Tunisia

Tunisia

Feedback welcome

Our aim is to use the best data to inform our analysis. See our Technical page for information on the IFs forecasting platform. We appreciate your help and references for improvements via our feedback form.

This report analyses Tunisia’s current development path and future prospects, examining how various sectoral interventions could shape the country’s economic and social landscape through to 2043, the end of the third ten-year implementation plan of the African Union's Agenda 2063. The analysis is grounded in scenario modelling and explores eight key sectors: Demographics and Health, Agriculture, Education, Manufacturing, Large Infrastructure and Leapfrogging, the African Continental Free Trade Area (AfCFTA), Financial Flows, and Governance. In addition to evaluating the effects of each sectoral scenario individually, the report assesses the combined impact of these interventions on Tunisia’s long-term growth and development trajectory.

The report begins by introducing Tunisia, providing an overview of its geographic location, social and demographic structure and political history to establish the context for the development analysis. This background sets the stage for understanding the country’s current economic position and institutional landscape.

Following this, the report outlines Tunisia’s expected development trajectory without major policy changes, referred to as the Current Path scenario. This scenario spans the period from 2023 to 2043 and is based on data from reputable international and national sources, emphasising prioritising national statistics where available. The section covers a range of key indicators including demographics, GDP at market exchange rates (MER), informal sector dynamics, GDP per capita in purchasing power parity (PPP), poverty rates and alignment with Tunisia’s National Development Plan.

The third section presents the individual sectoral scenarios, each modelling the potential effects of targeted improvements in one of the eight identified areas. These scenarios provide insights into how sector-specific interventions could influence Tunisia’s developmental outcomes over the next two decades.

The fourth section is divided into two parts. The first part analyses the impact of both individual and combined scenarios on GDP per capita and poverty alleviation. The second part explores the wider socio-economic implications of the Combined scenario, examining changes in economic growth, structural economic transformation, the size of the informal economy, life expectancy, income inequality (measured by the Gini coefficient), carbon emissions, and energy production and demand.

The report concludes by summarising the key findings and offering policy insights to support Tunisia in pursuing a more inclusive, resilient, and sustainable development path. It underscores the importance of coordinated, multi-sectoral reforms to unlock the country’s long-term economic and social potential.

Visit the Technical section for additional information on the International Futures (IFs) modelling platform, which serves as the analytical foundation for this report's scenario simulations.

Summary

This page begins with an introductory assessment of the country’s context, examining current population distribution, social structure, climate and topography.

- Tunisia, located in North Africa, has a well-educated population, relatively strong institutions and a legacy of early post-independence investment in health, education and gender equality. However, its democratic transition since 2011 has been accompanied by political fragmentation, economic stagnation and rising public discontent.

This section is followed by an analysis of the Current Path for Tunisia which informs the country’s likely current development trajectory to 2043. It is based on current geopolitical trends and assumes that no major shocks would occur in a ‘business-as-usual’ future.

- Tunisia’s population structure is characterised by an ageing demographic, with the share of the working-age population declining slightly from 66% in 2023 to 65.7% in 2043. The demographic dividend is narrowing, requiring policies to improve labour force participation and productivity.

- In terms of GDP at market exchange rates (MER), Tunisia’s economy will expand from US$43.05 billion in 2023 to US$75.1 billion by 2043, reflecting a modest average annual growth rate of 2.8%.

