Côte d'Ivoire

Côte d'Ivoire

Feedback welcome

Our aim is to use the best data to inform our analysis. See our Technical page for information on the IFs forecasting platform. We appreciate your help and references for improvements via our feedback form.

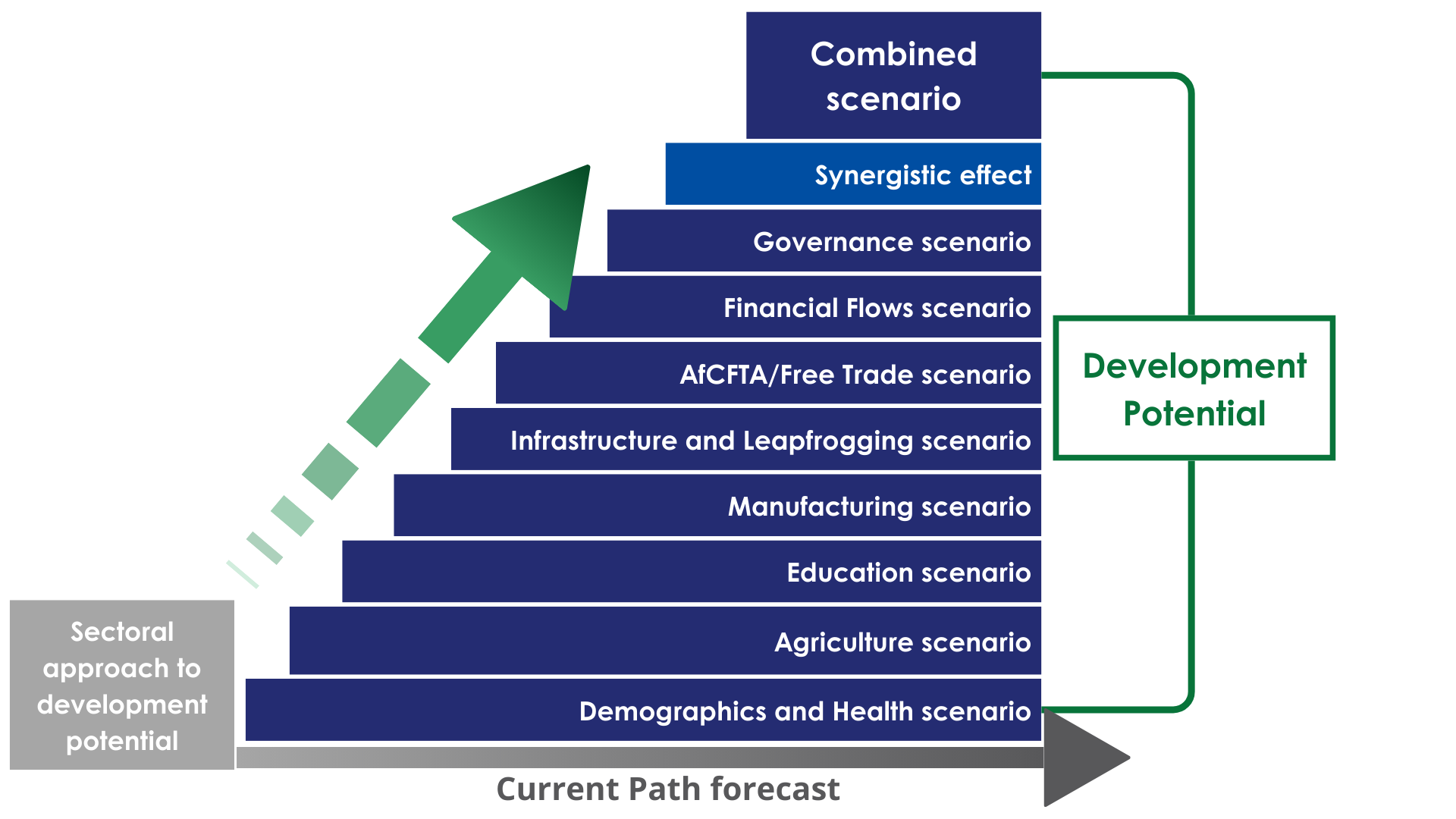

This page explores Côte d'Ivoire's current and projected future development, examining various sectoral scenarios and their potential impacts on the country's growth and development. It explores eight individual sectoral scenarios: demographics and health, agriculture, education, manufacturing, infrastructure and leapfrogging, the African Continental Free Trade Area (AfCFTA), financial flows and governance. Additionally, it evaluates the combined impact of these scenarios on Côte d'Ivoire's economic growth and development up to 2043, marking the conclusion of the third ten-year implementation plan for the African Union Agenda 2063. The analysis provides insights into policy measures that could strengthen the country's development path.

The assessment discusses the region's demographics, economic sectors and various development scenarios with a forecast horizon to 2043. The analysis also highlights the importance of governance and infrastructure improvements for economic and social development. It further addresses challenges such as energy demand and poverty, suggesting that strategic initiatives across all sectors could greatly benefit the region's prosperity and stability. It emphasises the potential impacts of these scenarios on GDP, GDP per capita, life expectancy, education, industrialisation, poverty reduction, inequality and carbon emissions.

For more information about the International Futures modelling platform we use to develop the various scenarios, please see the Technical Site.

Summary

We begin this page with an introductory assessment of Côte d'Ivoire’s context by looking at current population distribution, social structure, climate and topography.

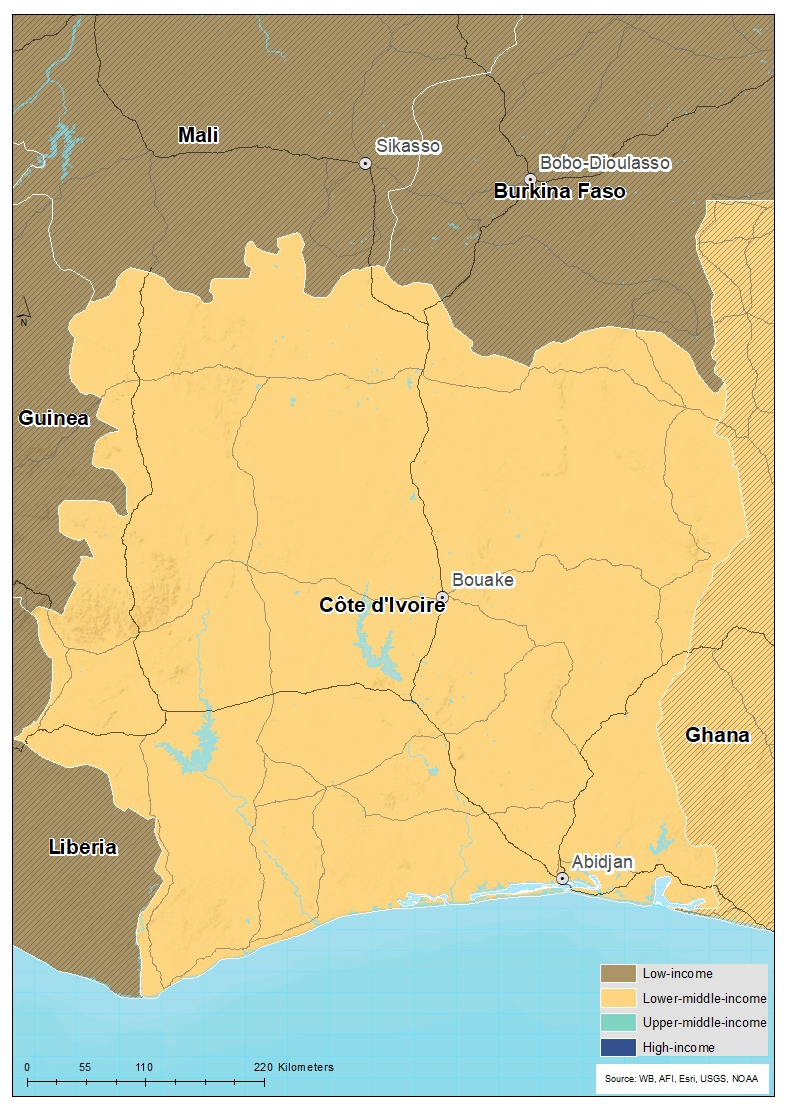

- Côte d'Ivoire is a lower-middle-income country in West Africa. It has a long coastline with the Atlantic Ocean that forms its southern border. The country is bordered by Liberia and Guinea to its west, Burkina Faso and Mali to its north, and Ghana to its east. Côte d'Ivoire is a member of the Economic Community of West African States (ECOWAS) and the African Union. It has a large economic and cultural presence in Francophone Africa and experiences a large amount of migration from other French-speaking African countries.

This section is followed by an analysis of the Current Path for Côte d'Ivoire, which informs the country’s likely current development trajectory to 2043. It is based on current geopolitical trends and assumes that no major shocks would occur in a ‘business-as-usual’ future.

- Côte d'Ivoire had a population of 31.3 million people in 2023 which is expected to increase to 50.3 million by 2043 in the Current Path. The country has the second-largest immigrant population in Africa as immigrants comprise between 10%-20% of the Ivorian population.

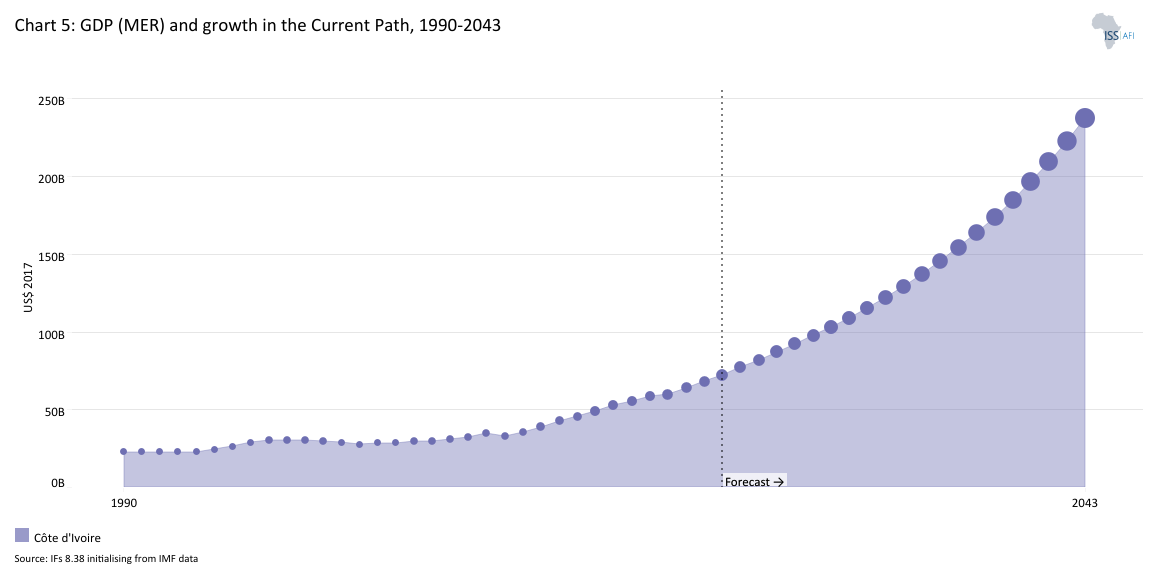

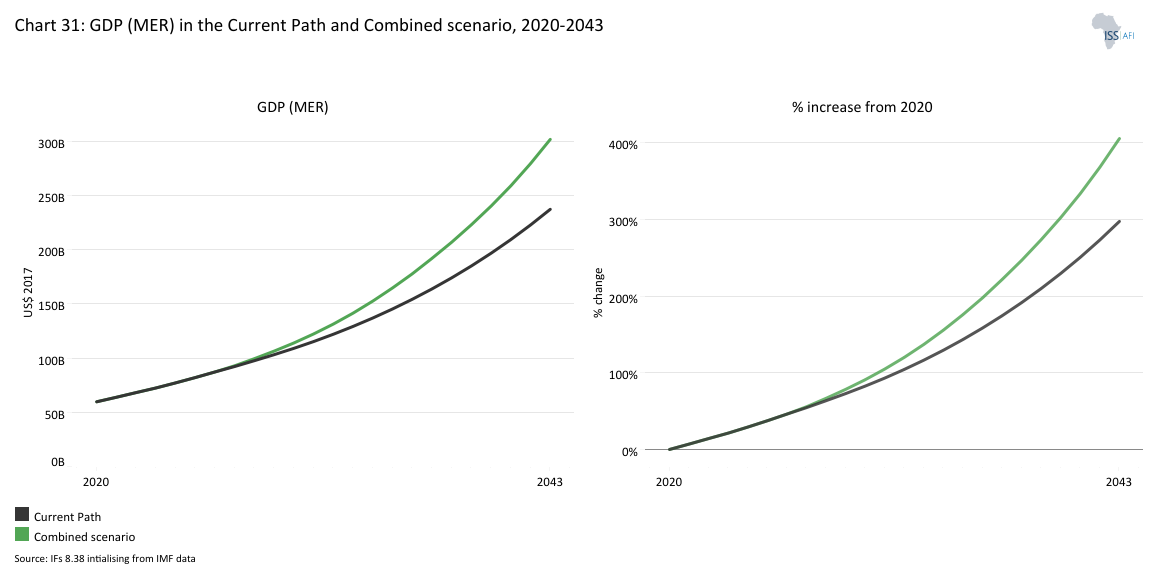

- Côte d'Ivoire has the third-largest economy in ECOWAS at US$72.4 billion and has experienced average annual growth of 8% since 2010, making it one of the fastest-growing economies in Africa. The Current Path projects Côte d'Ivoire’s GDP to continue to grow, reaching US$237.1 billion by 2043.

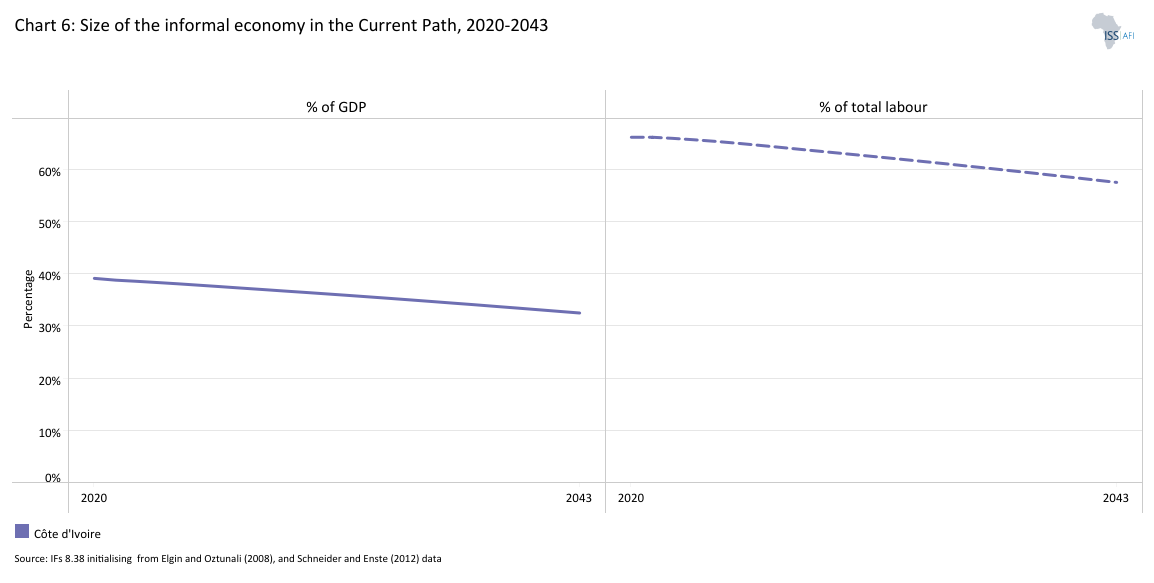

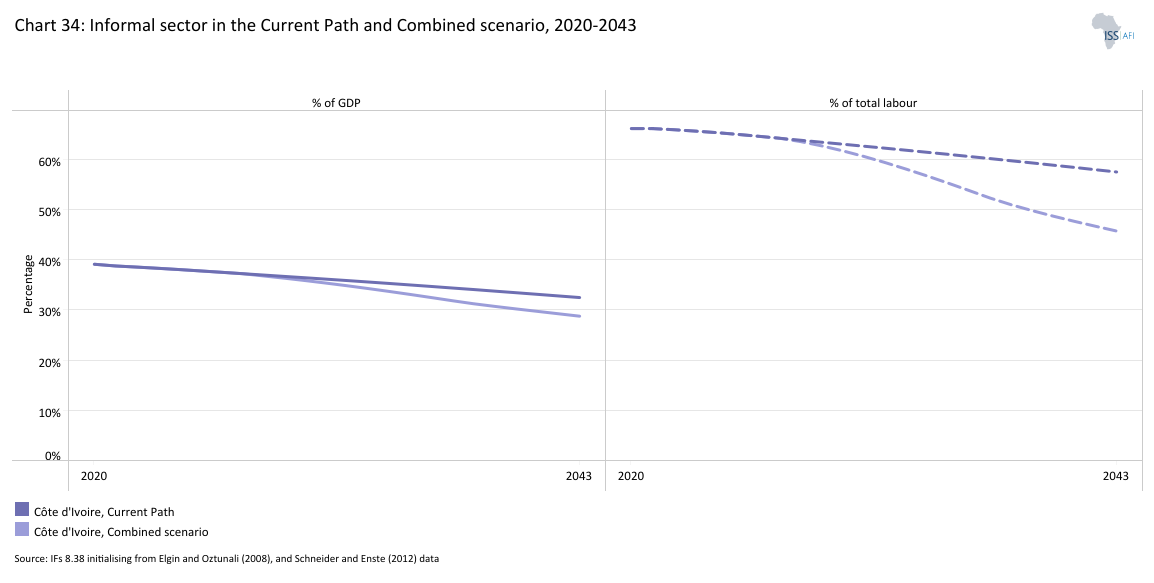

- Côte d'Ivoire has a large informal sector that makes up 38% of GDP and is expected to shrink only to 32% along the Current Path by 2043.

