Kenya

Kenya

Feedback welcome

Our aim is to use the best data to inform our analysis. See our Technical page for information on the IFs forecasting platform. We appreciate your help and references for improvements via our feedback form.

This report examines Kenya's current and projected future development. It presents eight sectoral scenarios to forecast progress by 2043, including demographic, economic and infrastructure-related outcomes. The country grapples with challenges such as corruption, infrastructure deficits and rising public debt yet has a resilient and diversified economy, especially through geothermal production. The analysis also considers the implications of the Agenda 2063 goals, aiming to offer insights into policy actions that could enhance Kenya's developmental trajectory and guide it towards a more prosperous future.

For more information about the International Futures modelling platform that we use for the development of the various scenarios, please see About this Site.

Summary

We begin this page with an introductory assessment of Kenya’s context looking at the current population distribution and structure, climate and topography. We also provide an overview of the national development plan.

- Kenya, a lower-middle-income country in East Africa, bordered by South Sudan to the north-west, Ethiopia to the north, Somalia to the east, Uganda to the west, Tanzania to the south, and the Indian Ocean to the south-east. As a member of the Intergovernmental Authority on Development (IGAD), the East African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA), Kenya is a critical commercial hub on the continent.

- The country is currently implementing its Vision 2030 launched in 2008 as the long-term development blueprint for the country. It aims to transform Kenya into ‘a newly industrializing, middle-income country providing a high quality of life to all its citizens by 2030 with a GDP growth rate of 10% per annum starting in 2012.

This section is followed by an analysis of the Current Path forecast for Kenya which informs the country’s likely current development trajectory to 2043. It is based on current geopolitical trends and assumes that no major shocks would occur in a ‘business as usual’ future. This section further compares progress on the Current Path with eight sectoral scenarios. These are Demographics and Health; Agriculture; Education; Manufacturing; the African Continental Free Trade Area (AfCFTA); Large Infrastructure and Leapfrogging; Financial Flows; and Governance. Each scenario is benchmarked to present an ambitious but reasonable aspiration in that sector.

- By 2043, the ratio of the working-age population to dependants will be 2.35 to 1 in the Demographics and Health scenario, 20% higher than the Current Path. The Demographics and Health scenario will reduce Kenya’s infant mortality rate to 9.3 deaths per 1 000 live births by 2043 and increase life expectancy to 77.1 years by 2043.

- In the Education scenario, the mean years of adult education will rise to 8.6 by 2043, which will be equal to the average for lower-middle-income countries in Africa and 0.4 years more than on the Current Path. The Education scenario will increase average test scores for primary and secondary learners by 10.3% and 7.5% respectively above the Current Path.

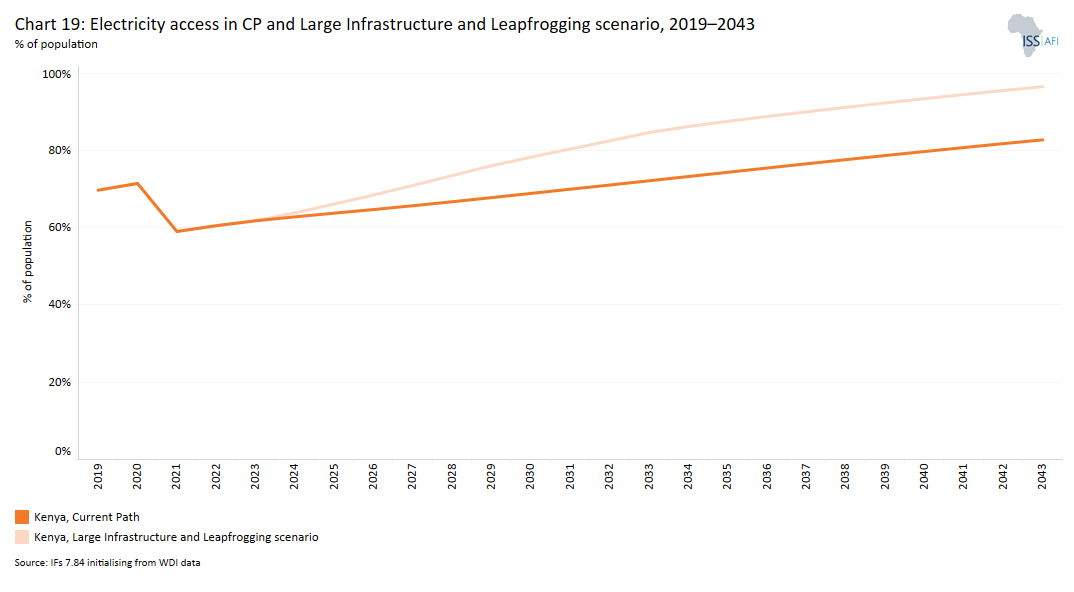

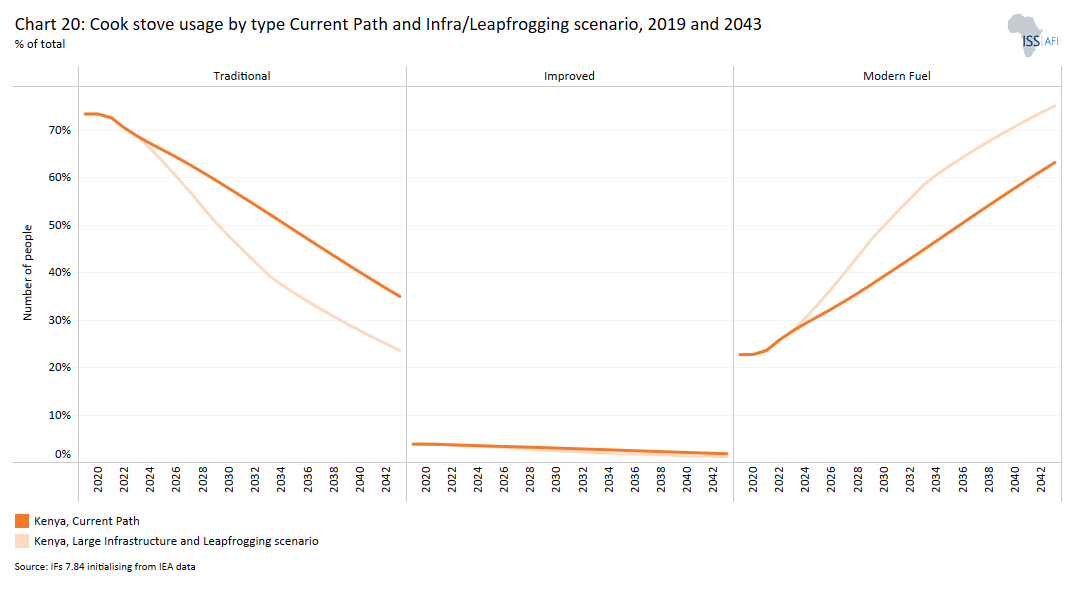

- Based on the Large Infrastructure and Leapfrogging scenario, 96.5% of the population will have access to electricity by 2043, compared with 82.7% of the population in the Current Path. By 2043, only 23.6% of households will use traditional cookstoves in this scenario compared with 35% in the Current Path, whilst 75.1% of households will use modern stoves in this scenario compared with 63.2% in the Current Path.

- In the Agriculture scenario, yield per hectare will increase by 60% above the Current Path to reach 6.7 metric tons by 2043. The scenario further reduces import dependency, such that by 2043 to 24.2% of total agricultural demand instead of the 35% in the Current Path.

- In the Manufacturing scenario, the manufacturing sector will contribute an additional US$30.9 billion to GDP in 2043, which will be equivalent to 10 percentage points above the Current Path.

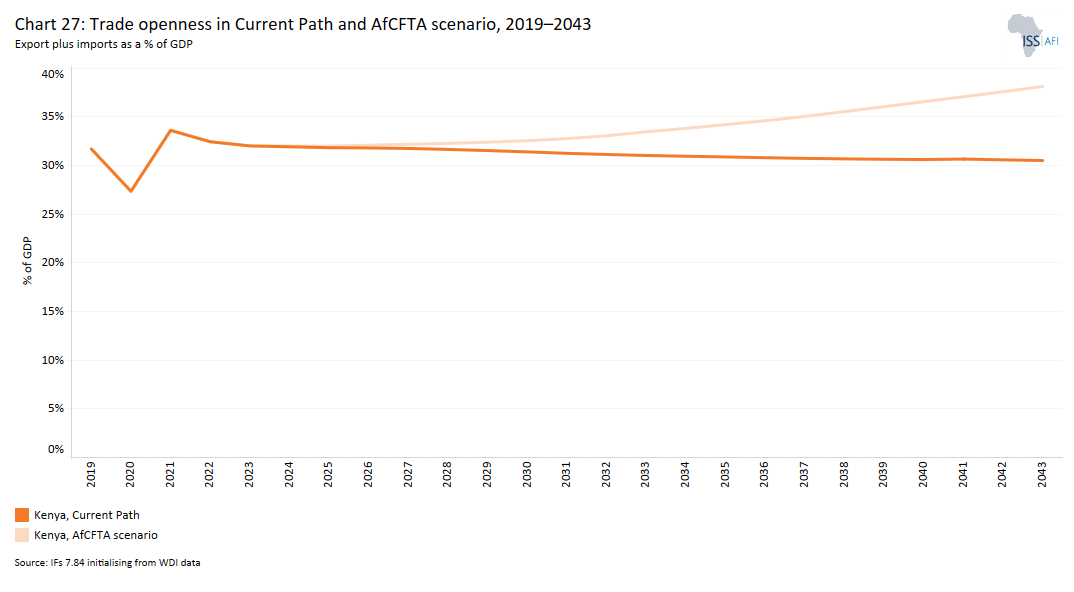

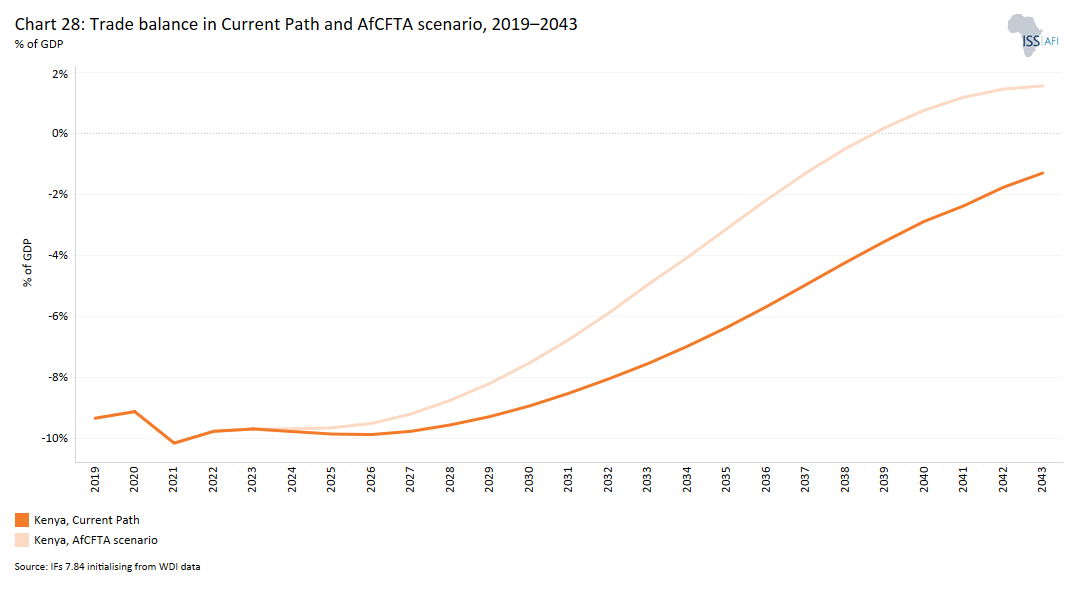

- By 2043, Kenya’s trade deficit in the Current Path will constitute about 1.3% of GDP, whereas in the same year, the AfCFTA scenario will reverse this situation leading to a surplus of 1.6% of GDP.

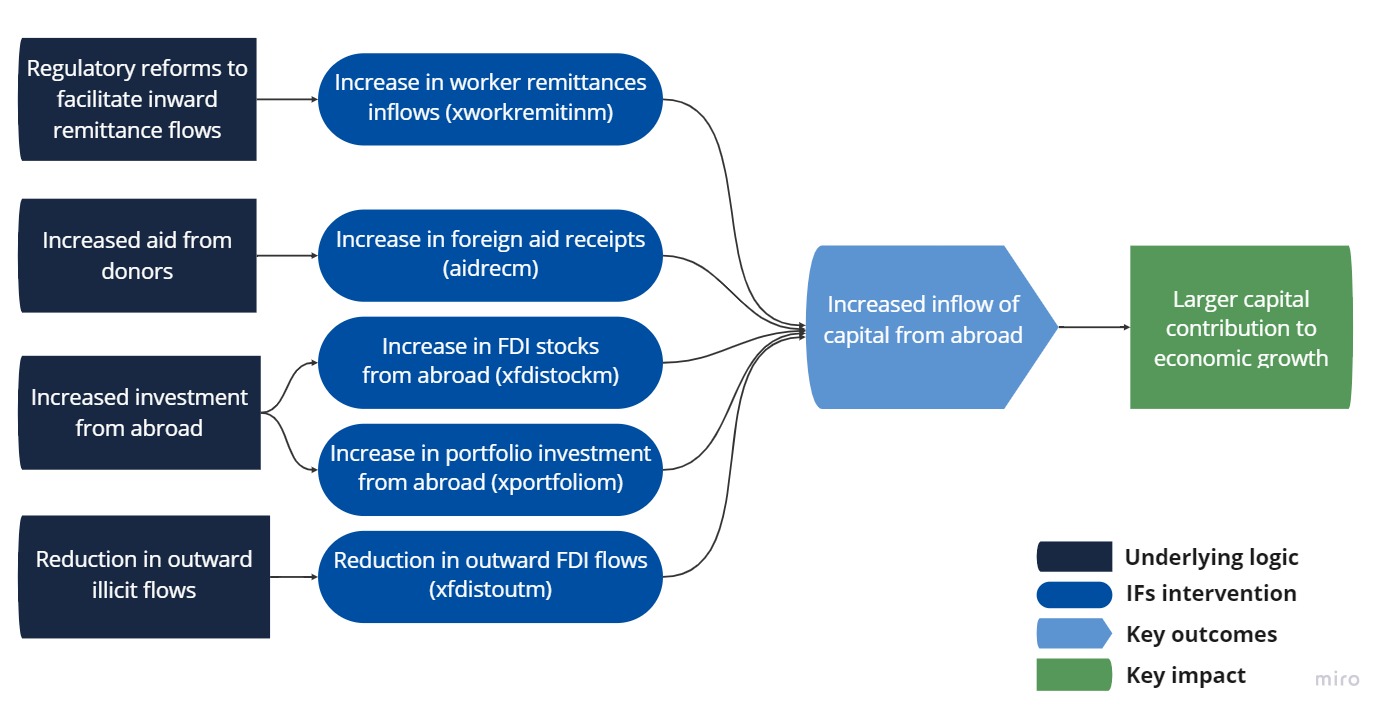

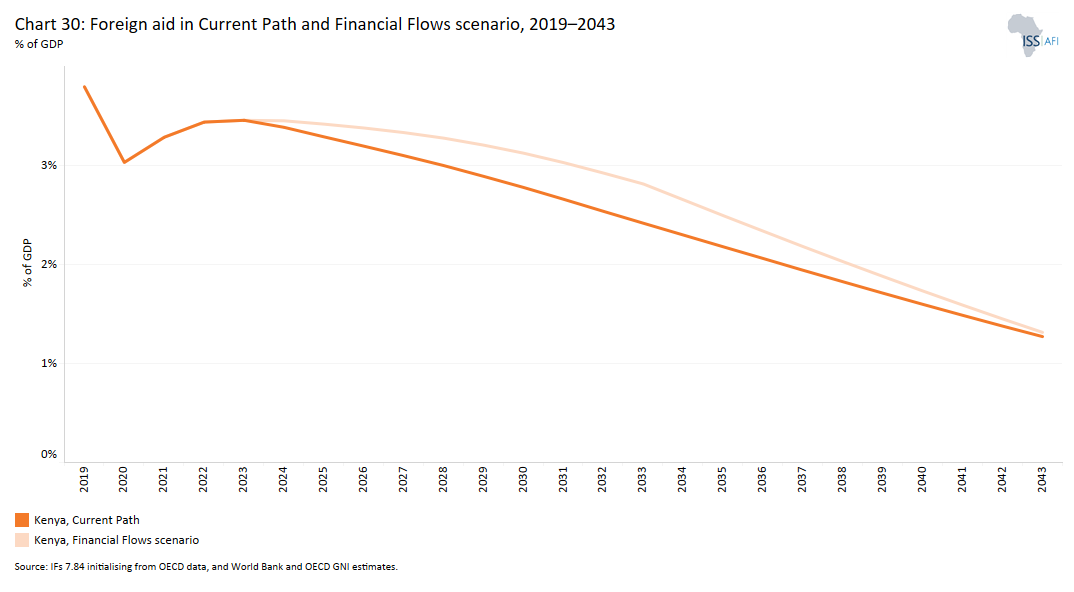

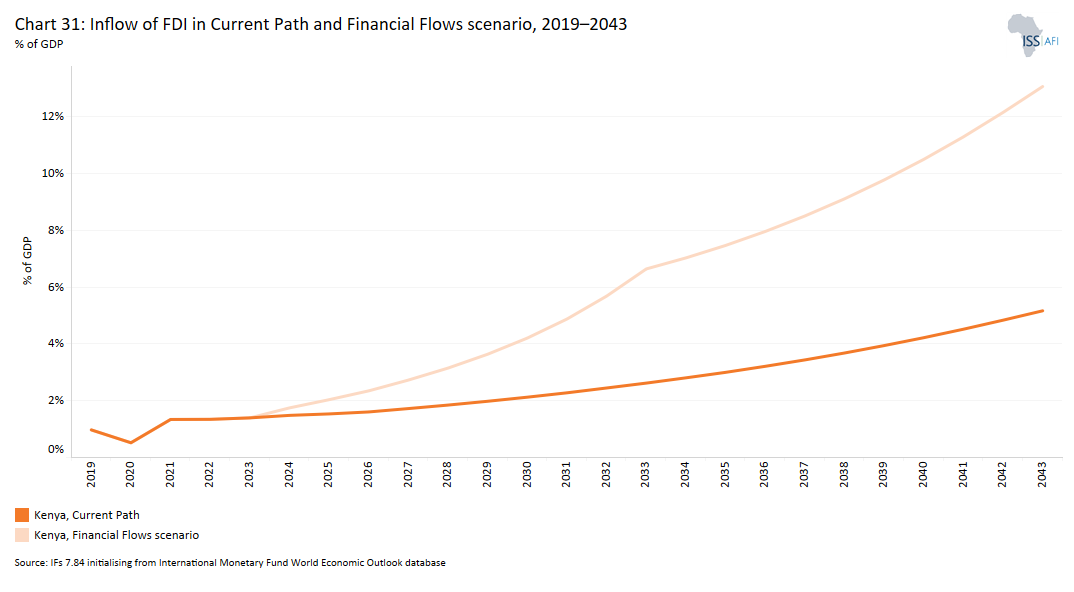

- By 2043, FDI as a percentage of GDP will increase from 1.34% to 4.7% of GDP in the Financial Flows scenario above the projected 2% on the Current Path. Total aid will amount to 1.31% of GDP in the Financial Flows scenario and to 1.27% in the Current Path.

