Tanzania

Tanzania

Feedback welcome

Our aim is to use the best data to inform our analysis. See our Technical page for information on the IFs forecasting platform. We appreciate your help and references for improvements via our feedback form.

This page provides an in-depth analysis of Tanzania's current and projected future development, examining various sectoral scenarios and their potential impacts on the country's growth. It explores eight sectors including demographic, economic, and infrastructure-related outcomes for Tanzania up to 2043. The analysis also considers the implications of the Agenda 2063 goals and aims to provide policymakers and researchers with insights to guide Tanzania towards a more prosperous future.

For more information about the International Futures modelling platform that we use for the development of the various scenarios, please see About this Site.

Summary

We begin this page with an introductory assessment of the country’s context by looking at current population distribution, social structure, climate and topography. The United Republic of Tanzania is the 13th largest country in Africa with the 11th largest economy and 5th largest population, but it ranks at only 31st when comparing GDP per capita in PPP. After two decades of sustained economic growth, Tanzania graduated from low to lower-middle-income country status in 2020. It will likely remain at the lower end of the group in various development indicators and achieve upper-middle income status at around 2054, largely because of the drag from its very large informal sector on productivity improvements.

The next section consists of an analysis of the Current Path forecast for Tanzania which informs the country’s likely current development trajectory to 2043. It is based on current development trends and assumes that no major shocks would occur in a ‘business as usual’ future.

- Tanzania has a young (median age 18.5 years) and rapidly growing population that is still several decades away from entering a potential demographic window of opportunity.

- Tanzania has experienced strong economic growth for decades but also struggled with competitiveness. Its sizeable informal sector (46%) and the associated large portion of labour (76%) constrain growth.

- In 2023, Tanzania's GDP per capita (PPP), at US$2 668, was 56% of the average for Africa’s lower-middle-income countries, third lowest amongst its peer grouping, but improving. On the Current Path, GDP per capita will grow steadily to US$4 890, or 43% of the group average, by 2043.

- Using the monetary poverty line of US$3.65, 74.1% (or 48.7 million) Tanzanians were poor in 2023, a ratio that will decline to 39.8% (40.5 million) in 2043 on the Current Path. Tanzania will drop in the poverty ranking from third highest position to seventh within the 24-country lower-middle-income group in Africa.

- Tanzania’s current Five Year Development Plan lll (2021/22 - 2025/26) is the third in a series to achieve the goals of the National Development Vision 2025.

The analysis then proceeds to compare progress on the Current Path with eight sectoral scenarios. These are Demographics and Health; Agriculture; Education; Manufacturing; the African Continental Free Trade Area (AfCFTA); Large Infrastructure and Leapfrogging; Financial Flows; and Governance. Each scenario is benchmarked to present an ambitious but reasonable aspiration in that sector.

- Poor health and malnutrition are significant constraints on development in Tanzania which also does poorly on various indices of basic infrastructure, such as unimproved water supply. In the Demographics and Health scenario, Tanzania will enter a demographic window of opportunity from 2036, on par with the average for its lower-middle-income peer group and about a decade earlier than on the Current Path.

- In 2023, agriculture contributed 26% to Tanzania’s GDP, and the country could be a significant agricultural exporter. Yet, Tanzania struggles to meet its domestic food requirements due to low productivity of predominant subsistence farming. The Agriculture scenario will see Tanzania essentially meet its domestic demand.

- Tanzania performs significantly worse than its income peer group in the mean number of years of adult education. In the Education scenario, the mean number of years of education increases from 6.6 years in 2023 to 8.4 years in 2043, representing an improvement of 0.6 years in 2043 compared to the Current Path.

- The Manufacturing scenario will reduce the share of Tanzanians living below the US$3.65 poverty line from 74.1% in 2023 (equivalent to 48.3 million people) to 39.7% in 2043 (40.3 million people). This translates to 837 000 people escaping poverty compared to the Current Path in that year.

- Tanzania makes solid gains in the African Continental Free Trade Areas (AfCFTA) scenario. Because it has recently graduated from low to lower-middle-income status, its GDP per capita in 2023 is only 44% of the peer group average. In the AfCFTA scenario, it increases to 61% in 2043 instead of 57% on the Current Path.

- In the Current Path, 72.3% of Tanzanians will have access to electricity by 2043. In the Large Infrastructure and Leapfrogging scenario, access to electricity will expand faster, reaching 81.5% of the population by 2043, meaning only 19 million Tanzanians will still be without electricity access.

- Government revenues in Tanzania are below 16% of GDP in 2023, almost three percentage points below the peer group average. In the Financial Flows scenario, government revenues increase by 1.47 percentage points of GDP in 2043, equivalent to US$1.47 billion - a cumulative increase of US$12.2 billion additional revenues from 2024 to 2043.

- Tanzania's scores on governance are comparable to the average for lower-middle-income African countries. In 2023, Tanzania scored better in security and much higher in inclusion but had slightly less capacity than its peers. In the Governance scenario, Tanzania will do better than the group average in security and capacity by 2043 and improve regarding inclusion.

In the third section, we compare the impact of each of these eight sectoral scenarios with one another and subsequently with a Combined Agenda 2063 scenario (the integrated effect of all eight scenarios).

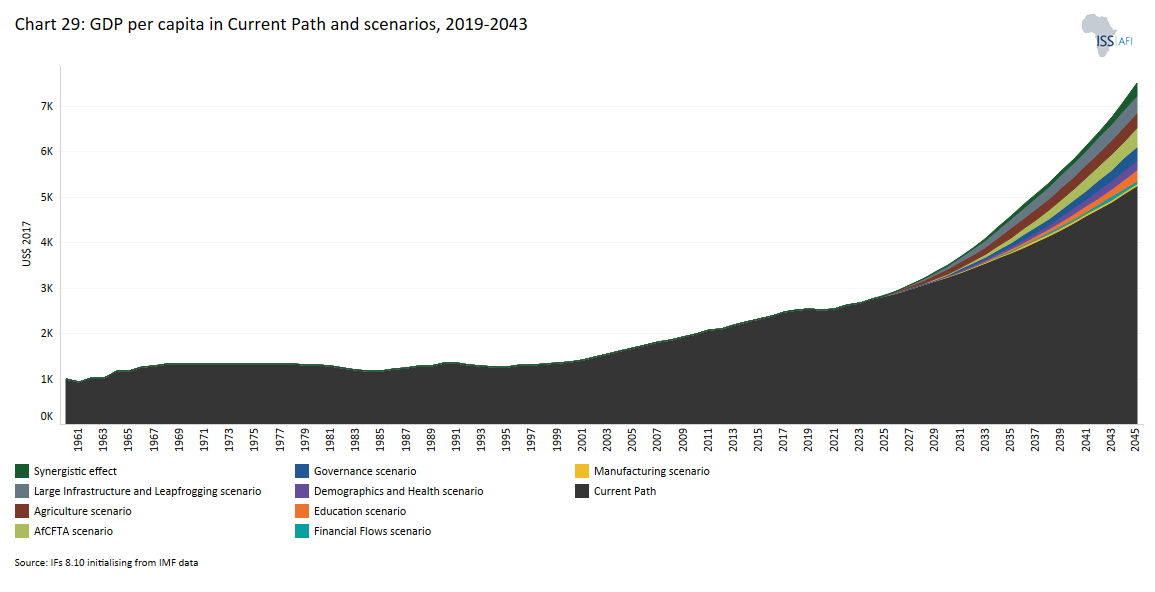

- In 2023, Tanzania’s GDP per capita was 50% lower than the average of Africa’s 24 lower-middle-income countries. It will slightly improve its ranking on the Current Path by 2043, yet the Combined scenario will increase Tanzania’s GDP per capita by 38% or US$1 855 above the Current Path. The Large Infrastructure and Leapfrogging scenario will have the most significant positive impact on the GDP per capita, followed by the AfCFTA and the Agriculture scenarios.

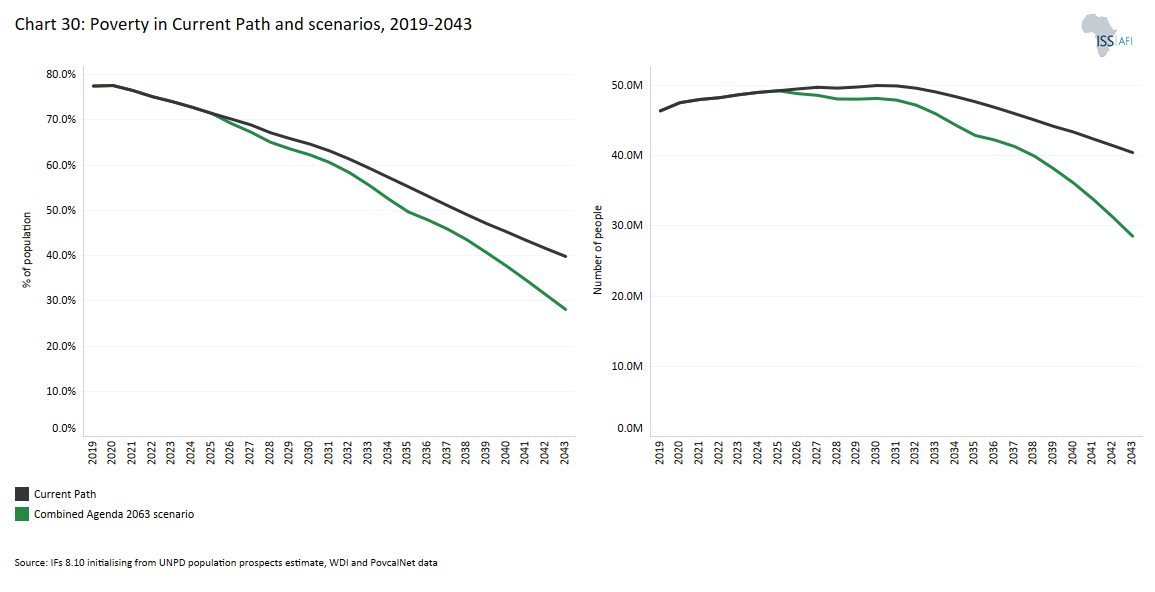

- Poverty in Tanzania is stubborn, with limited responsiveness to growth. In 2023, 48.7 million Tanzanians lived below the US$3.65 poverty line for lower-middle-income countries, equivalent to 75.2% of the population. On the Current Path, that number will decline to 40.5 million (39.8%). In the Combined scenario, poverty in Tanzania will decrease to 28.1% or 28.6 million people. The positive impact of the interventions in the Agriculture, Demographics and Health and Education scenarios on poverty are most significant.

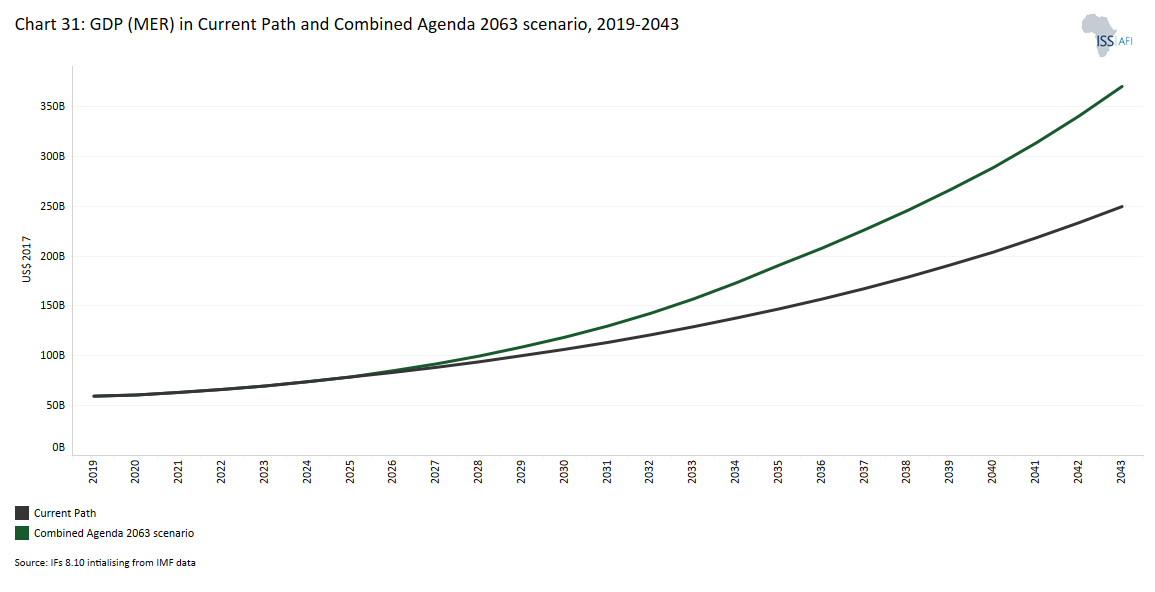

- Tanzania’s GDP will grow substantially from US$69.7 billion (2023) to US$249.6 billion in 2043 on the Current Path and to US$370 billion in the Combined scenario, making it Africa’s sixth largest economy.

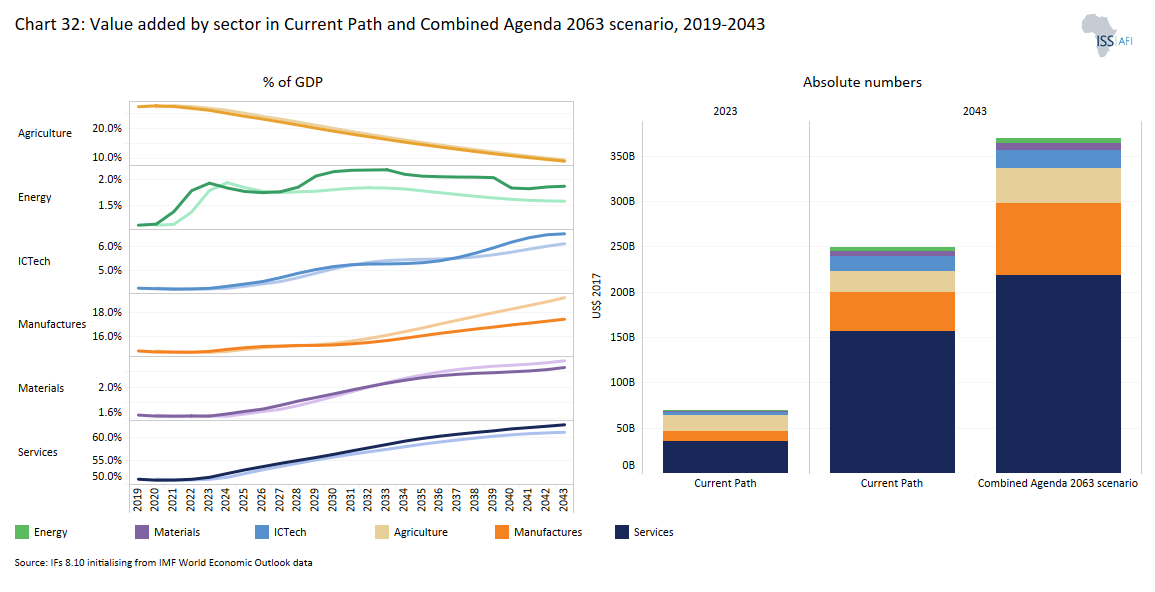

- Low-end services dominate Tanzania’s economic structure. In 2023, the services sector contributed 51% to GDP, followed by agriculture at 26%. Tanzania’s manufacturing sector is one of the smallest among its lower-middle-income peers and contributed 5.6 percentage points less to GDP than the group average in 2023.

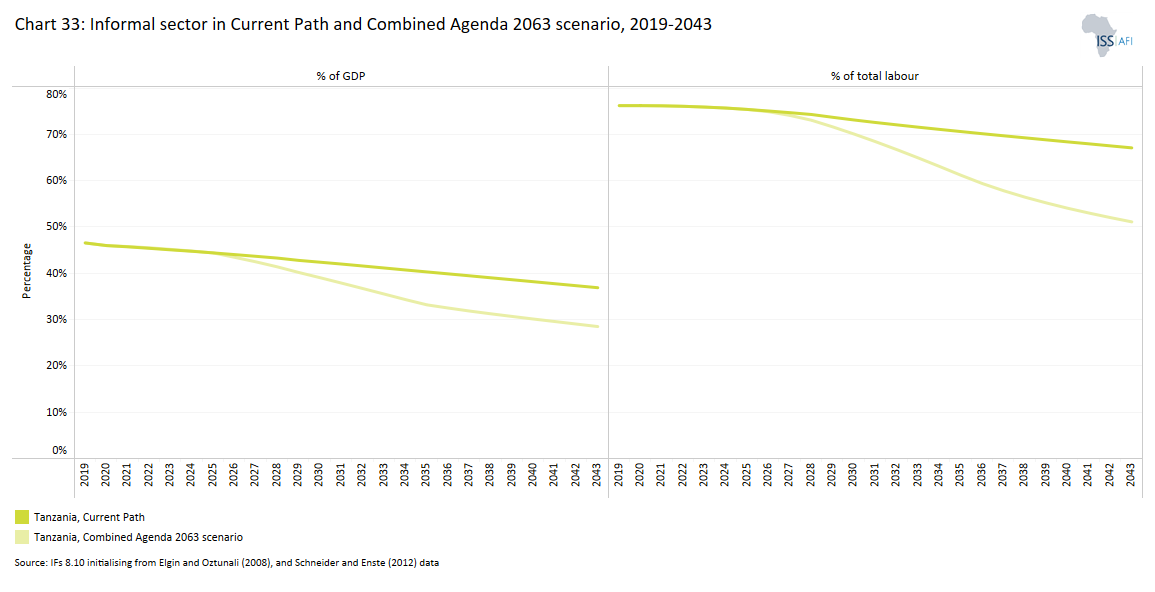

- In 2023, Tanzania’s informal sector accounted for approximately 45% of GDP, second only to Zimbabwe in Africa. It is a significant constraint on economic growth. By 2043, the contribution of the informal sector to the country’s GDP will decline to 37% in the Current Path and 28.5% in the Combined scenario, then at number 20 in Africa.

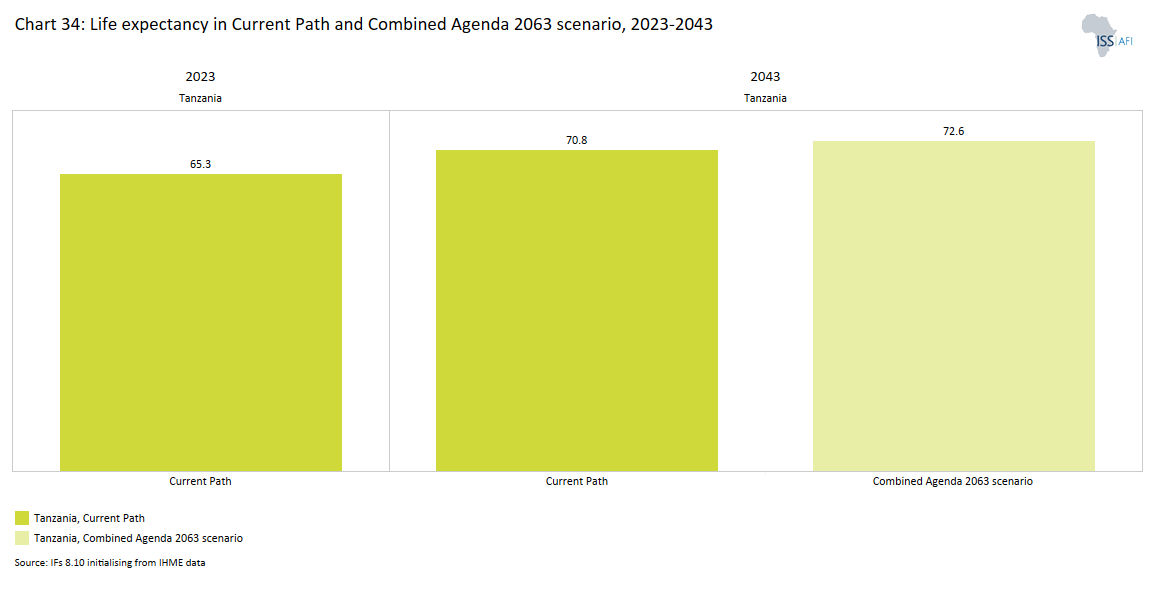

- In 2023, the life expectancy at birth for the average Tanzanian was 65.3 years, with women having almost four years higher life expectancy than men. On the Current Path, average life expectancy in Tanzania will increase to 70.8 years in 2043, with female life expectancy 4.3 years above men's. Tanzania’s lower life expectancy is attributed to a relatively high disease burden for both communicable and non-communicable diseases, as well as high levels of stunting. Life expectancy in Tanzania will increase to 72.6 years in the Combined scenario by 2043.

