Mozambique

Mozambique

Feedback welcome

Our aim is to use the best data to inform our analysis. See our Technical page for information on the IFs forecasting platform. We appreciate your help and references for improvements via our feedback form.

This page explores the current and projected future development of Mozambique, examining various sectoral scenarios and their potential impacts on the country's growth. It explores eight sectors including demographic, economic, and infrastructure-related outcomes for Mozambique up to 2043. The analysis also considers the implications of the Agenda 2063 goals, aiming to offer insights into policy actions that could enhance the country's developmental trajectory.

For more information about the International Futures modelling platform we use to develop the various scenarios, please see About this Site.

Summary

We begin this page with an introductory assessment of Mozambique’s context looking at the current population distribution and structure, climate and topography.

Mozambique, situated in Southern Africa and bordered by six countries, is rich in mineral reserves, arable land and a coastline. After achieving independence in 1975 and ending a 15-year civil war in 1992, Mozambique began to experience socio-economic progress. Between 1993 and 2015, it was one of Africa’s fastest-growing economies, with an average annual growth rate of about 8%. This growth was driven by factors such as political and macroeconomic stability, a rebound in post-war economic activity, increased Foreign Direct Investment (FDI) in extractive industries and post-war reconstruction efforts.

However, these high growth rates were not inclusive enough and not accompanied by a structural transformation of the economy. The country remains one of the poorest globally, with a GDP per capita of about US$450 in 2023 and high levels of poverty and inequality. Post-2015 growth slowed to an average of about 3% due to various challenges including the "hidden debt" scandal, insurgencies, natural disasters and the COVID-19 pandemic. The Government of Mozambique faces the urgent task of achieving sustainable and inclusive growth, with hopes pinned on gas megaprojects.

This section is followed by an analysis of the Current Path forecast for Mozambique which informs the country’s likely current development trajectory to 2043. It is based on current geopolitical trends and assumes that no major shocks would occur in a ‘business as usual’ future.

Since 2000, Mozambique’s population has increased by about 70% from 18 million to about 32.9 million in 2022, making it the 14th largest population in Africa and the 3rd largest in the southern African region after South Africa and Angola. On the Current Path, Mozambique’s population will reach 55.4 million people by 2043, reflecting the reduction in mortality and elevated fertility.

Agriculture, mining and energy form the foundation of Mozambique's modest economy. On the Current Path, the average growth rate between 2023-2043 will be 6%. As a result of these expected positive growth rates, Mozambique's GDP (2017 constant US$) will triple from US$15.7 billion in 2023 to US$48.2 billion in 2043.

In 2023, Mozambique had Africa's 7th lowest GDP per capita (PPP). On the Current Path, Mozambique’s real GDP per capita (2017 PPP) will increase by 64.7%, from US$1 300 in 2023 to US$2 141 by 2043, below the average of US$3 254 for low-income Africa.

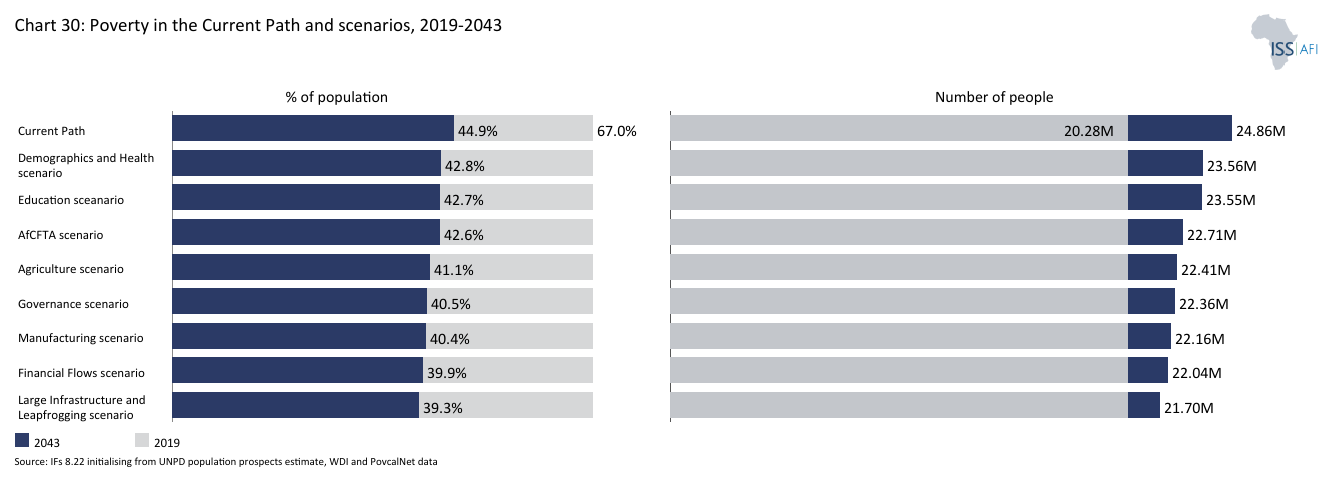

Using the poverty threshold of US$2.15, Mozambique had the fourth-highest poverty rate at 71% among the 22 low-income countries in Africa in 2022. On the Current development trajectory, the poverty rate in Mozambique (at US$2.15) will reach 44.9% by 2043, about 25 percentage points above the projected average of 21.2% for low-income Africa in the same year. The number of poor people will peak at 32.5 million in 2030 due to population growth before steadily declining to 24.8 million by 2043.

Mozambique’s National Development Plan (ENDE) is structured around five main pillars: (i) Structural Transformation of the Economy; (ii) Social and Demographic Transformation; (iii) Infrastructures; (iv) Governance; and (v) Environment and Circular Economy. Each pillar has strategic objectives, result indicators and targets for the period 2023-2043.

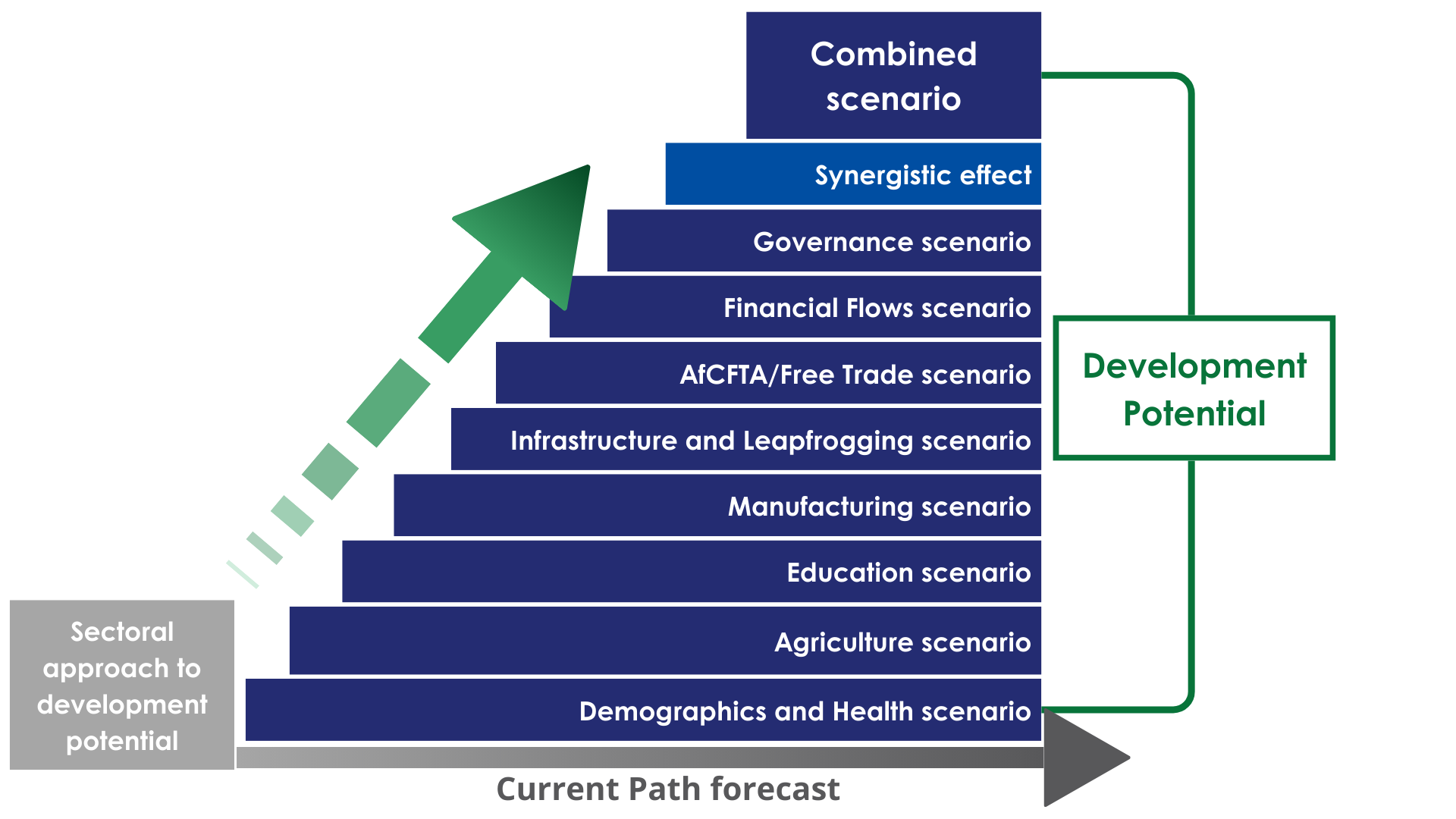

The next section compares progress on the Current Path with eight sectoral scenarios. These are Demographics and Health; Agriculture; Education; Manufacturing; the African Continental Free Trade Area (AfCFTA); Large Infrastructure and Leapfrogging; Financial Flows; and Governance. Each scenario is benchmarked to present an ambitious but reasonable aspiration in that sector.

Under the Demographics and Health scenario, Mozambique accelerates its demographic transition and could reap the demographic dividend by 2041, ten years later than on the Current Path. The GDP per capita (PPP) is about US$106 more than the Current Path in 2043. Also, there are 2.7 million fewer Mozambiquans living in extreme poverty (less than US$2.15 per day) in 2043, equivalent to a poverty rate of 42.8% instead of 44.9% for the Current Path in the same year.

Agriculture is the source of livelihood for millions of Mozambicans. Yet, the sector faces several challenges that negatively impact productivity. Under the Agriculture scenario, the average crop yield is 5.6 tons per hectare by 2043, on par with the regional average. The poverty rate will be 3.8 percentage points less than the Current Path in 2043, while the GDP per capita (PPP) will be US$213 larger than on the Current Path in 2043.

The Education scenario increases the overall average educational attainment (for adults 15+ years) level to 6.5 years by 2043 in line with the target set by the GOM. In this scenario, Mozambique’s GDP per capita (PPP) is about US$ 54 more than the Current Path in 2043. Also, there are about 1.3 million fewer Mozambicans living in extreme poverty (less than US$2.15 per day) in 2043, equivalent to a poverty rate of 42.6% instead of 44.9% for the Current Path in the same year.

In the Manufacturing scenario, the average Mozambican will have an income that is US$ 117 (PPP) higher than the Current Path, while 2.5 million fewer Mozambicans will live in extreme poverty in 2043 compared to the Current Path.

In the African Continental Free Trade Area (AfCFTA) scenario, the income per capita (PPP) is US$144 higher than the Current Path while the poverty rate will be 2.3 percentage points lower (or 1.3 million fewer people in extreme poverty) in 2043 compared to the Current Path.

In the Large Infrastructure and Leapfrogging scenario, the GDP per capita (PPP) will be US$240 above the Current Path in 2043. There will be 3.2 million fewer Mozambicans living in extreme poverty in 2043 compared with the Current Path. This translates to a poverty rate of 39.3% against 44.9% on the Current Path.

In the Financial Flows scenario, the average Mozambican will have an income that is US$140 (PPP) higher than the Current Path while the poverty rate will be five percentage points lower (or 2.8 million fewer people in extreme poverty) in 2043 compared to the Current Path.

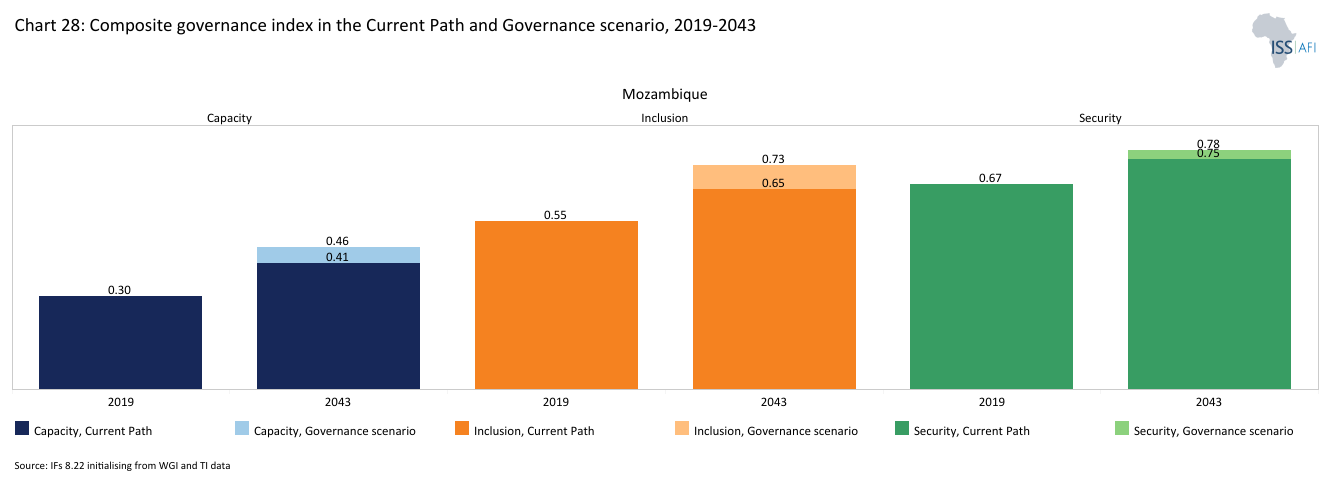

In the Governance scenario, the average Mozambican will gain US$151 in GDP per capita (PPP) in 2043 compared to the Current Path of US$2 141. There will be 2.4 million fewer Mozambicans surviving on less than US$2.15 per day in 2043 compared with the Current Path of 24.8 million people in the same year. This is equivalent to a monetary poverty rate of 40.4% against 44.9% on the Current Path in 2043.