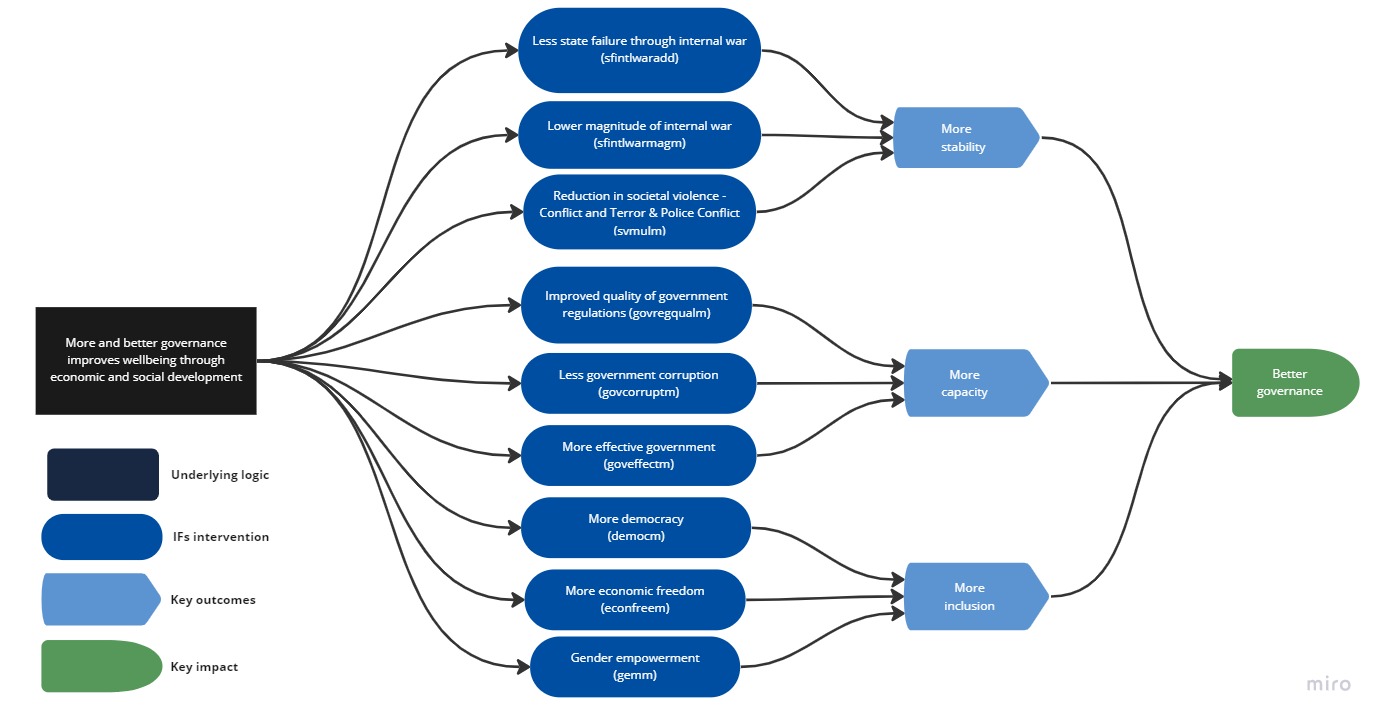

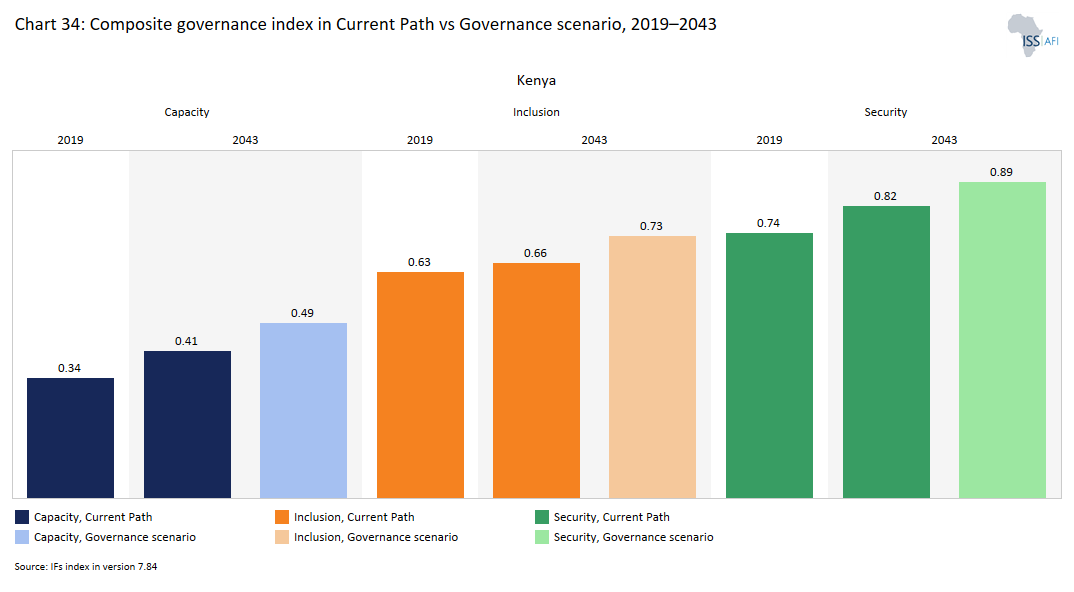

- In the Governance scenario, Kenya's security index score of 0.89 will be 9% above the Current Path by 2043. The scenario will also improve Kenya’s governance inclusion score by 11.4% above the Current Path to reach 0.73 in 2043. Governance capacity will also improve in the scenario by 15% above the Current Path to 0.49 by 2043.

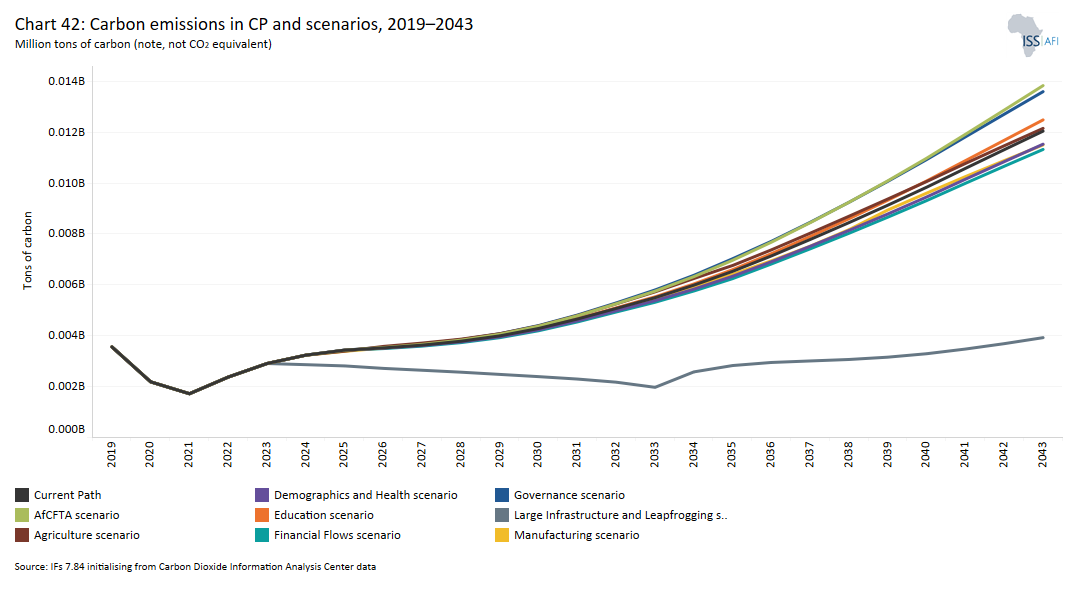

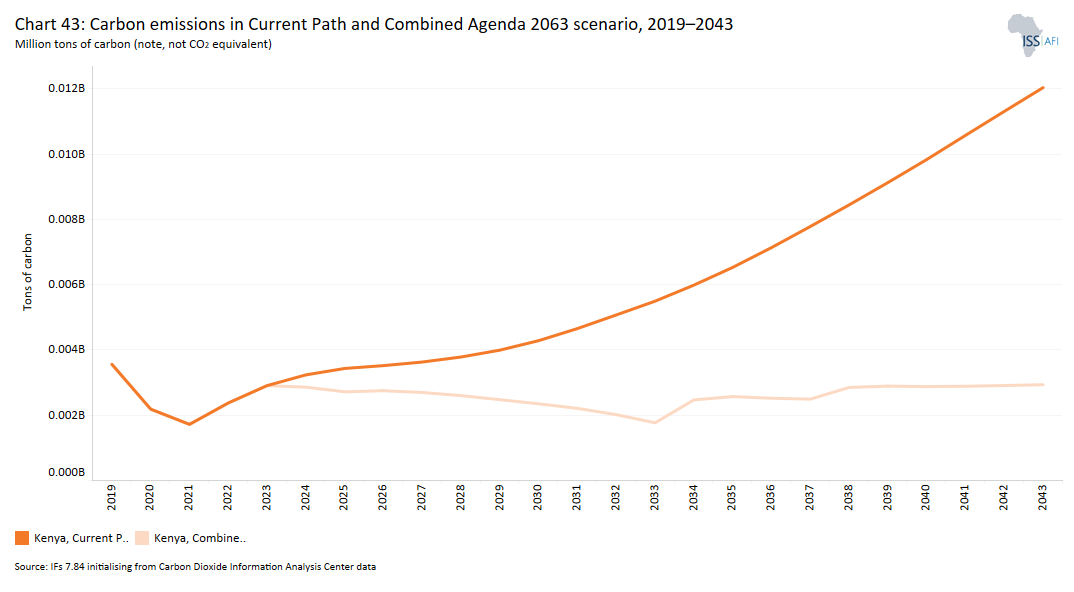

The third section compares the impact of each of the eight sectoral scenarios on key indicators (economy, poverty and inequality, carbon emissions). It then proceeds with a Combined Agenda 2063 scenario analysis (the sum effect of all eight scenarios).

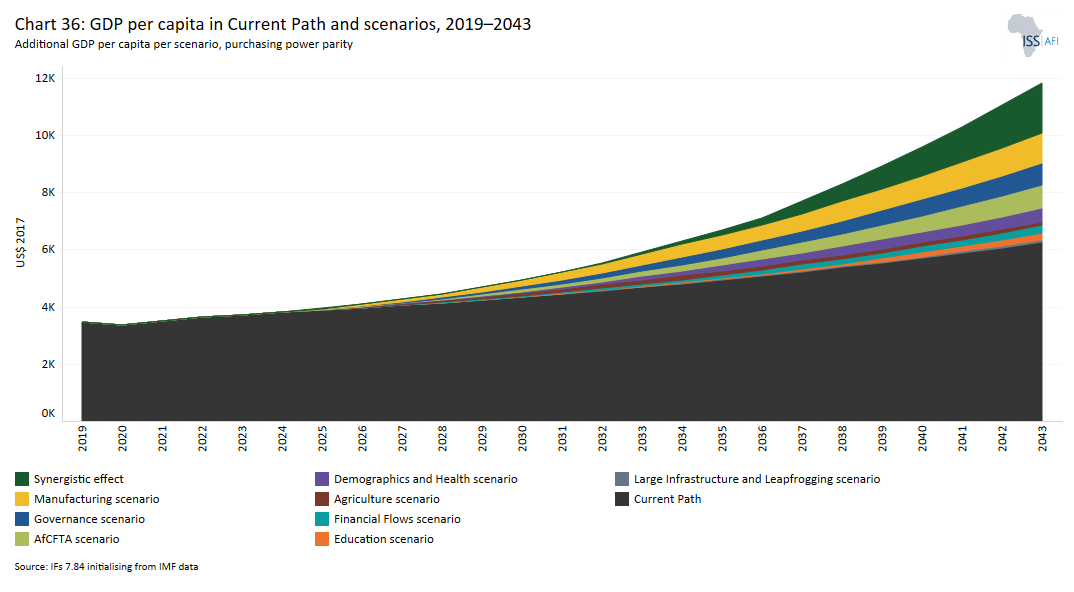

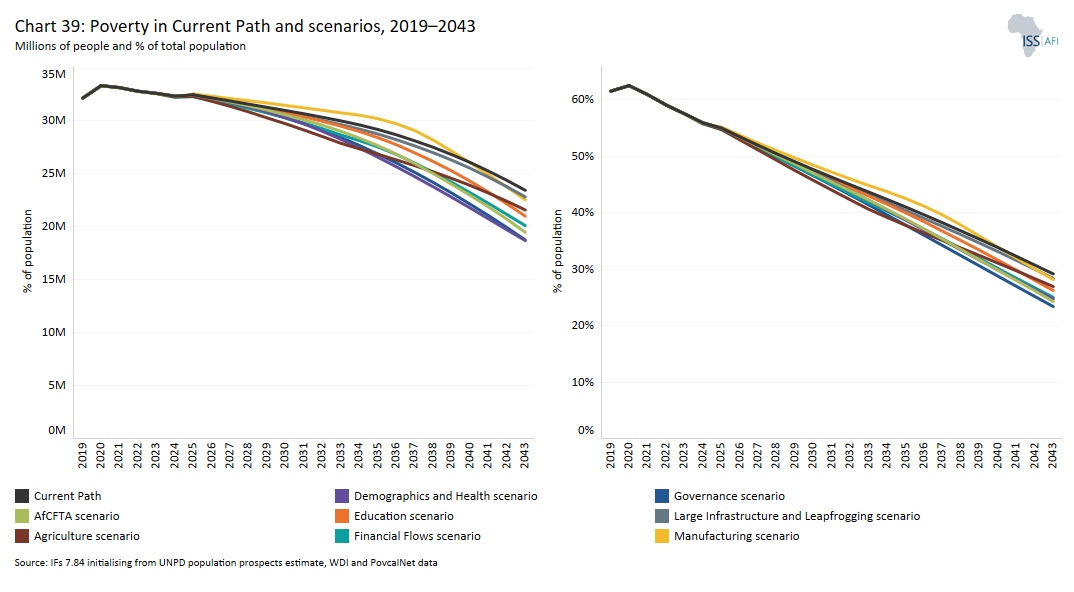

- The scenario with the greatest impact on GDP per capita by 2043 is the AfCFTA scenario, followed by the Government and the Demographics and Health scenarios. Likewise, the Governance scenario has the greatest potential to reduce extreme poverty in Kenya followed by the Demographics and Health and the Education scenarios.

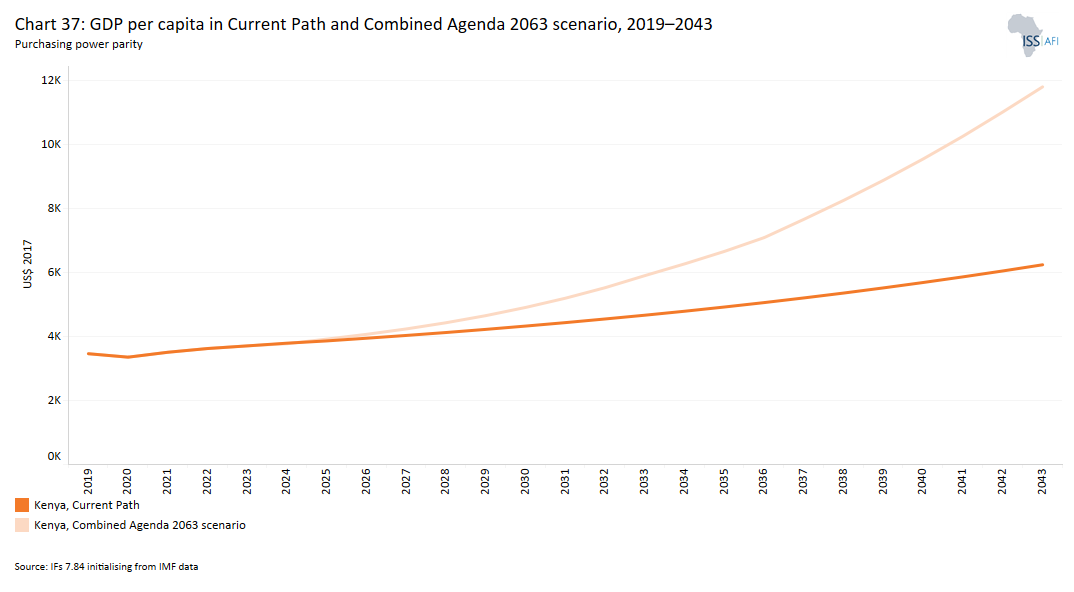

- GDP will rise to US$576.2 billion in the Combined scenario, an increase of 123.1% compared with the Current Path. Kenya’s GDP per capita will increase to US$11 982 by 2043 in the Combined scenario, a 92% improvement over the Current Path.

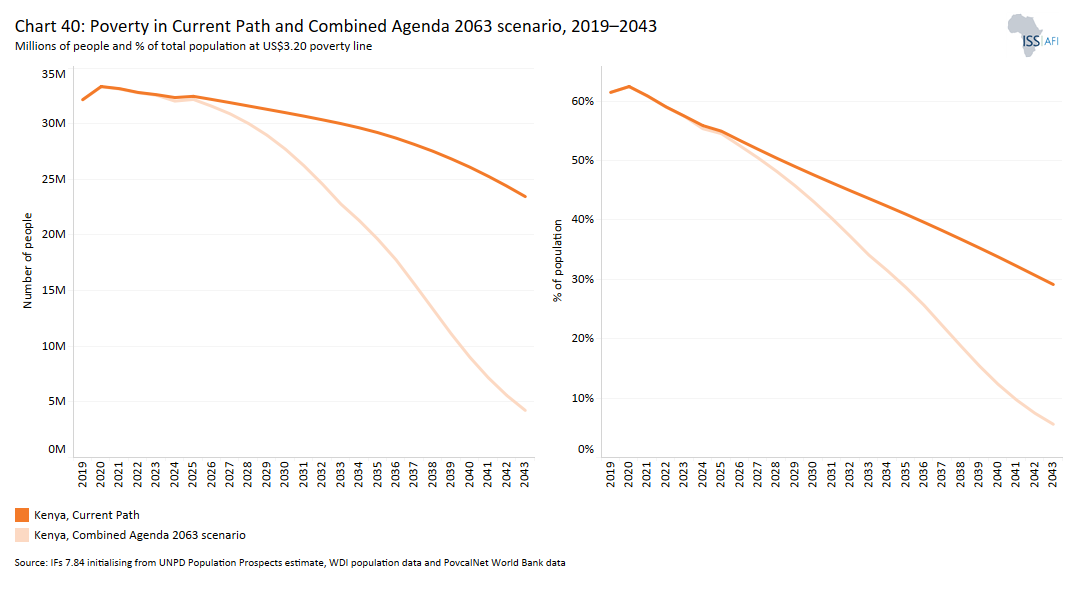

- By 2043, the Combined scenario can lead to 18.6 million fewer poor people in Kenya equivalent to a 22.9 percentage points decline compared with the Current Path. This will result in only 4.9 million people living below the poverty line of US$3.20, constituting 6.2% of the population.

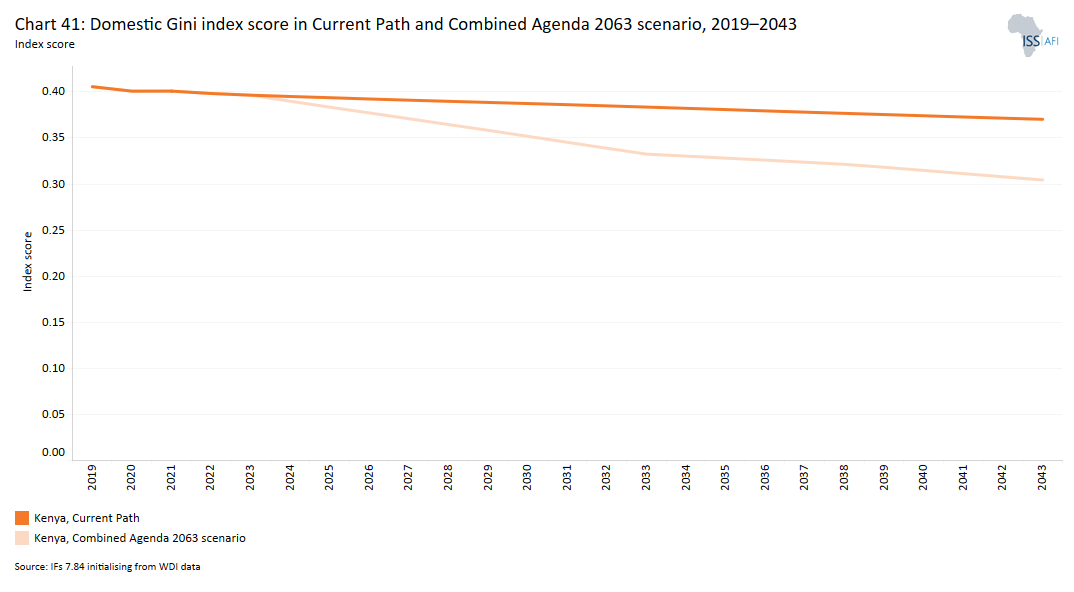

- In the Combined scenario, inequality in Kenya will reduce more rapidly, reaching 0.31 by 2043, a 16.6% reduction relative to the Current Path.