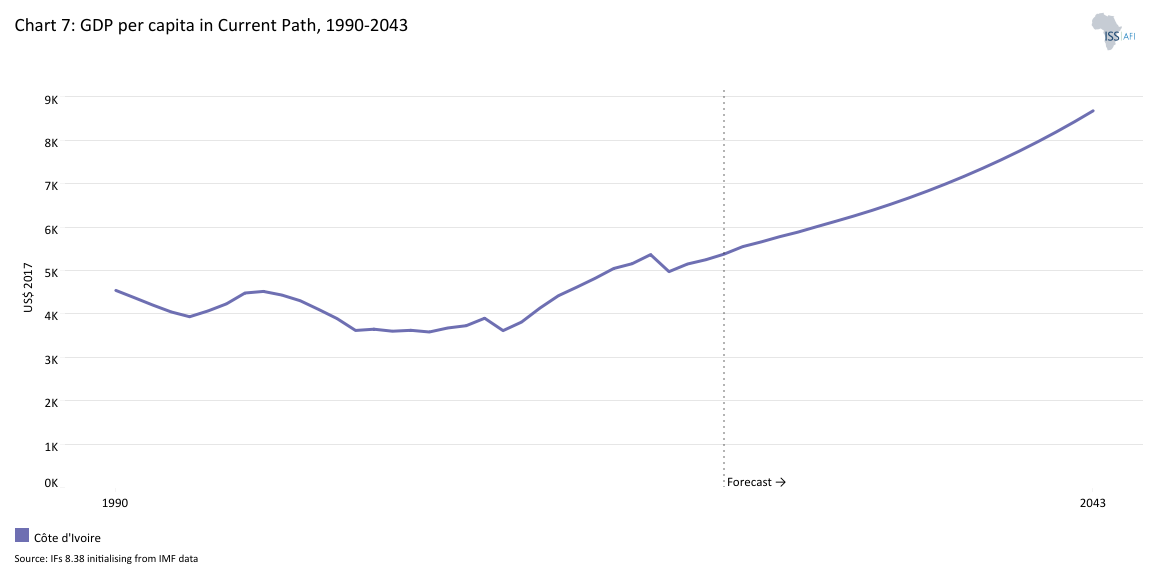

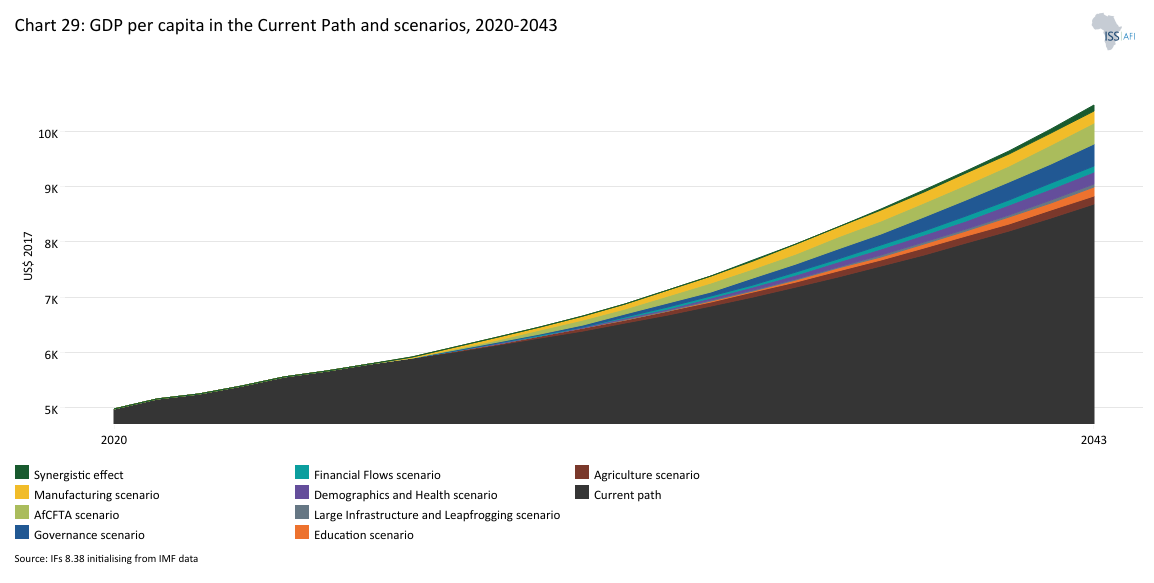

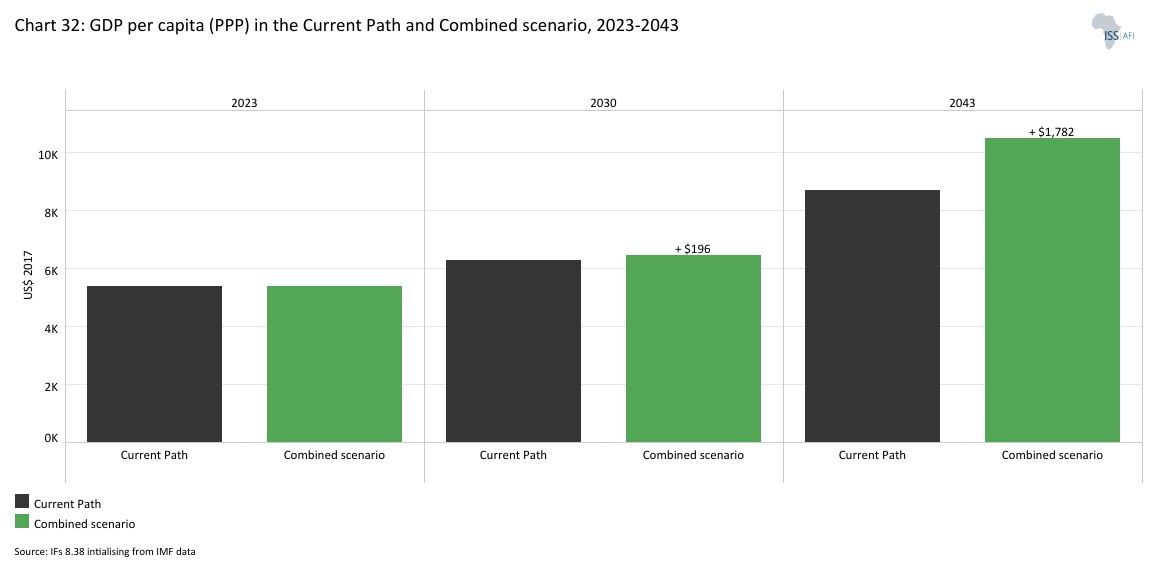

- As of 2023, Côte d'Ivoire’s GDP per capita was US$5 434, having grown by 47% since 2012. Along the Current Path, the Ivorian GDP per capita will almost double and reach US$8 678 by 2043.

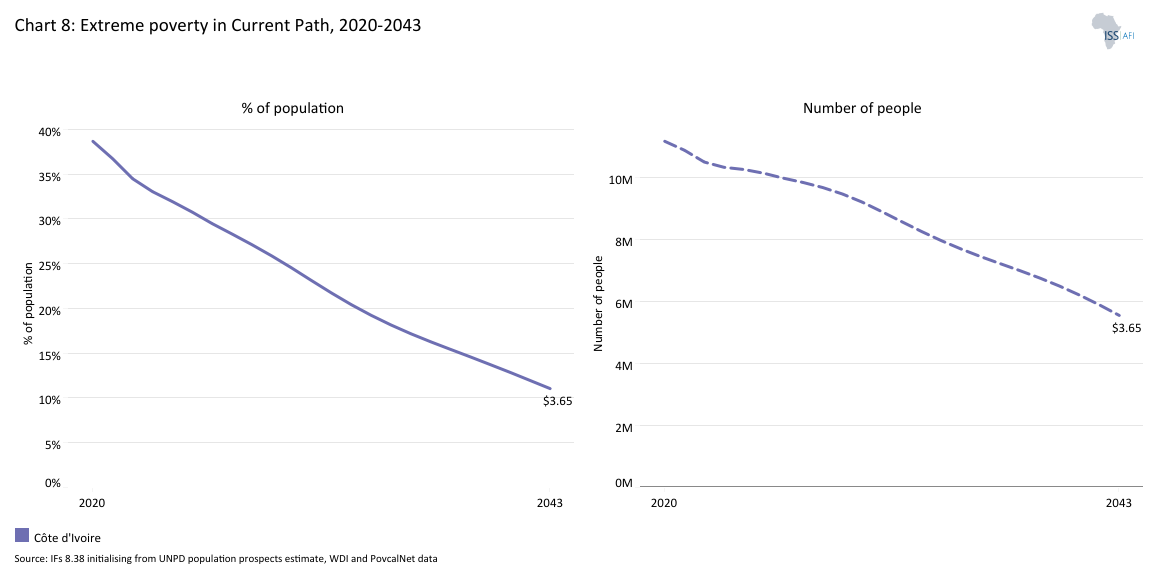

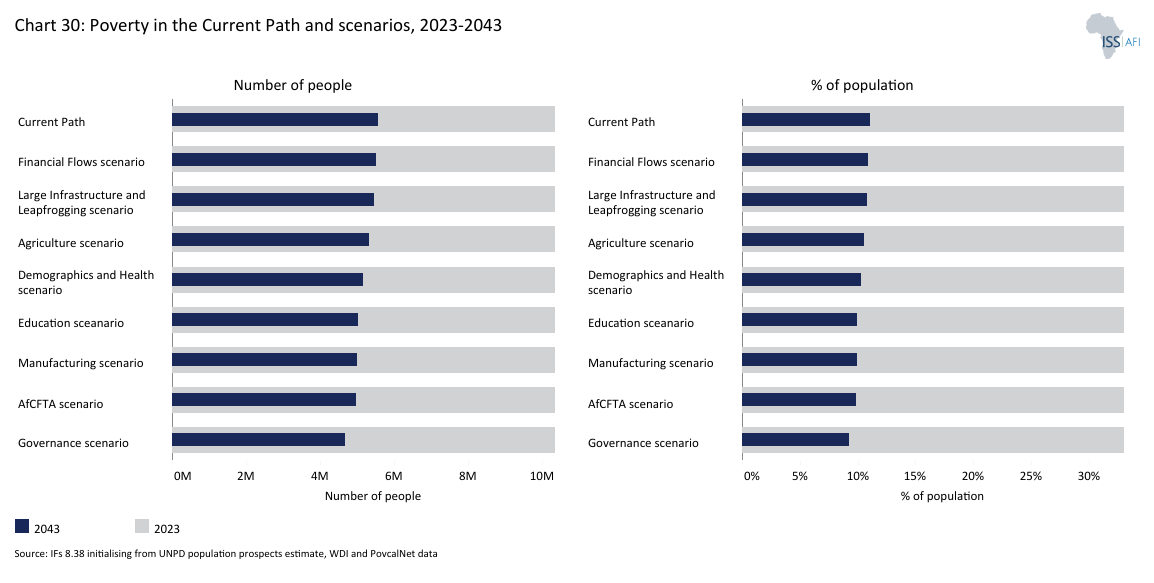

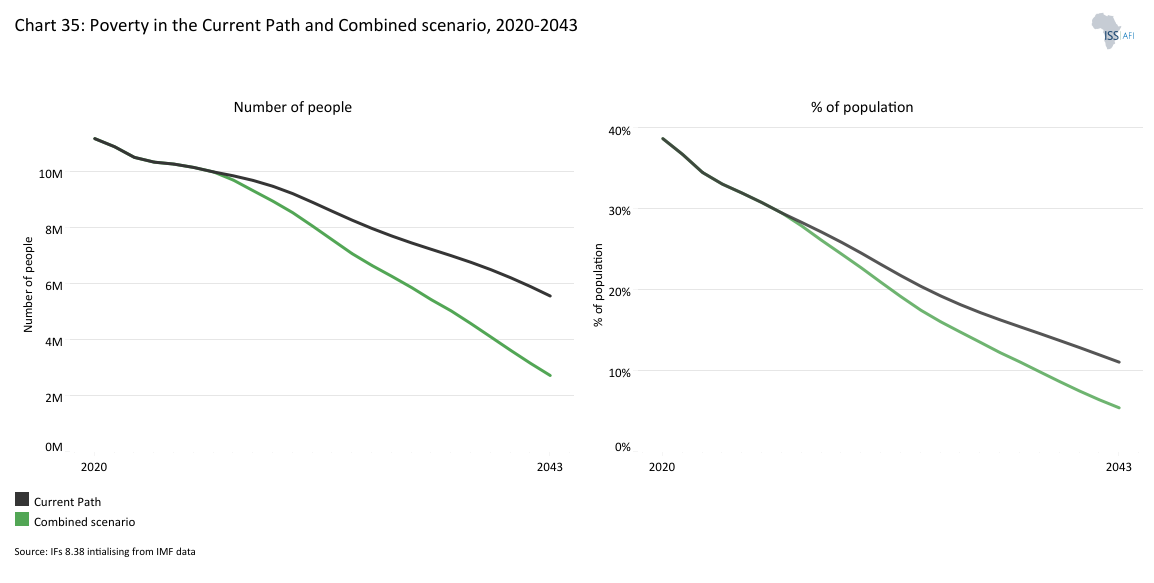

- In 2023, 33% of Ivorians lived below the lower-middle-income line of $3.65/day. In the Current Path, this is expected to shrink to 11% of the country’s population by 2043, which would be a reduction from 10.3 million people to 5.6 million.

- Côte d'Ivoire has been in its 3rd National Development Plan since the end of the civil conflict in 2011. The NDP 2021-2025 focuses on bringing the country to upper-middle-income status by 2030 through industrialisation of the economy, modernisation of the state and investment in human capital.

The next section compares progress on the Current Path with eight sectoral scenarios. These are Demographics and Health; Agriculture; Education; Manufacturing; the African Continental Free Trade Area (AfCFTA); Large Infrastructure and Leapfrogging; Financial Flows; and Governance. Each scenario is benchmarked to present an ambitious but reasonable aspiration in that sector.

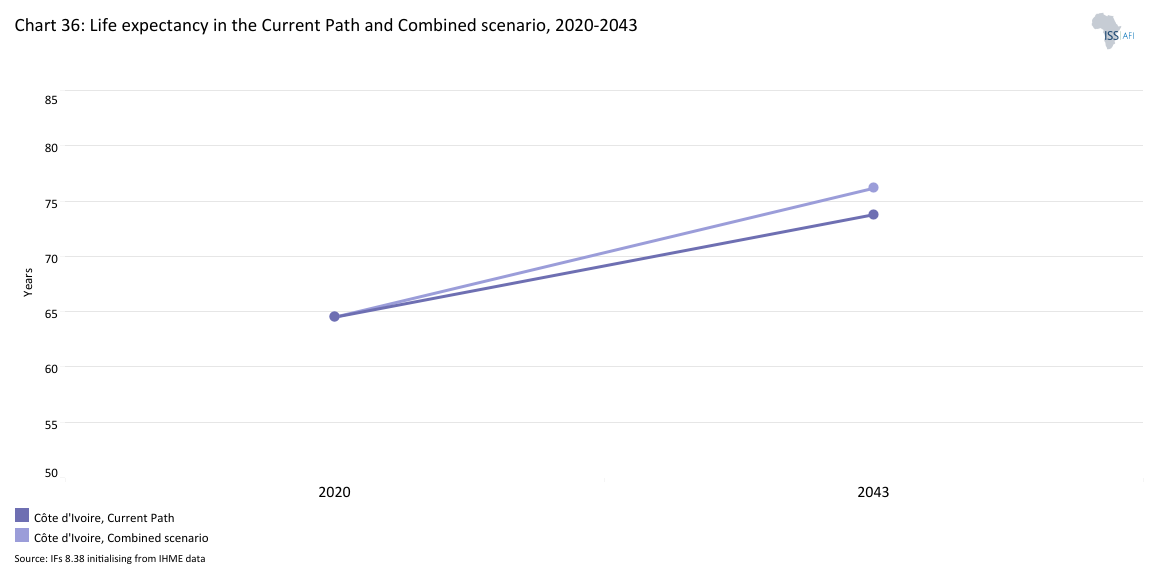

- The Demographics and Health scenario leads to notable improvements in health outcomes in Côte d'Ivoire. Life expectancy is projected to rise to 75.5 years by 2043, up from 73.8 years in the Current Path. Infant mortality declines significantly, dropping from 21.2 to 14.4 deaths per 1 000 live births. Similarly, maternal mortality will fall from 195 to 116.3 deaths per 100 000 live births, highlighting the scenario’s impact on maternal and child health.

- Under the Agriculture scenario, crop yields are projected to reach 5.4 metric tons per hectare by 2043, compared to 4.6 metric tons per hectare in the Current Path.

- In the Education scenario, the average years of education for Ivorians stood at 7.1 years in 2023. This will rise to 9.6 years by 2043, reflecting significant progress in educational attainment. In addition to increased access, the scenario also leads to improvements in the overall quality of education.

- The Manufacturing scenario projects that, by 2043, Côte d'Ivoire’s manufacturing sector will account for 23.7% of GDP, contributing approximately US$58.3 billion to the economy.

- The AfCFTA scenario offers a bright outlook for Côte d'Ivoire’s trade prospects. While the country already maintains a positive trade balance, AfCFTA is expected to significantly enhance its position. By 2043, Côte d'Ivoire’s trade balance is projected to reach 3.13% of GDP under the AfCFTA scenario, more than doubling the 1.35% forecasted in the Current Path.

- In the Large Infrastructure and Leapfrogging scenario, Côte d'Ivoire is set to make remarkable strides in energy access. By 2043, the national electrification rate will reach 96.3%, up from 89.3% on the Current Path. Similarly, the adoption of modern fuels for cooking is expected to climb to 76.2%, compared to 70% in the Current Path. These advancements highlight the transformative potential of targeted infrastructure investments.

- The Financial Flows scenario forecasts a notable rise in FDI inflows to Côte d'Ivoire, contributing to stronger government revenue. By 2043, government revenue will reach US$46.6 billion, compared to US$45.7 billion on the Current Path. This represents 19.0% of GDP, highlighting the positive impact of increased financial inflows on fiscal capacity.