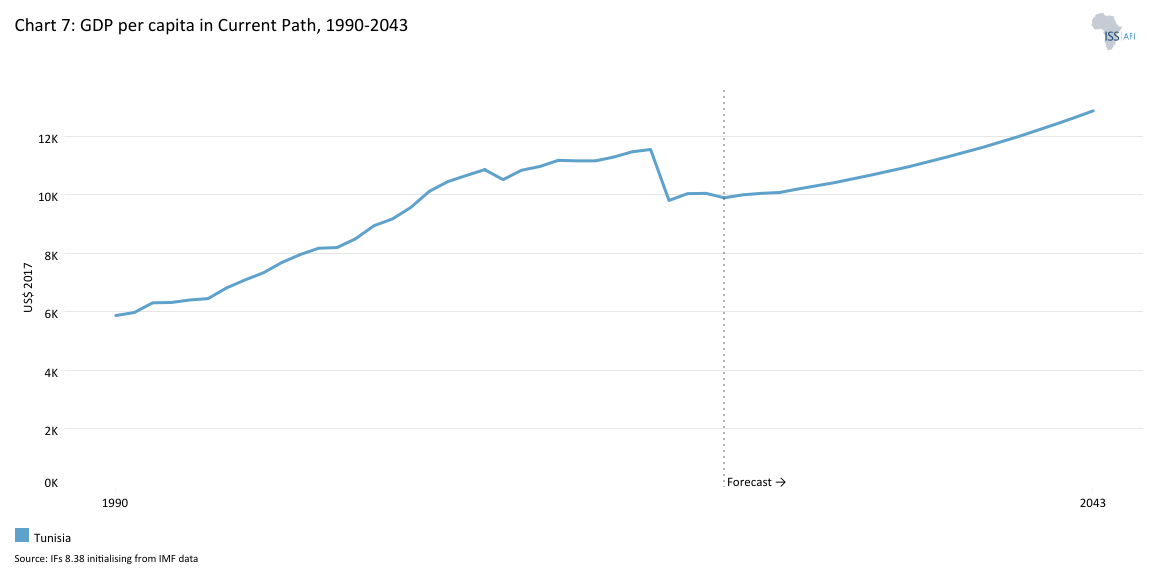

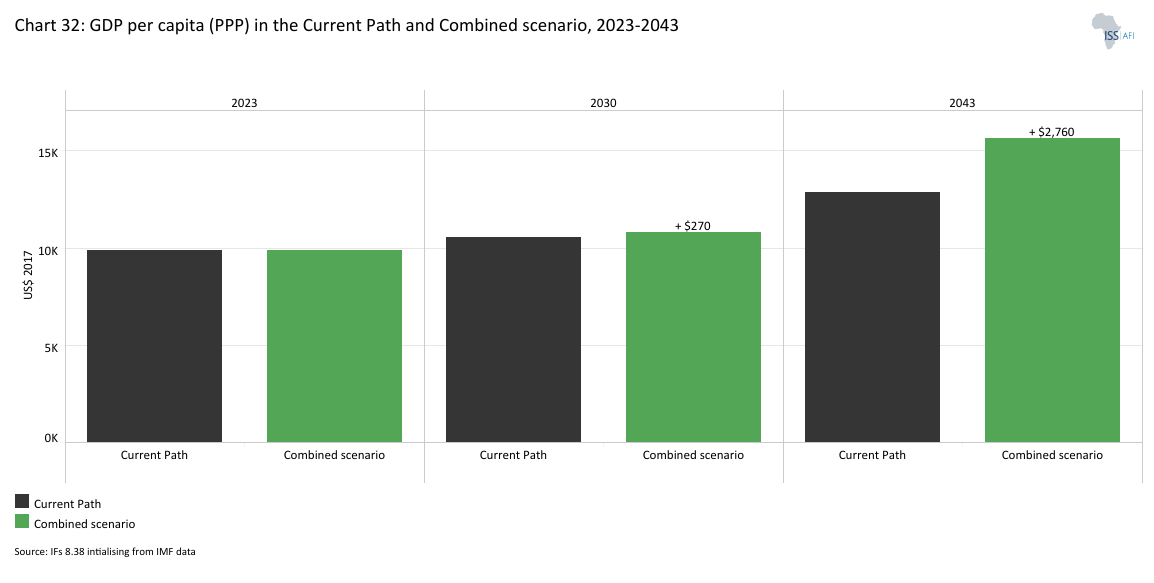

- GDP per capita in Purchasing Power Parity (PPP) will increase gradually from US$9 900 in 2023 to US$12 870 in 2043, but this growth is insufficient to drive convergence with upper-middle-income countries.