- In the Combined scenario, Kenya’s total carbon emissions of 1.9 million tons will be equal to almost six times less than what is estimated in the Current Path.

We end this page with a summarising conclusion offering key recommendations for decision-making. Kenya's strategic emphasis on economic reform, infrastructure development and renewable energy positions it well for future growth. However, addressing the underlying issues of poverty, inequality and governance is essential for ensuring that the benefits of growth are broadly shared.

All charts for Kenya

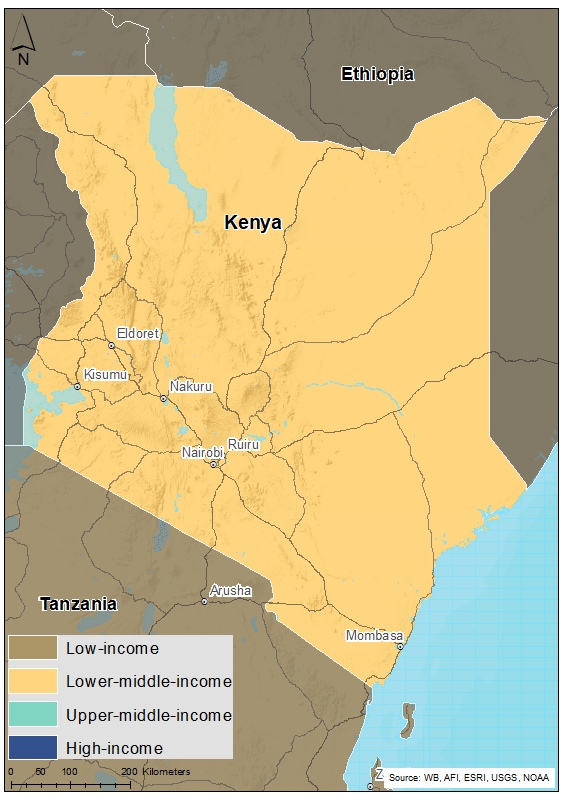

- Chart 1: Political map of Kenya

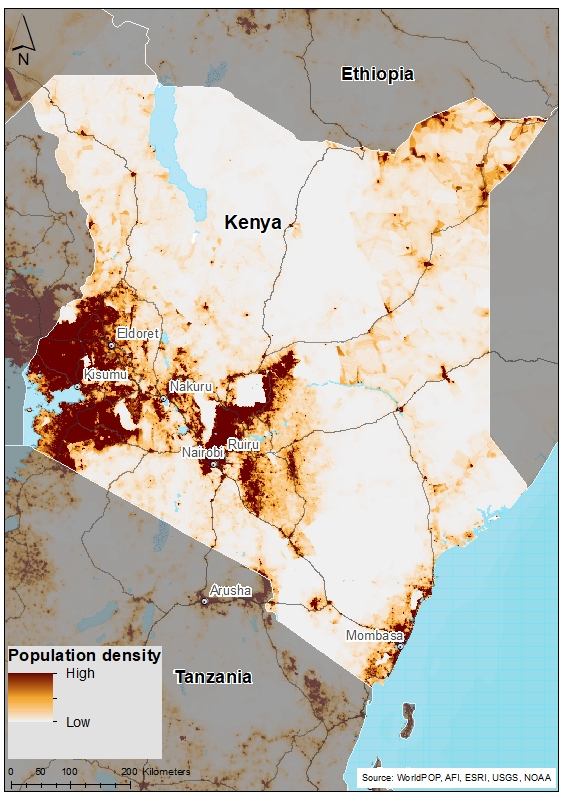

- Chart 2: Population distribution map of Kenya

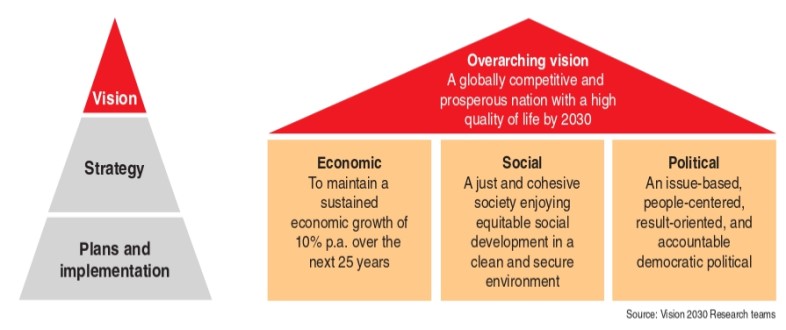

- Chart 3: Thematic overview of Kenya national development plan

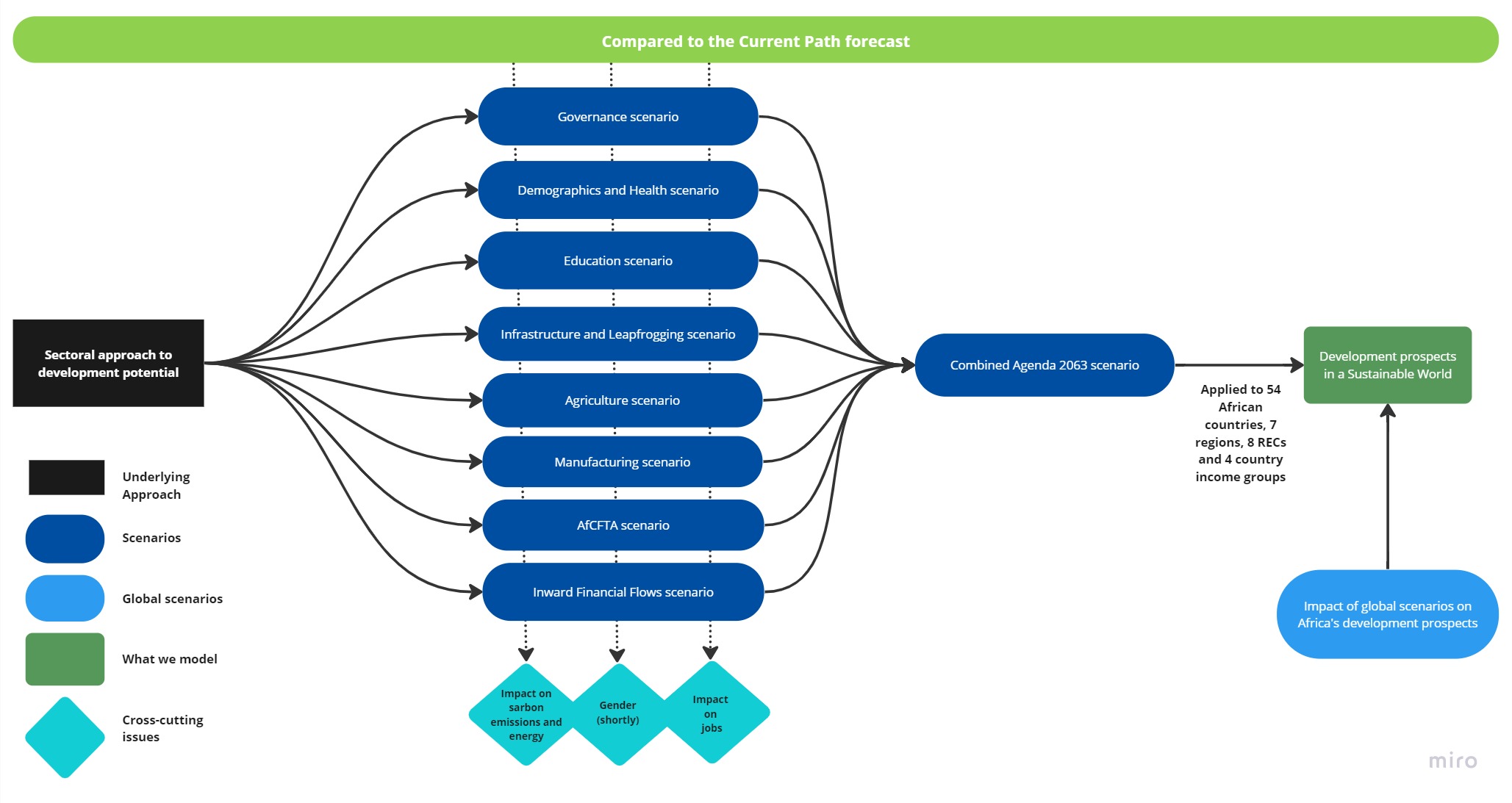

- Chart 4: Diagram of Current Path and sectoral scenarios

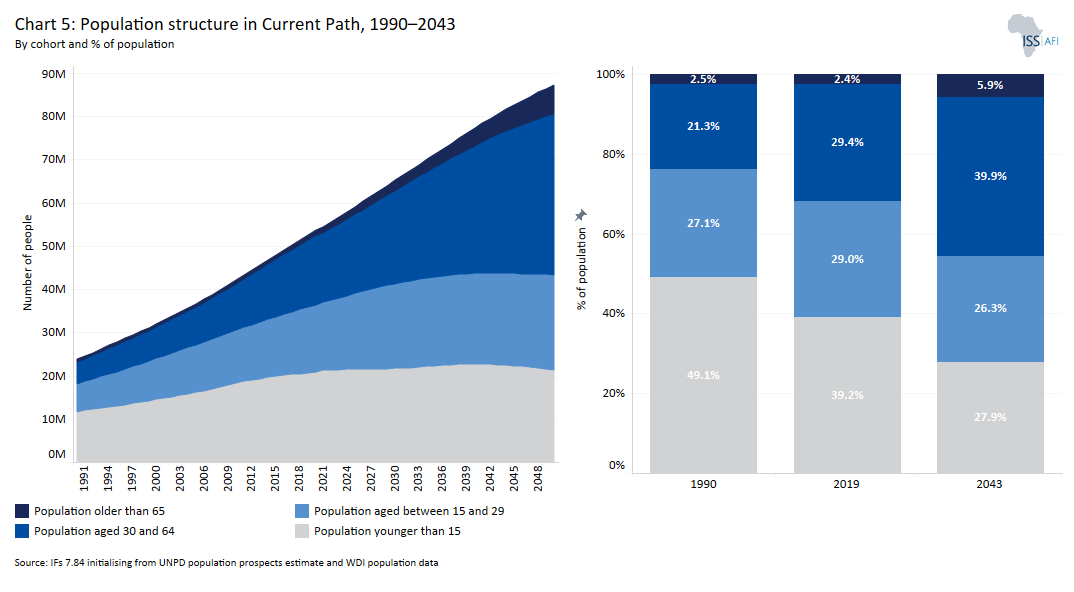

- Chart 5: Population structure in Current Path, 1990–2043

- Chart 6: Population distribution map, 2022

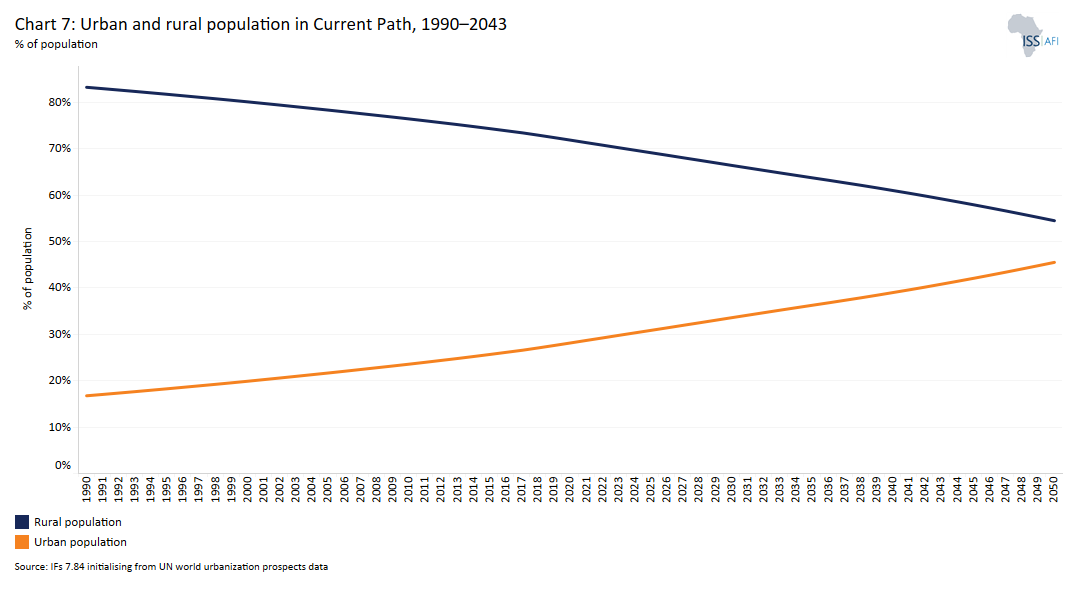

- Chart 7: Urban and rural population in Current Path, 1990–2043

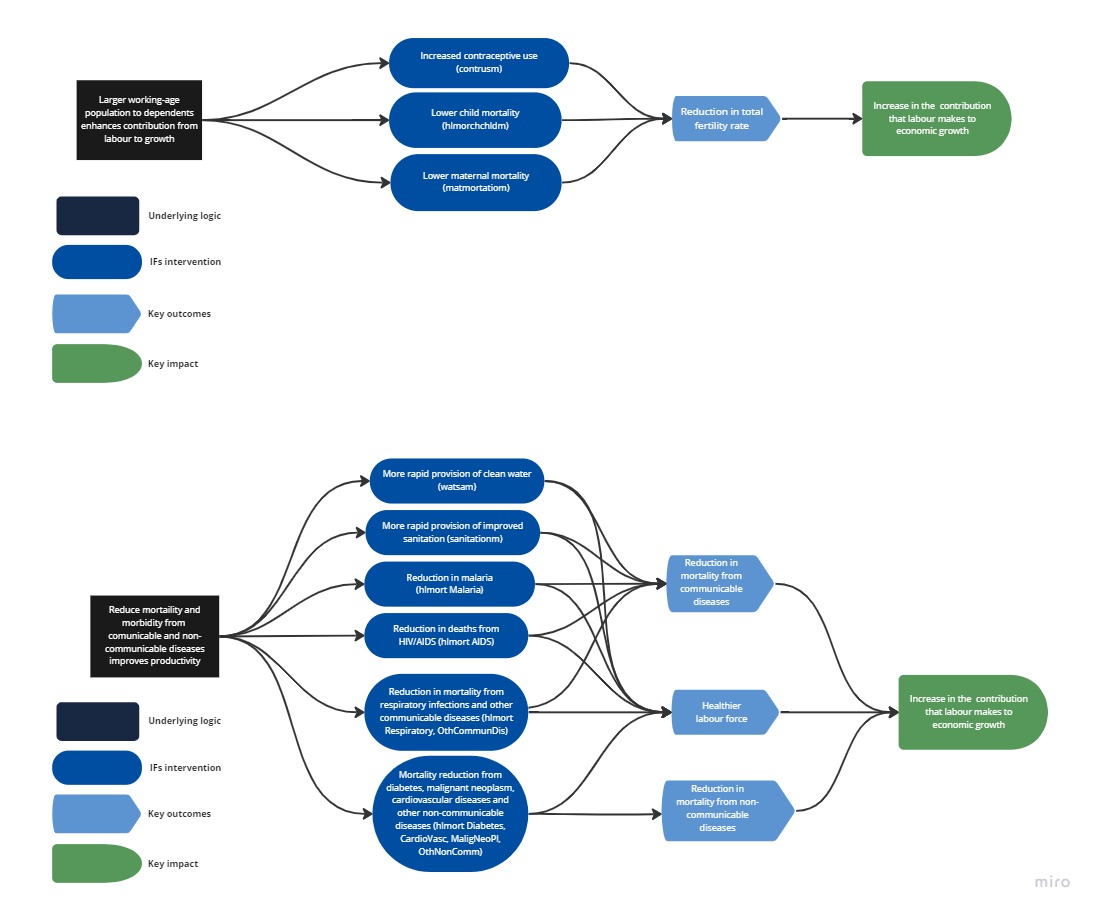

- Chart 8: Demographic and Health scenario diagram

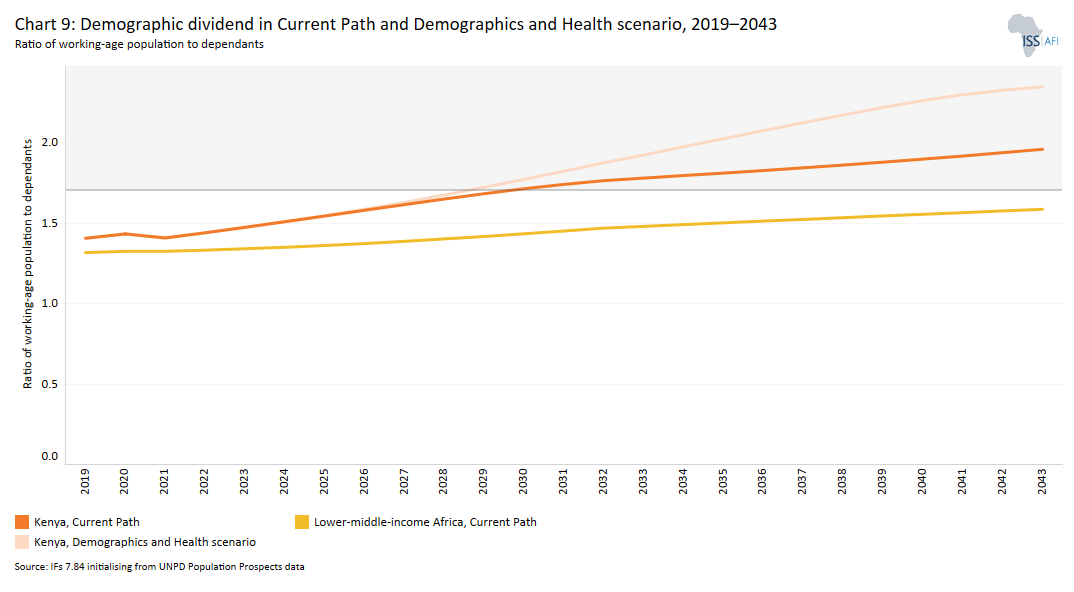

- Chart 9: Demographic dividend in Current Path and Demographics and Health scenario, 2019–2043

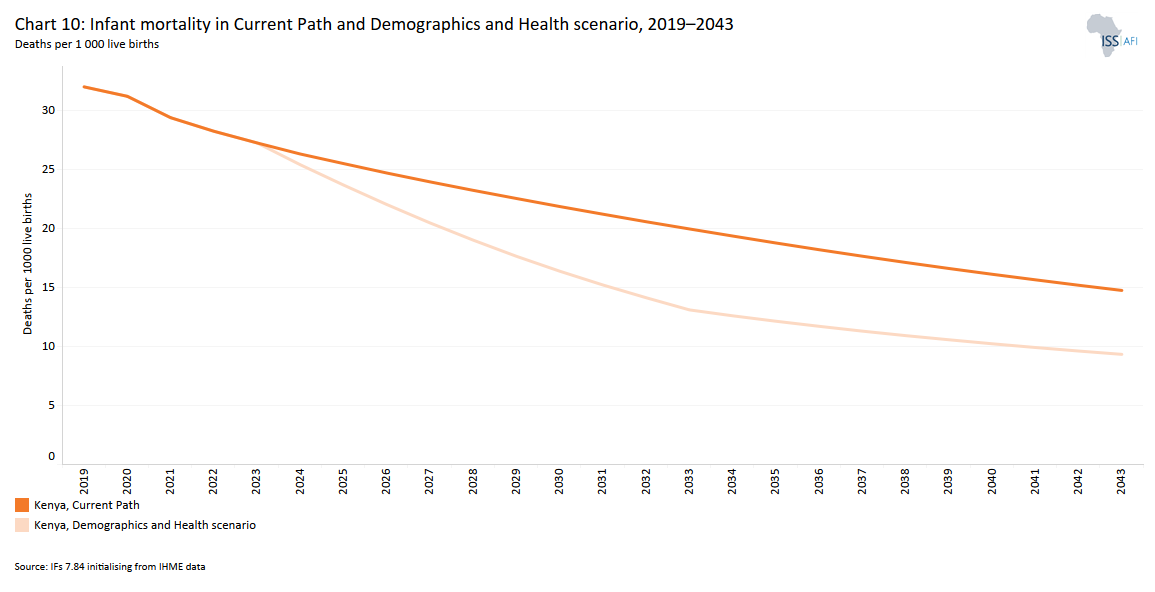

- Chart 10: Infant mortality in Current Path and Demographics and Health scenario, 2019 –2043