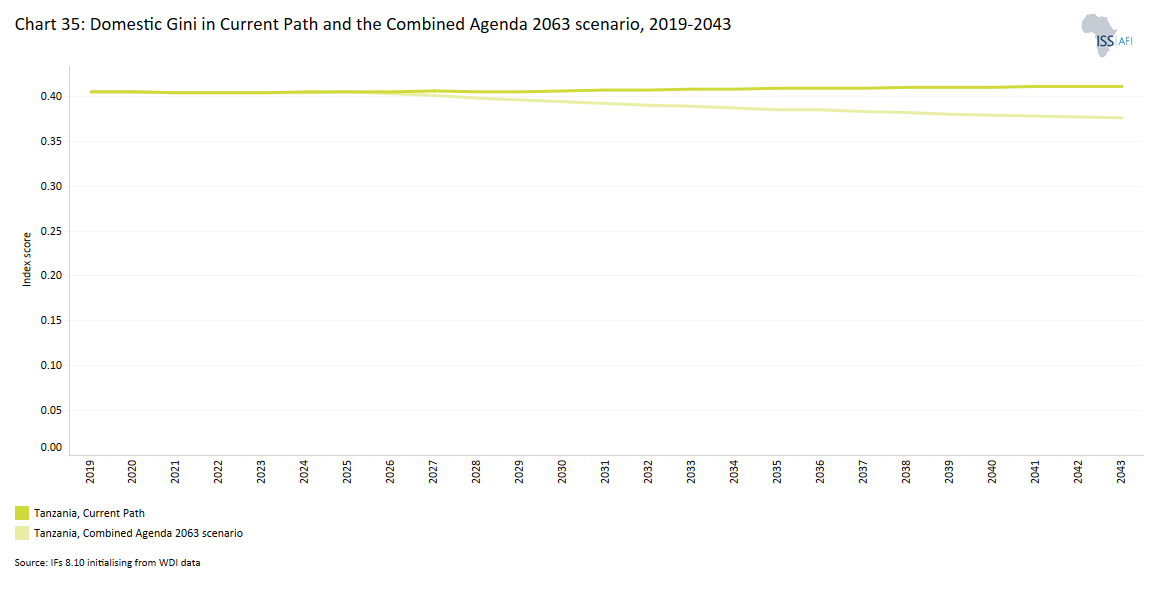

- Tanzania is, on average, about 7% more unequal than Africa’s lower-middle-income countries. Using the Gini coefficient, Tanzania’s score in 2023 is comparable to Djibouti and Kenya. The effect of the Combined scenario is to reduce inequality. By 2043, Tanzania would be doing about 3% better than its peer group.

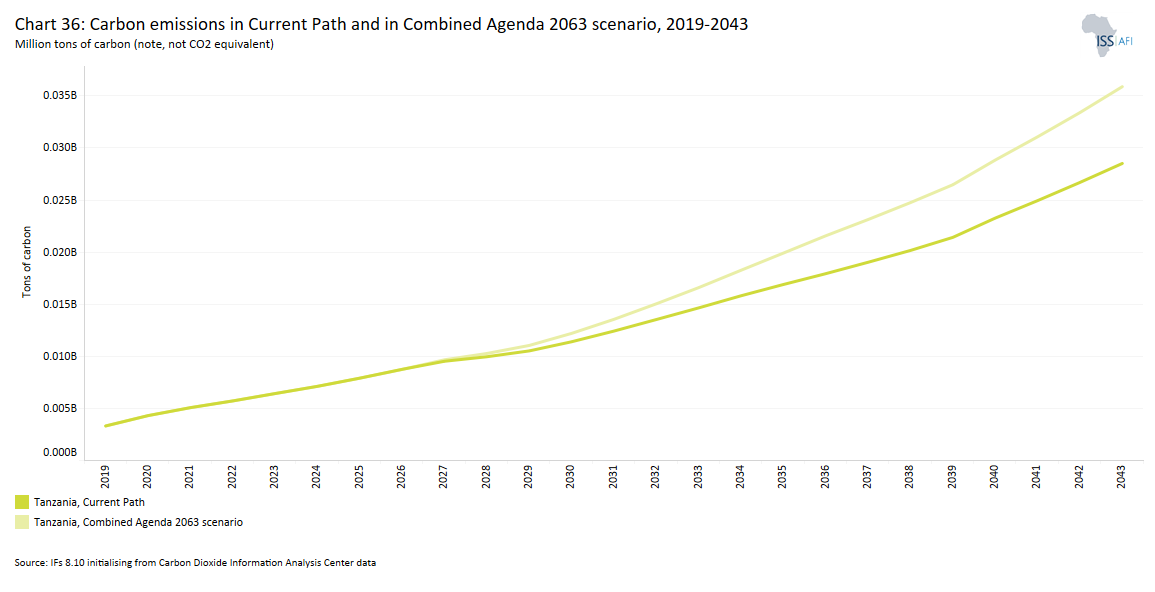

- Tanzania was the 12th largest carbon emitter in Africa, with the 11th largest economy. In the Current Path, emissions will increase more than fourfold to 28.5 million tons of carbon by 2043. In the Combined scenario, Tanzania will become the seventh most significant emitter by 2043 and the economy will be the sixth largest.

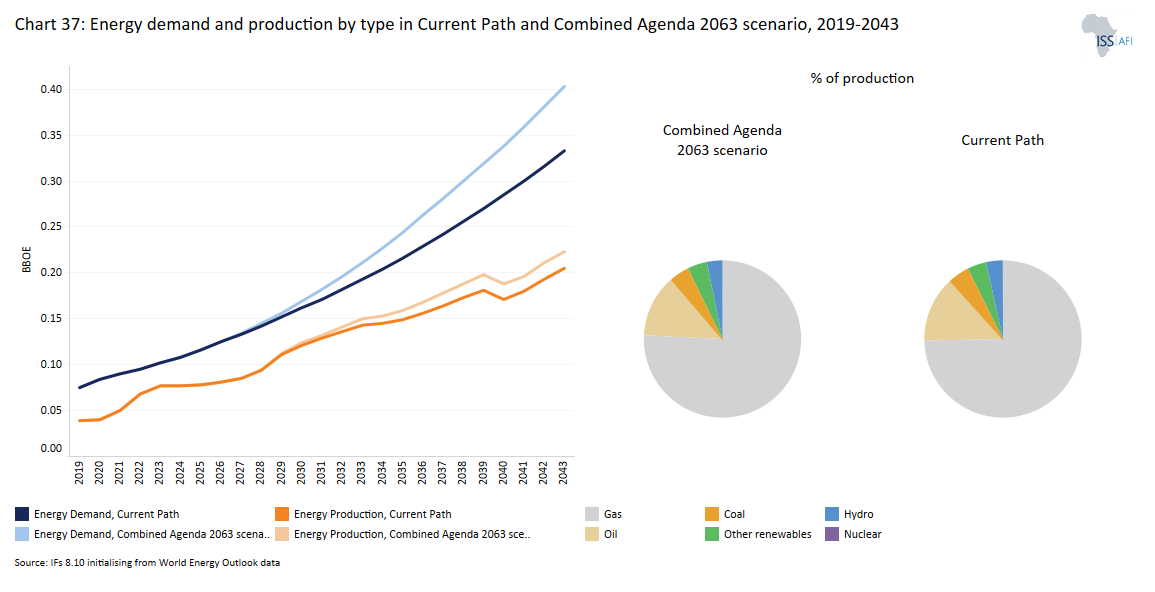

- Tanzania's total energy balance reflects a substantial energy import dependence. By 2043, production will exceed 205 million barrels of oil equivalent (MBOE) even including increased energy production from gas and hydro. Still, energy demand will have increased to 333 MBOE in the Current Path and 403 MBOE in the Combined scenario. In 2023, Tanzania imported roughly 30% of its domestic energy demand, which would increase to 41% in the Current Path and 46% in the Combined scenario.

We end this page with a summarising conclusion offering key recommendations for decision-making. Tanzania faces key challenges such as a large low-end services sector, substantial subsistence agriculture, a poorly educated youthful population and a sizable informal sector. Targeted sectoral interventions are essential to accelerate development, reduce poverty, and enhance economic productivity, aligning with the African Union’s Agenda 2063 for sustainable growth and shared prosperity.