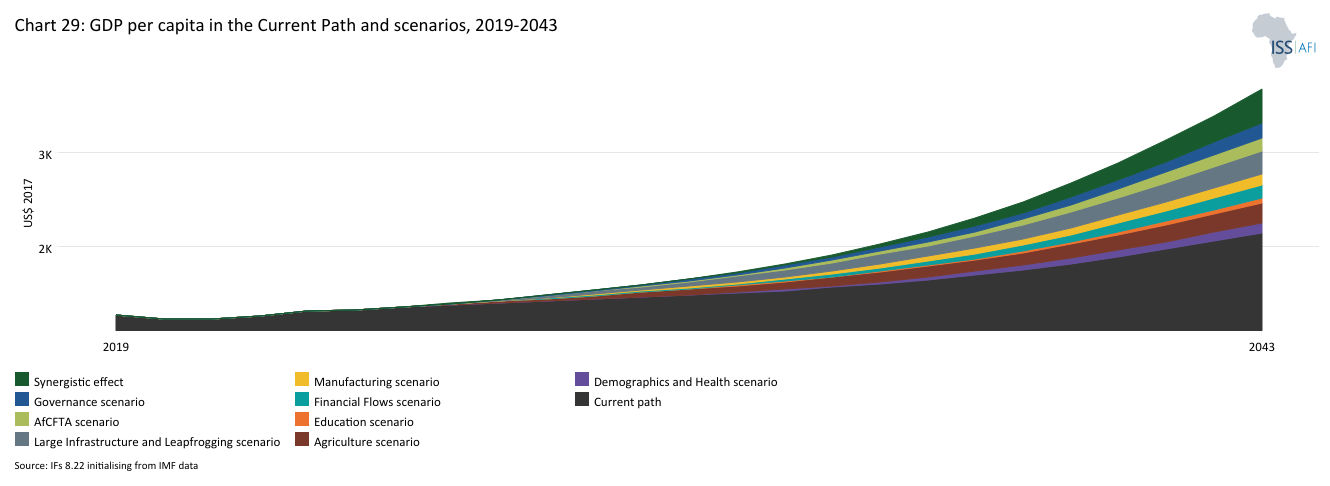

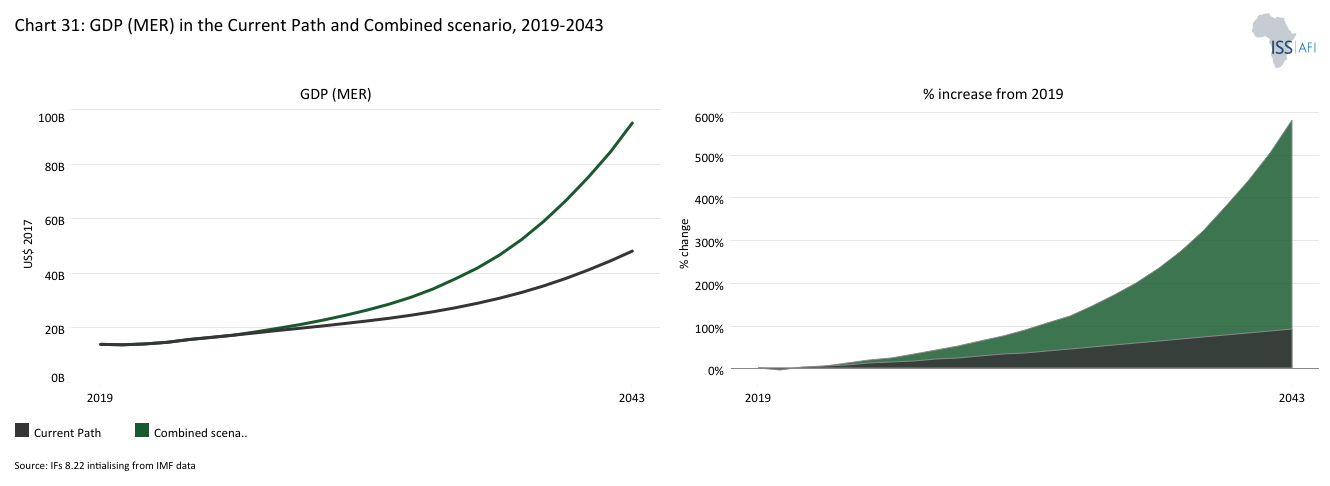

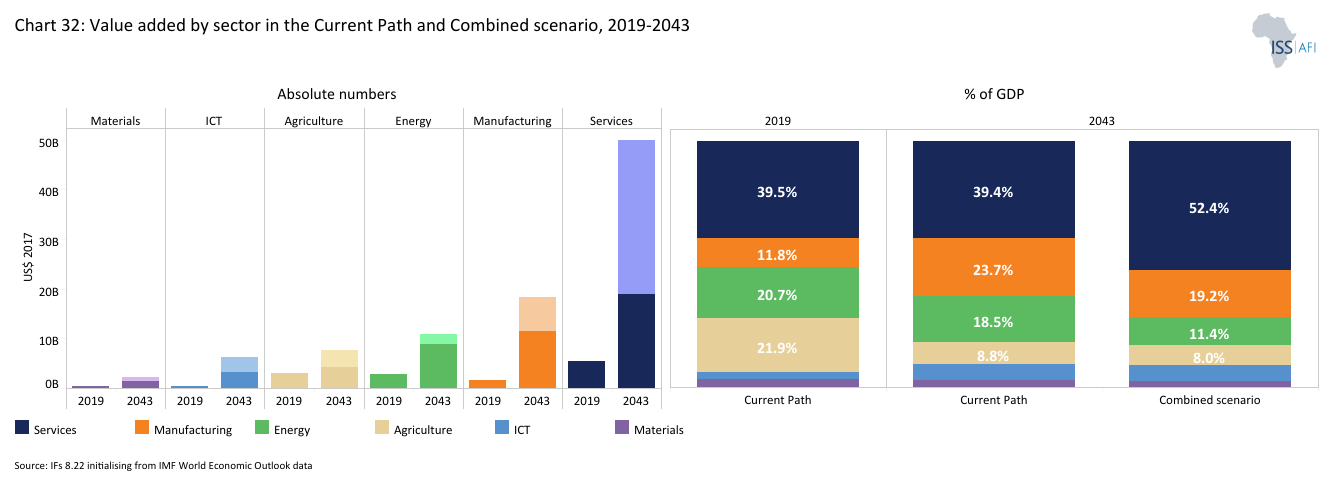

In the third section, we compare the impact of each of these eight sectoral scenarios with one another and subsequently with a Combined Agenda 2063 scenario (the integrated effect of all eight scenarios). In our forecasts, we measure progress on various dimensions such as economic size (in market exchange rates), gross domestic product per capita (in purchasing power parity), extreme poverty, carbon emissions, the changes in the structure of the economy, and selected sectoral dimensions such as progress with mean years of education, life expectancy, the Gini coefficient or reductions in mortality rates.

The Combined scenario has a much greater impact on GDP per capita compared to the individual sectoral scenarios. By 2043, the GDP per capita of Mozambique (PPP) will be US$ 3 677, which will be US$1 536 larger than on the Current Path in 2043.

All the sectoral scenarios improve the GDP per capita , however, the Large Infrastructure and Leapfrogging scenario has the most significant positive impact on GDP per capita with an increase of US$148 above the Current Path in 2043.

All the sectoral scenarios contribute to poverty reduction in Mozambique; however, in the short to medium term, infrastructure development and growth in the agriculture sector have the most potential to raise income and consumption among the poorest in Mozambique.

The Combined scenario significantly improves Mozambique’s growth prospects. In this scenario, the size of the Mozambican economy measured in GDP at the market exchange rate (MER) is US$47 billion larger than the Current Path in 2043.

We end this page with a summarising conclusion offering key recommendations for decision-making.

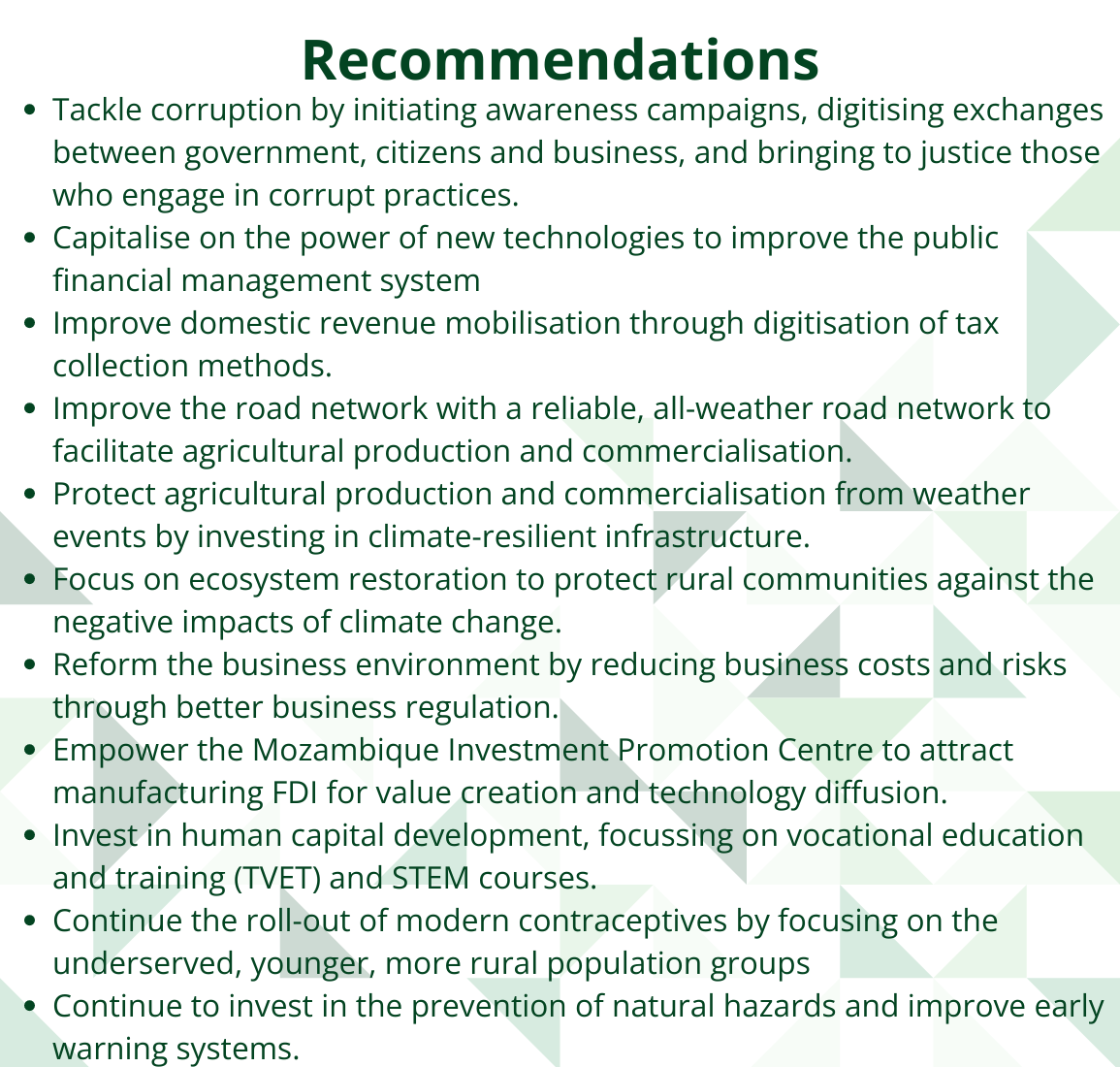

The analysis shows that Mozambique faces significant development challenges impeding progress: weak governance, corruption, slow demographic transition, infrastructure and human capital bottlenecks, low agriculture productivity and limited economic diversification. Even despite expected revenues from gas megaprojects, Mozambique will likely continue to have a larger number of people living in extreme poverty in 2043, implying that the Current Path is not a good option. An integrated development push across key sectors is essential. Progress will depend on the quality of governance and institutions, as weak governance leads to public financial mismanagement, macroeconomic instability and poor policy implementation.

