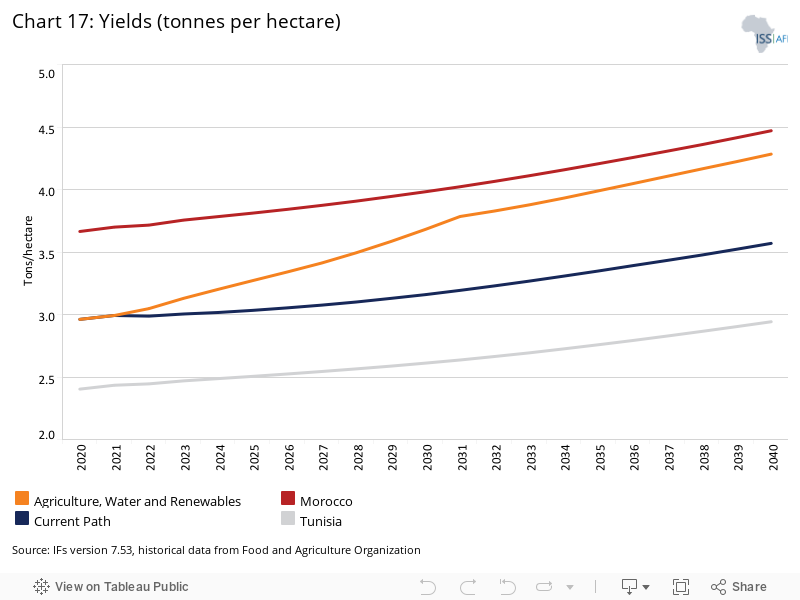

- Chart 17: Yields (tons per hectare)

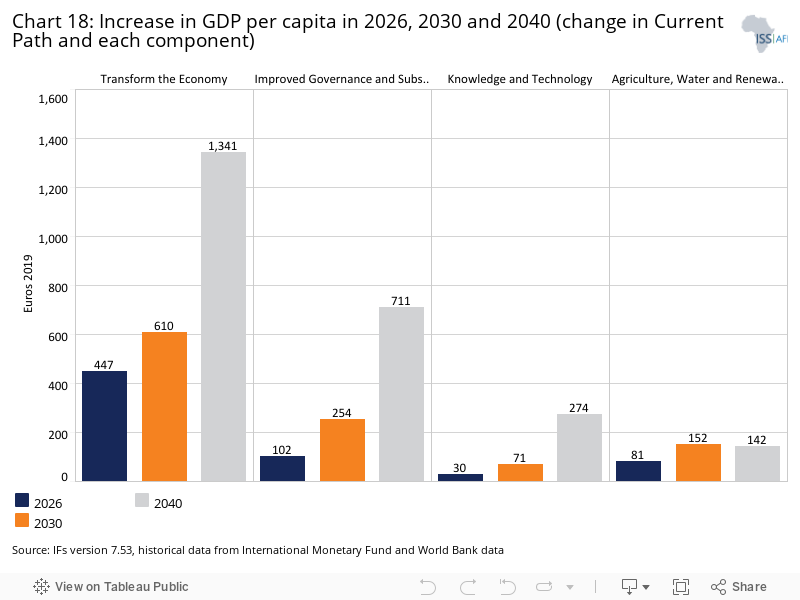

- Chart 18: Increase in GDP per capita in 2026, 2030 and 2040 (change in Current Path and each component)