All charts for Tanzania

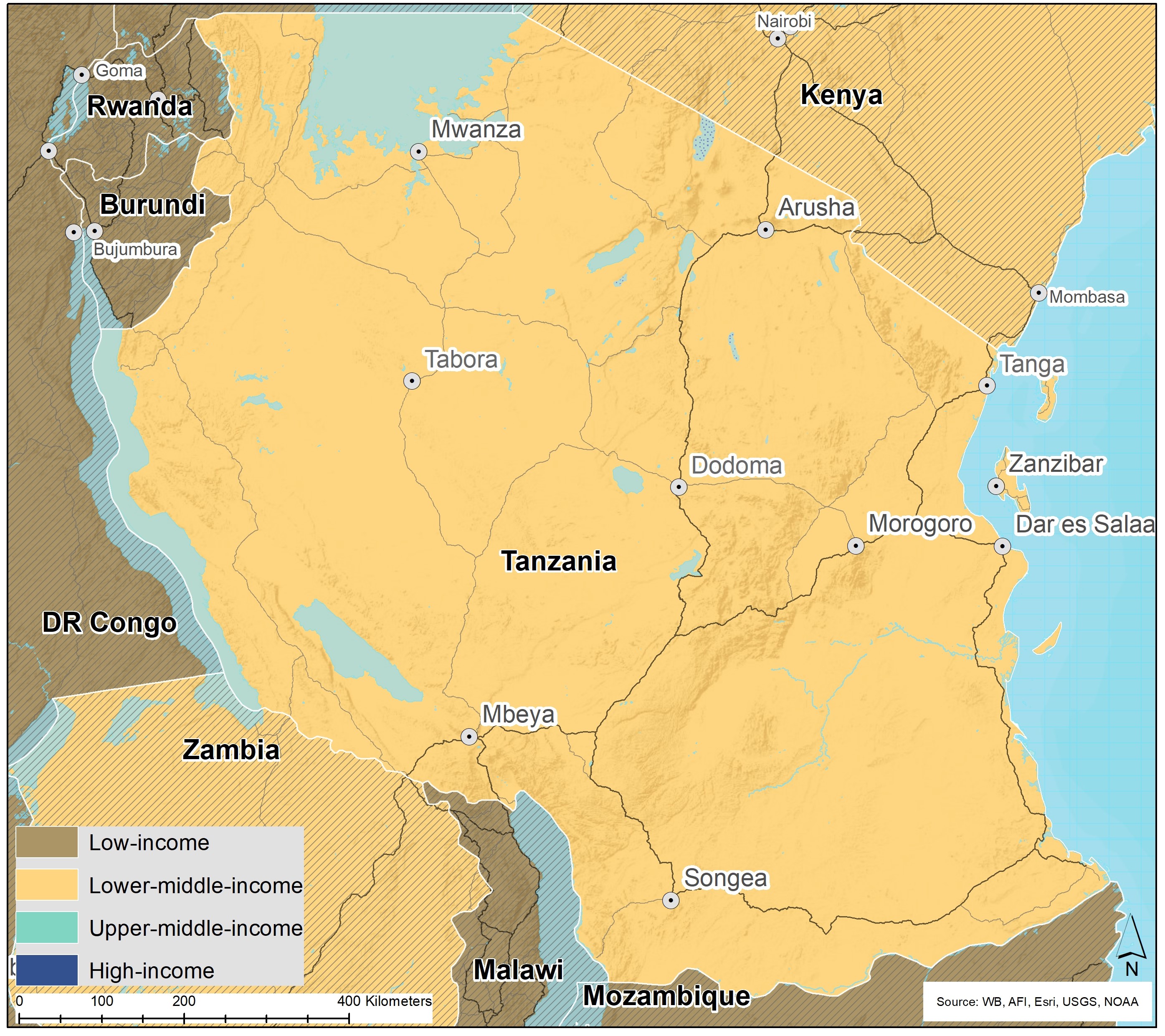

- Chart 1: Political map of Tanzania

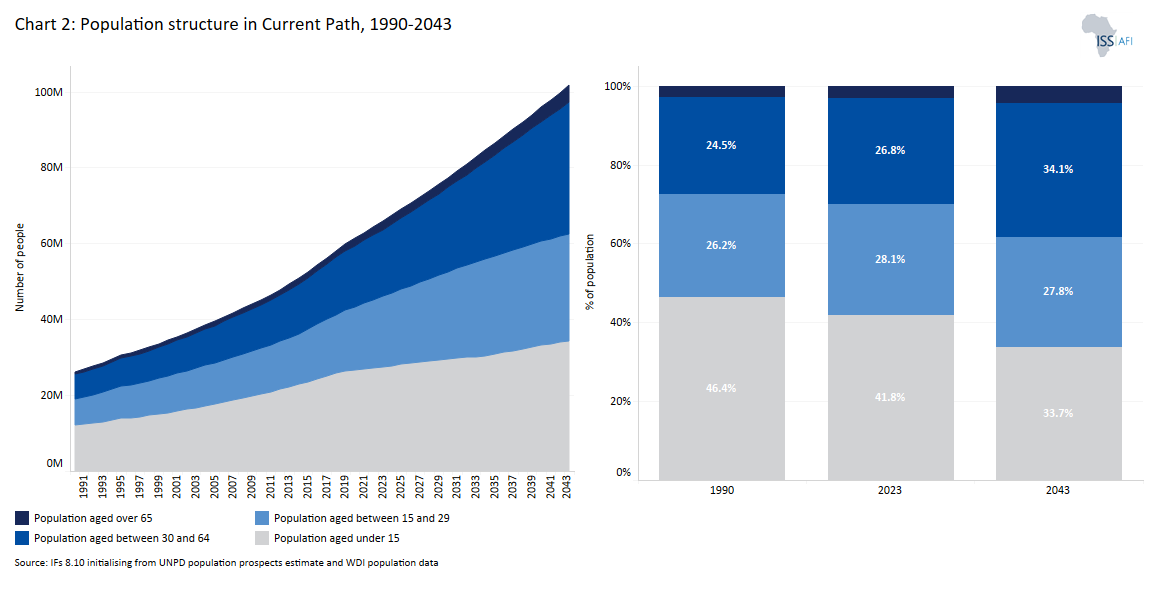

- Chart 2: Population structure in Current Path, 2019–2043

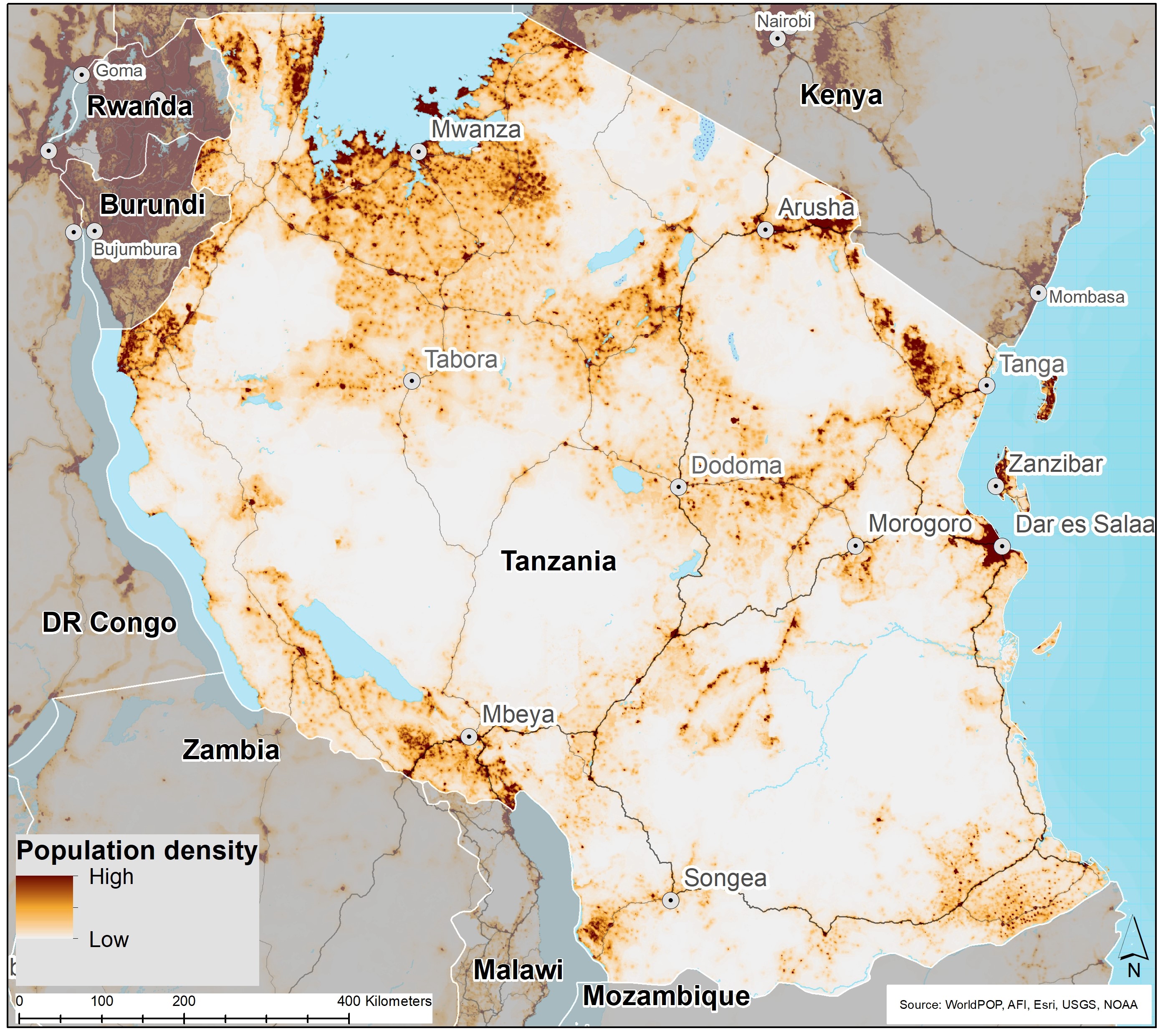

- Chart 3: Population distribution map, 2022

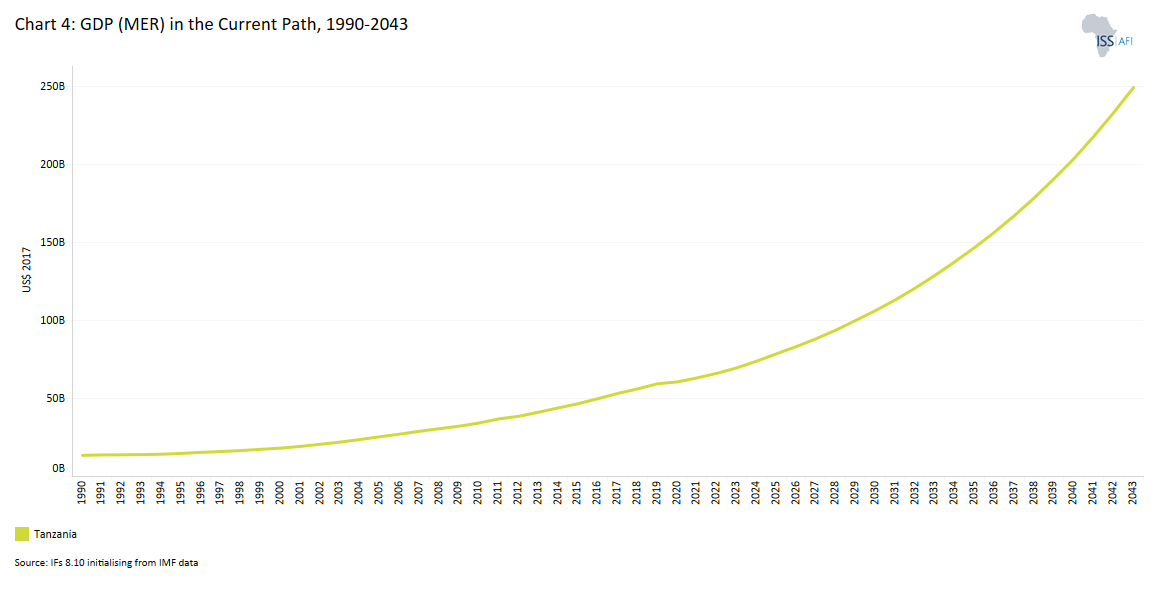

- Chart 4: GDP in MER and growth in the Current Path, 1990–2043

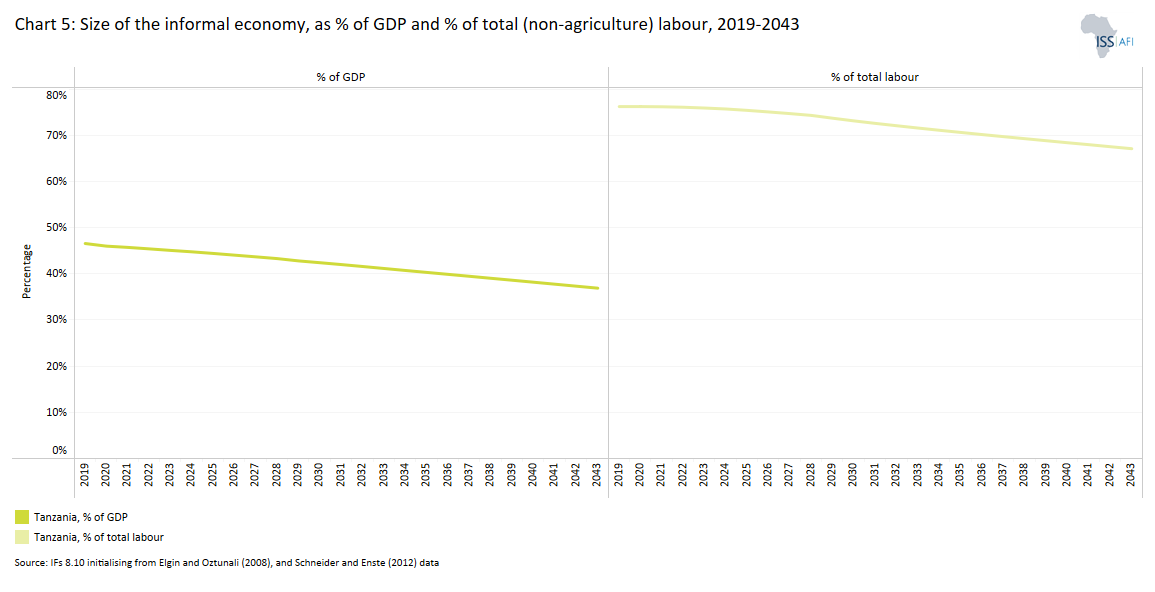

- Chart 5: Size of the informal economy as % of GDP and % of total labour (non-agriculture), 2019-2043

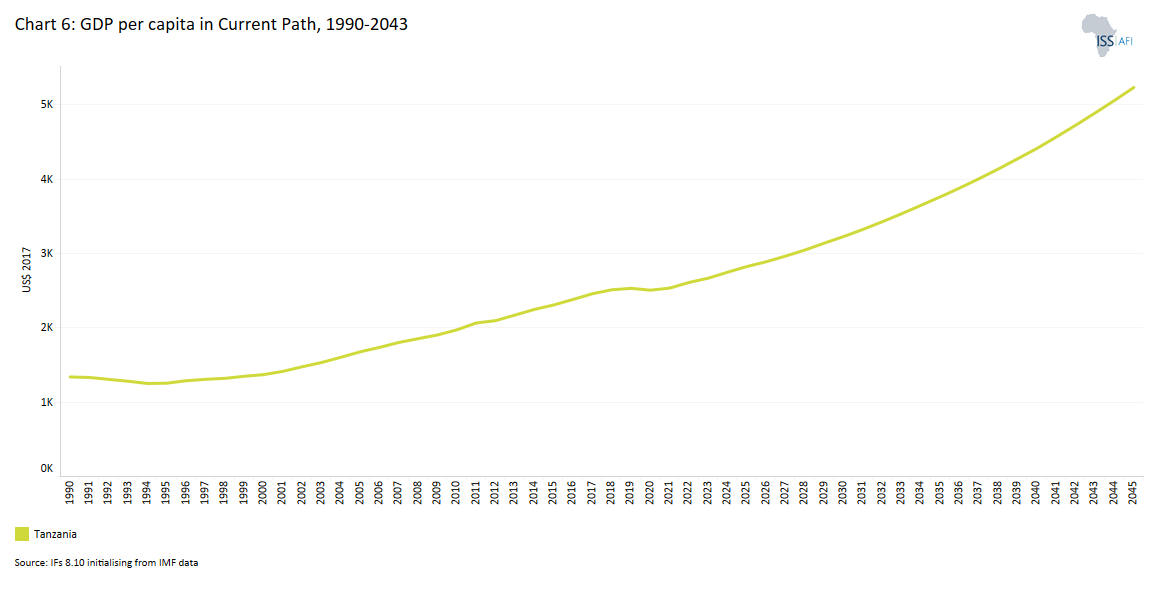

- Chart 6: GDP per capita in Current Path, 1990–2043

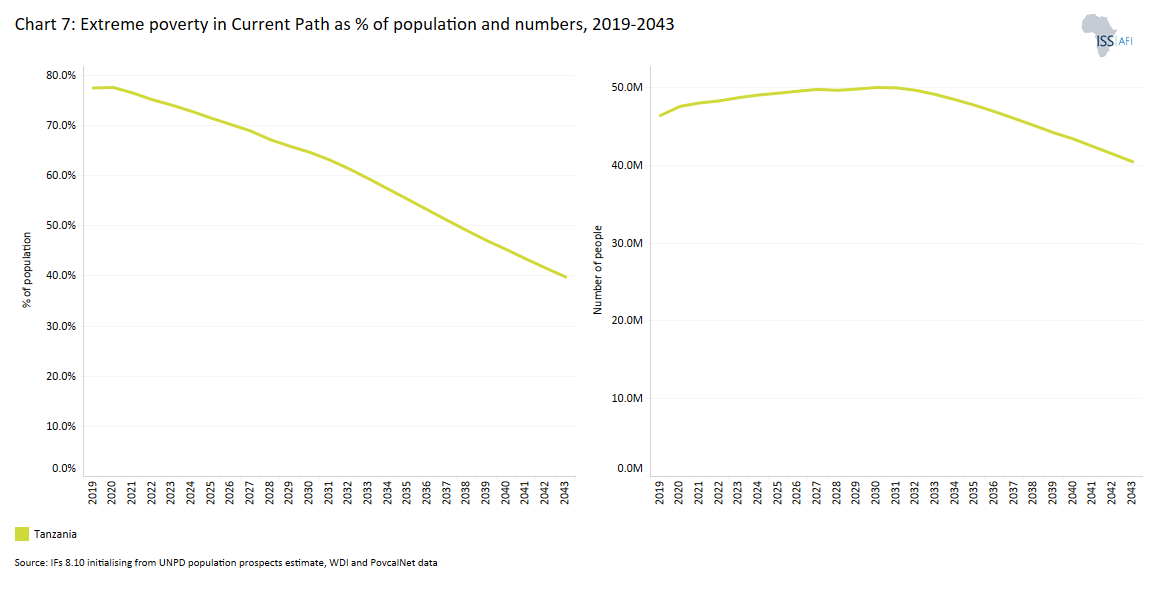

- Chart 7: Extreme poverty in Current Path as % of population and numbers, 2019–2043

- Chart 8: The Tanzania Development Vision 2025

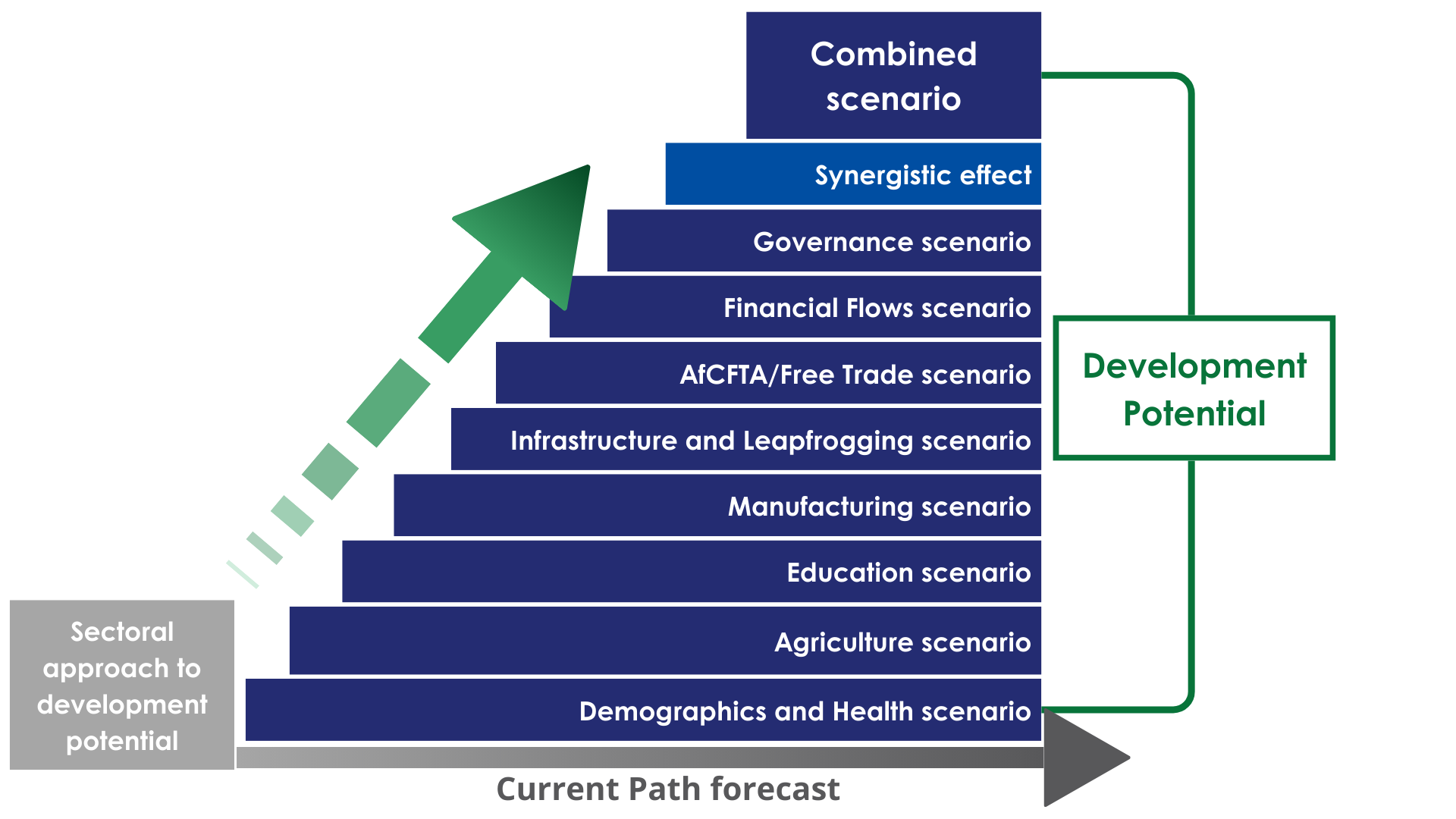

- Chart 9: Current Path and scenarios

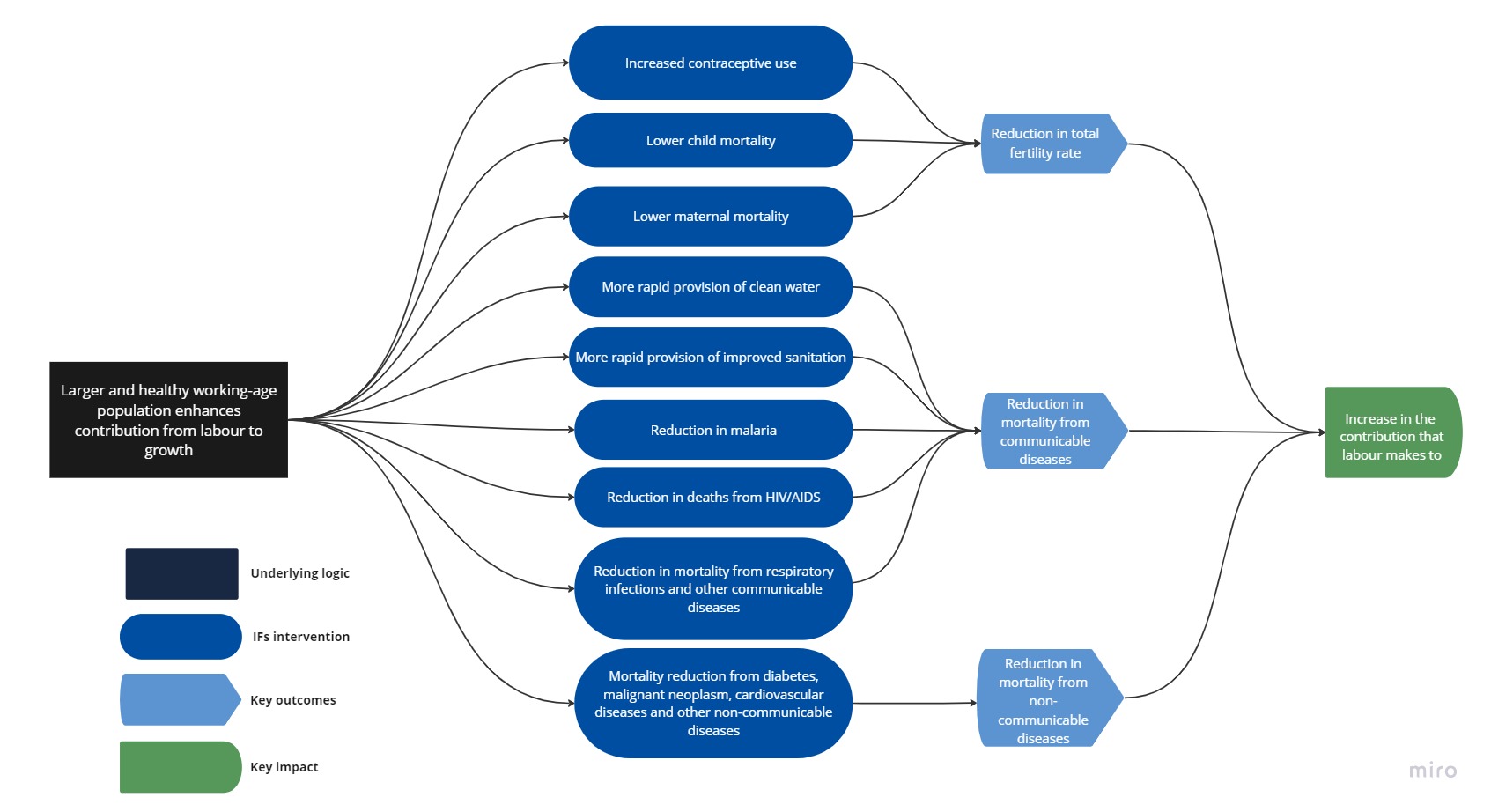

- Chart 10: Demographics and Health scenario

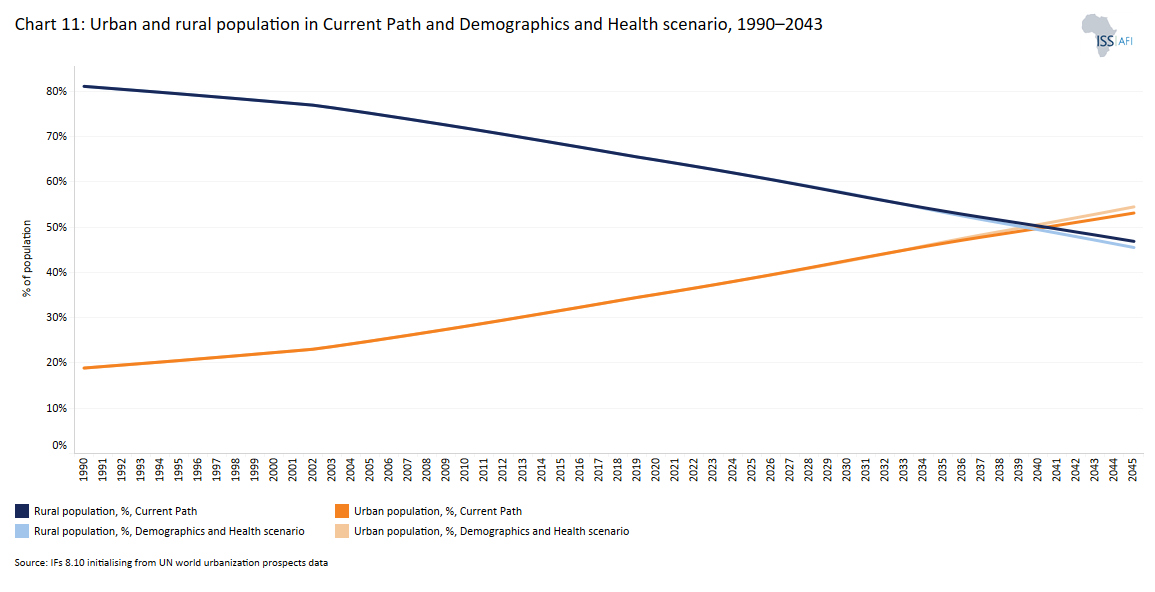

- Chart 11: Urban and rural population in Current Path and Demographics and Health scenario, 1990–2043)