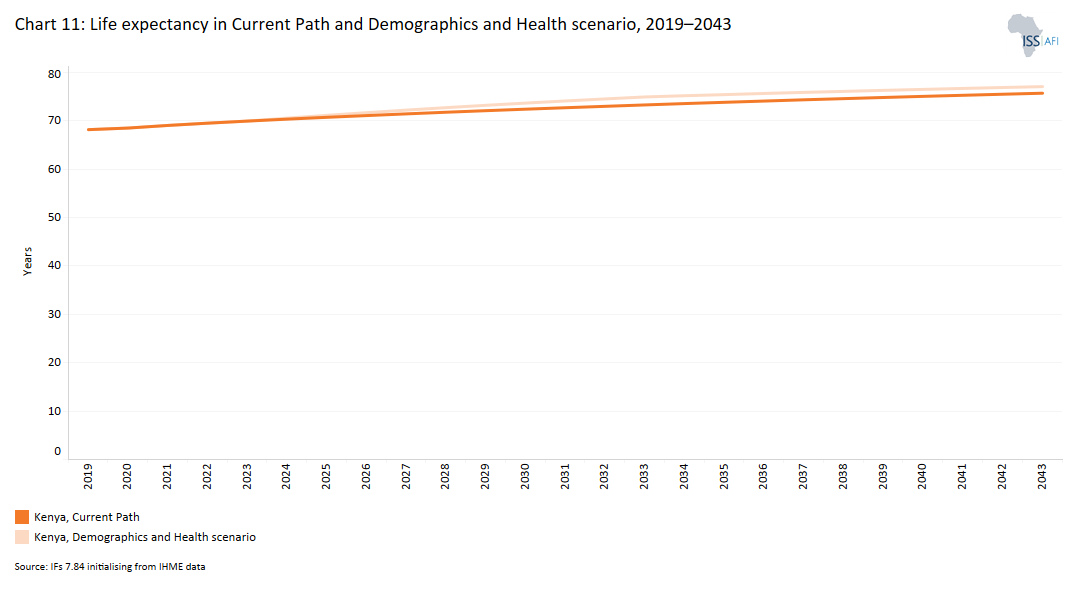

- Chart 11: Life expectancy in Current Path and Demographics and Health scenario, 2019–2043

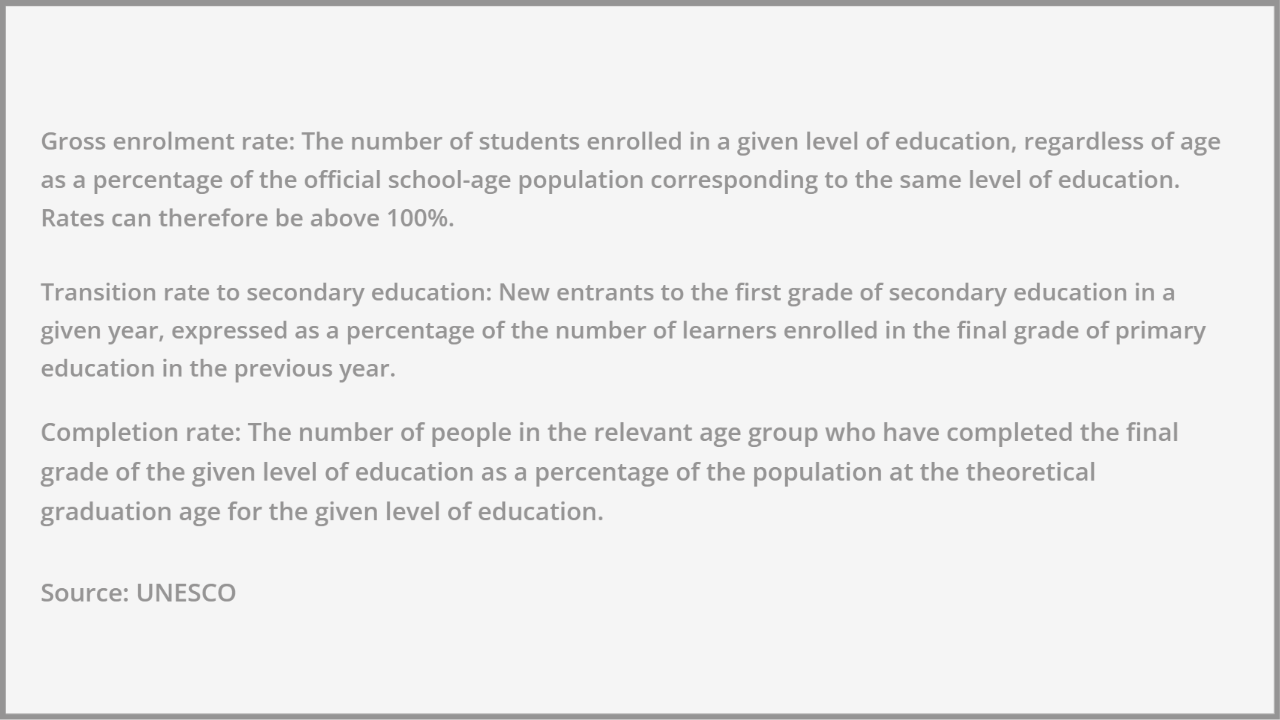

- Chart 12: Definitions in education

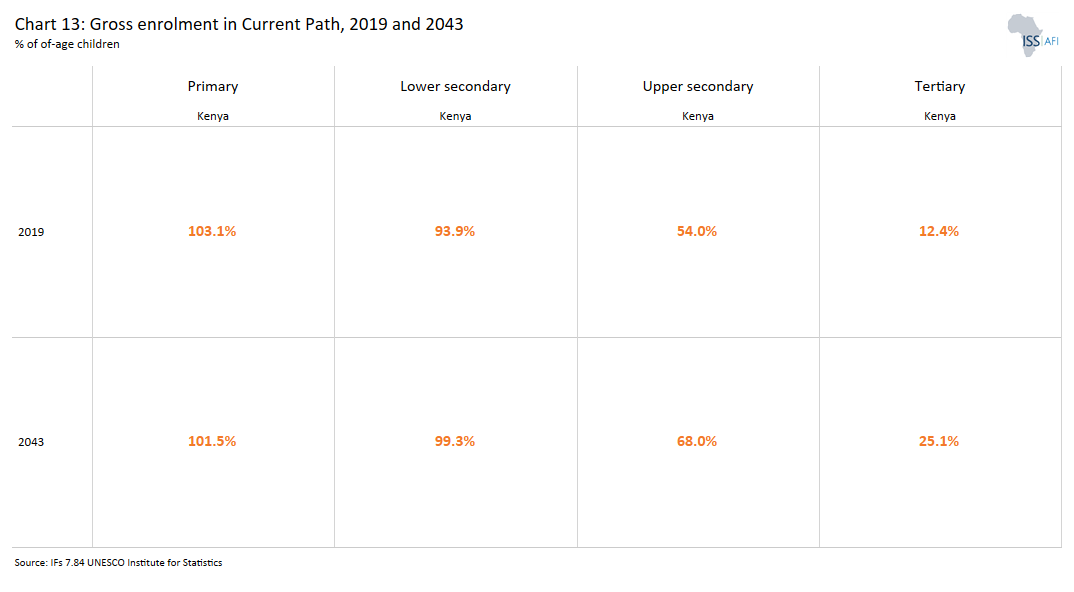

- Chart 13: Gross enrolment in Current Path, 2019 and 2043

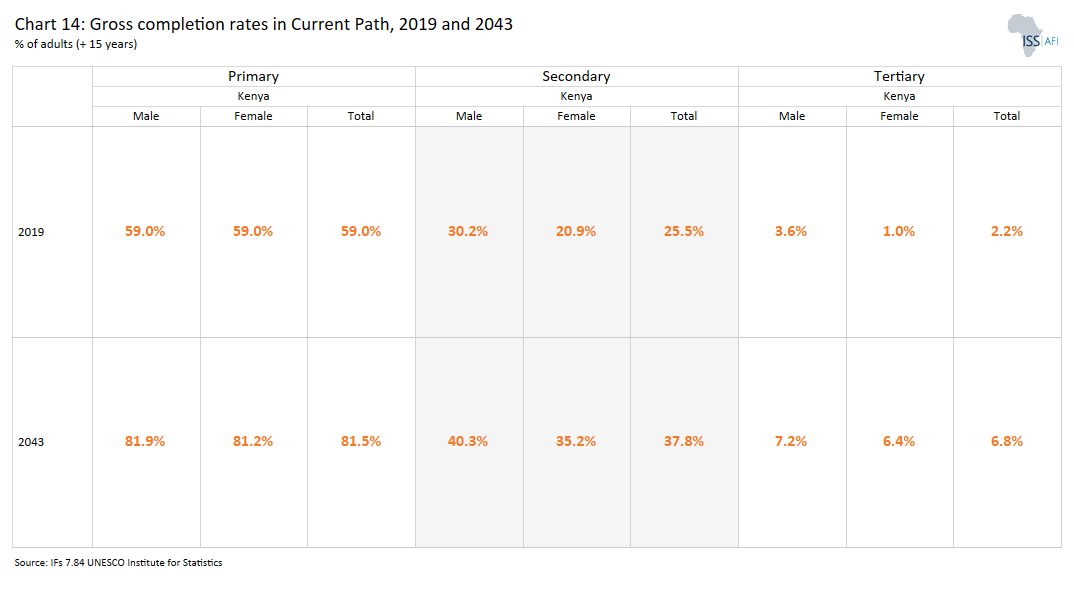

- Chart 14: Gross completion rates in Current Path, 2019 and 2043

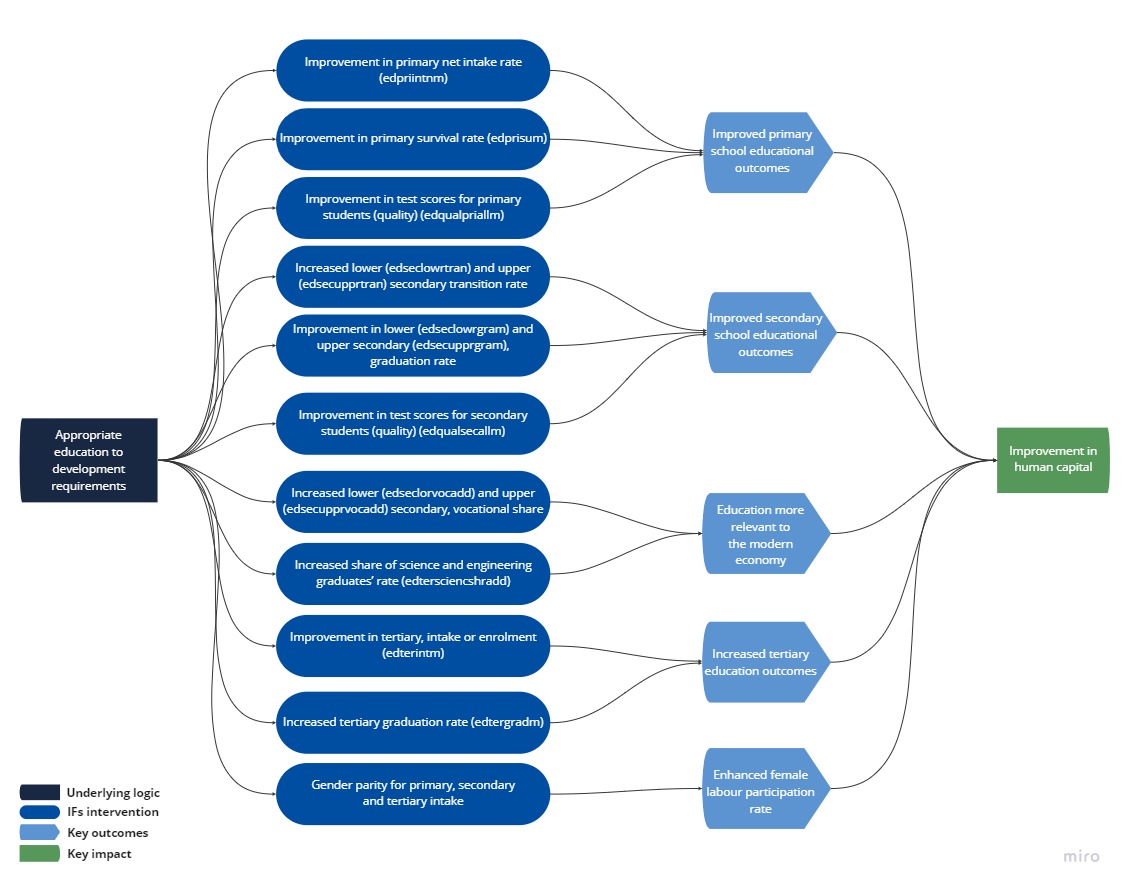

- Chart 15: Education scenario diagram

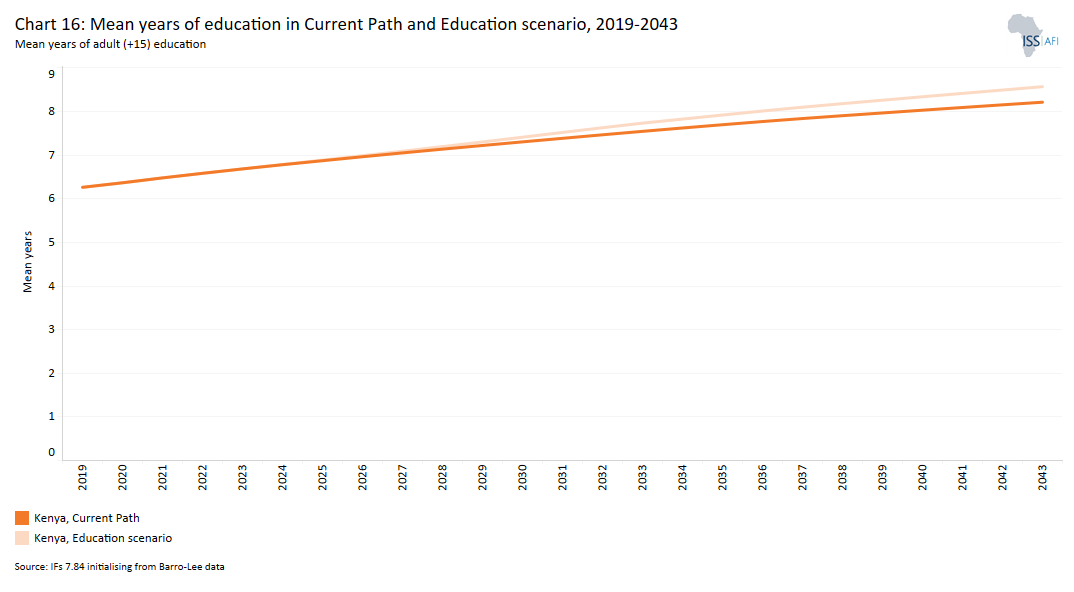

- Chart 16: Mean years of education in Current Path and Education scenario, 2019–2043

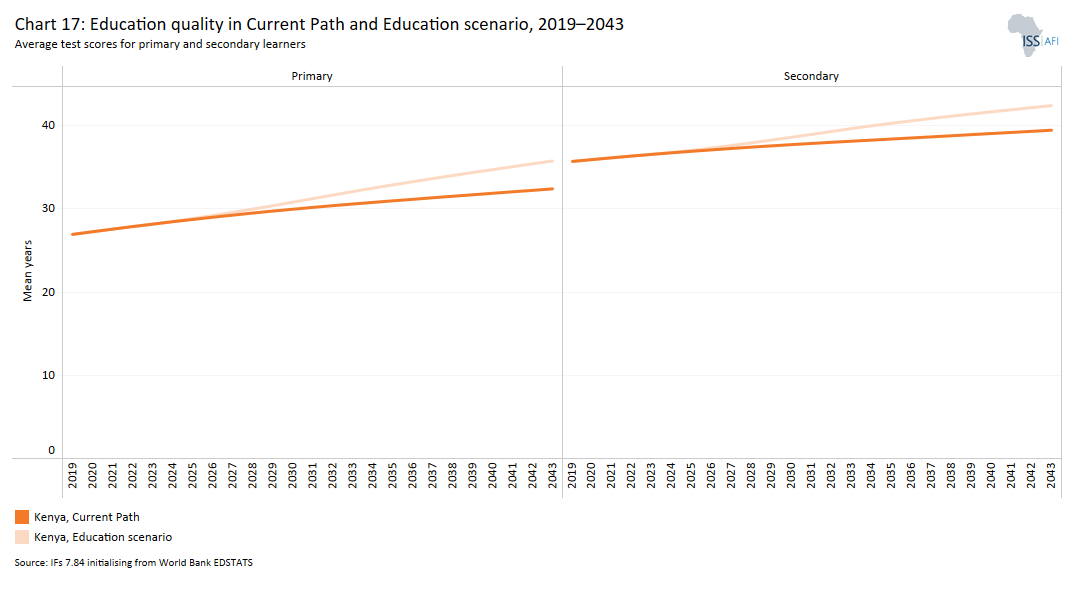

- Chart 17: Education quality in Current Path and Education scenario, 2019–2043

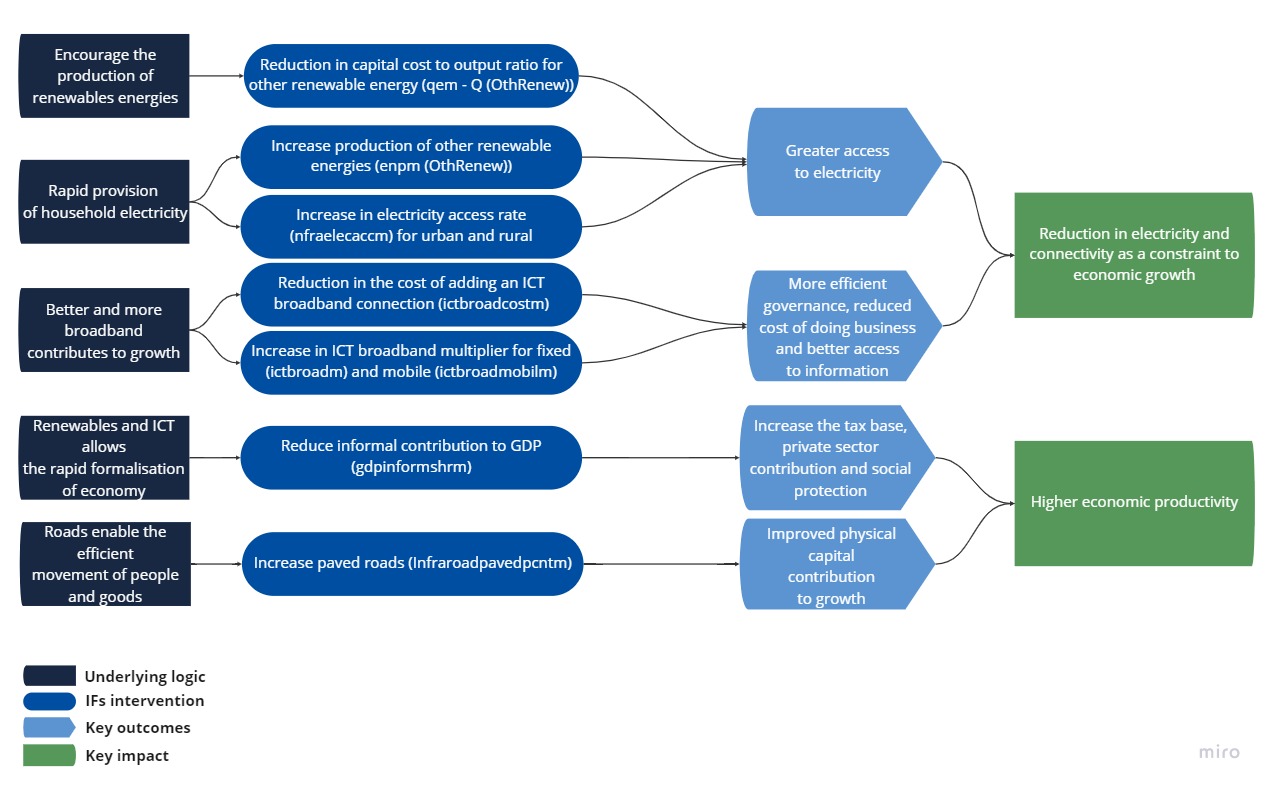

- Chart 18: Infrastructure and Leapfrogging scenario diagram

- Chart 19: Electricity access in Current Path and Infra/Leapfrogging scenario, 2019–2043

