Development prospects for the Horn of Africa countries to 2040

Summary

- The Horn is one of the main regions producing refugees and internally displaced people globally. Jump to Introduction

- Governance failure, political exclusion and ethnic and religious-based discrimination hinder stability and development. Jump to Governance and security in the Horn

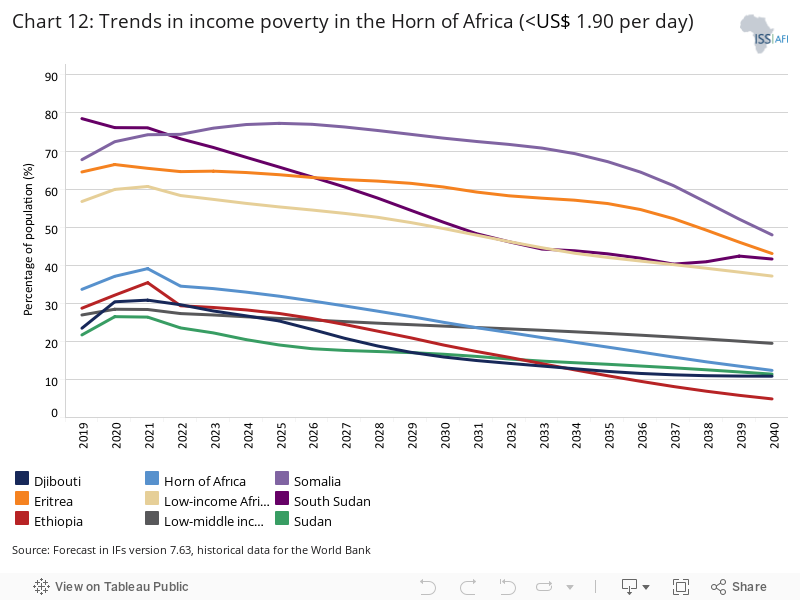

- Widespread insecurity, frequent droughts and limited livelihood opportunities keep many in conditions of poverty and vulnerability. Jump to Poverty and income inequality

- On the current trajectory, no Horn countries are on track to achieve the Sustainable Development Goal of eliminating extreme poverty by 2030. Jump to Poverty and income inequality

- The region has an extraordinarily young population, with nearly 60% of these youth in Ethiopia. Low schooling, a dysfunctional health system and poor infrastructure hinder human development. Jump to Demographics

- Most economic activities are in Sudan and Ethiopia, which account for 89% of the region’s total GDP. Jump to Economy

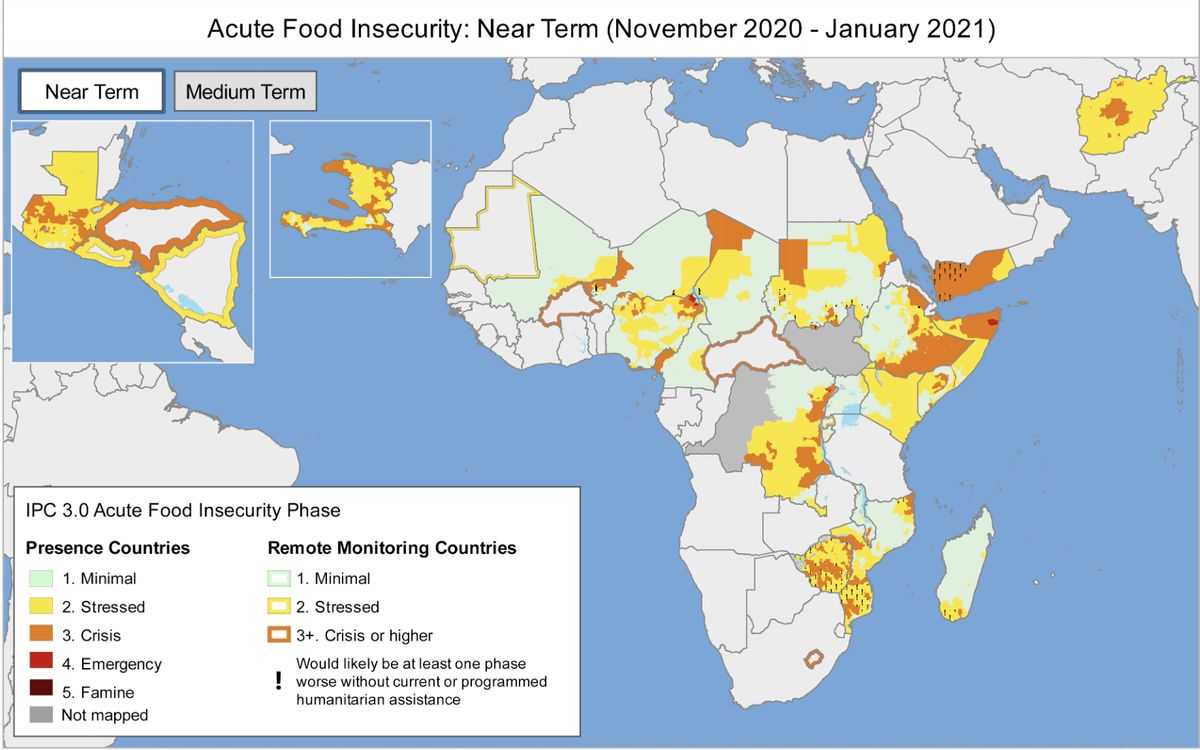

- Agriculture and pastoralism are the main sources of livelihood. The region is highly food insecure, owing to recurrent droughts, natural disasters and conflicts. Jump to Agriculture and climate change

- Exports from the Horn are poorly diversified. China and the Gulf countries are the region’s key trade partners. Jump to International trade

- Aid is the largest source of external finance, particularly aid and investment from the Gulf countries. Jump to Foreign direct investment, aid and remittances

- Despite its manifold challenges, the Horn is one of the world’s most important geostrategic sites. Jump to Background

Recommendations Jump to Conclusion

At the regional level, Horn leaders should:

- address border disputes, such as that over the Nile River, to create a favourable environment for development.

- speed up regional integration and refrain from interfering in neighbours’ internal disputes.

- collectively address cross-border environmental risks.

At the national level, Horn governments should:

- improve security through better governance and inclusion.

- tackle corruption, strengthen the judiciary and provide wider access to justice.

- integrate border communities into welfare and service delivery programmes and combat ethnic- and religious-based discrimination.

- take into account the role of the diaspora in peacebuilding and state-building.

- scale up agricultural production and food access to reduce poverty and malnutrition.

- increase expenditure on health, education, water and sanitation, and rural development.

- work with religious leaders to advocate for family planning and improve female education to reduce fertility and accelerate the demographic transition.

- Harness the huge renewable energy potential to accelerate electrification, especially in rural areas.

- enhance connectivity by expanding road infrastructure and opening the information and communications technology sector to foreign investors and competition.

- speed up economic diversification to create employment and livelihood opportunities, and a dynamic private sector.

The Intergovernmental Authority on Development and the African Union should:

- coordinate efforts to audit border disputes and develop an operational mechanism to address them.

- engage in political dialogue with all stakeholders to help them define their goals, programmes and cooperative strategies.

All charts for Development prospects for the Horn of Africa countries to 2040

- Chart 3: Governance triangle of the Horn countries, 2020

- Chart 4: Population size 2000, 2020 and 2040

- Chart 5: Population structure

- Chart 6: Demographic dividend

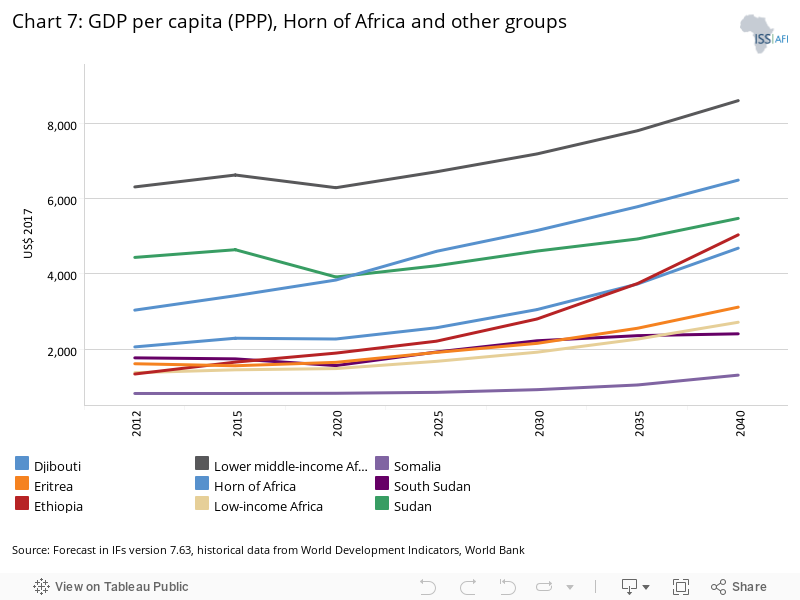

- Chart 7: GDP per capita (PPP), Horn of Africa and other groups

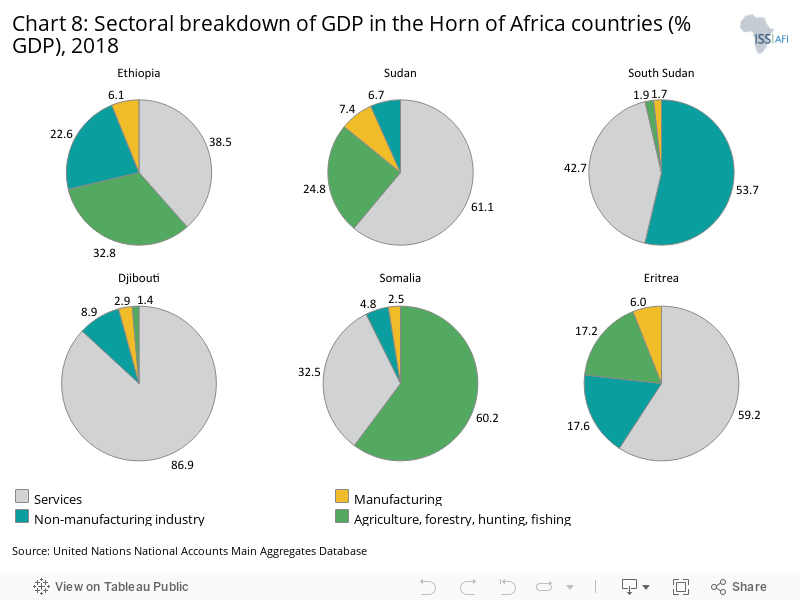

- Chart 8: Sectoral breakdown of GDP in the Horn of Africa countries (% GDP), 2018

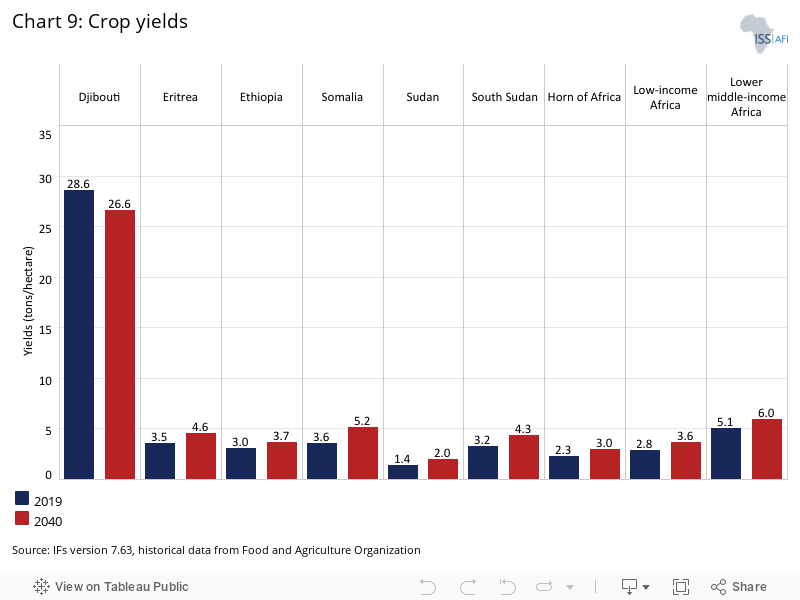

- Chart 9: Crop yields

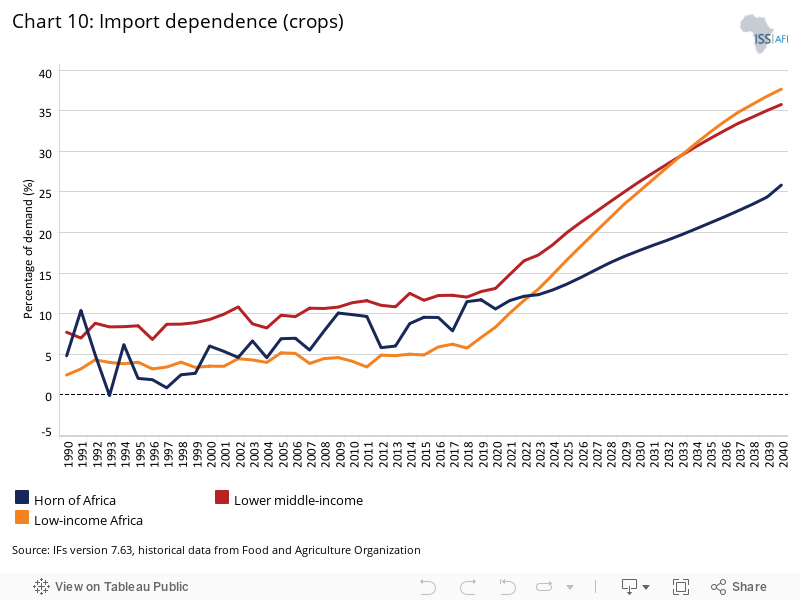

- Chart 10: Import dependence (crops)