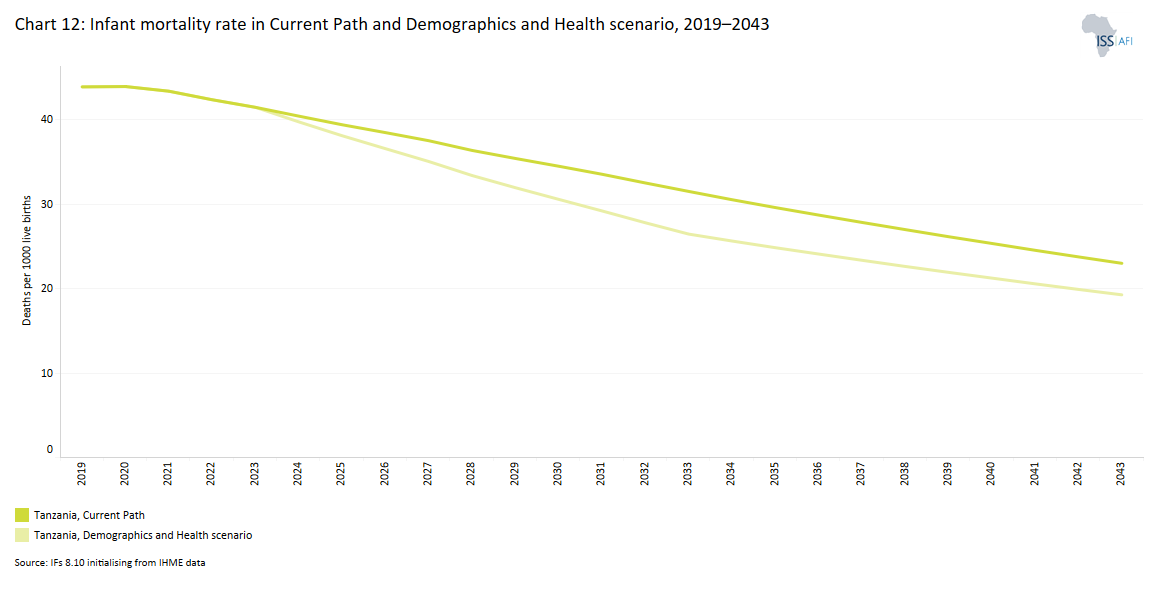

- Chart 12: Infant mortality rate in Current Path and Demographics and Health scenario, 2019–2043

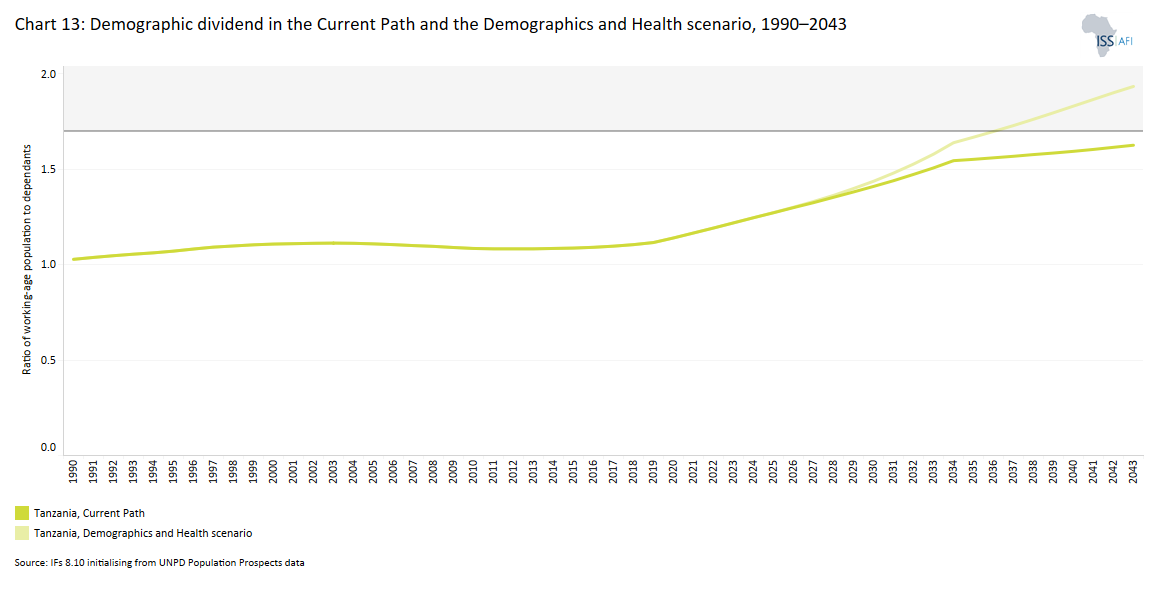

- Chart 13: Demographic dividend in the Current Path and the Demographics and Health scenario, 2019–2043

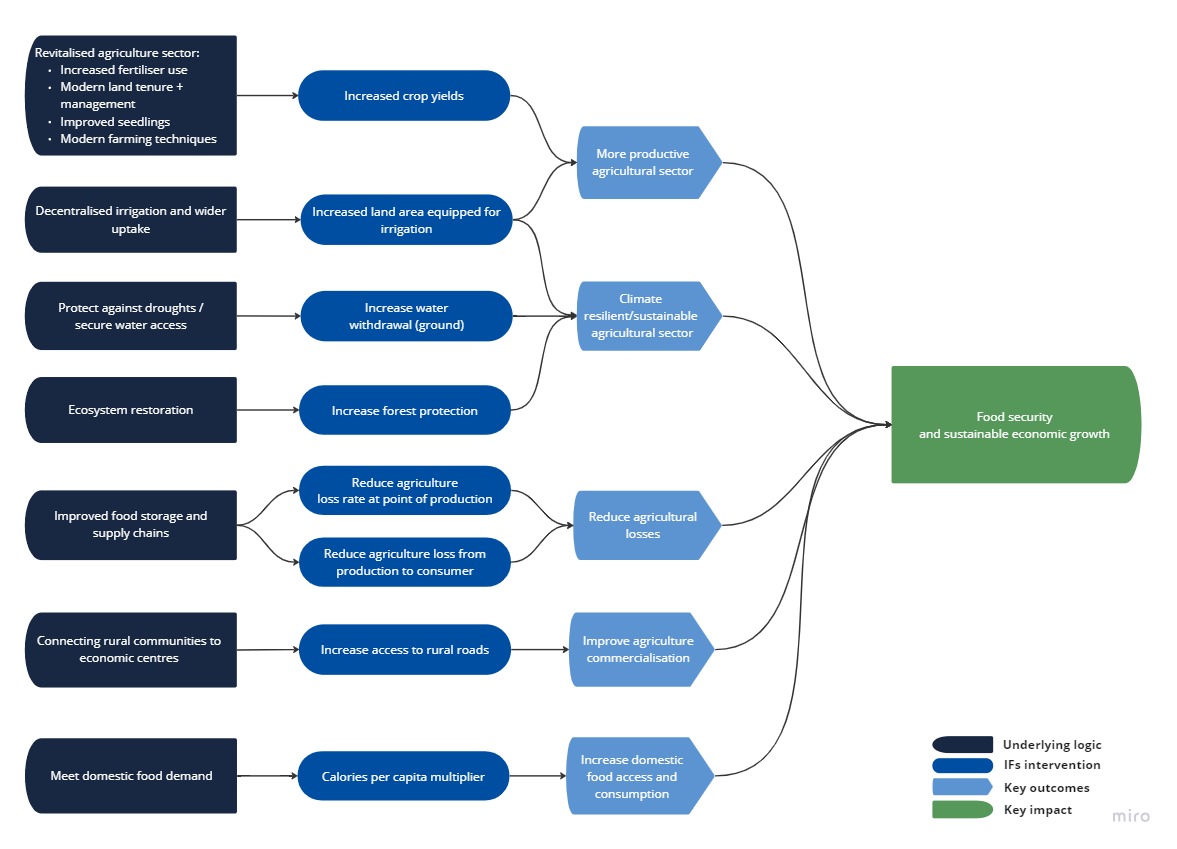

- Chart 14: Agriculture scenario

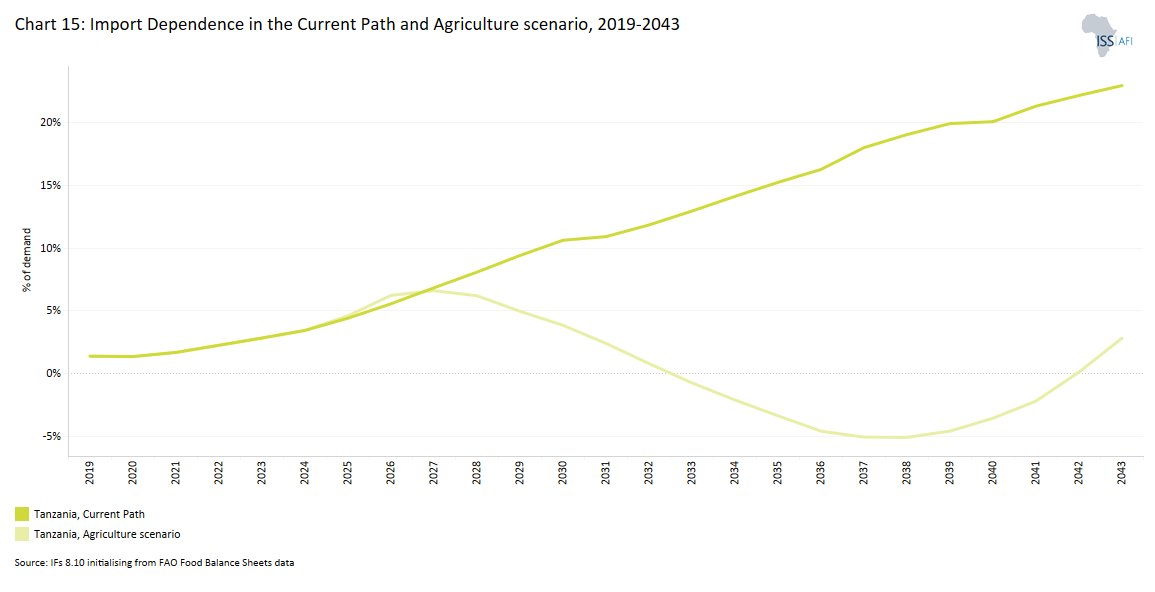

- Chart 15: Import dependence in the Current Path and Agriculture scenario, 2019–2043

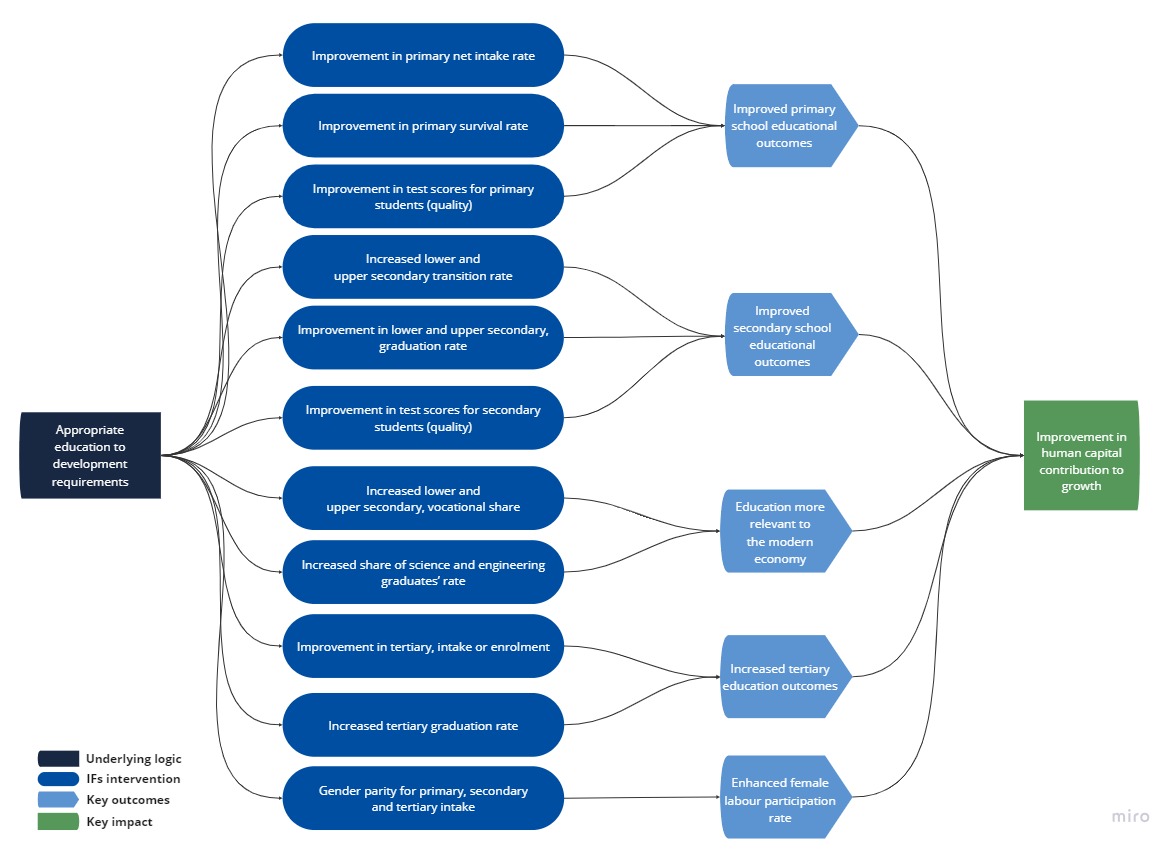

- Chart 16: Education scenario

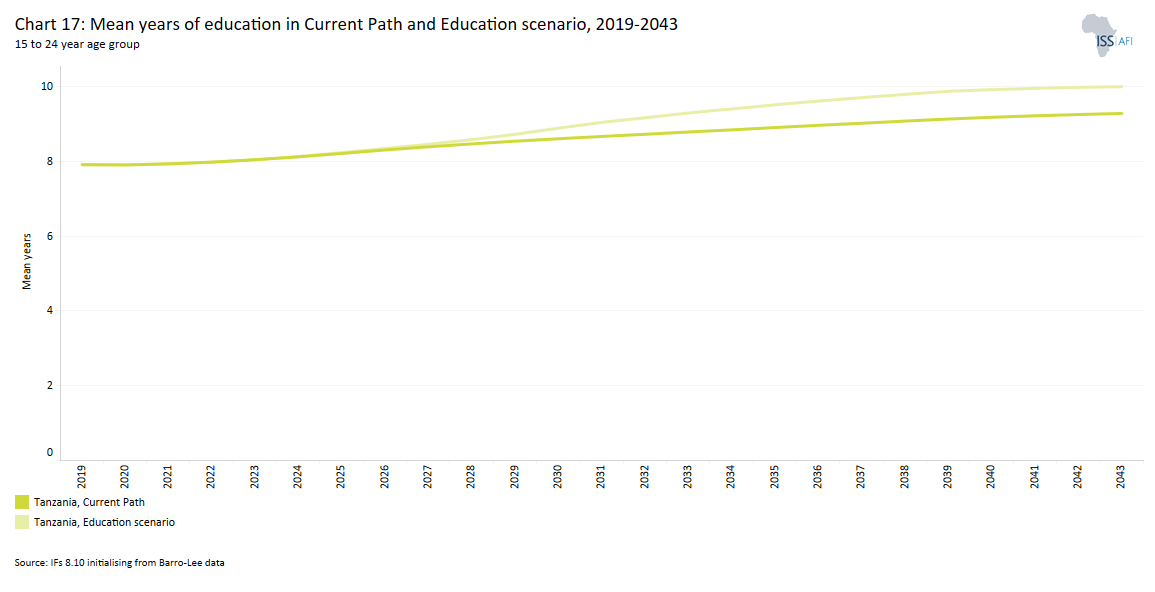

- Chart 17: Mean years of education in Current Path and Education scenario, 2019–2043

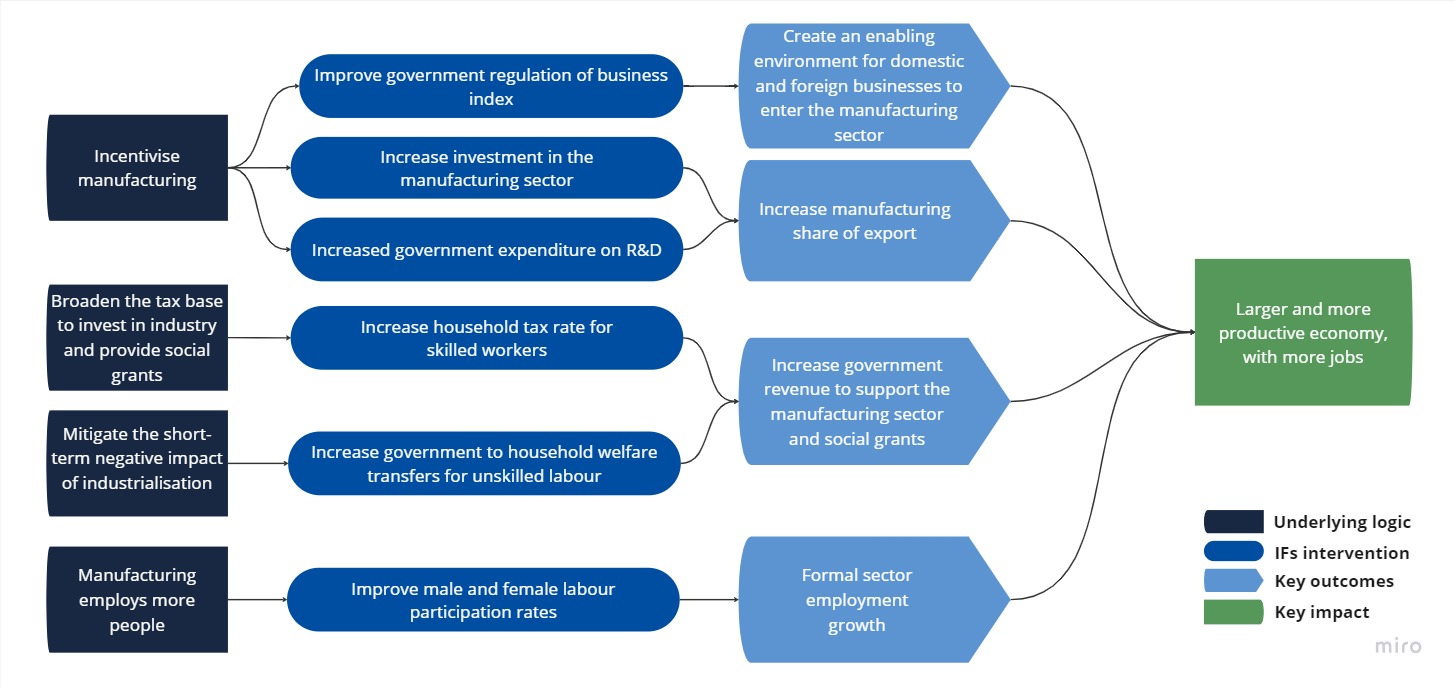

- Chart 18: Manufacturing scenario

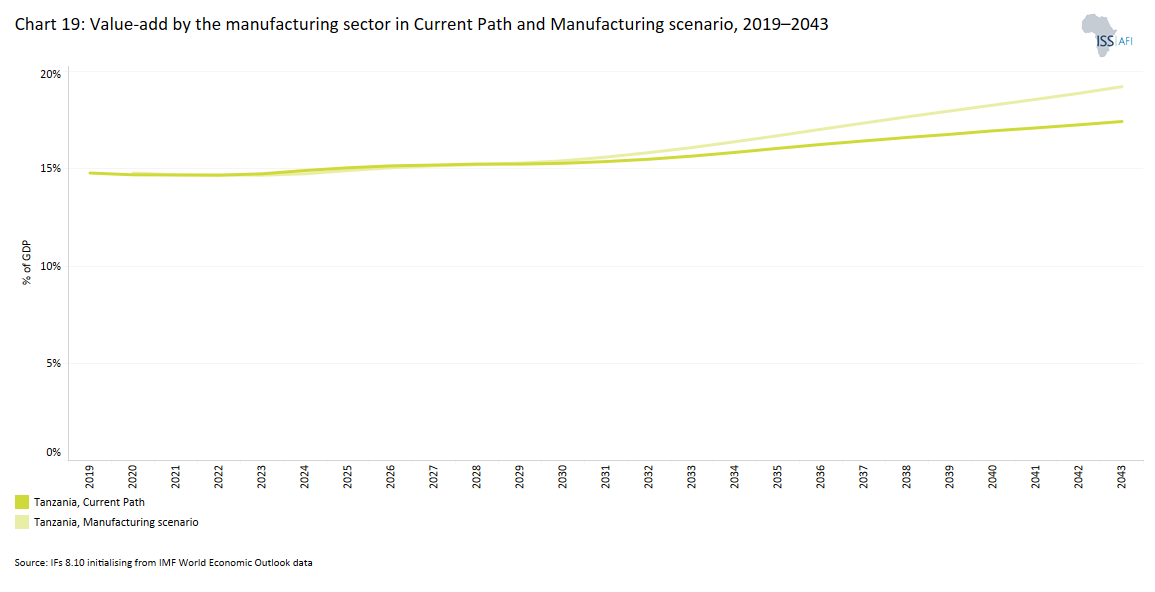

- Chart 19: Value-add by the manufacturing sector in Current Path and Manufacturing scenario, 2019–2043