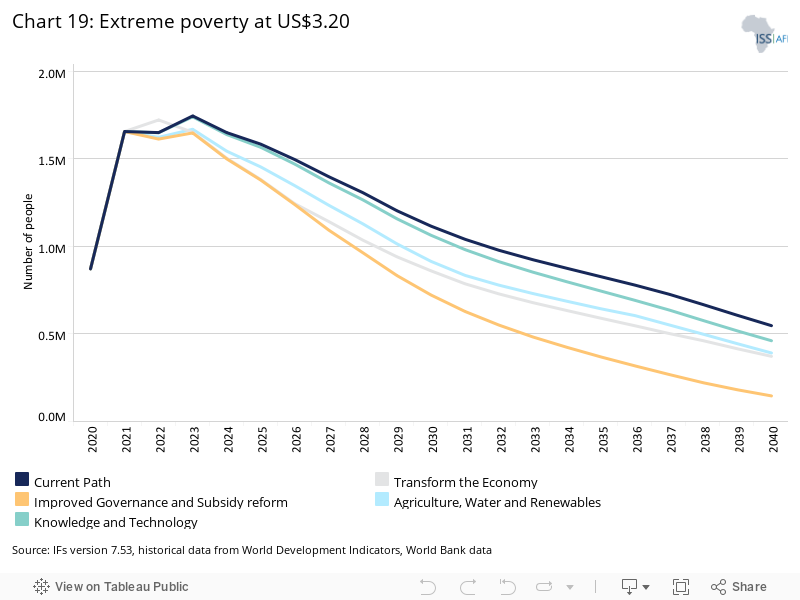

- Chart 19: Extreme poverty at US$3.20

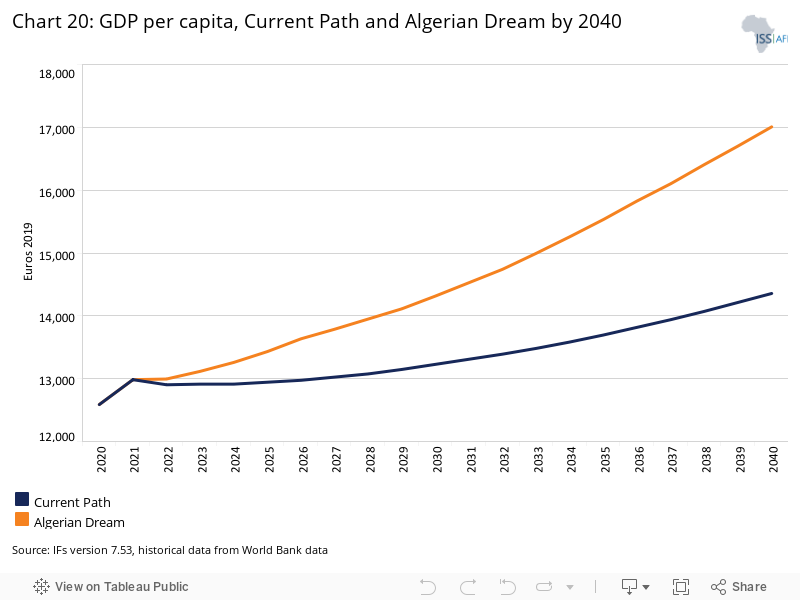

- Chart 20: GDP per capita, Current Path and Algerian Dream by 2040

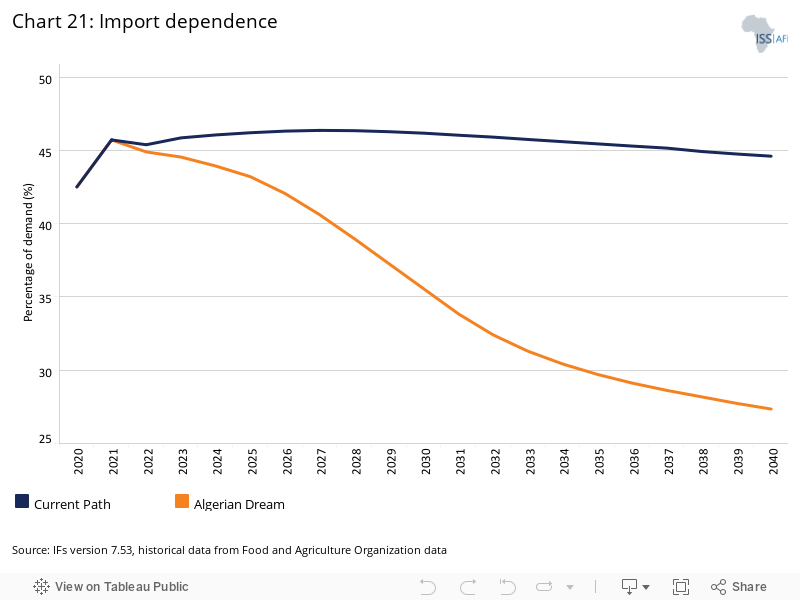

- Chart 21: Import dependence

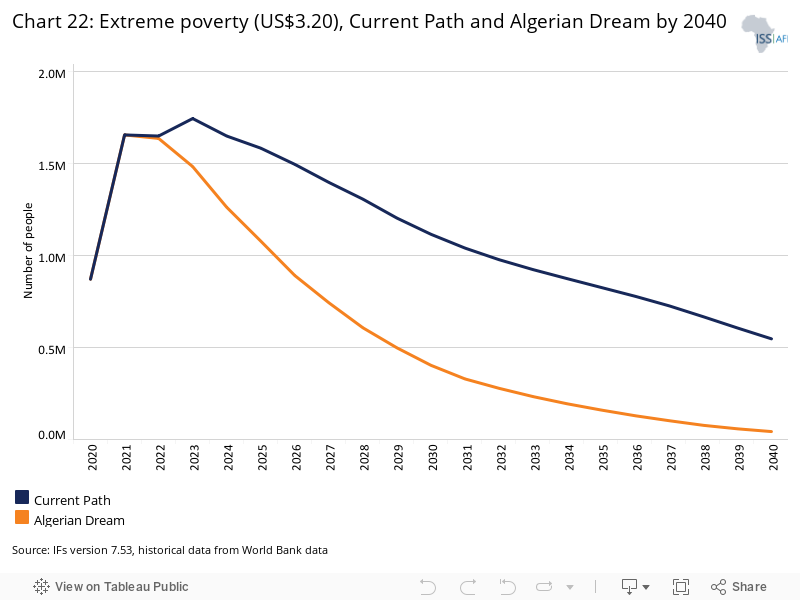

- Chart 22: Extreme poverty (US$3.20), Current Path and Algerian Dream by 2040

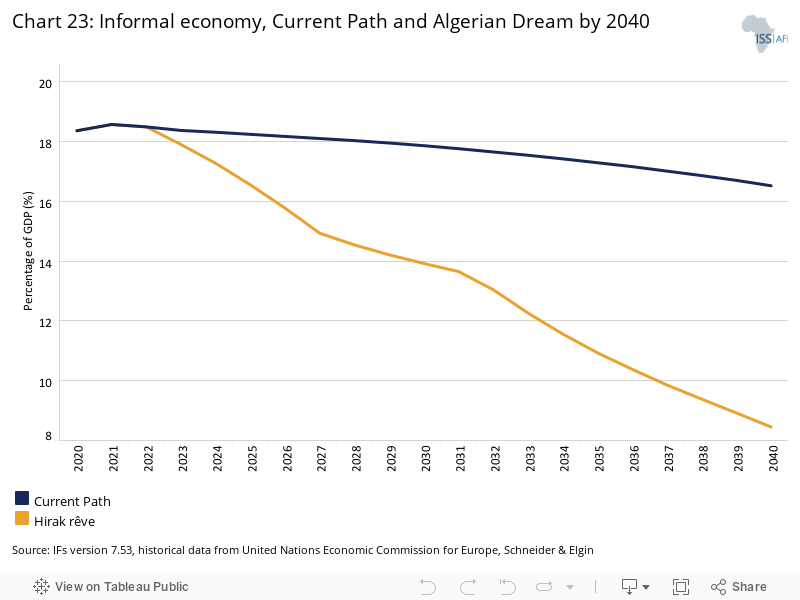

- Chart 23: Informal economy, Current Path and Algerian Dream by 2040

Algeria finds itself at a crossroads: the country needs comprehensive social, economic and governance reforms to rebuild its fractured social contract and end the ongoing stalemate between the Hirak movement and the regime.

The country also has to manage the impact of the COVID-19 pandemic and the plunge in oil prices, which has decimated government revenues and cut the state budget by roughly 50%.

For many, the political uncertainty and rising social tensions reflect the long-running and increasingly unsustainable economic, political and social system that has come to characterise Algeria. This system has marginalised large sections of the population.

Using the International Futures (IFs) forecasting system, we project that Algeria will achieve a modest average gross domestic product (GDP) growth rate of 1.8% between 2020 and 2040.

Given the country’s closed and state-led economic system, dependence on hydrocarbons, the drop in oil prices, high unemployment rates and the generous yet ineffective subsidy system, this growth rate is insufficient to adequately improve the incomes and livelihoods of most Algerians.

The country is in desperate need of comprehensive structural reform towards an opportunity-based economy hinged on a legitimate government that acts in the interests of all its citizens.

Moreover, Algeria faces other pressures in terms of its limited natural resources like water and the impact of climate change, which will worsen the country’s already poor agricultural yields and high dependence on imported foodstuffs.

The country’s working-age population as a portion of its total population has stagnated and Algeria needs more capital (through savings and investments) if it wants to improve productivity and incomes. Also crucial are better technology and modern management practices.

In addition, Algeria has not completely weathered the storm of domestic and regional terrorist threats coming from Tunisia, Libya, Niger and Mali. Its security apparatus, particularly the army, which has thus far dealt effectively with these threats, remains on high alert.

The country missed its chance to diversify its economy in recent decades characterised by high revenues on the back of oil prices. The current socio-political uncertainty, worsened by the impact of the COVID-19 pandemic, might heighten if policymakers fail to act quickly and decisively. In fact, the World Bank has recently reclassified Algeria from an upper- to a lower middle-income country.

Comprehensive structural reforms are needed to advance good governance, as well as transform and modernise the economic system to tear down market barriers, accelerate economic growth and create greater social cohesion in the country.

This report uses the International Futures modelling platform to analyse Algeria’s current state of development and most likely development pathway to 2040. The Current Path forecast is followed by the development of four scenario components into a positive Algerian Dream (Rêve algérien) scenario. In the Algerian Dream, the country sets itself on a prosperous and more equitable pathway under a legitimate and democratic government.

The project is conducted by the African Futures and Innovation (AFI) programme at the Institute for Security Studies (ISS) in Pretoria, South Africa, with the support of the Netherlands Institute of International Relations, Clingendael, and the Frederick S. Pardee Center for International Futures at the University of Denver.

Our research indicates that governance issues, and the consequent policy framework that has defined the economic order, lie at the root of most of Algeria’s challenges. That is where we start with our analysis.

|

Chart 1: Comparison groups To create comparisons across countries and regions, the report uses the World Bank’s classification of economies into low-income, lower middle-income, upper middle-income and high-income groups for 2020—2021.[1IK Harb, Challenges facing Algeria, المركز العربي بواشنطن,, Arab Center, July 2017] The World Bank now classifies Algeria as one of 22 lower middle-income economies in Africa. Where Algeria is compared to the averages for lower middle-income Africa or globally, it is excluded from the group, hence the use of the terms ‘other lower middle-income countries’ (OLMICs). Also, when comparing Algeria to averages for upper middle-income countries (UMICs) we have removed Libya and China because the former has unreliable data and the latter’s population and economic size skew averages. Algeria straddles various identities that complement income-based comparisons. It is at once part of Africa, North Africa, the Middle East and North Africa (MENA) region, and the Maghreb, and shares many characteristics with all of them. For this reason, we use the global upper middle-income groups for most comparative purposes but also use regions such as sub-Saharan Africa where appropriate. For the purposes of this report, North Africa consists of Algeria, Egypt, Libya, Mauritania, Morocco and Tunisia. The Maghreb has a similar composition but excludes Egypt. MENA consists of Algeria, Bahrain, Djibouti, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Syria, Tunisia, the United Arab Emirates and Yemen. |

All euro numbers are in 2019 values.

Governance and the deep state

In addition to the scars of the brutal civil conflict in Algeria (from December 1991 to February 2002), the country’s political system has become increasingly lethargic and its economic framework is performing poorly. The economy has been bedevilled by overregulation, cronyism, corruption, lack of innovation and dependence on a rapidly declining hydrocarbon industry.

Like many other societies in North Africa, Algerians show increasing disenchantment with a political system that prevents many from participating in gainful economic activities.[1IK Harb, Challenges facing Algeria, المركز العربي بواشنطن,, Arab Center, July 2017] This widespread dissatisfaction, coupled with an economic environment that offers few opportunities, has repeatedly triggered the formation of Islamist fundamentalist and extremist groupings in the country.

In response to the first wave of the Arab Spring, the government of Algeria (GoA) instituted a set of political reforms in 2011 in an attempt to undercut the rising tide of discontent. It ended a 19-year-old state of emergency, increased female representation in elective posts and expanded subsidies.[2Central Intelligence Agency (CIA), The World Factbook: Algeria] High oil prices allowed the government to increase spending on various social programmes in an effort to ensure stability.

However, later that year its eastern neighbour, Libya, descended into civil war in a region characterised by poor border control and rampant organised crime and smuggling.[3See, for example, R Dhaouadi, Cross-border smuggling: what drives illicit trade in North Africa?, ENACT Observer, 5 July 2019] It was only the size and efficiency of its large security establishment that allowed Algeria to contain the destabilising impact of the spread of weapons and the influx of terrorism.

Oil rents have allowed the regime to promote social stability and co-opt several opposition groups. State subsidies (which amounted to €62.8 billion in 2018)[4Le Point, Èconomie, Algérie: hausse des dépenses sociales et des taxes au menu du budget 2018, 26 November 2017] cover a vast array of goods and services ranging from bread and milk to energy, water and social housing.

The drop in oil prices since 2014 has, however, constrained the ability of the state to implement social programmes and so dampen the impact of rising popular discontent. This disaffection is the product of years of economic stagnation, high unemployment, extreme labour market segmentation and chronic corruption.

Discontent peaked in February 2019, when then president Abdelaziz Bouteflika announced his intention to stand for a fifth presidential term in the April 2019 elections.[5Bouteflika had, in 2016, engineered a constitutional amendment that limited presidential terms to two, but since it was not retroactive it allowed him to stand for a fifth term.] Long confined to a wheelchair, incapacitated and presiding over a government considered corrupt and elitist, his announcement triggered weekly protests by millions of Algerians in what became known as the Hirak movement.

With no signs of the protests abating, Bouteflika eventually announced that he would not seek re-election and then postponed the elections. This did not quell the protests and eventually the military forced his resignation.

For over a year Algerians protested twice a week and promised to keep doing so until the country achieved what they considered to be ‘genuine reform’. This included a complete overhaul of the regime and free and fair elections. The establishment of a new electoral authority also failed to halt the protests.

The election that took place on 12 December 2019 was a dismal and widely boycotted affair. The candidates were all perceived to be part of the same political establishment that gave rise to protestors’ discontent. Former prime minister Abdelmadjid Tebboune, a perceived loyalist of the ousted president, won the presidential vote with the lowest voter turnout in the country’s history.[6J Burke and R Michaelson, Mass boycott and police clashes as Algeria holds disputed elections, The Guardian, 12 December 2019]

With the arrival of COVID-19, street demonstrations have been banned but protestors have vowed to resume marching, with the possibility of escalation.[7H Baala, Algeria’s Hirak: Rachad movement at center of major row among activists, The Africa Report, 24 July 2020] The Hirak movement is now faced with both a pandemic and police repression as it struggles to maintain its momentum.[8HO Ahmed, Algeria bans street marches due to virus; some protestors unswayed, Reuters, 17 March 2020]

The sustained anti-government protests have extended beyond demands for change in leadership and bridge religious, ethnic and tribal divisions in an unprecedented display of unity of purpose.