- Chart 20: Cook stove usage by type Current Path and Infra/Leapfrogging scenario, 2019 and 2043

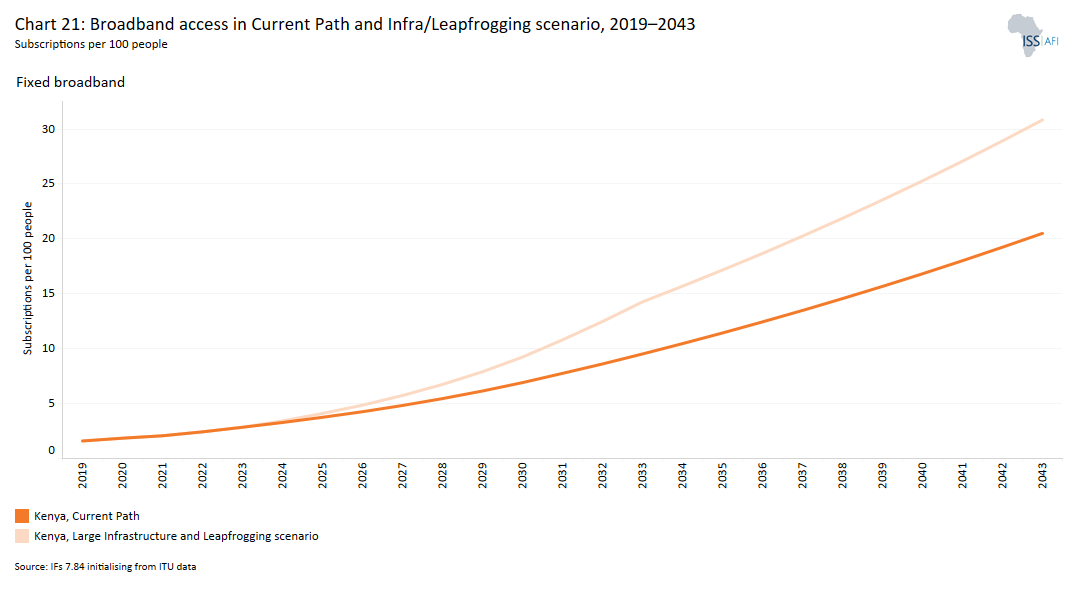

- Chart 21: Broadband access in Current Path and Infra/Leapfrogging scenario, 2019–2043

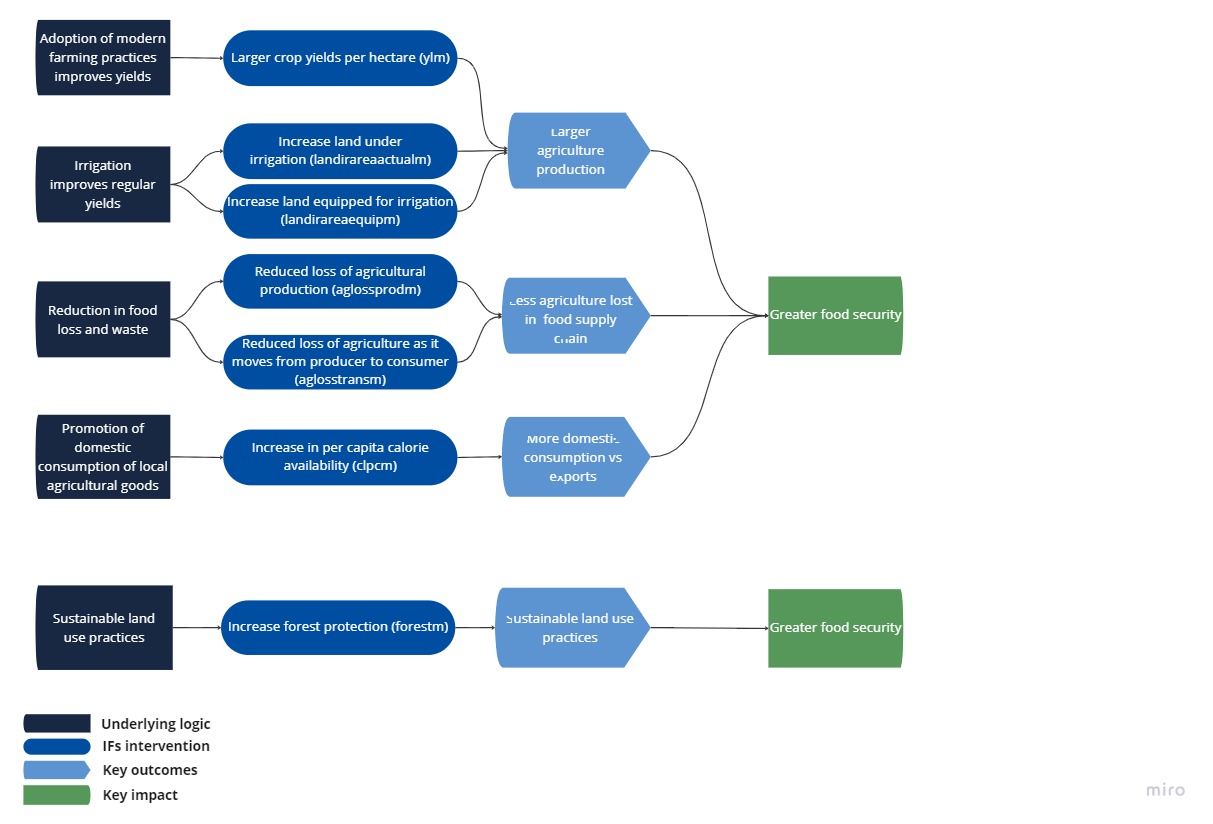

- Chart 22: Agriculture scenario diagram

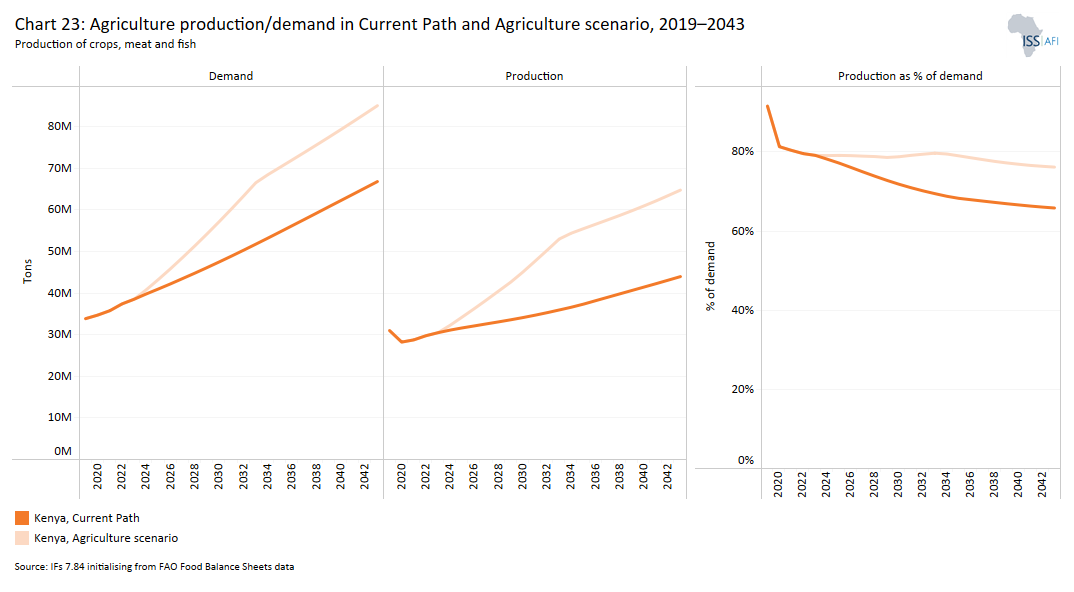

- Chart 23: Agriculture production/demand in Current Path and Agriculture scenario, 1990–2043

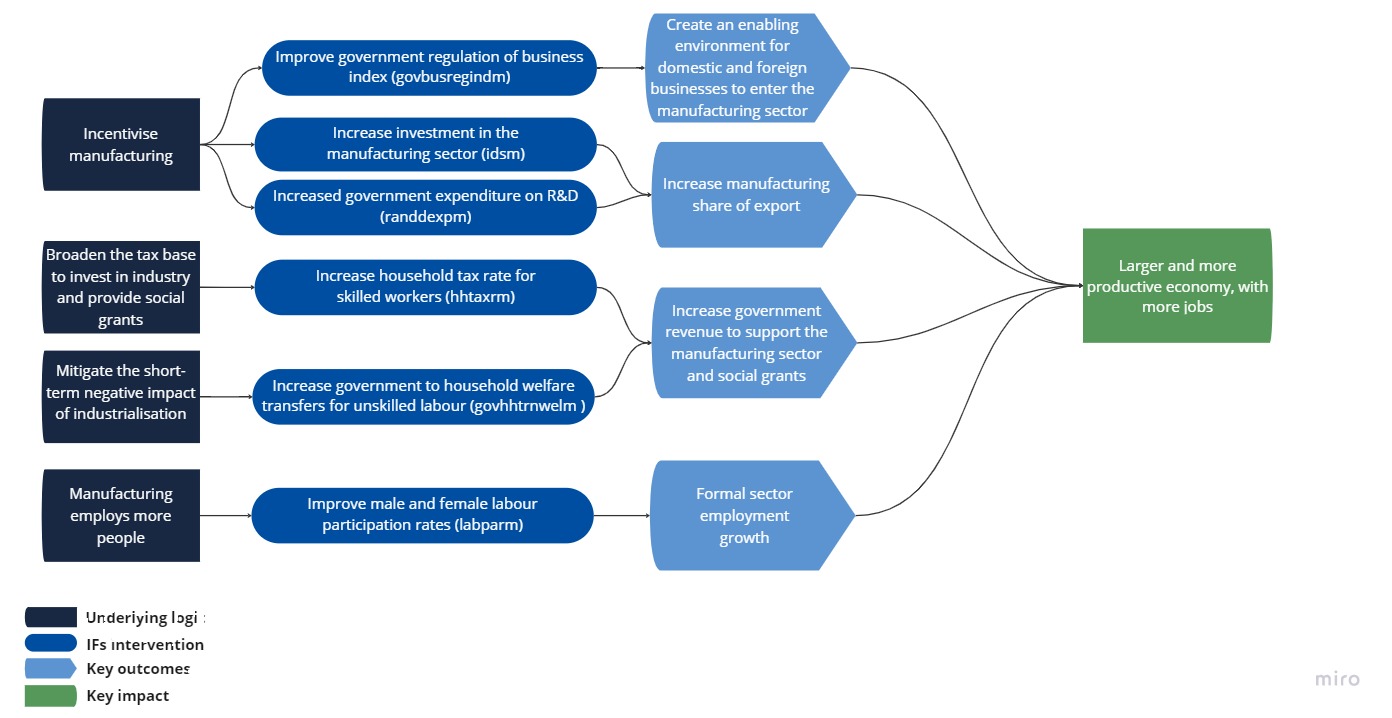

- Chart 24: Manufacturing scenario diagram

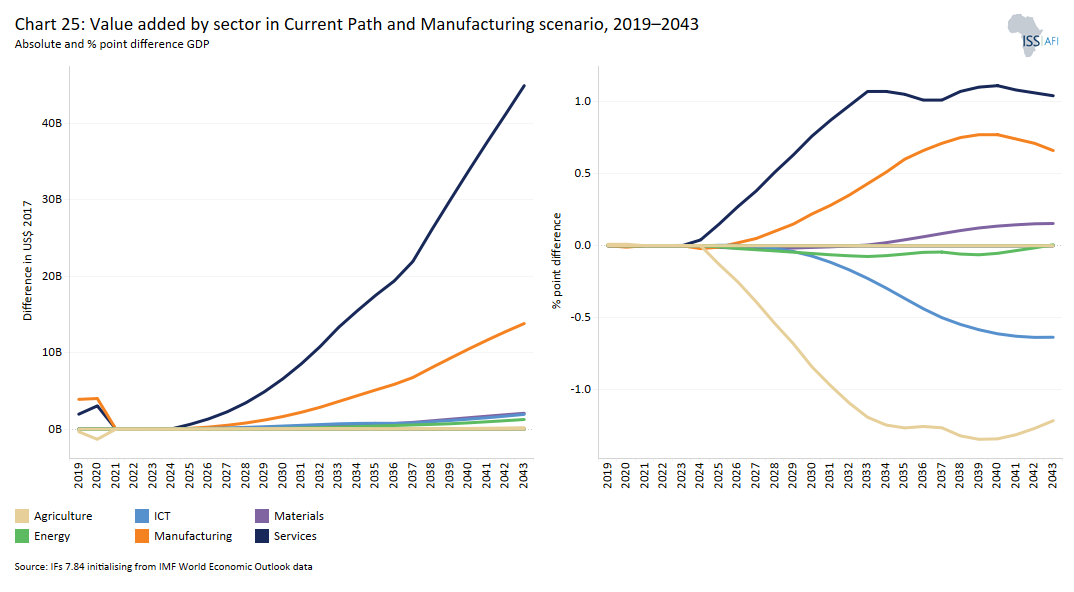

- Chart 25: Value added by sector in Current Path and Manufacturing scenario, 2019–2043

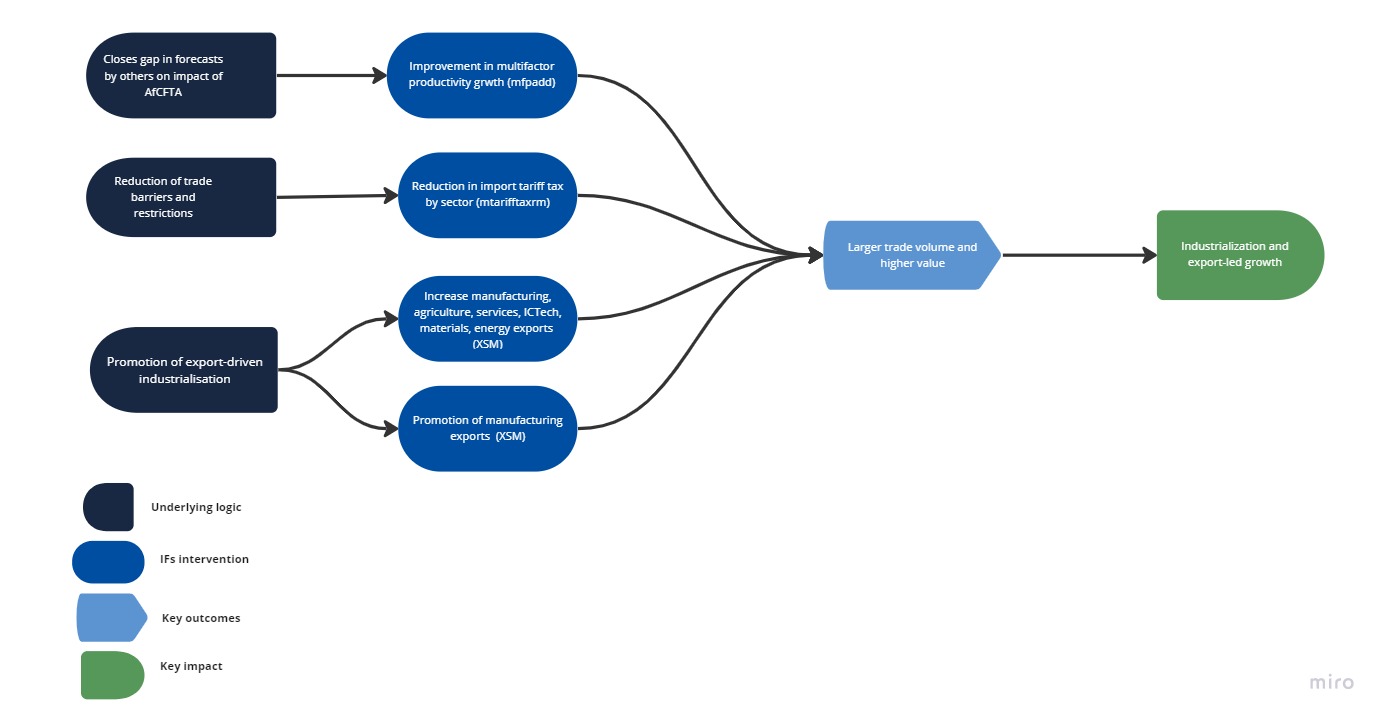

- Chart 26: AfCFTA scenario diagram

- Chart 27: Trade openness in Current Path and AfCFTA scenario, 2019–2043

- Chart 28: Trade balance in Current Path and AfCFTA scenario, 2019–2043

- Chart 29: Financial Flows scenario diagram

- Chart 30: Foreign aid in Current Path and Financial Flows scenario, 2019–2043

- Chart 31: Inflow of FDI in Current Path and Financial Flows scenario, 2019–2043

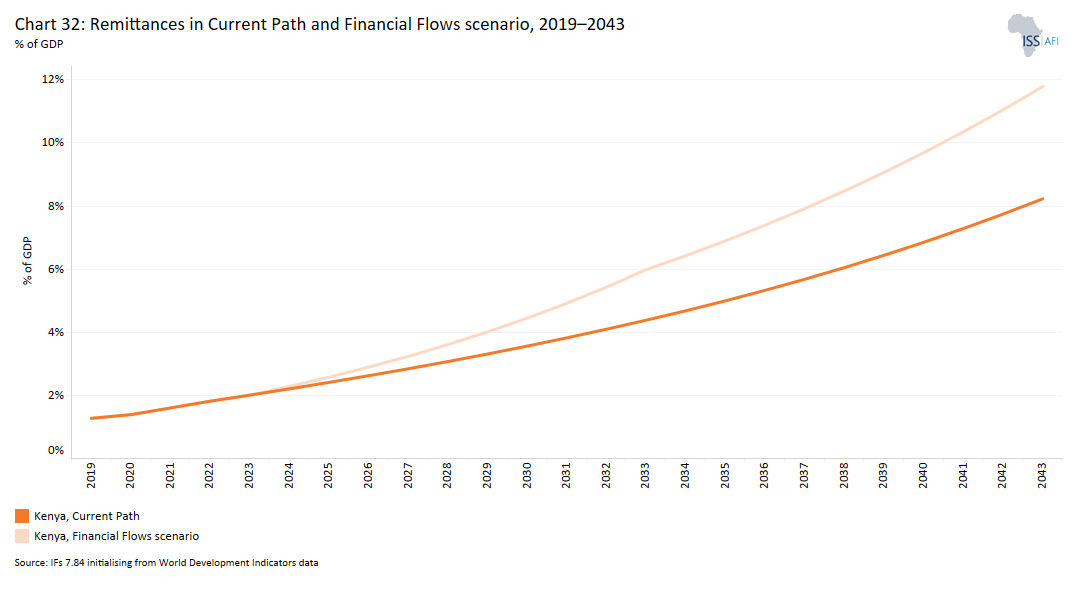

- Chart 32: Remittances in Current Path and Financial Flows scenario, 2019–2043

- Chart 33: Governance scenario diagram

- Chart 34: Composite governance index in Current Path vs Governance scenario, 2019-2043