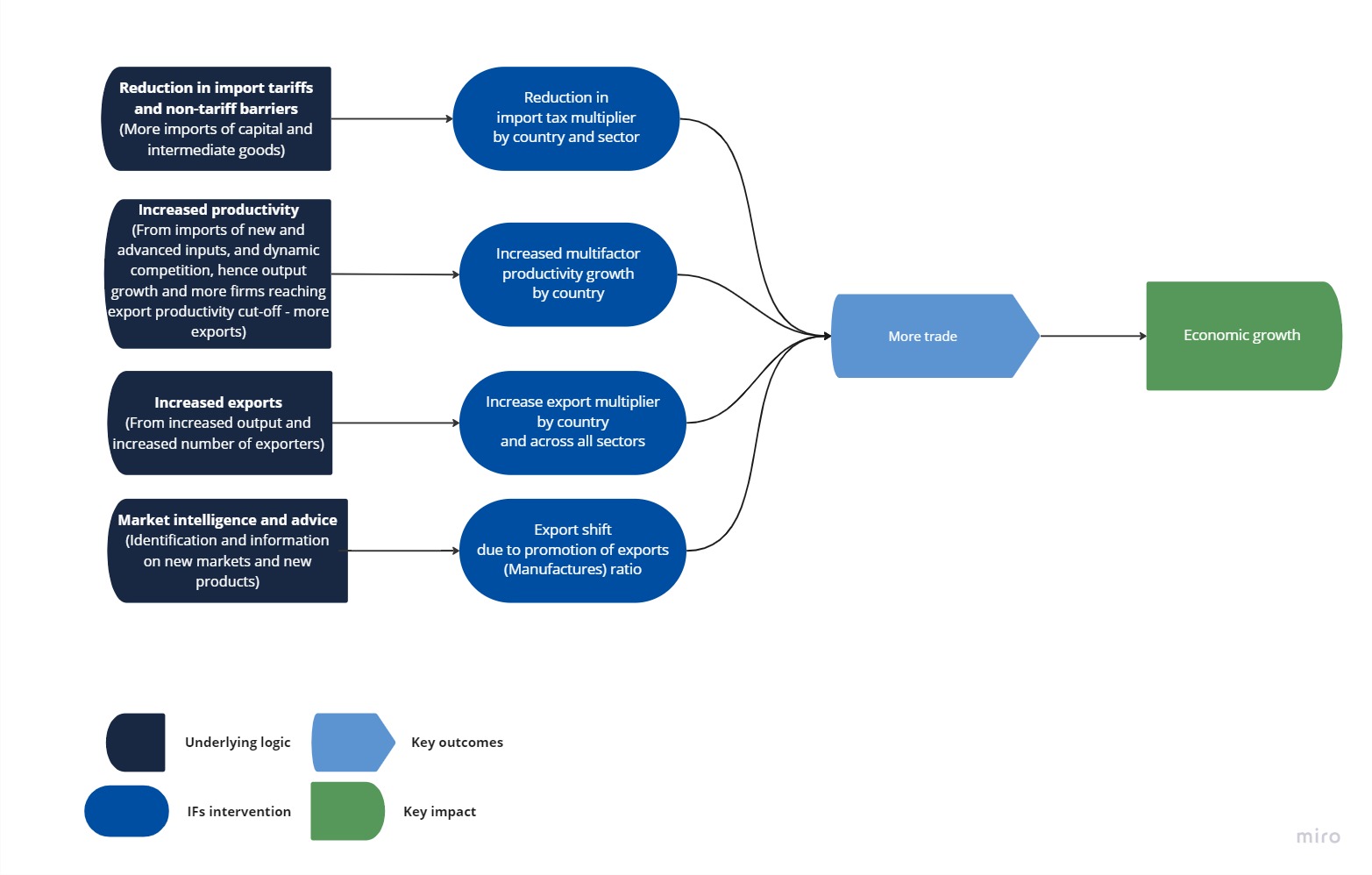

- Chart 20: AfCFTA scenario

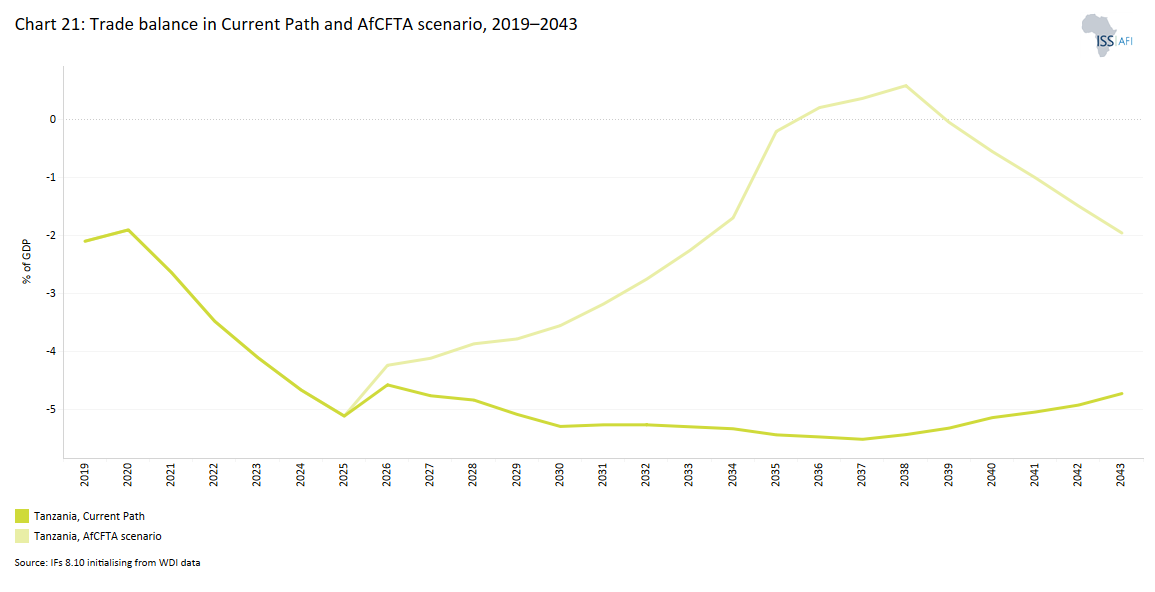

- Chart 21: Trade balance in Current Path and AfCFTA scenario, 2019–2043

- Chart 22: Large Infrastructure and Leapfrogging scenario

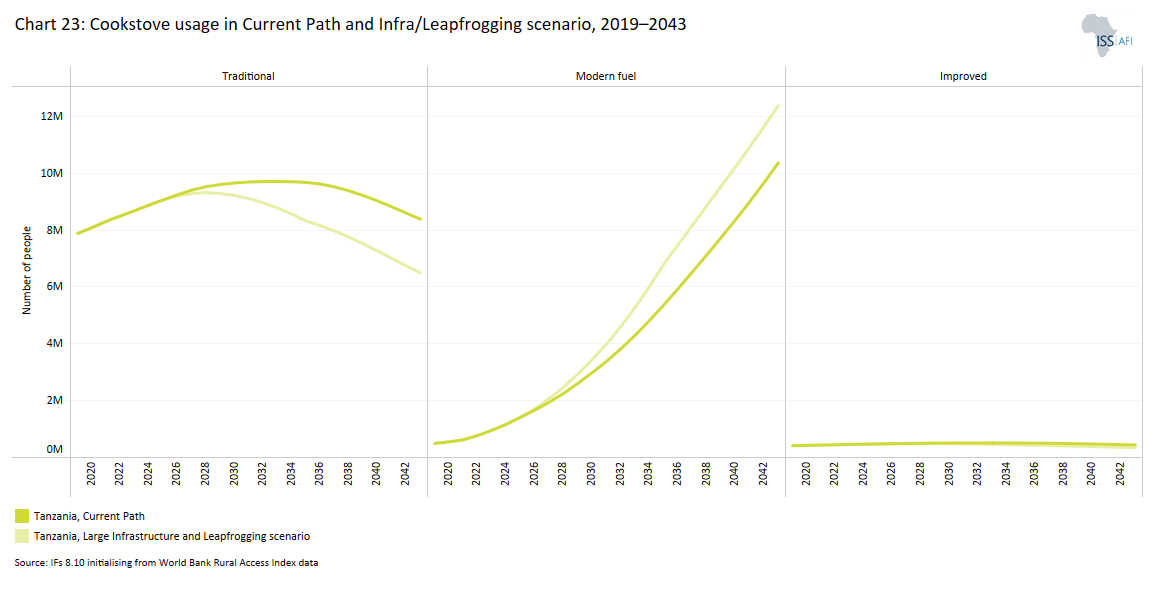

- Chart 23: Cookstove usage in Current Path and Large Infra/Leapfrogging scenario, 2019–2043

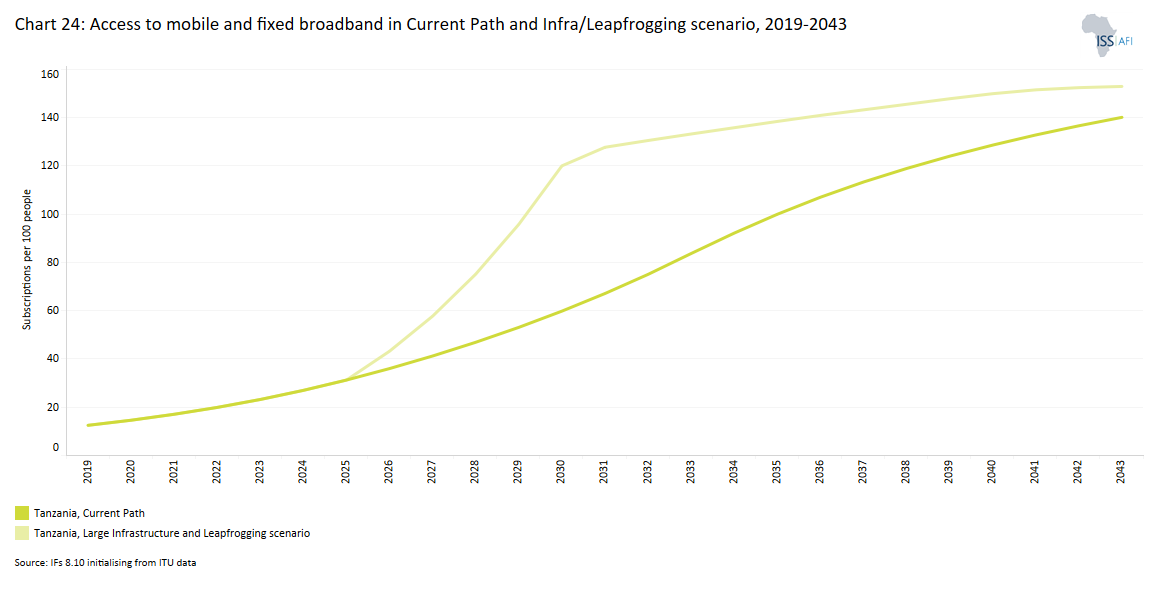

- Chart 24: Access to mobile and fixed broadband in Current Path and Large Infra/Leapfrogging scenario, 2019–2043 % of population Toggle between mobile and fixed broadband

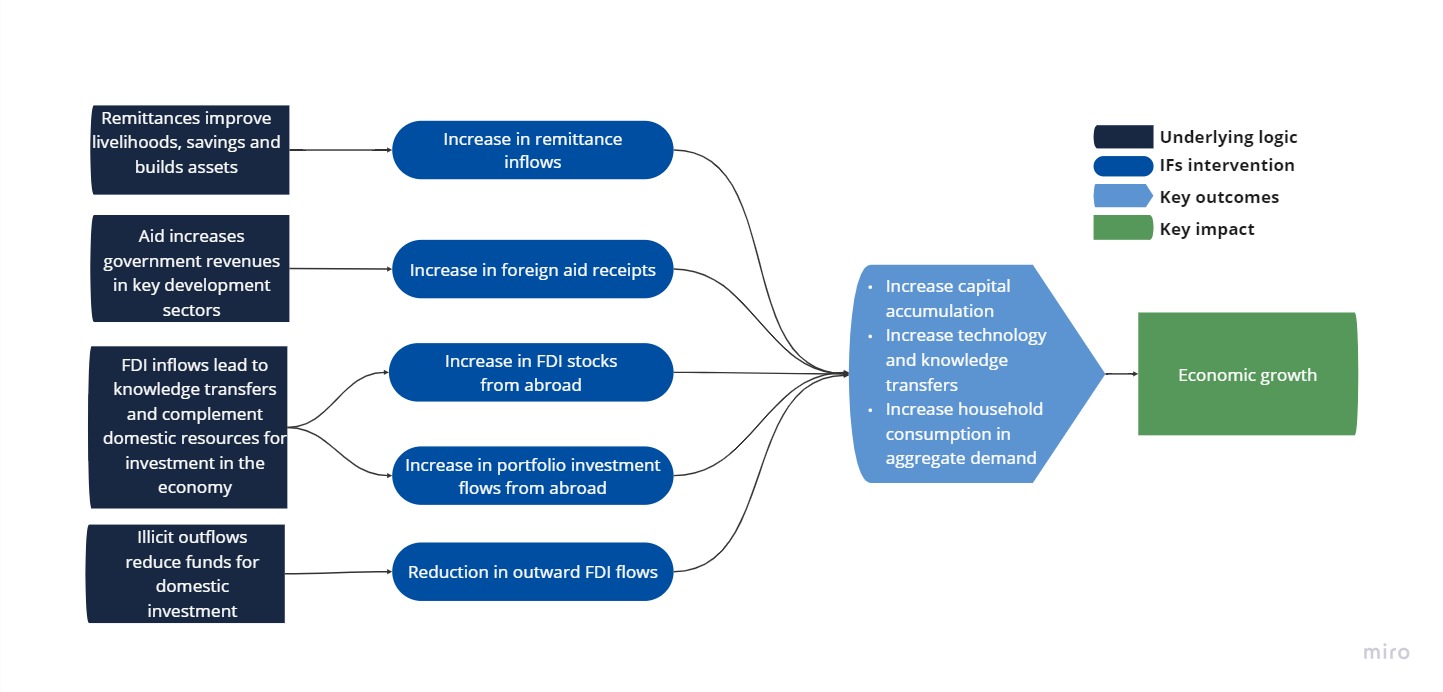

- Chart 25: Financial Flows scenario

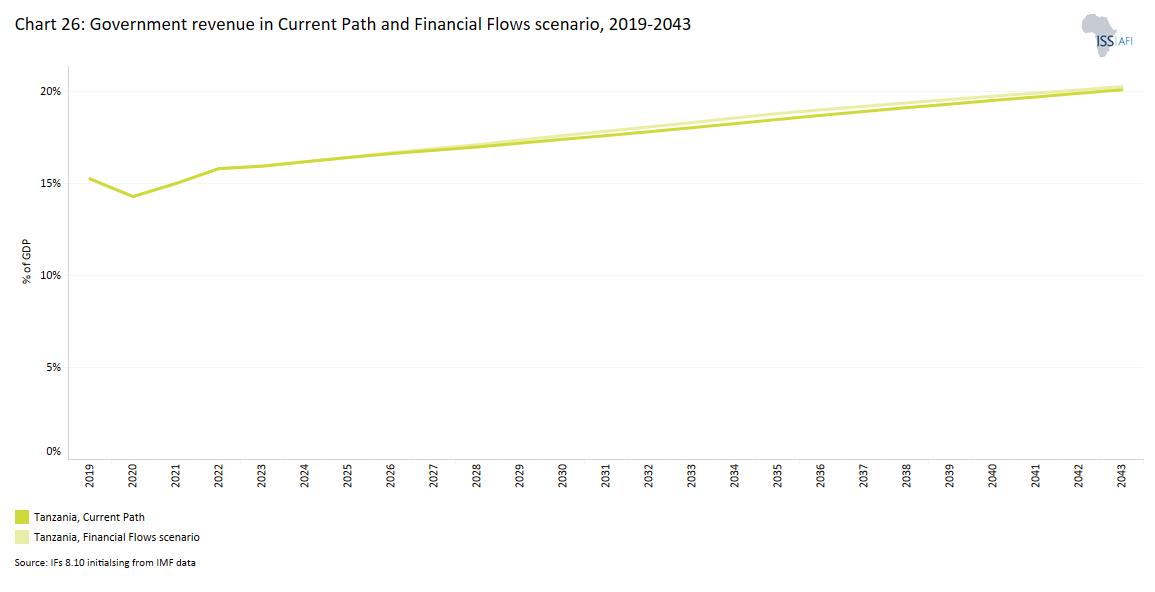

- Chart 26: Government revenue in Current Path and Financial Flows scenario, 2019–2043