The demands are wide-ranging, including a broad-based renewal of the social contract, the dissolution of the ruling elite and their control of the economy, and the end of the dominant role of the military in political and economic matters. Other demands include more democracy, rule of law, individual freedom and equal opportunity. Exactly how this is to be achieved is less clear.[9A Boubekeur, Demonstration effects: How the Hirak protest movement is reshaping Algerian politics, European Council on Foreign Affairs, Policy Brief, 27 February 2020]

To date, the protests have generally been non-violent, but the impact of COVID-19 will inevitably increase the sense of desperation among Algerians, many of whom are deeply distrustful of the government. The potential for violence is high.[10C Alexander, Anger is spreading in a tinderbox on Europe’s doorstep, Bloomberg Businessweek, 29 July 2020]

Regardless of the domestic situation, it is clear that governance in Algeria is out of step with its peers globally.

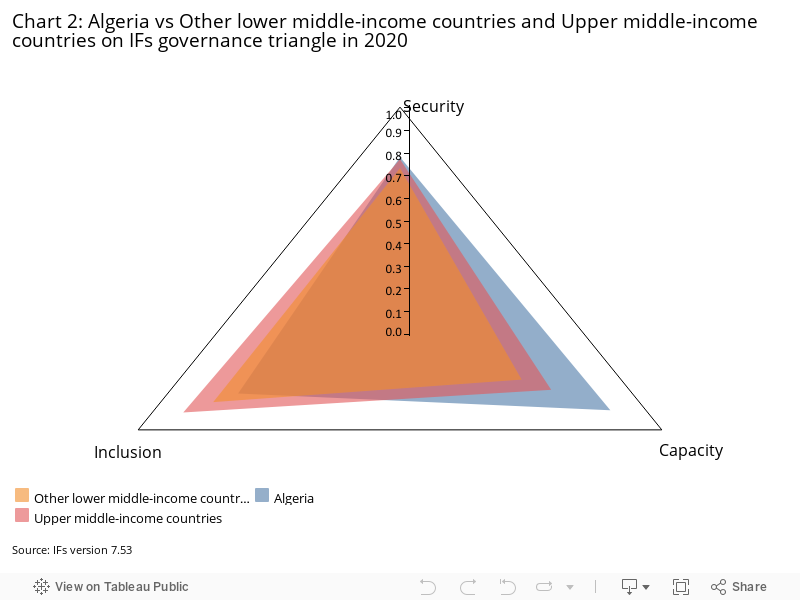

Within IFs, governance consists of three dimensions, namely security, capacity and inclusion. Each is constructed out of a series of subsidiary data and indices. Chart 2 compares Algeria, OLMICs and UMICs in 2020. Whereas Algeria does well compared to UMICs in the security and capacity dimension, it trails in terms of inclusion, which consists of broad elements of democracy, gender empowerment and youth participation.

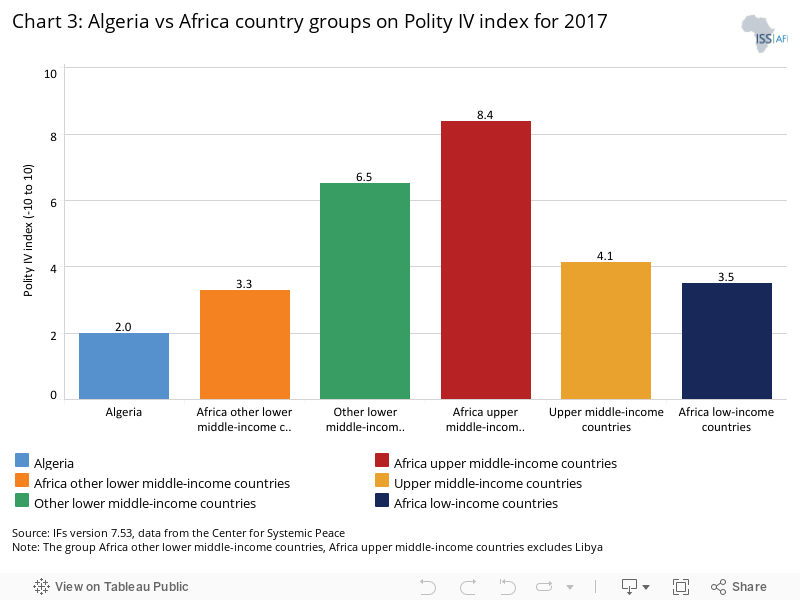

The Polity IV composite index from the Center for Systemic Peace (CSP) categorises states according to their regime characteristics. It provides a spectrum of governing authority types from full autocracies, to mixed systems or anocracies, to fully institutionalised democracies. The index [11The Polity IV dataset shows a spectrum of governing authority that ranges from full autocracy and mixed systems (anocracies or intermediate regimes) to fully institutionalised democracies. Its composite score (on a scale from -10 to +10) is divided into a three-part categorisation of ‘autocracies’ (-10 to -6), ‘anocracies’ (-5 to +5) and ‘democracies’ (+6 to +10).] currently ranks Algeria as an anocracy (or hybrid regime) [12The term ‘anocracy’ captures the extent to which a country in this range has both autocratic and democratic characteristics. A score of -10 generally indicates a hereditary monarchy and +10 a consolidated multiparty democracy.] with a score of 2.7, about 3.6 points (or 57%) below the average index for OLMICs on a scale that ranges from -10 to +10.

Algeria therefore has a substantial democratic deficit compared to its peers, and recent socio-political events underscore the extent to which most ordinary Algerians are aware of this gap.

Whereas the average Polity scores for OLMICs all fall within the stable range of multiparty democracies (i.e. with scores of more than +5),[13Although a number fall outside this range, such as Turkmenistan, Azerbaijan, Iran, Libya, Belarus, Cuba, etc.] Algeria is considered to have an anocratic, mixed or hybrid regime type (countries that score from -5 to +5). Anocratic regimes are inherently unstable since they have elements of a democracy (such as regular elections) that raise expectations of citizens’ power and participation but co-exist with elements of autocracy (such as limited legislative powers), as evident in Algeria.

The third and final index is from the Varieties of Democracy (V-Dem) project, which distinguishes between substantive (or liberal) [14The V-Dem codebook provides the following clarification of its liberal democracy index: ‘The liberal principle of democracy emphasizes the importance of protecting individual and minority rights against the tyranny of the state and the tyranny of the majority.’ V-Dem] vs electoral (or nominal) [15In the V-Dem conceptual scheme, electoral democracy is understood as an essential element of any other conception of representative democracy: ‘liberal, participatory, deliberative, egalitarian, or some other.’ V-Dem] democracy. According to V-Dem historical data, [16V-Dem provides a multidimensional and disaggregated dataset that reflects the complexity of the concept of democracy as a system of rule that goes beyond the simple presence of elections. The V-Dem project distinguishes between five high-level principles of democracy: electoral, liberal, participatory, deliberative and egalitarian, and collects data to measure these principles.] Algeria’s electoral democracy score has improved but the gap between electoral and liberal democracy has grown.

This reflects the extent to which Algeria goes through the motions of regular elections, yet the elections lack legitimacy and many of the independent institutions typically associated with democracy are absent or exist in name only. The levels of liberal democracy have largely remained unchanged.

The promise of democracy is therefore unfulfilled, and it is inevitable that frustration among citizens is mounting. The result is a divided government faced with a range of challenging issues, including political legitimacy, economic hardship, social discontent and terrorist threats from both domestic and neighbouring networks. [17A Bendaoudi, Hints of crisis as Algeria enters election mode, The Washington Institute, Policy Watch, 12 December 2018; C Alexander, Anger is spreading in a tinderbox on Europe’s doorstep, Bloomberg Businessweek, 29 July 2020]

Achievements and the problem of subsidies

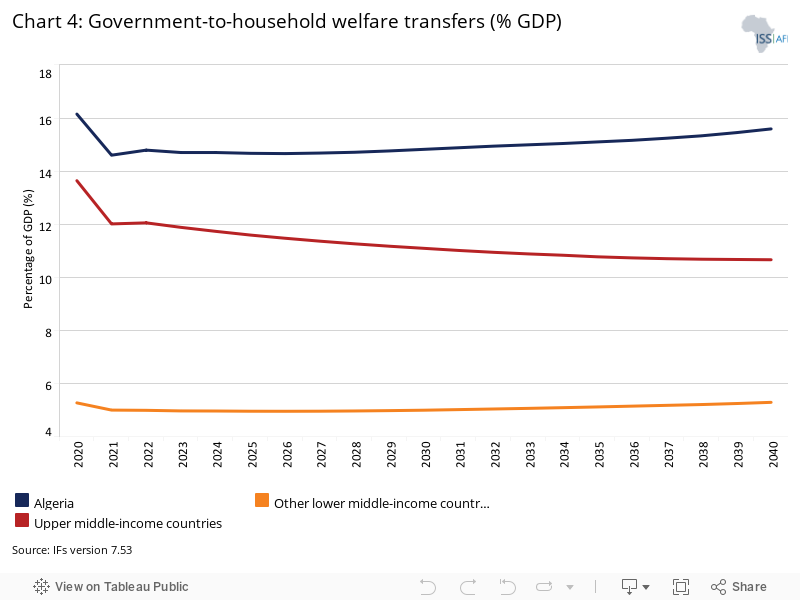

Algeria has a vast system of subsidies through which the GoA has managed not only to provide impressive levels of access to services such as water, sanitation and electricity but also to ensure social stability. [18World Economic Forum (WEF), How Algeria can boost its economy, April 2019]

Budgeted transfers are found in food products, the housing sector and the financial sector through loans at low interest rates. Apart from these explicit transfers, the prices of essentials such as water, fuel and electricity are set well below international market rates and those of neighbouring countries like Tunisia.

However, the associated price distortions have led to large-scale waste and environmental damage and made the cost of transition towards renewable energy sources and diversifying Algeria’s economy both high and painful.

These price distortions also encourage the smuggling of goods, particularly fuel, increase social inequality (since they largely benefit the middle class) and create economic inefficiencies.[19Z Barka and ZE-A Djelil, The sustainability of Algeria subsidies, Groupe de Recherche en Economie des Finances Publiques (GREFiP), University of Tlemcen]

For example, water scarcity has long been a challenge in Algeria and threatens to be further complicated by rapid urbanisation and climate change. Despite climate change and the complexity of water availability and supply, Algeria’s access rate to safe water is at just over 98%, achieved through massive subsidies that discourage conservation efforts.[20Expert data validation workshop, Tunis, September 2019.]