All charts for Mozambique

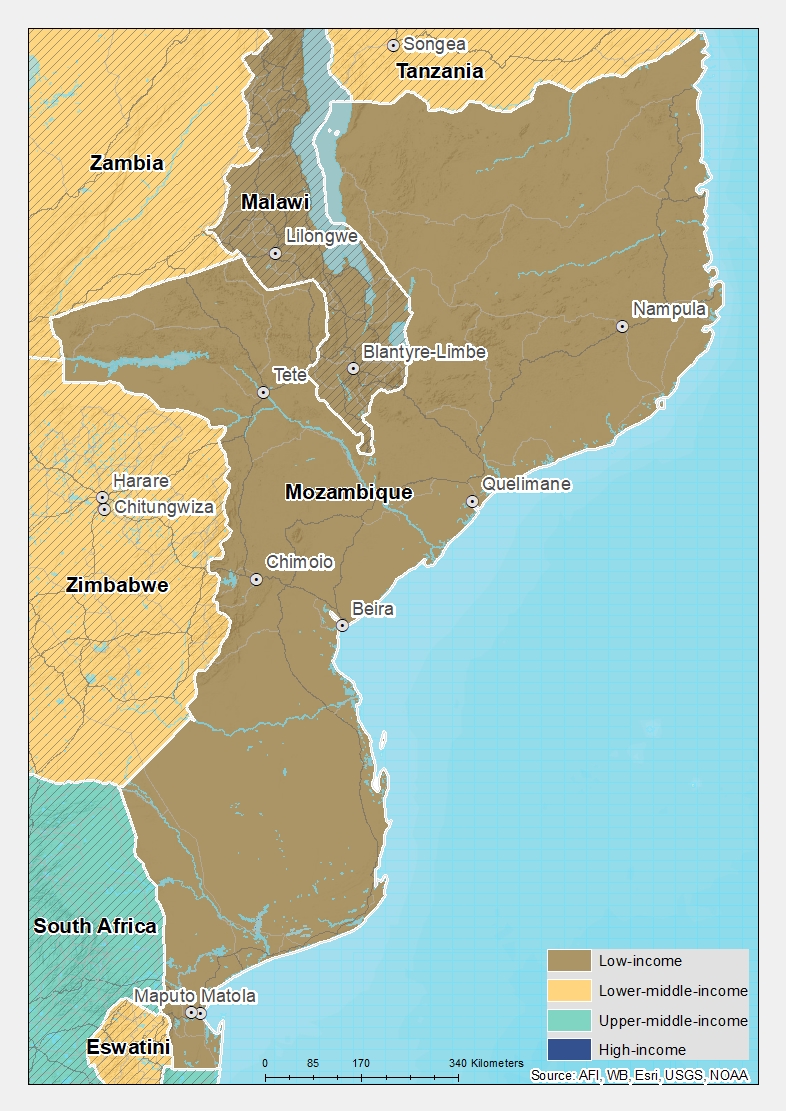

- Chart 1: Political map of Mozambique

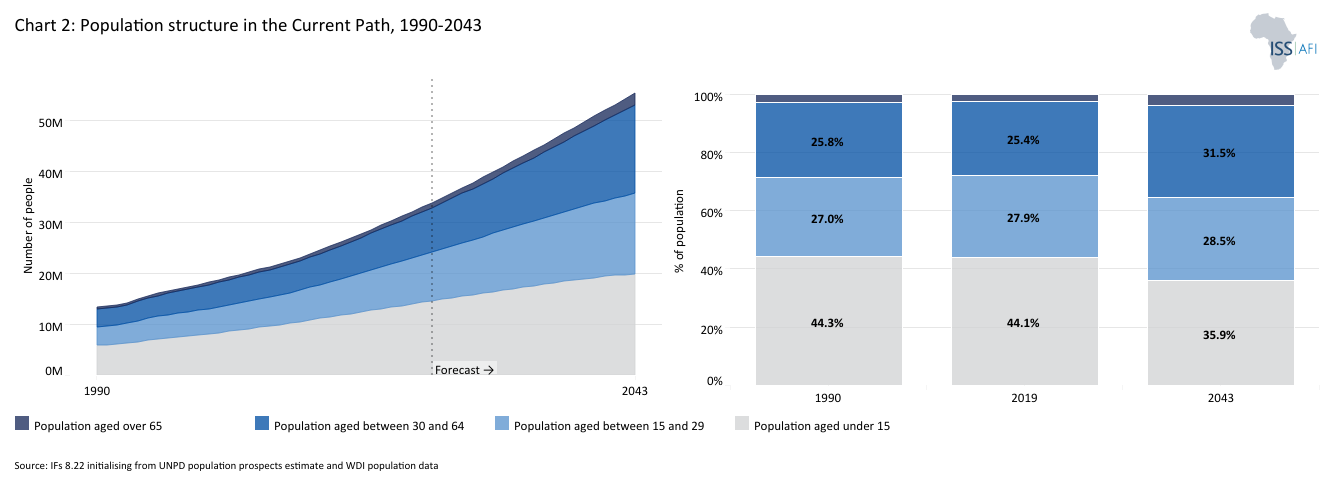

- Chart 2: Population structure in Current Path, 2019–2043

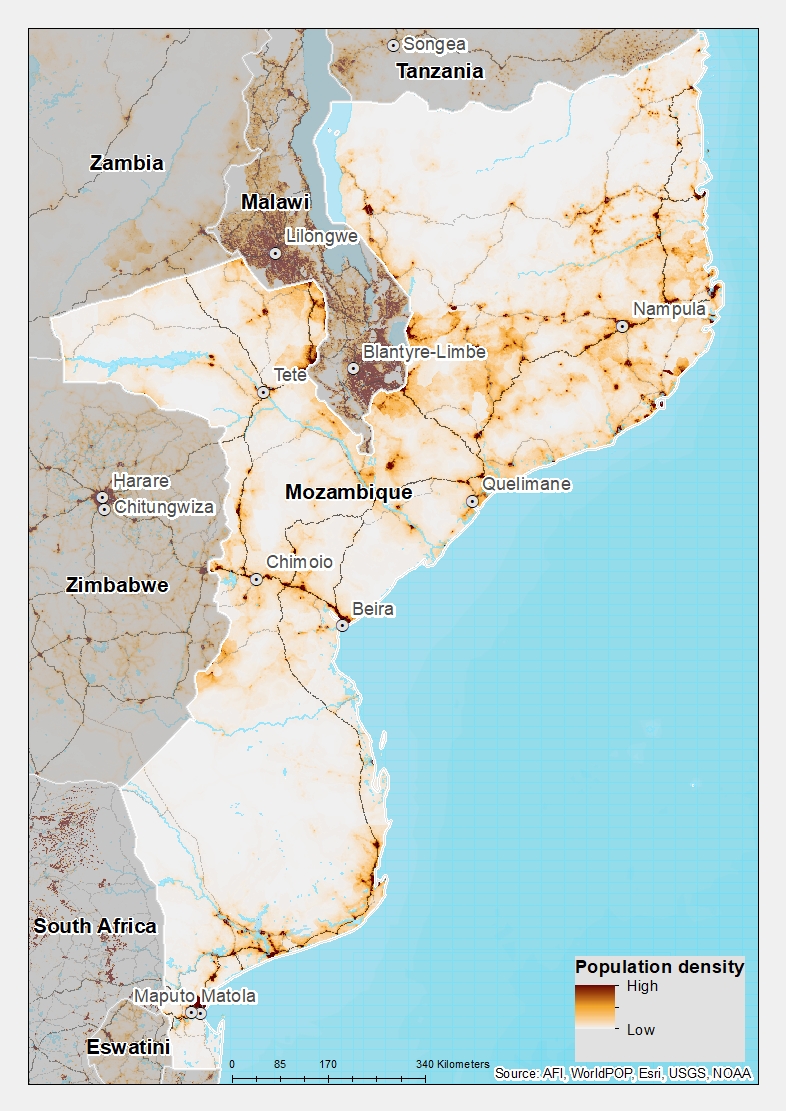

- Chart 3: Population distribution map, 2023

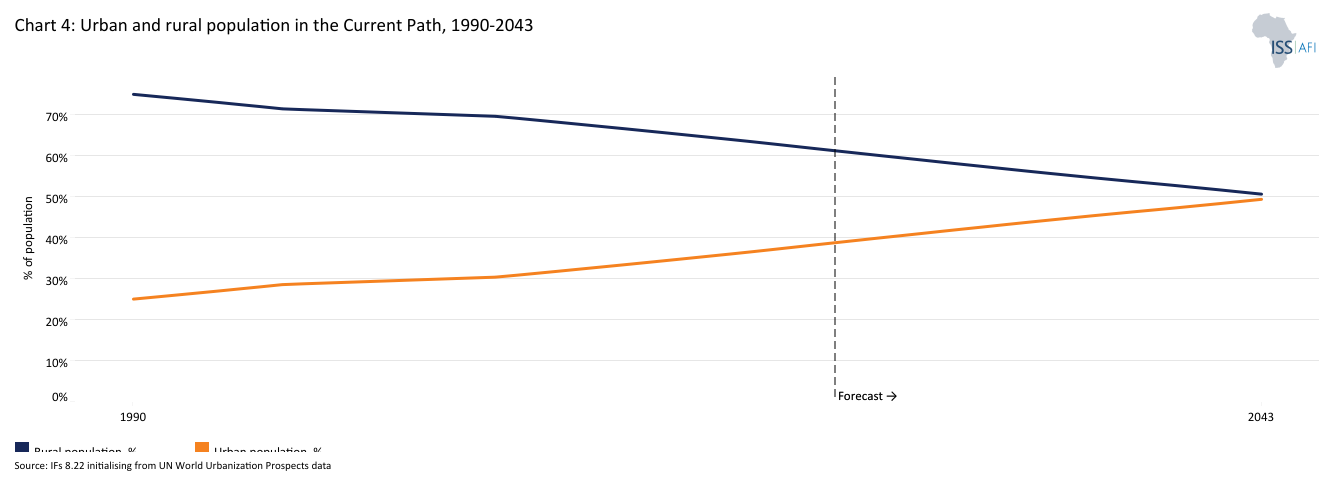

- Chart 4: Urban/rural population, 1990-2043

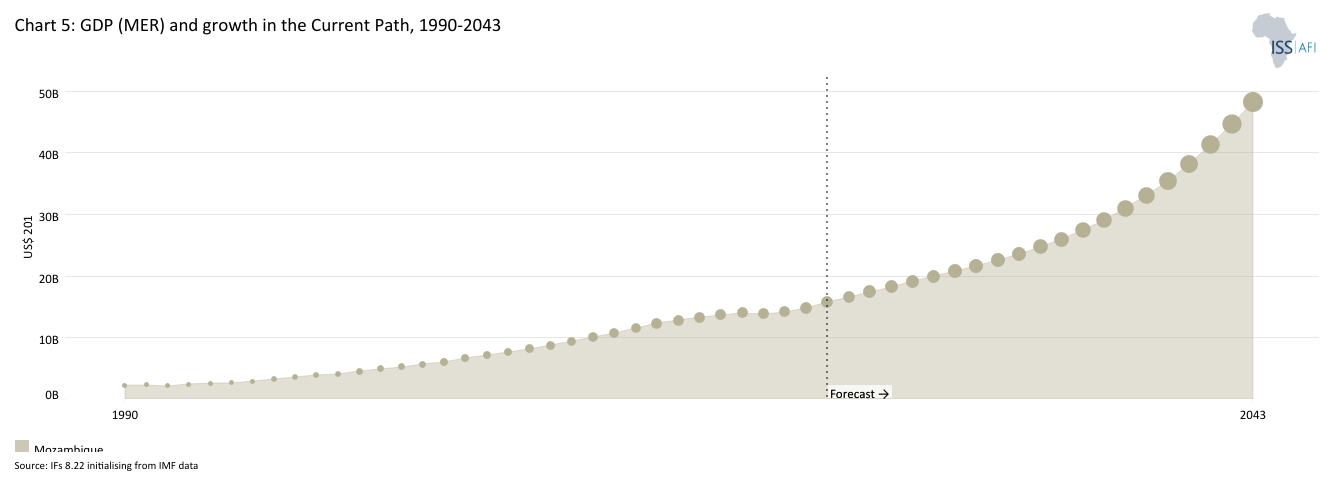

- Chart 5: GDP in MER and growth rate in the Current Path forecast, 1990–2043

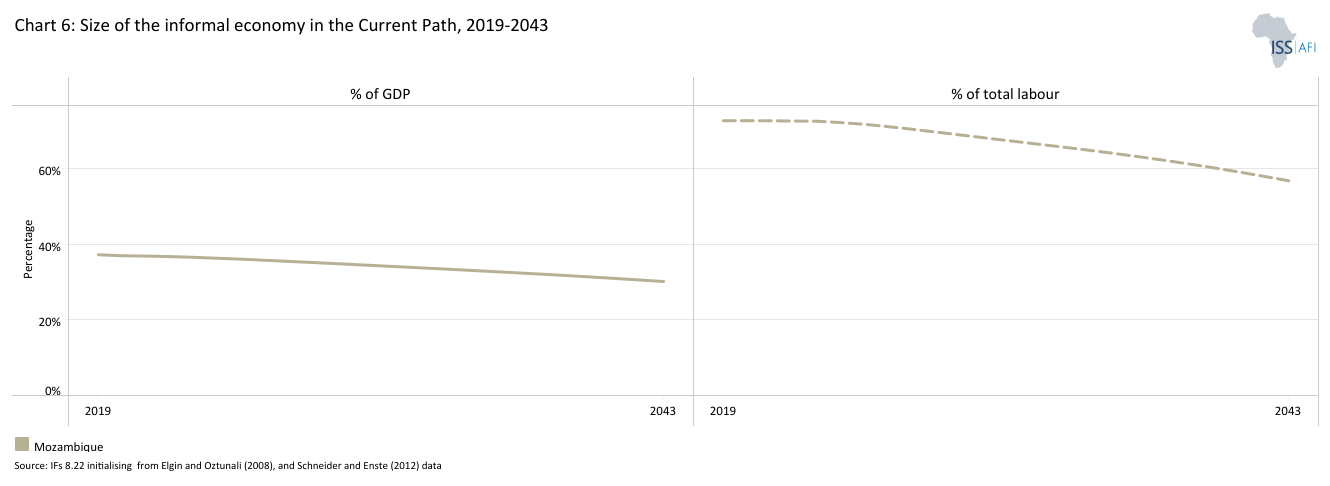

- Chart 6: Size of the informal economy as per cent of GDP and per cent of total labour (non-agriculture), 2019-2043

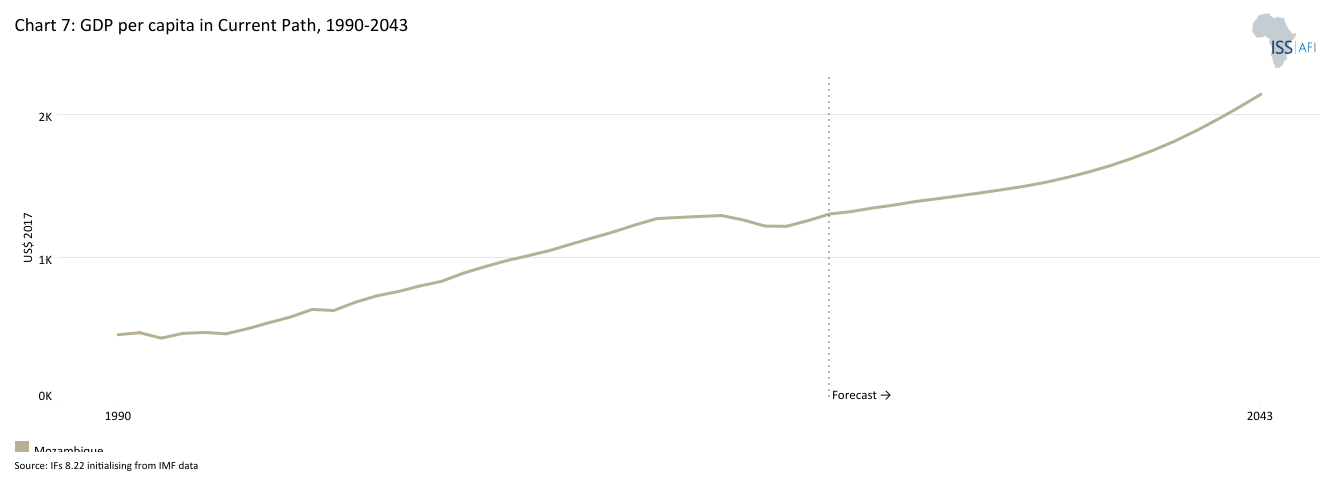

- Chart 7: GDP per capita in Current Path forecast, 1990–2043 compared with the average for income group

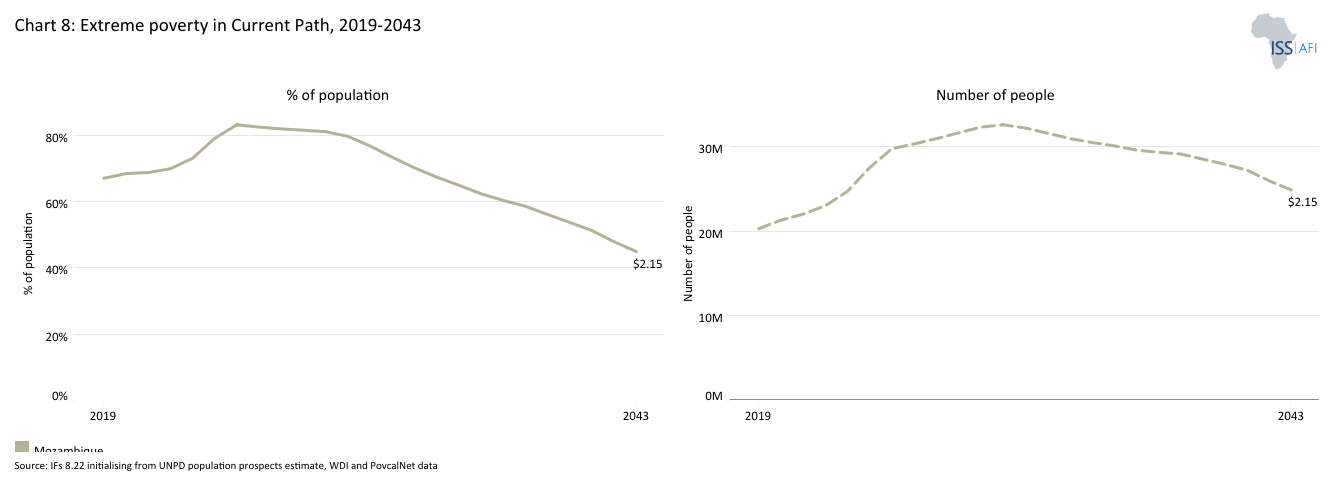

- Chart 8: Extreme poverty in Current Path as per cent of population and numbers, 2019–2043

- Chart 9: National Development Plan of Mozambique

- Chart 10: Relationship between Current Path forecast and scenario

- Chart 11: Mortality distribution in 2023

- Chart 12: Infant mortality rate in Current Path and Demographics and Health scenario, 1990–2043

- Chart 13: Demographic dividend in the Current Path forecast and the Demographics and Health scenario, 2019–2043

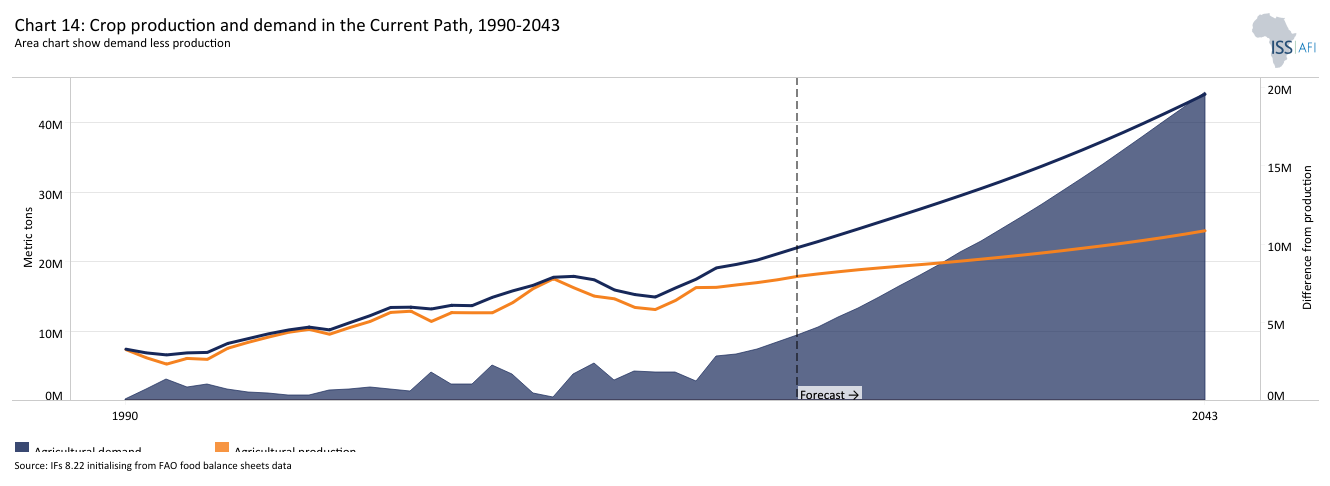

- Chart 14: Crop production and demand, 1990-2043

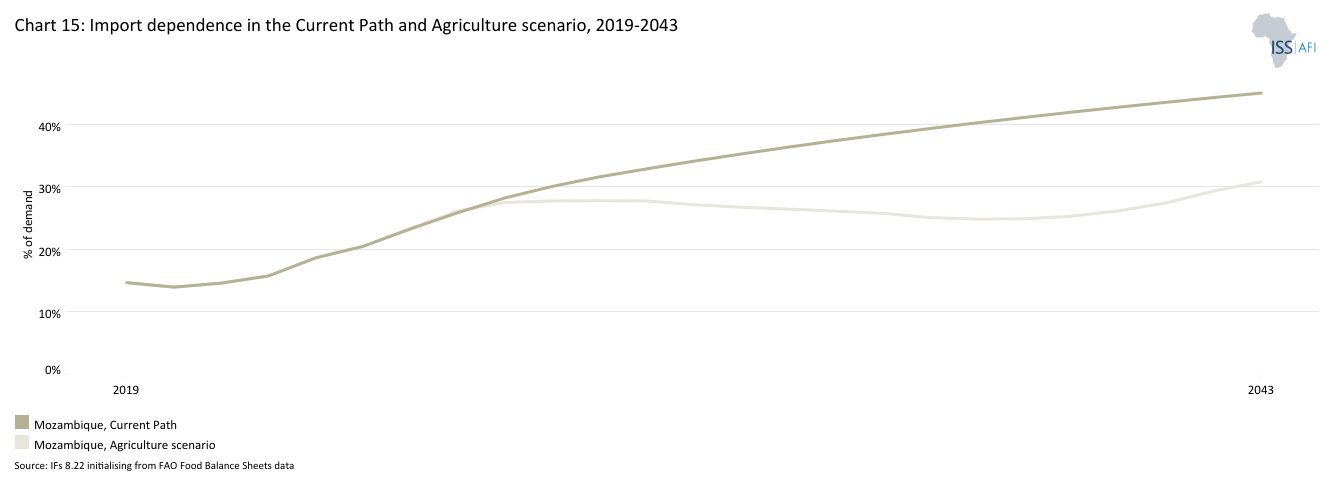

- Chart 15: Import dependence in the Current Path forecast and Agriculture scenario, 2019–2043

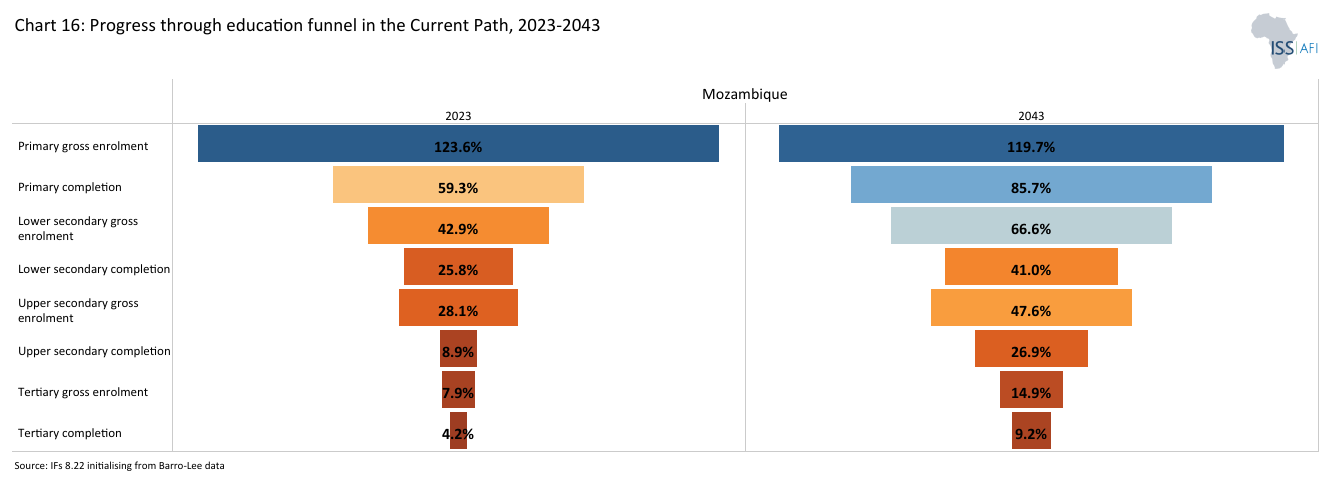

- Chart 16: Progress through the educational funnel in the country compared to income group (2023 and 2043)

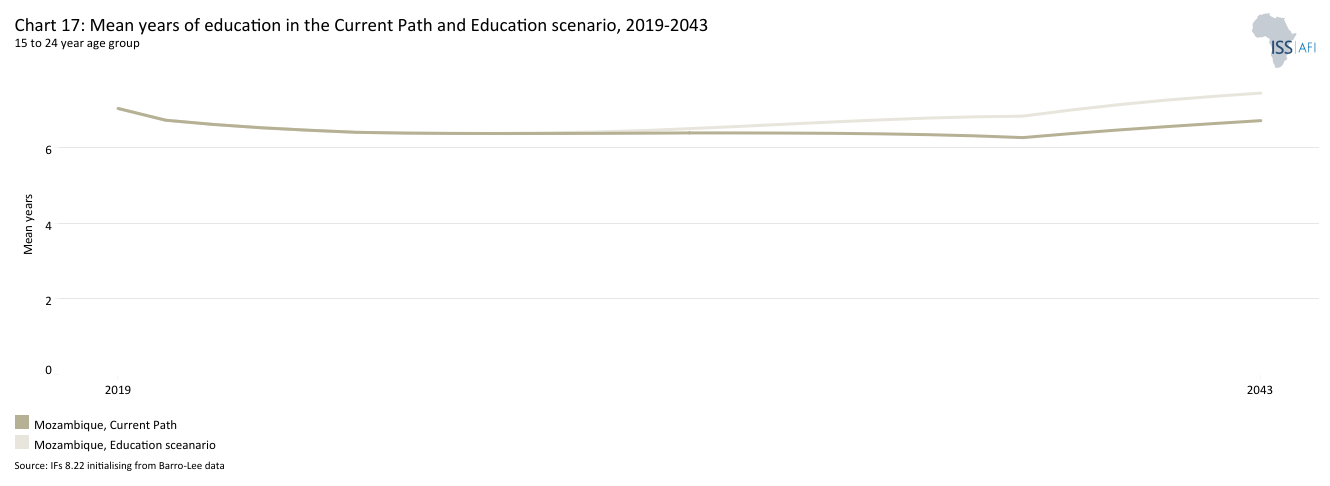

- Chart 17: Mean years of education in Current Path and Education scenario, 2019–2043