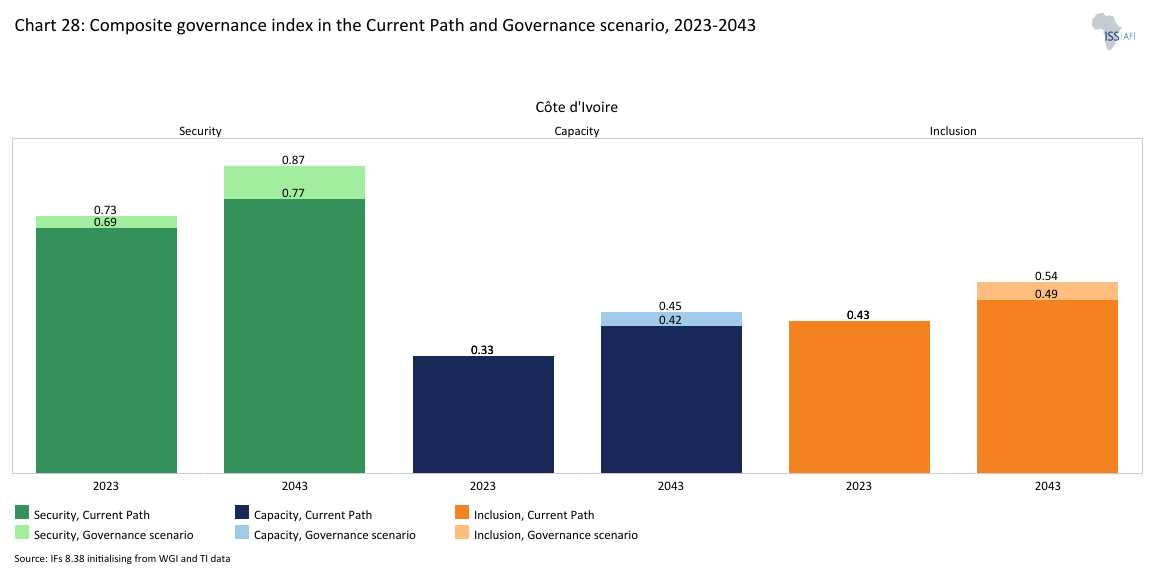

- Côte d'Ivoire’s governance landscape has evolved steadily, shaped by both domestic reforms and broader regional dynamics. By 2023, the country’s composite governance index stood at 0.48. Under the Governance scenario, targeted interventions are expected to strengthen institutional quality and accountability, pushing the index to 0.62 by 2043, compared to 0.56 on the Current Path.

In the fourth section, we compare the impact of each of these eight sectoral scenarios with one another and subsequently with a Combined scenario (the integrated effect of all eight scenarios). In our forecasts, we measure progress on various dimensions such as economic size (in market exchange rates), gross domestic product per capita (in purchasing power parity), extreme poverty, carbon emissions, the changes in the structure of the economy, and selected sectoral dimensions such as progress with mean years of education, life expectancy, the Gini coefficient or reductions in mortality rates.

- Based on the Combined scenario, governance, manufacturing and trade openness, specifically the AfCFTA, are integral to maximising the development potential of Côte d'Ivoire.

We end this page with a summarising conclusion offering key recommendations for decision-making.

The country has made serious progress since the end of hostilities in 2011, but the path forward to economic and societal transformation is, while possible, not guaranteed. Côte d'Ivoire has the opportunity to reach upper-middle-income status. However, that possibility is contingent on smart investment, good governance and maximising the potential of its own population and its regional neighbours. Côte d'Ivoire should focus on ensuring that it build stronger, more inclusive democratic institutions, diversifying its economy to reduce the dependence on export commodities, investing in human capital to meet the needs of a changing industrialising nation, and integrating further with its neighbours and other African countries to make the most of its comparative advantages.

All charts for Côte d'Ivoire

- Chart 1: Political map of Côte d'Ivoire

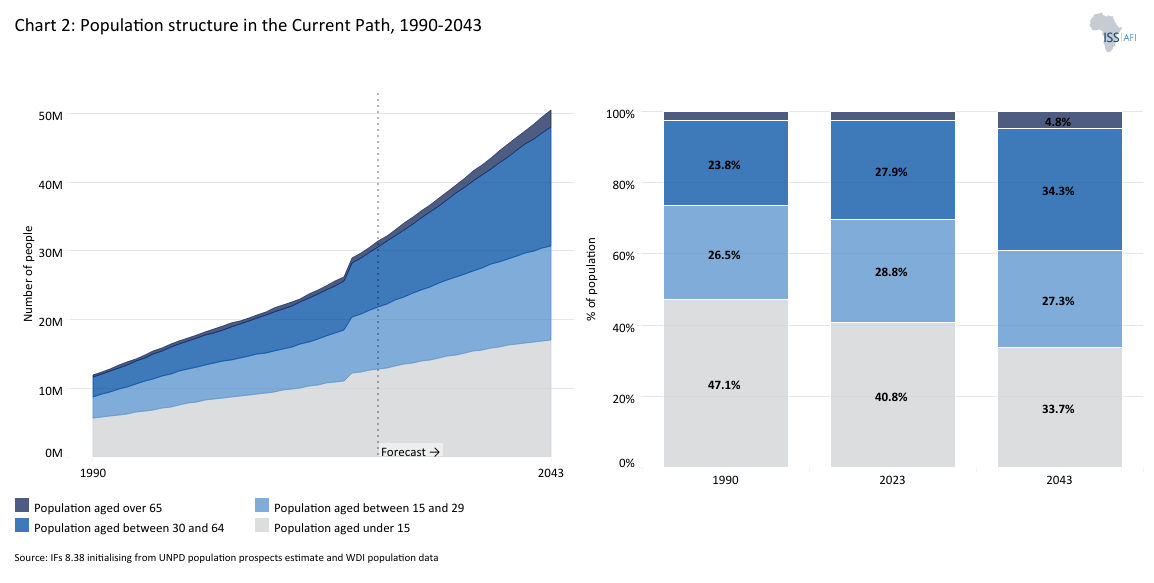

- Chart 2: Population structure in the Current Path, 1990–2043

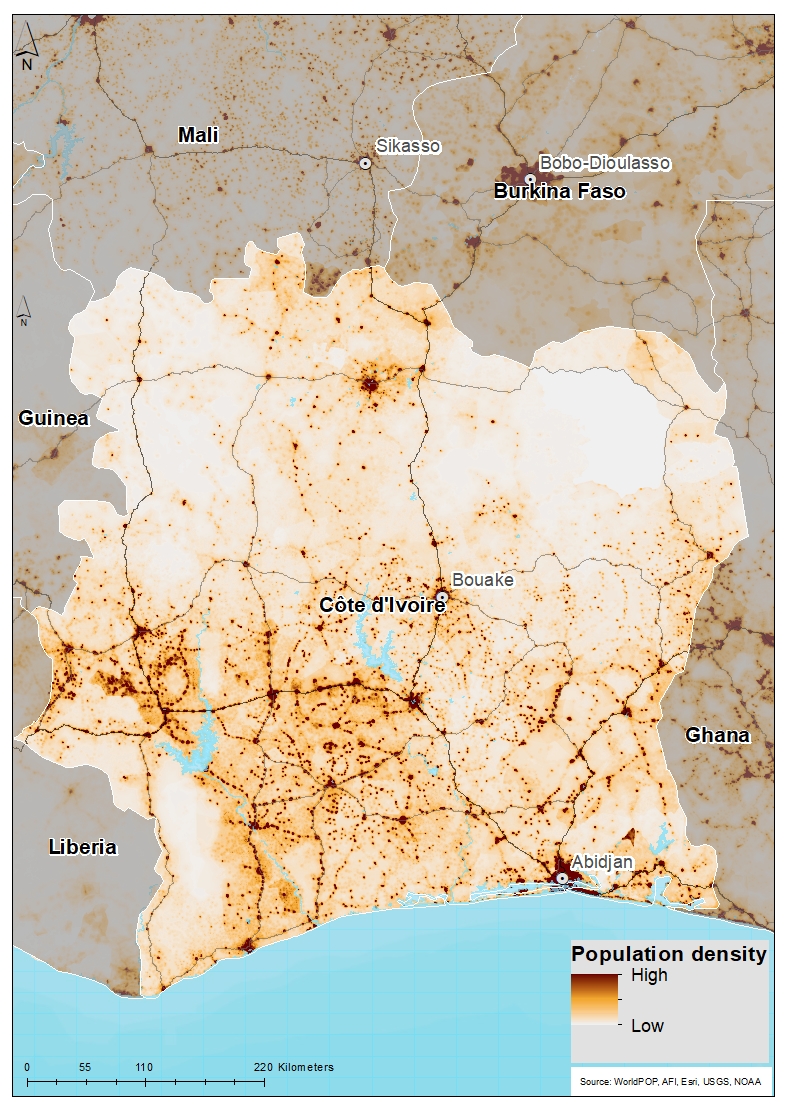

- Chart 3: Population distribution map, 2023

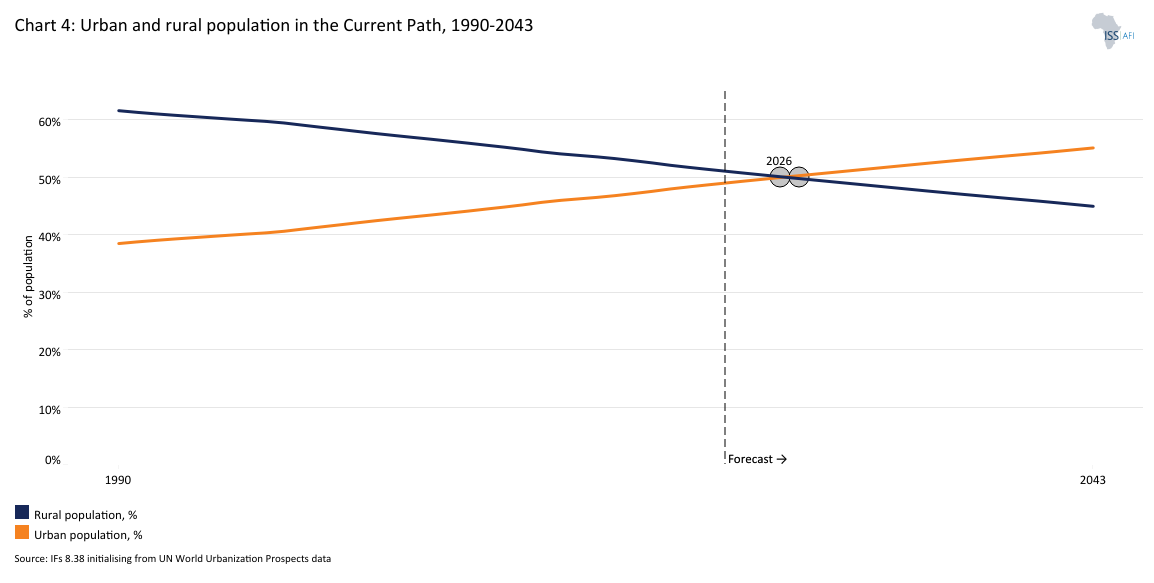

- Chart 4: Urban and rural population in the Current Path, 1990-2043

- Chart 5: GDP (MER) and growth rate in the Current Path, 1990–2043

- Chart 6: Size of the informal economy in the Current Path, 2020-2043

- Chart 7: GDP per capita in Current Path, 1990–2043

- Chart 8: Extreme poverty in the Current Path, 2020–2043

- Chart 9: National Development Plan of Côte d'Ivoire

- Chart 10: Relationship between Current Path forecast and scenario

- Chart 11: Mortality distribution in the Current Path, 2023 and 2043

- Chart 12: Infant mortality rate in Current Path and Demographics and Health scenario, 2020–2043

- Chart 13: Demographic dividend in the Current Path and the Demographics and Health scenario, 2020–2043

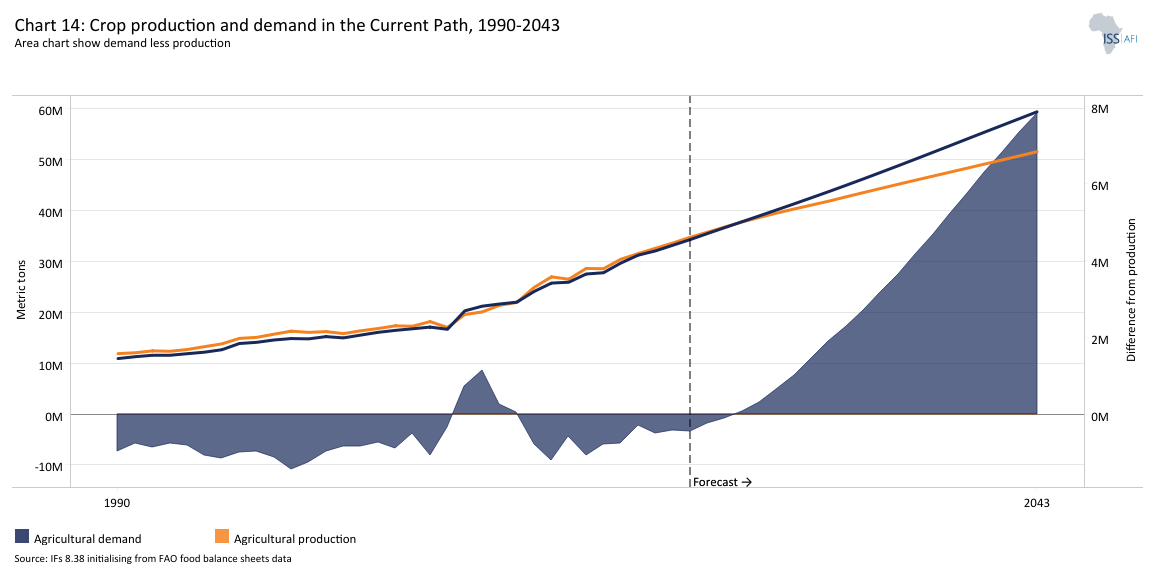

- Chart 14: Crop production and demand in the Current Path 1990 to 2043

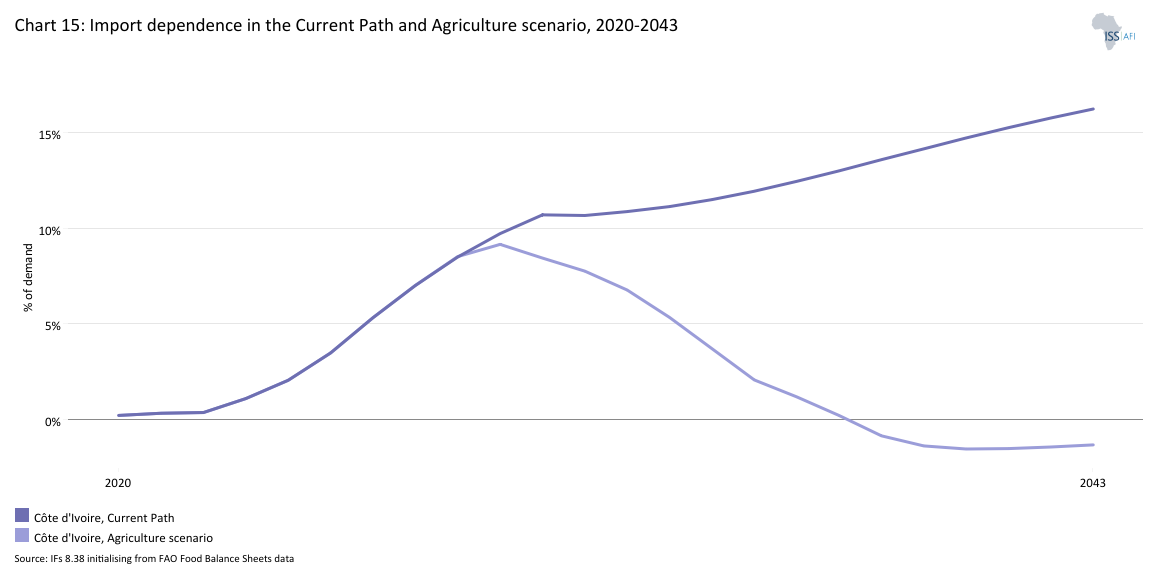

- Chart 15: Import dependence in the Current Path and Agriculture scenario, 2020–2043

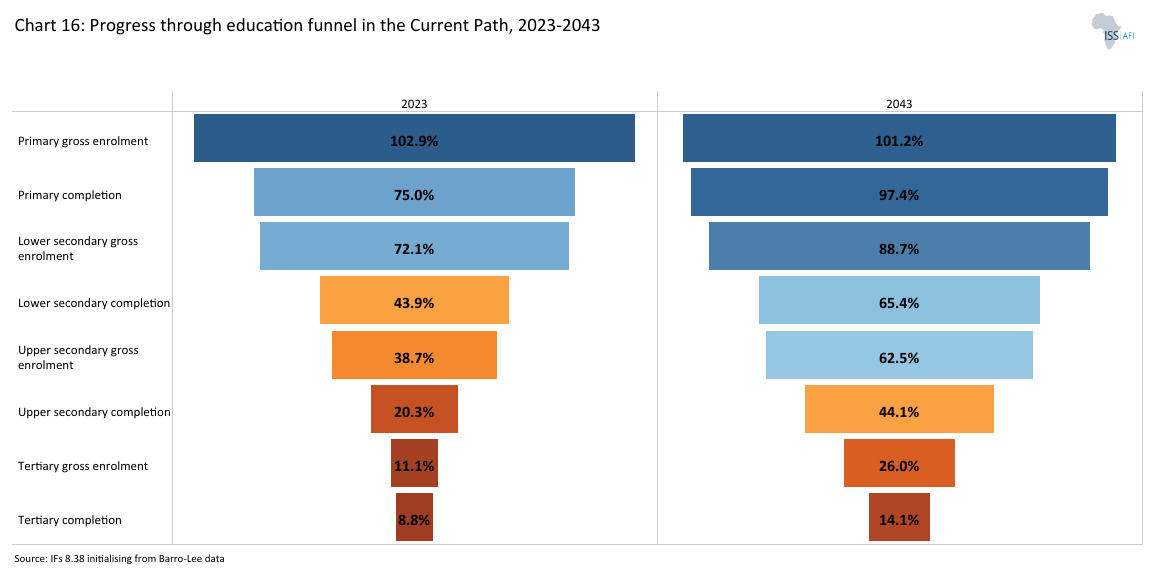

- Chart 16: Progress through the education funnel in the Current Path, 2023 and 2043