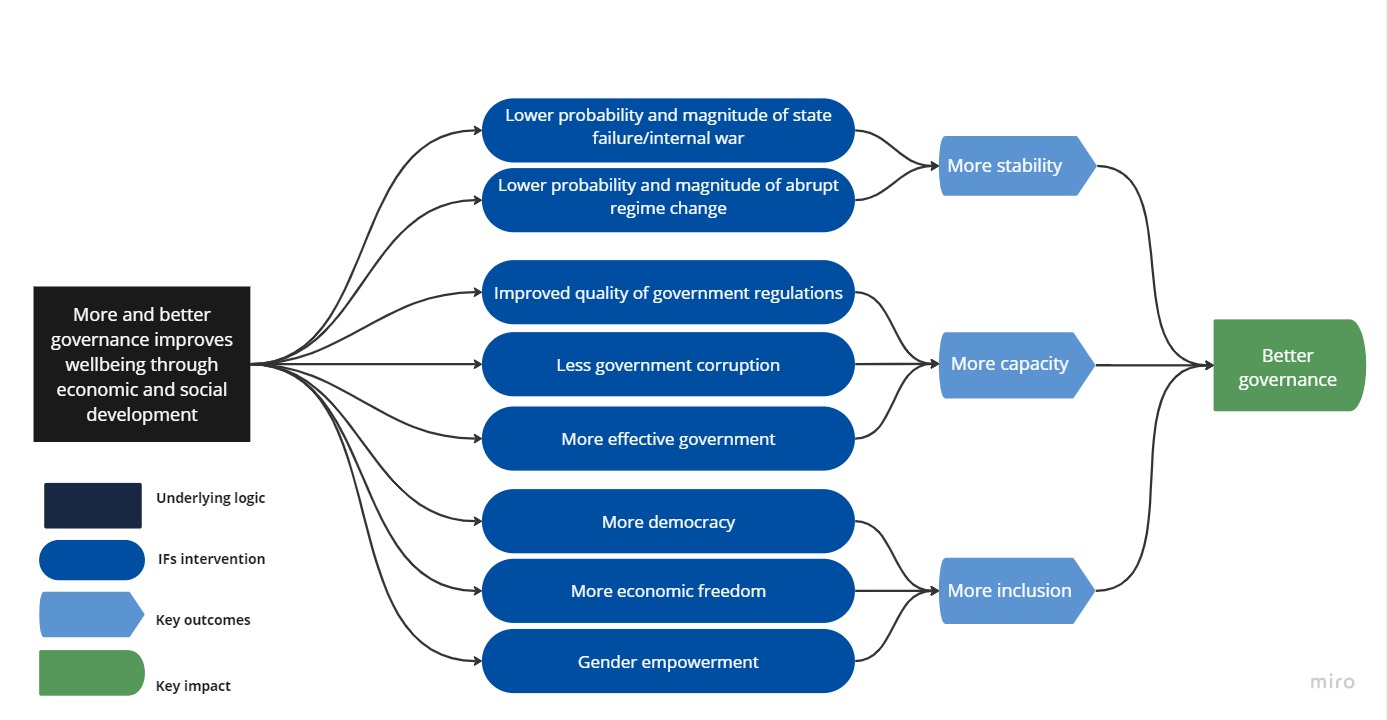

- Chart 27: Governance scenario

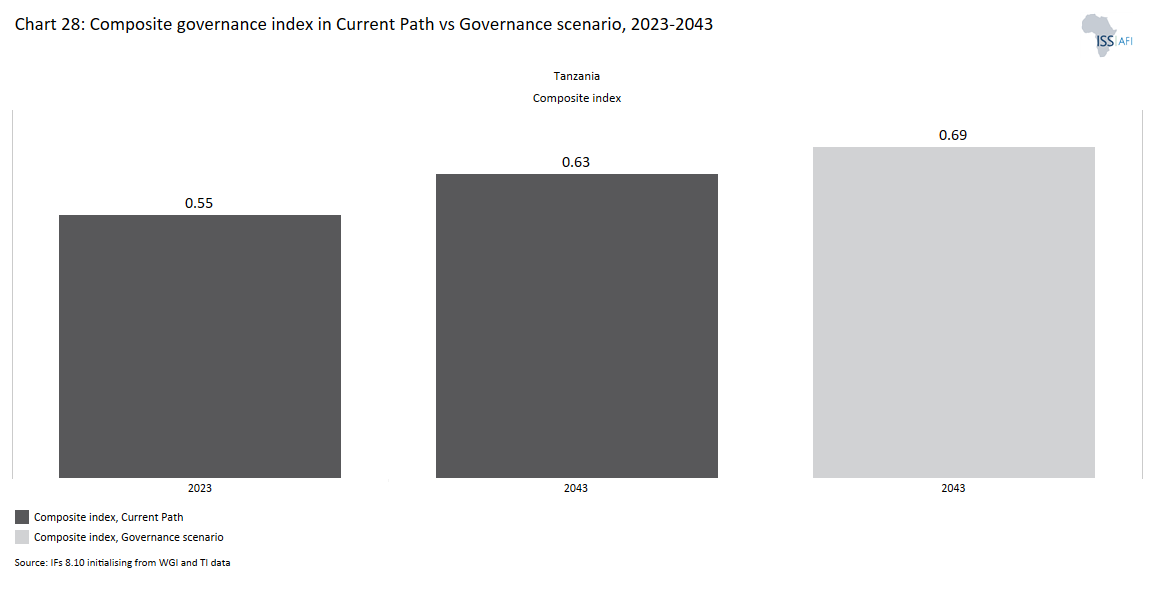

- Chart 28: Composite governance index in Current Path vs Governance scenario, 2019–2043

- Chart 29: GDP per capita in Current Path and scenarios, 2019–2043

- Chart 30: Poverty in Current Path and scenarios, 2019–2043

- Chart 31: GDP (MER) in Current Path and Combined Agenda 2063 scenario, 2019–2043

- Chart 32: Value added by sector in Current Path and Combined Agenda 2063 scenario, 2019–2043

- Chart 33: Informal sector as % of GDP and % of total labour in Current Path and Combined Agenda 2063, 2019–2043

- Chart 34: Life expectancy in Current Path and Combined Agenda 2063 scenario, 2019–2043

- Chart 35: Domestic Gini in Current Path and the Combined Agenda 2063 scenario, 2019–2043

- Chart 36: Carbon emissions in Current Path and in Combined Agenda 2063 scenario, 2019–2043

- Chart 37: Energy production by type in Current Path and Combined Agenda 2063 scenario, 2019-2043

- Chart 38: Recommendations

Chart 1 is a political map of Tanzania.

At 947 303 km2, the United Republic of Tanzania is the 13th largest country in Africa, with the 11th largest economy and 5th largest population. Still, it ranks at only 31st when comparing GDP per capita in PPP. It borders Uganda to the north, Kenya to the north-east, Comoros and the Indian Ocean to the east, Mozambique and Malawi to the south, Zambia to the south-west, and Rwanda, Burundi, and the Democratic Republic of the Congo (DR Congo) to the west. The official capital is Dodoma, which is located 309 km west of Dar es Salaam, which is the country's commercial capital major seaport. Other big urban centres include Arusha, Moshi, Tanga, Mwanza, Morogoro, Mbeya, Iringa, Tabora, Kigoma, Shinyanga and Zanzibar.

Tanzania has an Indian Ocean coastline of approximately 1 424 km, and its territory includes the semi-autonomous region of Zanzibar. Mount Kilimanjaro, Africa's highest mountain, is in the mountainous and densely forested north-east of Tanzania. Three of Africa's Great Lakes are partly within Tanzania: Lake Victoria, Africa’s largest lake; Lake Tanganyika, the continent's deepest lake; and Lake Malawi. Tanzania’s eastern shore is hot and humid, and the Zanzibar Archipelago is just offshore.

After two decades of sustained economic growth, Tanzania graduated from low- to low-middle-income country status in July 2020. Given that its GDP per capita is still amongst the lowest of Africa’s low-middle-income countries, higher than only Lesotho and Zimbabwe, it will likely remain at the lower end of the group in various development indicators on the Current Path forecast. It also has one of the largest informal sectors in Africa, second only to Zimbabwe as a per cent of GDP. On the Current Path forecast, Tanzania would only graduate to upper-middle income status at around 2054, mainly because of the drag from its substantial informal sector on productivity improvements.

Tanzania is a member of the Southern African Development Community (SADC), the East African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA). Its level of engagement with the latter has declined in recent years, with attention shifting to the EAC which has been more succesful in liberalising agricultural trade which is important for the country. The EAC has negotiated an Economic Partnership Agreement with the European Union, a comprehensive trade agreement that aims to promote economic cooperation and development between the two regions. The Agreement was finalised in October 2014 but has not been fully implemented due to concerns (and disagreements) by some EAC member states about the economic impact of the agreement. As a result Tanzania, Uganda, Rwanda, and Burundi, have not yet ratified.

Tanzania maintains a trade relationship with the EU under the Everything-But-Arms scheme that removes tariffs and quotas for all imports of goods (except arms and ammunition), coming into the EU from least developing countries. It also benefits from the preferential access to the USA market through the African Growth and Opportunity Act (AGOA). However, it is trade relations with Asia that is growing more rapidly, facilitated by the China-Africa Forum, the TICAD process led by Japan, and the Africa-India Partnership Forum.

Recent years have seen the discovery of large gas reserves that could transform the Tanzanian energy sector. Two fields (Songo Songo and Mnazi Bay) produce gas since 2004/05 that is used for power generation at the Ubungo power plant in Dar es Salaam and for industrial use, including for cement production. The majority of Tanzania's larger and more recent discoveries of gas reserves were between 2010 and 2015 in deep-water blocks off the coast of Lindi and Mtwara by Shell Exploration and Production Tanzania LTD (Shell) and its partners Ophir and Pavilion. Tanzania's proven natural gas reserves are estimated to be around 57 trillion cubic feet (TCF), with at least 49.5 TCF of those reserves located far offshore. Its proven gas reserves are comparable to Libya and the largest in East Africa.

As part of the National Development Plan lll (2021/22 - 2025/26) (see below) the government envisages a multi-billion investment in an LNG plant and the associated infrastructure. Talks on developing the plant have been held intermittently since 2017, nearing conclusion in 2023 with construction due to begin around 2026 and the first exports forecast for 2028.

The Current Path forecast within IFs on gas production in Tanzania already includes substantial growth to 127 MBOE in 2043 and has been adjusted upward in the expectation of gas production commencing as from 2028. In 2043 Tanzania is now forecast to produce 154 MBOE, most likely for export. The forecast also includes the completion of the 2 100 MW Rufiji hydroelectric scheme in 2027. Tanzania is now forecast to produce 11 MBOE of hydropower in 2040. The extent to which the benefits from these projects will trickle down to citizens will require appropriate government policies and determined implementation.

Tanzania generally exports commodities. Gold was Tanzania’s most significant export product by value in 2021, accounting for 37% of exports by value, followed by raw copper, dried legumes, rice, refined copper, nuts, and coffee, mainly exported to India (22%), the United Arab Emirates (UAE) (16%), South Africa, Switzerland and Kenya.

Tanzania’s top imports are refined petroleum (16% of imports), palm oil, packaged medicaments, coated flat-rolled iron, and hot-rolled, importing mainly from China (34% of imports), India (11%), UAE (10%), Saudi Arabia, and South Africa.

Tanzania could be a significant food-exporting country but currently struggles to meet its food requirements due to low productivity and the predominance of subsistence farming. The result, amongst others, is high levels of stunting in the population, particularly among children below five years of age, at 30% in 2023, declining to 17% in 2043.

Chart 2 presents the population structure for 2043 in the Current Path.

Tanzania has a young (median age 18.5 years) and rapidly growing population reflected in a population pyramid that is very broad at the bottom and still several decades away from entering a potential demographic window of opportunity. At independence in 1963, its population was estimated at 11 million. By 2000, it had increased to 34.5 million and, by 2023, to 65.8 million, growing at a rate of 2.4% per annum. In the Current Path, Tanzania will have 102 million people in 2043. Total fertility rates are coming down, but slowly. In 2023, it was 4.7 children per fertile woman, and by 2043, it will have declined to 3.3 - consistently above the average for lower-middle-income countries. In fact, in its immediate region, Tanzania’s fertility rate is above rates in Mozambique, Uganda, South Sudan and Sudan.

Various factors contribute to Tanzania’s high fertility and rapid population growth, including its large informal economy (45% of GDP in 2023) with low levels of urbanisation (37% in 2023) and education (adults above 15 years of age have 6.6 years of schooling), as well as the fact that the average age of first marriage is two years below that of its peer group. In all these indices, Tanzania trails below the average for Africa's lower-middle-income countries.

These structural characteristics are such that they outweigh the fact that Tanzania has slightly higher access to modern contraceptives (at 41% in 2023) than the average for lower-middle-income Africa (at 38%).

Because Tanzania has a larger cohort of children (aged 15 and below) at 42% of its total population compared to 38% of its peers in 2023, Tanzania’s working-age population (aged 15 to 64) constituted 55% of its total population. The latter is three percentage points lower than the average for Africa’s lower-middle-income countries, translating into a comparatively smaller potential labour force with a commensurate reduction in the contribution that labour could make to economic growth.

Chart 3 presents a population density map.

An estimated 63% of Tanzania’s population was considered rural in 2023, comparable to Sudan, Zimbabwe, Guinea and Mozambique. Technically, Tanzania will become urban in 2040, at which point more than 50% of its population will be classified as urban. Overall population density is average for Africa, but it is vastly different between its 31 administrative regions.

The Dar es Salaam, the Mwanza and the Arusha Regions are the most densely populated areas, home to Tanzania’s major cities and commercial centres. The least densely populated areas are the Singida Region, the Manyara Region and the Tabora Region. These regions are primarily rural and contain large semi-arid and arid land areas.

The uneven population distribution in Tanzania is due to several factors, including climate, geography and economic development. The northern border and eastern coast regions have more favourable temperatures and are more fertile than the interior regions. They are also home to more infrastructure and economic opportunities.

Chart 4 presents the size of Tanzania’s economy from 1990 and includes a forecast for 2043, including the associated growth rate.

Tanzania has experienced strong economic growth for several decades, primarily driven by its growing population. Still, it has long struggled with competitiveness, reflected in its poor ranking by various indices such as the World Economic Forum Global Competitiveness Index (2019), where it is ranked 117 out of 141 countries.

Despite various efforts to strengthen the competitiveness of the economy, improve the business and investment environment, and reduce the cost of regulatory compliance, the World Bank's Global Competitiveness Report 2022-2023 ranked Tanzania 147th out of 180 countries, scoring below the average for sub-Saharan Africa and the world average. According to the Bank, one of the main challenges to Tanzania’s competitiveness is its high infrastructure costs, including its extensive and underdeveloped road network and unreliable electricity supply.

The World Bank's ease of doing business[1The ease of doing business is a measure of how easy or difficult it is for a business to operate in a particular country. It is calculated by the World Bank Group and takes into account a number of factors, including the time and cost required to start a business, obtain construction permits, register property, get credit, and pay taxes.] (2020 data) ranks Tanzania 141 out of 190 countries. The extent to which the country trails in the region is evident, considering that neighbouring Kenya is at 56, Uganda at 116 and Rwanda at 38.

In Transparency International’s corruption perception index (2023), Tanzania is considered moderately corrupt and ranked 103 out of 180 countries.

In the Global Innovation Index (2023), Tanzania is ranked 103 out of 132 countries. Its most positive aspects relate to the strength of its institutions.

According to the Economic Freedom Index by the Fraser Institute (2024), Tanzania is the 86th freest economy out of 165, considered ‘mostly unfree’ and ranked towards the bottom end of the index, doing particularly poorly on judicial effectiveness.

Chart 5 presents the size of the informal economy as a percentage of GDP and, in absolute terms, as well as the percentage of total non-agriculture labour involved in the informal economy. Chart 33 presents the impact of the Combined scenario on the informal sector.

Estimations and data on the informal sector are often unreliable and must be treated carefully. Researchers generally distinguish between the shadow and informal economy. According to the International Labour Organization (ILO): ‘The informal economy refers to all economic activities by workers and economic units that are – in law or practice – not covered or insufficiently covered by formal arrangements. Where data is not available, our modelling estimate the size. The ILO definition of employment in the informal economy excludes the agricultural sector.

Much work has been done to understand Tanzania’s informal sector.

For example, the 2002 Roadmap Study on the Informal Sector in Mainland Tanzania reflects the regulatory and policy environment as an apparent handicap to the growth of small and medium-sized businesses. The study identified numerous regulatory constraints, including legal leftovers from colonial times or the previous socialist economic model, which only envisaged large enterprises. The Roadmap found that smaller business operators could broadly fit into two categories: survivalists and entrepreneurs. Survivalists tended to want to remain small and invisible and to avoid compliance. Entrepreneurs were split again into broadly two types: those who managed to comply to prevent harassment and be free to pursue their growth, and those who, while pursuing their growth, refused to comply with the demands of a corrupt bureaucracy.

At 45% of GDP in 2023, Tanzania has the second largest informal sector among Africa's lower-middle-income countries a portion of its total economy. Only Zimbabwe’s informal sector is larger. This means that a significant portion of Tanzania's economic activity occurs outside the formal economy, where businesses are not registered or taxed. By 2043, the contribution from Tanzania’s substantial informal sector will decline to 37%, which is still very large. As a portion of the total economy, it will be the largest amongst Africa’s 24 lower-middle-income countries, followed by Nigeria, Benin and Zimbabwe. As a result, Tanzania has the lowest labour productivity amongst its peers.

At 76%, the percentage of Tanzania’s informal labour is more significant in 2023 than any lower-middle-income country and modestly declines to 67% in 2043. Benin had the second-largest informal labour share at 74%. Casual labour in Zimbabwe, which had a more significant informal sector than Tanzania in 2023, only constituted 41% of its labour force. By implication, not only is Tanzania’s informal sector huge but it also reflects very low levels of productivity. The informal sector in Tanzania is survivalist in nature. Although it provides a means of subsistence and survival for a large portion of the population, many are trapped in poverty.

Chart 6 presents the average GDP per capita from 1990, including the Current Path to 2043.

Until 1989, the GDP per capita for Tanzania was below the average of Africa’s low-income countries, although the gap had been slowly closing. After that, more rapid growth in Tanzania meant that the World Bank upgraded the country to lower-middle-income status in 2020, reflecting the extent to which the country was growing more rapidly than most other low-income countries in Africa.

In 2023, the GDP per capita of Tanzania, at US$2 668, was 56% of the average for Africa’s lower-middle-income countries, third lowest amongst its peer grouping of lower-middle-income countries, but improving. The two lower-middle-income countries that, in 2023, had a lower GDP per capita than Tanzania were Lesotho and Zimbabwe.

On the Current Path, Tanzania will grow its GDP per capita to US$4 890 or 43% of the group average by 2043, reflecting steady progress. Whereas it had the third lowest GDP per capita in the group in 2023, by 2043, it will improve its ranking by one position, doing better than Comoros, Zimbabwe and Lesotho. The long-term growth prospects for Tanzania are positive.

Chart 7 presents the number of people living in extreme poverty, also expressed as a percentage of the population.

In 2015, the World Bank adopted US$1.90 per person per day (in 2011 prices using GNI), also used to measure progress towards achieving Sustainable Development Goal (SDG) 1 of eradicating extreme poverty.

In 2022, the World Bank updated the poverty lines to 2017 constant dollar values as follows:

- The previous US$1.90 extreme poverty line is now set at US$2.15 for use in low-income countries.

- US$3.20 for lower-middle-income countries, now US$3.65 in 2017 values.

- US$5.50 for upper-middle-income countries, now US$6.85 in 2017 values.

- US$22.70 for high-income countries. The Bank has not yet announced the new poverty line in 2017 US$ prices for high-income countries.

Monetary poverty only tells part of the story. In addition, the global Multidimensional Poverty Index (MPI) measures acute multidimensional poverty by measuring each person’s overlapping deprivations across ten indicators in three equally weighted dimensions: health, education and standard of living. The MPI complements the international US$2.15 a day poverty rate by identifying who is multidimensionally poor and also shows the composition of multidimensional poverty. The headcount or incidence of multidimensional poverty is often several percentage points higher than that of monetary poverty. This implies that individuals living above the monetary poverty line may still suffer health, education and standard of living deprivations.

Starting with monetary poverty. Using US$2.15, 50.3% of Tanzania’s population was considered extremely poor in 2023, equivalent to 33.1 million people. As a percentage of its total population, only Zambia and Angola had higher monetary poverty rates among Africa’s 24 lower-middle-income countries in 2023. On the Current Path, Tanzania’s extreme poverty rate will decline to 18.9% (or 19.1 million people) in 2043. Then Tanzania will still have a sizeable extreme poverty burden but rank 7th instead of third in the portion of extremely poor people among Africa’s 24 lower-middle-income countries.

While the US$2.15 extreme poverty line is used to monitor progress towards achieving goal 1 of the SDGs towards eliminating the extreme poverty line by 2030, Tanzania is now categorised as a lower-middle-income country. The World Bank and others consider US$3.65 a more appropriate monetary poverty line than US$2.15 for these countries.

Using US$3.65, 74.1% (or 48.7 million) Tanzanians will be considered poor, a ratio that will decline to 39.8% (40.5 million) in 2043 on the Current Path. These are large numbers, with only Nigeria, and Sao Tomé and Princípe having more significant portions of their populations classified as such. Tanzania will, however, make steady progress within the 24-country lower-middle-income group and improve its ranking to the extent that, in 2043, it will have dropped from the country with the third-highest poverty rate to seventh.

Poverty has many dimensions. For example, the number of children under 15 in poor households in Tanzania is almost double that in non-poor households. Poor households also have significantly higher dependency ratios. About 44% of households with five or more children under 15 are poor, 18 percentage points higher than the national average and 28 percentage points more than the poverty rate for households with just one or two children. Furthermore, poverty is more prevalent among women. In urban areas, more women-headed households are poor than men-headed ones, and single and divorced women are poorer than men. The gap is high in rural and urban areas, particularly in the latter. Urban widows are also poorer than urban widowers. Ownership of assets, especially mobility and communication equipment, is also significantly lower among women-headed households, indicating women's limited access to productive assets.