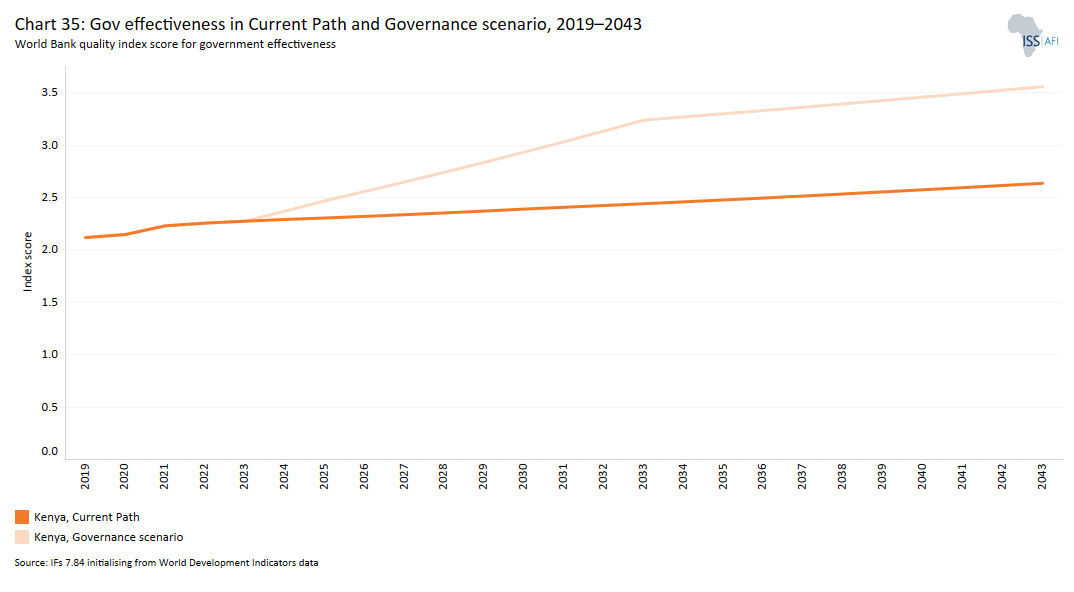

- Chart 35: Gov effectiveness in CP and Governance scenario, 2019–2043

- Chart 36: GDP per capita in Current Path and scenarios, 2019–2043

- Chart 37: GDP per capita in Current Path and Combined Agenda 2063 scenario, 2019–2043

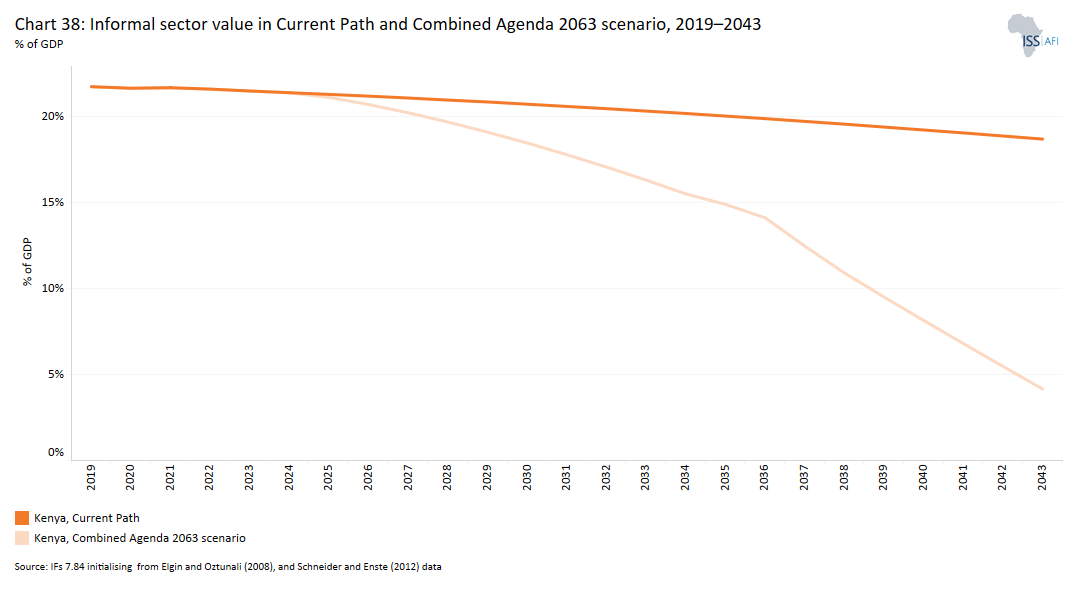

- Chart 38: Informal sector value in Current Path and Combined Agenda 2063 scenario, 2019–2043

- Chart 39: Poverty in Current Path and scenarios, 2019–2043

- Chart 40: Poverty in Current Path and Combined Agenda 2063 scenario, 2019–2043

- Chart 41: Domestic Gini index score in Current Path and Combined Agenda 2063 scenario, 2019–2043

- Chart 42: Carbon emissions in Current Path and scenarios, 2019–2043

- Chart 43: Carbon emissions in Current Path and Combined scenario, 2019–2043

- Chart 44: Recommendations

Kenya: Background

Download to pdfKenya, a lower middle-income country in East Africa, is bordered by South Sudan to the north-west, Ethiopia to the north, Somalia to the east, Uganda to the west, Tanzania to the south, and the Indian Ocean to the south-east. As a member of the Intergovernmental Authority on Development (IGAD), the East African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA), Kenya is a critical commercial hub on the continent. Its economy is the largest in East Africa and the third largest in sub-Saharan Africa.

Kenya gained independence in 1963 and became a republic a year later with Jomo Kenyatta becoming the first president after his release from detention. In 1966, an opposition party, the Kenya People’s Union (KPU), was formed, but it was banned shortly after and its leaders were arrested. This made the country a de facto one-party state, legally confirmed as such by the national assembly in June 1982. In 1991, the Parliament of Kenya annulled the one-party constitutional provision which paved the way for multiparty elections and democracy. Consequently, the country transitioned to a multiparty political system in 1992, with elections held every five years. From then, Kenya was relatively peaceful and stable, until the political crises in 2007/08 after former president Mwai Kibaki was declared the winner of the disputed presidential election. This led to reforms with the promulgation of the 2010 constitution that established a bicameral legislature, devolved the country’s executive government and instituted a tenured judiciary and the Independent Electoral and Boundaries Commission (IEBC).

The country covers an area of 580 367 km2 and had a population of about 47.6 million in 2019. Its geography and climate vary widely, including cold, snow-capped mountaintops, vast forests with abundant wildlife, fertile agricultural regions and temperate climates in the western and Rift Valley counties, and arid and semi-arid areas that are less fertile. Administratively, Kenya is divided into 47 semi-autonomous counties that are headed by governors. The capital of Kenya, and its largest city, is Nairobi, but there are also other significant and large cities, such as Mombasa (the oldest city and original capital), Kisumu City and Nakuru city. The official languages of the country are English and Swahili, although there are a number of ethnicities, each with their own language.

Kenya has titanium, gold, and coal deposits as well as copper, niobium, manganese, oil and gas reserves. It also holds other natural and mineral resources such as zinc, soda ash, salt, limestone, gemstones, gypsum, fluorspar, diatomite, thermal and wind power. The country produces agricultural commodities such as maize, tea, coffee, rice, wheat, sugar, livestock, cut flowers and vegetables. Resultantly, its principal exports include tea, cut flowers, refined petroleum, vegetables and coffee.

The Kenya Vision 2030 launched in 2008 is the long-term development blueprint for the country. It is an aspirational development plan aimed at transforming Kenya into ‘a newly industrializing, middle-income country providing a high quality of life to all its citizens by the 2030.’ Prior to the adoption of Vision 2030, the country pursued the Economic Recovery Strategy for Wealth and Employment Creation that was credited with increasing GDP growth from 0.6% in 2002 to about 7.1% in 2007.

Vision 2030 is anchored on three main pillars: economic, social and political. The economic pillar is to improve the prosperity of all Kenyans through an economic development programme that will achieve an average GDP growth rate of 10% per annum starting in 2012. The social pillar seeks to attain a ‘just and cohesive society with social equity in a clean and secure environment,’ while the political pillar endeavours to ‘realize a democratic political system founded on issue-based politics that respects the rule of law and protects the rights and freedoms of every individual in Kenyan society.’

Each of the three pillars is made up of several sectors with a number of ‘flagship projects’ underpinning them. The economic pillar focuses on structural transformation of the economy and infrastructure development. The social pillar focuses on increasing access to basic social services including education, health, and water and sanitation facilities with emphasis on marginalised and vulnerable groups such as women and the youth. The political pillar focuses on the public sector which has already led to the promulgation of a new constitution. The Medium Term Plans (MTPs) outlined detailed plans for each sector under each pillar for five years. Vision 2030 further recognises reforms in eight key strategic sectors expected to ‘form the foundation of society for socio-political and economic growth.’ These include macroeconomic stability; infrastructure; energy; science, technology and innovation; land reform; human resources development; security; and public sector reforms.

The Vision 2030 is linked to the Millennium Development Goals (MDGs) and the Sustainable Development Goals (SDGs). It is also aligned with the African Union’s Agenda 2063 framework. The Vision 2030 is to be implemented in phases through successive five-year MTPs. The first MTP (MTP1) was implemented from 2008 to 2012, the second (MTP2) from 2013 to 2017, and the third (MTP3) from 2018 to 2022. Under the first two MTPs, the country made significant progress in growing the economy and reducing extreme poverty. Between 2010 and 2019, the economy grew at an average of 5%. Likewise, according to the 2015/16 Kenya Integrated Household Budget Survey, poverty levels (at US$1.90) declined from 46% in 2005 to 36.1% in 2015. The country moved from 129th position in 2013 to 61st position in 2019 on the World Bank Ease of Doing Business report. However, despite this progress, the economy still faces a number of challenges.

The MTP3 was launched in December 2017 by then President Uhuru Kenyatta and is based on the ‘the Big 4 Agenda’, which seeks to prioritise interventions in manufacturing, food and nutrition security, and health and affordable housing. It seeks to build on the progress of the MTP1 and the MPT2 by achieving an economic growth rate of 7% at the end of the implementation period. According to the MTP3, critical challenges facing the country include overreliance on rainfall for agriculture, low manufacturing and export growth, persistent trade and balance of payment deficit, low investment, high unemployment rates, high cost of doing business, high energy cost, increasing cost of living, and high food prices. The World Bank also identifies the key development challenges of the country that include high levels of poverty and inequality, weak private sector investment, corruption, climate change, and susceptibility to internal and external shocks.

Like all other economies, the COVID-19 pandemic greatly affected the Kenyan economy. In 2020, the economy shrunk by 0.3% from the 5% growth rate it recorded in the previous year. With declining revenue and increased government expenditure, total public debt grew from 59.5% of GDP in 2019 to 65.8% in 2020 with a fiscal deficit of 7.9%. This put the country at the risk of debt distress with rising debt servicing costs. The current account deficit also widened to 5.2% of GDP in 2021 due to the rising trade deficit and is expected to deteriorate further as a result of higher food and fuel import bills. Likewise, a rising inflation rate, due to the Ukraine–Russian war, has resulted in skyrocketing prices for crude oil and other essential imports to Kenya. Nonetheless, the economy has shown signs of recovery with an estimated growth rate of 7.5% in 2022 and forecasted growth of 6.5% for 2023 and 6.9% in 2024. With the resumption of the IMF-supported fiscal consolidation and debt management programme, the fiscal deficit is expected to reduce in the coming years.

Kenya: Sectoral analysis

Download to pdf- Scenarios diagram

- Demographics and Health: Current Path vs scenario

- Education: Current Path vs scenario

- Infrastructure/Leapfrogging: Current Path vs scenario

- Agriculture: Current Path vs scenario

- Manufacturing: Current Path vs scenario

- Free Trade: Current Path vs scenario

- External Financial Flows: Current Path vs scenario

- Governance and Stability: Current Path vs scenario

This section provides an overview of the key characteristics of Kenya along its likely (or Current Path) development trajectory and the impact of a single positive scenario in eight separate sectors.

The Current Path forecast from the International Futures forecasting (IFs) platform is a dynamic scenario that imitates the continuation of current policies and environmental conditions. The Current Path is, therefore in congruence with historical patterns and produces a series of dynamic forecasts endogenised in relationships across crucial global systems.

The eight sectoral scenarios are on: Governance and Stability, Demographics and Health, Education, Infrastructure/Leapfrogging (consisting of the impact of renewables, ICT and the more rapid formalisation of the informal sector), Agriculture, Manufacturing, Free Trade (the implementation of the African Continental Free Trade Area), and External Financial Flows (consisting of aid, foreign direct investment, remittances and a proxy on illicit financial flows). The interventions in each scenario are benchmarked to present an ambitious but reasonable aspiration for countries at similar levels of development.

Kenya’s population more than doubled between 1989 and 2019, increasing from 21.4 million people to 47.6 million in 2019 with an inter censual growth rate averaging 2.2%. In 2019, Kenya was the third most populous country in East Africa and the seventh most populous in Africa. On the Current Path, the population of the country is projected to rise to 65.1 million in 2030 and to 80.5 million by 2043, equivalent to an increase of 53%. Although Kenya’s population growth rate declined from 3.4% per annum in 1990 to 2.0% in 2019 and is set to decline to 1.3% by 2043, population growth is still rapid because of the country’s youthful population. In 2019, 39.2% of Kenya’s population was below the age of 15 years, 58.4% in the age group 15–64 years (working-age group) and 2.4% for the age group 65 years and older. Compared with 1990, the structure of Kenya’s population has not fundamentally changed over the past three decades.

Kenya’s youth bulge (the portion of its adult population below 29 years of age) stood at about 48% — a fall from 53% in 1990 and slightly higher than the average for Africa at 46.5%. The median age for Kenya in 2019 was 19.3 years — an increase from 15.5 years recorded in 1990 and almost equal to Africa’s median of 19.7 years. Clearly, this reveals the youthful nature of Kenya’s population. The large youth bulge will continue to pose challenges to Kenya's development. In 2016, the unemployment rate of people between 15 and 24 years was five times the national rate, with an annual influx of an estimated 800 000 people into the labour market. Kenya’s large youthful population, combined with significant rates of unemployment, could be a catalyst for potential instability in the country.

By 2043, the median age is expected to increase to 27.6 years, and the youth bulge will decline to 32.4%. Consequently, the proportion of people under the age of 15 will decline to 28% while the share of the working population and the population aged 65 and older increase to 66.2% and 6%, respectively, by 2043. This will be made possible by the expected decline in fertility emanating from urbanisation, better education and increased access to improved contraceptives over the forecast period, among other measures. Access to modern contraceptives by women of child-bearing age is expected to increase from 62.2% in 2019 to 70.4% in 2030, meaning that the country will miss the SDG target 3.7.1 of ensuring universal access to modern family planning methods by women of reproductive age.

Family planning injections are the commonly used method of contraception among Kenyan women. In 2021, over 2.4 million women used the family planning injections, followed by implant insertion which was used by over 800 000 women in the same year. Other commonly used methods of contraception include combined oral contraceptive pills, intrauterine contraceptive device insertion, progestin-only pills, sterilisation bilateral tubal ligation, and sterilisation vasectomy. By 2043, access to contraceptives by women of child-bearing age will rise to 81.4%. As a result, Kenya’s total fertility rate will fall more rapidly than the average for lower middle-income countries in Africa, from 3.4 births per woman in 2019 to 2.2 by 2043.

With a total land area of approximately 580 367 km², Kenya was the sixth most densely populated country in East Africa and the 18th most densely populated country in Africa in 2019. Its estimated population density of 0.92 people per hectare in 2019 was higher than the average for Africa, at 0.44 people per hectare, and East Africa, at 0.62 people per hectare.

The capital, Nairobi, is the largest city in the country, with an estimated population of about 3 million people. The county of Nairobi has a population density of 4 515 people/km2, followed by Mombasa (4 292 people/km2) as most migrants move to settle in the Nairobi and Mombasa centres. For instance, in 2019, 48.4% of recent migrants moved to Nairobi and 12.5% moved to Mombasa. In contrast, the county of Marsabit which is the least densely populated has a population of only approximately 290 000 people.

The population of Kenya is predominantly rural. In 1990, 19.8 million Kenyans, constituting 83.3% of the total population, lived in rural areas. By 2019, this figure had declined to about 72.4%, equivalent to 38.1 million people, far above the average of 57.1% for Africa in the same year. Consequently, the urban population stood at 27.6% in 2019, making Kenya the 10th least urbanised country in Africa and the sixth least urbanised country out of the 12 countries in the Horn of Africa/East Africa. It means that Kenya has experienced a slower rate of urbanisation than most African countries. The country is still struggling to keep pace with its urbanisation rate as there are high rates of informality in urban areas. For instance, about 250 000 people live in Kibera, a densely populated slum in the capital Nairobi.

Even by 2043, the country will not achieve rural–urban parity, with 59.2% of its population expected to still be living in rural areas. Urbanisation is, however, speeding up and the urban population is expected to reach 40.8% in 2043. By then, Kenya will be the 15th least urbanised country in Africa having overtaken Mauritius, Sudan, Lesotho and Comoros. This expected rapid urbanisation will place significant pressure on housing, social amenities and service delivery in the urban centres. Some of the drivers of urbanisation in Kenya include the pursuit of employment and social amenities, which are more readily available in urban areas.

The Demographic and Health scenario consists of reasonable but ambitious reductions in the communicable and non-communicable-diseases mortality, the disease burden for children under five, and the maternal mortality ratio. The scenario also provides for increased access to modern contraception, as well as improvements in access to safe water and better sanitation. The effect on this scenario is an improvement in important health outcomes such as infant mortality and life expectancy as well as the demographic dividend in Kenya.

Demographers typically differentiate between a first, second and even a third demographic dividend. Given Kenya’s youthful population structure, the study focuses on the first dividend. There are different ways to conceptualise the first demographic dividend. For example, studies have shown that a promising demographic window occurs when less than 30% of the population falls within the age of 0 to 14 years (children) while those 65 years and older (elderly people) make up less than 15%. Alternatively, a demographic dividend arises when a country attains an average median age of between 26 and 41 years. The study uses the ratio of working-age persons to dependants, i.e. the size of the labour force (between 15 and 64 years of age) relative to dependants (children and the elderly).

A window of opportunity opens when the ratio of the working-age population to dependants is at least 1.7 to 1, meaning that there are 1.7 working people for every dependent person. When there are fewer dependants to take care of, resources made available for investment in both physical and human capital formation, and eventually female labour force participation increases. Studies have shown that about one-third of economic growth during the East Asia economic ‘miracle’ can be attributed to the large worker bulge and a relatively small number of dependants. However, growth in the working-age population relative to dependants does not automatically translate into rapid economic growth unless the labour force acquires the needed skills and is absorbed by the labour market. Without sufficient education and employment generation to successfully harness their productive power, the growing labour force (especially in urban areas) could increasingly become frustrated with the lack of job opportunities leading to social tension and even the emergence of civil instability.

In 2019, the ratio of the working-age population to dependants in Kenya was 1.4 to 1, which means that, on average, there were only 1.4 persons of working age (15–64 years of age) for every dependant in Kenya. This is low but higher than the average of 1.32 to 1 for lower middle-income countries in Africa. In the Current Path forecast, Kenya will achieve the minimum ratio of 1.7 to 1 for a demographic dividend by 2030, the end of its Vision 2030, after which it enters a potential period of higher economic growth given its larger labour force relative to dependent children and elderly people. By 2043, the ratio of the working-age population to dependants is projected to be 2 to 1 on the Current Path. Kenya should achieve its peak demographic dividend in around 2058.