Algeria has one of the lowest water prices in the region, in spite of the scarcity of water and its reliance on expensive reverse-osmosis desalination plants. Since 2003 the GoA has built 11 such plants and started the construction of three new ones with a capacity of 300 000 m3/d each.[21I Magoum, Three seawater desalination plants to be constructed soon, Afrik21, 12 May 2020]

Recent revisions to the water price do not even cover the maintenance costs of existing desalination plants, let alone allow investment in more efficient water management technologies such as the treatment of wastewater.

The country’s water shortage is compounded by the depletion of groundwater reserves, ageing infrastructure, supply and distribution challenges and water quality issues. The available water resources are below the acceptable standards of water potability because the country has not developed a standard policy on desalination technology.[22P Sleet, Water protests in Algeria are giving cause for concern about its long-term stability, Future Directions International, May 2019; JM Dorsey, Desalination technology: Algerian plants highlight the challenges of getting drinking water to a parched region, Science Business, June 2014]

Desalination has also come with negative environmental impacts from the heavy energy consumption required, which contributes to greenhouse gas emissions.[23A Hamiche et al., Desalination in Algeria: Current state and recommendations for future projects, in Z Driss, B Necib and H-C Zhang (eds.), Thermo-Mechanics Applications and Engineering Technology, Cham: Springer, 2018.]

Algeria’s 2015–2019 national development plan earmarked €18.3 billion for water infrastructure projects. But with the persistent drop in oil revenues since 2014, the budget is constrained. Given the GoA’s history of using subsidies to quell potential social unrest, they are likely to continue—unsustainably so.[24A Hamiche et al., Desalination in Algeria: Current state and recommendations for future projects, in Z Driss, B Necib and H-C Zhang (eds.), Thermo-Mechanics Applications and Engineering Technology, Cham: Springer, 2018.]

The recent plunge in oil prices has left the GoA hard pressed to find additional sources of revenue. The country’s large shale reserve is the current focus of government attention. However, shale gas extraction requires a lot of water and protests have already started, leaving the development of shale gas resources uncertain for the foreseeable future.[25L Chikhi, D Zhdhannikov and R Bousso, Exxon’s talks to tap Algeria shale gas falter due to unrest—sources, Reuters, 20 March 2019]

The continued provision of improved sanitation (Algeria’s average access rate stands at nearly 89%) is fundamentally linked to the effective management of water supply.

Algeria has achieved 100% access to electricity but this too is heavily subsidised.

Domestic demand for electricity has been growing at 20% annually since 2010. The GoA has brought additional generation capacity online to keep up with the pace of domestic demand, most of which is provided by natural gas. It plans to introduce renewable energy into the local power market to save more natural gas for export.

To that end, Sonatrach, in partnership with Eni (a private energy entity), opened a 10 MW solar power plant in the Bir Rebaa North oil production facility in November 2018. This initiative sees an off-grid PV system supplying electricity to the treatment facilities, so reducing the amount of power purchased from the national grid.

Additionally, in May 2020 the government announced 4 000 MW solar projects set to cost about €3 billion to provide solar energy for both domestic demand and export.[26Reuters, Algeria plans $3bln solar power projects for home demand and exports, 21 May 2020]

The Renewable Energy and Energy Efficiency Programme adopted in 2011 aims to meet up to 40% of domestic power demand through renewable energy sources by 2030, mostly from solar, with 3% coming from wind. It has since set a new target for approximately 18.5 GW from renewable sources (13.6 GW of solar PV and 5 GW of onshore wind) by 2030.[27D Dib, Renewable Energy and Energy Efficiency Program in Algeria (Investigation and Perspective), May 2012] In 2017, solar voltaic power capacity rose by 83% to 400 MW and generation increased by 50% to 87 GWh.[28Eniday, The story of the future of energy in Algeria]

Despite the plans for an energy shift, Algeria has been slow in implementing its renewable energy programme because of the reliance on fossil fuels and subsidies for energy products (and arguably an oil and gas lobby resisting change).[29Tin Hinane El Kadi, Peer reviewer, London School of Economics, 15 June 2020. The lack of ‘will’ by governments to engage in restructuring efforts is explained by Karl (TL Karl, The Paradox of Plenty: Oil Booms and Petro-States, 1997, University of California Press) as situations of ‘arrested institutional adjustment’, whereby strong rentier constituencies block reforms as they hold vested interests in the existing order. In an influential book (DM Shafer, Winners and losers: How sectors shape the developmental prospects of states, Cornell University Press, 1994), Shafer argues that dominant sectors characterised by capital intensiveness such as minerals and oil create powerful lobbies that pressure state incumbents to maintain the status quo as a prerequisite for their political survival despite long term welfare loss.]

Regulatory and administrative challenges impede the ability of international investors to expand and increase uptake in this sector.[30US Energy Information Administration (EIA), Algeria] ‘Rather than using the oil and petrol wealth to diversify the economy, more than a fifth of Algeria's budget is used for subsidies.’[31Aljazeera, Algeria economy: Where has all the money gone?, 23 March 2019]

There have been efforts to reform subsidies. By 2018 the GoA had raised diesel and gasoline prices by 48% and 54% respectively since the last price adjustment in 2016. Reforms stalled with the reversal of the consolidated fiscal policy in the last half of 2017.[32S Haddoum, H Bennour and T Ahmed Zaïd, Algerian Energy Policy: Perspectives, Barriers and Missed Opportunities, Global Challenges, 2:8, 2018] It was expected that subsidies would again be lowered at the beginning of 2019, but instead the draft budget increased subsidy spending by 7% to account for 21% of the total budget.[33HO Ahmed, Algeria shelves subsidy reforms before presidential elections, Reuters, 16 November 2018]

The GoA raised fuel prices further in June 2020 following the sharp drop in oil prices associated with the impact of COVID-19 on global growth. However, in order to avoid further social unrest, the government has opted to leave food subsidies unchanged.[34L Chikhi, Analysis: Algeria pins hope on oil prices to avert cuts and renewed unrest, Nasdaq, 4 June 2020]

Recently, while discussing the new economic and social revival plan at a cabinet meeting, Tebboune tried to place more emphasis on the private sector and reducing reliance on oil and gas. However, he announced that the government would keep the country’s subsidy policy unchanged.[35HO Ahmed, Algeria prepares new plan to revive economy, reduce dependence on oil, Reuters, 8 July 2020]

The main beneficiaries of most subsidies are civil servants, public corporations and middle-/upper-class households. Generally, subsidies do not benefit poor households but instead perpetuate inequality.

From a regional perspective, heavily subsidising goods creates incentives for cross-border smuggling, terrorism and other illegal activities, as is the case with northern Mali and Tunisia.[36A Boukhars, Barriers versus smugglers: Algeria and Morocco’s battle for border security, Carnegie Endowment for International Peace, 19 March 2019]

Thanks to heavy social spending and its large security establishment, Algeria was able to quell protests during the first wave of the Arab Spring. However, this is unsustainable given its dwindling oil and gas reserves and low prices following the COVID-19 crisis. In April 2020, Algeria’s Saharan blend was trading at US$20 per barrel, US$30 below the budgeted austerity measure for 2020.[37North Africa Post, Oil plunge worsens Algeria’s combustible mix, 22 April 2020]

The state budget is slated for a further 50% cut. These factors make for a potentially disastrous situation in a situation where the social peace is already fragile.[38T Paraskova, Oil price crash forces Algeria to cut state budget by 50%, OilPrice.com, 4 May 2020]

With rising aspirations, citizens are demanding better governance and structural economic reforms. The government does not have the means to effect these and its own initiatives. Its intention to hold a referendum on constitutional amendments to boost freedoms and give Parliament more powers appears to have gained limited traction.[39Xinhua, Algerian presidency reveals draft of amended constitution, 5 July 2020]

At the heart of political and economic reforms must be improvements in overall effectiveness. These consist of providing better quality public services and more civil liberties, eliminating corruption, addressing social inequalities by removing the subsidies benefiting big businesses and state-owned enterprises (SOEs), and opening up the economy to encourage fair and equal participation.[40R Arezki, Reforming Arab economies in times of distrust, Brookings Institute, 17 January 2020] This will require Algeria to envision a new social pact and trust between the regime and its citizens.

Algeria’s population in 2020 was estimated at 43.5 million, of which approximately 90% live along the Mediterranean coast, particularly in the sprawling Algiers metropole.[41World Population Review, Algeria population 2019]

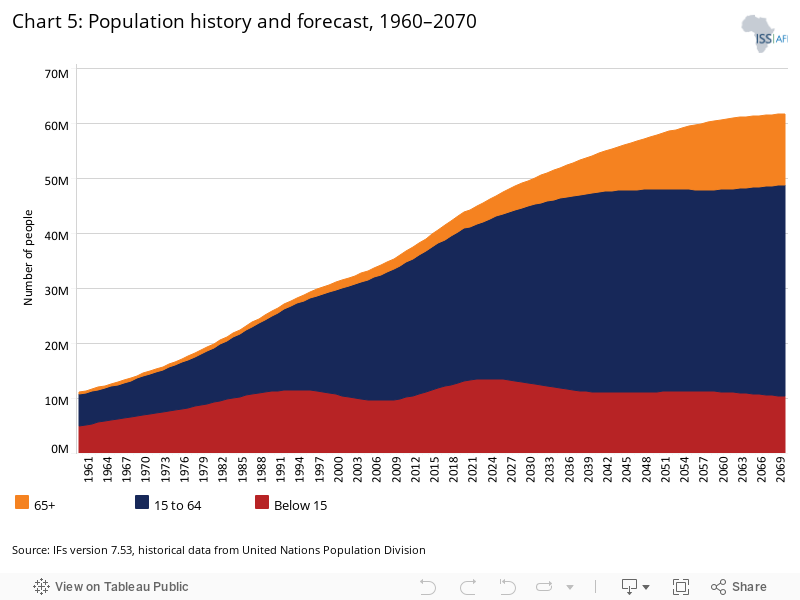

The rate of population growth in Algeria is significantly below the average for countries in the Middle East and North Africa and even further below the average for sub-Saharan Africa. In the Current Path forecast, Algeria will have nearly 54 million people by 2040, which is about a 24% increase over the next 20 years.