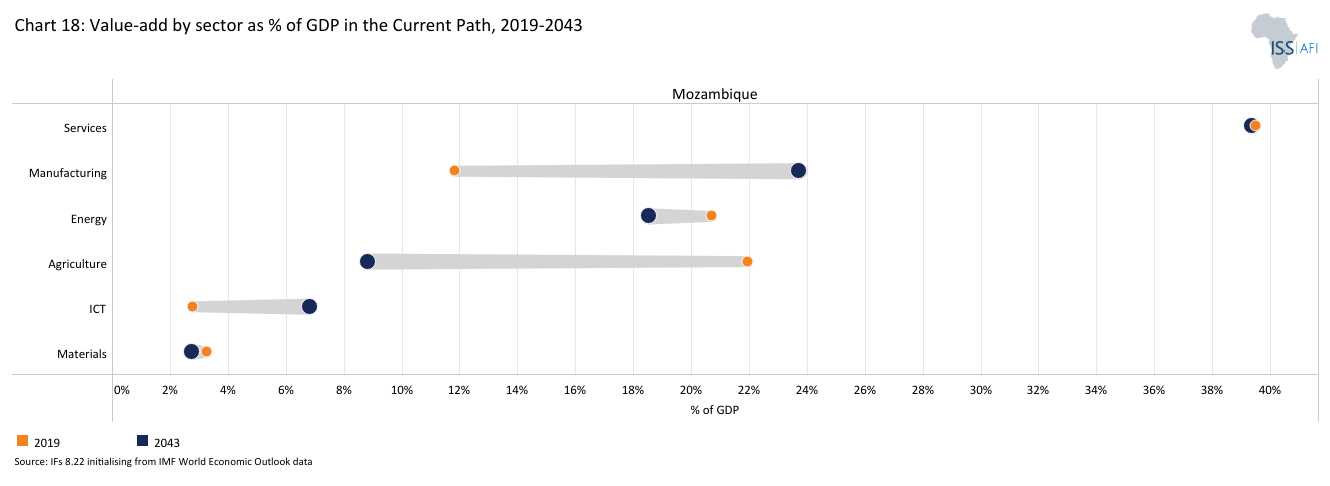

- Chart 18: Current Path manufacturing, share of GDP for country compared to income group for Africa, 2019-2043

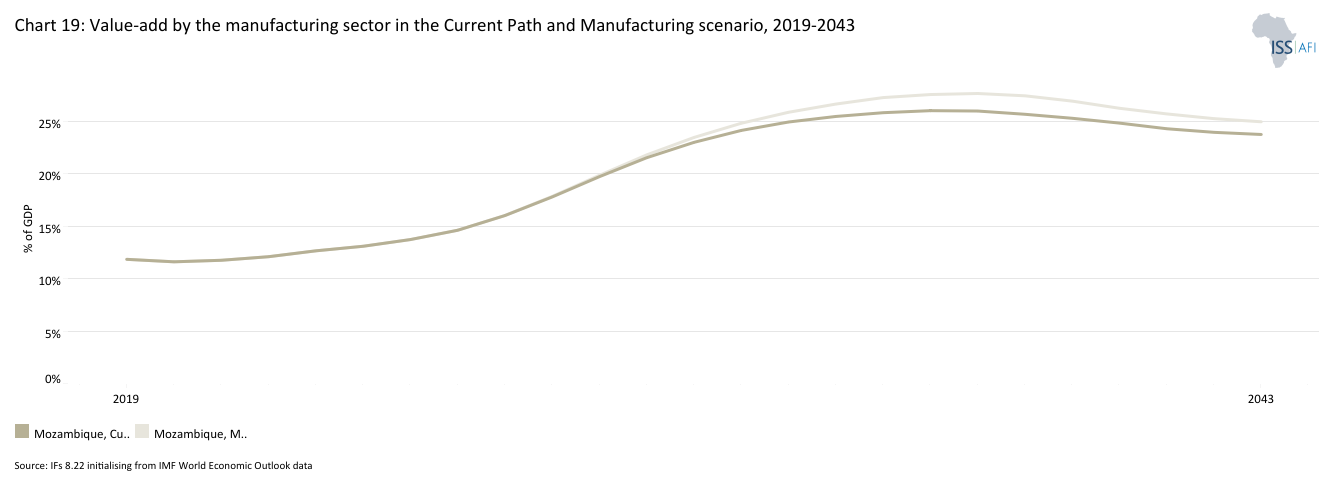

- Chart 19: Value-add of the manufacturing sector in Current Path and Manufacturing scenario, 2019–2023

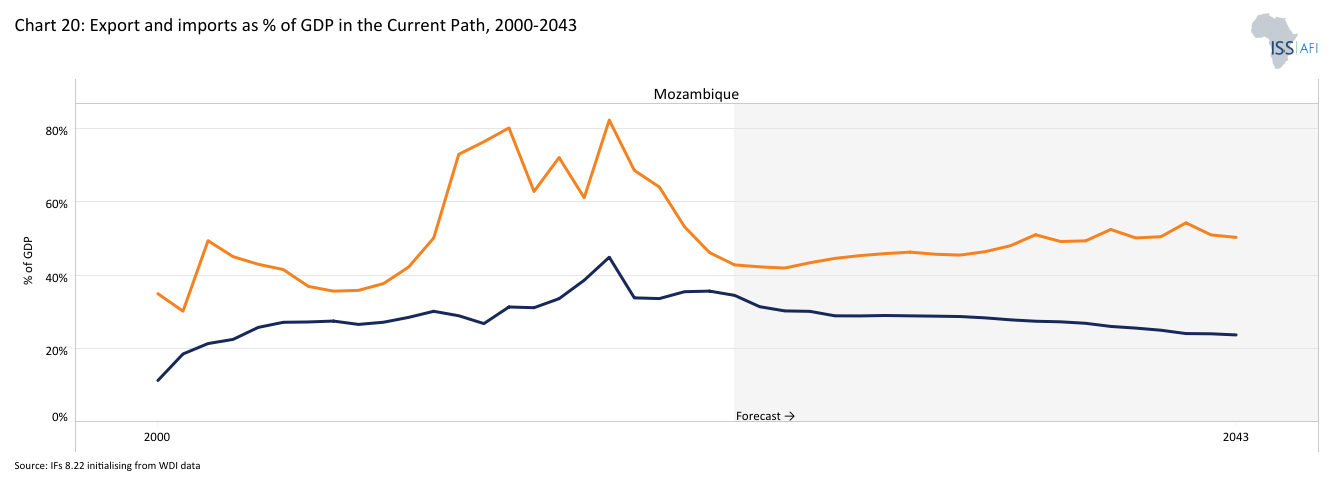

- Chart 20: Exports and imports as a per cent of GDP, 1990 to 2043

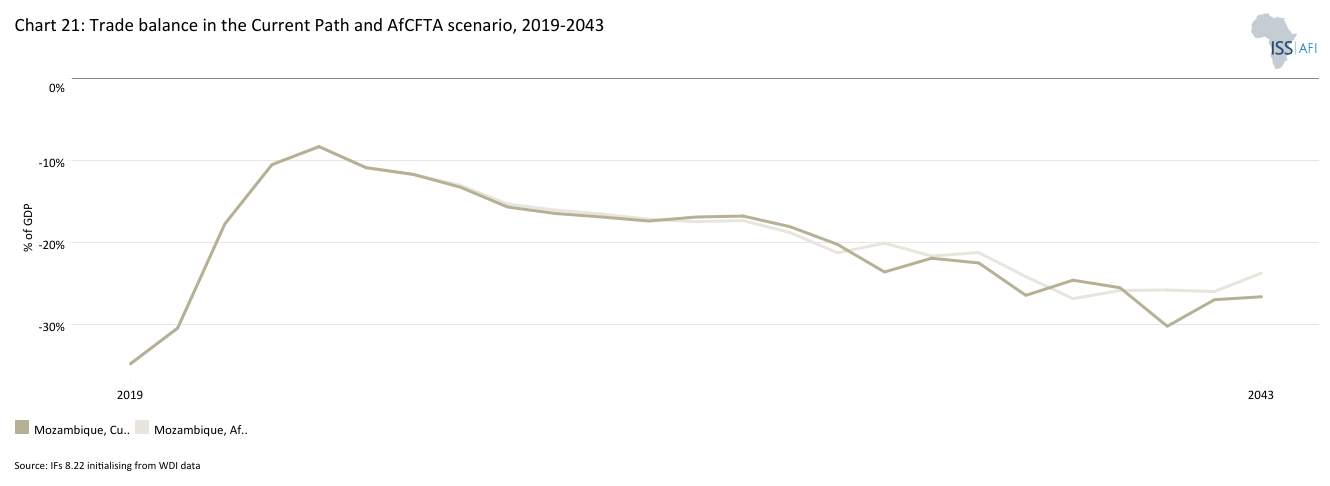

- Chart 21: Trade balance in CP and AfCFTA scenario, 2019–2043

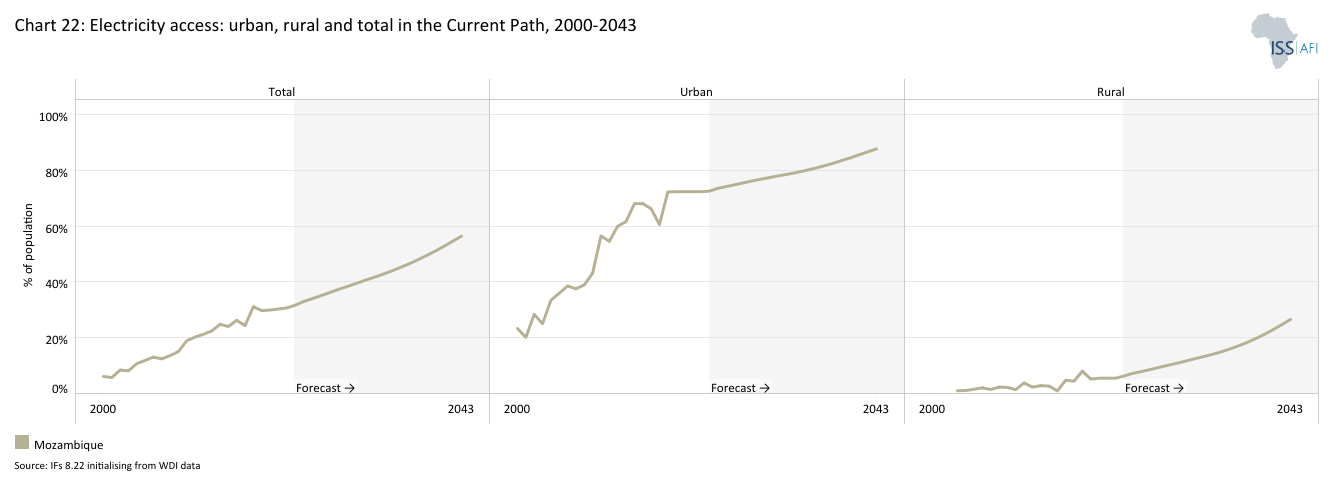

- Chart 22: Current Path access to electricity: urban, rural and total, 1990 to 2043

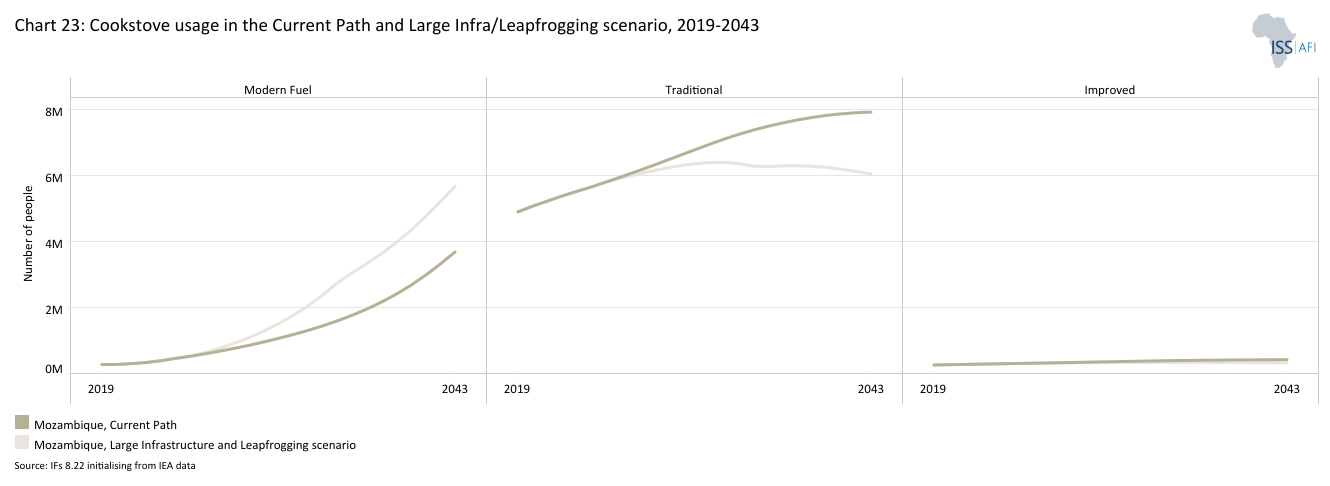

- Chart 23: Cookstove usage in Current Path and Large Infra/Leapfrogging scenario, 2019–2043

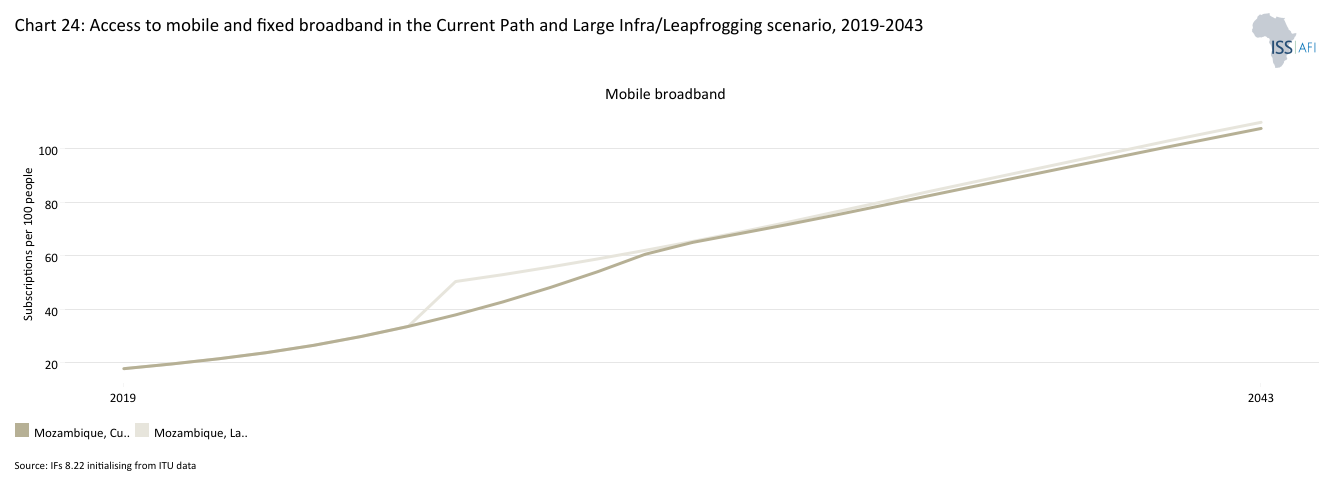

- Chart 24: Access to mobile and fixed broadband in Current Path and the Large Infra and Leapfrogging scenario, 2019–2043

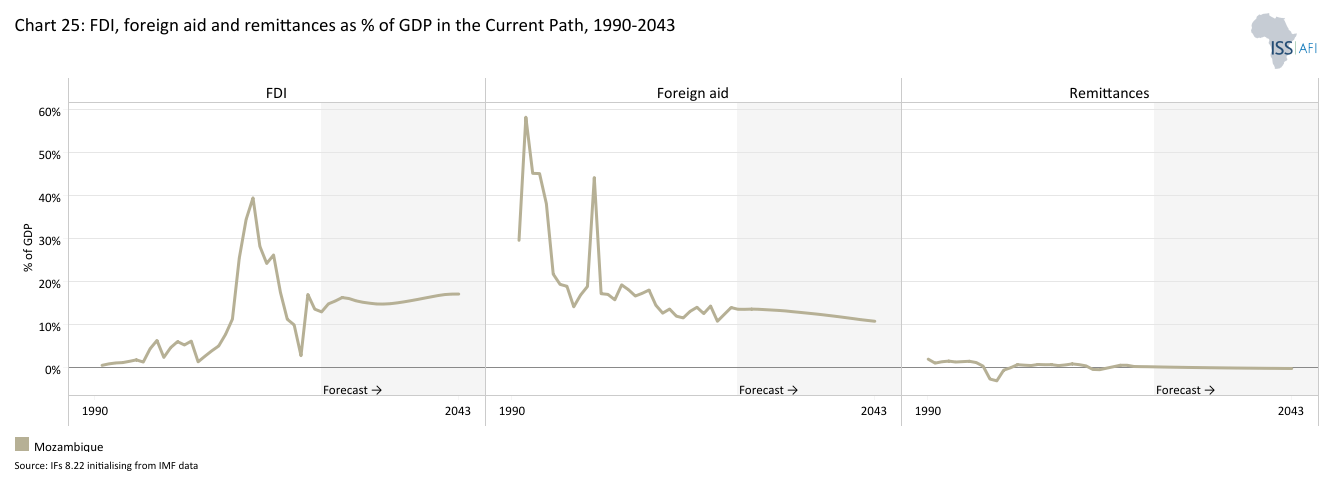

- Chart 25: Trends in FDI, aid and remittances as a % of GDP, 1990 to 2043

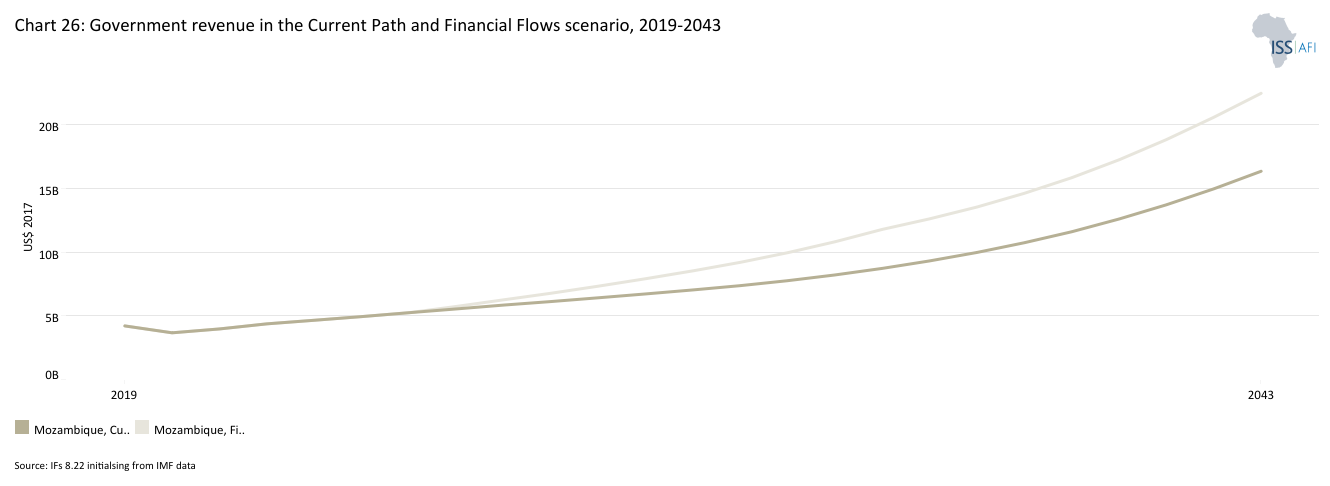

- Chart 26: Government revenue in Current Path and Financial Flows scenario, 2019–2043