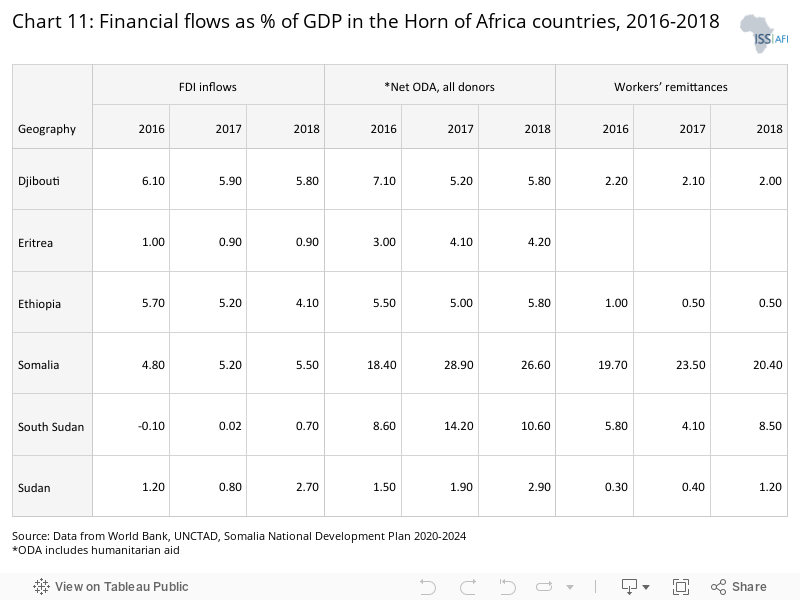

- Chart 11: Financial flows as % of GDP in the Horn of Africa countries, 2016–2018

- Chart 12: Trends in income poverty in the Horn of Africa (< $US 1.90 per day)

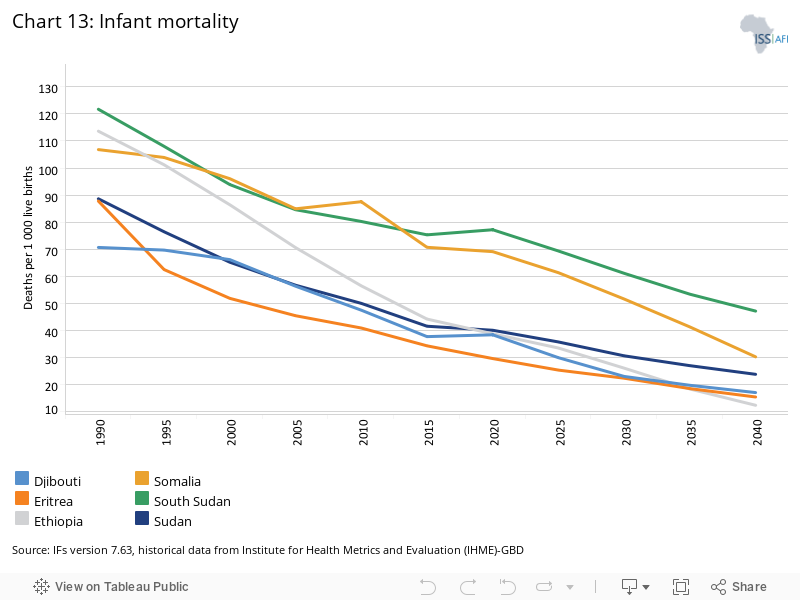

- Chart 13: Infant mortality

- Chart 14: Food insecurity in the Horn of Africa

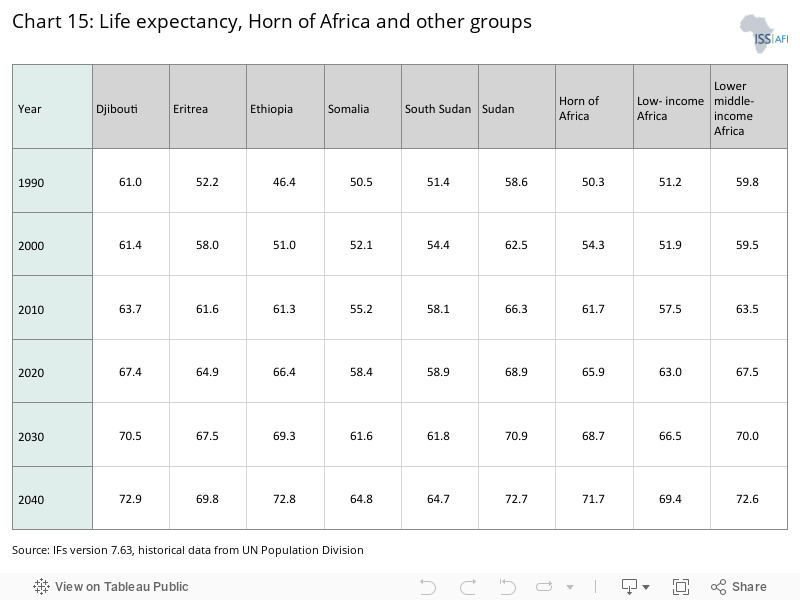

- Chart 15: Life expectancy, Horn of Africa and other groups

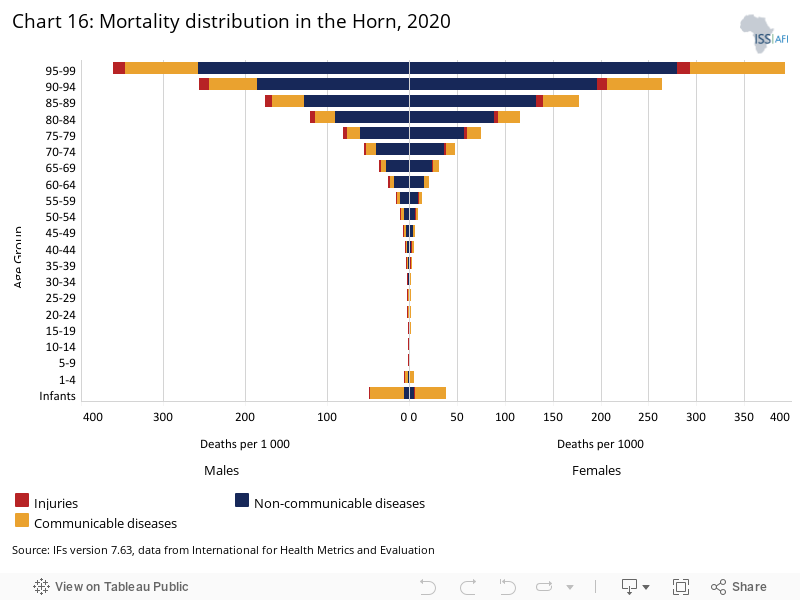

- Chart 16: Mortality distribution in the Horn, 2020

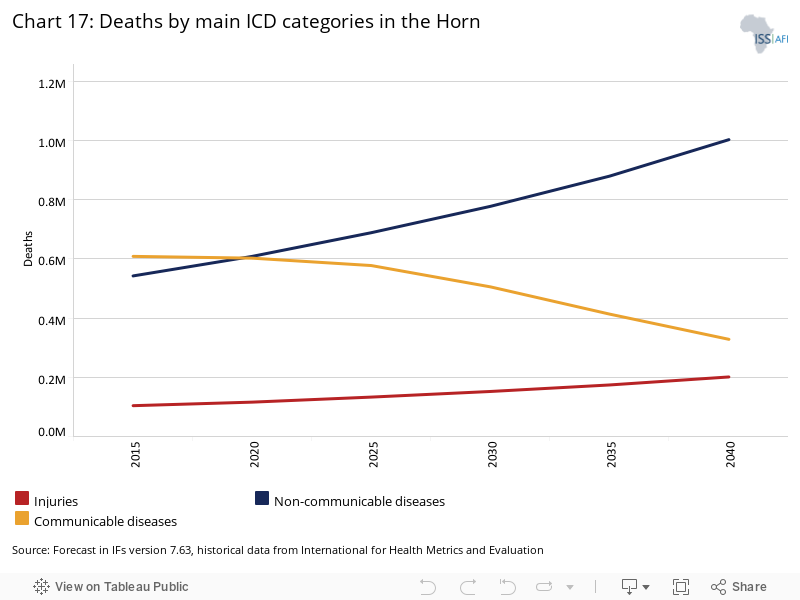

- Chart 17: Deaths by main ICD categories in the Horn

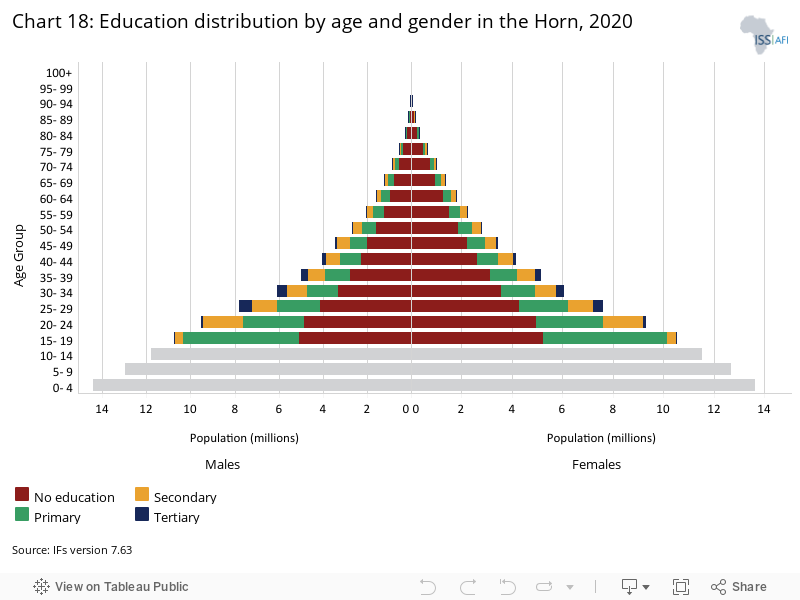

- Chart 18: Education distribution by age and gender in the Horn, 2020

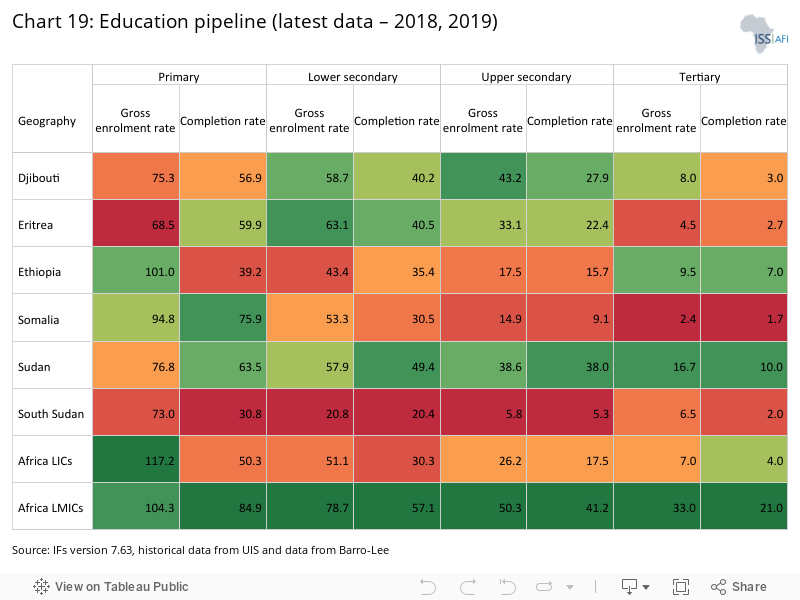

- Chart 19: Education pipeline (latest data – 2018, 2019)

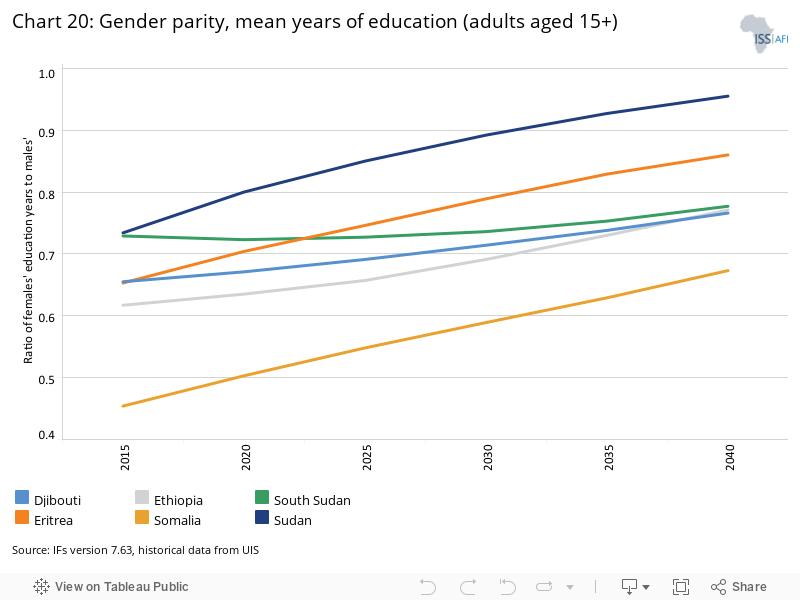

- Chart 20: Gender parity, mean years of education (adults aged 15+)