Algeria’s population growth rate has been falling since the 1960s owing to declining fertility rates. This is as a result of improvements in levels of female education, use of modern contraceptives and the overall impact of urbanisation.

Algeria’s total fertility rate (TFR) dropped to about 2.6 live births in 2005 but increased slightly to 2.8 in 2010 and is estimated at 2.7 births in 2020. Such an increase in births often accompanies periods of social and political instability.[42I Pool, Demographic Turbulence in the Arab World: Implications for Development Policy, Journal of Peacebuilding & Development, October 2012]The result is a distinct double hump in the population below 15 years of age in Chart 5 (1990–2030) that dissipates over time while older population cohorts grow.

Algeria’s TFR is among the ten lowest on the continent. It is projected to reach the replacement level of 2.1 births by 2035 and then drop below two children per woman after 2040. It will join over 80 developed countries in this stage of demographic transition, where fertility rates fall below replacement levels.

This trajectory will likely present the country with a number of challenges, including increased health spending for its older population and the associated burden of more expensive non-communicable diseases (NCDs), a shrinking economy and possibly declining average incomes per capita. Such an outcome is inevitable if it is not able to invest in and improve the productive structures of its economy through better use of technology.

One contributing factor to Algeria’s modest improvements in income per capita is its relatively low ratio of working-age people to dependants, which peaked in 2009, albeit at a relatively low rate of 2.1. This ratio is currently declining and IFs forecasts that the ratio will bottom out at 1.7 working-age people for every dependant in 2022. It will thereafter increase and peak again at two working-age persons for every dependant shortly before 2040, in line with the shifts in fertility rates discussed previously.

Generally, countries experience more rapid economic growth if the ratio of working-age persons to dependants is 1.7 and above.[43J Cilliers, Getting to Africa’s demographic dividend, Institute for Security Studies (ISS), Africa Report, 31 August 2018] Most European and North American countries have not experienced the high ratios of China and the Asian Tigers (peaking at 2.8) but have kept the ratio of working-age people to dependants above 1.7 over an extended period of time—a ratio that Algeria is projected to maintain until 2051.

Although Algeria has a favourable working-age population, unemployment remains high and female labour participation is well below that of its peers, by about 20.5 percentage points at an estimated 18.5%. This gap is currently projected to persist well beyond 2040. It is imperative that the government finds a mechanism to include this large and relatively youthful working-age proportion of the population in the economy.

In the second half of the century, the country will be faced with a declining working-age population. Algeria will need to invest in technologies that allow for improvements in productivity as its labour force shrinks as a portion of the total population. It will also need to attract significantly higher levels of investment to offset the decline in the contribution that labour makes to growth.

Chart 6 compares the ratio of working-age people to dependants in Algeria with the averages in OLMICs, UMICs and sub-Saharan Africa.

About 74% of Algeria’s population (32 million) lives in the urban areas of the coastal plain. This share is projected to increase to roughly 82% (44 million) by 2040.

Generally, North Africa is the most urbanised region in Africa and has relatively fewer informal settlements in its towns than sub-Saharan Africa. This dynamic is typically attributed to better urban development strategies, but it is also influenced by the inhospitable desert climate in its southern regions.[44J Cilliers, Getting to Africa’s demographic dividend, Institute for Security Studies (ISS), Africa Report, 31 August 2018]

High rates of urbanisation and investments in basic infrastructure have translated into high rates of access to public services.

Finally, the ratio of the population aged between 15 and 29 relative to the total adult population is considered a factor in social instability, particularly a large youthful male population.[45H Weber, Demography and Democracy: The Impact of Youth Cohort Size on Democratic Stability in the World, Democratization, 20:2, 2013] Generally, the larger this youth bulge, the more prone a country is to protests and riots in the absence of socio-economic opportunities.

Algeria’s youth bulge peaked in the 1980s (52%) and may have contributed to the bread riots in 1988 and their aftermath (see Chart 7). It remained above the average of OLMICs until around 2011, after which it started to decline rapidly. At the time of the Arab Spring in 2011, the share of the population between 15 and 29 years had dropped to 41% of Algeria’s population.

Today Algeria’s youth bulge stands at just over 30%, which is significantly different from that of sub-Saharan Africa (48%), which has a much larger youth bulge. This phenomenon should moderate the demographic tendency for instability in Algeria.

Increasing unemployment, poor quality of education, lack of economic opportunities and decades of strife and instability have resulted in disenchantment and, sometimes, the radicalisation of youth. In fact, several hundred young male Algerians left the country to fight the jihad (holy war) against the Soviet Union in Afghanistan in 1989 as part of a proxy war against the GoA’s most important foreign ally. The subsequent return of these battle-hardened veterans reinvigorated terrorism in Algeria. [46J Cilliers, Violent Islamist extremism and terror in Africa, ISS, Paper 286, 1 October 2015]

In response, the Algerian government implemented a successful campaign of amnesty and reconciliation, as well as tighter security and comprehensive deradicalisation programmes to prevent violent extremism from taking root. Radical movements now appear to have lost their appeal among the youth and as a result fewer Algerians have joined the Islamic State (ISIS) in the recent past.[47Expert workshop, Tunis, 9–11 September 2019.]

More young people are now using drugs to cope with their socio-economic frustrations.[48J Ben Yahia and R Farrah, Algerian cocaine bust points to alarming trends, ENACT Observer, 10 December 2018] Additionally, to escape their grim prospects, both legal and illegal, migration is a widespread phenomenon.

There is no reliable data on the number of Harraga (Algerian neologism for irregular immigration to Europe) fleeing the country every year, but Algeria is also losing a share of its human capital through legal migration. It is estimated that over 14 000 Algerian medical doctors currently work in France, for example. This brain drain reinforces the vicious cycle of poverty.[49Tin Hinane EL Kadi, Peer reviewer, London School of Economics, 15 June 2020.]

The World Bank now uses US$3.20 and US$5.50 (2011 US$, purchasing power parity) per person per day to measure extreme poverty in lower middle- and upper middle-income countries, respectively.

Algeria has achieved significant income-poverty reduction in the last two decades. In terms of human development, it is among the 20 countries on the continent to have achieved the most substantial decrease in their Human Development Index deficit between 1990 and 2015.

The country now has inclusive, albeit low-quality, social services (universal education and healthcare, and subsidised food, housing and public transportation). These policies have lessened inequality, although sub-national and regional differences remain significant.[50United Nations Economic Commission for Africa (UNECA), Country Profile: Algeria, 2016]

Although Algeria’s subsidies and transfers have reduced poverty, they have also created other social and regional inequalities owing to inefficient and poor targeting of subsidy items.[51A Jewell, The need for subsidy reform in Algeria, International Monetary Fund (IMF), 31 August 2016] These disparities manifest in significant inequalities in consumption rates with a gap of nearly 28% between the rich and the poor.[52World Bank, Poverty has fallen in the Maghreb but inequality persists, 17 October 2016]

The benefits are also not divided fairly between regions. For example, there is twice as much poverty in provinces in the Sahara, and three times the national average among people living in the Steppe ecological region.[53World Bank, Poverty has fallen in the Maghreb but inequality persists, 17 October 2016] The coastal regions and the north are the hub of economic activity and experience significantly lower rates of poverty than the arid south.[54UNECA, Country profile: Algeria, 2016]

IFs estimates that about 2% of Algeria’s population currently lives on less than US$3.20 per day. This represents fewer than 1 million people. According to the UN Development Programme, roughly 5.5% of Algerians are surviving on an income below the national poverty line.[55United Nations Development Programme (UNDP), Human development reports: Algeria 2019]

The Multidimensional Poverty Index (MPI) shows that only 2.1% of Algerians were estimated to be multidimensionally poor in 2019, i.e. they were deprived of at least one-third of the weighted MPI indicators. Deprivation in education contributes the most to the index (46.8), followed by health (29.9) and standard of living (23.2). Unemployment coupled with declining oil prices will, however, make tackling poverty and inequality a serious challenge in the future.

After independence from France in 1962, Algeria embarked on a concerted effort at Arabisation and Islamisation that sought to displace the dominant role of French and French culture in the country.[56CS le Roux, Language in Education in Algeria: A Historical Vignette of a ‘Most Severe’ Sociolinguistic Problem, Language & History, 60:2, September 2017] Compulsory basic education was introduced in the 1970s, and the country’s enrolment levels have improved significantly since then.

The government invested heavily in expanding access to education. In 1990, for example, the education sector received almost 30% of the national budget. [57HC Metz (ed.), Education, in Algeria: a country study, Washington: GPO for the Library of Congress, 1994] As a result, the country’s literacy rate currently stands at about 78%, compared to under 50% in the 1980s.

Algeria is also considered to have achieved universal primary education with a 97% net enrolment rate in 2015. [58World Bank, Algeria: Country overview] Today Arabic is the language of instruction from primary to secondary school. At tertiary level, hard sciences are taught in French.

The average years of education in the adult population is a good first indicator of the stock of knowledge in society. Improvements in the average years of education slowed down in Algeria from 1995 at the height of the civil war and only began an upward trajectory again after 2005.

The average years of education for adults aged 15 and over is currently 7.6 years and will improve to 9.2 years by 2040. This is almost a year above the average for OLMICs and 1.6 years below the average for UMICs.

Education can be conceptualised as a pipeline. The more learners a country can enrol in primary school, the more learners will complete that level and so become eligible for secondary and tertiary education. Bottlenecks or leakages at any stage in the system hamper efforts to grow the overall stock of education, with negative implications for improvements in human capital.