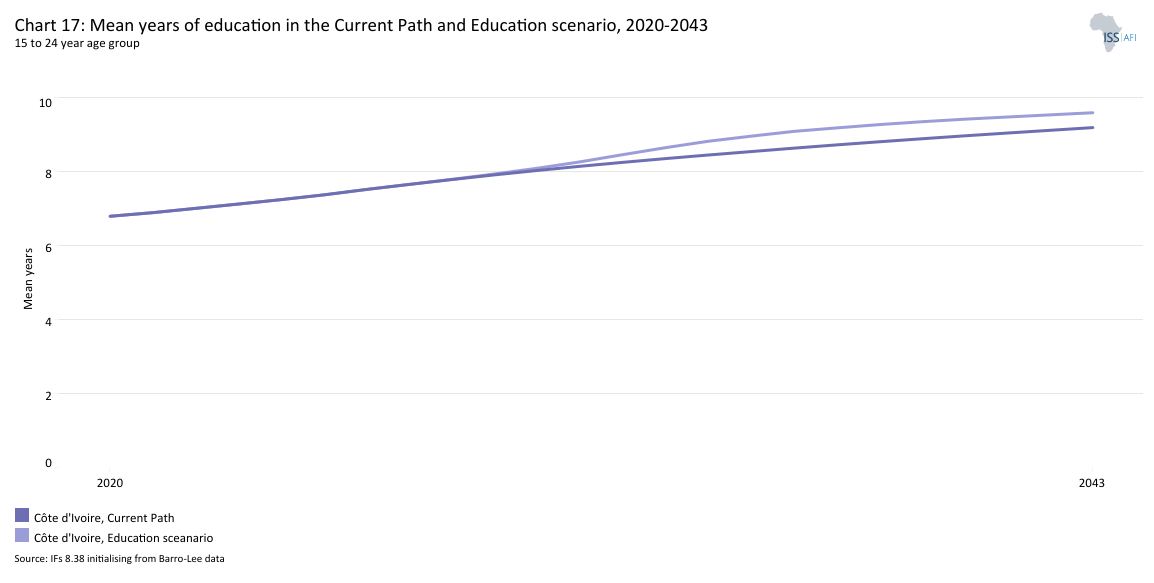

- Chart 17: Mean years of education in Current Path and Education scenario, 2020–2043

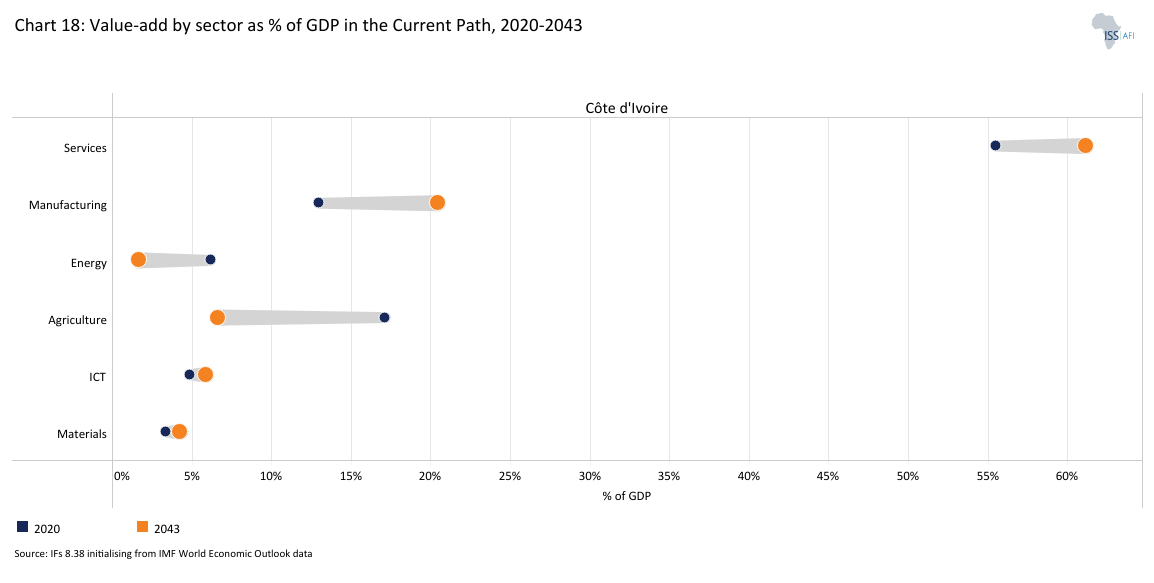

- Chart 18: Value-add by sector as % of GDP in the Current Path, 2023 and 2043

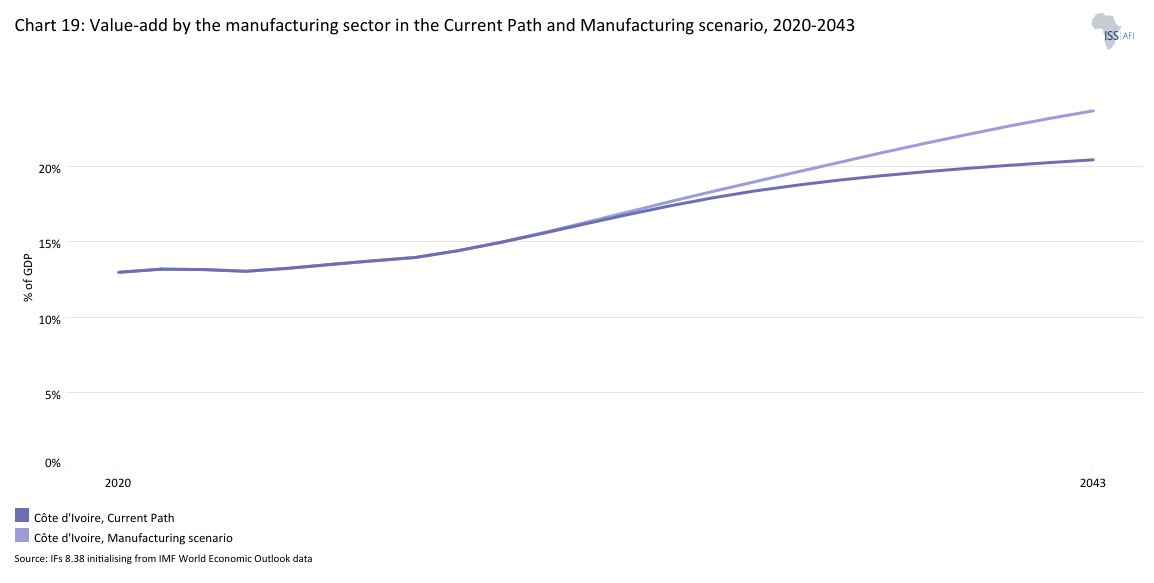

- Chart 19: Value-add of the manufacturing sector in Current Path and Manufacturing scenario, 2020–2023

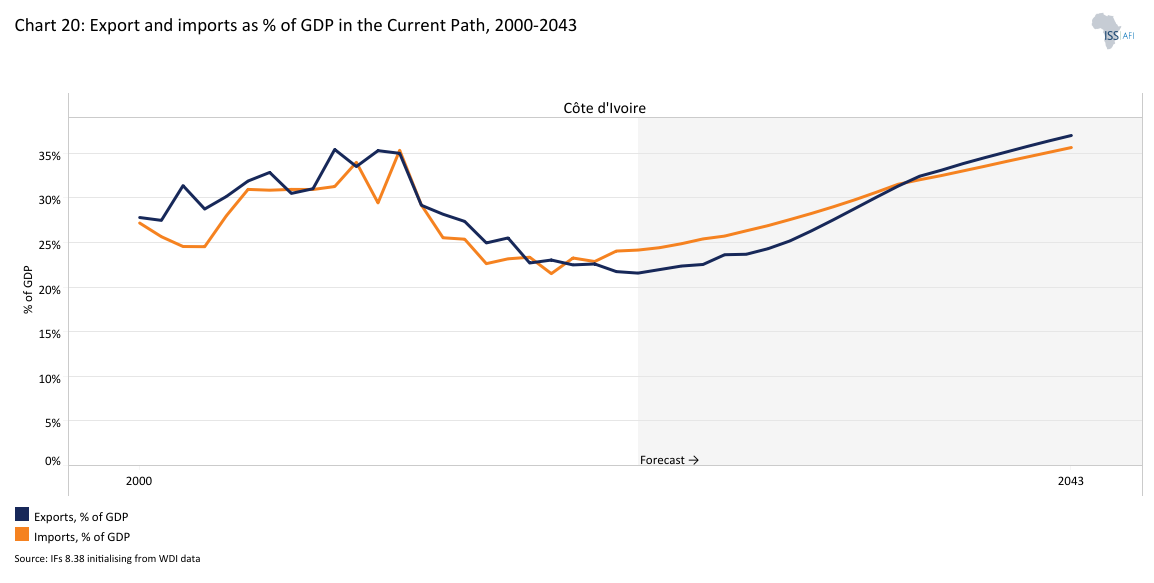

- Chart 20: Exports and imports as a per cent of GDP, 2000 to 2043

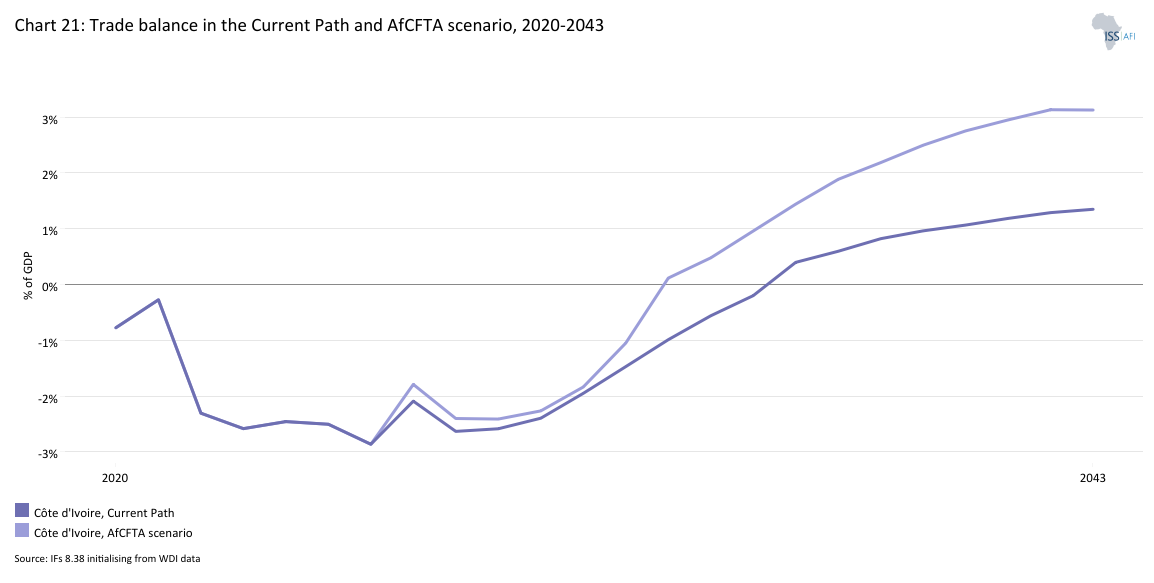

- Chart 21: Trade balance in CP and AfCFTA scenario, 2020–2043

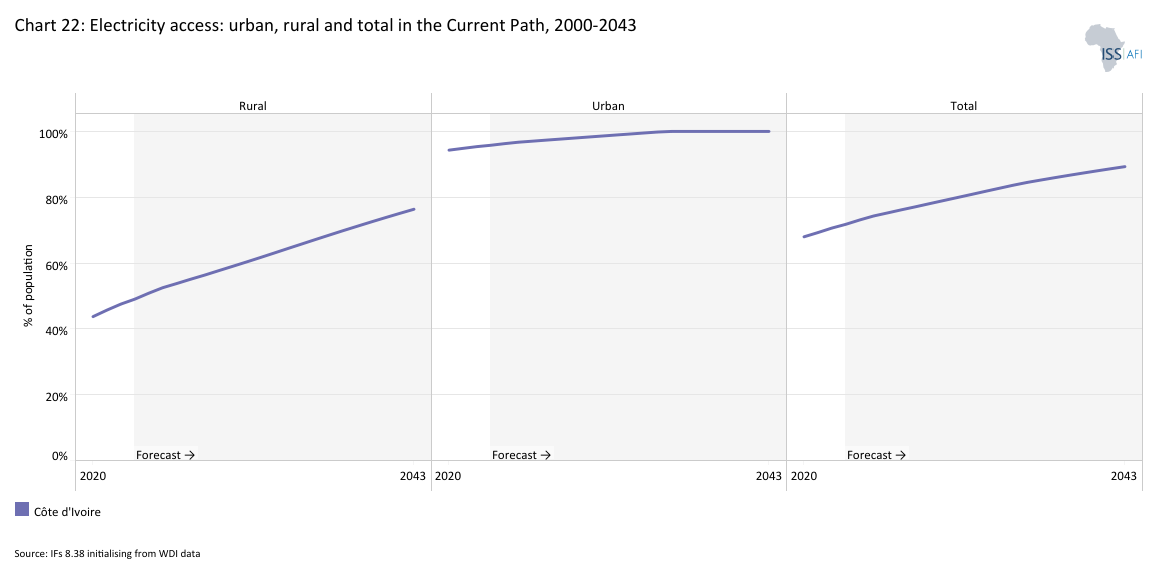

- Chart 22: Electricity access: urban, rural and total in the Current Path, 2000-2043

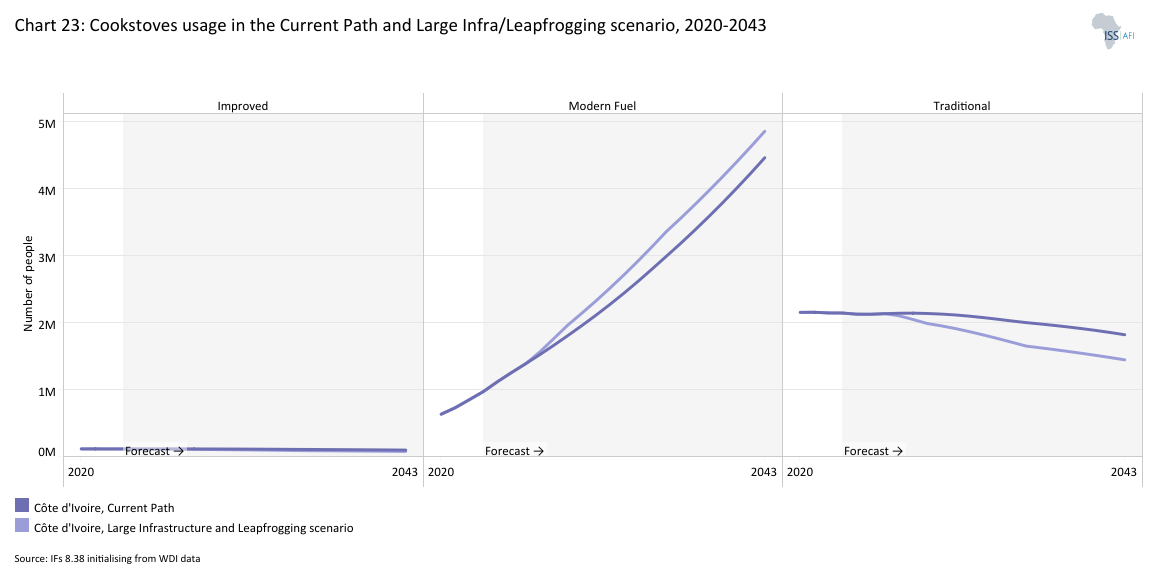

- Chart 23: Cookstove usage in the Current Path and Large Infra/Leapfrogging scenario, 2020–2043

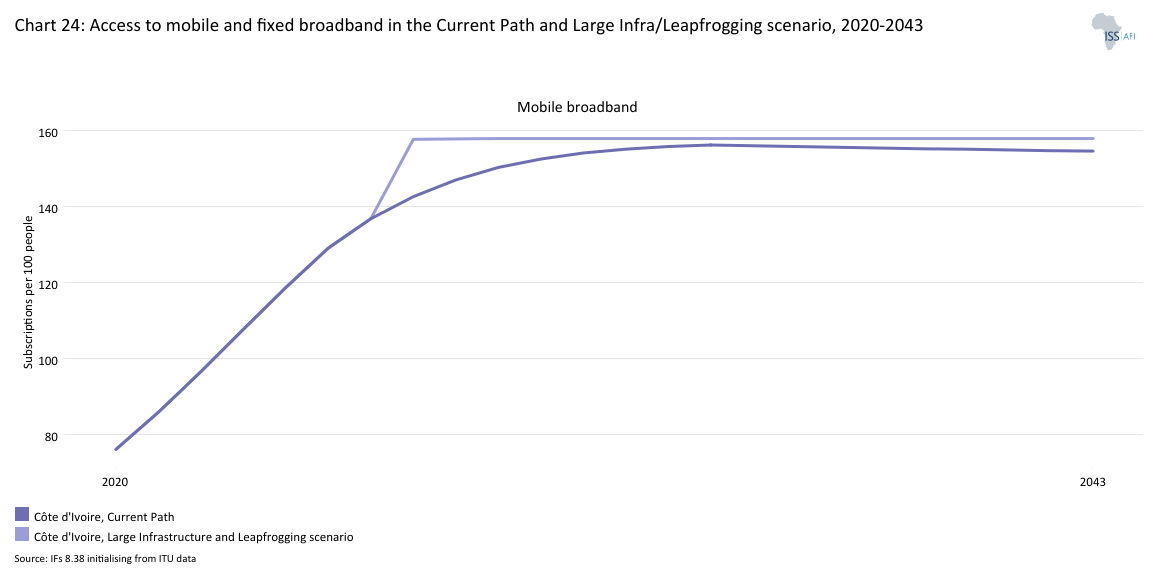

- Chart 24: Access to mobile and fixed broadband in the Current Path and the Large Infra/Leapfrogging scenario, 2020–2043