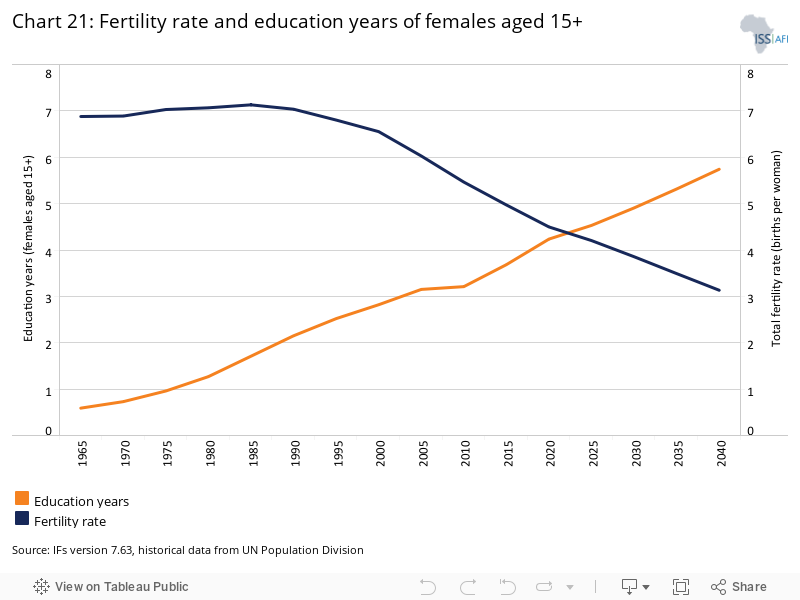

- Chart 21: Fertility rate and education years of females aged 15+

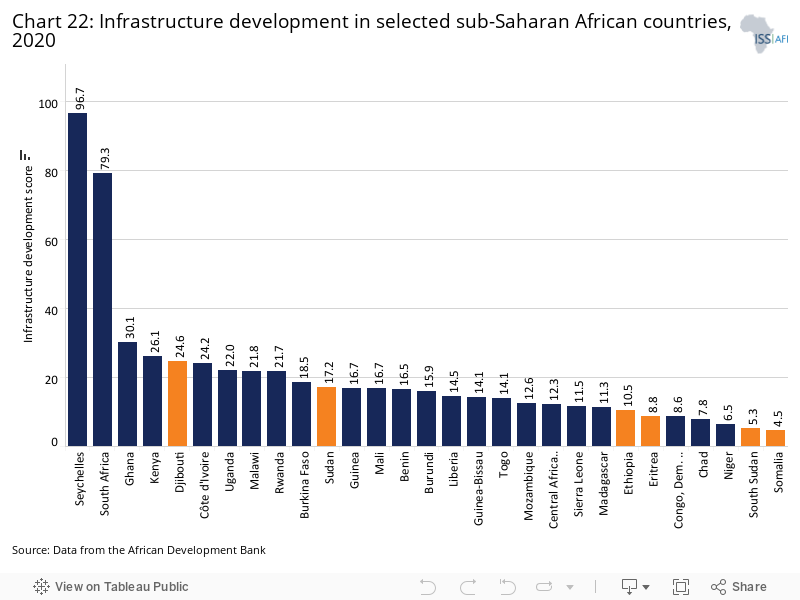

- Chart 22: Infrastructure development in selected sub-Saharan African countries, 2020

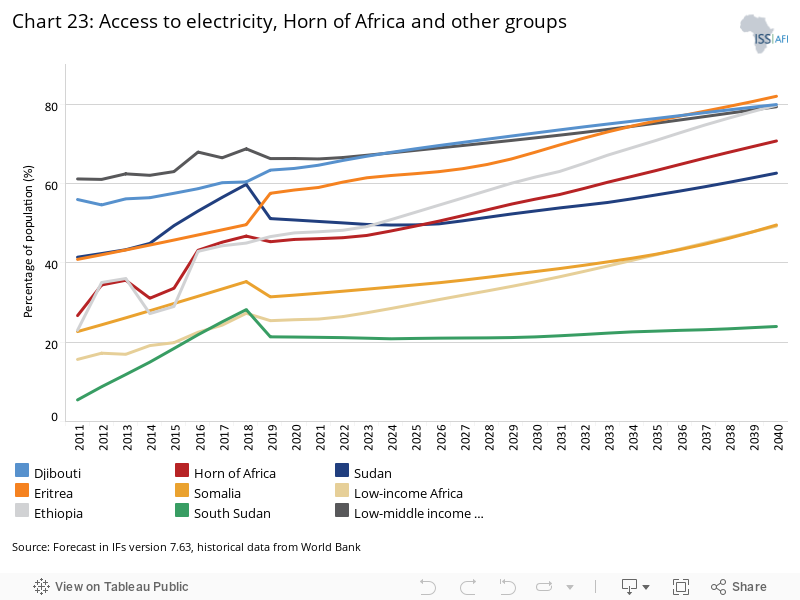

- Chart 23: Access to electricity, Horn of Africa and other groups

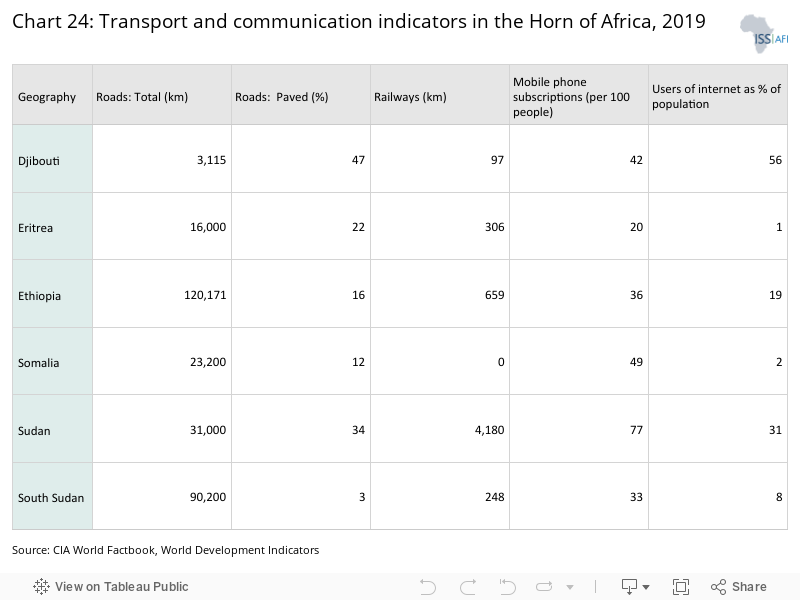

- Chart 24: Transport and communication indicators in the Horn of Africa, 2019

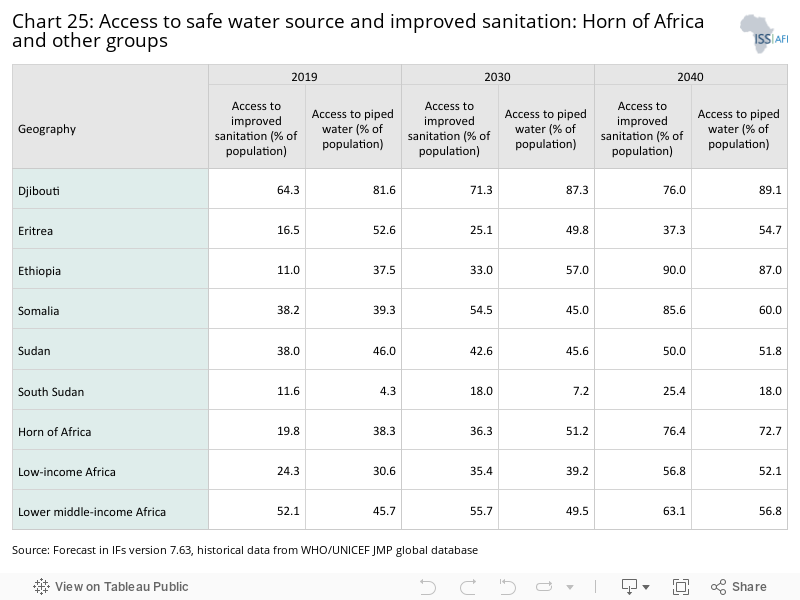

- Chart 25: Access to safe water source and improved sanitation: Horn of Africa and other groups

- Chart 26: Intervention clusters

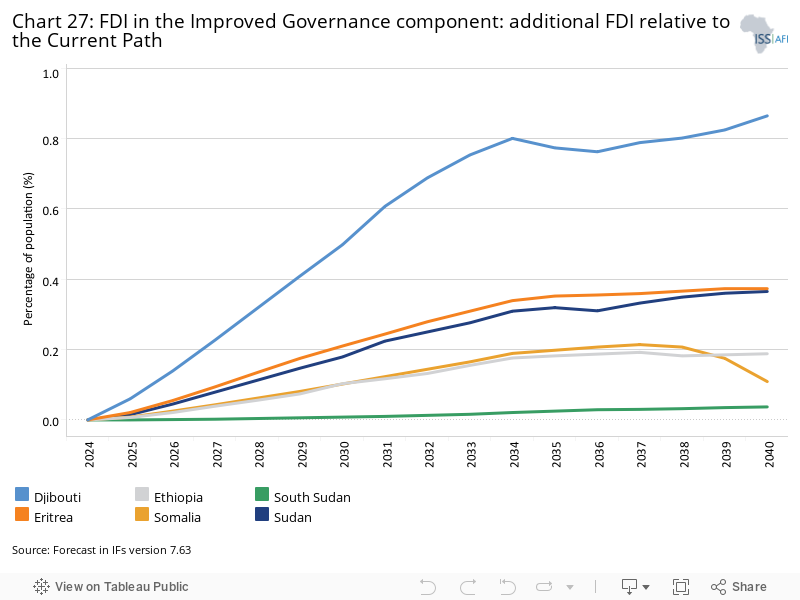

- Chart 27: FDI in the Improved Governance component: additional FDI relative to the Current Path

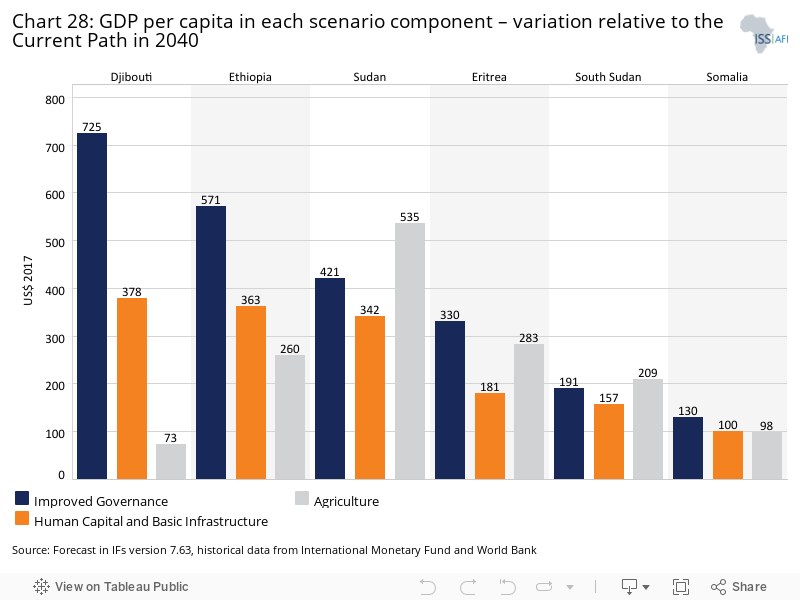

- Chart 28: GDP per capita in each scenario component—variation relative to the Current Path in 2040

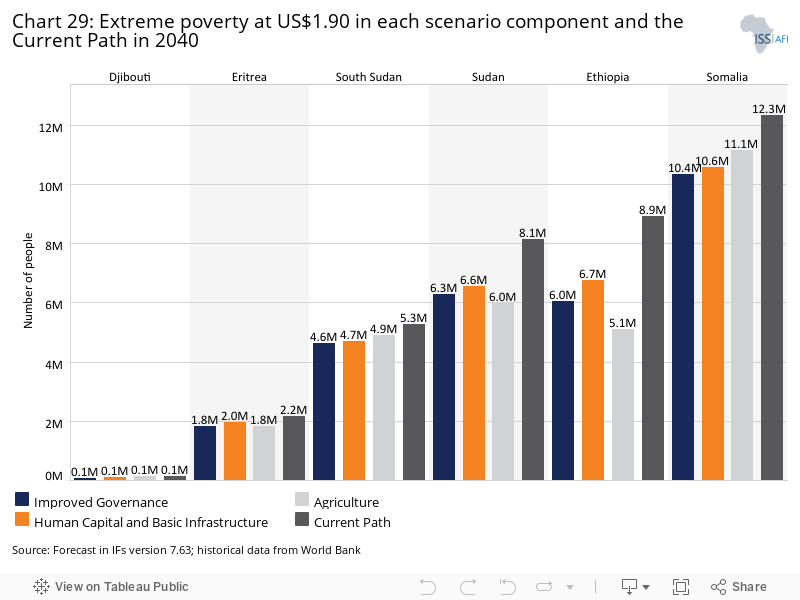

- Chart 29: Extreme poverty at US$1.90 in each scenario component and the Current Path in 2040