In the Health and Demographic scenario, Kenya will achieve the minimum ratio of 1.7 working-age persons to 1 dependant for a demographic dividend by 2029, after which it enters a potential period of higher economic growth given its larger labour force relative to dependants. By 2043, the ratio of the working-age population to dependants is projected to be 2.35 to 1 in the Health and Demographic scenario. This will be 20% higher than the Current Path forecast and 48% more than the projected Current Path average of 1.59 for lower middle-income countries in Africa.

The Kenya Vision 2030 aims to offer equitable, affordable and quality healthcare of the highest standards to all citizens. One of the initiatives under the Universal Health Coverage, as part of the Big 4 Agenda in the MTP3, is to implement programmes that will lead to increased health insurance coverage and increased access to quality but affordable healthcare services. The priorities of the MTP3 of achieving universal healthcare are supported by the Kenya Health Policy 2014–2030 and are also aligned to the attainment of SDG goal 3 on ensuring healthy lives and promoting well-being for all citizens. However, challenges such as corruption, shortages of essential medical equipment and medications, and healthcare worker strikes continue to plague healthcare delivery in the country.

Expenditure by the Kenyan government on healthcare as a percentage of GDP of 5.3% is above the average for lower middle-income African countries. Substantial allocations from international donors are included. The government’s health expenditure increased by 55% from 2012/13 to 2015/16, and the national health budget increased by 67% from 2012/13 to 2016/17. The total national government expenditure on health totalled KSh 94.5 billion (about US$945 million) and in 2020/21 financial year and increase by 16.6% to KSh 110.2 billion (US$110.2 million) in the 2021/22 financial year mainly driven by the 50.2% growth in development expenditure on health services.

This huge investment in the health sector has impacted positively on the country’s health infrastructure and outcomes. There are different levels of health infrastructure in Kenya. In 2021, the basic infrastructure facilities (level 2), consisting of dispensaries, medical clinics and stand-alone clinics, constituted 77.4% of all health facilities. Level 3 facilities, also comprising medical centres, health centres and nursing homes, accounted for 16% of all health facilities, while hospitals, which are level 4 (primary care hospitals), level 5 (secondary care hospital) and level 6 (referral hospitals) facilities, accounted for the remaining facilities. Between 2005 and 2012, the country constructed over 1 500 healthcare facilities and increased the number of clinics from 6 200 to about 8 500. The national average healthcare facility density increased from 1.9 healthcare facilities per 10 000 people in 2013 to 2.2 health facilities per 10 000 people in 2016. Also, the introduction of free maternal care in public healthcare facilities reduced maternal mortality rates by 26% from 2013 to 2017 and increased hospital birth deliveries from 43% to 62%.

IFs uses the International Classification of Disease (ICD) to differentiate between three broad categories of diseases: communicable, non-communicable and injuries, as well as 15 subcategories of mortality and morbidity. Vision 2030 seeks to eliminate deaths from communicable diseases in Kenya, to reduce the prevalence of non-communicable diseases, to reduce exposure to health risk factors, and to strengthen collaboration with health sector providers. Between 2003 and 2019, deaths from communicable diseases declined from 227 400 to 139 000 per year. Non-communicable diseases caused about 100 000 deaths in 2019, while deaths from injuries stood at 21 000. Despite the rapid decline in the communicable disease burden, it is still the leading cause of death in Kenya and will remain so until 2024. With the rising cases of non-communicable diseases such as heart diseases, diabetes, cancer and hypertension in the country, from 2025 onwards non-communicable diseases will become the leading cause of death in Kenya such that by 2043, deaths from non-communicable diseases will be 258 300, while deaths from communicable diseases will drop drastically to 75 700. The transition to deaths from non-communicable diseases as the main cause of mortality will inevitably increase health sector costs as they are more expensive to treat.

Using the other 15 subcategories, death from other communicable diseases (e.g. Ebola virus disease and dengue fever) constitute the highest cause of death averaging 52 000 deaths in 2019. This was followed by deaths as a result of AIDS (43 000), of which mainly the youth and adolescents are infected, cardiovascular related diseases (28 000), other non-communicable diseases (24 000) and malaria (5 000). The reduction in deaths as a result of malaria is due to the interventions that the government has put in place over the years to prevent malaria prevalence and mortality. For instance, from 2013 to 2016, government provision of long-lasting treated mosquito nets increased from 1.7 million nets to 7.3 million. Similarly, the proportion of pregnant women and children sleeping under mosquito nets increased from 36% in 2010 to 58% in 2015, and children sleeping under mosquito nets increased from 39% to 56% in the same period. By 2043, cardiovascular disease is expected to be the leading cause of death in the country, followed by AIDS and malaria.

Access to improved, safe, treated water, such as piped water, is an important means of preventing the spread of communicable diseases. Since 1980, Kenya has battled 16 cholera outbreaks that have affected an estimated 81 000 people with the most recent cases occurring in 2016, 2017 and 2019. As a result, the country has made efforts to ensure access to safe water for all citizens. In 2019, 36.8 million Kenyans (65.5% of the population) had access to safe water. More than a third (34.2%) of the households relied on piped water as a source of drinking water. Out of this, about half constituted access to piped water supply in the country. By 2043, it is projected that access to improved water will increase to about 82% of which piped water will constitute almost 60% connections. Over 58.6% of Kenyans (30.7 million people) had access to improved sanitation in 2019, while the share of the population with access to shared sanitation amounted to 34.1%. The percentage of the population with improved access to sanitation is estimated to rise to 75.2% by 2043.

The infant mortality rate is the number of infant deaths per 1 000 live births and is an important marker of the overall quality of the health system of a country. According to the Kenya Demographic Health Survey of 2014, the infant mortality rate declined from 52 deaths per 1 000 live births in 2008 to 39 deaths per 1 000 live births in 2014. In 2019, the infant mortality rate in Kenya was 35.5 deaths per 1 000 live births, a decline from the almost 65 deaths per 1 000 live births in 1990. This was 40% lower than the average of 43.4 deaths for lower middle-income countries in Africa. It was also below the averages for Africa and East Africa estimated at 40.5 deaths per 1 000 live births and 44.7 deaths per 1 000 live births, respectively. Pneumonia, malaria, diarrhoea and undernutrition are leading causes of child mortality in Kenya.

Migori county recorded the highest infant mortality with 67.2 deaths per 1 000 live births, followed by Homa Bay with 57.5 deaths per 1 000 live births. The county with the lowest infant mortality rate is Laikipia with 17.3 deaths per 1 000 live births, followed by Tharaka-Nithi with 18.5 deaths per 1 000 live births. On the Current Path, the infant mortality rate is expected to decline further, reaching 21.9 deaths per 1 000 live births by 2030 and 14.8 deaths per 1 000 live births by 2043.

In addition, the Health and Demographic scenario will reduce Kenya’s infant mortality rate to 16.4 deaths per 1 000 live births in 2030 and to 9.3 deaths per 1 000 live births by 2043. It means that Kenya will achieve the SDG target of 12 deaths per 1 000 live births by 2035 in this scenario. This is about six fewer deaths per 1 000 live births than in Kenya’s Current Path forecast and 21 fewer deaths than the Current Path average for lower middle-income countries in Africa.

Life expectancy measures the average lifespan of individuals in a country. In 2019, the average life expectancy at birth in Kenya was 63.6 years, which was about 2.4 years higher than the average for Africa and a year higher than the average for its income peers in Africa. Women in Kenya generally have 5.9-year longer life expectancy (66.5 years) than men (60.6 years). This relatively higher life expectancy can be explained by the country’s success in reducing deaths due to communicable diseases. There are, however, variances at the county level. The lowest life expectancy at birth for males was recorded in Homa Bay and Migori at 50.5 years, while Tana River county recorded the lowest life expectancy for females at 58.6 years. Nyeri county recorded the highest life expectancies for both males and females at 66.4 years and 75.8 years, respectively.

On the Current Path, life expectancy will increase to 72.4 years by 2030 and to 75.7 years by 2043, which will both be higher than Africa’s average and the average for lower middle-income African countries. Women will continue to have a higher life expectancy than men by 2043. By then, life expectancy for women will be about 6 years higher than for men

In the Health and Demographic scenario, life expectancy will increase to 77.1 years by 2043, which will be 1.5 years higher than the country’s Current Path forecast and about four years higher compared with the Current Path average of 73.1 years for lower middle-income African countries. In both the Current Path forecast and the Health and Demographic scenario, women will continue to have a higher life expectancy than men by 2043. By then, life expectancy for women will be 5.8 years more than for men.

Education is one of the main sectors under the social pillar of Vision 2030. The education sector comprises basic education, vocational and technical training, post-training and skills development, and university education subsectors. According to the MTP3, the main priorities of the education sector are making the right to free and compulsory basic education a reality, advancing post-basic education, improving the quality and relevance of education, incorporating information and communication technologies (ICT) into teaching and learning, and increasing education financing.

For over 30 years, Kenya’s education system followed the 8-4-4 learning model comprising eight years of primary education, followed by four years of secondary education and an additional four years of tertiary education. In 2018, Kenya moved to the 2-6-6-3 learning model (two years of pre-primary, six years of primary, six years of secondary and three years of tertiary education). Free universal basic education was instituted in 2003 and, subsequently, free secondary education was introduced in 2008. In addition, various efforts have been made to improve education infrastructure in Kenya. The number of primary schools increased from 28 026 in 2013 to 35 442 in 2017. Likewise, the number of secondary schools also grew from 7 834 to 10 655 in the same year.

The total number of schools at the basic level stood at 89 747 in 2021, an increase of 1.4% from 2020. Out of this, 46 671 were pre-primary schools, 32 594 were primary schools and 10 482 were secondary schools. In addition, there were 2 396 technical and vocational education and training (TVET) institutions, consisting of 1 244 vocational training institutions, 1 140 technical and vocational colleges and 12 national polytechnics. There were a total of 65 universities in 2021, comprising 33 private universities and 32 public universities. The government continues to invest in education in order to improve educational outcomes. For instance, total education sector expenditure for the 2020/21 financial year stood at KSh 472.4 billion (about US$472.4 million) and is expected to increase by 2.9% for the 2021/22 financial year.

The huge investments in the education sector over the years have resulted in improved access to primary and secondary education. For instance, enrolment increased by 1.3 million learners after the introduction of free basic education in 2008. In 2019, the gross enrolment rate for primary school learners was 103% and net primary enrolment stood at 80.4%. This is an improvement from 93.2% and 63.7%, respectively, recorded in 2000. Both gross and net primary enrolment for females are slightly higher than for males. On the Current Path, while gross primary enrolment is set to slightly decline reaching 101.5% in 2043, net enrolment will increase to 93.6% in the same period. The primary completion rate stood at almost 99.4% in 2019 meaning that the overwhelming majority of learners enrolled in primary school in Kenya successfully completed the last year of primary education. On the Current Path, the primary completion rate is expected to rise to 101.5% by 2043.

Gross secondary school enrolment rose from 38.8% in 2000 to 68% in 2019 and net secondary school enrolment increased from 33.4% to 50.3% in the same period. By 2043, gross and net secondary enrolment rates are expected to increase to 76.8% and 68.9%, respectively. While the primary completion rate is very high in Kenya, the secondary completion rate stood at just 25.5% in 2019, up from 10.3% recorded in 2000. By 2043, it is expected that only 38% of the Kenyan population will have attained secondary education.

Despite the significant strides made in primary and secondary enrolment, the education sector in Kenya is still confronted by a number of challenges, especially at higher levels. Challenges such as inadequate funding, a shortage of teaching and learning materials, an insufficient number of teachers, inadequate educational infrastructure and low teacher remuneration still need to be addressed. As of 2019, gross tertiary enrolment was 12.4%, a huge improvement on the paltry 2.7% in 2000. Gross tertiary enrolment is projected to reach 25% by 2043. Even with this, only about 7.5% of Kenyans had graduated from a tertiary institution with at least a first degree in 2019. Merely 10.6% of these constituted graduates with a science and engineering background, which is considered key to the future of work. To increase enrolment in higher education, especially for science and technology, the government has been sponsoring students to the universities and TVET institutions. In 2021, the number of students sponsored by the government in this regard increased by 21.9% to 265 095 students. Out of these, 48.3% were students placed in the universities to read various degree programmes and the remaining placed in various TVET institutions to read diploma, certificate and artisan courses.

The Education scenario represents reasonable but ambitious improvements in the intake, transition and graduation rates from primary to tertiary levels of schooling and increases in the quality of education. It also models substantive progress towards gender parity at all levels, additional vocational training at secondary school level, and increases the number of science and engineering graduates.

In 2019, the mean years of adult education in Kenya was estimated to be 6.3 years, which was a year lower than the average of 7.3 for lower middle-income countries on the continent. In terms of gender parity, the mean years of education for males was 6.8, one year more than for females. However, this gap is lower than the average of 1.3 years for lower middle-income countries in Africa, meaning that Kenya has performed relatively better at closing the gender gap. In the Education scenario, the mean years of adult education will rise to 8.6 by 2043, which will be equal to the average for lower middle-income countries in Africa and 0.4 years more than on the Current Path forecast. By 2043, males are expected to have 0.7 more years of education than females in both the Current Path forecast and the Education scenario. This will be on par with the gap between males and females in lower middle-income African countries by then.

While access to education is important, the quality of education determines the human capital formation of the country. Quality education is usually measured by the student’s ability to pass their test. A critical contributor to student performance is the number and quality of teachers available. In 2021, there were 220 744 teachers in public primary schools, of which 83.5% were certificate holders, 8.4% had diploma qualifications, 7.9% had bachelor’s degrees and 0.2% had either master’s or doctorate degree qualifications. Primary education quality in Kenya was above the average for lower middle-income Africa and it is set to improve considerably. The average test score for primary learners in Kenya in 2019 was 34.3, slightly higher than the average of 33.1 for lower middle-income countries in Africa. On average, females in Kenya have a slightly higher primary test score than their male counterparts. The Education scenario will increase average test scores for primary learners to 47.4 in 2043 so that by then, the average will be 24.3% above the Current Path forecast. In addition, the quality of primary education in the Education scenario will be 33.6% higher than the Current Path average for lower middle-income African countries.

At secondary level, there were 120 279 teachers in public secondary schools and teacher training colleges in 2021. An overwhelming 96.6% of the teachers at the public secondary schools and teacher training colleges had bachelor’s degrees and 1.4% had either master’s or doctorate degrees. The remaining either held diploma qualifications or a Post Graduate Diploma in Education. The average secondary test score in Kenya was about 40.9, slightly below the average for its income peers on the continent at 41.4. There is no significant difference between the test scores of males and females. By 2043, the average test scores for secondary learners in the Education scenario will improve by 15% relative to the Current Path forecast and will be 21% higher than the Current Path average for lower middle-income countries in Africa.

Modern infrastructure can improve productivity, augment healthy lifestyles, boost educational outcomes and facilitate government effectiveness. Infrastructure development is positioned as a key enabler in the Vision 2030 strategy. Indeed, the MTP2 emphasises the need to enhance efficiency and competitiveness of the economy through investment in infrastructure.[1Republic of Kenya, Second Medium Term Plan 2013–2017: Transforming Kenya: Pathway to devolution, socio-economic development, equity and national unity, 2013] Physical infrastructure, such as roads and railways, is a critical driver of economic growth and an important component of development. It facilitates the movement of people, goods and services, promotes inter and intra-country trade and serves as an enabler of social service provision such as education and health.

The Kenyan government continues to make efforts to improve the road network in the country. A key achievement listed by the Kenyan government under the MTP2 was the construction or rehabilitation of 3 250 km of road from 2013 to 2017. In 2020/21, total national government expenditure on roads amounted to KSh 195.3 billion (US$195.3 million). Out of this, trunk[2A major road used for long distance connecting at least two cities, airports or ports. ] and primary roads expenditure accounted for 39%, and secondary and minor roads expenditure constituted 21.8% of total expenditure. The remaining amount was spent on miscellaneous roads and maintenance and repairs.

As a result, there are several ongoing road construction projects at various stages of completion. Key among them include Kenol–Sagana, Lokitaung Junction–Kalobeyei River, Kalobeyei River–Nadapal/Nakodok, Mau Mau Road Lot2 Murang’a, Mombasa–Kwa Jomvu Road, and Sagana–Marua. The government has also resorted to public–private partnership agreements to build more road networks. Through the public–private partnership arrangement, important roads such as the 108.4 km-Nairobi Expressway have been constructed at a total cost of KSh 72.8 billion (US$72.8 million). Other roads constructed under public–private partnership arrangement in the period include the upgrade of the Nairobi Eastern Bypass and the construction of the Makupa Causeway Bridge. Notwithstanding this progress, Kenya is still lagging behind in regard to the quality and reach of its road network.

In 2019, the total length of roads in Kenya was estimated to be 173 300 km of which only 13 440 km, or 7.8%, were paved. The length of paved international trunk roads in 2021 totalled 54 000 km, while paved national trunk roads totalled 56 000 km. At the same time, the length of super highways and primary paved roads in the country were 157 km and 75 000 km, respectively. On the Current Path, by 2043 the total road network in Kenya will increase to 221 227 km, of which 47.3% will be paved. The SDG Indicator 9.1.1 refers to the proportion of the rural population who live within 2 km of an all-season road and is captured in the Rural Access Index. In 2019, the proportion of Kenyans who lived within 2 km of an all-weather road was 63.8% compared with the 67.3% average for lower middle-income countries in Africa. Access to rural areas is essential for improving integration and interaction between rural and urban economies, which is important for spurring local economic development.

The R2000 and the R10000 programmes initiative serve as a means to improve and upgrade road networks in the country using local resources that are technically and economically feasible. Through these programmes, the national government, in partnership with county governments and other stakeholders, has developed rural roads across the counties. For instance, in 2021, a total of 2 712.5 km of roads were constructed under these programmes. Indeed, with the exception of Mombasa, Lamu and Nairobi City, all counties in the country had ongoing roads constructed under the R2000 and R1000 programmes between 2020 and 2021. By 2043, the proportion of the rural population with access to an all-weather road will improve slightly to 68.8%, which will be below the average of 73.6% for lower middle-income countries in Africa.

Kenya relies heavily on renewable energy for producing electricity, although total production is quite small. In 2015, it was estimated that geothermal and hydro energies constituted 46% and 39% of electricity production, respectively. The remaining energy sources were biofuels, oil and wind. By 2021, electricity generation from renewable sources accounted for 90% of all electricity in Kenya. The principal renewable energy source was geothermal generation, which accounted for 40.6%, followed by hydro generation at about 30% and wind generation at 16%. The remaining 10% was sourced from thermal sources, which is the only non-renewable electricity generation source in the country.

Total installed capacity for electricity in 2021 stood at 2 989.6 MW — a rise from 2 836.7 MW in 2020. The increased capacity was as a result of a rise in solar and hydro capacity. Similarly, total electricity generation increased by 7% in 2021 due to a 67.3% rise in thermal generation. The addition of the Kipeto Wind Power Project also increased wind electricity generation. Likewise, the addition of the Selenkei, Cedate and Malindi power plants to the grid also increased solar generation in 2021. There are still efforts to increase generation capacity with the expected completion of the Olkaria I Unit 6 geothermal power plant in 2022 and an additional six solar, geothermal and wind power plants from 2026 to 2030. Total domestic demand for electricity stood at 9 565.4 GWh in 2021, accounting for 98% of total electricity supplied. The growth in demand was as a result of a rise in demand for electric street lighting and rural electrification as well as demand for domestic and small commercial usage. Demand for domestic and small commercial usage accounted for 42.7% of total domestic demand, while commercial and industrial usage constituted 49.4% of domestic demand.