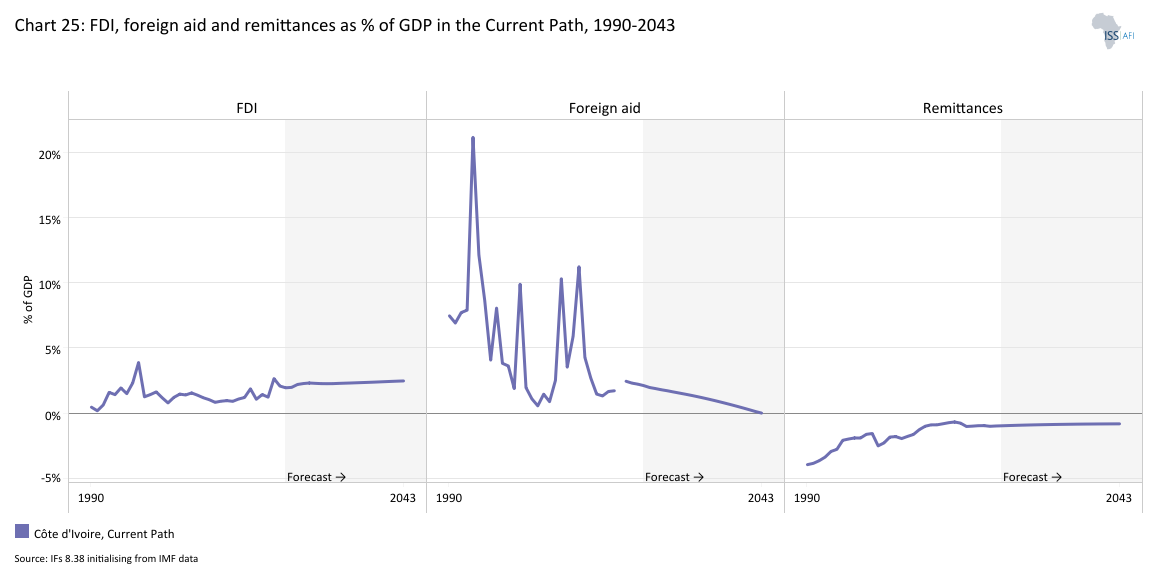

- Chart 25: FDI, foreign aid and remittances as % of GDP in the Current Path and in the Financial Flows scenario, 1990-2043

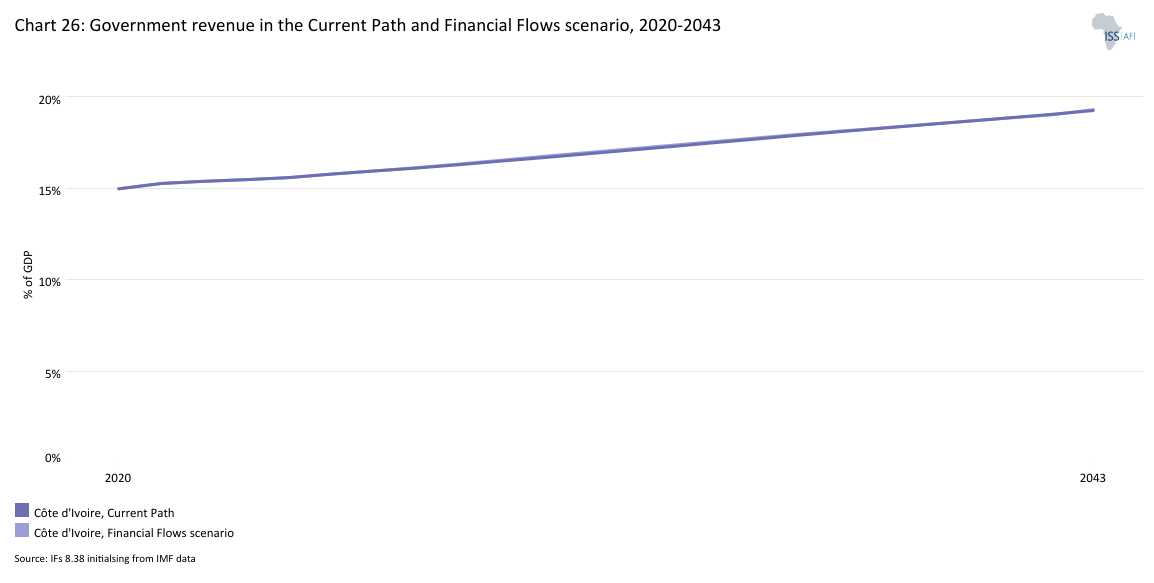

- Chart 26: Government revenue in the Current Path and Financial Flows scenario, 2020–2043

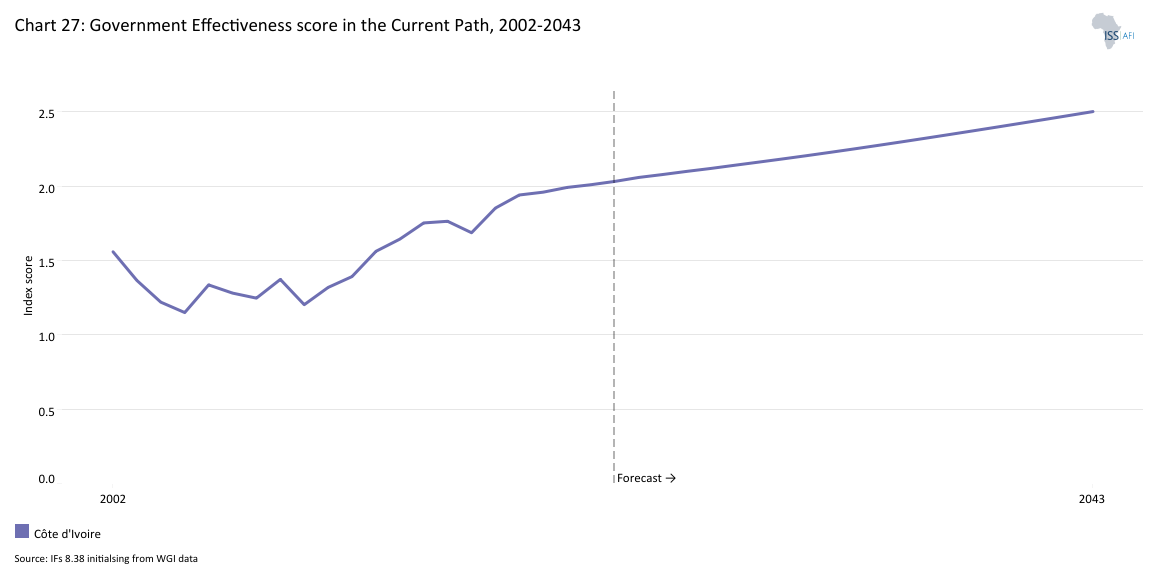

- Chart 27: Government effectiveness score in the Current Path, 2002-2043

- Chart 28: Composite governance index in the Current Path and Governance scenario, 2023 and 2043

- Chart 29: GDP per capita in the Current Path and scenarios, 2020–2043

- Chart 30: Poverty in the Current Path and scenarios, 2020–2043

- Chart 31: GDP (MER) in Current Path and Combined scenario, 2020–2043

- Chart 32: GDP per capita in the Current Path and the Combined scenario, 2023-2043

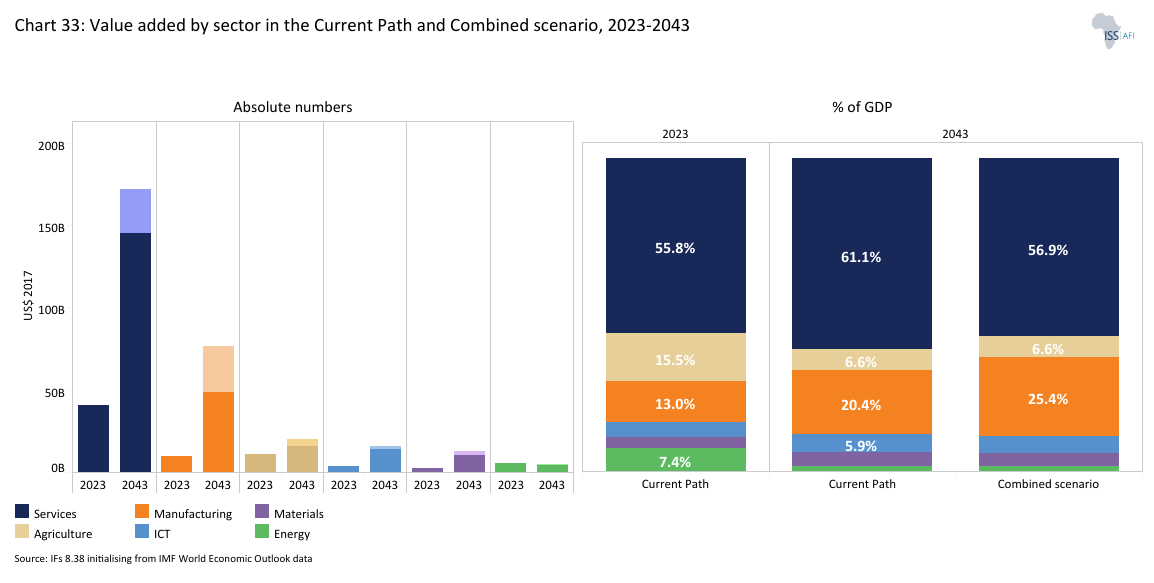

- Chart 33: Value added by sector in the Current Path and Combined scenario, 2023 and 2043

- Chart 34: Informal sector in the Current Path and Combined scenario, 2020–2043

- Chart 35: Poverty in the Current Path and Combined scenario, 2023 and 2043

- Chart 36: Life expectancy in the Current Path and Combined scenario, 2020–2043

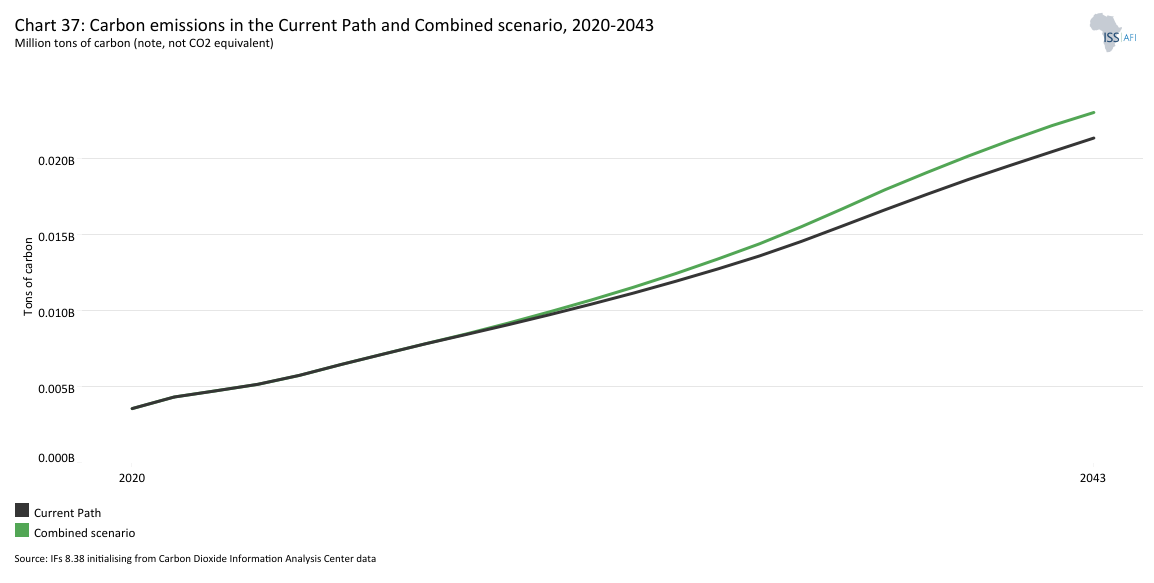

- Chart 37: Carbon emissions in the Current Path and Combined scenario, 2020–2043

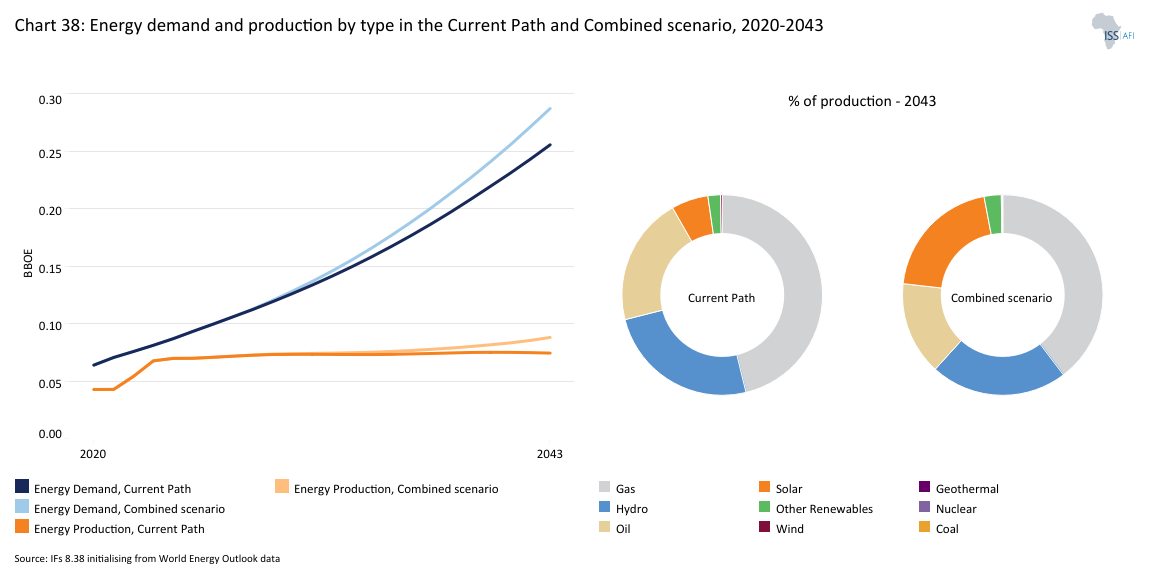

- Chart 38: Energy demand and production by type in Current Path forecast and Combined scenario, 2019-2043

- Chart 39: Policy recommendations

Chart 1 is a political map of Côte d'Ivoire.

Côte d'Ivoire is a lower-middle-income country located in West Africa, bordered to the north by Mali and Burkina Faso, to the east by Ghana, to the south by the Gulf of Guinea and to the west by Liberia and Guinea.

The country is a member of the Economic Community of West African States (ECOWAS) and the West African Economic and Monetary Union (WAEMU/UEMOA). It is the world’s leading cocoa exporter and the economic hub of francophone West Africa. It exerts a significant influence in the region. It has the third-largest economy in ECOWAS, after Nigeria and Ghana, and accounts for more than 30% of WAEMU's GDP.

Côte d'Ivoire suffered an unstable socio-political environment from the late 1990s to the first decade of this century. In 2010, elections plunged the country into deep chaos, which ended with the inauguration of Alassane Ouattara, a former IMF Economist, as Côte d'Ivoire's president in May 2011. He was first re-elected in October 2015 and won the more recent elections held in October 2020, which were boycotted by the major political parties. The political landscape has been peaceful and stable for nearly four consecutive years since the last presidential election. All attention is now focused on the upcoming presidential election scheduled for October 2025.

Due to considerable public investment in infrastructure, education, and health, as well as domestic reforms in the administration and key economic sectors under the auspices of President Ouattara, the country's overall macroeconomic performance has improved enormously since 2011. However, high levels of corruption and unemployment threaten the country's development prospects. The main challenge remains the implementation of a reform that fosters inclusive growth by encouraging the private sector to create better jobs, build capacity in the agricultural sector and develop human capital for the sustainable improvement of development indices.

Chart 2 presents the Current Path of the population structure, from 1990 to 2043.

During the latter half of the 20th century, Côte d'Ivoire had one of the highest population growth rates in sub-Saharan Africa. Its high rate of natural increase, together with the massive influx of immigrants from neighbouring countries like Burkina Faso, Mali and Benin, attracted by its comparatively strong economy, were the main reasons for its rapid growth. Migrants account for between 10% and 25% of the Ivorian population. On the entire continent, only South Africa, which has more than double Côte d'Ivoire's population and a much bigger economy, has more migrants. However, the country's population growth rate declined from about 4.9% in 1980 to 2.7% in 2023, above the average of 2.2% for lower-middle-income countries in Africa. The population of Côte d'Ivoire was 31.3 million in 2023, and on the Current Path, it will be 50.3 million by 2043, about a 61% increase over the next 20 years.

The structure of Côte d'Ivoire's population is typical of countries with a low life expectancy and high fertility rates. The total fertility rate (TFR) declined from 6.7 births per woman in 1990 to 4.3 births per woman in 2023, above the average for African lower-middle-income countries at 3.8. In the Current Path, TFR will slowly decline to about three births per woman by 2043.

As of 2023, 40.8% of the population was in the below 15 years of age dependency age group, while 2.5% were in the 65 and above dependency age group. In the Current Path, the share of these two dependency age groups is projected to be 33.7% and 4.8%, respectively, by 2043. Consequently, about 56.7% of the Ivorian population is in the 15–64 working-age group as of 2023, which will increase to 61.6% by 2043.

The working-age group, 15 to 64 years of age, is the largest share of the population, and this can be a potential source of growth provided the labour force is well trained with the skills that are demanded by the economy, and sufficient jobs are created.

Chart 3 presents a population distribution map for 2023.

The population of Côte d'Ivoire is concentrated in the central and the wetter south-eastern regions, dominated by Abidjan, the largest city and the country's main maritime outlet. The drier north is, in comparison, much less populated, while the south-western forest zone (specifically the Tai National Park) is almost completely empty.

The density of Côte d’Ivoire's population amounted to 0.96 inhabitants per hectare in 2023, 0.28 above the average for lower-middle-income countries in Africa, and almost double the total average for Africa at 0.50. On the Current Path, the population density will increase to 1.6 inhabitants per hectare in 2043, still above the total average for Africa and lower-middle-income African countries.

Chart 4 presents the urban and rural population in the Current Path, from 1990 to 2043.

Like many African countries, Côte d'Ivoire is experiencing rapid urbanisation. In 2023, 49% of the population lived in urban areas, up from 38.4% in 1990. This trend is partly the result of development policies since the 1960s that prioritised urbanisation as a driver of socio-economic growth, establishing cities as key engines of national development. Côte d'Ivoire’s urbanisation rate is above that of Africa and below that of lower-middle-income African countries by 4.8 and 2 percentage points, respectively. On the current development trajectory, the rate of urbanisation in Côte d'Ivoire will increase to 55% by 2043, while the rural population is expected to drop to 44.9% from 61.6% in 1990 and 51% in 2023.

This rapid urbanisation will undoubtedly place enormous pressure on the delivery of housing and basic services. If not well managed and planned for, this will lead to inadequate healthcare, poor sanitation, urban slums, and environmental degradation, especially in the main cities such as Abidjan (the largest city), which is the home to about 36% of the urban population in the country. Good urban planning could foster an inclusive economy by improving service delivery and reducing urban poverty. In addition, adequate and appropriate urban planning is essential to mitigate the impacts of climate change, such as flooding, which is recurrent in Abidjan during the rainy season.