Although Algeria has achieved universal primary education and generally records good educational outcomes, there are significant leakages in its secondary system, particularly in upper secondary. Here completion rates are 11 percentage points below the average for OLMICs (see Chart 8). The continuous but flawed reforms in the education sector are behind some of these leaks.[58World Bank, Algeria: Country overview]

|

Chart 9: Definitions in Education Analysis in this section is done according to the UNESCO Institute for Statistics classification of primary, lower and upper secondary education schooling. UNESCO does not currently include/gather data on pre-primary education.[59IFs uses the UIS International Standard Classification of Education (ISCE) codes. See UNESCO Institute for Statistics, International Standard Classification of Education ISCED 2011] Gross enrolment rate: The number of learners enrolled at a given level of education, regardless of age, expressed as a percentage of the official school-age population corresponding to the same level of education. Rates can therefore be above 100%. Completion rate: The number of people in the relevant age group who have completed the last grade of the given level of education, as a percentage of the population at the theoretical graduation age for the given level of education. |

Like many African countries, greater access to education in terms of number of learners enrolled has come at the cost of quality and relevance. Educational reforms stalled under Bouteflika, and education modernisation appears to have halted as rote learning predominates.[60H Saleh, State education: Bias towards rote learning stifles critical thinking, Financial Times, 20 October 2013]

The quality of education in Algeria lags behind that in UMICs, including in Africa, but is above the averages for OLMICs. The challenges include shortages in educational resources such as teachers, issues with the language of instruction and poor infrastructure.

Reforms to improve quality of education were introduced in 2003, and included new teaching methods, restructuring of the curriculum and an ongoing switch in the language of instruction from French to Arabic. Despite these reforms, the UN special rapporteur reported in 2015 that the quality of education in Algeria was low, citing inadequate teacher training and overcrowding in classrooms as key factors.[61Oxford Business Group, Algeria overhauls teaching methods and increases funding]

In 2008, private higher institutions were authorised to operate. [62Lois, Journal Officiel De La République Algérienne, February 2008] There has been a significant shift towards and greater support for these institutions since 2018 in an effort to alleviate some of the pressure on the free government-sponsored public education system.

The language of instruction at various educational levels also plays a big role in the ‘quality’ of graduates. In September 2019, Algeria’s higher education minister introduced a proposal to switch from French to English in teaching and research. This reform aims to increase the visibility of research in higher education institutions and to open it up to the international environment in the belief that English is the language of the ‘knowledge economy’.[63E Fox and R Mazzouzi, Algeria’s higher education minister encourages switch from French to English, Al-Fanar Media, 3 September 2019]

There is also a disconnect between the current demands of the job market, future prospects for the Fourth Industrial Revolution (4IR) and the education system.[64A Nagazi, Reading the shortcomings of the Tunisian educational system, World Bank blog, 30 October 2017]

Algeria has not fully achieved gender parity, with female gross enrolment below that of males. However, it does better than most sub-Saharan countries. The situation is significantly worse in rural areas and the obstacles often cited include socio-cultural limitations on girls’ potential, remote schools and domestic chores.[65A Nagazi, Reading the shortcomings of the Tunisian educational system, World Bank blog, 30 October 2017]

Trends do show that beyond age 16, which is the age up to which education is compulsory, girls stay in school longer than boys and do better in getting high school diplomas and proceeding on to higher education. As a result, at higher levels of education Algeria has seen an inversion of the gender imbalance in favour of women.[66O-B Zahia, Gender Inequity in Algeria: When Inequalities are Reversed, Journal of Education and Social Policy, 5:2, June 2018] The ratio of females to males is more than 1.5 to 1 at the tertiary level.

To prepare for the 4IR, countries need to invest in science, technology, engineering and mathematics (STEM), and commit to life-long learning and education that encourages entrepreneurship. An encouraging trend in Algeria is that the number of learners enrolling in vocational training has risen in the recent past.[67The 2015/16 enrolment was estimated to have increased by 14%. See Oxford Business Group, Efforts to improve educational infrastructure and technical skills in Algeria]

In addition, the per cent of learners studying STEM fields in tertiary school is higher in Algeria (9.1%) than what would be expected for its level of development (2.6%).[68Expert workshop, Tunis, September 2019.] In 2018, for example, women accounted for 41% of STEM graduates.[69O Khazan, The more gender equality, the fewer women in STEM, The Atlantic, 18 February 2018] This mismatch between the skills of the labour force and the needs of the market is one of the reasons for high unemployment rates in the country.[70Tin Hinane El Kadi, Peer reviewer, London School of Economics, 15 June 2020.]

Free healthcare was introduced in Algeria in 1974. In 1984, the government introduced reforms that shifted the health system from a curative to a preventive one more suited to its then youthful population with high levels of communicable diseases. The results were impressive. For example, compared to 1970, when the infant mortality rate was 106 per 1 000 live births, by 1990 it had fallen to just 41. In 2020, Algeria’s infant mortality rate is estimated at roughly 22 and by 2040 it is forecast to drop to 17 deaths per 1 000 live births.

Under current policies, Algeria will not achieve the aspirational objective of the Sustainable Development Goals (SDGs) to end preventable deaths of newborns and children under five by 2030.

Although the country has continued to invest in its health sector, it faces considerable pressure as its ageing population needs inherently more expensive care for NCDs. This is complicated by a shortage of healthcare professionals and social inequalities in the country.[71N Mahfoud and B Brahamia, The Problems of Funding the Health System in Algeria, International Journal of Medicine and Pharmaceutical Sciences, 4:2, April 2014]

Currently, life expectancy at birth in Algeria is estimated at 77.6 years. By 2040 it is projected to reach 80—significantly higher than that for OLMICs, UMICs and Africa.

Algeria’s maternal mortality ratio is currently estimated at 129.7 per 100 000 live births and the country is on track to achieve the SDG target of fewer than 70 deaths per 100 000 live births in around 2033.

Deaths from communicable diseases are low when compared to sub-Saharan Africa. ‘Other communicable diseases’[72Catch phrase for other communicable diseases that are not prevalent enough to be categorised on their own.] are more common among infants while respiratory infections are more prevalent in the older cohorts.

Given the heavy burden of NCDs and the associated comorbidities of COVID-19, Algeria’s population is at a relatively high risk of developing severe complications related to COVID-19.[73Wie-Jie et al, Comorbidity and Its Impact on 1590 Patients with COVID-19 in China: A Nationwide Analysis, European Respiratory Journal, 55:5, 2020] The pandemic is stretching the country’s health system and resources at a very vulnerable time.

Injuries as a result of road traffic accidents, although declining, are also more common with males, especially 15–39 years. In 2019, an estimated 3 275 people were killed in road accidents.[74MENAFN, Road accidents kill 3 275 in Algeria in 2019, 18 January 2020]

Chart 10 shows that NCDs will increase in the foreseeable future in Algeria and the country will need to invest in the associated health system, facilities and diagnostics.

Owing to the vast expanse of the Sahara Desert, Algeria has only about 8.4 million ha of arable land—less than 4% of the total land area. Just over 50% of arable land is dedicated to the cultivation of crops, mostly cereals and pulses.

In 2016, the sector was estimated to employ nearly 20% of the rural population. Approximately 70% of farming activities are small-scale and families depend on farming for food security, but productivity is low.[75Food and Agriculture Organization (FAO), Family Farming Knowledge Platform: Algeria]

The sector contributes a modest 11–12% of GDP, having declined in importance after independence as successive governments favoured industrialisation.[76Tin Hinane El Kadi, Peer reviewer, London School of Economics, 15 June 2020. After independence Algeria’s industrial policy was based on an import substitution industrialisation (ISI) strategy and focused on the promotion of unbalanced growth, favouring heavy manufacturing over agriculture and investment over consumption.] Lack of investment, years of government restructuring, limited water resources and dependence on rainwater, and state-controlled land ownership policies have constrained improvements in agricultural production.[77Encyclopedia of the Nations, Algeria: Agriculture]

Although agriculture’s contribution to GDP is projected to decline steadily out to 2040, the sector’s absolute contribution (estimated at €40.9 billion in 2020) is forecast to increase to €50.2 billion by 2040.

Through various National Agricultural Development Plans (PNDAs) since 2000, agricultural yields have improved although the sector is generally less productive than that of its income peers. Algeria’s average yield of 3 metric tons per hectare is closer to the average for low-income African countries (2.6 tons per hectare) than the rest of lower middle-income Africa (5.2 tons per hectare).

Algeria’s heavy reliance on commodity exports (aka the Dutch disease) makes agriculture and manufacturing less competitive.[78Tin Hinane El Kadi, Peer reviewer, London School of Economics, 15 June 2020]

Moreover, global warming is causing serious drought concerns in the region. The year 2020 has been marked by below-average rainfall, with pockets of drought constraining yields.[79OCHA-ReliefWeb, GIEWS Country Brief: Algeria, 30 April 2020]

Although Algeria’s yields are projected to improve to 3.6 metric tons by 2040, they will still be significantly below the average for OLMICs and UMICs. Currently the gap is 3.7 and 4.7 metric tons respectively, which will stay more or less the same until 2040.

Since there is limited scope to increase land under cultivation, intensification is the most viable pathway to improve efficiency in agriculture. This involves increasing land under irrigation, using better seeds and fertilisers, and introducing modern farming practices, including urban, indoor and vertical farming.

Additionally, reductions in loss and waste from production to consumption could help to meet food demand.

Because of poor yields, agricultural demand has outstripped supply since the 1970s, making Algeria heavily dependent on food imports. According to the Algerian Customs’ National Centre of Data Processing and Statistics (CNIS), in 2017 the country imported foodstuffs worth about €6.7 billion, reflecting a 3% increase from 2016.[80Global Islamic Economic Gateway, Algeria’s food imports increase, January 2018]

This heavy import dependence exposes the country to disruptions in international supply chains, price shocks and other related risks. This is particularly becoming evident with the COVID-19 crisis amid the depletion of the country’s foreign reserves.