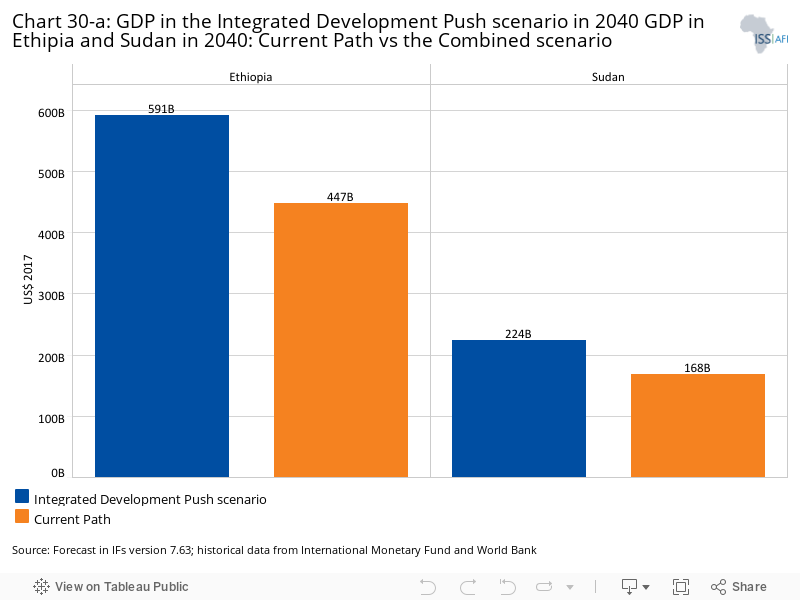

- Chart 30-a: GDP in the Integrated Development Push scenario in 2040

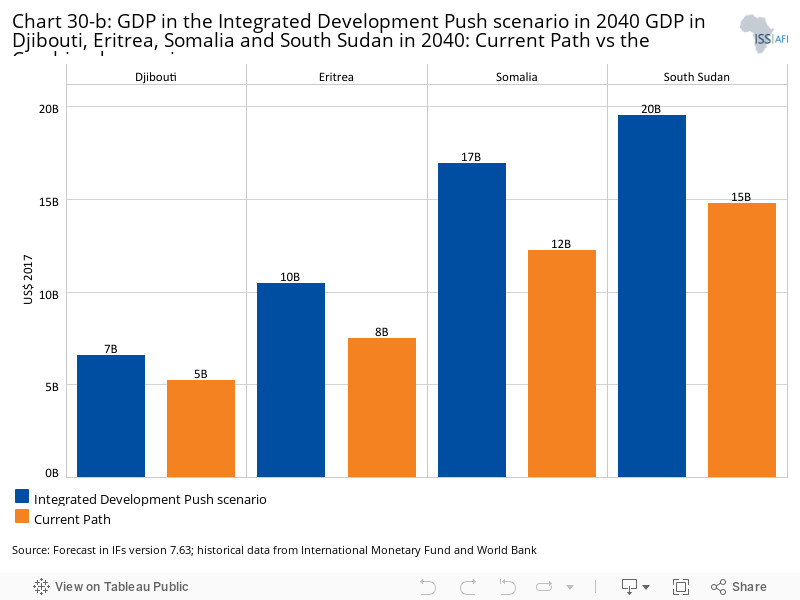

- Chart 30-b: GDP in the Integrated Development Push scenario in 2040

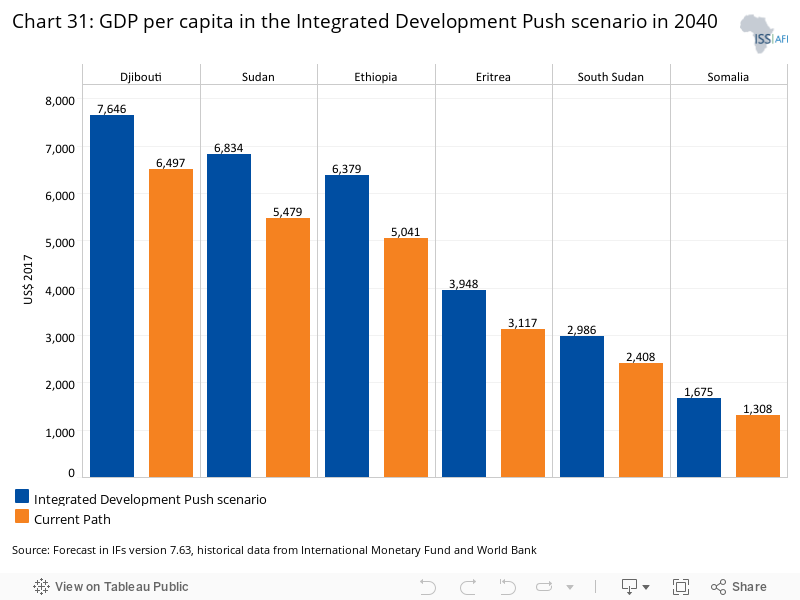

- Chart 31: GDP per capita in the Integrated Development Push scenario in 2040

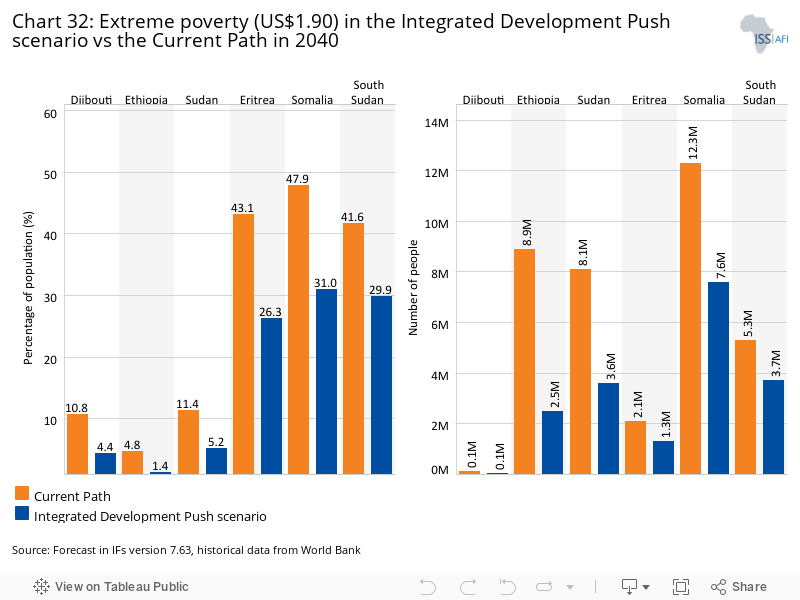

- Chart 32: Extreme poverty (US$1.90) in the Integrated Development Push scenario vs the Current Path in 2040

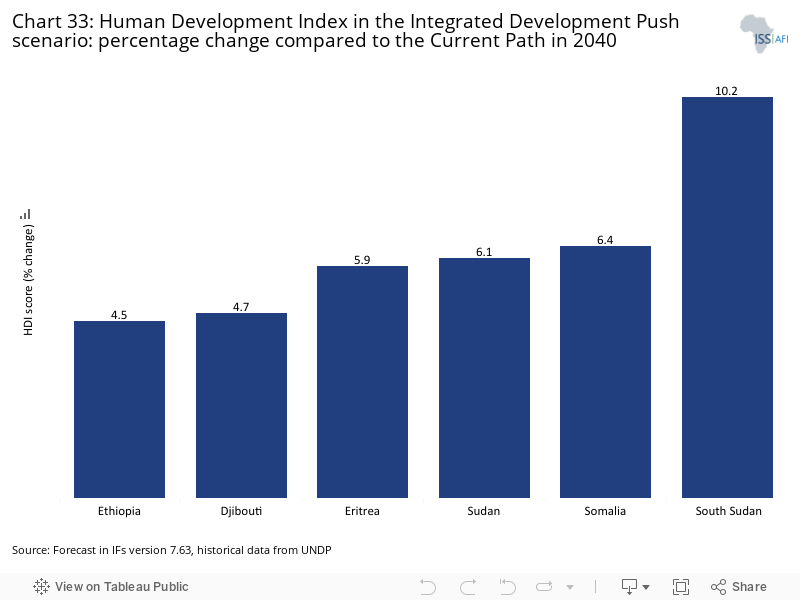

- Chart 33: Human Development Index in the Integrated Development Push scenario: percentage change compared to the Current Path in 2040

The Horn of Africa, which for the purpose of this study is defined as the region comprising Djibouti, Eritrea, Ethiopia, Somalia, Sudan and South Sudan, covers about 4.3 million square kilometres. It has a population of about 190 million people.

These countries are socially, economically and ecologically diverse and, at the same time, are related geographically, historically and demographically.[1Horn of Africa—NCCR North-South, Development Challenges and Mitigation Pathways in the Horn of Africa] They are also all members of the Intergovernmental Authority on Development (IGAD), an eight-country regional bloc in Africa with ambitions to embark on regional integration.

The Horn of Africa is known for its long history of armed conflict, large influxes of refugees, and poor state capacity and governance. It is also one of the world’s poorest regions, where weak infrastructure, widespread insecurity, frequent droughts and limited livelihood opportunities condemn many people to poverty and vulnerability.

Although growth rates in the region have, overall, been robust in recent years, countries face numerous major development challenges. They rank near the bottom on the Human Development Index—a summary measure of human development in three basic dimensions: health, education and a decent standard of living. According to the 2019 Human Development Report, the Horn nations rank from 168th for Sudan to 189th for South Sudan.[2United Nations Development Programme, Human Development Report 2019, 2019, http://hdr.undp.org/sites/default/files/hdr2019.pdf.]

The livelihood of the majority of the population in the region highly depends on rain-fed agriculture and pastoralism. However, farming opportunities are only available to a small part of the region, as 70% of the area is made up of arid and semi-arid lands.[3J Probynon, Developing the Greater Horn: Opportunities and challenges, 4 April 2017

] Competition to access these limited natural resources is thus a major factor fuelling conflicts and insecurity in the region.

Some progress has been made in socio-economic terms, especially in Ethiopia, which has a track record of high economic growth, major improvements in infrastructure and poverty reduction. But the Horn of Africa faces many development challenges that necessitate bold action from all stakeholders.

This report uses the International Futures (IFs) modelling platform to analyse the current state of development and the most likely development pathway of the Horn countries to 2040. The presentation of the Current Path forecast (see Chart 1) is followed by the development of scenario components. These are then combined into a comprehensive scenario where the countries and the region are able to get on a sustainable and peaceful development trajectory.

|

Chart 1: Comparison groups To create comparisons across countries and regions, the report uses the World Bank’s 2020/21 classification of economies into low-income, lower-middle-income, upper-middle-income and high-income groups.[4World Bank, New World Bank classifications by income level: 2020–2021, 1 July 2020] With the exception of Djibouti, which is lower-middle, the rest of the Horn countries are classified as low-income. Where Horn countries are compared to the averages for low- and lower-middle-income Africa or globally, they are excluded from these groups. |

The Horn of Africa has experienced many social, political and economic transformations since independence, resulting in military coups, inter-state and civil wars, revolutions, ethnic and religious disputes, and complex humanitarian crises, among others. Every country in the region has faced at least one civil war during the postcolonial era.

The Horn of Africa has also experienced more inter-state wars than any other region in Africa, most significantly Ethiopia-Somalia, 1977–78 and 2006–2009; Ethiopia-Eritrea, 1998–2000; and Eritrea-Djibouti, 2008.[5K Mengisteab, Critical Factors in the Horn of Africa’s Raging Conflicts, Discussion Paper 67, 2011, Nordiska Afrikainstitutet, Uppsala.]

These inter-state wars were fought mostly over territorial and border disputes. The poorly demarcated borders between competing pre-colonial empires, and subsequently defined by colonialists, have played a major role in these conflicts. And they continue to resonate—e.g. the Kenya-Somalia dispute on their maritime border in the Indian Ocean, thought to be rich in oil and gas reserves,[6K Mengisteab, Critical Factors in the Horn of Africa’s Raging Conflicts, Discussion Paper 67, 2011, Nordiska Afrikainstitutet, Uppsala.] and the Sudan-Ethiopia al-Fashaga triangle farming dispute.

The region is not only plagued by inter-state tensions but also intra-state conflicts and other local and national grievances. There is also a host of identity politics such as the crisis in Darfur, between clans in Somalia, within South Sudan, and among various ethnic groups in Ethiopia.

Violent conflicts and military coups are political tactics that many leaders in the region have used to come to power and weaken their opponents. Countries in the Horn of Africa frequently interfere in their neighbours’ disputes either by sending troops directly or by supporting rebel groups. Some of these disputes have resulted in national borders being redrawn in the region,[7S Healy, Hostage to Conflict: Prospects for Building Regional Economic Cooperation in the Horn of Africa, 2011, London: Chatham House.] such as Eritrea in 1993, South Sudan in 2011, and Somaliland’s ongoing attempts to separate from Somalia.[8Somaliland’s story is somewhat complex given the fact that the territory attained independence but rejoined Somalia a few days later. Following tensions with Mogadishu and the outbreak of conflicts, Somaliland has attempted to secede.]

There are also ethnic overlaps and affinities that transcend national borders (e.g. the Afars in Djibouti-Eritrea-Ethiopia, Somalis in Somalia and Ethiopia and other transnational ethnicities in the region). Such overlaps serve as a conduit for a significant amount of informal trade and are often seen as a potential source of insecurity by state authorities.

The borderland populations in each of these nations are also generally economically and politically marginalised. Consequently, this ethnic overlap in poorly governed spaces is often used by neighbouring countries as an entry point for cross-border destabilisation.[9Somaliland’s story is somewhat complex given the fact that the territory attained independence but rejoined Somalia a few days later. Following tensions with Mogadishu and the outbreak of conflicts, Somaliland has attempted to secede.]

War, conflict and insecurity, famine, environmental factors such as droughts, governance failures, and lack of economic conditions cause substantial displacement within countries and across borders. This makes the Horn one of the main regions producing refugees and internally displaced people globally.

Specific border areas such as the Sudan-Ethiopia, South Sudan-Uganda and Somalia-Ethiopia borders have been in an intermittent state of crisis with the back-and-forth movements of refugees for the past 40 years.[10C Clapham, Boundary and territory in the Horn of Africa, in P Nuguent and AI Asiwaju (eds.), African Boundaries: Barriers, Conduits and Opportunities, London: Pinter, 1996, pp. 237–50.] About 8.5 million forcibly displaced people, including over six million internally displaced people and around 2.5 million refugees and asylum seekers, are currently hosted within the Horn of Africa.[11M Noack, Protracted Displacement in the Horn of Africa, internal report, February 2020, Transnational Figurations of Displacement (TRAFIG).] Ethiopia, for example, is the second largest refugee-hosting country in Africa, after Uganda, while Sudan is the third largest country of asylum in Africa.[12M Noack, Protracted Displacement in the Horn of Africa, internal report, February 2020, Transnational Figurations of Displacement (TRAFIG).]

The current unrest in Ethiopia’s Tigray region is, for example, causing substantial numbers of refugees to cross into Sudan, further increasing the economic and demographic pressure on the host communities. The COVID-19 pandemic has further compounded the pre-existing difficulties in the region, including food insecurity, extreme poverty, social unrest, security concerns and political instability.[12M Noack, Protracted Displacement in the Horn of Africa, internal report, February 2020, Transnational Figurations of Displacement (TRAFIG).]

Despite its manifold challenges, the Horn of Africa is one of the most important geostrategic sites in the world given its proximity to the trade artery that runs from the Indian Ocean to Europe via the Red Sea and the Suez Canal, passing through the Strait of Bab el-Mandeb between Djibouti and Yemen.[13W van den Berg and J Meester, Turkey in the Horn of Africa: Between the Ankara Consensus and the Gulf Crisis, Clingendael: Netherlands Institute of International Relations, 2019.]

The combination of economic, political and security interests of foreign powers in the region has led to a proliferation of foreign military bases, often accompanied by the provision of military and development assistance.[14W van den Berg and J Meester, Turkey in the Horn of Africa: Between the Ankara Consensus and the Gulf Crisis, Clingendael: Netherlands Institute of International Relations, 2019.] Thus the United States (US) installed a military base in Djibouti after the 9/11 attacks to prosecute its war against terrorism (al-Qaeda and al-Shabaab). The first overseas military base of China since the Second World War is also in Djibouti as the country has moved to protect its growing investments in Africa.

Together with a French military base (that includes troops from Germany), tiny Djibouti with a population of less than a million people is also home to military bases from Italy, Japan and Spain. The country relies heavily on the associated rents. And in December 2020, Russia signed a deal with Sudan to establish a military base in Port Sudan on the Red Sea coast.

The Horn of Africa seems to have ‘become a laboratory where different foreign policy approaches and aid modalities meet.[15J Meester, W van den Berg and H Verhoeven, Riyal Politik: The Political Economy of Gulf Investments in the Horn of Africa, CRU Report, 2018, Clingendael: Netherlands Institute of International Relations.]’ Middle East countries, particularly the Gulf countries (Saudi Arabia, United Arab Emirates (UAE), Kuwait and Qatar), and Turkey have a long history in the Horn of Africa. Turkey’s presence in the region dates back to the Ottoman Empire. But in the modern era its engagement in the region dates to 2011, with Somalia as the entry point.