Chart 5 presents GDP in market exchange rates (MER) and growth rate in the Current Path, from 1990 to 2043.

From 1960 to 1979, Côte d'Ivoire had a strong economy, though this began to change in the late 1980s when the country experienced almost seven straight years of recession from 1987 to 1993 due to a significant fall in cocoa and coffee prices and high indebtedness. During that time, the country could not meet its foreign debt obligations, but new financial arrangements by creditor banks and a 50% devaluation of its currency (the CFA franc) helped the country toward economic recovery by the mid-1990s. However, political instability from the late 1990s and during the first decade of this century significantly stunted economic growth. Macroeconomic stability, the business environment and public investment in infrastructure have improved markedly since 2012. As a result, Côte d'Ivoire has become one of the fastest-growing economies globally, with an average growth rate of 8% between 2012 and 2019.

The country's vibrant, robust and stable economic growth since 2012 experienced a slowdown and reached 1.8% in 2020 owing to the COVID-19 pandemic. Yet, it is one of the few countries that recorded positive GDP growth in 2020. Since 2021, Côte d'Ivoire has returned to its high-growth trajectory. The resilience of the Ivorian economy can be explained in part by the relative diversification of its productive fabric and the monetary stability conferred by its membership in the WAEMU.

In 2023, the size of Côte d'Ivoire's economy was US$72.4 billion, up from US$22.7 billion in 1990. Between 2012 and 2023, the size of GDP more than doubled, increasing by 106%. Looking forward, the growth prospects for Côte d'Ivoire remain positive, driven by sustained investment in infrastructure, especially in the transport sector, alongside the expected increase in oil production and sound macroeconomic policies. Real GDP growth is projected to average about 6.5% between 2024 and 2026. By 2043, the economy will grow to US$237.1 billion, making it the 8th largest economy in Africa in the Current Path, improving two places from 2023 when Côte d'Ivoire ranked 10th on the continent. However, this outlook could be jeopardised by a deterioration of the security situation in the north, worsened by high youth unemployment and climate hazards. Strengthening macroeconomic stability, inclusiveness, sustainability of growth, and security and institutional stability should make it possible to contain these risks.

Chart 6 presents the size of the informal economy as per cent of GDP and per cent of total labour (non-agriculture), from 2020 to 2043. The data in our modelling are largely estimates and therefore may differ from other sources.

The informal sector is a crucial lifeline for many people in Côte d'Ivoire. Informal employment has grown by more than 90% since the process of liberalisation of the economy in the 1980s. In 2024, 65.3% of Ivorians found employment in the informal sector, a slight decrease from 2020, when 66% of Ivorians were employed in the informal sector.

In urban areas especially, informal work is present in Côte d'Ivoire. From street vendors and taxi drivers to hairdressers, mechanics and metal workers, small-scale businesses shape the daily economy of cities across the country.

With the formal job market unable to keep up with the pace of urban population growth, the informal urban sector has stepped in to absorb much of the workforce. It now accounts for nearly 7 million jobs, more than both the formal economy and agriculture. Notably, women play a leading role, making up about two-thirds of informal business owners.

In 2023, the size of the informal economy represented about 38.3% of the country's GDP, and by 2043, it is projected to modestly decline to 32.4%, above the average of 26.4% for lower-middle-income countries in Africa for that year.

Although the informal economy provides a safety net for the large and growing working-age population in the country, it impedes economic growth. Reducing informality will allow more people to benefit from better wages and increased security from shocks, such as the COVID-19 pandemic, that severely hurt those in the informal sector. Currently, the informal urban sector is the largest employment provider in Côte d'Ivoire. Up to a third of the informal firms could significantly benefit from formalisation, both in terms of personal security for the firm owners and economic productivity for Côte d'Ivoire as a whole.

Chart 7 presents GDP per capita in the Current Path, from 1990 to 2043, compared with the average for the Africa income group.

Over the period 1960–1977, the GDP per capita of Côte d'Ivoire was higher than that of South Korea as a result of strong economic growth underpinned by massive public investment and high prices of cocoa and coffee on the international markets. The GDP per capita grew about 90% between 1960 and 1979.

However, after years of steady growth, the GDP per capita started to decline in the late 1980s due to deep recessions following both adverse external shocks and subsequent inappropriate domestic policy responses. The GDP per capita shrank by 54.1% between 1980 and 1994, before slightly improving by 5.5% between 1995 and 1999. GDP per capita growth again started to decline from 2000 due to socio-political instability that undermined economic growth.

Since 2012, Côte d'Ivoire has experienced a steady increase in GDP per capita: it increased by 48.8% between 2012 and 2023. As a result, the GDP per capita (PPP) was US$5 434 in 2023 and, on the Current Path, is forecast to increase to US$9 235 by 2043. This would also mean that Côte d'Ivoire will surpass its previous peak GDP per capita, US$5 645 in 1979, by 2025.

Chart 8 presents the rate and numbers of extremely poor people in the Current Path from 2020 to 2043.

In 2022, the World Bank updated the poverty lines to 2017 constant dollar values as follows:

- The previous US$1.90 extreme poverty line is now set at US$2.15, also for use with low-income countries.

- US$3.20 for lower-middle-income countries, now US$3.65 in 2017 values.

- US$5.50 for upper-middle-income countries, now US$6.85 in 2017 values.

- US$22.70 for high-income countries. The Bank has not yet announced the new poverty line in 2017 US$ prices for high-income countries.

Poverty in Côte d'Ivoire is driven by a mix of economic, social and structural issues. A large portion of the population relies on agriculture, particularly cocoa farming, which is highly susceptible to global price fluctuations and changing weather patterns, leaving many farmers earning less than a dollar per day. Limited access to healthcare services, worsened by the aftermath of civil war, has left many Ivorians without adequate medical care, making diseases like malaria prevalent and putting additional strain on household incomes. Educational barriers, such as low school enrolment rates and limited access to quality education, hinder opportunities for upward mobility, trapping many families in cycles of poverty. Past political instability and conflicts have disrupted economic activities, displaced communities and destroyed vital infrastructure, leaving lasting effects on poverty levels. Furthermore, inadequate infrastructure, such as roads and electricity, restricts economic opportunities and access to essential services, particularly in rural areas.

The economic crisis in the 1980s and the socio-political instability from the late 1990s onward significantly increased poverty in Côte d'Ivoire. The extreme poverty rate at US$2.15, which was about 4.4% in 1981, reached its peak in 2011 at 38.6% of the population.

In the current development trajectory, the extreme poverty rate will decline to 3.6% by 2043, well below the average of 18% for lower-middle-income countries in Africa.

However, using US$3.65 as the poverty threshold, Côte d'Ivoire had 31.94% of its population living below the lower-middle-income threshold as of 2024. This is about eight percentage points lower than the projected average for lower-middle-income countries in Africa. Although the poverty rate has declined, it is characterised by regional disparities and remains unfavourable for women (51.05% of poor individuals are women) and in rural areas ( 54.7% in 2018.

Going forward, the poverty level at US$3.65 will maintain its downward trend to decline to 13.2% (6.2 million people) by 2043, well below the projected average for lower-middle-income countries in Africa, which will then be at 38.3%.

To sustain economic growth in the long term, it must be inclusive. These projections are by no means guaranteed, and it is the impetus of policymakers to ensure that these trends come to pass in the Ivorian economy. The government should ensure that the most vulnerable members of society, such as minority groups and women, are uplifted by the positive trends in the broader economy. Inequality, which has historically been pervasive in Côte d'Ivoire, may pose a serious threat to the gains across the economy and should be accounted for in economic policy going forward.

The Human Poverty Index (HPI) takes into account poverty as understood by income levels, weighted equally with indicators for health, education and standards of living. Similar to the projected progress in decreasing monetary poverty, Côte d'Ivoire is projected to decrease its poverty as measured by the HPI. Côte d'Ivoire’s HPI will decrease from 12.6 in 2023 to 6.7 in 2043. This indicates that, as well as bringing people above the monetary poverty lines, Côte d'Ivoire will see improvements in the quality of life for the poorest members of society through increased access to education, health care, infrastructure improvements and standard of living.

Chart 9 depicts the National Development Plan of Côte d'Ivoire.

The 2021-2025 National Development Plan (NDP) capitalises on international and regional development priorities, in particular the Sustainable Development Goals (SDGs) and the African Union's 2063 vision.

The main objective of Côte d'Ivoire’s NDP 2021-2025 is to achieve the economic and social transformation necessary to elevate the country to upper-middle-income status by 2030.

With this objective, the NDP 2021-2025 focuses on six pillars: accelerating the structural transformation of the economy through industrialisation; developing human capital and promoting employment; developing the private sector and investment; strengthening inclusion, national solidarity and social action; achieving balanced regional development, preserving the environment and combating climate change; and strengthening governance and modernising the state.

The eight sectoral scenarios as well as their relationship to the Current Path forecast and the Combined scenario are explained in the Technical Page. Chart 10 summarises the approach.

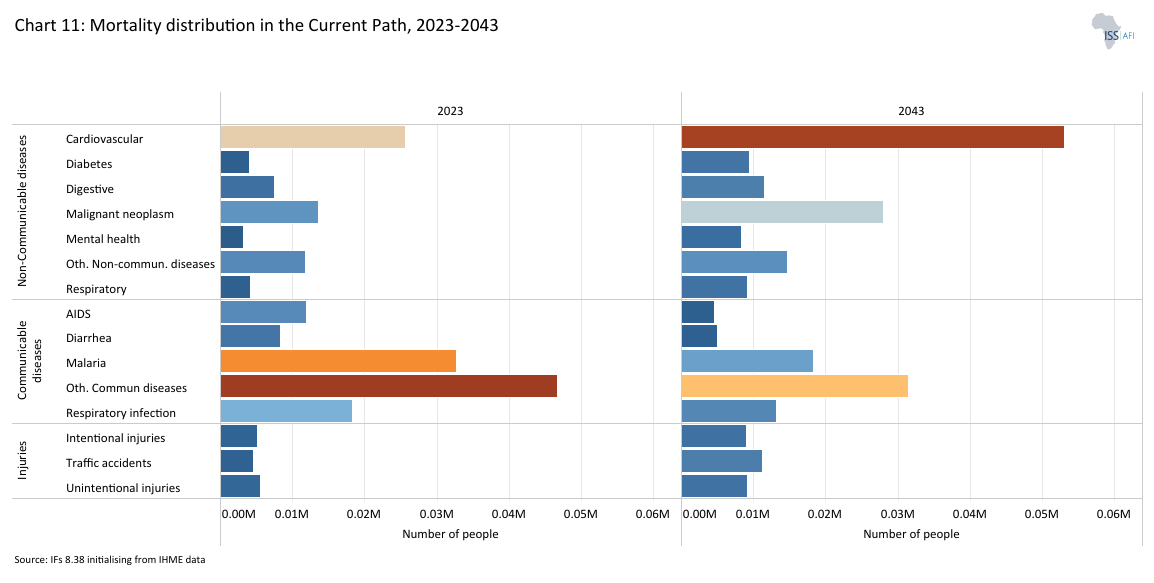

Chart 11 presents the mortality distribution in the Current Path for 2023 and 2043.

The Demographics and Health scenario envisions ambitious improvements in child and maternal mortality rates, enhanced access to modern contraception, and decreased mortality from communicable diseases (e.g., AIDS, diarrhoea, malaria, respiratory infections) and non-communicable diseases (e.g., diabetes), alongside advancements in safe water access and sanitation. This scenario assumes a swift demographic transition supported by heightened investments in health and water, sanitation and hygiene (WaSH) infrastructure.

Visit the themes on Demographics and Health/WaSH for more detail on the scenario structure and interventions.

Despite the dynamic economy, Côte d'Ivoire lags in several health indicators. The health sector was severely affected by years of underinvestment due to political and military conflict. However, the Ivorian government has made a concerted effort in recent years to improve access to services, rehabilitate and build facilities, and develop technical platforms aligned with international standards. Despite these efforts, there is still room for improvement in quality, especially as the country rolls out universal health coverage.

Maternal mortality remains a serious challenge for the country, with a rate of 424.3 deaths per 100 000 live births, more than six times higher than the UN Sustainable Development Goal target of 70.

In 2023, communicable diseases were the leading cause of death in Côte d'Ivoire, accounting for 58% of fatalities (117 720), while non-communicable diseases followed at 34% (69 670). For instance, malaria, a major communicable disease, remains endemic in Côte d'Ivoire and is the leading cause of death among children and adolescents. Beyond its immediate effects, malaria has been linked to long-term metabolic health issues. Studies show that malaria can alter lipid profiles and increase glucose and insulin resistance, even in non-diabetic individuals. Additionally, maternal malaria has been found to affect the blood pressure and glucose metabolism of offspring, raising their risk of hypertension and diabetes later in life. These metabolic changes not only contribute to rising cardiovascular diseases in the country but also influence the incidence of neonatal disorders, as maternal health directly impacts the developing child.

By 2034, this trend is expected to reverse as the country experiences an epidemiological transition, with non-communicable diseases surpassing communicable diseases, accounting for 46% of deaths, while communicable diseases will account for 43%. This shift is largely attributed to increased life expectancy and the westernisation of lifestyle factors. This trend is expected to continue into 2043, with non-communicable diseases projected to account for 57% of all fatalities, while communicable diseases will make up 31%.

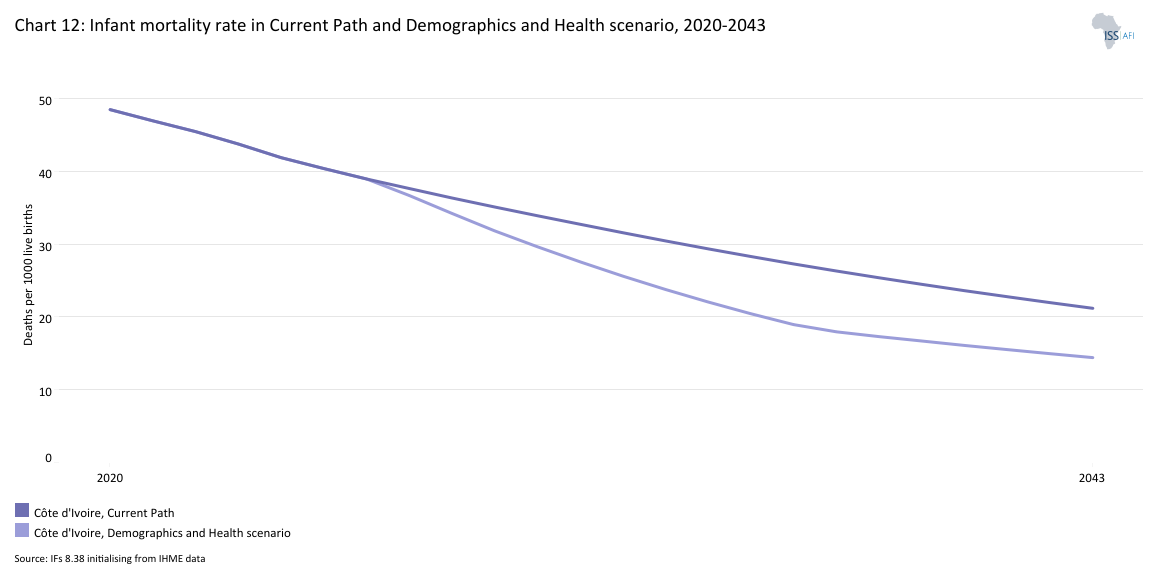

Chart 12 presents the infant mortality rate in the Current Path and in the Demographics and Health scenario, from 2020 to 2043.

The infant mortality rate is the probability of a child born in a specific year dying before reaching the age of one. It measures the child-born survival rate and reflects the social, economic and environmental conditions in which children live, including their health care. It is measured as the number of infant deaths per 1 000 live births and is an important marker of the overall quality of the health system in a country.

According to the Global Burden of Disease (GBD), neonatal disorders are the second leading cause of death in Côte d’Ivoire. An audit of neonatal deaths conducted between 1 January and 31 December 2022, identified the primary direct causes as neonatal asphyxia (34%), neonatal infections (24%) and prematurity (14%). The most common contributing factors were delays in decision-making (84.2%), delays in accessing health services (20.2%) and delays in receiving appropriate care (15.7%). As of 2023, Côte d’Ivoire’s infant mortality rate stood at 43.7 deaths per 1 000 live births, exceeding the average of 41.4 deaths among its lower-middle-income African peers. By 2043, under the Demographics and Health scenario, this rate is projected to fall significantly to 14.4 deaths per 1 000 live births, compared to 21.2 deaths per 1 000 live births in the Current Path. This represents a major improvement, placing Côte d’Ivoire well below the projected average for lower-middle-income African countries, which is estimated at 29.4 deaths per 1 000 live births.

The Demographics and Health scenario also projects a reduction in maternal mortality in Côte d’Ivoire. By 2043, the maternal mortality rate will decline from 195 deaths per 100 000 live births in the Current Path to 116.3. This would place Côte d’Ivoire below the projected average for lower-middle-income African countries, which stands at 266.8 deaths per 100 000 live births. However, even under this improved scenario, the country is unlikely to meet the UN Sustainable Development Goal target of 70 deaths per 100 000 live births by 2030, with the maternal mortality rate still projected to be 312.3 at that point.