Using MPI, the Tanzania Human Development Report 2019-2022 estimated that the poverty rate in Tanzania was higher than the monetary measure of US$2.15, at 57.1% in 2021, while an additional 23.4% of the population was classified as vulnerable to multidimensional poverty. The contributions to overall poverty by the MPI dimensions were as follows:

- Health: 39.8%

- Education: 34.2%

- Standard of living: 26.0%

Nationally, the poor are defined as those whose consumption is below Tanzania’s national poverty line and who, therefore, were not able to meet their basic consumption needs; the extreme poor were not able to afford enough food to meet the minimum nutritional requirements of 2 200 kilocalories (Kcal) per adult per day. The national basic needs poverty line in 2018 was TZS 49 320 per adult per month, and the food poverty line was TZS 33 748.

In response to its high poverty burden, the government has instituted numerous programs that range from investments in education, health, economic growth and social welfare that have helped the poorest Tanzanians, without which poverty rates would have been much higher. The potential income from its enormous gas resources would, if appropriately managed, allow the government to expand these efforts significantly by ringfencing profits for social grants.

The effects of such widespread and deep poverty mean that many Tanzanians are unable to afford enough food to eat, resulting in high levels of malnutrition and stunted growth. Nor can parents afford to send their children to school, and many citizens do not have access to quality healthcare and suffer from limited economic opportunities.

Poverty in Tanzania has been widely studied and is well understood, reflected in extensive reporting such as the 2020 Tanzania Mainland Poverty Assessment Report published by the World Bank and the Tanzania National Bureau of Statistics.

Tanzania has a long history of national development plans, dating back to the country's independence in 1961. The first five-year development plan was launched in 1964, and it was followed by a series of plans, each of which has been informed by the country's changing development priorities.

The early development plans in Tanzania were focused on achieving economic growth and self-reliance. The Arusha Declaration of 1967, a policy statement issued by the ruling party at the time, enshrined the principles of ujamaa (socialism) and self-reliance as the basis for the country's development. The development plans of the 1970s and 1980s focused on implementing these principles through policies such as the collectivisation of agriculture and the promotion of village industries.

In the early 1990s, Tanzania started to move towards a more market-oriented approach to development. The development plans of this period were therefore focused on promoting economic growth through private-sector investment and trade liberalisation. The National Development Vision 2025, launched in 1999, set a long-term goal for Tanzania to become a middle-income country by 2025. The three principle objects are achieving quality and good life for all, good governance and the rule of law, and building a strong and resilient economy that can effectively withstand global competition.

The current Five Year Development Plan lll (2021/22 - 2025/26) is the third in a series of plans to achieve the National Development Vision 2025 goals. The plan focuses on increasing the country's capacity for production, building a competitive economy and stimulating human development.

FYDP III also aims to implement sectoral strategic plans, agreements and regional and international strategic plans, including implementing the Sustainable Development Goals (SDGs) to accelerate economic growth and social development.

The specific objectives of the FYDP III are:

(i) To build on achievements realised towards the attainment of the National Development Vision 2025 to make Tanzania a semi-industrialised, middle-income country by 2025;

(ii) To strengthen capacity building in the areas of science, technology and innovation to enhance competitiveness and productivity in all sectors, especially the productive, manufacturing and services sectors, to enable Tanzanians to benefit from the opportunities available within the country;

(iii) To strengthen the industrial economy as a basis for export-driven growth, including investing in new products and markets and enabling Tanzania to become a production hub in the countries of East, Central and Southern Africa and, thus increasing the country’s contribution to international trade;

(iv) To enhance the scope of Tanzania’s benefits from strategic geographical opportunities by enabling improved business environments and strengthening the country’s regional position as a hub for production, trade, supply and transportation;

(v) To facilitate increased business start-up and private sector involvement to find the best way to promote the growth of the sector in tandem with job creation and make the sector a strong and reliable partner in development;

(vi) To promote exports of services, including tourism, banking services, insurance and entertainment;

(vii) To strengthen the implementation of FYDP III, including prioritisation, planning, integration and alignment of implementation interventions;

(viii) To accelerate inclusive economic growth through poverty reduction and social development strategies as well as productive capacity for youth, women and people with disabilities;

(ix) To ensure that regional and global agreements and commitments are fully integrated into national development for the benefit of the country;

(x) To strengthen the relationship between the sectors that are endowed with natural wealth and resources with other economic and social sectors;

(xi) To strengthen the role of Local Government Authorities (LGAs) in bringing about development and increasing income at the community level; and

(xii) To strengthen the country’s capacity to finance development by ensuring access to domestic revenue and effective management of public expenditure.

Chart 9 depicts the relationship between the Current Path, the various sectoral scenarios and the Combined Agenda 2063 scenario.

The Current Path forecast is a dynamic scenario in in our modelling that imitates continuing current policies and environmental conditions.

The eight sectoral scenarios are each explained in the various themes on the website and the impact on each is compared with the Current Path and a Combined Agenda 2063 scenario. The eight scenarios are:

- A more rapid demographic transition and investments in better health and water, sanitation and hygiene (WaSH) infrastructure.

- Better and more education (looking at quantity, quality and relevance).

- Large infrastructure and leapfrogging (the impact of renewables, ICT and the more rapid formalisation of the informal sector).

- Food security and an agricultural revolution.

- A low-end manufacturing transition.

- The full implementation of the African Continental Free Trade Area (AfCFTA).

- More inward financial flows (consisting of aid, foreign direct investment, remittances and illicit financial flows).

- Better governance (consisting of stability, capacity and inclusion).

The Combined Agenda 2063 scenario is a combination of all eight sectoral scenarios.

The impact of these scenarios on jobs/employment and greenhouse gas emissions and energy are presented in separate themes.

A final theme models the effect of alternative global scenarios on Africa’s development potential.

General information about the interventions for each section can be found in the About section.

Chart 10 presents the structure of the Demographics and Health scenario that advances the demographic dividend and improves health.

The Demographics and Health scenario consists of reasonable but ambitious reductions in child and maternal mortality ratio and increased access to modern contraception. It decreases in the mortality rates associated with both communicable diseases (e.g. AIDS, diarrhoea, malaria and respiratory infections) and non-communicable diseases (e.g. diabetes), as well as improvements in access to safe water and better sanitation.

Visit the themes on Demographics and Health/WaSH for more detail on the scenario structure and interventions.

Poor health is a significant constraint on development in Tanzania. Labour productivity in Tanzania is roughly one-third of the average for Africa’s 24 lower-middle-income countries and particularly low in the manufacturing and ICTech sectors, both crucial to productivity growth.

Tanzania underwent its epidemiologic transition in 2023. After that, death rates from non-communicable diseases exceed those from communicable diseases, reflecting the general shift from acute infectious and deficiency diseases characteristic of low levels of development to chronic non-communicable diseases characteristic of modernisation and higher levels of development. As a result, after 2023, citizens are, on average, more likely to die from (and require treatment for) chronic diseases such as heart disease, stroke and cancer. The shift occurred even though Tanzania has a large proportion of young people (median age of 18.5 years in 2023), high levels of poverty (using US$3.65, more than 70% of its population is poor) and low levels of income (GDP per capita was US$2 668 in 2023).

The early transition may have been accelerated by the country's high malnutrition rate, which increases the risk of developing chronic diseases later in life. Tanzania also has a limited healthcare system, meaning people may not have access to the care they need. From a health expenditure perspective, the main challenge with the transition is that non-communicable diseases are more expensive to treat. It, therefore, is an additional burden on an already constrained health budget. Death rates are, therefore, changing. In 2023, the category ‘other communicable diseases’ had the most significant statistical death rate on the Current Path, whereas, by 2043, it would be cardiovascular afflictions.

Tanzania also needs to improve on various indices of basic infrastructure. For example, among Africa’s 24 lower-middle-income countries, it has the fourth largest population still dependent upon unimproved water supply at 26% in 2023. Only Angola, Zambia and Kenya did worse. On the Current Path, the percentage will decline to 18% in 2043 and 13% in the Demographics and Health scenario.

Whereas access to improved sanitation was at 54% of the population in 2023, it will improve to 78% by 2043 in the Demographics and Health scenario compared to 68% on the Current Path. The difference is equivalent to 4.8 million additional persons.

Chart 11 compares urban and rural populations in the Current Path and the Demographics and Health scenario.

Tanzania’s population is still largely rural, with only 37% of its total population considered urban, set to increase to 52% in 2043. The annual rate of increase of the urban population, at 4.4% per annum in 2023, is among the highest in Africa and presents authorities with numerous challenges. The primary reason for urbanisation is often to escape rural poverty rather than the attraction of jobs in urban areas. Rural areas offer limited economic opportunities and poor access to education and healthcare. As a result, Tanzania’s urbanising population is moving from rural subsistence farming to informal settlements engaged in low-end services in the informal sector with only limited positive impact on improved productivity and economic growth.

Chart 12 presents the infant mortality rate in the Current Path and the Demographics and Health scenario.

The infant mortality rate is the probability of a child born in a specific year dying before reaching the age of one. It measures the child-born survival rate and reflects the social, economic and environmental conditions in which children live, including their health care. It is calculated as the number of infant deaths per 1 000 live births and is an important marker of the overall quality of the health system in a country.

Infant mortality in Tanzania is relatively high, although it has improved drastically since 1990 when it stood at 101.6. Tanzania performs better than the average for its lower-middle-income peer group, with 41.4 deaths per 1 000 live births in 2023, roughly comparable to rates in Zimbabwe and Zambia. The contributors to high infant mortality rates in Tanzania include poverty, malnutrition, infectious diseases such as malaria and pneumonia and limited health care access. In the Demographics and Health scenario, infant mortality rates in Tanzania decline to 19 deaths per 1 000 live births by 2043 compared to 23 deaths in the Current Path. The improvements follow from the determined implementation of the government's National Immunization Program, the Integrated Management of Childhood Illness program, and improved access to healthcare in rural areas, amongst others.

Chart 13 presents the demographic dividend in the Current Path and in the Demographics and Health scenario.

The dividend is the window of economic growth opportunity when the ratio of working-age persons to dependents increases from 1.7:1 and higher.

Increased access to modern contraception supported by appropriate education and information will have a dramatic impact on Tanzania’s total fertility rate, which was at 4.7 children per fertile woman in 2023. In 2023, modern contraceptive use in Tanzania stood at 41% and will increase to 59% in 2043. In the Demographics and Health scenario, fertility rates will decline much quicker, dropping to 2.4 births per woman by 2043 compared to 3.3 on the Current Path. A lower average fertility rate will slow down Tanzania’s population growth, with 6.4 million fewer people by 2043. Instead of 102 million people in 2043, Tanzania will only have 96 million. As a result, in the Demographics and Health scenario, Tanzania will enter a demographic window of opportunity (a potential demographic dividend) from 2036, on par with the average for its lower-middle-income peer group on the continent and about a decade earlier than on the Current Path.

Chart 14 sets out the composition of the Agriculture scenario to advance food security.

The Agriculture scenario represents reasonable but ambitious increases in yields per hectare (reflecting better management and seed and fertiliser technology), increased land equipped and under irrigation and reductions in food loss and waste. We use increased calorie consumption as a proxy for prioritsing food self-sufficiency above food exports as a desirable policy objective.

The increase in forest protection reflects sustainable land use practices.

Visit the theme on Agriculture for our conceptualisation and details on the scenario structure and interventions.

In 2023, agriculture contributed 26% to Tanzania’s GDP which was almost ten percentage points above the average for lower-middle-income African countries. On the Current Path, the contribution from agriculture will decline to a difference of only one percentage points in 2043. Because the sector grows more rapidly in the Agriculture scenario, Tanzania's agricultural sector is still around five percentage points above the average for lower-middle-income Africa in the Agriculture scenario by then.

Tanzania has the potential to be a major agricultural exporter, with an estimated 44 million hectares of arable land, of which only about 10 million hectares are currently under cultivation. The horticulture sector has, in particular, been growing rapidly in recent years. Tanzania struggles to meet is domestic food requirements, however, due to generally low productivity in an agricultural sector that predominantly consists of subsistence farming. Agribusiness is still in its infancy in Tanzania and largely located in its traditional export crops such as coffee, tea, cotton, cashew nuts and tobacco. Yet, the country has a diverse range of agro-ecological zones, allowing for the production of a wide variety of crops, including maize, rice, wheat, sorghum, cassava, sweet potatoes, beans, peas, coffee, tea, cotton and oilseeds.

In 2023, yields in Tanzania stood at 3.4 metric tons per hectare, which is low compared to the average of 5.5 metric tons per hectare for Africa’s lower-middle-income peer group. In the Current Path, yields in Tanzania will increase modestly to 4 tons by 2043 and the gap in average yields per hectare between Tanzania and the lower-middle-income Africa grouping will widen. However, in the Agriculture scenario, yields increase to 6.1 tons which is almost on par with the forecast of 6.8 tons per hectare for the peer group.

Chart 15 presents import dependence in the Current Path and the Agriculture scenario.

The agricultural production and demand data in our modelling initialises from data provided on food balances by the Food and Agriculture Organization (FAO). The model contains data on numerous types of agriculture but aggregate its forecast into crops, meat and fish, presented in million metric tons. Chart 17 shows agricultural production and demand as a total of all three categories.

In 2023, nearly 17 million hectares of land in Tanzania were used for crops, and crop yields were only 3.3 tons per hectare compared to the average of 5.5 tons for its African income peer group. Tanzania’s agricultural crop production stood at 50 million metric tons (54.7 if meat and fish are included), matching agrarian demand. However, the forecast is for a growing gap between demand and production on the Current Path, resulting in about 21.6 million metric tons of unmet agrarian needs in 2043.

Tanzania’s rapidly expanding population fuels agricultural demand, a situation that increases food insecurity, which is already troubling. This trend is visible across Africa’s lower-middle-income economies generally.

Because of widespread poverty and lack of access to calories, over 34% of Tanzanian children under five are stunted, and nearly 45% of women of reproductive age are anaemic, according to USAID. The agency lists four challenges: ‘Limited access to productive and financial resources, weak infrastructure, and poor policies reduce incentives to develop the agriculture sector. Private-sector investment in agriculture is constrained by limited access to long-term capital, low capacity and business skills, and policies discouraging growth. Climate change poses significant risks of prolonged drought and unpredictable weather, threatening the livelihoods of subsistence farmers. Rapid population growth and agricultural expansion threaten Tanzania’s natural resources that, when managed effectively, support livelihoods and agriculture.’

In the Agriculture scenario, that sees yields in Tanzania more than double to 6.1 metric tons per hectare in 2043, the country will start closing the gap in average yields per hectare with lower-middle-income African countries. The result is that instead of producing 64.7 million metric tons of crops in 2043, Tanzania will produce 89.3 million metric tons. Total production from agriculture (i.e. including crops, meat and fish) will be at 101.3 million metric tons instead of 76.1. In the Agriculture scenario, Tanzania will have the ninth highest yields per hectare amongst Africa’s 24 lower-middle-income countries in 2043. In 2023, it stood at number 18.

The Agriculture scenario will free Tanzania from import dependence. By 2043, the country will be producing 101.3 million metric tons of crops, meat and fish, comparable to its 2043 demand of 102.4 million metric tons.

Chart 16 presents the structure of the Education scenario. It improves the quantity and quality of education and its relevance to job requirements.

The Education scenario represents reasonable but ambitious improved intake, transition and graduation rates from primary to tertiary levels and better quality of education at primary and secondary levels. It also models substantive progress towards gender parity at all levels, additional vocational training at the secondary school level and increases in the share of science and engineering graduates.

You can visit the theme on Education for our conceptualisation and details on the scenario structure and interventions.

The 2020 World Bank report Tanzania Mainland Poverty Assessment found that large numbers of dependents and disadvantaged burdened poor households by too little education. About 29% of household heads have no education, and 19% did not complete primary school, with rates being highest among poor rural households. Only 3.4% of the heads of poor households (and 1.3% of rural ones) went beyond primary education, compared to 20% for nonpoor households. Of households whose heads have no education or did not complete primary, about 35% live in poverty. The poverty rate drops to 26% for those who completed primary schooling and to just 6% among households with lower secondary education and above. It concluded that while education is still the best shield against poverty, primary education seems no longer sufficient to open up opportunities.

Literacy rates in Tanzania are higher at 79% in 2023 than most lower-middle-income African countries, which has an average of 73%. On the Current Path, literacy rates will improve to 92% in 2043 and slightly higher in the Education scenario.

Tanzania’s primary test score in 2023 was roughly on par with the average for Africa’s lower-middle-income countries but fell behind the average of its peer group by five percentage points in 2043 as education expenditure per learner remains flat due to the ongoing increase in the number of learners that enter the system. The Education scenario modestly changes this trajectory.

The average test scores for secondary learners in Tanzania was 5% below the average for Africa’s lower-middle-income countries and will increase above the Current Path by 2043.

Chart 17 presents mean years of education in the Current Path and the Education scenario for the 15 to 24-year age group.

The average years of education in the adult population aged 15 to 24 is an excellent first indicator of how the stock of knowledge in society is changing.

In 2023, Tanzania performed significantly worse than its income peer group, with its mean of years of education in 2023 around one year below the average for Africa’s 24 lower-middle-income countries. In the Education scenario, the mean years of education increase from 6.6 years in 2023 to 8.4 years in 2043. This represents an improvement of 0.6 years in 2043 compared to the Current Path. In addition, the gap will slowly increase in the Current Path over the forecast horizon. In the Education scenario, the gap between the mean years of education in Tanzania and the average for Africa’s lower-middle-income countries is halved to 0.5 years instead of one year.

Turning to gender issues, according to USAID: ‘While primary school enrolment among girls and boys is nearly equivalent, only one in three girls who start secondary school will finish their lower secondary education. Causes of low secondary enrolment and retention among girls include economic hardship, early marriage and teen pregnancy, and school-related gender-based violence.’

Chart 18 presents the structure of the Manufacturing scenario.

The Manufacturing scenario represents reasonable but ambitious manufacturing growth through greater investment in the manufacturing sector, in research and development (R&D) as well as improvement in government regulation of businesses. It increases total labour participation rates with a larger increase in female participation rates where appropriate. It is accompanied by increased welfare transfers (social grants) to unskilled workers to moderate the initial increases in inequality typically associated with a manufacturing transition.

Visit the theme on Manufacturing for our conceptualisation and details on the scenario structure and interventions.

In this scenario, the government of Tanzania raises around US$4.4 bn more tax in 2043. It invests most of that money in the manufacturing sector while transferring around US$1.7 bn as a social grant to offset the likely negative effects of a manufacturing transition, borrowing the balance.

Chart 19 presents the contribution of the manufacturing sector to GDP in the Current Path and in the Manufacturing scenario. Our modelling uses data from the Global Trade and Analysis Project (GTAP) to classify economic activity into six sectors: agriculture, energy, materials (including mining), manufacturing, services and information and communication technologies (ICT). Most other sources use a threefold distinction between only agriculture, industry and services, with the result that data may differ.

Tanzania has built a more resource-intensive manufacturing sector focused on serving domestic and regional markets but in spite of robust improvements, it lagged at around 4.4 percentage points below the average for lower-middle-income Africa in 2023. On the Current Path, the gap closes slightly to 4.1 percentage points. In the Manufacturing scenario, the gap is reduced to 1.8 percentage points by 2043 and the value of Tanzania’s manufacturing sector is then US$6.2 billion larger than in the Current Path for that year.

The Manufacturing scenario has limited impact on poverty. It will reduce the share of Tanzanians living below the US$3.65 poverty line from 74.1% in 2023 (equivalent to 48.3 million people) to 39.7% in 2043 (40.3 million people). This represents a 0.8 percentage point improvement that will translate to 837 000 people escaping poverty in 2043.