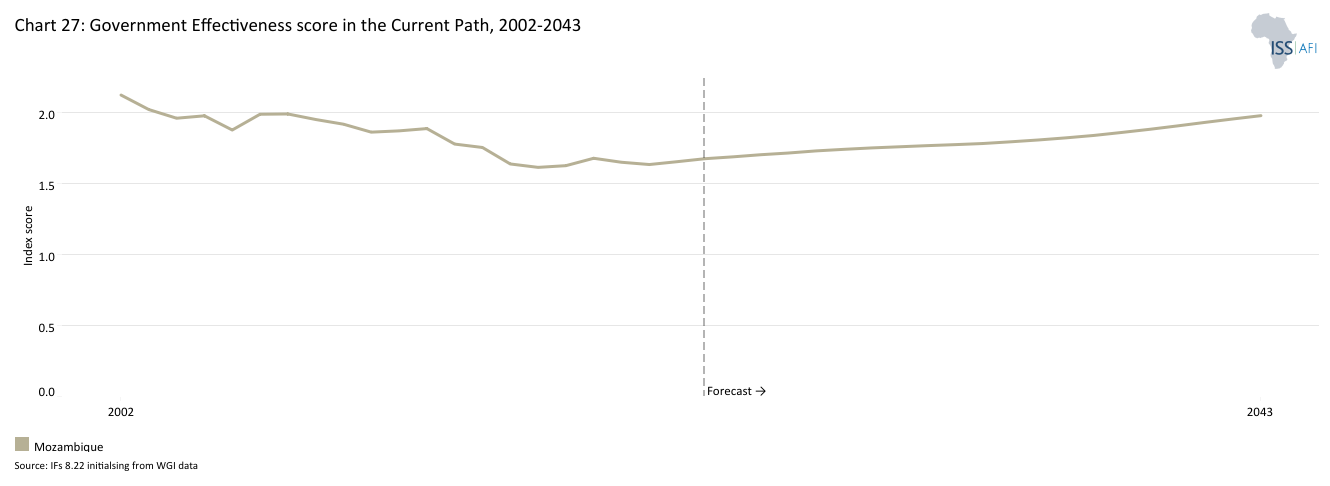

- Chart 27: Current Path of Government Effectiveness comparing country to average for Africa income group, 1990 to 2043

- Chart 28: Composite governance index in Current Path vs Governance scenario, 2019–2043

- Chart 29: GDP per capita in Current Path and scenarios, 2019–2043

- Chart 30: Poverty in Current Path and scenarios, 2019–2043

- Chart 31: GDP (MER) in Current Path and Combined scenario, 2019–2043

- Chart 32: Value added by sector in Current Path and Combined scenario, 2019–2043

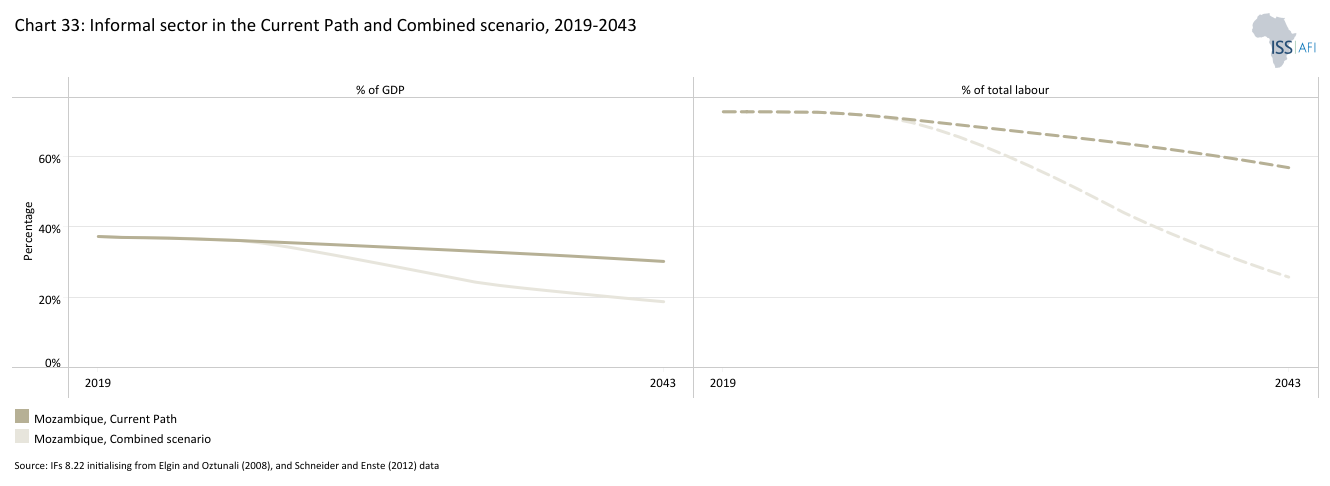

- Chart 33: Informal sector as % of total economy in Current Path and Combined scenario, 2019–2043

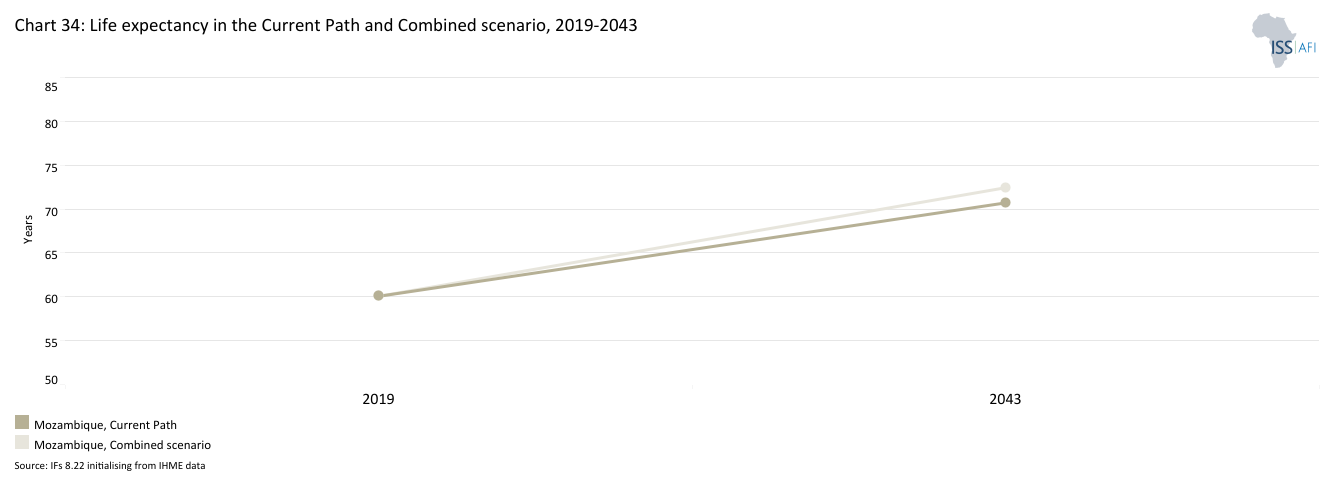

- Chart 34: Life expectancy in Current Path and Combined scenario, 2019–2043

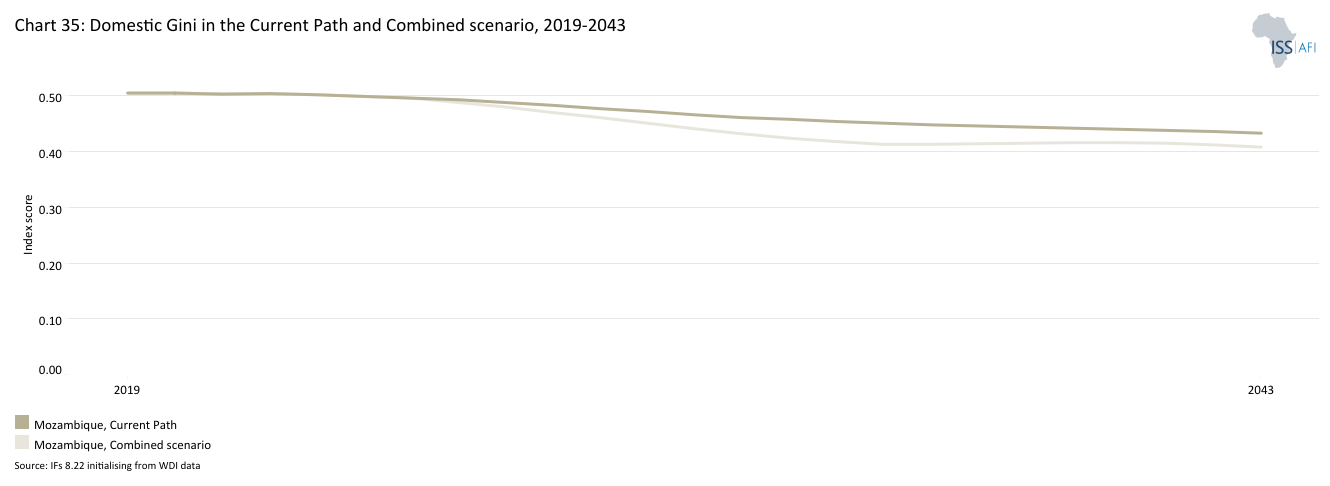

- Chart 35: Domestic Gini in Current Path and Combined scenario, 2019–2043

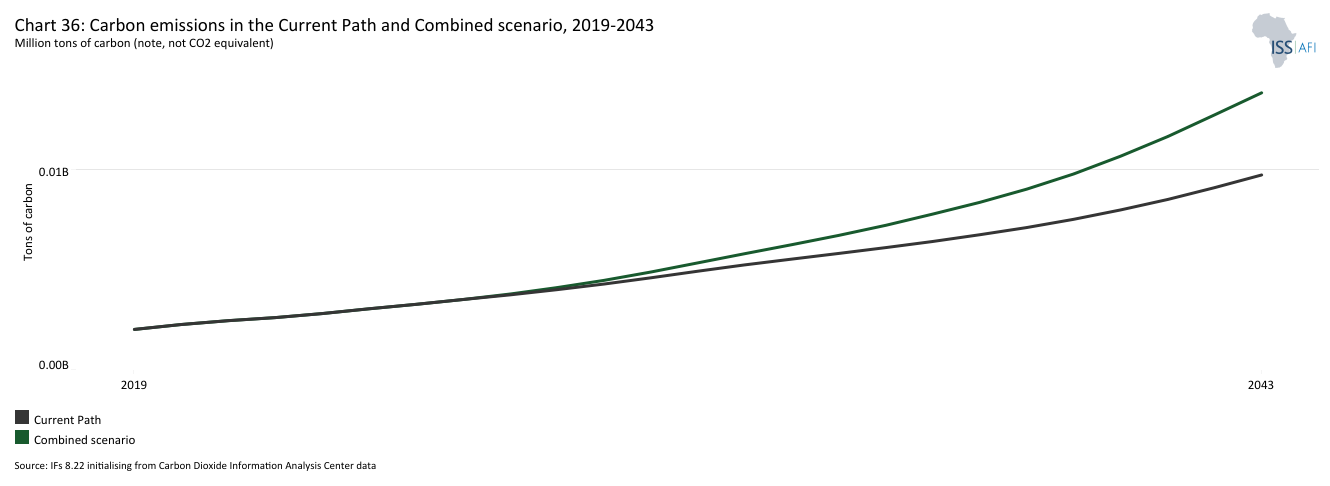

- Chart 36: Carbon emissions in Current Path and Combined scenario, 2019–2043

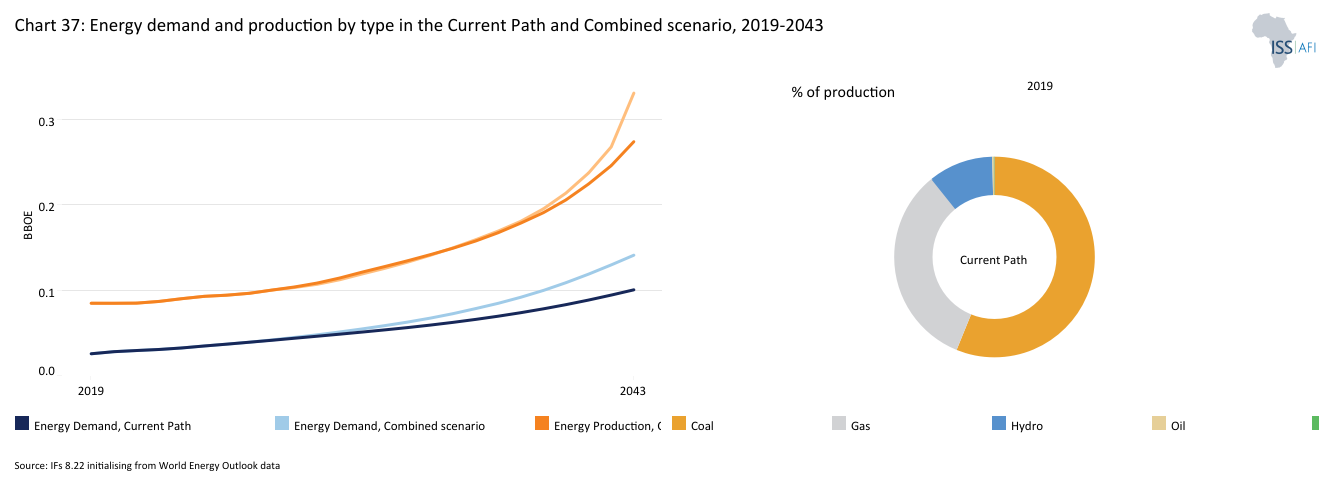

- Chart 37: Energy demand and production by type in Current Path forecast and Combined scenario, 2019-2043

- Chart 38: Policy recommendations

Chart 1 is a political map of Mozambique.

Located in Southern Africa, Mozambique is nestled between Tanzania, Malawi, Zambia, Zimbabwe, South Africa and Eswatini. It is one of the 22 low-income countries in Africa and had an estimated population of about 33 million in 2023. The country has considerable mineral reserves, vast arable land and an extensive coastline along which flows the warm Mozambique current that feeds its rich aquatic life.

Mozambique achieved independence in 1975, but only after the end of a 15-year civil war in 1992 did it begin to experience socio-economic progress. Between 1993 and 2015, Mozambique was one of Africa’s fastest-growing economies, with an average annual growth rate of about 8% as the fruits of several factors such as political and macroeconomic stability, rebound in post-war economic activity, more Foreign Direct Investment (FDI) into the extractive industries and post-war reconstruction.[1The World Bank, Poverty Reduction Setback in Times of Compounding Shocks: Mozambique Poverty Assessment, June 2023.] During this period, important gains have been achieved, such as reduced maternal and child mortality rates, increased access to basic education services for girls and boys, water and electricity. Around one-third of the population now has access to electricity, compared to barely 4% in 1998, and over the last decade, new HIV cases have fallen by 34% and AIDS-related deaths by 27%.[2UK–Mozambique development partnership summary, Policy paper, July 2023] The combination of these results is reflected in the improvement of the life expectancy of Mozambicans from 51 years in 1992 to about 61 in 2021.

Yet, the country faces significant development challenges. It is among the poorest countries in the world, with a GDP per capita of US$447 (market exchange rate) or US$1 243 (purchasing power parity (PPP)) in 2022, only ahead of Somalia, Central African Republic, Burundi and South Sudan in Africa. According to the latest estimates, by the end of 2022, 71% of Mozambicans lived below the international poverty line of US$2.15 per day[3Salome Ecker et al.(2023), the impact of the cost-of-living crisis on poverty in Mozambique and possible policy responses, United Nations Development Programme.] and the country is among the most unequal in sub-Saharan Africa. In its 2021/2022 report, the United Nations Development Programme (UNDP) classified Mozambique as a country with low human development, with a score of 0.446 (out of 1) on the Human Development Index (HDI). Mozambique ranks 185th out of 191 countries, far below its neighbours.

The post-2015 growth has been slow (averaging 3% between 2016 and 2022) amid the ‘‘hidden debt’’ scandal which coincided with a series of shocks, including an insurgency in Northern Mozambique, tropical cyclones and the Covid-19 pandemic, while unemployment, poverty and inequality have increased.

The previous decade of high growth rates was not accompanied by structural transformation and industrialisation of the economy, which continues to rely heavily on the extractive sector, with limited linkages with the rest of the economic sectors, and a low-productivity agriculture sector, which is extremely vulnerable to weather shocks and climate change. Factors such as inadequate infrastructure, ineffective policy implementation, corruption and a poor business environment constrain economic diversification and the quality of growth.[4Neil Balchin et al (2017). Economic transformation and job creation in Mozambique, Synthesis paper.]

The government is now faced with a pressing question of how to achieve long-term sustainable and inclusive growth to ensure steady reductions in income inequality and extreme poverty. Expectations from the gas megaprojects in its northern provinces to transform the country’s future are high. However, experience elsewhere in Africa has shown that natural resource extraction has rarely lived up to its promise, often doing more harm than good. Translating growth and revenue from natural resource extraction into improved and inclusive development outcomes requires visionary leadership and developmentally oriented governing elites to carefully manage and invest the revenue in sustainable economic and human development.