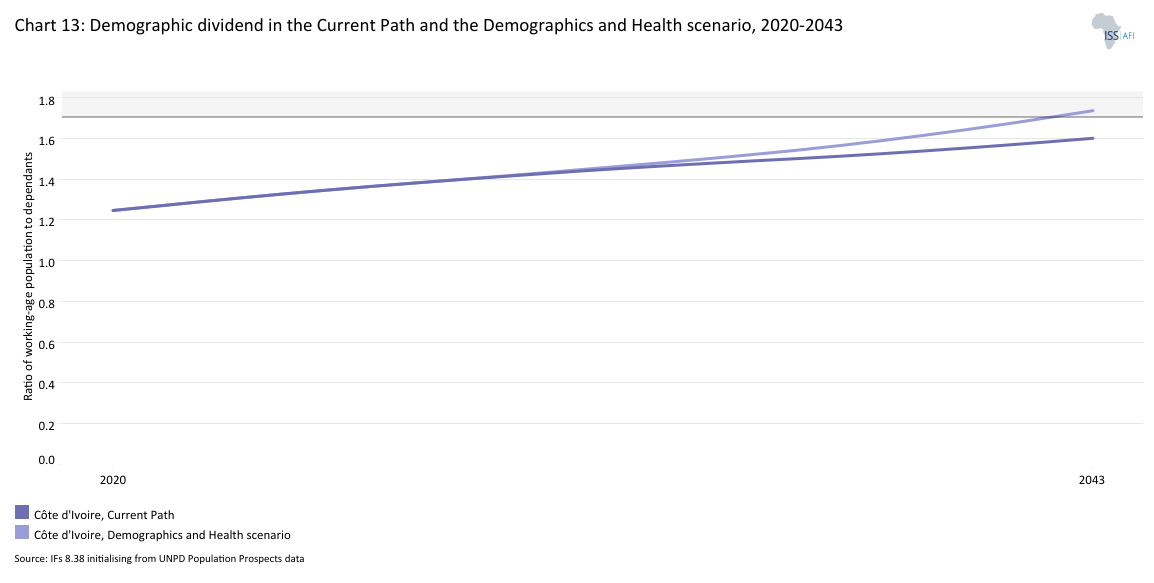

Chart 13 presents the demographic dividend in the Current Path and in the Demographics and Health scenario, from 2020 to 2043.

The use of modern contraceptives in Côte d’Ivoire remains relatively low. A 2018 survey found that 20.9% of women used contraceptives to space or limit births, with 19.6% using modern methods. By 2020, the modern contraceptive prevalence rate among married women had modestly increased to 22%. Côte d’Ivoire's contraceptive use could reach 56.7% by 2043 under the Demographics and Health scenario, compared to 43.8% under the Current Path.

Côte d'Ivoire's total fertility rate (TFR) has been steadily declining over the past few decades. In 1990, the TFR was 6.6 children per woman. By 2020, it had decreased to 4.7, and in 2023, it further declined to 4.3 births per woman. Under the Demographics and Health scenario, the TFR could fall to 2.5 births per woman by 2043, compared to 3 in the Current Path.

If Côte d’Ivoire enhances its investments in reproductive health and family planning, fertility rates could decline more rapidly, leading to healthier families and communities. Coupled with increased investments in health, education and job creation, this shift could pave the way for a demographic dividend, where a larger, healthier workforce drives economic growth. This dividend is the window of economic growth opportunity that opens when the ratio of working-age persons to dependents increases to 1.7 to 1 and higher.

In 2023, the ratio of working-age individuals to dependants stood at 1.3, meaning there were 1.3 working-age individuals for each dependant. In the Current Path, this ratio will reach 1.6 by 2043. In the Demographics and Health scenario, the working-age to dependant ratio will reach 1.7 by 2040, indicating a more favourable age structure and potential for accelerated economic growth. However, reaching this ratio is not an automatic guarantee of achieving the dividend; it has to be accompanied by increased investments in health, education and job creation opportunities.

Chart 14 presents crop production and demand from 1990 to 2043.

The Agriculture scenario envisions an agricultural revolution that ensures food security through ambitious yet feasible increases in yields per hectare, thanks to improved management, seed, fertiliser technology and expanded irrigation. Efforts to reduce food loss and waste are emphasised, with increased calorie consumption as an indicator of self-sufficiency and prioritising it over food exports. Additionally, enhanced forest protection signifies a commitment to sustainable land use practices.

Visit the theme on Agriculture for our conceptualisation and details on the scenario structure and interventions.

The agriculture sector remains one of the pillars of Côte d'Ivoire's economy, although its contribution to GDP has declined over time. As the third-largest contributor to GDP, it accounts for about 60% of export receipts and employs two-thirds of the population. The contribution of the agriculture sector to GDP was 15.5% (US$11.2 billion) in 2023 and is projected to steadily decline as a portion of GDP to 6.6% while nominally growing to US$15.7 billion by 2043, indicating the structural transformation of the economy.

Côte d’Ivoire has considerable agriculture potential. Its geographical position contributes to about 75% of the national territory being suitable for agriculture. The country is a net exporter of major cash crops such as cocoa, coffee, rubber, cotton, palm oil and cashew nuts. It is also self-sufficient in foodstuffs such as cassava, yam and bananas but depends heavily on imports of rice, wheat and dairy products, among others.

Indeed, Côte d'Ivoire is the world’s largest cocoa exporter. Cocoa and cocoa-related products dominate the agricultural export economy of Côte d'Ivoire as well as the general Ivorian export economy. Despite this, chocolate exports remain low at 2.4% of Ivorian total exports, while much of the country's raw cocoa exports are to large chocolate-producing countries such as France and Belgium. Labour conditions on cocoa farms, the poverty of cocoa farmers, and the prevalence of child labour in the industry have come under intense international scrutiny recently. The large profits in the international chocolate market have not translated to better working or living conditions for those who harvest cocoa; these factors are compounded by the fact that a changing climate threatens the stability of the industry across Côte d'Ivoire. Investment in domestic chocolate production value chains may be a source of future economic growth, stability, and development for Côte d'Ivoire.

Côte d'Ivoire also exports large amounts of rubber, cashews, coconuts and palm oil. The domestic production of foodstuffs is buttressed by high production of yams (over 7 million tons per year) and cassava (over 5 million tons per year), as well as oil palms and paddy rice. The country, however, does import a significant amount of foodstuffs such as rice, wheat and onions.

Deforestation, a changing climate, land degradation and biodiversity loss pose serious threats to the future of the Ivorian agricultural sector. There are some interesting developments that have taken place in the country that might be able to counteract these trends. In June 2024, Côte d'Ivoire received a US$35 million payment from the World Bank's Forest Carbon Partnership Facility (FCPF) for successfully reducing 7 million tons of carbon emissions between late 2020 and 2021. This payment, part of an Emission Reductions Payment Agreement (ERPA), rewards the country's efforts in forest conservation, agroforestry and sustainable land management, particularly in regions under environmental stress, such as the cocoa belt and Taï National Park. Côte d'Ivoire was one of only four African countries, alongside Mozambique, Ghana and Madagascar, to receive results-based payments for meeting sustainability and environmental protection goals, putting the country at the forefront of sustainable development on the continent. Due to more than 60% of Ivorians relying on crops to feed their families and earn an income, further development in the agriculture sector is a viable option to reduce poverty in Côte d'Ivoire by a significant margin.

The use of higher-quality seeds, fertiliser and agricultural machinery generally remains low for staple crop production. An estimated 50% of farms in Côte d'Ivoire persist with traditional farming methods, and only 10% use intensive systems. Owing to low yields, population growth and diet preferences, Côte d'Ivoire's import bill for foodstuffs is increasing. Improvements in the agriculture sector would help reverse this trend. Côte d'Ivoire has begun utilising digital technology and ICT networks to provide small-scale farmers with information that will help them maximise yields, minimise losses and gather better agricultural data. This digitisation of the agricultural system in Côte d'Ivoire may provide a path to improved agricultural outcomes.

Moreover, low agricultural productivity, low purchasing prices, high input costs, considerable post-harvest losses, coupled with inefficient use of modern farming techniques, have contributed to a decline in agricultural production and kept farmers' incomes low.

Total agricultural production for Côte d'Ivoire is projected to grow to 50.2 million metric tons by 2043, an increase of 58% along the Current Path. This growth is, however, not sufficient to keep up with rising demand which is projected to increase to 62.7 million metric tons. Agricultural crop production in 2023 stood at 34.7 million metric tons, compared to demand which stood just under production at 34.2 million metric tons, making Côte d'Ivoire one of the few countries in Africa to have a food surplus. This agricultural surplus is forecast to end by 2026. By 2043, agricultural crop production and demand will be 51.5 and 59.3 million metric tons, respectively. This is equivalent to an excess demand for crops of about 7.8 million metric tons that will likely be met through imports.

Côte d'Ivoire's agriculture sector is both a key driver of the national economy and a primary player in global markets for goods such as cocoa and rubber. The sector accounts for around half of national employment and 80% of export revenue.

Chart 15 presents the import dependence in the Current Path and the Agriculture scenario, from 2020 to 2043.

As Côte d'Ivoire imports wheat, corn meal and dairy products to meet its food demand, it has also become the fifth-largest rice importer in the world, with 1.25 million tons per year. Based on its demand-to-production ratio, the import dependence of Côte d'Ivoire’s agricultural sector is expected to grow along the Current Path. In 2023, Côte d'Ivoire’s import dependence stood at 2.44%, indicating that it had imported 2.44% of its total consumption. This was significantly lower than the lower-middle-income African average of 12.9%, ranking the country 19th among 22 nations in its income group. By 2043, under the current trajectory, import dependence will increase to 18.3%.

The Agriculture scenario would allow for further growth in the agricultural export market, as well as free up capital for investment and economic activity outside of meeting the food demand of Ivorian citizens. In the Agriculture scenario, crop yields in Côte d'Ivoire will rise from 3.4 metric tons per hectare in 2023 to 5.4 tons per hectare by 2043. This represents a 17.4% increase over the Current Path of 4.6 metric tons per hectare in the same year. It will be 3% below the average for lower-middle-income countries in Africa at 6.1 tons per hectare in that year.

The increase in crop yield will translate into an improvement in crop production. In the scenario, agricultural production will increase to 72.6 million metric tons by 2043 and outpace the growth in agricultural demand over the course of the projected time period. As a result, Côte d’Ivoire’s import dependence will shift dramatically, declining from 18.3% in 2043 to 1.6%, marking a 91.3% decrease. This shift would indicate a transition from being a net importer to a net exporter, reflecting a surplus in agricultural production. This reduction in imports could release funds for other productive investments in the economy and ensure food security. It would also improve the country's current account balance and make it less vulnerable to international food price shocks.

The development of domestic agriculture is crucial in preventing the country from becoming overly dependent on agricultural imports to meet the growing population’s demand for food.

Chart 16 depicts the progress through the educational system in the Current Path, for 2023 and 2043.

The Education scenario represents reasonable but ambitious improvements in intake, transition, and graduation rates from primary to tertiary levels and better quality of education at primary and secondary levels. It also models substantive progress towards gender parity at all levels, additional vocational training at the secondary school level, and increases in the share of science and engineering graduates.

Visit the theme on Education for our conceptualisation and details on the scenario structure and interventions.

The educational system of Côte d’Ivoire is structured around primary, secondary, and tertiary education, as in most countries. The primary level lasts for six years, the lower-secondary level lasts for four years, the upper-secondary level lasts for three years, and the tertiary level lasts between three and four years. Côte d’Ivoire’s educational system was weakened during the political instability of the late 1990s and 2000s. School enrolment and the quality of education declined. However, since 2012, reforms aimed at improving Côte d’Ivoire’s education system are ongoing. Government spending in the sector has increased in recent years, and the country recently announced a universal schooling initiative. To achieve this goal, the government is investing in educational infrastructure and recruiting new teachers.

The total educational expenditure stands at 5.2% of GDP (US$4 billion) in 2023. Among the different levels, the country spends 2% of GDP (US$1.45 billion) on primary education, 1.7% (US$1.25 billion) on secondary education, and 1.5% (US$1.06 billion) on tertiary education. This is a slightly higher yet similar rate of relative economic investment compared to the average for African lower-middle-income countries which spend 4.5% of GDP on education. This spending has, however, not been able to overcome the drop in educational quality that was experienced during the periods of instability prior to 2011.

The quality of education in Côte d'Ivoire has deteriorated. Studies have shown that less than half of Ivorian learners have the required reading or mathematics skills at the end of the primary school cycle. Ivorian primary students receive an average score of 24/100 on reading at the end of schooling and 28/100 on math. This is poor compared to the average scores of students in other lower-middle-income countries in Africa, who average scores of 32/100 and 33/100 on reading and math, respectively. The low attainment rate and low quality of education in Côte d'Ivoire are a serious concern to potential future economic growth as it threatens the potential gains from the window of demographic dividend by hampering human capital. A recent study shows that the low level of technical/vocational skills is one of the binding constraints to economic growth in the country.

According to the African Center for Economic Transformation (ACET), Côte d’Ivoire's education system faces significant challenges in aligning its offerings with labour market demands, particularly in technical and vocational education and training (TVET). As of the 2015–2016 academic year, only 6.1% of students were enrolled in TVET programs. Moreover, there is a notable gender disparity, with girls underrepresented in agricultural and industrial courses. The majority of TVET students (72.5%) are enrolled in service-related fields, while only 0.2% and 27.3% pursue agriculture and industry, respectively. This indicates a misalignment between training programs and the country's economic sectors, particularly agri-business. In higher education, the trend continues, with liberal arts dominating enrolments and scientific and technical disciplines lagging behind. Recognising these issues, the government has initiated reforms aimed at enhancing the quality and relevance of education to better prepare students for the workforce.

Quality education is crucial for economic development. Countries such as South Korea and Malaysia have succeeded in transitioning to emerging market status thanks to their investments in building some of the best education systems in the world. According to the Nobel Prize winner in economics, Robert Lucas, and the former World Bank chief economist, Paul Romer, economic development depends above all on a country's ability to value its human capital. It allows not only the country to increase its current added value but also to create tomorrow's technological innovations. Hence, Ivorian authorities should accelerate reforms to improve the quality of education in Côte d'Ivoire.

In 2023, Côte d’Ivoire's gross enrolment rates were 102.9% for primary education, 72.1% for lower secondary, 38.7% for upper secondary, and 11% for tertiary education. The over-100% rate in primary education suggests the inclusion of over-aged or under-aged students, while the significant drop in enrolment at higher education levels indicates challenges in student retention and progression. By 2043, Côte d’Ivoire's gross enrolment rates will shift, with primary education experiencing a slight decrease to 101.2%, while lower-secondary education will rise to 88.7%, upper secondary to 62.5%, and tertiary education to 26%. These trends suggest progress in educational attainment, particularly at higher levels, reflecting ongoing efforts to enhance access to education.

In 2023, Côte d’Ivoire's education completion rates stood at 75% for primary education, 44% for lower secondary, 20.2% for upper secondary, and 8.8% for tertiary education. By 2043, these rates will improve significantly, reaching 97.4% for primary, 65.4% for lower secondary, 44% for upper secondary, and 14.1% for tertiary education. This upward trend reflects ongoing efforts to enhance educational access and quality across all levels.

Chart 17 presents the mean years of education in the Current Path and in the Education scenario, from 2020 to 2043, for the 15 to 24-year age group.

The average years of education in the adult population aged 15 to 24 is a good first indicator of how the stock of knowledge in society is changing.

The mean years of education for 15-24-year-old Ivorians stands at 7.2 years as of 2024. This means that the average Ivorian attains a primary education. Along the Current Path, this will improve to 9.2 years by 2043, indicating a positive trend for the country. The Education scenario further raises this average to 9.6 years by 2043, indicating an improvement of almost half a year of additional education for the average Ivorian aged 15-24.

As of 2024, the female educational attainment for the 15-24 year age cohort lagged behind their same-aged male peers. The female mean stood at 6.2 years, which is 2 years less than the male average of 8.2 for the same age cohort. Along the Current Path, this gap is expected to close slightly by 2043, with the female mean improving to 8.6 years and the male mean improving to 9.8 years, shrinking the gap to 1.2 years on average. In the Education scenario, the female mean improves further to 9 years and the male mean to 10.1 years. This shows larger gains among both sexes in the 15-24 year age group, as well as an improvement in gender parity in education and an acceleration of educational attainment for both males and females in Côte d'Ivoire.

In the Education scenario, the score for the quality of primary education improves from 22.2 out of a possible 100 in 2023 to 27.3 in 2043, an 23% increase compared to the Current Path. In addition, the score for the quality of secondary education increases from 32.9 in 2023 to 37.4 in 2043 in the scenario, an 4.5% improvement compared to the Current Path in 2043.

Chart 18 presents the value-add by sector as share of GDP in the Current Path, for 2023 and 2043.

In the Manufacturing scenario, reasonable but ambitious growth in manufacturing is envisaged through increased investment in the sector, research and development (R&D) and improved government regulation of businesses. This aims to enhance total labour

Visit the theme on Manufacturing for our conceptualisation and details on the scenario structure and interventions.

Manufacturing in Côte d'Ivoire plays a developing role in the country's economy. The sector is largely driven by agro-processing which benefits from the country’s strong agricultural base. A substantial portion of manufacturing revolves around processing cocoa, coffee, cashew nuts, palm oil, rubber and cotton into semi-finished or finished goods for both local consumption and export. While light industries such as food processing, beverages, textiles, construction materials and chemicals have a notable presence, often supported by multinational firms like Nestlé, much of the sector remains constrained by challenges such as high energy costs, inadequate infrastructure and dependency on imported machinery. In response, the Ivorian government has implemented policies to stimulate industrial growth, including the development of industrial parks like PK24 near Abidjan, fiscal incentives for foreign investors, and integration with regional trade initiatives such as ECOWAS and the African Continental Free Trade Area. These efforts reflect a broader ambition to shift from raw commodity exports to value-added manufacturing and industrial diversification.

Côte d’Ivoire’s manufacturing sector has struggled to expand its presence in both regional and global markets. Between 2010 and 2017, manufactured goods accounted for an average of just 14% of the country's total merchandise exports, significantly lower than the average for lower-middle-income countries in Africa. While a substantial portion of these exports, approximately 75%, are directed toward the ECOWAS region.

Currently, the rubber and fruit industries are under industrialisation, leaving potential gains from exporting highly processed rubber and other processed agriculture on the table. Bringing these value-add manufacturing processes onshore to Cote d’ivoire is crucial for future growth. High level manufacturing processes, such as pharmaceutical manufacturing, may provide future sustainable economic growth, as well as decreasing Côte d'Ivoire’s dependence on imported medicine.

Like in other African countries, many impoverished individuals in Côte d'Ivoire find themselves entrenched in low-productivity agriculture and informal service-based activities. Boosting the manufacturing sector will generate inclusive growth by facilitating the transition of low-income individuals from these sectors to higher productivity areas. This structural shift not only boosts incomes but fosters a positive cycle wherein the growth of productive employment, capacities and earnings mutually reinforce one another, propelling economic expansion and poverty reduction.