Gulf and Turkish assistance, including direct budgetary support, humanitarian aid, infrastructure development, and funding for Somali security forces, has been critical for the Somali people. Turkey has established its largest overseas military facility in Mogadishu to assist with training for the Somali National Army. The country has also significantly increased trade, investment and aid in Sudan and Ethiopia. For instance Ethiopia’s trade with Turkey increased by a hundredfold, from US$40 million in 2003 to about US$4 billion in 2013.[16F Donelli, The Ankara Consensus: The Significance of Turkey’s Engagement in Sub-Saharan Africa, Global Change, Peace & Security, 30:1, 2018, 57–76.]

The Arab Gulf states have also in recent years increased their influence in the Horn of Africa. From 2000 to 2017, they collectively made investments worth approximately US$13 billion and provided official development assistance (ODA) amounting to US$6.6 billion[17J Meester, W van den Berg and H Verhoeven, Riyal Politik: The Political Economy of Gulf Investments in the Horn of Africa, CRU Report, 2018, Clingendael: Netherlands Institute of International Relations.] (see Chart 2).

The challenge is that the Horn governments face constant pressure to pick sides in geopolitical rivalries often between the Gulf Arabs and Iran or among the Gulf states. For instance Eritrea, which used to support Qatar, has switched its orientation to the UAE, and now hosts a military base that is used to prosecute the war in Yemen. The European Union (EU) and Russia also have a critical influence on a number of Horn countries such as Ethiopia and Sudan, among others.

This external involvement in the region means that the Horn countries are often instrumentalised against each other instead of in pursuit of collective security. They politically back different Gulf states or serve foreign interests, undermining the prospects for regional economic integration and development. In the process, the rivalries among the Gulf powers—particularly between the UAE on the one hand and Qatar and, by extension, Turkey on the other—have fuelled instability in Somalia.[18International Crisis Group, Somalia and the Gulf Crisis, Report No. 260/AFRICA, 2018.]

Chart 2: Summary of Gulf interests and policy instruments in the Horn of Africa

|

|

Saudi Arabia |

United Arab Emirates |

Qatar |

Kuwait |

|

Main partners in the Horn of Africa |

Sudan, Ethiopia |

Eritrea, Somaliland, Ethiopia |

Sudan, Somalia, Ethiopia |

Sudan |

|

Main political interest |

Isolating Iran |

Isolating Iran, pushing back against political Islam |

Leverage relating to Saudi Arabia |

Regional stability |

|

Main economic interest |

Food production |

Regional trade, port expansion |

Financial diversification |

Food production |

|

Key policy instruments |

Budgetary support Multilateral funds |

Budgetary support |

Central Bank of Qatar, Qatar Foundation |

Bilateral and multilateral development funds |

Source: Adapted from J Meester et al, Riyal Politik, The political economy of Gulf investments in the Horn of Africa, CRU Report, Netherlands Institute of International Relations, Clingendael, 2018.

Good governance and security are key to economic progress and poverty reduction. Greater security at the national level creates an enabling environment for investment, economic activity and social stability. It also creates conditions in which governments can pursue effective sustainable development strategies.

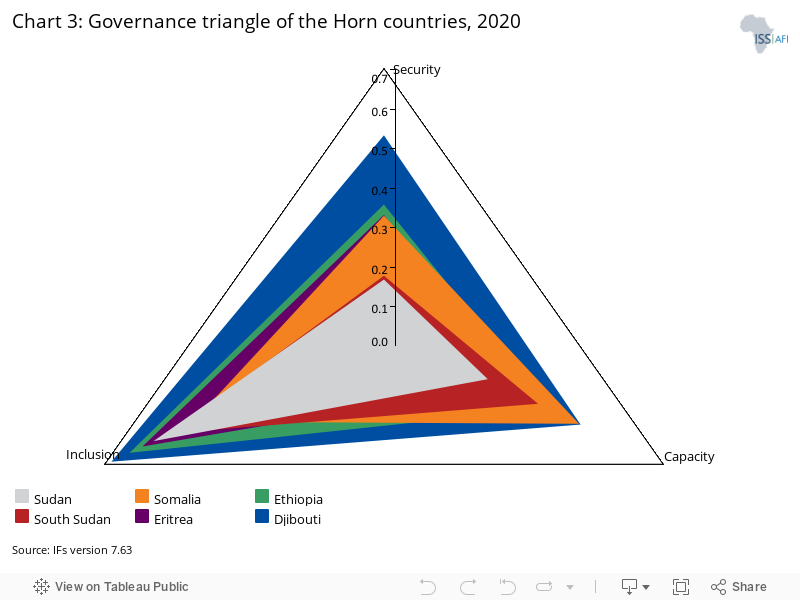

In the IFs system, governance is conceptualised along three dimensions—security, capacity and inclusion—reflecting the traditional sequencing of the state-formation process. The security dimension measures the probability of intra-state conflict and the general level of risk.

The second dimension, capacity, is related to government revenue, corruption, regulatory quality, economic freedom, and government effectiveness. The third dimension, inclusiveness, measures the level of democracy and gender empowerment. Chart 3 shows the position of each Horn country along these three dimensions.

What is evident from Chart 3 is that Djibouti does best in each dimension of governance compared to its peers. It is followed by Ethiopia in terms of security and governance capacity. Somalia is the most challenged country in the region in terms of security while Sudan performs worst in inclusion.

Despite significant progress, bad governance and an increasingly unstable security situation are characteristic of most Horn of Africa countries. For many years the fragility and violence of South Sudan and Somalia coexisted alongside the apparent stability and rapid development of Ethiopia until that too descended into violence. Sudan is now on a rocky political transition while the isolationist approach of Eritrea continues.

According to the 2020 Ibrahim Index of African Governance, there is an overall decline in civic and democratic space and rights in the Horn of Africa that appears to have been exacerbated by the COVID-19 outbreak. Among other effects, Ethiopia postponed parliamentary elections that were supposed to take place in 2020 to June 2021.

At the country level, this index shows that Ethiopia is the only country to have improved in all 16 sub-categories of governance over the period 2010–2019, while Somalia remains bottom for the 10th consecutive year with a score of 19.2 out of 100.[19Ibrahim Index of African Governance, Index Report, 2020] Somalia, South Sudan and Eritrea have the worst governance in Africa.

Since the fall of the Siad Barre regime and the complete collapse of state institutions in 1991, Somalia has been without a viable functioning central government and represents one of the modern world’s most protracted cases of statelessness.[20BTI, Somalia Country Report 2020, 2020, www.bti-project.org/en/reports/country-report-SOM-2020.html.] Despite many domestic initiatives and the efforts of the international community, Somalia is still deeply affected by decades of internal conflict, which has largely destroyed the country’s security and judiciary institutions. Since 2012, Somalia has had an internationally recognised government but with limited capacity to provide security throughout the country.

The federal government, which depends on 20 000 troops of the African Union Mission to Somalia and other international powers to provide law and order and exercise territorial control, faces numerous challenges both internally and externally. Al-Shabaab effectively controls many rural areas and the supply routes to many towns.

In a country dominated by the management of community affairs through clan and sub-clan arrangements, efforts by neighbours and the international community to introduce elections (and democracy) as a solution to its intractable lack of central authority have repeatedly been thwarted. Elections were originally to occur in November 2020, but Somali political leaders at federal and state level have struggled to agree on a timetable and the process and composition of the electoral body. This despite the fact that President Mohamed Abdullahi Mohamed’s term expired in February 2021.

On 12 April 2021, the Somalia Lower House of Parliament declared a two-year extension—but the move was met by serious opposition from key regions of Somalia and the international community. Factional tensions and violence ensued before the president agreed, in April 2021, to return to a commitment made in September 2020 to initiate dialogue and begin preparations for elections without further delay.

The rampant corruption and the absence of the rule of law have weakened state authority in Somalia. The country is ranked as the world’s most corrupt globally by Transparency International. Corruption, clan-based patronage, and misappropriation of public funds continue unabated and are particularly pronounced in government procurement.[21BTI, Somalia Country Report 2020, 2020, www.bti-project.org/en/reports/country-report-SOM-2020.html.]Building inclusive political structure at the federal and state levels and addressing the security threat posed by al-Shabaab are essential for Somalia’s progress towards political stability, good governance, economic progress and poverty alleviation. At the time of writing, presidential elections are scheduled for October 2021.

Born a decade ago after years of strife, South Sudan experienced a devastating civil war between 2013 and 2018. Thanks to a peace treaty negotiated in 2018, the war has subsided. The main protagonists, Salva Kiir Mayardit and Riek Machar, agreed to form a unity government, but the situation remains fragile as the pact could again crumble as it has previously.[22International Crisis Group, Toward a Viable Future for South Sudan, Report No. 3, 2021] Aside from a recent ceasefire, little else has been achieved, and mistrust among the various parties persists. The governance and security situation in South Sudan is not much different from its neighbour Somalia.

South Sudan has the second worst governance in Africa after Somalia, according to the Ibrahim Index of African Governance, and rates similarly regarding corruption. For example, one year after independence in 2012, the ruling elites stole an estimated US$4 billion of public money.[23African Development Bank Group, The Political Economy of South Sudan, 2018.] The officials were never prosecuted, as legal and anti-corruption systems are weak.[24Attempts to hold these individuals behind the stolen funds accountable are part of the reasons for the high levels of mistrust among the country’s politicians, and eventually led to the outbreak of conflict in December 2013.] A mix of political, economic and military dominance makes it difficult to investigate corruption and prosecute influential players.[25African Development Bank Group, The Political Economy of South Sudan, 2018.]

Insecurity is widespread as the South Sudanese state’s monopoly over power is challenged with only a semblance of government control evident in small parts of the country. The country’s political space is dominated by the military due to its long history of armed liberation struggle.[26BTI, South Sudan , 2020, www.bti-project.org/en/reports/country-report-SSD-2020.html.] In addition to its limited capacity, the government is unable to protect the civilian population since its national police, security forces and other armed actors are themselves involved in infighting and large-scale abuses of human rights.

Overall, South Sudan’s governance institutions are dysfunctional. The lack of consensus among the national and local elites (political and military), who prioritise their own interests instead of the needs of the population, continues to threaten the country’s stability, security and development.

Eritrea lacks functional democratic institutions. It has not had a national election since it gained independence from neighbouring Ethiopia in 1991, and it is governed by an authoritarian regime that is frequently condemned by the United Nations (UN) for human rights violations. The country is considered a ‘gulag’ state where civil rights and freedom of expression and assembly are non-existent.

Human Rights Watch reports that: ‘Eritreans are subject to arbitrary arrest and harsh treatment in detention. Eritrea has had no national elections, no legislature, no independent media and no independent non-governmental organisations (NGOs). Religious freedom remains severely curtailed.[27Human Rights Watch, World Report 2019 Eritrea Events of 2018, 2019]

The ruling People’s Front for Democracy and Justice is the only political party allowed to exist in the country, and the president and a small ruling elite appear to steer political and economic affairs according to their specific interests. These realities, including the mandatory military training and national service, have depopulated the country as young people seek to emigrate.

Eritrea has become the African country with the highest number of migrants. There is also no separation of powers or checks and balances as Eritrea has not implemented its constitution and its National Assembly does not meet in a country fully dominated by President Isaias Afwerki. This has led to massive corruption, especially in civil administration and the military.[28BTI, Eritrea Country Report 2020, 2020, www.bti-project.org/en/reports/country-report-ERI-2020.html.] The concentration of power around the president and his dominance of all aspects have weakened the country, as there is no certainty as to how the state will sustain itself in case of his eventual exit. In sum, the lack of democratic transformation and militarisation of Eritrean society constitute a significant hindrance to inclusive development.

Compared to its peers in the Horn of Africa, Djibouti, which hosts a multitude of foreign military bases, enjoys relative peace and stability and regularly goes through the motions of elections. Despite some latent clan-level grievances, there are no separatist or insurgent movements, and the authority of the government is established nationwide.

However, graft is widespread and public officials are rarely held accountable for their actions. The judiciary is inefficient and corrupt and lacks independence; only individuals deemed disloyal or acting against the president’s political and economic interests are prosecuted for corruption.[29BTI, Djibouti Country Report 2020, 2020, www.bti-project.org/en/reports/country-report-DJI-2020.html.]

Although the separation of powers is enshrined in the constitution, the president has concentrated all the decision-making power in his hands. Recent calls from al-Shabaab for attacks on ‘American and French interests’ in Djibouti do, however, indicate that the country may not be insulated from trends elsewhere in the region. The last attack, in 2014, targeted a restaurant frequented by foreigners.[30Africanews, Al-Shabaab calls for attacks on U.S, French interests in Djibouti, Africanews, 29 March 2021, ]

Under former president Omar al-Bashir, political and economic corruption as well as US sanctions prevented Sudan from optimally benefiting from its abundant oil resources. Graft undermined the government’s capacity to maintain its strategic priorities and to implement its policies.[31Sudan National Report, Implementation of Istanbul plan of action for least developed countries (IPoA), 2011–2020, 2019, Ministry of Finance and Economic Planning.] Poor governance, US sanctions, civil war and the loss of revenue from oil due to the independence of South Sudan led to economic woes such as galloping inflation and currency depreciation, among others. In reaction to the economic hardships, nationwide anti-government public protests led to the removal of al-Bashir in April 2019 and ushered in change.

The current transitional government is tasked mainly with improving governance by repealing laws restricting freedom, establishing the judiciary’s independence and rule of law, reforming government structures to ensure its equity, combating corruption and achieving lasting peace with armed groups.[32Sudan National Report, Implementation of Istanbul plan of action for least developed countries (IPoA), 2011–2020, 2019, Ministry of Finance and Economic Planning.] Since 2003, violence in Darfur, its most unstable region, has left at least 300 000 people dead and 2.5 million displaced, according to the UN.

Following the Juba Peace Agreement that was signed on 3 October 2020, the new government includes ministers from former rebel groups. This augurs well for security and stability as well as inclusive governance in Sudan, but the ravages of COVID-19 severely constrain progress. Sudan has subsequently also been removed from the US list of State Sponsors of Terrorism, leading to the lifting of sanctions on the country; and a new cabinet based on the peace agreement now includes most of the former armed movements. The Declaration of Principles calls for freedom of religion and cultural identity in Sudan, removing another source of exclusion.