Labour participation rates for males increase by 2.6 percentage points in 2043 and by 4.1 for females relative to the Current Path.

In this scenario, government revenues are US$4.1 billion larger in 2043 compared to the Current Path.

Chart 20 presents the structure of the AfCFTA scenario. It represents the impact of fully implementing the African Continental Free Trade Agreement by 2034. The scenario increases exports in manufacturing, agriculture, services, ICT, materials and energy. It also includes an improvement in multifactor productivity growth emanating from trade and a reduction in tariffs for all sectors.

Visit the theme on AfCFTA for our conceptualisation and details on the scenario structure and interventions.

Chart 21 compares the trade balance in the Current Path with the AfCFTA scenario.

Tanzania makes solid gains in the AfCFTA scenario. Whereas, in 2023, its GDP per capita was US$2 668, it will increase to US$5 285 in 2043 instead of US$4 890, an improvement of 8% (or US$395) above the Current Path. Because it has recently graduated from low- to lower-middle-income status, Tanzania's GDP per capita in 2023 is only 44% of the average for Africa’s 24 lower-middle-income countries. In the AfCFTA scenario, it increases to 61% in 2043 instead of 57% on the Current Path.

The scenario stimulates both exports and imports. By 2043, Tanzania’s export value will increase by 52% and imports by 32%. Whereas Tanzania’s 2023 current account stood at 1.2% of GDP and will decline to -1.2% by 2043, in the AfCFTA scenario the current account remains positive throughout the forecast horizon.

The AfCFTA scenario does little to reduce extreme poverty compared to the Current Path, however, it is likely because few of its positive effects trickle down to Tanzania’s large informal sector.

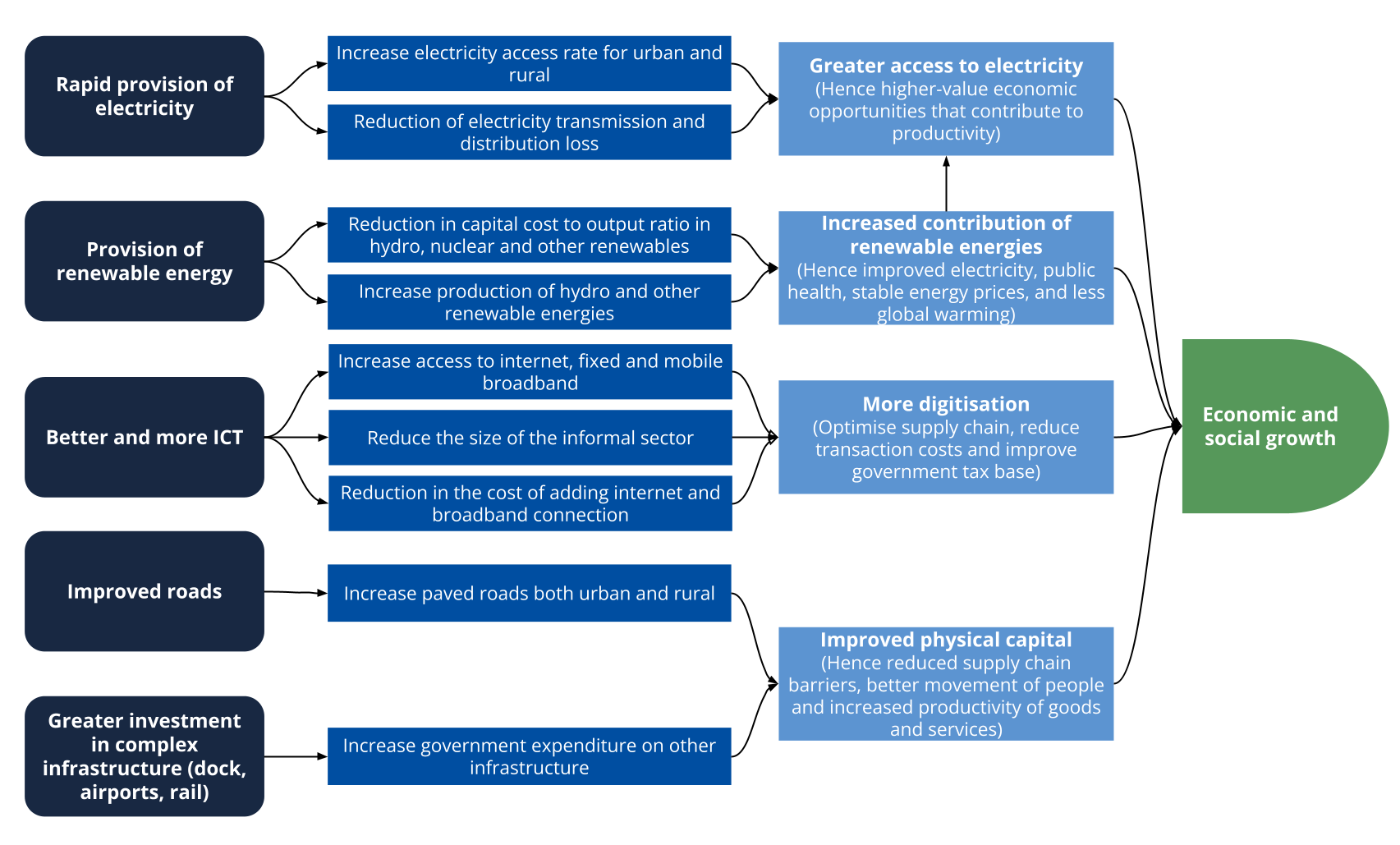

Chart 22 presents the structure of the Large Infrastructure and Leapfrogging scenario.

The Large Infrastructure and Leapfrogging scenario represents a reasonable but ambitious investment in road infrastructure, renewable energy technologies and improved access to electricity in urban and rural areas. The scenario includes accelerated access to mobile and fixed broadband and the adoption of modern technology that improves government efficiency and allows for the more rapid formalisation of the informal sector. A final intervention emulates investments in large infrastructure such as rail, port and airports.

Visit the themes on Large Infrastructure and Leapfrogging for our conceptualisation and details on the scenario structure and interventions.

According to the World Bank, poor households suffer from less access to infrastructure and community services such as electricity, water supply, health facilities, roads, markets and communication networks. These are the backbone of household development, they structure the household environment and promote emergence of opportunities. Their absence minimises opportunities and perpetuates their dire lack of cash. The 2020 study goes on to note that only 7% of poor households were connected to the electrical grid and 28% use solar energy; the rest rely on inefficient energy sources for lighting and that 90% of poor households use firewood and charcoal for cooking. About 30% of poor households still have access only to unsafe sources of drinking water, and over 90% rely on unimproved sanitation facilities or none at all. Only about 13% of poor households have access to tarmac roads; 44% lack any source of access. Among nonpoor households, the corresponding rates are 22% with good access and 32% without any. Also, 41% of households have no access to a health center, dispensary or hospital, whether public or private.

Looking nationally, only 41.7% of Tanzania’s population had access to electricity in 2023. In fact, Tanzania ranks second to last on access to electricity in its African lower-middle-income peer group with 38.3 million persons without access. At 70% in 2023, the latter has an average access rate that is almost twice as high.

In the Current Path, 72.3% of Tanzanians will have access to electricity by 2043. In the Large Infratructure and Leapfrogging scenario, access to electricity will expand faster reaching 81.5% of the population by 2043, but still lag by four percentage points behind the average for the continent’s lower-middle-income economies. In that scenario only 19 million Tanzanians will still be without electricity access. Rural access increases more than urban access by 15 percentage points from 22% in 2023 to 70% instead of 55% on the Current Path by 2043.

The 2020 World Bank report Poverty Assessment for Mainland Tanzania notes, that access to electricity has progressed somewhat, but that national electrification remains insufficient, particularly in rural areas and for poor households. Although 29% of Tanzania’s households have access to electricity, it notes, access is available to just 10% of rural and 7% of poor households. The report finds that the country’s strategy to diversify toward solar energy has started to pay off, particularly in rural areas, where 33% of households use solar energy for lighting compared to 14% in urban areas. Howvver, in spite of some improvements, about 45% of households still rely on such inefficient lighting sources as torches and kerosene. Use of efficient energy sources for cooking has improved slightly, but over 80% of all households, and more than 90% of rural and poor households, continue to rely on firewood and charcoal, it found.

Investments in rural road infrastructure are associated with positive socio-economic impacts, such as increased rural incomes and poverty reduction, improved maternal health as well as paediatric health and increased agricultural productivity. In 2023, 29 % of Tanzania’s rural population had access to an all-weather road. This is roughly on par with the average access rate for Africa’s lower-middle-income economies. The Large Infrastructure and Leapfrogging scenario will improve rural road access by one percentage point to 39% in 2043 compared to the Current Path.

Chart 23 presents cookstove usage in the Current Path and the Large Infrastructure and Leapfrogging scenario.

In 2023 only Nigeria, which has a much larger population than Tanzania, had more persons among Africa’s 24 lower-middle-income country populations still using traditional cookstoves (at 24.8 million) than Tanzania (at 8.7 million). In the Large Infrastructure and Leapfrogging scenario 1.9 million fewer Tanzanians will rely on traditional cookstoves in 2043 and 0.8 million fewer will rely on cookstoves using improved fuel.

Chart 24 presents access to mobile and fixed broadband in the Current Path and the Large Infrastructure and Leapfrogging scenario.

Fixed broadband subscription is particularly important for the private sector and to enable the expansion of business in the formal sector. Mobile broadband, on the other hand, is important for the informal sector, and small and medium-sized businesses as well as to unlock educational and other opportunities.

Tanzania, like most African lower-middle-income countries, had a very low fixed broadband rate of 7.8 per 100 people in 2023, although high within its peer group. The global average in 2023 is more than double that at 19 subscriptions per 100 people. In the Large Infrastructure and Leapfrogging scenario, Tanzania’s fixed broadband will increase to 46 subscriptions per 100 people by 2043 compared to only 30 per 100 people in the Current Path. Despite these low rates, Tanzania performs above the average of its African income peer group.

In 2023, Tanzania had a mobile broadband subscription rate of 23 subscriptions per 100 people. This rate is significantly lower than the average rate of subscriptions per 100 people for Africa’s lower-middle-income economies, which is at 66 per 100. Only Angola, the Republic of Congo and Comoros had a lower mobile broadband subscription rate in that year. On the Current Path, Tanzania’s mobile broadband subscription rates will increase to 141 per 100 persons and to 153 in the Large Infrastructure and Leapfrogging scenario. The average rate for lower-middle-income countries in 2043 is below that, at 143 per 100 people. The improvement in the ranking of Tanzania compared with others is large. Instead of the lower-middle-income country with the 19th highest rate amongst its peers, it will have the 12th. These improvements occur in spite of the damping effect rates as rates approach a saturation rate of 150 subscriptions per 100 people evident in Chart 24.

Chart 25 presents the structure of the Financial Flows scenario.

The Financial Flows scenario represents a reasonable but ambitious increase in inward flows of worker remittances, aid to poor countries and an increase in the stock of foreign direct investment (FDI) and additional portfolio investment inflows. We reduce outward financial flows to emulate a reduction in illicit financial outflows.

Visit the theme on Financial Flows for our conceptualisation and details on the scenario structure and interventions.

Chart 26 presents government revenues in the Current Path and Financial Flows scenario.

Wagner's law, or the law of increasing state activity, is the observation that public expenditure increases as national income rises. It is, therefore, reasonable to expect that government revenues will increase as a percentage of GDP in the Financial Flows scenario compared to the Current Path. Between 1999/00 and 2020/21, public expenditure in Tanzania rose 26-fold, while the government's revenue from taxes and other sources rose 20-fold, leading to a 15-fold increase in the budget deficit, although still below the 3% of GDP target set by the East-African Community and generally financially manageable. An analysis by Joseph Semboja and Derick Msafiri for REPOA[2J Semboja and D Msafiri, Should Tanzania be concerned about its budget deficit? REPOA Brief 17/2022, December 2022] on Tanzania's budget deficit points to the challenge of a shrinking operational budget inadequate to support the expanding infrastructure, a repeat of the 1970s when capacity expansion went hand in hand with high capacity underutilisation. They highlight 'a seemingly contradictory phenemenom in which public facilities are expanding at the same time as public services are declining.'

Government revenues in Tanzania are below 16% of GDP in 2023, almost three percentage points below the average for Africa’s 24 lower-middle-income countries. It is the result of:

- A large informal sector that is not taxed, meaning that Tanzania’s tax base is relatively small,

- Widespread tax evasion,

- Inefficient tax administration, and

- Various tax exemptions and incentives.

Once the contribution of foreign aid is removed, government revenues decline to below 12%, reflecting the extent to which Tanzania depends on aid to fund government expenditures. The average contribution of aid to GDP amongst Africa’s 24 lower-middle-income countries is significantly lower.

Tanzania has been a significant recipient of development aid that peaked at an unprecedented 30% of GDP in 1992, equivalent to US$4.2 billion, before declining to US$1.37 billion in 1998 and then resuming its upward trajectory in absolute amounts to US$3.8 billion in 2007. Compared to the average for Africa’s lower-middle-income countries, foreign aid accounts for a quarter of government revenues in Tanzania at 25.1% in 2023. However, given rapid economic growth, its importance has declined recently. In 2023, Tanzania ranked ninth out of 24 lower-middle-income economies on the continent regarding aid receipts as a percentage of government revenues. The average for the group was much lower at 8.7% and will decline to 2.8% in 2043. In the Financial Flows scenario, aid accounts for 8.9% of Tanzania’s government revenues in 2043, still significantly higher than the peer group's average. In the Financial Flows scenario, Tanzania gets an additional US$12 billion in aid, i.e. above the Current Path from 2024 to 2043.

In both the Current Path and the Financial Flows scenarios, the contribution of foreign aid to government revenues will decline. By 2043, aid will constitute 9.8% of government revenues in the Financial Flows scenario compared to 9.4% in the Current Path, equivalent to US$342 million that year.

FDI inflows to Tanzania as a percentage of GDP have steadily increased since democratisation in 1992. However, they declined during the global financial crisis in 2007/08, and later during the COVID-19 pandemic from 2020 that saw a sharp drop to 0.8% in 2020 before a robust recovery to 3.8% in 2021. FDI flows to Tanzania accounted for 3% of GDP in 2023, 0.5 percentage points above the average for Africa’s lower-middle-income economies, primarily as investments in mining (gas in particular), manufacturing (in response to government efforts to promote industrial development) and financial services (in response to the growing demand). Much of it comes from China, India and the United Kingdom.

By 2043, FDI flows will account for 5% of Tanzania’s GDP in the Financial Flows scenario compared to 3.9% in the Current Path. The impact will be a substantial increase in the stock of FDI in Tanzania from 38.2% of GDP in 2023 to 47.9% in 2043 compared to 38.2% of GDP on the Current Path. The corresponding amounts in 2043 will be US$123 billion in the Combined scenario compared to US$95.4 billion in the Current Path.

In 2023, remittance inflows to Tanzania accounted for 0.6% of GDP (US$415 million), more than two percentage points below the average for its income peer group. In the Current Path and the Financial Flows scenario, remittances will decline, if expressed as a percentage of GDP, to 0.49% and 0.54%, respectively in 2043. In absolute terms, remittances will increase to US$1.4 billion in the Financial Flows scenario by 2043, US$160 million above the Current Path.

In the Financial Flows scenario, government revenues will increase by 1.47 percentage points of GDP in 2043, equivalent to US$1.47 billion - a cumulative increase of US$12.2 billion more revenues from 2024 to 2043.

Chart 27 is a summary chart that sets out the composition of the Governance scenario. Thinking of governance in terms of security, capacity and inclusion provides a valuable lens to compare how countries progressed over time and the state of governance between countries and groups of countries.

You can visit the theme on Governance for a complete conceptualisation and details on the scenario structure and interventions.

In brief, the stability dimension uses data from the Political Instability Task Force on:

- the probability and magnitude of state failure/internal war,

- the probability and magnitude of abrupt regime change, and

- social violence consisting of reductions in conflict and terror and police conflict.

Capacity is enhanced by improving the quality of government regulation, government effectiveness (both from the Worldwide Governance Indicators) and corruption reductions using Transparency International data.

Inclusion improves as a result of the following:

- an improvement in levels of democracy using the Polity IV index applied to those countries that evidence a democratic deficit,

- an improvement in gender empowerment using the gender empowerment measure (GEM) from the United Nations Development Programme (UNDP), and

- more economic freedom (using the associated index from the Fraser Institute).

These indices compare well with the results from others, although our modelling adopts a more structural/long-term approach. For example, the Worldwide Governance Indicators published by the World Bank measure six dimensions of governance, many of which overlap with the three indices. These are voice and accountability, political stability and absence of violence/terrorism, government effectiveness, regulatory quality, rule of law, and control of corruption.

Since independence in 1961, Tanzania has been ruled by five Presidents, namely Mwalimu Julius Kambarage Nyerere (1961-1985), Haj Ali Hassan Mwinyi (1985 – 1995), Benjamin William Mkapa (1995 – 2005), Jakaya Mrisho Kikwete (2005-2015), John Magafuli (2015-2021) and since the death of President Magafuli, by Samia Suluhu Hassan, the first female president of the United Republic of Tanzania.

Until the mid-1980s, Tanzania was a one-party state with a socialist and inclusive economic development model. Nyerere introduced a socialist policy of ujamaa (Swahili for familyhood) in 1964 that called for the creation of communal villages, where people would share land and resources and introduced a one-party system with Chama Cha Mpinduzi (CCM) as the ruling party. The Arusha Declaration of 1967 placed an emphasis on the egalitarianism inherent in a socialist society by leveraging the collective ability of the population to determine the destiny of the country.

Various challenges, including inefficiency, corruption and a lack of incentives for individual effort, meant slow growth, and the economy suffered from several external shocks, including the oil crisis in the 1970s and the fall of world coffee prices.

Beginning in the mid-1980s, under the administration of President Ali Hassan Mwinyi, Tanzania undertook several political and economic reforms, including a shift away from state control of the economy, the introduction of multi-party politics, and the adoption of a market-based economy.

The current multi-party political system was introduced in 1992, followed by regular elections, with the first conducted in 1995. CCM won the elections, but it lost its majority in parliament. The opposition parties joined CCM to form a coalition government, and Tanzania has been a multi-party democracy ever since.

Chart 28 presents progress with the three governance dimensions by 2043 in the Current Path and Governance scenario compared to 2019.

We measure and compare security, capacity and inclusion within and between countries and combine them in an average governance index.

In 2023, Tanzania scored better than the average of the lower-middle-income Africa group in security and much higher in inclusion but had slightly less capacity than its peers. In the Governance scenario, Tanzania will do better than the group average in all three dimensions by 2043 and further improve its leadership in inclusion. These individual scores affect its combined governance index score. In 2023, Tanzania was ranked 10th out of 24 lower-middle-income countries and will improve its ranking to eighth in 2043 on the Current Path. In the Governance scenario, its ranking improves to an impressive third by 2043, behind only Lesotho and Cape Verde.

We start with security.

Tanzania has generally been an island of stability in a turbulent region compared to neighbouring Uganda, DR Congo, Rwanda and Burundi. In the process, it has become host to a large refugee population, mainly from Burundi and DR Congo. Most refugee camps are located in the northwestern region of Kigoma.

Perhaps the most significant threat to its instability came when, in April 1964, Zanzibar merged with mainland Tanganyika as the United Republic of Tanzania, within which Zanzibar remains an autonomous region. The complex relations between the semi-autonomous archipelago of Zanzibar and the mainland sometimes threatened the political stability of the union. Zanzibar has long maintained a strong sense of autonomy, and in 1972, there was a brief attempt to break away from the union. In 2010, Zanzibar was granted greater autonomy, including the right to elect its own president, which has eased relations.