Chart 2 presents the Current Path forecast of the population structure, from 2019 to 2043.

The characteristics of a country’s population can shape its long-term social, economic and political foundations; thus, understanding a nation’s demographic profile indicates its development prospects. Since 2000, Mozambique’s population has increased by about 70% from 18 million to about 32.9 million in 2022, making it the 14th largest population in Africa and the 3rd largest in the southern African region after South Africa and Angola.

On the Current Path, Mozambique’s population will reach 55.4 million people by 2043, reflecting the reduction in mortality and elevated fertility. The average population growth rate between 2023 and 2043 will be 2.5%, which is significantly above the target of 1.8% set out in the National Development Strategy (ENDE) over the same period. In 2043, Mozambique's population growth rate will be 2.1%, on par with the average for low-income Africa but above the target of 1.3% set out in the ENDE for that year.

The GOM has reiterated that the management of population growth is a critical priority in order to meet the country’s social and economic development goals. This is currently prioritised as a focus area in the ENDE. On the Current Path, the total fertility rate in Mozambique will be 3.1 births per woman in 2043, below the average of 3.4 for African low-income countries and above 2.8 for Southern Africa.

High fertility rates coupled with low life expectancies resulted in Mozambique having one of Africa's most youthful age structures. The median age was 16.8 years in 2021 (the latest available data), the thirteenth lowest in Africa. Yet, this is an increase from 15.5 years at the end of the civil war in 1992, indicating a transition in Mozambique’s age structures, albeit slowly. The Current Path shows that the median age in 2043 is likely to be 21.8 years, meaning that half of the population will be younger than 22 years. This gradual ageing of the population is most noticeable in the decline in the population below 15 years, with associated growth in the economically active age groups.

In 2023, about 43% of the Mozambique population was below the age of 15 years. This large cohort of children below 15 years of age requires huge investment in education and healthcare infrastructure. With an expected drop in fertility rates by 2043, 35.8% of the population will be below 15 years of age. The increase in life expectancy is evident in the growing elderly dependent population group, which will increase from 2.8% in 2023 to 4.1% by 2043.

Mozambique has a large youth bulge at 49%, which, on the Current Path, will slightly decline to 44.5% by 2043. A youth bulge, defined as the percentage of the population between 15 and 29 years old relative to the population aged 15 and above, exhibits a strong relationship with upsurges in violence, and socio-political instability in poor countries, particularly when opportunities are scarce, education quality is low and democratic expression is inhibited.

Chart 3 presents a population distribution map for 2023.

Mozambique is a sparsely populated country. Its population density is about 40 people per square kilometre. Three large populations clusters are found along the southern coast between Maputo and Inhambane, in the central area between Beira and Chimoio along the Zambezi River, and in and around the northern cities of Nampula, Cidade de Nacala, and Pemba; the northwest and southwest are the least populated areas (Chart 3).

Chart 4 presents the urban/rural population, from 1990 to 2043.

Together with population growth and structural demographic changes, Mozambique will see a dramatic shift towards urban areas. Mozambique is one of the least urbanised in the world, with 61% of its population dwelling in rural areas as of 2023. On the Current Path, the urban transition will get momentum, with 49.4% of the population in urban areas and 50.6% in rural areas.

Urbanisation is critical to economic growth and development as it fosters entrepreneurship and increases productivity. Despite constituting only about 5% of the country’s population, Maputo is responsible for about 20% of Mozambique’s GDP. Urbanisation can reduce poverty and provide several social and economic benefits when managed sustainably.

Chart 5 presents GDP in MER and growth rate in the Current Path forecast, from 1990 to 2043.

Agriculture, mining, and energy form the foundation of Mozambique's modest economy. From 1992 until 2015, the country consistently ranked among the world's top 10 fastest-growing economies. However, the revelation of undisclosed debts in 2016, commonly referred to as "hidden debt", precipitated a sharp decline in growth, triggering an economic governance crisis and a prolonged deceleration in economic activity, with growth plummeting from 6.7% in 2015 to an average of 3% between 2016 and 2019. This growth slump was further compounded by the compounding impact of natural disasters in 2019, the insurgency in Northern Mozambique escalating since 2017, the global pandemic in 2020 and the Russian–Ukraine war with its associated high energy and food prices.

Going forward, Mozambique's growth prospects look positive. The LNG production and the associated revenue for the GOM are expected to boost GDP growth rates, although at risk from climate-related shocks and uncertainty around the security situation in the North despite recent improvements and macroeconomic instability. The total public debt is forecast to stabilise at about 92 per cent of GDP in the medium term.[5Mozambique Macro poverty outlook, The World Bank, April 2024]

Due to the delay in gas exploitation, the benefits of the megaprojects in terms of economic growth will probably materialise beyond our forecast horizon (2043). Under a business-as-usual scenario incorporating LNG, the average growth rate between 2023-2034 will be 5.8% compared with 7.1% over 2035-2043. The average growth rate between 2023 and 2043 will be 6%, 3.2 percentage points below the expected 9.2% in the GOM's optimistic scenario over the same period in the National Development Strategy (2023-2043). As a result of these expected positive growth rates, Mozambique's GDP (2017 constant US$) will triple from US$15.7 billion in 2023 to US$48.2 billion in 2043, about US$7 billion larger than the US$41 billion projected under a scenario without natural gas resources in the same year.

Chart 6 presents the size of the informal economy as per cent of GDP and per cent of total labour (non-agriculture), from 2019 to 2043.

Like many other low-income countries, the size of the informal economy is very large in Mozambique. In 2021, Mozambique had around a 96% informality rate among its workforce. Countries with high informality have a whole host of development challenges, such as low revenue mobilisation. Economic growth tends to be below potential in countries with high levels of informality. A recent study conducted in Mozambique shows that compared to formal micro enterprises, informal firms sell about 14 times less, make 17 times lower profits and are 2-3 times less productive.

As of 2023, the size of the informal sector in Mozambique was equivalent to 36.5% of its GDP. On the Current Path, informality will decline to about 30% of GDP by 2043, above the average of 26% for African low-income countries and 18.4% for Southern Africa.

Our fieldwork revealed that the time, fees and cumbersome paperwork needed to register a business and the lack of information and training to comply with rules are some of the key factors preventing the formalisation of informal firms. The interviews indicated that some government officials do not know the regulations and ask for more documents than needed to register a business, a practice that discourages formalisation. The formalisation of informal enterprises to boost the Mozambican economy and tax revenue should be gradual as the informal sector is currently the lifeblood of the growing population of young Mozambicans in the absence of formal sector opportunities.

Chart 7 presents GDP per capita in the Current Path forecast, from 1990 to 2043 compared with the average for the Africa income group.

In 2023, Mozambique had Africa's 7th lowest GDP per capita (PPP). The country significantly reduced the gap between its GDP per capita and the average for its income peers in Africa between 1995 and 2015, reflecting the high growth performance recorded over this period. The gap has started to widen again due to the post-2015 poor growth performance and elevated population growth.

On the Current Path, Mozambique will likely not close the gap with the average for its peers as its real GDP per capita (2017 PPP) will increase by 64.7%, from US$1 300 in 2023 to US$2 141 by 2043, below the average of US$3 254 for low-income Africa, and US$215 larger than the GDP per capita of US$1 927 under a scenario without natural gas resources in 2043. As for the real GDP per capita (market exchange rate), it increases by 87% from US$465 in 2023 to US$870 by 2043, about half of the US$1 610 for low-income Africa in the same year. The increase in Mozambique's GDP per capita between 2023 and 2043 will remain modest compared to the increase in GDP over the same period. High population growth means economic growth rates translate into smaller per capita income increases.

Chart 8 presents the rate and numbers of extremely poor people in the Current Path forecast, from 2019 to 2043.

In 2015, the World Bank adopted US$1.90 per person per day (in 2011 prices using GNI), also used to measure progress towards achieving Sustainable Development Goal (SDG) 1 of eradicating extreme poverty. In 2022, the World Bank updated the poverty lines to 2017 constant dollar values as follows:

- The previous US$1.90 extreme poverty line is now set at US$2.15, also for use with low-income countries.

- US$3.20 for lower-middle-income countries, now US$3.65 in 2017 values.

- US$5.50 for upper-middle-income countries, now US$6.85 in 2017 values.

- US$22.70 for high-income countries. The Bank has not yet announced the new poverty line in 2017 US$ prices for high-income countries.

Using the poverty threshold of US$2.15, Mozambique had the fourth-highest poverty rate at 71% among the 22 low-income countries in Africa in 2022. Chart 6 shows the past trends in poverty and projections on the Current Path. It indicates that poverty is not a new phenomenon but a long-standing issue in Mozambique. The downward trend of the poverty rate in the 1996/1997-2014/15 period has been reversed, and poverty rose from 64.6% to 71% in 2022, erasing the important gains in poverty reduction of the preceding decade. Yet, the number of people living in extreme poverty in Mozambique has consistently increased from 13 million in 1996 to nearly 17 million in 2014 and 23 million people in 2022.

The period following 2015 witnessed pronounced economic volatility, both domestically and globally, resulting in a significant reversal in poverty reduction. Various shocks, including the hidden debt crisis and subsequent macroeconomic instability, led to a notable deceleration in economic growth. This situation was exacerbated by the impact of severe cyclones Kenneth and Idai in 2019, the COVID-19 pandemic and the cost-of-living crisis induced by the onset of the war in Ukraine in early 2022. By the end of 2021, before the beginning of the Ukraine war and the cost-of-living crisis, extreme poverty (<US$2.15/day) was estimated at 67.9% of the Mozambican population (about 21 million people). About 3.3% of Mozambique’s population was classified as extremely poor in 2022 compared to a year before due to elevated food, energy, and transport costs. This represents a 4.8% increase in extreme poverty rates in Mozambique during this period, reaching 71% by the end of 2022.

Poverty in Mozambique disproportionately affects young people, women, individuals with lower education levels, residents of larger rural households, and those working in the agricultural sector. Geographically, provinces in the northern and central regions of the country are hardest hit by poverty. In contrast, the Maputo Province and Maputo City in the South have the lowest poverty rates, standing at 22.4% and 11.4%, respectively.

In the Mozambique National Development Plan (ENDE), the target is to reduce the proportion of the population living below the national poverty line from 68.2% currently to 35.8% by 2043. On the Current development trajectory, the poverty rate in Mozambique (at US$2.15) will reach 44.9% by 2043, about 25 percentage points above the average of 21.2% for low-income Africa in the same year. The number of poor people will peak at 32.5 million in 2030 due to population growth before steadily declining to 24.8 million by 2043. Under the Non-LNG trajectory, the poverty rate will be 52.3%, equivalent to 29 million people.

Even with the significant boost to economic growth from natural gas production, Mozambique will likely have almost the same number of people living in extreme poverty in 2043 as it has today. For growth to contribute effectively to poverty reduction, it needs to happen in a way that benefits the poor. The production of gas may generate jobs, but not many will be permanent. On a business-as-usual pathway, Mozambique will miss the SDG target of eliminating extreme poverty by 2030 by a substantial margin.

Mozambique’s historical and continuing burden of poverty is largely a function of its population growth rates, the limited access to education, health and basic services, especially in rural areas, low productivity and lack of resilience against climate disasters in the agriculture sector, poor infrastructure, recurrent natural disasters in some regions and persistent high level of income inequality which negatively affects social cohesion.

Chart 9 depicts the National Development Plan.

The Mozambique National Development Plan or Estratégia Nacional De Desenvolvimento (ENDE) 2023-2043 guides the country's development process, aiming to achieve a long-term vision for the country. Its objectives include improving the country's infrastructure, increasing productivity and competitiveness, promoting economic diversification, promoting access to basic services, promoting social inclusion, strengthening governance and transparency, as well as environmental sustainability to increase the country's productive capacity, the population's living conditions, and reduce social and regional inequalities. To achieve these objectives, the ENDE is structured around five main pillars: (i) Structural Transformation of the Economy; (ii) Social and Demographic Transformation; (iii) Infrastructures; (iv) Governance; and (v) Environment and Circular Economy. Each pillar has strategic objectives, result indicators and targets for the period 2023-2043.

Mozambique National Development Plan (ENDE) targets to:

- Reduce the proportion of the population living below the national poverty line from 68.2% currently to 35.8% by 2043.

- Reach a Gini coefficient of 0.3 by 2043.

- Reduce population growth rate to 1.8% by 2043.

- Increase life expectancy to 69.5 years.

- Increase the share of exports as a percentage of GDP to 42.3% by 2043.

The eight sectoral scenarios as well as their relationship to the Current Path forecast and the Combined Agenda 2063 scenario are explained in the About Page. Chart 10 summarises the approach.

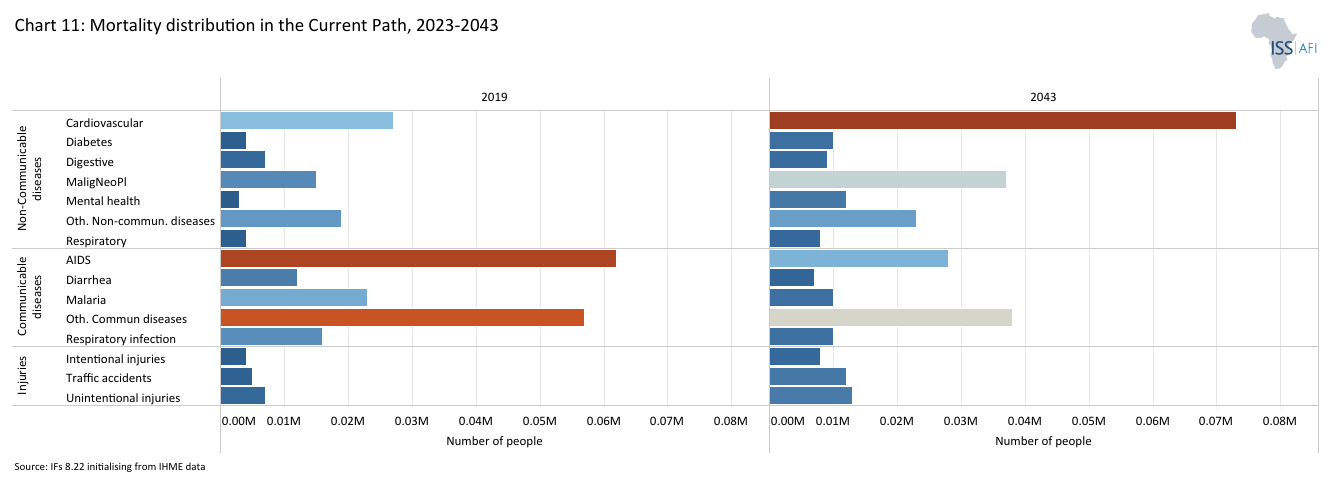

Chart 11 presents the mortality distribution in 2023.

There are strong interactions between population and health. The status of a country’s health influences levels of fertility, mortality and morbidity. At the same time, high population growth contributes to an increased need for basic necessities for life, such as nutrition and health.

Despite efforts to improve Mozambique’s public health sector, the sector remains one of the least resourced in the world which has negatively affected the GOM's ability to improve its population's healthcare. As a result, Mozambique has some of the worst healthcare statistics in the world. In 2019, the country ranked 184th for overall health efficiency among 191 World Health Organisation (WHO) member states, with a low score of 0.26 out of 1.0.[6A Tandon, CJL Murray, JA Lauer and DB Evans, Measuring overall health systems performance for 191 countries, World Health Organisation, GPE Discussion Paper Series No. 30, 2019.]

The country has a ratio of only three doctors per 100 000 people, a proportion that is among the lowest in the world. Systems for tracking, motivating and retaining staff are weak, and frontline health providers are often poorly trained and have limited management skills. For those in rural areas and the extremely poor, women, adolescent girls, and children, quality healthcare is very unsatisfactory and hard to reach, exposing health system inequalities between genders and geographic regions.[7World Bank, Mozambique’s health system expands coverage with more frontline community workers, October 2023]

Mozambique has made significant progress in reducing mortality rates and improving access to primary health services. It has lower maternal mortality ratios than the average for low-income African countries, and for the Southern Africa regional peers, 112 maternal deaths per 100 000 live births in 2022 compared to an average of 384 maternal deaths per 100 000 live births for low-income Africa and 190 for its Southern Africa regional peers. The SDG target for maternal mortality (SDG 3.1) is a ratio of fewer than 70 deaths per 100 000 by 2030, a target that will likely be attainable on the Current Path of the country with a ratio of 68.4 deaths per 100 000 live births in 2030 and 44.9 by 2043.

Although Mozambique's life expectancy has improved from 35 years in 1960, it is still below the average of its peers. At 61.8 years in 2022, Mozambique’s life expectancy was about two years lower than the average for low-income African countries and nearly 0.8 years lower than the average of its Southern African peers. Life expectancy will improve over the forecast horizon, surpassing its peer's averages by 2036. By 2043, the country’s life expectancy will reach 70.7 years, 1.2 years above the GOM target in the same year, 0.7 years above the average for low-income countries and 1.3 years above the average for its regional peers.

In 2022, Mozambique’s infant mortality ranked among the highest in low-income countries in Africa, with 49.9 deaths per 1 000 live births. The SDG target regarding the infant mortality rate is below 25 deaths per 1 000 live births by 2030. On the Current Path, Mozambique is not on track to achieve this target as it will have an infant mortality rate of 39 deaths per 1 000 live births by 2030 and 23 deaths per 1 000 live births in 2043, significantly below the GOM target of 35 deaths per 1 000 live births.

The combination of low life expectancy and high infant mortality is often a result of high levels of communicable disease prevalence. The death rate from communicable diseases in Mozambique stood at about 4.9 per thousand, 23% higher than the average low-income African country (4.0 per thousand) and 18% higher than the average of its regional peers (4.2 per thousand) in 2022. The cohort death rate distribution shows that most premature deaths in Mozambique occur in the early stages of life and are heavily skewed toward communicable diseases. Even in the working age groups, communicable disease deaths dominate. AIDS is by far the largest burden in both the 30 to 44 and 45 to 59 years of age cohorts.

Much of the communicable disease burden for infants and 1 to 4 years of age is the result of a lack of health infrastructure. The use of traditional fuel sources (i.e., coal, dung) is a core driver of childhood pneumonia and other respiratory infections. Lack of health facilities for malaria testing and treatments and low bed net use contribute to Mozambique’s high malaria burden. Meanwhile, poor water and sanitation access is a core driver of communicable disease deaths (such as diarrhoea) for children under five years of age. This high communicable disease prevalence in under five years of age can also lead to undernourishment and stunting.