Overall, the brief summary above explains why the Horn region scores lowest among African regions in terms of political participation, security and stability, and rights indicators. The poor management of diversity (political views, gender and identity) constitutes a major source of popular grievance and instability.

Improving governance and building an inclusive national political system that reflects the diversity in each country and effective management of the various intra-state conflicts is crucial for peace, stability and development, as are efforts to ensure that national conflicts do not engulf the region. These include the filling of the Grand Ethiopian Renaissance Dam and the challenges that reduced downstream water flows in the Nile River present to Sudan and Egypt. They also include the regionalisation of Ethiopia’s war in Tigray, clashes around al-Fashaga, between Sudan’s eastern province of Al-Qadarif and Ethiopia’s Amhara regional state, and unresolved border issues between Djibouti and Eritrea. The disagreement between Sudan and South Sudan on Abyei and the maritime boundary dispute in the Indian Ocean between Somalia and Kenya also feature.

Djibouti, Eritrea, Ethiopia, Somalia, Sudan and South Sudan were home to about 190 million people in 2020—less than half the population of Western Africa, which is estimated at slightly under 400 million. With its population of roughly 206 million, Nigeria alone is significantly larger. From a more global perspective, the world’s two largest populations—China and India—each have populations that are more than seven times larger than that of the Horn.

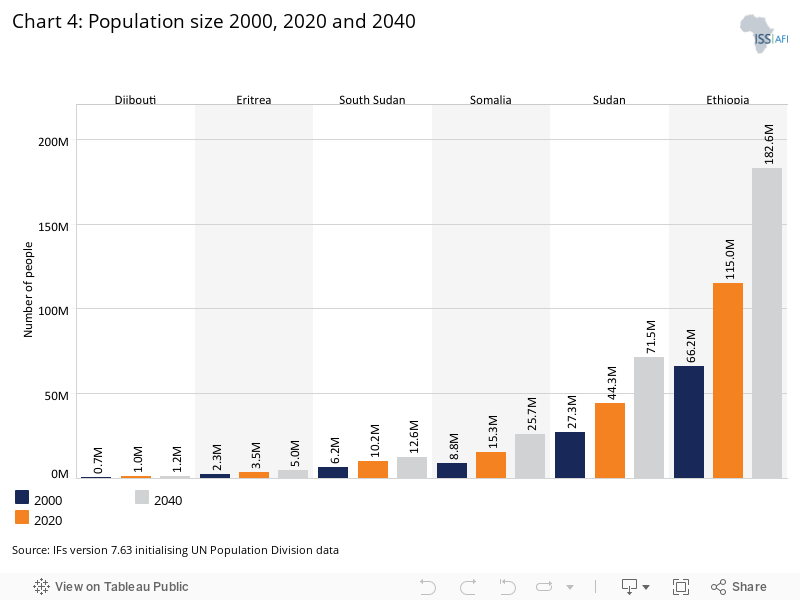

Nearly two-thirds (60%) of the region’s population is in Ethiopia, the second most populous country on the continent. Home to an estimated 115 million people, Ethiopia’s population is larger than the other five countries combined. Sudan’s population of roughly 44.3 million follows as the next largest in the region, trailed by Somalia (15.3 million), South Sudan (10.2 million), Eritrea (3.5 million) and Djibouti. Djibouti’s tiny population of approximately one million in 2020 was less than a quarter of the size of Addis Ababa (4.8 million in the city proper).[33World Population Review, Addis Ababa Population] Chart 4 illustrates the population sizes of each country.

Over the next 10 years, the populations of Ethiopia, Somalia and Sudan will increase by 33.4 million, 3.8 million and 13.5 million people respectively, reaching 241.3 million for the region by 2030.

Over the longer term, Ethiopia’s population is set to grow the fastest, although rates differ sharply between urban and rural areas. After growing on average 2.75% between 2010 and 2020, Ethiopia’s population growth rate is expected to rise moderately to average 2.8% growth between 2020 and 2030. By mid-century, Ethiopia’s population is expected to be more than 200 million people.

From 2020 to 2030, the total population of the Horn of Africa is expected to grow at an average rate of 2.6% per year. This is significantly slower than Central Africa (3.16%) and Western Africa (2.96%), slightly lower than the whole Eastern African region (2.8%), and more rapidly than Southern Africa (2.3%).

Djibouti, being at a later stage in the demographic transition than the other five Horn of Africa countries, has the lowest total fertility rate, estimated at 2.8 children per woman in 2020. Somalia’s total fertility rate of 6.1, meanwhile, is the second highest in the world (Niger, recorded at 6.8, has the highest). This means that the average Djiboutian woman will have about three children in her lifetime. In Eritrea and Ethiopia, meanwhile, the average woman has four. South Sudan recorded a total fertility rate of 4.8.[34The UN’S 2019 World Population Prospects roughly agrees with these TFR estimates, providing the following averages for 2015-2020: Djibouti: 2.8; Eritrea: 4.1; Ethiopia: 4.3; Somalia: 6.1; Sudan 4.4; South Sudan: 4.7]

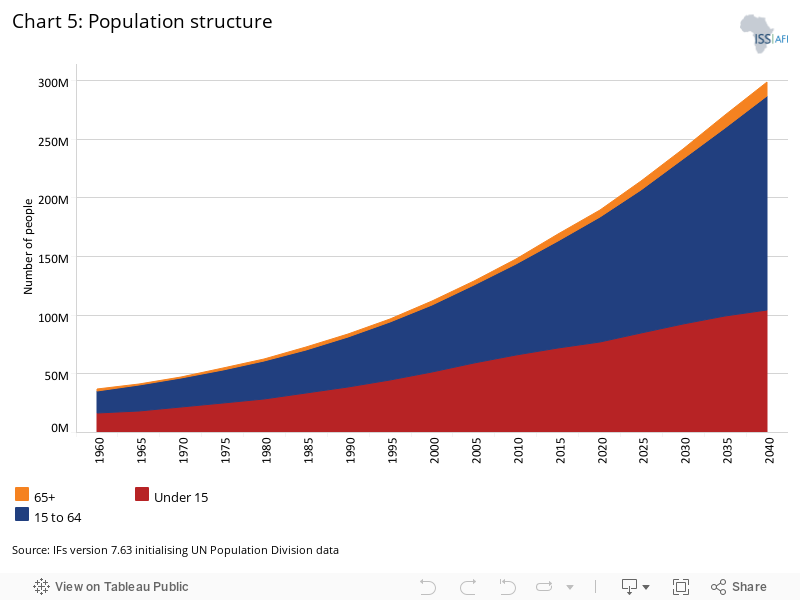

The Horn of Africa has an extraordinarily young population. Even in Djibouti, half of the population is younger than 25 years of age. The median ages of the populations of Eritrea, Ethiopia, Somalia, Sudan and South Sudan range from 19 (Ethiopia and Sudan) to 16 (Somalia). In fact, Niger, with a median age of 15, is the only country in the world with a younger population than Somalia.

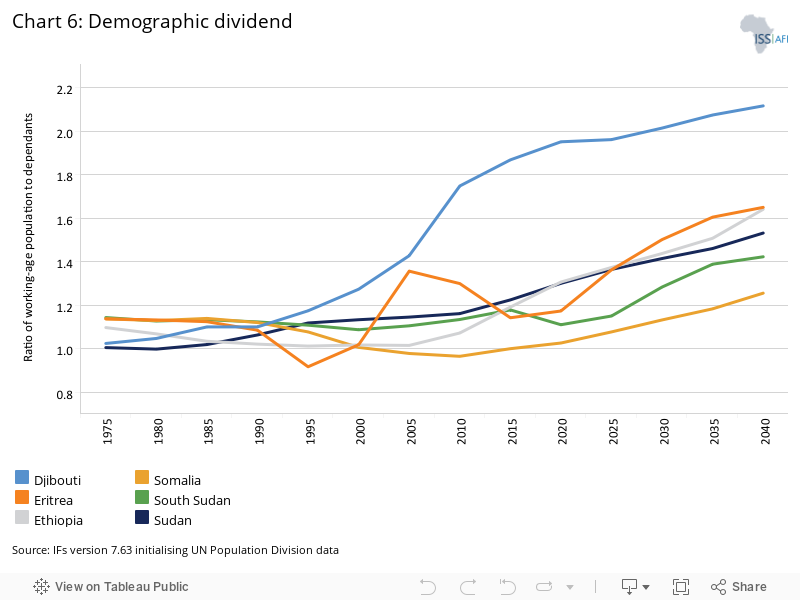

With the exception of Djibouti, the region’s youthful age structure constrains economic growth. There are few people of working age (between 15 and 65) relative to child dependants (that is, children younger than 15). It will therefore continue to be difficult for countries like Ethiopia, Eritrea, South Sudan and Somalia to benefit from a demographic dividend and the potential for more rapid economic growth over the next 20 years.

Historically, nations that have achieved rapid economic growth, such as South Korea and Taiwan, did so partly because they had large labour forces relative to dependants. When the working-age population far outnumbers the dependant population, the opportunity for a ‘demographic dividend’, or an economic bonus, arises. But this is provided the growing labour force acquires the needed skills and is productively employed in the formal economy. Broadly speaking, a nation must reach at least 1.7 people of working age for each dependant to potentially experience a demographic dividend.[35J Cilliers, Getting to Africa’s Demographic Dividend, ISS paper, 31 August 2018.]

Chart 6 shows that of the six Horn of Africa countries, only Djibouti has reached this ratio, recording an estimated 1.9 people of working age for each dependant. This ratio is set to stagnate until 2030 before gradually resuming its upward trajectory to peak at 2.2 working-age people for each dependant by mid-century.

Ethiopia and Eritrea are projected to reach 1.7 working-age people for each dependant after 2040, at which point the ratios of Sudan and South Sudan are expected to reach roughly 1.5 and 1.4, and Somalia, 1.2. Somalia is expected to reach the important ratio of 1.7:1 only by 2070. Eritrea, Sudan and South Sudan, meanwhile, are projected to reach this ratio in the 2050s.

But achieving the demographic dividend is not a given. To boost economic growth, people need meaningful employment and access to their rights of a quality education, clean water and sanitation facilities, and freedom from violence and conflict.

Studies show that a youth bulge (defined as the portion of the population 15 to 29 years of age relative to the total adult population) increases the potential for socio-political instability if there are no job prospects. In general, countries have a higher risk of political instability when 40% of the adult population is between 15 and 29 years old.And that risk is compounded when opportunities for young people are severely restricted in the forms of low access to participation in governance, limited education, and failing economic development.[36M Basedau, C Heyl and E Woertz, Population Growth and Security in Africa: Myth or Underestimated Risk?, Policy paper, 2020, Hamburg: German Institute for Global and Area Studies.]

The youthful population structure and limited socio-economic opportunities, among other challenges, contribute to the social instability experienced in the region.

The Horn of Africa is the most rural African region. On average, only 27% of its population lives in urban areas. The region has only three cities/urban agglomerations with at least one million inhabitants: Addis Ababa, Khartoum and Mogadishu. In Western, Central and Southern Africa, nearly half of all inhabitants are urban. Across sub-Saharan Africa, two out of every five people live in urban areas.

Djibouti, however, is an important exception. Although Ethiopia is the most densely populated country in the Horn, Djibouti is by far the most urbanised. Here, an estimated four out of every five people live in the cities, mostly in Djibouti City—a feature that reflects Djibouti’s extremely small population and land area. Eritrea is the second most urbanised in the group.

Somalia and Sudan lie in the middle. About 48% and 34% of their respective populations reside in an urban area compared to one out of every five Ethiopians. Nearly half of all Somalis live in urban areas, while in Sudan, only about one in three.[37The 35% urban estimate provided by Sudan’s National Household Budget and Poverty Survey 2014/15 agrees with this forecast from IFs. See: Central Bureau of Statistics of Sudan, Sudan National Household Budget and Poverty Survey 2014/15, First Draft, 13 December 2016, http://cbs.gov.sd/index.php/en/home/version_details/24/25, pp. 10, 23, 2016.] Meanwhile, fewer than one out of every four South Sudanese live in an urban area, making the country the 13th most rural in the world, and the second most rural state in the Horn of Africa after Ethiopia.

In urban areas, it is often easier for governments to provide services and for people to access the basic resources they need. For example, in Somalia, an exhaustive World Bank survey held in 2017 found that: ‘Cities consistently provide better access to services and more stable income sources than rural areas except for land and housing.[38World Bank, Somali Poverty and Vulnerability Assessment: Findings from Wave 2 of the Somali High Frequency Survey, Report No. AUS0000407, October 2019]’ Rather than viewing urbanisation as a challenge, it offers an opportunity to accelerate the provision of a range of services including education.

GDP growth and sectoral contribution

Since the second half of the 1990s, average GDP growth rates have been high across the Horn, especially in Ethiopia, which has become one of the fastest-growing economies in the world. Ethiopia is followed by Djibouti, although it experienced its first economic contraction in two decades in 2020 as a result of the global health pandemic.

Over the period 2000–2010, Sudan experienced an average growth rate of 7% induced mainly by oil extraction. However, this decade of high economic growth ended abruptly in 2011 following South Sudan’s secession when Sudan lost 75% of its oil resources.[39Congressional Research Service, Sudan in Focus, 2017.]

On average, Ethiopia, Djibouti and Eritrea have recorded between 5% and 9% GDP growth per annum over the past decade. However, conflict and political instability have led to the South Sudanese economy shrinking while the Somalian economy is now growing slowly.

The region had a total GDP of about US$160 billion in 2019, and most economic activities are concentrated in Sudan and Ethiopia, which account for 89% of the total GDP of the Horn. With the exception of Djibouti, which was recently classified as lower middle-income, the rest are all categorised as low-income by the World Bank. The average GDP per capita of the region (adjusted for purchasing power parity, or PPP) was about US$2 070 in 2019. It is projected to be US$3 030 in 2030 and US$4 685 in 2040, above the projected average of US$2 725 for other low-income countries in Africa in the same year (Chart 7).

GDP per capita for Djibouti is below the average for its African lower middle-income peers, but has recently overtaken that for Sudan, which is above the average of other low-income countries in Africa. Currently all the countries except Somalia have their GDP per capita (in PPP) above the average for low-income Africa.