Algeria thus faces an interlinked double risk of commodity vulnerability: one from food imports and a second from hydrocarbons. A slump in oil prices from over US$100 a barrel in 2014 to roughly US$20 in 2020 has left it struggling to fund its approximately €46 billion annual import bill, of which food comprises about 20%.

Chart 11 shows the excess demand for crops that is likely met through imports.

Water is under great stress. It is central to agriculture - the sector that also uses the most water (5.4 km3 of total water demand of 8.3 km3). This is despite the fact that Algeria straddles large non-renewable fossil water reserves that were vigorously exploited in neighbouring Libya before the civil war.

Currently, Algeria withdraws about 1.7 km3 fossil water, while about 11% of its water supply is from expensive desalination plants. It is therefore ironic that it is one of the most wasted resources in the country owing to the subsidy policies. Subsidised electricity (which also stalls the transition to cleaner energy)[81Tin Hinane El Kadi, Peer reviewer, London School of Economics, 15 June 2020; Subsidies in traditional sources of energy stall the transition towards cleaner sources of energy. State subsidies of electricity generated by fossil fuel create a disincentive to move towards solar energy. The government should accelerate its energy transition by decreasing its subsidies of traditional energy sources and supporting renewable energies.] is used to produce desalinated water, to which a second round of subsidies is then applied.

In turn, any food wastage squanders all the previous energy and water inputs that went into its production, cultivation, processing and packaging. It is very likely that the current water subsidy policy is unsustainable[81Tin Hinane El Kadi, Peer reviewer, London School of Economics, 15 June 2020; Subsidies in traditional sources of energy stall the transition towards cleaner sources of energy. State subsidies of electricity generated by fossil fuel create a disincentive to move towards solar energy. The government should accelerate its energy transition by decreasing its subsidies of traditional energy sources and supporting renewable energies.] and the Current Path forecast is that water prices will increase through 2040.

Apart from a difficult agricultural ecosystem, North Africa is highly vulnerable to the impact of climate change, which is expected to significantly undermine water supplies and food security, in turn threatening regional stability and creating security concerns.[82S Haddoum, H Bennour and T Ahmed Zaïd, Algerian Energy Policy: Perspectives, Barriers and Missed Opportunities, Global Challenges, 2:8, 2018]

|

Chart 12: Impact of climate change In July 2018 the people of Ourgla, Algeria experienced the hottest temperature ever reliably recorded in Africa, at 51.3 °C.[83J Samenow, Africa’s record high temperature likely set as city in Algeria hits 124 degrees, The Washington Post, 6 July 2018] Analysis of climate data from 1931–1990 shows that northern Algeria has already recorded a temperature rise of 0.5 °C and could see an increase of 1 °C by 2020,[84F Sahnoune et al., Climate Change in Algeria: Vulnerability and Strategy of Mitigation and Adaptation, Energy Procedia, 36, 2013] while rainfall will reduce by 5–13%.[6] A 2 °C rise is expected by 2050.[85T Mohammed and AQ Al-Amin, Climate Change and Water Resources in Algeria: Vulnerability, Impact and Adaptation Strategy, Economic and Environmental Studies, 18:1, 45/2018, 411–429.] Rising temperatures associated with climate change will reduce the area of land available for agriculture, shorten the length of growing seasons, reduce yields, and affect freshwater availability and population growth. The expected drop in annual precipitation will aggravate these effects. Studies show that sea-level rise, droughts and floods are also direct threats. They will potentially affect livelihoods and have devastating socio-economic impacts. Sea-level rise will likely have a negative impact on livelihoods along the coast, where the main economic and social activities are concentrated. Nearly 69% of Algeria’s population lives within 100 km of the coast. Apart from disruption in incomes from activities such as tourism, rising sea levels and the impact of storms will cause considerable population displacement.[86T Al-Olaimy, Climate change impacts in North Africa, ECOMENA, 30 August 2017] Climate change will have cross-cutting effects beyond agriculture and should be taken into account in development planning in Algeria. |

Climate change’s possible impacts in North Africa are not fully understood, but what is clear is that many factors interact and amplify other drivers and impacts. Nonetheless, the relationship between climate change, stresses on natural resources and increased risk of internal conflict is well established.[87CE Werrell and F Femia, Climate change raises conflict concerns, The UNESCO Courier, 2018–2]

Algeria’s economy is heavily dependent on the hydrocarbon industry, although the service sector dominates in its contribution to GDP. Oil and gas account for nearly 30% of GDP, 65% of budget revenues, more than 85% of exports and an estimated 95% of Algeria’s foreign currency receipts.[88S Elliot, Algeria’s new hydrocarbon law comes into force amid output slump, S&P Global Platts, 6 January 2020; H Saleh, Algeria faces economic crunch as oil and gas revenues fall short, Financial Times, 24 March 2019]

Because of this hydrocarbon dependence, Algeria recorded multiple bouts of negative growth rates from 1986 to 1994 linked to dropping oil prices and periods of domestic instability. Since 2014, low oil prices, political instability, unemployment and widening fiscal and external deficits have undermined the economy.

In 2017, the government designed a fiscal consolidation policy to reduce public spending in light of its budget deficit. Its reversal in the second half of the year has since led to an even higher-than-expected current account deficit at 8.2% of GDP, particularly because of subsidies and transfers, wages[89IMF, Algeria Country Report No. 18/168, June 2018] and depletion of foreign exchange and savings.

Continued spending at the current level, along with low oil prices, is expected to deplete official foreign exchange reserves by 2024 and lead to rapidly increasing public debt.[90S Constable, Economic disaster threatens Algeria as oil revenues sink, Forbes, 28 February 2019] This timeline could accelerate given the impact of the COVID-19 pandemic on the Algerian economy.

The country’s economic challenges are worsened by its closed and state-controlled economy (in spite efforts to grow the private sector and economic liberalisation in the early 1990s). It is characterised by a lack of competition, high barriers to entry in the most productive and labour-intensive sectors, a weak legal and judicial system, and cronyism. Other issues are social exclusion, high public employment and universal [91Meaning there is a single subsidised price with no restrictions on consumption.] consumer subsidies that draw resources away from effective and diversified sustained growth.[92R Arezki, How Algeria can boost its economy, WEF, 11 April 2019]

Algeria recorded an average annual GDP growth of 2.8% between 1980 and 2010. IFs projects that it will achieve an annual average growth of about 1.9% between 2020 and 2040, roughly 2.7 percentage points below that of OLMICs.

This growth rate is optimistic given the shadow cast by the COVID-19 pandemic on future prospects.

On 14 April 2020, the IMF released its most recent growth forecast of Algeria at -5.2% in 2020. The World Bank estimates growth of -6.4% in the same year and 1.9% in 2021 on the assumption that the pandemic would fade in the second half of 2020.[93The IMF’s growth forecast of 6.2% in 2021 is probably unrealistic.]

Algeria’s oil and gas sector performs poorly. It scores 33 out of 100 points and ranks 73rd out of 89 countries in the 2017 Resource and Governance Index, which measures the quality of governance in the oil, gas and mining sectors.[94Natural Resource Governance Institute, Algeria: Oil and gas] Moreover, the increasing energy independence of countries like the US, global efforts to fight climate change and the transition to renewable forms of energy have created more uncertainty.

Apart from low prices and uncertainty around the hydrocarbon industry, Algeria is also struggling with reduced production from ageing oil fields and a hostile investment climate, which impedes new exploration and production activities.[95C Sertin, Algeria fights to grow upstream sector, Oil & Gas Middle East, 10 March 2020]

According to S&P Global Platts data, oil production has been falling over the last few years. It averaged about 1.03 million b/d [96b/d = barrels per day.] between January and November 2019, the lowest daily average since 2002. In January 2020, a new hydrocarbon law designed to reverse declining foreign investment through tax cuts of up to 20% and improved contract terms came into force.[97S Qekeleshe, Algeria passes new hydrocarbons law, Africa Oil & Power, 20 November 2019]

Most recently, Algeria's focus in the energy space has been on natural gas. With the discovery of recoverable reserves of shale gas, it appears the country has shifted its long-term strategy to shale gas development. Although this might sustain it in the short to medium term, it is not consistent with the country’s efforts to diversify and insulate itself from shocks associated with natural resources dependence.[98T Boersma, M Vandendriessche and A Leber, Shale gas in Algeria: No quick fix, Brookings Institute, Policy Brief 15-01, November 2015]

The high dependence on hydrocarbons, stifling bureaucracy and the closed nature of the country’s economy mean that Algeria’s economy is not diversified enough, although there have been recent improvements.

The economy is less sophisticated than expected for its level of income and as a result it is projected to grow slowly.[99Atlas of Economic Complexity, Algeria] Because of restricted markets, foreign direct investment (FDI) has also been deterred sectors such as tourism and hospitality that could increase employment.[x]

Restructuring the economy, for example through infant industry protection of non-hydrocarbon sectors, could generate wealth and unlock greater employment opportunities, especially for young people. The Atlas of Economic Complexity Index indicates that the country has potential for diversification in industrial machinery and plastics.[100Atlas of Economic Complexity, Algeria: Algeria’s product space]

Per capita income in Algeria has more or less stagnated since 1980. Although per capita income is expected to improve from €12 608 in 2020 to €14 112 by 2040, the average income in the country will continue to fall further behind that of UMICs, and remain on a convergence path to the OLMICs average. This alarming trend indicates that the gap between average income for Algeria and its international peers will grow.

Current and projected economic growth rates are therefore insufficient and translate into slow income growth in Algeria.

In 2018, the unemployment rate was estimated at over 12%[101IMF, Algeria Country Report No. 18/168, June 2018] and largely affected the youth (29%), women (19.4%) and university graduates (18.5%). The pandemic will also likely increase unemployment. Historically, high rates of unemployment reflect the mismatch between market demand and labour supply.[102Lloyds Bank, Algeria: Economic and political overview]

Algeria also has a large informal and parallel economy. Informal activity is here defined as any activity that is not declared to the social security system, a legal obligation in the country.