The Demographics and Health scenario envisions ambitious improvements in child and maternal mortality rates, enhanced access to modern contraception, and decreased mortality from communicable diseases (e.g., AIDS, diarrhoea, malaria, respiratory infections) and non-communicable diseases (e.g., diabetes), alongside advancements in safe water access and sanitation. This scenario assumes a swift demographic transition supported by heightened investments in health and water, sanitation, and hygiene (WaSH) infrastructure.

Visit the themes on Demographics and Health/WaSH for more detail on the scenario structure and interventions.

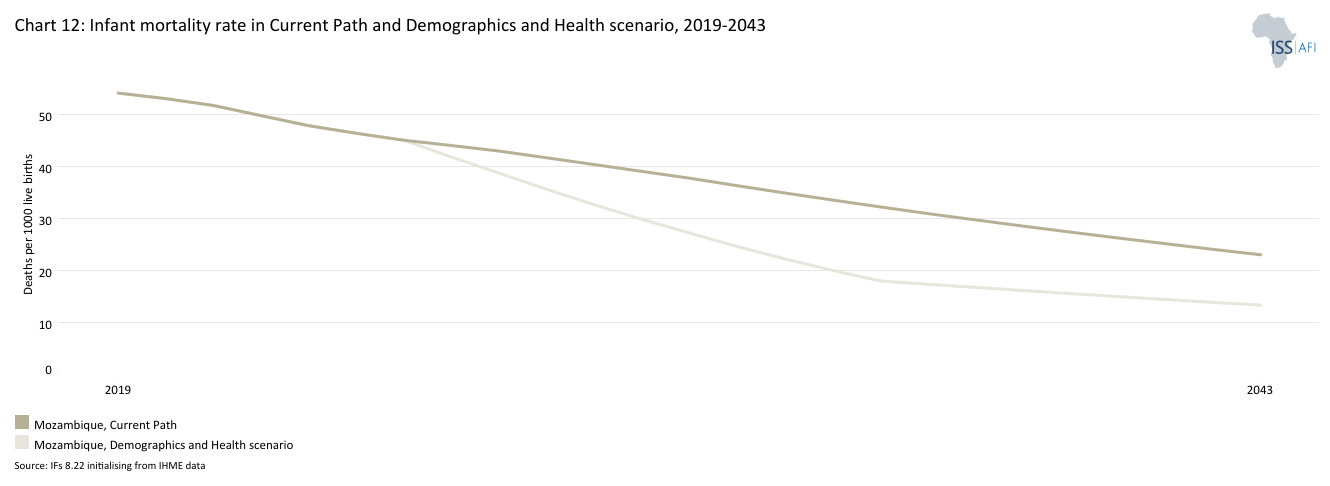

Chart 12 presents the infant mortality rate in the Current Path forecast and in the Demographics and Health scenario, from 1990 to 2043.

The infant mortality rate is the probability of a child born in a specific year dying before reaching the age of one. It measures the child-born survival rate and reflects the social, economic and environmental conditions in which children live, including their health care. It is measured as the number of infant deaths per 1 000 live births and is an important marker of the overall quality of the health system in a country.

In 2022, Mozambique’s infant mortality ranked among the highest in low-income countries in Africa, with 49.9 deaths per 1 000 live births. The SDG target regarding the infant mortality rate is below 25 deaths per 1 000 live births by 2030. On the Current Path, Mozambique is not on track to achieve this target as it will have an infant mortality rate of 39 deaths per 1 000 live births by 2030 and 23 deaths per 1 000 live births in 2043, significantly below the GOM target of 35 deaths per 1 000 live births. In the Demographics and Health Scenario, infant mortality is projected to decline to 13 deaths per 1 000 live births by 2043.

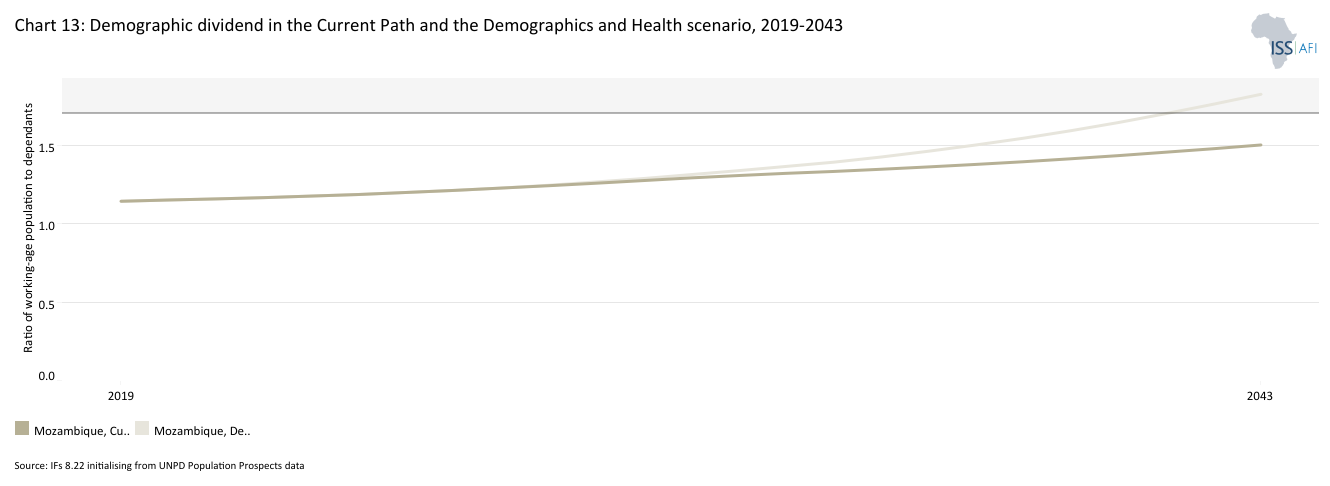

Chart 13 presents the demographic dividend in the Current Path forecast and in the Demographics and Health scenario, from 2019 to 2043.

The demographic dividend or demographic gift can be defined as the economic growth generated by the change in a country’s demographic structure. It generally materialises when a country reaches a ratio of at least 1.7 people of working age (15-64 years of age) for each dependant (children (0-14 years) and elderly people (65+ years). The ratio was 1.16 in 2022 and will be 1.5 by 2043 and 1.7 in 2050.

When there are fewer dependants to care for, it frees up resources for savings and investment and eventually allows women, in particular, to pursue careers, skills, and training and increases female labour force participation in a way that they aren’t able to if they are caring for large families.

The working-age population cohort (between 15 and 64 years) will increase from 54% in 2023 to 60% by 2043. Properly educated and skilled, this growing workforce can contribute to innovation, entrepreneurship, and economic diversification, allowing Mozambique to enter a potential demographic window of opportunity by 2050.

However, the growth in the working-age population relative to dependents does not automatically translate into rapid economic growth unless the labour force acquires the needed skills and is absorbed by the labour market. Currently, only 58% of the working-age population in Mozambique is economically active.[8Estratégia Nacional de Desenvolvimento 2023-2043, República de Moçambique.]

Under the Demographics and Health scenario, about 73% of fertile women in Mozambique will use modern contraception by 2043, slightly below Rwanda (89.3%) and Malawi (82.4%) in the same year. Population growth will decline to 1.3% compared with 2% on the Current Path, and in line with the GOM target by 2043. As a result, Mozambique is set on a different demographic path, where it converges with the average of its African income peers by 2043. If the Demographics and Health scenario were to be implemented, Mozambique could accelerate its demographic transition to reap the demographic dividend by 2041 (Chart 13), ten years later than on the Current Path.

Chart 14 presents crop production and demand from 1990 to 2043.

Mozambique has huge untapped agricultural potential as 45% of its land is arable, yet only 16% is currently cultivated. The country’s strategic geographical position allows it to play an important entrepot role for agricultural trade with its neighbouring landlocked countries.[9The World Bank, Mozambique economic update: Getting Agricultural Support Right, June 2022]

The agriculture sector is the mainstay of Mozambique's economy. It constitutes over a quarter of its GDP and engages 80% of the workforce. The majority of agricultural output originates from smallholder farmers, encompassing approximately 3.2 million individuals who contribute to 95% of the nation's agricultural production, while the remaining 5% is attributed to commercial farming enterprises.

Maize and cassava are the main food staples and are grown by 80% of all Mozambican smallholders. Other important staples are wheat and rice. Animal production, particularly poultry and small ruminants, holds significant importance in rural livelihoods and nutritional sustenance. In urban settings, formal meat outlets rely heavily on beef and poultry, supplying over 80% of the meat demand. The limited number of commercial farmers focus on cash crops such as tobacco, cotton, cashew nuts and sugar. The volatility of commodity prices and fluctuations in global markets considerably impact Mozambique's commercial agriculture and overall economic landscape.

The potential has not translated into production. Mozambique has one of the lowest average crop yields per hectare in Africa. With an estimated 3 tons per hectare in 2023, the country ranked 36 out of 54 countries in Africa and had the 5th lowest crop yields in Southern Africa in 2023. On the Current Path, the average crop yields per hectare in Mozambique will marginally increase to 3.5 tons by 2043, below the average of 5.6 tons for Southern Africa but on par with the average for low-income countries in Africa.

The low agricultural productivity in Mozambique stems from various factors, including limited access to agricultural finance and improved inputs, slow adoption of technology, insufficient agricultural services and reliance on rain-fed farming coupled with vulnerability to climate hazards.[10The World Bank, Mozambique economic update: Getting Agricultural Support Right, June 2022]

Mozambique ranks as the third most vulnerable African country to climate change, facing threats such as tropical cyclones, droughts and coastal flooding. Its extensive coastline, spanning 2 700 km, exacerbates this vulnerability, particularly for the 60% of the population residing in low-lying coastal regions.[11The World Bank, Mozambique economic update: Getting Agricultural Support Right, June 2022] These areas face risks to infrastructure, coastal agriculture, ecosystems and fisheries from intense storms and rising sea levels, with repercussions felt inland as well. Between the period 1980–2019, Mozambique experienced a total of 53 natural disaster events, comprising 21 tropical cyclones, 20 floods and 12 drought occurrences.[12African Climate Foundation (ACF) and the International Food Policy Research Institute (IFPRI), from Climate Risk to Resilience: Unpacking the Economic Impacts of Climate Change in Mozambique, November 2023.] According to the Global Climate Risk Index, Mozambique was the most affected country in the world by the impacts of extreme weather events in 2019 and the fifth most affected when considering the period 2000–2019.[13African Climate Foundation (ACF) and the International Food Policy Research Institute (IFPRI), from Climate Risk to Resilience: Unpacking the Economic Impacts of Climate Change in Mozambique, November 2023.]

Disasters further impede access to markets, compounding challenges for rural producers heavily reliant on climate-sensitive agriculture for sustenance and income. In addition to being among the most vulnerable countries regarding natural disasters, Mozambique is among the least prepared countries for these climatic hazards, ranking 154 out of 185 nations on the Global Adaptation Index (ND-GAIN).

Moreover, inadequate road infrastructure poses a significant obstacle to agricultural development; it hinders the establishment of essential linkages along value chains and impedes the adoption of modern technologies crucial for enhancing productivity, such as fertilisers, pesticides, improved seeds and mechanised equipment. They increase transportation costs, hampering farmers' access to both domestic and international markets. Our interviews conducted during the fieldwork found that food importers in Maputo prefer to import from South Africa rather than from the local production zones because it can take a week to bring produce from these areas to Maputo due to poor road conditions.

Compared to many developing countries, the GOM's support for the agriculture sector is high, although the recent period has seen a slow decline in public spending on agriculture. The average share of agriculture in the national budget was slightly above 4 per cent from 2010 to 2014 and fell to 4 per cent in the subsequent five-year period (2015–2019)[14The World Bank, Mozambique economic update: Getting Agricultural Support Right, June 2022], less than half of the 10% target recommended by the Comprehensive Africa Agriculture Development Programme (CAADP).

The low agricultural productivity is unable to meet the nutritional demands of the growing population. Many rural farmers remain net food consumers and vulnerable to increases in food prices. As a result, the nutrition situation in the country remains precarious, with about 43% of children under five suffering from chronic undernutrition. In 2022, the Global Food Security Index placed the country at the lower end of the rank (94 out of 113 countries), with particularly low scores on food quality, safety and affordability.

Going forward, climate change will exacerbate their frequency and intensity in Mozambique. Feeding the growing population under such conditions will be one of the country's biggest challenges. In 2023, an estimated 16.2 million metric tons of crops were produced, a significant increase from the 5 million metric tons produced at the end of the civil war in 1992. On the Current Path, crop production will increase to about 20 million metric tons by 2043, while crop demand is set to increase from 20 million metric tons in 2023 to about 38.5 million metric tons by 2043, a deficit of 18.5 million metric tons (Chart 14). The Current Path paints a picture of a growing gap between domestic food production and demand, a situation that will exacerbate Mozambique's agricultural trade deficit.

The Agriculture scenario envisions an agricultural revolution that ensures food security through ambitious yet feasible increases in yields per hectare, thanks to improved management, seed, fertiliser technology, and expanded irrigation and equipped land. Efforts to reduce food loss and waste are emphasised, with increased calorie consumption as an indicator of self-sufficiency and prioritising it over food exports. Additionally, enhanced forest protection signifies a commitment to sustainable land use practices.

Visit the theme on Agriculture for our conceptualisation and details on the scenario structure and interventions.

Chart 15 presents the import dependence in the Current Path forecast and the Agriculture scenario, from 2019 to 2043.

Under the Agriculture scenario, the average crop yield is 5.6 tons per hectare by 2043, on par with the regional average. The country will produce about 10.3 million metric tons of additional food (crops, meat and fish) in 2043 compared to the Current Path. The agriculture import dependence will be about 30% of total demand compared to 45% in the Current Path in 2043.

The scenario improves food access and consumption in Mozambique, as available kilocalories per capita per day from crops, fish and meat increase from 2 180 in 2023 to 2 837 in 2043. The number of people suffering from malnutrition will decline by about 3 million lower than the Current Path in 2043. Reduced malnutrition rates, especially in children under 5 years of age, will have an impact on education outcomes, particularly learning.

Chart 16 depicts the progress through the educational system in the country compared to Africa income group (primary gross enrolment, primary completion, lower secondary gross enrolment, lower secretary completion, upper secondary enrolment, upper secondary completion, tertiary enrolment, tertiary completion (2023 and 2043).

The educational system under Portuguese rule in Mozambique had a distinct dual structure. It aimed to provide basic skills to the majority African populace while offering liberal and technical education to the settler community and a small fraction of Africans. The vast majority of students, more than four-fifths, were limited to basic education within this colonial framework. Public education, supported by the state and the Roman Catholic Church, was predominant although private options, primarily affiliated with religious institutions, also existed. Literacy in Portuguese, the primary language of instruction, was limited among the African population at the time of independence.

The introduction of the National System of Education in the early 1980s, aimed at enhancing literacy and technical skills across all age groups, catering to both part-time and full-time students. The nationalisation of private and religious educational institutions facilitated the restructuring and consolidation of the education system. Despite rapid expansion, the state struggled to meet the growing demand for education. Primary school enrollment surged from 643 000 in 1973 to approximately 1.5 million by 1979, but declined in the 1980s due to the destruction of schools by Renamo insurgents. The civil war destroyed critical infrastructure including schools, and prevented meaningful education for the majority of Mozambican older generation.

Only about 63% of the adult population was literate in 2022, which was about 22 percentage points lower than the average for Southern Africa, while only 31% of the adult population (15+ years) completed primary school and nearly 8.1% completed secondary education in 2022.

The current education system in Mozambique is similar to other countries in the region, with schooling comprising three levels starting from primary school and ending at tertiary level. In 2018, the National Education System Law of Mozambique was revised, establishing a new structure in the sector and increasing mandatory (and free) education from seven to nine years. The duration of the education cycles was restructured, reducing primary education from seven to six years and increasing secondary education from five to six years. The law recognises, for the first time, preschool as a sub-sector of education, although it is not a requirement to enter primary school. These changes and more investment and government commitment to keep education expenditure high have led to progress. Yet, efficiency challenges still plague the system and a significant bottleneck between primary and lower secondary schools constrains educational attainment.

The GOM has made significant progress in primary school enrolment, increasing the enrolment rate by more than 70% between 1998 and 2018. As a result, Mozambique has a higher primary school enrolment rate than its peers, as primary school is free and compulsory in Mozambique, but barriers like the cost of supplies, preschool malnutrition, gender roles and transport infrastructure limit the ability of students to access and stay in school. In 2022, Mozambique’s gross primary school enrolment stood at 118.7%. Typically, gross enrollment rates being over 100% reflect the presence of students who are not in the age range of the educational levels they are attending.

While the primary school enrolment rate is higher, the human capital for Mozambique remains very low as the completion rate is extremely low. The percentage of enrolled primary students that made it to the final grade of primary was only 51.2%. Thus, although many Mozambican children get into primary school, only about half make it to the end of primary.

There is a significant bottleneck in the transition between lower secondary and upper secondary school. Only 25.1% of students who enter lower secondary school complete it. And only 27.8% of those students who completed lower secondary school move on to upper secondary. This means that the already small pool of students who make it through primary gets even smaller further along the pipeline. The result is that very few students make it to upper secondary. Such lower secondary educational outcomes are some of the key underlying factors of the lower educational outcomes for tertiary levels, which impede progress in poverty and inequality reduction.

The mean educational attainment for adults (15+ years of age) is a good indicator of the stock of human capital in a country but Mozambique has one of the lowest in the world, at 3.9 years in 2022. Mozambique ranked 47th in Africa (out of 54) and 179th globally (out of 186) in the same year.

According to the African Development Bank (AfDB), the low quality of the labour force remains a significant issue both for employers who are unable to engage qualified labourers as well as for promoting a culture of entrepreneurship. The low education level has led some foreign companies to import labour. Recently, the GOM has increased the maximum quota for employing foreign workers as a percentage of the workforce from 10% to 15% for companies with up to 10 employees, and from 8% to 10% for companies with 11-30 employees. The quota remains unchanged at 8% for companies with 31-100 employees and at 5% for companies with over 100 workers. Recently, the GOM has been offering scholarships to its citizens to study abroad - to acquire the required skills, especially in the extractive sector. Skills mismatches are prevalent in Mozambique. In 2008, between 43% and 8% of the employed were underqualified for the position they held, even as the labour market requires relatively low-skilled labour. The severe lack of skilled labour is not only for managerial positions but also for skilled professionals such as engineers, skilled technicians and accountants.