Somalia currently has the lowest GDP per capita in the Horn of Africa and, on the Current Path, will still have the lowest per capita income in the region by 2040. The slow pace of GDP growth in Somalia is not enough to keep pace with population growth, and hence constrains improvements in income per capita.

The economies of the Horn of Africa countries have experienced some structural change but, like many other African countries, this transformation is mainly between subsistence agriculture and low-end services. The share of the agriculture sector in total regional GDP declined from 46.7% in 1997 to 28.9% in 2019. The contribution of the manufacturing sector increased slightly from 7.8% to 11.3% over the same period. The service sector has become the dominant economic activity in the Horn, with its contribution to total regional GDP increasing from 35.9% in 1997 to 48.4% in 2019. However, this regional picture masks large differences between countries (see Chart 8).

Djibouti’s economy relies heavily on the service sector as it accounts for nearly 87% of GDP. The country’s geographical location, its political and economic stability and dynamic port sector offer the opportunity to strengthen its position as a regional hub for various financial, information and communications technology (ICT), and logistics services.

Recognising the need for economic transformation, the government of Djibouti has initiated, through its Vision 2035, a programme to boost economic transformation and diversification. Through this development plan, Djibouti aims to develop a digital technology hub, promote light manufacturing, create more than 200 000 jobs and triple its GDP per capita by 2035[40World Bank, Republic of Djibouti, High-Level Development Exchange: Launch of Vision Djibouti 2035, 2014.]. Djibouti also has enormous tourism potential that remains untapped due to obstacles such as insufficient tourism-related infrastructure.[41World Bank, Republic of Djibouti, High-Level Development Exchange: Launch of Vision Djibouti 2035, 2014.]

Mining and agriculture constitute the main drivers of economic growth in Eritrea. These sectors are highly dependent on commodity prices and hazards associated with climatic change, and hence create significant volatility in the growth performance of the country. Economic opportunities in the country are mainly in mining, tourism and agriculture. However, agriculture, which accounts for 17% of GDP, is still very rudimentary and subject to recurrent droughts.

The dependence of two-thirds of the population on subsistence agriculture coupled with indefinite military service make the labour market almost non-existent.[42Coface for Trade, Major Macro Economic Indicators, 2020, ] Increased investment in mining is expected to drive growth. However, Eritrea is already at high risk of debt distress. Although the large share of this debt is domestic, external debt represents 64.4% of GDP.[43African Development Bank, African Economic Outlook, 2020.] This difficult macroeconomic situation limits the country’s growth prospects.

Years of conflicts and political division have destroyed much of the Somalian economy. The country’s exposure to recurrent shocks and crises, including drought and insecurity, locust infestation, and more recently the COVID-19 pandemic, pose many challenges for the economy.

Agriculture/livestock remains the backbone of the economy, accounting for around 60% of GDP and employing around 65% of the labour force.[44CIA, The World Factbook, 2020] The economy is however slowly transitioning from traditional rural pastoralism to urban trade and services. This offers several opportunities for investment and job creation. Most economic activities are centred around Mogadishu, the capital city, and security concerns continue to dominate business in the country.

Somalia’s economy is also highly dollarized. According to the International Monetary Fund (IMF), about 90% of currency in circulation in the economy is US$, and this makes it difficult for the Central Bank of Somalia to conduct effective monetary policy. Also, the country is in debt distress, with external debt estimated at 99.5% of GDP in 2019. However, Somalia is in a debt relief process through the Heavily Indebted Poor Countries initiative, and this could free up vital financial resources to support growth and reduce poverty.

The Sudanese economy, which was suffering from US sanctions, received a huge blow with South Sudan’s secession, losing two-thirds of its export earnings and over half the fiscal revenues, resulting in high macroeconomic imbalances.[45Congressional Research Service, Sudan in Focus, 2017.] The service sector accounts for about 60% of GDP while agriculture contributes a quarter of GDP and employs 80% of the workforce.

A year after former president al-Bashir was overthrown, Sudan is still trapped in economic mire; with currency depreciation, rising inflation and food shortages. According to Jonas Horner of the International Crisis Group, ‘economic recovery in Sudan will be a long road and will require sustained and coordinated technical and financial support of its traditional donors such as EU, US, UK and the Gulf states.’[46Deccan Herald, Sudan still in crisis a year after Omar al Bashir ouster, Deccan Herald, 9 April 2020] Prime Minister Abdalla Hamdok has noted that the country needs up to US$8 billion in support over the next two years to rebuild the economy given its high levels of external debt estimated at 88% of GDP.[47K Strohecker, Bashir ouster rekindles interest in long-defaulted Sudan loans, Reuters, 12 April 2019, ]

The removal of Sudan from the US State Sponsors of Terrorism list, reportedly in exchange for its recognition of Israel, opens the door for aid, debt relief, trade and investment. These are badly needed to pull the country out of its severe economic crisis compounded by COVID-19.

As for South Sudan, oil extraction continues to be the backbone of its economy, accounting for nearly 90% of government revenue and more than 30% of its GDP.[48World Bank, The World Bank in South Sudan overview, 2020] The country’s production potential has been drastically reduced by ongoing conflicts and economic mismanagement, and the economy is highly vulnerable to weather, oil conflicts and related shocks. Outside the oil sector, economic activities are concentrated in rudimentary agriculture and pastoral work.

The average inflation rate peaked at almost 380% in 2016 before declining to an estimated 27% in 2020.[49Statista, South Sudan: Inflation rate from 2016 to 2026,] Sustainable economic recovery in South Sudan will require long-term peace and comprehensive macroeconomic reforms to combat inflation, addressing foreign exchange distortions, and policies to diversify the economy away from oil.

With the exception of Ethiopia, which has determinedly pursued policies to attract investment in its manufacturing sector, the contribution of manufacturing to GDP in the Horn of Africa countries is marginal. For example, over the period 2005–2017, on average, output in Ethiopia’s manufacturing sector grew by 11% annually. However, the sector is still at the embryonic stage and its contribution to job creation and output is far from being an engine for growth and economic transformation.

The agriculture sector has historically been the backbone of the Ethiopian economy, although it has recently been overtaken by the service sector. Agriculture’s share in GDP has been falling, but it still employs more than 70% of the country’s workforce.[50African Development Bank, African Economic Outlook, 2020.] Manufacturing contributes to less than 10% of Ethiopia’s GDP. However, the ongoing conflict in the Tigray region will probably reduce investors’ appetite for Ethiopian destinations, and this could slow the growth in the manufacturing sector as it is mainly driven by foreign direct investment.

Agriculture and climate change

Agriculture is the backbone of the economies of the Horn and the source of livelihoods for the majority of the population. The sector is, however, poorly developed and faces numerous challenges as well as climatic and conflict impediments. The region is highly food insecure, owing to recurrent droughts, natural disasters and poor governance that hamper crop and livestock production.

Out of Djibouti’s 23 200 km2 of land, only 1 000 km2 are arable, and the country receives an average annual rainfall of only 130 mm. Djibouti has the biggest food deficit in the Horn of Africa and imports up to 90% of foodstuffs. As a result, the country is highly dependent on international market prices. Any variation in international prices has a considerable impact on the poorest segment of the population, who spend 77% of their household budget on food.[51]

Agriculture contributes about 4% of GDP. Approximately 30% of Djibouti’s rural population depends on this sector, and because most of the country is semi-arid to arid and water resources are limited, pastoralism is the main form of agriculture.[52IFAD, Djibouti]

In Eritrea, nearly 75% of the population depends on agriculture. Out of the 26% arable land, only 4% is actually under cultivation. The country is highly dependent on rainfall thus frequent droughts make crop farming even more difficult.[53IFAD, Eritrea] In fact, 70% of Eritrea’s land is hot and arid and it receives less than 350 mm of rainfall annually. As an acknowledgment of the situation, the Eritrean government has agreed to reserve US$17 million to administer solutions for drought effects in rural communities.[54The Borgen Project, 9 Facts About Poverty in Eritrea]

Between 80% and 85% of Ethiopians are engaged in agriculture and account for about 33% of GDP.[55Deloitte, Agricultural Opportunities in Africa: Crop farming in Ethiopia, Nigeria and Tanzania, August 2017] In Somalia, crop and livestock farming remain the main source of economic activity, constitute about 75% of GDP and represent 93% of exports.[56World Bank, Agriculture remains key to Somalia’s economic growth and poverty reduction, 28 March 2018]

Somalia is a fragile state but has huge agriculture and livestock potential. The country’s arable land is estimated at 8.5 million hectares with only 2.3 million hectares under rain-fed agriculture and 630 000 hectares under irrigation.[57Agra, Somalia: A fragile state with great potential for agricultural transformation, News and Update, 5 November 2019] Somalia also exports more than 50 million livestock and about 1.8 million tons of fish annually.[58Agra, Somalia: A fragile state with great potential for agricultural transformation, News and Update, 5 November 2019] In the current Somalia National Development Plan (2020–2024), agriculture is at the centre of the strategies to promote growth and reduce poverty.

South Sudan also has huge agricultural potential. Favourable soil, water and climatic conditions make 75% of its total land area suitable for agriculture. However, only 4% of the total land area is cultivated continually.[59African Development Bank, Development of Agriculture in South Sudan] Limited use of productivity-enhancing technologies, capacity constraints, poor infrastructure and protracted conflict have constrained agriculture production and the country continues to face recurrent episodes of acute food insecurity. In South Sudan, over 80% of the rural population depend on agriculture.[60African Development Bank, Development of Agriculture in South Sudan, www.afdb.org/fileadmin/uploads/afdb/Documents/Generic-Documents/South%20Sudan%20Infrastructure%20Action%20Plan%20-%20%20A%20Program%20for%20Sustained%20Strong%20Economic%20Growth%20-%20Chapter%206%2%20Development%20of%20Agriculture%20in%20South%20Sudan.pdf.]

In Sudan, agriculture is the main economic sector, contributing 25% to the GDP and employing about 80% of the workforce.[61MB Elgali and RH Mustafa, Sudan Agricultural Markets Performance under Climate Change] It has vast areas of agricultural land (about 200 million acres of arable land) and adequate water resources (25% share of Nile water resources under regional agreements). In fact, due to Sudan’s loss of access to most of its oil revenue with South Sudan’s secession, and Sudanese authorities’ desperate need for revenue, a new focus on agriculture has resurrected its long-standing dream of becoming an agricultural powerhouse.[62P Schwartzstein, One of Africa’s most fertile lands is struggling to feed its own people, Business Week, 2 April 2019]

Because of harsh climatic conditions, dependence on rain-fed agriculture, lack of infrastructure and investment in agriculture, poor governance, and persistent violent conflicts, agricultural yields and thus productivity are quite low in the Horn countries. As a result, many people suffer from food insecurity and malnutrition.

The combination of poor domestic crop production and increased domestic food demand, driven by rapid population growth and urbanisation, has led to a massive increase in food imports. From a food-security perspective, the Horn countries are in a precarious situation due to volatile international prices. It is therefore no surprise that the region is one of the most food-insecure regions in the world.[63Global Food Security Index, The Global Food Security Index]

IFs forecasts import dependence on crops to be about 10.6%, and that by 2040 it will have increased to roughly 25.8%, an increase of more than 15 percentage points in 20 years. Djibouti has a very high import dependence that has increased during the COVID-19 pandemic.

The situation is probably worse in South Sudan, where an unprecedented economic crisis, drop in oil prices and conflict have even made it difficult for the country to export, leaving many in need of humanitarian assistance. Prior to 2016, the country imported virtually everything. However, given the range of challenges in the country, the government is urging its citizens to turn to agriculture as an extreme poverty-alleviation strategy.[64M Nduru, South Sudan—Turning to agriculture, 8 April 2016]

Despite the poor performance in the agriculture sector, there is considerable scope for expansion and improvement. For example, in its National Development Plan, Djibouti hopes to increase domestic production, including seafood, and encourage value addition with the aim of exporting to Gulf countries. By 2035, Djibouti aims to have its agriculture sector contributing 5% of GDP.[65Republic of Djibouti, Vision Djibouti 2035]

Irrigation could ensure that more land is used for crop farming, although water access is an obvious constraint. Some projects have identified interventions that could moderate this challenge through improved collection, storage and use of surface water for drinking, agriculture and livestock farming. Efforts at sustainable agriculture have also attracted ideas to access and save water, such as importing palm trees for the production of dates, and to provide shade for other produce to be farmed. Djibouti, for example, is also experimenting with drip irrigation.[66Oxford Business Group, Plans to develop Djibouti’s agriculture and fishing to promote food and employment security]

Improving agricultural productivity is possible. In Ethiopia, the agriculture sector has seen the fastest expansion of land under irrigation of any African country by nearly 52% between 2004 and 2014. This is due to the Ethiopian government’s prioritisation of agriculture.[67The Conversation, How investment in irrigation is paying off for Ethiopia’s economy, The Conversation, 17 January 2019] To complement irrigation, other factors to consider in the development of agriculture include reform of land ownership, better farming practices, efficient use of fertilisers and less reliance on seasonal variability of production.[68]

Aside from crop farming, the Horn region has the largest population of nomadic pastoralists in the world. The pastoralists in the region are shifting to more commercial systems as populations grow and markets change. This trend is not uniform across the region and will probably create a mix of long-term challenges given the economic, environmental and demographic dilemmas faced in the region. As such, policies that support pastoralists opting out of the lifestyle as a means of earning their livelihood and those venturing into commercial systems need to be supported.[69]

The agriculture sector also faces risks associated with climate change that will likely affect crop and livestock production. Aside from affecting agricultural production, the International Food Policy Research Institute highlights the relationship between global warming and conflict in East Africa. The research finds that higher temperatures greatly affect the risk of conflict due to livestock price shocks and the stress on water and feed sources. It is projected that without intervention, the risk of conflict could increase by up to 30% in Sudan and South Sudan, and up to 50% in Somalia by 2030 as temperatures continue to rise.[70M Bernal Calderone, D Headey and J Maystadt, Enhancing Resilience to Climate-Induced Conflict in the Horn of Africa, The International Food Policy Research Institute (IFPRI), 2014.]