According to 2017 data, about 6.2 million Algerians were not registered with the social security system and only about 4.2 million benefitted from it. About 57% of Algerians are thus engaged in the informal economy,[103M Saiib Musette, Critical views on the informal economy in Algeria: Eradication or integration?, Center for Research in Applied Economics for Development, 5 June 2019] which is estimated to contribute about 40% to GDP.[104M Saiib Musette, Critical views on the informal economy in Algeria: Eradication or integration?, Center for Research in Applied Economics for Development, 5 June 2019]

The informal economy also acts as a safety valve to reduce unemployment and provide some degree of sustenance. S Mohamed estimates that between 2000 and 2017 the informal economy helped to cut unemployment from 30% to 12%.[105M Saiib Musette, Critical views on the informal economy in Algeria: Eradication or integration?, Center for Research in Applied Economics for Development, 5 June 2019]

In the long run, a large informal sector is, however, detrimental to the overall functioning of the economy, given its limited contribution to taxes and low levels of productivity compared to the formal sector.

In addition to ongoing efforts to grow its manufacturing base and expand the role of the private sector, it is important for Algeria to find ways to gradually integrate the informal economy into the formal sector with the least friction possible. This can be done through policies and legislation that reduce barriers to entry and embrace localised and flexible procedures. Critical to this integration is the decriminalisation of parts of the informal economy by distinguishing between illicit and informal activities.[106M Saiib Musette, Critical views on the informal economy in Algeria: Eradication or integration?, Center for Research in Applied Economics for Development, 5 June 2019]

Hydrocarbons (petroleum gas, crude petroleum and refined petroleum) dominate Algeria’s exports. According to the most recent data in 2017, they accounted for 94% (€37.4 billion) of total exports, while semi-finished products accounted for 4.5% of the rest of exports.

Algeria’s trade balance was historically positive but started showing a deficit in late 2012. The trade deficit jumped from €15.7 billion in 2015 to €17.4 billion in 2016.[107Oxford Business Group, Algeria’s economy on stable footing and demonstrating great potential] In 2017 it stood at about €9.5 billion.[108OEC, Algeria]

Imports are largely controlled by politically connected corporate barons who get tax holidays, energy subsidies and credit from state-owned banks to expand their businesses.[109H Saleh, Algeria’s corporate barons cast themselves as saviors of economy, Financial Times, 11 July 2018] Because they are entrenched and incentivised to import, they effectively prevent the industrialisation of Algeria.[110Expert opinion interview by Jalel Harchaoui, 21 October 2019; TH El Kadi, Upgrading or buying time: Oil rents, economic transformation and political survival in Algeria, Friedrich Ebert Stiftung, April 2020]

In 2018, the GoA imposed temporary restrictions on imports to protect foreign currency reserves and incentivise local production and diversification.[111L Ghanmi, Algeria must reckon with distortions of undiversified economy after import ban, The Arab Weekly, 4 March 2018] In light of the COVID-19 pandemic, the government introduced additional restrictions on imports in 2020 and committed to reduce imports by $6 billion. The aim is to cap imports at $30 billion in 2020.[112I Kimouche, Coronavirus: Algeria’s imports to reduce to $6b within 90 days, Echorouk Online, 23 March 2020]

As a result of a 2005 free trade agreement, most of Algeria’s trade is with the European Union (EU). This is in spite of the fact that its trade complementarity with the Maghreb region is virtually identical with that of Europe and, in some instances, better. For example, instead of trading with Mauritania and Morocco, where Algeria’s trade complementarity index was higher in 2016, it mostly traded with Italy.

Trade within the North African region is limited and Algeria’s poor export performance reflects this. In fact, the Maghreb is the least economically integrated bloc in the world with a share of intra-regional trade of only around 5% of total trade.

The lack of regional integration is a significant obstacle to diversification and growth for countries in the region. A mere 4% of Algeria’s trade is within the Maghreb and the 1 600 km border between Algeria and Morocco has been closed since 1994, reflecting the extent to which fraught political relations in the region determine economics.[113AP Kireyev et al., Economic Integration in the Maghreb: An untapped source of growth, IMF, Departmental Paper 19/01, 13 February 2019, 14]

In a 2019 IMF report on how economic integration could accelerate growth in the Maghreb, the authors point to the lack of regional considerations on trade and the restrictions on trade and capital flows that constrain regional integration.

The report lists the myriad economic benefits that would flow from such integration. These include attracting FDI, easing the movement of capital and labour, ensuring more efficient resource allocation and making the region more resilient to external shocks and market volatility. However, except for Morocco, instead of increasing, regional trade openness has steadily declined and traders face significant hurdles.[114AP Kireyev et al., Economic Integration in the Maghreb: An untapped source of growth, IMF, Departmental Paper 19/01, 13 February 2019, vii and 7]

Source: IMF[115AP Kireyev et al., Economic Integration in the Maghreb: An untapped source of growth, IMF, Departmental Paper 19/01, 13 February 2019, 12]

Note: Size of the nodes is proportional to total exports; width of the arrows is proportional to the size of the flow

Despite (and perhaps because of) the limited formal trade within North Africa, there is evidence of significant volumes of informal trade with Tunisia and Mali. This informal trade is facilitated by the associated topography—mountains and deserts that offer ample opportunities for illicit activities. Gasoline is ten times cheaper in Algeria than in Tunisia and informal traders benefit from this disparity at the expense of tax revenues.

Tax and subsidy differentials are the main drivers of the considerable unregulated and informal trade between Algeria and its neighbours.[115AP Kireyev et al., Economic Integration in the Maghreb: An untapped source of growth, IMF, Departmental Paper 19/01, 13 February 2019, 12]

Similarly, there is evidence of significant informal trade between Algeria and Mali despite the closure of the 1 300 km border between the two countries since 2013. As a result of the cross-border trade between southern Algeria and northern Mali, the area benefits from lower prices than if goods came from the south of Mali. This phenomenon partially explains the lower poverty levels in the north of Mali, particularly in and around Kidal.[2]

While trade with its North African neighbours stagnates or takes the form of informal and illegal trade, Algeria will be phasing out its tariffs as part of its free trade agreement with the EU. The agreement was meant to take effect in September 2020 if it were not able to renegotiate the terms.

The EU is Algeria’s largest trading partner, and it is the EU’s third-largest supplier of natural gas, after Russia and Norway. In return, Algeria imports machinery, transport equipment and agricultural products.[116AFP, Algeria wants to ‘reassess’ EU trade deal, ENCA, 10 August 2020]

Given its proximity to the EU and the proposed free trade zone, it seems unlikely that Algeria will be able to pursue a manufacturing-growth path without significant asymmetrical trade arrangements with the largest economic bloc globally.

Algeria attracts significantly lower levels of FDI as a per cent of GDP compared to the averages for OLMICs and UMICs.[117L Ghanmi, Algeria lags behind neighbors in attracting foreign direct investment, The Arab Weekly, 1 July 2018] This gap has steadily widened. The stock of investment as a per cent of GDP in Algeria is nearly three times lower than the average for UMICs and only 42% of that in OLMICs.

Since the Arab Spring, FDI from Europe into Algeria and the region has dropped, although Gulf investors have shown greater interest. China has also increased its investments in Algeria over the past two decades, recently taking over France's historical position as the largest investor mainly in the construction and mining sectors. Algeria is a close ally of Beijing and the two countries have a strategic partnership.[117L Ghanmi, Algeria lags behind neighbors in attracting foreign direct investment, The Arab Weekly, 1 July 2018]

According to UNCTAD’s World Investment Report 2019, FDI inflows fell from roughly €1.4 to €1 billion between 2016 and 2017 but improved to €1.3 billion in 2018. The stock of FDI was estimated at a meagre €27 billion in 2018.

The World Bank ranked Algeria 157th out of 190 countries in its Doing Business 2020, which measures aspects of business regulation and their implications for firm establishment and operations.[118Santander Trade Portal, Algeria: Foreign investment, October 2019]

Numerous regulatory and practical hurdles constrain FDI in Algeria. The World Economic Forum [119R Arezki, How Algeria can boost its economy, WEF, 11 April 2019] lists impenetrable markets, protectionism, corruption, weak and overregulated digital and e-commerce economy, weak intellectual property laws and bureaucracy as obstacles to investment.

Algeria has also been protecting and promoting SOEs, which generally lack managerial independence, efficiency and accountability and place a burden on the national budget through contingent liabilities. A shakeup of SOEs and promotion of the private sector are key requirements if Algeria is to grow faster.

There are signs of progress: improved investment laws and plans for diversification are outlined in the Complementary Finance Law of 2020. This law removes the application of the 51/49 investment rule on domestic ownership of foreign business and cuts corporate taxes for investment in certain locations. It also provides for concession of land by mutual agreement and tax exemptions throughout the life of exporting projects.[120Ernst & Young, Algeria enacts 2020 Complementary Finance Act including foreign direct investment incentives, 15 June 2020]

Algeria can also take advantage of information and communications technology (ICT) to promote efficiency and direct less effort at the speculative economy and more at the productive economy.[121H Ouguenoune, The policy of promoting and attracting of foreign direct investment in Algeria, December 2014]

Finally, remittance flows to Algeria were valued at roughly €1.6 billion in 2018 (1% of GDP) and outflows in 2017 at €64 million. December 2019 estimates put inflows at US$1.792 billion.[122World Bank, Migration and remittances data, April 2019]

Studies like that of David Margolis et al. investigating the impact of remittances generally agree that they reduce poverty and improve livelihoods. The study also found that in two regions of Algeria, remittances—especially foreign pensions—reduced not only poverty but also inequality, leading to a nearly 4% reduction in their respective regional Gini indices.[123D Margolis et al., To have and have not: Migration, remittances, poverty and inequality in Algeria, Université Paris 1 Panthéon Sorbonne, November 2013]