The lack of sufficient skilled labour is, therefore, a major challenge for moving the workforce from low-paying, low-productivity, informal and rural work to the more productive, formal sectors.

The Education scenario represents reasonable but ambitious improved intake, transition and graduation rates from primary to tertiary levels and better quality of education at primary and secondary levels. It also models substantive progress towards gender parity at all levels, additional vocational training at the secondary school level and increases in the share of science and engineering graduates.

Visit the theme on Education for our conceptualisation and details on the scenario structure and interventions.

Chart 17 presents the mean years of education in the Current Path and in the Education scenario, from 2019 to 2043, for the 15 to 24 age group.

The average years of education in the adult population aged 15 to 24 is a good first indicator of how the stock of knowledge in society is changing.

The mean years of education (for adults aged between 15 and 24 years) was estimated at 6.4 years in 2023. On the Current Path, it will increase to 6.7 years by 2043, while illiteracy will be reduced to 18.8% - about 4.4 percentage points below the GOM targeted rate by 2043. The outcomes and benefits of improving education take decades to manifest and the more children Mozambique can get through primary school and into secondary school now, the better.

The Education scenario increases the overall average educational attainment (for adults 15+ years) level to 6.5 years by 2043 (compared to about 6.2 years in the Current Path), this is in line with the target set by the GOM. The scenario increases primary completion to 95.2% by 2043, compared to 84.6% along the Current Path. As a result, about 61.9% of adults (aged 15+ years) will have completed primary school by 2043. The Education scenario also increases the number of students who enrol and complete secondary school. By 2043, nearly 94% of age-appropriate students will enrol in secondary school (compared to 41% in the Current Path), and 49% of students will graduate from lower secondary school (compared to 41% in the Current Path) and 29% from upper secondary relative to 27% on the Current Path. Adults' literacy rate increases to 83.2%, about 2 percentage points above the Current Path.

Chart 18 presents the share of GDP for the country compared to the income group for Africa, from 2019 to 2043 in the Current Path forecast.

The manufacturing sector in Mozambique is weak and unable to play a leading role in economic growth and development; it is limited to small-scale processing, with its contribution to GDP declining since 2005. According to the Mozambican Manufacturing Firms survey in 2022, only 5% of the firms are exporting. The sector accounted for about 10% of GDP, on average, over the period 2000-2022, while the agriculture, extractive industry and services accounted for 24%, 18% and 45%, respectively. In 2023, manufacturing accounted for 12.6% of GDP below the average of 15.45% for low income countries in Africa. On the Current Path, manufacturing will account for 23.7% of Mozambique GDP by 2043, above the projected average of 20.7% for low income Africa.

During the interviews conducted on our fieldwork trip, many experts and economists indicated that the manufacturing sector in Mozambique has huge potential but its performance has been hamstrung by several factors, such as weak transport infrastructure, which prevents the connection between farmers and manufacturing firms (downstream beneficiation), poor implementation of business regulation (officially one day is required to register a business but three months in practice), the high cost of credit, technological delay and fierce competition from South African manufacturing firms.

Like in other African countries, many impoverished individuals in Mozambique find themselves entrenched in low-productivity sectors and informal service-based activities. Boosting the manufacturing sector will generate inclusive growth by facilitating the transition of low-income individuals from these sectors to higher productivity areas. This structural shift not only boosts incomes but fosters a positive cycle wherein the growth of productive employment, capacities and earnings mutually reinforce one another, propelling economic expansion and poverty reduction. Expanding more dynamic sectors can further fuel this virtuous cycle, leading to sustained growth and increased prosperity.

There is a need to enhance the manufacturing industry with strong backward and forward linkages with the agriculture, mining and service sectors to achieve sustained growth, reduce poverty and diversify the sources of income and foreign exchange earnings.

However, industrialisation or economic transformation is a long-term process. It requires constructive relationships between the state that encourages and supports the private sector. Firms need a state that has strong capabilities in setting an overall economic vision and strategy, efficiently providing supportive infrastructure and services, maintaining a regulatory environment conducive to entrepreneurial activity and making it easier to acquire new technology and enter new economic activities and markets.

In the Manufacturing scenario, reasonable but ambitious growth in manufacturing is envisaged through increased investment in the sector, research and development (R&D), and improved government regulation of businesses. This aims to enhance total labour participation rates, particularly among females where appropriate and is accompanied by increased welfare transfers to unskilled workers to mitigate the initial rises in inequality typically associated with a low-end manufacturing transition.

Visit the theme on Manufacturing for our conceptualisation and details on the scenario structure and interventions.

Chart 19 presents the contribution of the manufacturing sector to GDP in the Current Path forecast and in the Manufacturing scenario, from 2019 to 2023. The data is in US$ and % of GDP.

Under the Manufacturing scenario, the value added of the manufacturing sector is US$1.56 billion (equivalent to 1.2 percentage points of GDP) above the Current Path in 2043.

Chart 20 depicts exports and imports as a percent of GDP, from 1990 to 2043 in the Current Path forecast and in the AfCFTA scenario.

With merchandised exports accounting for over 36% and imports reaching about 70% of GDP, in 2021, international trade really plays an important role in Mozambique’s economy. Total merchandise trade represents nearly 90% of the country’s GDP. Mozambique is a founding member of the World Trade Organisation (WTO) and grants Most Favoured Nations (MFN) treatment to all of its trading partners. The country has a regional trade agreement in force with SADC and has signed bilateral trade agreements with Malawi and Zimbabwe (who are SADC members). Thus on paper, 99.6% of goods imported from SADC members have zero tariff rates.

Mozambique also signed the African Continental Free Trade Area (AfCFTA) and ratified the agreement in July 2023. The GOM seeks to reform its trade regulations to improve its business climate and encourage exports. Customs duties remain high, and there are numerous non-tariff barriers in the country (such as slow customs clearance procedures).

Mozambique exports homogenous goods (mineral fuels, mineral oils and raw aluminium) and imports more of heterogeneous goods (manufactured or processed goods). Its export composition is highly concentrated on a few primary goods, reflecting the narrow scope of the economy. This commodity dependence leaves Mozambique vulnerable to global commodity price shocks, creates volatility in government revenue and foreign exchange reserves and undermines inclusive growth and development prospects.

Mozambique's trade has suffered due to the economic slowdown from the COVID-19 pandemic and, more recently, the war in Ukraine which has resulted in rising fuel and basic food prices. Mozambique is a net importer of refined petroleum and basic food. In 2020, Mozambique's merchandise exports contracted by 10.2% relative to 2019 due to the pandemic but rebounded for 9.5% growth to the value of US$4.4 billion (about 31% of GDP) and accounted for only 0.8% of Africa’s total exports in 2021.

The country’s top exports are dominated by commodity goods, with coal briquettes accounting for about 22.4% of total exports, raw aluminium for 22%, petroleum gas (5.3%), gold (5.2%) and electricity nearly (4.4%) of total merchandise exports in 2021. The top exported goods were mostly destined for India (15.8%), South Africa (12%), China (10.3%) and the United Arab Emirates (5.7%).

Its imports contracted by 18.5% in 2020 before rebounding to a growth of 7.1% in 2021, reflecting a trade deficit of about US$5.3 billion (17.8% of GDP). Top imports of Mozambique were special purpose ships (14.4% of total imports), refined petroleum (11.1%), iron ore (5.1%), cobalt oxides (3.5%) and chromium ore (3.3%). Imported products were mostly from South Africa (23.5%), South Korea (14.5%), China (12.9%), India (8.6%) and the United Arab Emirates (4.2%).

The AfCFTA scenario represents the impact of fully implementing the African Continental Free Trade Agreement by 2034. The scenario increases exports in manufacturing, agriculture, services, ICT, materials and energy exports. It also includes improved multifactor productivity growth from trade and reduced tariffs for all sectors.

Visit the theme on AfCFTA for our conceptualisation and details on the scenario structure and interventions.

Chart 21 presents the trade balance in the Current Path forecast and in the AfCFTA scenario, from 2019 to 2043 as a % of GDP.

In the Current Path, Mozambique's exports will increase to US$11.4 billion by 2043, mainly reflecting expected export gains from increased new gas production. The value of exports will account for 23.7% of GDP in 2043 which is about 18.6 percentage points below its National Development Plan target by 2043.

Import values as a percentage of GDP will decrease to 24.6% by 2043, about 16.7 percentage points below its target. The trade deficit will decrease to 27.6% of GDP, against the target of 1.2% of GDP by 2043. The country has incurred large trade deficits in recent years, averaging 34.2% of GDP during 2011-2021, mainly due to high imports associated with its various megaprojects.

The country’s trade deficit as a percentage of GDP will decline by 2.9 percentage points relative to the Current Path to a negative 23.8% of GDP in 2043.

Chart 22 presents the Current Path forecast of access to electricity for urban, rural and total population from 1990 to 2043.

Infrastructure is generally poor in Mozambique, constraining the growth and diversification of the economy. In 2022, Mozambique ranked 44 out of 54 African countries and lowest in the Southern Africa region on the African Infrastructure Development Index (AIDI), with an index of 13.7 out of 100.

Mozambique has one of the largest electricity generation potentials in Southern Africa and among the highest on the continent, with the potential to become a regional hub, providing opportunities for investment and rapid socio-economic development. It is rich in renewables (hydro, solar, geothermal and tidal) and non-renewable (gas and coal) energy resources with an estimated potential to generate 187 gigawatts of electricity from coal, hydro, gas and wind, with natural gas expected to provide 44% of total grid electricity.

However, despite the potential, access to electricity remains low and the national grid is underdeveloped. In 2021 (most recent available historical data), only 31.5% of the Mozambican population had access to electricity compared to the average of 37.3% for its income peers (low-income Africa). Mozambique ranked 44 out of 54 African countries for domestic electricity access in the same year.

Mozambique is a net exporter of electricity to its neighbouring countries (Eswatini, Lesotho, South Africa, Zambia and Zimbabwe) with South Africa being the main importer. Yet, Mozambique’s exploitation of energy resources for domestic use remains limited and unevenly distributed. Equally, reliable and sustainable energy access (particularly in rural areas) remains relatively low compared to neighbouring countries (lower than South Africa, Zambia and Zimbabwe – the country’s importers) while urban areas suffer poor service quality. Only 3.8% of the rural population had access to electricity in 2021, compared to the average of 22.1% for its peers in 2021. Although Mozambique’s grid has grown it is not dense enough to supply electricity in many rural communities, where over 60% of the population lives. The main challenge is therefore to expand the network - a task that, given the long distances and the distribution of the population over 800 000 square kilometres, will require massive investments.

Mozambique needs to substantially accelerate the pace of national electrification to reach the target set in its development plan (2023-2043) if it is to achieve a 59.5% access rate by 2043. On the Current Path, the country’s national electricity access rate does show improvements, reaching 55.9% of the population, about 3.6 percentage points below the GOM target (59.5%) by 2043. Access to electricity in urban areas will increase to 87.2% by 2043 from 75.3% in 2022. Rural electricity access will reach 25.9% of the rural population by 2043, below the projected average of 42.5% for low-income Africa (Chart 22).

The Large Infrastructure and Leapfrogging scenario involves ambitious investments in road and renewable energy infrastructure, improved electricity access and accelerated broadband connectivity. It emphasises adopting modern technologies to enhance government efficiency and the rapid formalisation of the informal sector, incorporating significant investments in major infrastructure projects like rail, ports, and airports while highlighting the positive impacts of renewables and ICT.

Visit the themes on Large Infrastructure and Leapfrogging for our conceptualisation and details on the scenario structure and interventions.

Chart 23 presents the number of people using cookstoves in the Current Path forecast and in the Large Infrastructure and Leapfrogging scenario, from 2019 to 2043.

Due to the limited access to electricity, many households rely on firewood and charcoal (traditional cookstoves) for energy. Currently, about 90% of Mozambicans use charcoal for cooking, damaging their health through inhaling smoke and contributing to deforestation.

If this scenario were implemented, the proportion of households using traditional cookstoves could decline from about 90% in 2023 to about 50% in 2043 (about 16 percentage points below the Current Path in 2043). The share of households using modern cookstoves will increase from 6% in 2023 to 47% in 2043, compared to 30.6% on the Current Path in the same year. These findings imply that increasing access to energy/electricity and/or off-grid renewable energy solutions, especially in rural areas, could contribute to forest protection and reduce emissions by shifting households away from traditional cooking methods to modern ones.

Chart 24 presents the % of the population and number of people with access to mobile and fixed broadband in the Current Path forecast and in the Large Infrastructure and Leapfrogging scenario, from 2019 to 2043. The user can toggle between mobile and fixed broadband.

Although Mozambique's digital infrastructure is still far from reaching universal access, it has undergone rapid evolution. In 2020, only 16.3% of the population had internet access and nearly 15.5 million mobile subscriptions (corresponding to about half of the population) in 2020. The impact of the COVID-19 pandemic led companies and users to move to online platforms and remain sustainable through the pandemic by establishing remote work systems.

Mobile broadband subscriptions per 100 people in Mozambique stood at 20.8, compared to an average of 27.2 for low-income Africa and 41.7 for the Southern African Development Community (SADC) in 2022. By 2043, mobile broadband subscriptions per 100 people on the Current Path will reach 107 compared with 110 in the Large Infrastructure and Leapfrogging scenario.

Fixed broadband provides faster Internet access speeds with more secure connections and is important for the high-value-added service sector. Fixed broadband penetration in Mozambique is strikingly low, with a subscription rate of 0.06 per 100 people, below the low-income African countries average of 1.1 and 4.1 for SADC. On the Current Path, fixed broadband subscriptions for Mozambique will be 24 per 100 people by 2043 compared with 36 per 100 people in the Large Infrastructure and Leapfrogging scenario.

Chart 25 presents the trends in FDI, aid and remittances as a % of GDP, from 1990 to 2043.

Mozambique is a significant recipient of foreign direct investment (FDI) and official development assistance in Africa. For two decades after the civil war, Mozambique emerged as a favoured recipient of donors' support, receiving 10 to 15% of total FDI inflows into sub-Saharan Africa. Much of this FDI has financed large projects in the extractive industry with limited connection with the broader domestic economy.

Mozambique has benefited significantly from extensive development cooperation and Official Development Assistance (ODA), notably from key contributors such as the United States. Based on findings from a Congressional Research Service Report, Mozambique received an average annual aid of US$452 million from the US Government between 2016 and 2018 aimed at supporting primary healthcare services, acquiring essential medical infrastructure, and facilitating the training of healthcare professionals. The report further highlighted that international aid to Mozambique, spanning from 2008 to 2017, averaged US$1.96 billion annually, positioning Mozambique as the 15th highest recipient of global aid from the international community.

These substantial FDIs and ODA inflows facilitated Mozambique’s sustained, rapid post-civil war economic growth and political stability. In reaction to the 2016 clandestine loan, estimated at US$2 billion, donors that provided budget support including the IMF, united in cutting off financial aid to the government and demanded independent inquiries into the debts. Concessional lending from international financial institutions became limited, with ODA falling from 17.5 to 12.4% of GDP between 2013 and 2018. FDI dried up as international investors lost confidence. With almost half of the yearly national budget derived from donor funds, a suspension of aid impacted the country’s economic stability significantly. The Metical (domestic currency) depreciated drastically, inflation surged to 17.4% by the end of 2016 and fiscal space narrowed markedly. Mozambique’s external public and publicly guaranteed debt ballooned from 61% of GDP in 2016 to 104% in 2018 and the country inevitably defaulted on its debt in 2016. As a result, credit rating agencies downgraded the sovereign to selective or restricted default and the World Bank and the IMF re-classified Mozambique’s external debt to ‘in distress’.[15F H Gebregziabher and AP Sala. Mozambique’s ‘hidden debts’: Turning a crisis into an opportunity for reform. World Bank Blogs, April 2022]

On the Current Path, the average aid flows to Mozambique will be about 12.5% of GDP over the period 2023-2043 while the average FDI inflows will be about 16% of GDP over the same period.

Remittances play an important role in mitigating poverty in Mozambique as remittances from migrant workers (mainly from South Africa) are important sources of revenue for some families. The average value of remittances for Mozambique over the period 2005-2002 was US$94.4 million with a minimum of US$8 million in 2005 and a maximum of US$278.2 million in 2021. The value of remittances in 2022 (the latest available data) was US$160.9, equivalent to 1.69% of GDP.

In addition to their contribution to poverty reduction and human development, remittances tend to be less volatile to economic downturns than FDI and other types of capital flows and hence help boost foreign exchange reserves. Efforts should therefore be made to offer cheaper and faster ways for remitters to send money to their relatives in order to boost remittance inflows into the country.

Like many other countries, Mozambique experiences illicit financial flows (IFF). It is estimated that between 2005-2014, 10% of total government revenue left the country illicitly.[16N Overy and D Ribeiro, South African Public Financing of the Mozambique Liquid Natural Gas Project, Fair Finance Coalition Southern Africa] This is a deeply worrying reality given that there is a proven link between the extent of natural resources a country has and the magnitude of IFF. Given how weak governance controls in Mozambique actually are, research illustrates that an enabling environment is actually created for IFF to flourish in the country.[17R Kukutschka, Illicit financial flows in Mozambique, U4Anti-Corruption Resource Centre, 2018]

An increase in foreign financial flows can bring considerable economic benefits to Mozambique and reduce its persistent balance of payment difficulties. The Financial Flows scenario represents a reasonable but ambitious increase in inward flows of worker remittances, aid to poor countries and an increase in the stock of foreign direct investment (FDI) and additional portfolio investment inflows. We reduce outward financial flows to emulate a reduction in illicit financial outflows.

Visit the theme on Financial Flows for our conceptualisation and details on the scenario structure and interventions.

Chart 26 presents government revenue in the Current Path forecast and in the Financial Flows scenario, from 2019 to 2043. The data is in US$ and % of GDP.

In the scenario, government revenue increases across the forecast horizon to reach US$22.4 billion in 2043, US$6 billion larger than the Current Path in the same year (Chart 26).