Natural resources

Natural resources such as oil, gas and minerals have significant potential to contribute to economic growth and development, provided the necessary regulatory frameworks and policies are in place, coupled with visionary and accountable leadership. Experiences in countries such as Norway, Canada and Botswana corroborate the view that natural resources can boost development.

The Horn of Africa region has not been known for huge natural resources endowment, especially extractives. For example, Djibouti’s natural resources are very limited. The country has no proven oil or natural gas reserves, and only 1% of the territory is forest. Djibouti’s main natural asset is probably its strategic location.

However, in recent years, some countries in the region have shown a mineral boom. With a significant discovery of gold, copper and silver, Eritrea is one example. With a new Chinese majority shareholder, the country’s largest mine (the Bisha mine) is expected to continue operation at least until 2024. Two other major mining projects, the Asmara mining project and the Colluli potash mine, will enter production in 2021/2022.[71Coface for Trade, Major macro economic indicators, 2020]

Ethiopia on the other hand has operational gold mines and the potential for the discovery of oil and huge natural gas as well as salt and potash. The Adola gold mine in southern Ethiopia, currently owned by a private company (MIDROC) through a concession from the Ethiopian Mineral Resources Development Corporation, is the largest gold mine in Ethiopia with an average annual production of 4.5 tons of gold.[72AS Debelo, Development by Dispossession? A Reappraisal of the Adola Gold Mine in Southern Ethiopia, Horn of Africa Bulletin, 28:4, 2016.]

However, there are concerns on the part of local government authorities, members of the opposition and the local community that the right to mine gold has been granted to MIDROC without clearly stipulating corporate social responsibility guidelines. There are also other concerns such as corruption and clientelism. In addition, the company’s mining activities have seen the dumping of toxic chemicals and, given the lack of compensation and engagement with the local community, this could lead to instability.[73AS Debelo, Development by Dispossession? A Reappraisal of the Adola Gold Mine in Southern Ethiopia, Horn of Africa Bulletin, 28:4, 2016.]

Promising test wells, seismic and gravimetric surveys, actual oil seeps and the geological resemblance to oil-rich Yemen strongly indicate the presence of oil in commercial quantities in Somalia.[74Horn 2015, Horn petroleum updates activities in Puntland, Somalia, 2016.] Somalia is significantly underexplored and the Horn is considered by many as one of the last remaining oil frontiers in Africa.[75JB Bamberger and K Skovsted, Oil in Somalia: Renewed Interest in Somali Oil, Horn of Africa Bulletin, 28:4, 2016.] However in the immediate future security concerns limit oil exploration activities in the country as clan militias frequently ambush oil exploration teams.

Prior to the secession of South Sudan, Sudan as a whole was estimated to have six billion barrels of oil and three trillion cubic feet of natural gas reserves. As most oil blocks are in the territory of South Sudan, the oil-producing capacity of Sudan was heavily diminished by the secession. Crude oil production declined from about 130 000 barrels per day (bpd) in 2013 to 72 000 bpd in 2019. According to the BP Statistical Review of World Energy for 2019, Sudan’s oil reserves stand at 1 500 million barrels only.

In 2012, South Sudan shut down all its oil production for 15 months in response to the action by Khartoum, which confiscated the oil as it flowed through the pipeline to Port Sudan. This was in an effort to recover unpaid fees related to oil transportation through the pipeline on its territory.[76Sunday Tribune, South Sudan shuts down its oil production countrywide, Sudan Tribune, 20 January 2012, https://sudantribune.com/South-Sudan-shuts-down-its-oil,41353.] At the end of 2019, South Sudan owed Sudan US$574 million for the transfer of oil.[77According to the oil agreement between Sudan and South Sudan following the secession, the Government of South Sudan would pay US$3.028 billion under the Transitional Financial Arrangement (TFA) to the Government of Sudan for the oil field infrastructure over 3.5 years, or US$15 per barrel of oil produced in South Sudan, until the total amount was settled. South Sudan would also pay Sudan US$11 per barrel for crude produced in block 1, 2, and 4 in South Sudan, including oil processing fees (US$1.6 per barrel), transportation fees (US$8.4 per barrel), and transit fees (US$1.0). In addition, crude oil from blocks 3 and 7 in South Sudan would incur oil transit fees (US$9.1 per barrel) for oil transported through the pipeline to Port Sudan. The Oil Agreement has been extended several times since then.]

According to experts’ assessment, oil production in Sudan could get to 100 000 barrels a day by investing in primary oil recovery techniques. However most foreign investors chose to leave Sudan by 2020 after their contracts ended. There was no interest by international investors in exploring the market when the authorities offered 15 oil blocks to international investors after the US eased economic sanctions in 2017.[78According to the oil agreement between Sudan and South Sudan following the secession, the Government of South Sudan would pay US$3.028 billion under the Transitional Financial Arrangement (TFA) to the Government of Sudan for the oil field infrastructure over 3.5 years, or US$15 per barrel of oil produced in South Sudan, until the total amount was settled. South Sudan would also pay Sudan US$11 per barrel for crude produced in block 1, 2, and 4 in South Sudan, including oil processing fees (US$1.6 per barrel), transportation fees (US$8.4 per barrel), and transit fees (US$1.0). In addition, crude oil from blocks 3 and 7 in South Sudan would incur oil transit fees (US$9.1 per barrel) for oil transported through the pipeline to Port Sudan. The Oil Agreement has been extended several times since then.]

This lack of interest in the Sudanese offer reflects low expectations of large new oil finds in the country, governance and policy weaknesses as well as ongoing concerns about the threat of a resumption of conflict. Due to resource constraints, it will be very difficult for the Sudanese government to develop the oil sector without foreign investment.

Aside from the poor governance that continues to plague the extractive sector in the Horn of Africa, a large part of the resources is found in peripheral and border areas of the region where political marginalisation is compounded by conflicts and economic deprivation of local communities. Here literacy rates are among the lowest and poverty rates the highest.[79Life & Peace Institute, The Political Economy of Extractives in the Borderlands, Horn of Africa Bulletin, 28:4, 2016.] This existing pattern of resource extraction characterised by local communities’ exclusion and absence of positive trickle-down effects is likely to be confrontational unless appropriate policy frameworks are put in place and genuinely implemented by Horn governments.

The trade pattern of countries in the Horn of Africa is similar to that of many other African countries that rely on a few key commodity exports while importing higher-value manufactured goods, consumer items and foodstuffs.

Historically in deficit, the trade balance of the Horn of Africa region partially depends on weather phenomena, which sometimes forces the countries to import grains during drought. For instance, in the IFs database, the total exports and imports of the region amounted to respectively 13.3% and 24.6% of the regional total GDP, resulting in a trade deficit of about 11% of the regional total GDP in 2019.

The region is relatively open to trade with a foreign trade-to-GDP ratio of 38% in 2019, and Middle East countries, especially the Gulf countries, are among the key trading partners for most of the Horn nations.

Overall, China is the main destination of Horn export mainly due to fossil fuels from South Sudan, and the Gulf states are the main trading partner for goods (excluding fossil fuels) from Djibouti, Somali, South Sudan and Sudan.

Djibouti mainly exports cattle to the Gulf states and re-exports vehicles, machinery, food and cement. According to the latest UN Conference on Trade and Development (UNCTAD) data,[80UNCTAD, General profile: Djibouti, 2020] the top five major export destinations of Djibouti in 2019 were Yemen, Ethiopia, Saudi Arabia, Egypt and the US. The country imports mainly petroleum products, food, vehicles and other capital goods from the EU, UAE, Japan and Ethiopia.

The economies of Ethiopia and Djibouti are highly interdependent since the Port of Djibouti constitutes the only maritime outlet for the landlocked territory of Ethiopia. However, the recent peace between Ethiopia and Eritrea, with the resulting opportunity for Ethiopia to use Eritrea’s ports, may change this situation.

Coffee is the main export product of Ethiopia. In 2018, the share of coffee in the country’s export was 29.5%, followed by oilseeds (14.9%), pulses (9.5%), cut flowers (8%) and gold (3.5%). Manufacturing accounts for less than 8% of Ethiopia’s total exports but this is likely to increase in the near future as the country is doing relatively well in developing its manufacturing sector. The top five major destinations for Ethiopia’s exports in 2019 were China, the US, Sudan, Switzerland and Saudi Arabia. Imports mainly come from Asia (64.2%, of which China accounts for 39.3%) followed by Europe (19.3%), the US (9.4%) and Africa (7%).[81UNCTAD, General profile: Djibouti, 2020]

Eritrea’s export basket is made up of livestock, coffee, cotton and leather, which makes it very dependent on variable weather conditions given its underdeveloped irrigation systems, textile products and limited minerals (copper and gold). The country imports virtually all of its capital goods, oil/petroleum and food products. About 90% of its consumption of food is imported. Eritrea’s main trading partners are China, the Republic of Korea, India, the UAE and Myanmar.

The peace deal signed with Ethiopia in July 2018 will probably improve Eritrea’s trade relations with Ethiopia. However, the government maintains strict control on foreign exchange reserves, and this severely limits the freedom of trade and undermines the country’s economic progress.[81UNCTAD, General profile: Djibouti, 2020] At the time of writing this report, it is unclear as to the impact of the security alliance between Ethiopia and Eritrea that saw the latter provide substantial military resources in support of Ethiopia in the subjugation of Tigray.

Before South Sudan’s secession, especially during the period 2000–2011, Sudan was highly dependent on the revenues from oil exports. The loss of oil following secession eventually forced the government to boost non-oil exports to compensate for the loss of oil export revenue. Certain commodities such as sugar, cotton, wheat, edible oil, livestock and gum arabic, among others, were targeted for export and import substitution. As a result, exports in agriculture raw materials increased from 9% of total exports in 2011 to 57% in 2018.[82Sudan National Report, Implementation of Istanbul plan of action for least developed countries (IPoA), 2011–2020, 2019, Republic of the Sudan: Ministry of Finance and Economic Planning.]

Despite this improvement, government policies did not materialise in diversifying exports from agriculture raw material and natural resources to manufactured goods. The US sanctions also had negative impacts on promoting manufacturing in Sudan since it complicated cross-border payments, and the recent lifting should allow the country to increase exports.[83Sudan National Report, Implementation of Istanbul plan of action for least developed countries (IPoA), 2011–2020, 2019, Republic of the Sudan: Ministry of Finance and Economic Planning.]

Sudan mainly exports fuels, gold, oilseeds, live animals and cotton, and imports capital goods and foodstuffs. Sudan’s main export partners are the UAE (40% of total exports), China, Saudi Arabia, India, Egypt and Ethiopia (4%), while imports are from China (22% of total imports), the UAE, Saudi Arabia, India, Japan and Egypt (5%).[84Objectif Import Export, Country risk of Sudan: International trade]

Since its independence in 2011, the government of South Sudan has been struggling to integrate the young country into the international trade network. The country has gradually moved closer to the East African Community, becoming its latest member in 2016.

South Sudan is one of the most oil-dependent countries in the world; oil exports accounted for 98% of total exports in 2019. The top five major export destinations in 2019 were China, the US, India, UAE and Spain. South Sudan mainly imports vehicles, machinery, electrical appliances, pharmaceuticals, plastics and food and beverages. The peace agreement signed in September 2018aimed at ending the civil war has led South Sudan and Sudan to open four border crossings, which is likely to increase formal trade between the two.

Somalia has a systemic and large trade deficit which is estimated at over 70% of GDP per annum. This external deficit is the result of the country’s high dependence on food imports, which is the result of a chronic food crop deficit. It is also as a result of the import of construction materials, fuel and manufactured goods.

Livestock, bananas, skins, fish, charcoal, frankincense and scrap metal constitute Somalia’s main exports. According to UNCTAD data, in 2019 Somalia’s top five export destinations were Yemen, India, Japan, Bulgaria and Turkey, while imports were from China, India, Turkey, Malaysia, Indonesia, Brazil, Pakistan and the US. The absence of a stable customs authority, the poor quality of road and port infrastructure, as well as high levels of insecurity are some of the main factors that impede Somalia’s participation in international trade.[85Objectif Import Export, Country risk of Somalia: International trade]

Somalia’s prospects for expanding trade, both within the region and internationally, are contingent upon its accession to the World Trade Organization (WTO). Somalia has submitted its accession application but WTO membership has not yet been granted.

Accession could boost trade for the country and increase its participation in the global value chains provided the country undertakes the necessary structural and institutional reforms required to liberalise trade and build strong economic institutions. However, this is highly unlikely to happen soon because Somalia not only lacks a manufacturing base, but also the political capacity to implement the necessary reforms.

The official cross-border trade within the Horn region is low. Over 95% of cross-border trade within the region is informal, carried out by pastoralists trading livestock. For instance, the unofficial trade of live cattle, camels, sheep and goats from Ethiopia to other countries in the Horn is estimated to be between US$250 million and US$300 million annually. This is 100 times more than the official figure.[86] The formalisation of this trade could bring important additional tax revenue to the governments of the region but would require significant improvements in border control and management.

Overall, the exports of the Horn of Africa nations are poorly diversified. The share of manufacturing exports is very low. IFs estimated the value of total manufacturing exports at about 4% of the regional GDP in 2019. This overreliance on exports of low-value raw materials puts the economies at the mercy of fluctuating international markets and makes macroeconomic and budgetary planning difficult. The Africa Continental Free Trade Area agreement, once implemented, offers an opportunity to promote regional trade and manufacturing in particular, and hence diversify their economies away from commodity exports.

Foreign direct investment, aid and remittances

Access to international finance offers a possibility for countries to augment domestic savings for investment. Particularly, foreign direct investment (FDI) can be an important catalyst for growth and development as it brings much-needed capital and technology into the recipient economies.

Chart 11 shows the trends in external financial flows in the Horn of Africa countries from official data. In percentage of GDP, Djibouti and Ethiopia are the highest recipients of FDI inflows in the region while South Sudan and Eritrea are the lowest. In percentage of GDP, Somalia is by far the largest recipient of aid and remittances followed by South Sudan while Ethiopia receives the least remittances.

However, in absolute terms, most FDI and ODA into the region goes to Ethiopia. For example, in 2018, FDI inflows and ODA to Ethiopia were respectively US$3.3 billion (64% of regional total FDI inflows) and US$4.9 billion (50% of regional total aid). Official remittance flows to Ethiopia reached US$5 billion in 2018, a large increase from only US$140 million in 2002/3. The actual amount is likely much larger as informal remittances are not captured in official data.