The manufacturing sector in Côte d’Ivoire will contribute 20.5% to the national GDP, equivalent to US$48.5 billion, by 2043. This marks a significant increase of around 58% compared to its 2023 contribution of just 13% of GDP, or roughly US$9.4 billion. The anticipated growth of US$39.1 billion over two decades reflects the country’s ongoing industrial transformation, driven by government investment in infrastructure, the expansion of agro-industrial processing, and the strategic push to boost value-added production across key sectors such as food, textiles and construction materials.

Aggressive pursuit of manufacturing industries to develop and diversify the Ivorian economy to protect against shocks on the global commodities market and to secure high future growth rates is essential.

Chart 19 presents the contribution of the manufacturing sector to GDP in the Current Path and in the Manufacturing scenario, from 2020 to 2043. The data is in US$ and % of GDP.

By 2043, in the Manufacturing scenario, Côte d’Ivoire's manufacturing sector will contribute 23.7% to the nation's GDP, which is 3.25 percentage points higher than the Current Path. In monetary terms, the manufacturing industry's value-add will reach US$58.3 billion by 2043, representing an increase of US$9.8 billion compared to the Current Path projection. This anticipated growth underscores the potential of strategic investments in manufacturing to significantly boost the country's economic output.

Chart 20 depicts exports and imports as a percentage of GDP, from 2000 to 2043, in the Current Path and in the AfCFTA scenario.

The AfCFTA scenario represents the impact of fully implementing the African Continental Free Trade Agreement by 2034. The scenario increases exports in manufacturing, agriculture, services, ICT, materials and energy exports. It also includes improved multifactor productivity growth from trade and reduced tariffs for all sectors.

Visit the theme on AfCFTA for our conceptualisation and details on the scenario structure and interventions.

Côte d’Ivoire is a member of several key trade agreements aimed at regional and international economic integration. It is a signatory to the African Continental Free Trade Agreement (AfCFTA) and a member of the Economic Community of West African States (ECOWAS), which promotes free movement of goods within the region through the ECOWAS Trade Liberalization Scheme (ETLS). Côte d’Ivoire also belongs to the West African Economic and Monetary Union (WAEMU), which shares the CFA franc and coordinates economic policies with other francophone West African nations. Furthermore, it participates in the Organisation pour l’Harmonisation en Afrique du Droit des Affaires (OHADA), which harmonises business laws across member states. Internationally, Côte d’Ivoire benefits from the African Growth and Opportunity Act (AGOA) for tariff-free exports to the United States until 2025 and has ratified Economic Partnership Agreements (EPAs) with both the European Union (EU) and the United Kingdom (UK), granting them preferential tariff treatment for their exports while progressively reducing tariffs on its own imports from these regions.

According to the Observatory of Economic Complexity (OEC), the largest exports from Côte d'Ivoire are cocoa beans and cocoa-related products, such as cocoa powder, shells and paste, which comprise 30% of the country’s export portfolio. Cocoa is followed by rubber (12% of exports), gold (12%), refined petroleum (10.7%), nuts (5.86%) and palm oil (2.92%).

The largest trading partner for Côte d'Ivoire is Switzerland which receives 9.11% of Ivorian exports. This is almost entirely gold exports, as Switzerland imports 70.6% (US$1.5 billion) worth of Ivorian gold. Côte d'Ivoire’s other largest trading partners include Mali (8.34%), the Netherlands (8.14%), the United States (6.18%), France (5.36%) and Burkina Faso (4.82%). The largest importers of Ivorian cocoa beans are the Netherlands, Belgium, the United States and Malaysia. Mali dominates the Ivorian export market for refined petroleum with 60.5%, with other African neighbours such as Burkina Faso, Togo and Cameroon also importing significant amounts. Côte d'Ivoire exports its rubber to a number of countries such as China, Malaysia, the United States, India and Spain. Finally, the majority of Côte d'Ivoire’s nut exports, the country’s other staple food export, go to Vietnam (51%) and India (29.2%). Côte d'Ivoire's largest imports were crude petroleum (US$2.53 billion), refined petroleum (US$1.43 billion), special purpose ships (US$986 million), non-fillet frozen fish (US$846 million) and rice (US$721 million). The country's main suppliers were China (US$3.16 billion), Nigeria (US$2.4 billion), France (US$1.14 billion), India (US$982 million) and the United States (US867 million).

As of 2023, imports comprised 24.1% of Côte d’Ivoire's GDP, while exports accounted for 21.5%, indicating a trade deficit. Along the Current Path, both of these figures are projected to increase. Exports will outpace imports by 2036, with exports comprising 32.4% of GDP and imports comprising only 32%. Exports will remain higher than imports, reaching 37.9% and 35.6% of GDP by 2043, respectively.

Chart 21 presents the trade balance in the Current Path and in the AfCFTA scenario, from 2020 to 2043 as a percentage of GDP.

Implementation of the African Continental Free Trade Agreement (AfCFTA) would bring large opportunities to Côte d'Ivoire by reducing trade barriers between it and its African peers. This would reduce the costs of industry, open the Ivorian economy to more trading partners across the continent, and induce economic growth in the country.

In the AfCFTA scenario, trade will increase in Côte d'Ivoire, with a trade volume representing 75.5% of the Ivorian economy by 2043, an increase of 12.7% from the Current Path. In the AfCFTA scenario, Côte d’Ivoire's exports are anticipated to rise to 39.5% of GDP, while imports are expected to increase to 36.4% of GDP. This shift suggests a more balanced trade environment, with the country enhancing its export capacity and deepening integration into regional and global markets. Such developments could contribute to economic diversification and resilience against external shocks.

As a result, Côte d'Ivoire's trade balance will improve significantly in the AfCFTA scenario compared to the Current Path. In 2023, the country had a trade deficit, with the trade balance standing at -2.6% of its GDP. However, with the implementation of the AfCFTA, Côte d'Ivoire is expected to transition to a trade surplus by 2033, reaching a surplus of 0.1% of GDP, compared to the Current Path which anticipates a surplus only by 2036.

By 2043, the trade surplus will increase to 3.1% of GDP, compared to 1.3% in the Current Path for the same year. Côte d'Ivoire is in a position to take advantage of the AfCFTA and grow its economy at a faster rate than in the Current Path and compared to the rest of lower-middle-income Africa, which will have a trade balance of -3% of GDP by 2043.

Chart 22 presents the Current Path of access to electricity for urban, rural and the total population from 2000 to 2043.

The Large Infrastructure and Leapfrogging scenario involves ambitious investments in road and renewable energy infrastructure, improved electricity access and accelerated broadband connectivity. It emphasises adopting modern technologies to enhance government efficiency and incorporates significant investments in major infrastructure projects like rail, ports and airports (other infra) while highlighting the positive impacts of renewables and ICT.

Visit the themes on Large Infrastructure and Leapfrogging for our conceptualisation and details on the scenario structure and interventions.

Infrastructure in Côte d'Ivoire has been improving since the end of civil instability in 2011 through government investment. The main challenges that Côte d'Ivoire faces have been to keep up with rapid urbanisation and rural access to transportation.

Limited rural infrastructure poses a serious challenge in Côte d'Ivoire. According to World Bank officials, up to half of Ivorians have to travel more than 5 kilometers for access to all season serviceable roads. This poses serious problems for economic development, education and healthcare in Côte d'Ivoire.

Recently announced initiatives to address this issue include a focus in the government’s National Development Plan for 2021-2025 which included the Inclusive Connectivity and Rural Infrastructure Project. This project, in conjunction with the World Bank and the Asian Infrastructure Investment Bank, aims to provide 90% of the Ivorian population with access to suitable roads within 5 kilometres of their homes.

The government has also worked to improve the extreme congestion that has plagued Abidjan, which has undergone extreme growth in recent years. This congestion which led to an increase in traffic accidents as well as lost time and productivity due to long transportation times for those that work in the city.

The opening of Abidjan’s fourth bridge connecting towns to the city centre has worked to decrease congestion, as well as plans for a metro-line that will expand pedestrian commutability and decrease car congestion on the road.

Côte d'Ivoire has historically maintained high electricity coverage compared to its lower-middle-income peers. The size of the Ivorian energy system also allows the country to reap economic benefits from exporting a significant amount of its energy, around 10-20% of its production, to its neighbouring countries. Much of this recent progress around energy production and coverage has been due to recent discoveries of large offshore oil deposits, which have the potential to make Côte d'Ivoire a large player in the regional and global energy market.

However, significant disparities persist between urban and rural areas. In 2023, urban electricity access stood at 95.8%, an above-90% level sustained since 2014, while rural access lagged at approximately 49%. Urban access will reach 100% by 2043, while rural access will reach 76.4% by the same year. Efforts to bridge this gap include investments in rural infrastructure and renewable energy, notably the inauguration of the Boundiali Solar Power Plant in June 2023. This plant aims to enhance the electricity supply to over 430 000 households in the northern region.

Chart 23 presents the number of people using cookstoves in the Current Path and in the Large Infrastructure and Leapfrogging scenario, from 2020 to 2043.

The scenario distinguishes between three types of cookstoves: traditional, improved and modern. The transition from traditional fuels to modern fuels can significantly improve the health and well-being of communities, particularly women and children, by reducing exposure to harmful pollutants, preventing accidental fires and burns, and saving time and labour.

In 2023, 66.4% of Ivorians relied on traditional cookstoves in their homes. This is above the average rate for lower-middle-income African countries whose citizens used traditional cookstoves in 47.3% of households. Traditional cookstoves use wood, charcoal and other biofuels to cook foods which often require large amounts of fuel. This often results in soot, ash and smoke being produced in a closed environment with little ventilation. The smoke inhalation can lead to serious respiratory diseases that more sharply affect women, as they are often tasked with cooking for the family. The smoke exposure can also have long-term effects on children’s respiratory health who are exposed to smoke for prolonged amounts of time. Furthermore, the large amount of fuel needed often can be a catalyst for deforestation and environmental destruction around villages and towns where cookstoves are used. Biodiversity loss can seriously negatively affect the farming productivity of an agricultural community. Based on current projections, by 2043, approximately 28.5% of Ivorian households will still rely on traditional cookstoves. This figure remains above the average of 27.6% for lower-middle-income African countries.

Under the Large Infrastructure and Leapfrogging scenario, rural electricity access will rise to 92% by 2043, with urban areas achieving full electrification at 100%. Owing to this improvement in electricity access, especially in rural areas, the proportion of households that are expected to use traditional cookstoves will decline. In the Large Infrastructure and Leapfrogging scenario, that number will decrease to 22.6% of households, below the average of 27.4% for Côte d'Ivoire’s regional and income-group peers.

Consequently, the proportion of households using improved and modern stoves will increase.

In 2023, approximately 3.5% of Ivorian households utilised improved cookstoves, while 30% adopted modern cookstoves. Projections indicate that, in the Current Path, by 2043, the use of improved cookstoves will decline to 1.5%, whereas modern cookstove adoption is expected to rise significantly to 70%. Under the Large Infrastructure and Leapfrogging scenario, the share of households using improved cookstoves will decrease further to 1.2%, with modern cookstove usage increasing to 76.2% by 2043.

Improved and modern cookstoves have several advantages over traditional ones. First, they use more efficient and cleaner burning fuels such as natural gas, higher efficiency coal, and can even be powered by solar energy. This means that they will use less fuel, leading to lower environmental stress and biodiversity loss. They also may be better ventilated, which in combination with cleaner burning fuel, will lead to less respiratory disease among women and children.

Chart 24 presents the percentage of the population and number of people with access to mobile and fixed broadband in the Current Path and in the Large Infrastructure and Leapfrogging scenario, from 2020 to 2043. The user can toggle between mobile and fixed broadband.

Outside of physical infrastructure, technological transformation and investment are key for growing and modernising the economy of Côte d'Ivoire. Between 2010 and 2021, mobile broadband telecommunications contributed 20.57% to the country's GDP growth.

Côte d'Ivoire boasts a mobile broadband access rate that is above its peers in the lower-middle-income group in Africa; Ivorian mobile broadband subscriptions were at 107.6 per 100 people in 2023, compared to 64.7 for the average for its income peers. By 2043, Côte d'Ivoire’s mobile broadband infrastructure will continue to grow to 154.5 mobile broadband subscriptions for every 100 people.

While the country has seen rapid growth on mobile broadband, its progress on fixed broadband like in many African countries lagged behind. In 2023, Côte d’Ivoire had 1.8 fixed broadband subscriptions per 100 people, significantly lower than the average of 4.2 per 100 people among African lower-middle-income countries.

In the Large Infrastructure and Leapfrogging scenario, Côte d’Ivoire's mobile broadband subscriptions will reach 157.8 per 100 people by 2043, surpassing the projected average of 149 per 100 people for African lower-middle-income countries. This indicates a significant advancement in mobile connectivity for the country.

In terms of fixed broadband, Côte d’Ivoire will exceed the average rate of its income group by 2036. By 2043, fixed broadband subscriptions will reach 22.4 per 100 people, which is higher than both the Current Path of 18.6 and the African lower-middle-income group average of 21.7 per 100 people.

Widespread access to high-speed internet has the potential to improve a country's socio-economic outcomes. Broadband can increase productivity, reduce transaction costs and optimise supply chains, positively affecting economic growth. Ivorian authorities should make reforms to increase broadband penetration. Broadband also has the potential to contribute to formalisation of the economy, improve access to credit and improve efficiency of government provision of goods.

Chart 25 presents the trends in FDI, aid and remittances in the Current Path and in the Financial Flows scenario as a percentage of GDP, from 1990 to 2043.

The Financial Flows scenario represents a reasonable but ambitious increase in inward flows of worker remittances, aid to poor countries and an increase in the stock of foreign direct investment (FDI) and additional portfolio investment inflows. We reduce outward financial flows to emulate a reduction in illicit financial outflows.

Visit the theme on Financial Flows for our conceptualisation and details on the scenario structure and interventions.

Many countries in sub-Saharan Africa remain heavily reliant on foreign aid to deliver essential services such as education and healthcare. In Côte d'Ivoire, aid accounted for 2.1% of GDP in 2023, slightly below the African average of 2.4%.

However, the Trump administration's 90-day freeze on US foreign aid in early 2025 disrupted critical health services in Côte d'Ivoire. Although an emergency humanitarian waiver permitted some lifesaving HIV services to continue, ambiguity surrounding its scope led to interruptions, even in HIV treatment. This is particularly concerning as 85% of people living with HIV (PLHIV) on antiretroviral therapy (ART) in Côte d'Ivoire are directly supported by the US President’s Emergency Plan for AIDS Relief (PEPFAR) program. The pause has severely impacted the national AIDS response, highlighting the country's vulnerability due to its dependence on external funding for essential health services. By 2042, the Financial Flows scenario projects that financial aid will be a marginal part of the Ivorian economy with the nation gaining 0.1% of its GDP from aid. This is a year before the Current Path expects aid to hit almost 0% for Côte d'Ivoire, and the share is below the average of 0.5% of GDP for African lower-middle-income countries in 2043.

As the largest economy in francophone West Africa, Côte d'Ivoire's attracts migrants from countries such as Burkina Faso, Mali, Niger and Guinea. This makes the country a net supplier of remittances to the rest of the world. Net remittances to the rest of the world amounted to US$600 million in 2023, or 0.9% of GDP.

Across the forecast horizon, Côte d'Ivoire remains a net supplier of remittances. By 2043, net remittances to the rest of the world will amount to US$1.8 billion, equivalent to 0.8% of GDP. This continued outflow reflects Côte d'Ivoire's role as a regional economic hub, attracting migrant workers from neighbouring countries.

Until 2000, foreign direct investment (FDI) in Côte d'Ivoire was primarily in services like ICT, banking and tourism, absorbing around 80% of FDI flows between 2000 and 2006. By 2017, while services still accounted for over half (50.9%) of net FDI, extractive industries (39.2%) and financial intermediaries (27.8%) became significant recipients. Following the 2018 investment code, Côte d'Ivoire saw a surge in investment, increasing by 62% between 2018 and 2019, with the agro-industrial (27%) and transport/warehousing (24%) sectors receiving the most. In early 2020, these sectors, along with energy and BTP services, continued to attract substantial investment, although the service sector still recorded the highest cumulative net FDI inflows since the 2000s. CEPICI's 2023 data reveals that Burkina Faso led foreign investment in Côte d’Ivoire, accounting for 11%. Turkey followed with 7%, and China, France and Togo each represented 5%. The primary sectors attracting this investment were industry (52.20%) and services (46.90%), with a minimal 0.90% directed towards agriculture. This suggests a general investment trend favouring extractive industries and finance.

FDI flows to Côte d'Ivoire were about 1.9% of GDP in 2023. This is below the average for Africa's lower-middle-income countries, which was 2.6% of GDP in 2023. In the Financial Flows scenario, Côte d'Ivoire will experience an increase in FDI inflows, reaching 3.2% of GDP by 2043, compared to 2.5% on the Current Path. This uptick suggests a more favourable investment climate, potentially spurring economic growth through enhanced capital inflows and technology transfer.

The combination of increased FDI and persistent remittance outflows underscores the importance of implementing policies that not only attract foreign investment but also enhance the domestic economy's capacity to absorb and effectively utilise these financial inflows. Such measures are crucial for maximising the developmental benefits of external financial flows and reducing reliance on remittances.

Chart 26 presents government revenue in the Current Path and in the Financial Flows scenario, from 2020 to 2043. The data is in US$ 2017 and % of GDP.

Wagner's law, or the law of increasing state activity, states that public expenditure increases as national income rises. In the Financial Flows scenario, it is reasonable to expect that government revenues will increase as a percentage of GDP compared to the Current Path.

The observed decrease in Côte d'Ivoire's tax-to-GDP ratio from 13.7% in 2021 to 12.9% in 2022 indicates a short-term decline in tax revenue relative to the country's economic output. However, projections suggest a positive trend moving forward. In 2023, government revenue was estimated at US$11.2 billion, or 15.5% of GDP. By 2043, under the Current Path, government revenue will rise to US$45.7 billion (19.3% of GDP), and in the Financial Flows scenario to US$50.6 billion (20% of GDP). This means that the Financial Flows scenario has the potential to increase government revenue by an additional US$4.9 billion by 2043. This projection reflects anticipated improvements in tax collection and fiscal capacity, suggesting that the earlier decline may be a temporary fluctuation within a broader trajectory of fiscal strengthening.

Chart 27 presents the Current Path of government effectiveness comparing the country to the average for the African income group, from 2002 to 2043.

The World Bank’s index on government effectiveness captures perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation and the credibility of the government's commitment to such policies.