Aside from physical infrastructure, technological advancement is essential for economic growth. Technology improves productivity, and reduces transaction costs and bottlenecks associated with doing business. The ICT sector in Kenya boomed during the COVID-19 pandemic, just like in all other countries. As a result of the disruption in global supply chains emanating from COVID-19 pandemic restrictions, businesses and consumers resorted to online channels for commercial and recreational purposes. Resultantly, the value of output of the ICT sector grew by 6.9% in 2021 with a total of 420 licenced Internet service providers in Kenya. The country is more prepared than most in Africa to support and sustain e-commerce activity, ranking fourth in 2020 in UNCTAD’s B2C E-commerce Index, which measures an economy’s preparedness to support online shopping. However, an area of concern, which hampers online trade in the country, is Internet access, a metric the country ranked 18th on the continent for in 2019.

Kenya is generally recognised as a leader in mobile telephony, but its progress in fixed lines has lagged, negatively affecting Internet access as a result. In 2021, fixed telephone capacity stood at 121 000 while fixed total connections was 14 800 in 2021 consisting of 13 626 wireline connections and 1 174 wireless connections. Total wireless Internet subscriptions stood at 45.7 million while total fixed wired Internet subscriptions were estimated to be 672 700 in 2021.

In 2019, the total number of fixed[3Fixed broadband includes cable modem Internet connections, DSL Internet connections of at least 256 KB/s, fibre and other fixed broadband technology connections (such as satellite broadband Internet, ethernet local area networks, fixed-wireless access, wireless local area networks, WiMAX, etc.)] broadband subscriptions in Kenya was estimated at about 1.6 per 100 people. This was lower than the average of 3.3 for lower middle-income countries in Africa on the Current Path. Fibre to the home (FttH) is the largest share of total fixed broadband subscriptions accounting for 61% of subscriptions followed by cable modem subscriptions at 28.8%. Fibre to the office (FttO), copper line and other fixed broadband subscriptions constitute the remaining 10%. Despite being low, subscription to fixed broadband is growing. In 2021, total fixed wired broadband recorded 673 178 subscriptions, which was mainly driven by 20.7% growth in FttH subscriptions and 11.8% growth in FttO subscriptions. In the Current Path forecast, fixed broadband subscriptions will rise to 20.5 per 100 people by 2043.

Notwithstanding the low subscription to fixed broadband rates, mobile broadband subscription in Kenya is high. Mobile subscriptions rose by 6% to 65.1 million in 2021, while the number of mobile money subscribers also grew 8.5% to 35.2 million. In addition, total volume of mobile money transfer increased by 31.7% totalling KSh 6.9 trillion (US$6.9 billion) in 2021, and the value of commerce transaction amounted to KSh 15.3 trillion (US$15.3 billion) representing a growth of 63.2% from 2020. Mobile broadband refers to wireless Internet access delivered through cellular towers to computers and other digital devices. Mobile telephone capacity totalled 96 million in 2021 — a decline from the 96.7 million it recorded in previous year. Within the same year, the government increased the spectrum of international mobile telecommunications to 560 MHz in 2021 from the 360 MHz in 2020.

In 2019, Kenya had a mobile broadband subscription rate of 51.1 per 100 people, which was greater than the average of 49.1 for lower middle-income countries on the continent. Higher bandwidth capacity enables networks to handle surges and new patterns in Internet traffic. In 2021, bandwidth capacity in Kenya grew by 34.6% to 10.9 million Mbps. This consists of 20.2% increase in undersea bandwidth utilisation to 4.8 million Mbps, although satellite bandwidth slightly declined to 4.8 million Mbps.

The Kenya Vision 2030 underscores the importance of the informal sector in creating employment and driving the growth and productivity of the country. The informal sector in Kenya consists of semi-regulated, small-scale activities that mainly rely on low-level technology and are typically semi-organised. However, the ease of entry and exit makes it an easy platform for employment generation. The country’s first MTP (MTP1, 2008–2012), under the Vision 2030, identified low productivity, limited technological transfer, inadequate market access, information asymmetry and poor health and occupational safety measures as factors characterising the activities of the informal economy.

The majority of informal sector workers are engaged in wholesale and retail trade, and the hotel and restaurant industry. Over 80% of all jobs are created in the informal sector, and about 41% of youth employment occurs in this sector. For instance, in 2021, a total of about 15.3 million people were employed in the informal sector, equivalent to over 80% of all employment in the country, and a rise from 13.5 million in 2017. Out of this, rural inhabitants accounted for 59% of people employed in the sector. In addition, the sector created 753 800 jobs (an increase of 5.5% compared with 2020), representing 81.4% of all jobs created outside small-scale agriculture and pastoralist activities in the same year.

From the foregoing discussion, it is clear that road infrastructure, particularly paved roads, is low in Kenya. Also, despite its huge renewable energy potential, Kenya has not been able to increase electricity access to all citizens, especially in rural areas. Further, while the country has performed extremely well in ensuring access to mobile broadband, access to fixed broadband is lagging. Finally, Kenya has a huge informal sector that if formalised can increase GDP, government revenue and productivity. With these challenges in mind, the Infrastructure scenario addresses the need for improved road networks, increasing the amount of road which is paved in Kenya. Additionally, the scenario models a reasonable but ambitious increase in the adoption of and investment in renewable energy technologies, resulting in better access to electricity in urban and rural areas. The scenario includes accelerated access to broadband, especially fixed, and the adoption of modern technology that improves government efficiency and allows for the more rapid formalisation of the informal sector.

In 2019, 34.3 million people (69.7% of the Kenyan population) had access to electricity. This was above the average of 66.3% for lower middle-income countries in Africa. In contrast to 90.8% of urban residents, only 61.7% of rural dwellers had access to electricity in 2019, depicting a location disparity in favour of urban areas. The rural electrification programme, aimed at rural electricity access, increased the number of customers connected to about 410 000 between 2020 and 2021. On the Current Path, access to electricity is projected to reach 82.7% of the population by 2043. The disparity in electricity access in favour of urban residents will continue as 93% of urban residents will have access to electricity compared with 75.8% of rural residents by 2043.

Based on the Infrastructure scenario, it is expected that 96.5% of the population will have access to electricity by 2043, compared with 82.7% of the population in the Current Path forecast. The proportion of people with access to electricity in the Infrastructure scenario in 2043 will be higher than the average of 81.7% for lower middle-income countries in Africa on the Current Path. By 2043, 98.5% of urban residents will have access to electricity in the Infrastructure scenario, compared with 93% in the Current Path forecast. The proportion of people in rural areas with access to electricity will rise sharply to 95.6% in the Infrastructure scenario, compared with 75.8% in the Current Path forecast. It means that the Infrastructure scenario has the potential to markedly close the electricity access gap between urban and rural inhabitants.

As access to electricity in urban and rural areas increases, more households switch from traditional cooking stoves, such as wood-burning stoves and coal stoves, to improved and modern fuel stoves, such as electric and gas cookers. The IFs model distinguishes between three types of cooking stoves: traditional, improved and modern. In 2019, 73.4% of households in Kenya used traditional stoves for cooking while 3.9% used improved cooking stoves. The proportion of households that used modern stoves for cooking stood at 22.7%.

Based on these findings, it is clear that about three-quarters of all households in Kenya still rely on traditional stoves for cooking, thereby contributing to pollution and carbon emissions, and negatively impacting the health of these households. This is expected given the large proportion of Kenyans who live in rural areas where the use of traditional stoves is prevalent. By 2043, the composition of cooking stove usage in Kenya will reverse such that only 23.6% of households will use traditional stoves in the Infrastructure scenario compared with 35% in the Current Path forecast. Consequently, the proportion of households that are expected to use modern stoves for cooking will constitute 75.1% of households in the Infrastructure scenario compared with 63.2% in the Current Path forecast by 2043.

In 2019, fixed broadband subscriptions in Kenya was estimated at about 1.6 per 100 people. In the Current Path forecast, this will rise to 20.5 per 100 people by 2043. The Infrastructure scenario will lead to a much larger increase in fixed broadband, so that, by 2043, subscriptions will likely be at 30.8 per 100 people. This will be higher than the average of 20.5 subscriptions per 100 people on the Current Path. The number of subscriptions by 2043 in this scenario will also be greater than the average of 28 per 100 people for lower middle-income African countries.

In 2019, Kenya’s mobile broadband subscriptions equaled 51.1 per 100 people, which was higher than lower middle-income Africa’s average of 49.1 in the Current Path. Because Kenya is already performing well in terms of access to mobile broadband, with the Current Path forecast reaching 153 subscriptions by 2043, the Infrastructure scenario has only a marginal impact. Both the Current Path forecast and the Infrastructure scenario get to 153 subscriptions per 100 people by 2043, which is higher than the average of 144.7 for Africa’s lower middle-income countries.

Agriculture forms an integral part of the Kenyan economy, serving as a source of livelihood for about 40% of the population in general and 70% of rural inhabitants. The sector also accounts for 65% of the country’s total export earnings. Total agricultural land stood at 28 million hectares in 2019, constituting over 48% of the total land in the country. In 2021, the performance of the agriculture sector declined due to a decline in crops, particularly maize and coffee production, as well as livestock production. This could be attributed to unfavourable weather conditions that occurred in some parts of the country together with leaf rust infestation, increase in the cost of farm inputs, and increased switch in coffee land farming for real estate purposes. Some of the more important agricultural commodities produced in Kenya include corn, tea, coffee, rice, wheat, sugar, livestock, cut flowers and vegetables.

The data on agricultural production and demand in the IFs forecasting platform initialises from data provided on food balances by the Food and Agriculture Organization (FAO). IFs contains data on numerous types of agriculture but aggregates its forecast into crops, meat and fish, presented in million metric tons.

Total agriculture production in 1990 stood at 16.9 million metric tons. Of this, 13.5 million metric tons were crops, 3.2 million metric tons meat production, with the remaining constituting fish production. Total agricultural production in 1990 exceeded domestic demand by 310 000 metric tons, meaning that the country had a surplus of agricultural commodities and was technically food sufficient. However, since then, domestic demand has outgrown production, and by 2019, agricultural demand exceeded domestic production by 2.9 million metric tons, despite production increasing to 31 million metric tons. Of this, crop production constituted 78.2%, meat production 21.3%, and fish production constituted the rest of the total of production. The majority of the demand is for crops, constituting 81.5% of total demand (27.6 million tons). The remaining demand is mainly for meat (6.8 million tons), and the smallest demand is for fish (170 000 tons).

Despite the projected increase in domestic production to reach 44 million metric tons in 2043, it will not be enough to meet domestic demand of 66.8 million metric tons. As a result, agricultural demand will surpass domestic production by 22.8 million metric tons. This means that Kenya faces the risk of food shortages in the future if drastic measures are not adopted to revamp the agriculture sector to increase domestic production.

Increased food insecurity in the country, according to a 2018 UNICEF report, has been the result of severe drought conditions. Over the past four decades, Kenya has battled 74 devastating natural disasters of which 54 were floods and 14 were droughts. In addition, most of the regional climate models show a potential increase in the severity of rainfall in East Africa making the country even more susceptible to floods in the future. This will impact negatively on the 70% rural population that base their livelihoods on the agriculture sector.

The data on yields per hectare (in metric tons) is for crops, but it does not distinguish between different categories of crops. The average crop yield per hectare was 4.2 metric tons in 2019, which was below the average of 5 metric tons per hectare for lower middle-income countries in Africa, indicating that Kenya has not been able to adopt modern farming practices effectively like its income peers to improve yields. On the Current Path, yield per hectare will rise to 4.2 tons which will still be below the average for lower middle-income African countries.

The Current Path analysis has shown that agricultural production in Kenya is low and unable to meet domestic demand. This is partly attributable to low yield per hectare due to the inability of farmers to adopt modern and efficient technology for farming. Other challenges facing the sector in Kenya include a poor infrastructure network in the rural areas, poor climatic conditions and the overreliance on maize as the staple food crop. In addition to this, land ownership issues are affecting agricultural productivity in the country. Many smallholder farmers do not have title deeds to their land due to the high cost associated with registering land and acquiring titles. As a result, the Agriculture scenario represents reasonable but ambitious increases in yields per hectare (reflecting better management and seed and fertiliser technology), increased land under irrigation, and reduced loss and waste. It includes an increase in calorie consumption, reflecting the prioritisation of food self-sufficiency above food exports as a desirable policy objective.

In the Agriculture scenario, yield per hectare will increase faster, such that by 2043, it will reach 6.7 metric tons — 2.5 metric tons per hectare higher, or a 60% improvement, compared with the projections of the Current Path. By then, average yield per hectare in Kenya will be slightly above the average of 6.4 metric tons for lower middle-income countries in Africa. Due to the high yields expected in the Agriculture scenario, total agricultural production will rise to 64.8 million tons in this scenario — 20.8 million tons, or 47.3%, more than the Current Path forecast by 2043. Annual crop production in Kenya will increase to 45.9 million tons in the Agriculture scenario by 2043. This will be 17 million tons, or 59%, higher than the Current Path forecast for that year. Meat production will increase to 18.6 million tons from 2019 to 2043 in the scenario, representing a 25.8% increase above the Current Path forecast.

With total agriculture demand outgrowing domestic production, Kenya will have to resort to importation to meet the excess demand for agricultural commodities. In 2019, Kenya’s net agricultural imports were 18.5% of agricultural demand, which exceeded the average of 12.2% for lower middle-income countries in Africa. Fish imports stood at 13.8% of total demand and meat imports stood at 3.1% of total demand. Importing crop food appears to be the highest in Kenya valued at 22.2% of total demand in 2019. Although the country exports agricultural commodities such as tea, coffee, cut flowers and vegetables, it also imports large amounts of wheat, palm oil, sugar and rice to make up for the shortages in domestic production. For instance, in 2020, the country imported about 1.9 million tonnes of wheat.

In the Current Path forecast, net agricultural imports will increase to 35% of total agriculture demand by 2043, signalling growing national food insecurity, which is also due to changes in dietary preferences. The Agriculture scenario mitigates this situation, such that by 2043, import dependency is projected to reach 24.2%. Although this is quite high, it will be below the projected Current Path average of 33.3% for lower middle-income countries in Africa. By 2043, the importation of crops will constitute 30.5% of agriculture demand in the scenario compared with 45% in the Current Path. However, the importation of meat will increase in the scenario to reach 1.3% of total demand compared with the 1% on the Current Path in 2043. Likewise, importation of fish will increase in the Agriculture scenario reaching 50.7% of total demand compared with the 35.4% expected to occur on the Current Path.

The manufacturing sector is historically a key job creator, and output and export promotion sector, and it allows for the structural transformation of economies towards higher productivity, with spillover effects to other sectors. The sector is key in achieving economic development due to its backward and forward linkages with other sectors such as the agriculture sector and the service sector. In 2021, manufacturing subsectors like non-metallic mineral products (such as cement), leather and related products, dairy products, motor vehicles, trailers and semi-trailers, and sugar and meat products witnessed a growth in their performance. In contrast, the performance of subsectors such as prepared and preserved fruits and vegetables, animal and vegetable fats and oils, furniture, and pharmaceutical products declined in 2021.

The IFs platform uses data from the Global Trade and Analysis Project (GTAP) to classify economic activity into six sectors: agriculture, energy, materials (including mining), manufacturing, services, and ICT.

By 2019, the three largest contributors to GDP in Kenya were the service, agriculture and manufacturing sectors. The service sector contributed US$39.4 billion, equivalent to 58.5% of GDP. The agriculture sector, which is currently the second largest contributor to GDP, contributed US$13.9 billion, equivalent to about 20.7% of GDP. The manufacturing sector contributed US$8.6 billion, representing 12.3% of GDP in 2019, while the ICT sector contributed US$3.3 billion, constituting 4.8% of GDP. The contributions of the energy and materials sectors in 2019 were marginal and valued at US$1 billion and US$1.7 billion, respectively.

On the Current Path, the service sector is expected to almost quadruple in size to US$153.5 billion by 2043, which corresponds to 64.8% of GDP. By 2043, the manufacturing sector will overtake the agriculture sector as the second largest contributor and contribute about 12 percentage points more than agriculture to the economy. This will correspond to contributions of US$43.2 billion and US$15.1 billion for the manufacturing and agriculture sectors, respectively. The growth in the share of the manufacturing sector relative to the agriculture sector is associated with structural transformation of an economy which can lead to job creation. The Big Four, under the MTP3, identified textiles, agro-processing, leather, construction materials, oil and mining, iron and steel, and ICT as its priority sectors to grow manufacturing in Kenya.

At the initial stages of manufacturing, unskilled labourers are usually negatively affected. This is typically compensated for with welfare transfers especially to unskilled labour in the short term. As the economy shifts towards aggressive manufacturing, businesses begin to move from labour-intensive manufacturing towards capital intensive. Ultimately, labour, particularly unskilled labour, is displaced by capital, which may worsen poverty and inequality. Welfare losses are usually compensated for with social grants such as welfare transfers to compensate for the loss in income. These transfers should ease the disruption and displacement of labour caused by a transition towards aggressive manufacturing in the economy.

There are various welfare transfers in Kenya that are aimed at poor and vulnerable households. The government provides social assistance under three main schemes: cash transfers to orphans and vulnerable children, persons with severe disabilities, and older persons, and hunger-stricken households targeted at four counties in Northern Kenya. In 2020/21, KSh 7.1 billion (US$7.1 million) was disbursed under the Cash Transfers for Orphans and Vulnerable Children Programme to 293 665 households; KSh 814.8 million (US$814 800) disbursed through the Cash Transfers for Persons with Severe Disabilities Programme to 33 948 households, and KSh 18.3 billion (US$18.3 million) disbursed under the Hunger and Safety Net Programme to 763 553 households.

With weak manufacturing growth in Kenya, the Manufacturing scenario models robust manufacturing growth through greater investments in research and development, investment in the manufacturing sector, and promotion of the export of manufactured goods. It is also accompanied by an increase in welfare transfers (social grants) to moderate increases in inequality that are often associated with the initial stages of industrialisation due to an initial consumption crunch caused by a reallocation of resources to push the manufacturing sector.

In the Manufacturing scenario, the manufacturing sector is projected to contribute an additional US$31 billion to GDP in 2043, which will be equivalent to 9.9 percentage points above the Current Path forecast. However, the contribution of the service sector to GDP in this scenario is projected to decline by US$10.5 billion by 2043 compared with the Current Path forecast. This translates to an 8.3 percentage point reduction as a percentage of GDP compared with the Current Path forecast. The ICT sector is set to contribute US$1.6 billion less to GDP by 2043, which equates to a 1 percentage point decrease as a percentage of GDP over the Current Path forecast. The contribution of the agriculture sector to GDP will decline by 0.45 percentage points below the Current Path forecast in this scenario, translating into an absolute reduction of US$40 million by 2043.

Regarding welfare transfers, the total welfare transfers to Kenyan households amounted to US$6.7 billion in 2019. The Manufacturing scenario will almost quintuple welfare transfers in Kenya to US$34.7 billion by 2043, constituting an increase of about 418% between 2019 and 2043. This exceeds the projected US$28.9 billion in the Current Path forecast, meaning that the Manufacturing scenario leads to an additional US$5.8 billion (or 20% more) in government welfare transfers relative to the Current Path forecast by 2043.

The benefit of trade is to enable countries to specialise in the production of commodities they have a comparative advantage in and export them while importing those that are relatively costly to produce or unavailable in their home countries. Trade also opens up factors of production to be distributed in a more efficient manner and increases the total factor productivity of firms through competition and increased knowledge transfers.

One of the goals of Kenya’s Vision 2030 is to achieve an export sector that constitutes 29% of GDP by 2022. In 2019, the value of Kenya’s exports stood at US$7.9 billion, equivalent to 11.7% of GDP, which was below the average of 22.1% of GDP for lower middle-income countries in Africa. According to the Kenya National Bureau of Statistics, the value of principal domestic exports stood at KSh 666.7 billion (US$666.7 million) in 2021 — a rise of 17.5% compared with its 2020 figure. This growth was driven by a rise in earnings from horticultural products, articles of apparel and clothing accessories, animal and vegetable oils, titanium ores and concentrates, and iron and steel. However, the quantities of tea, coffee, iron and steel exported all declined. The majority of Kenya’s exports are destined for other African countries, particularly in the East African economic bloc, which accounted for 54% of all Kenya’s to other African countries in 2021.