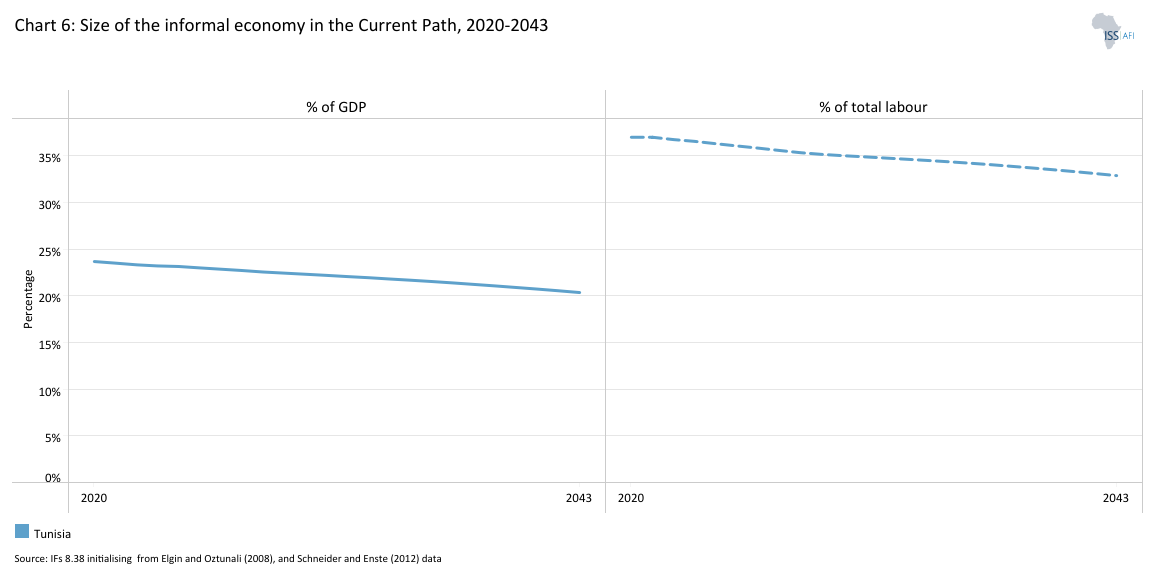

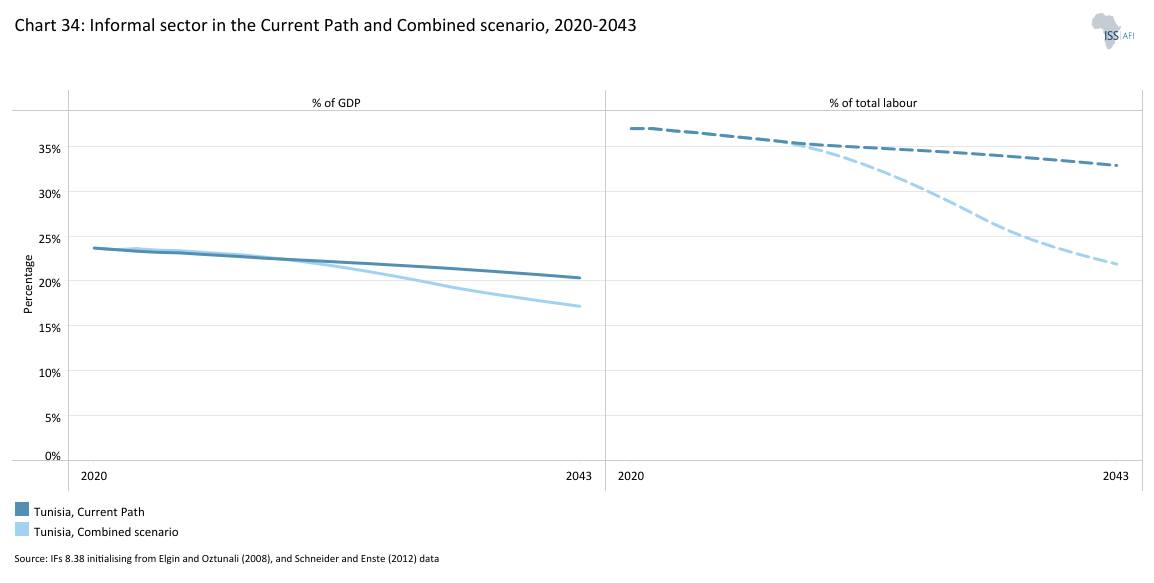

- The informal sector contributed 23.2% to GDP and employed 36.5% of the labour force in 2023. These shares will decline to 20.3% and 32.9%, respectively, by 2043, indicating slow formalisation of the economy.

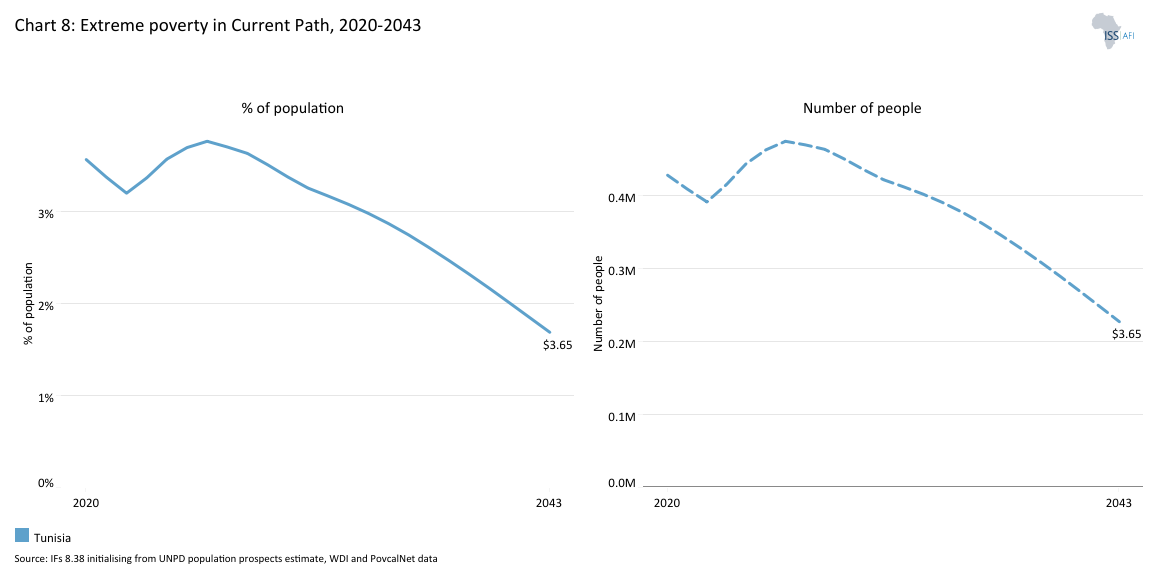

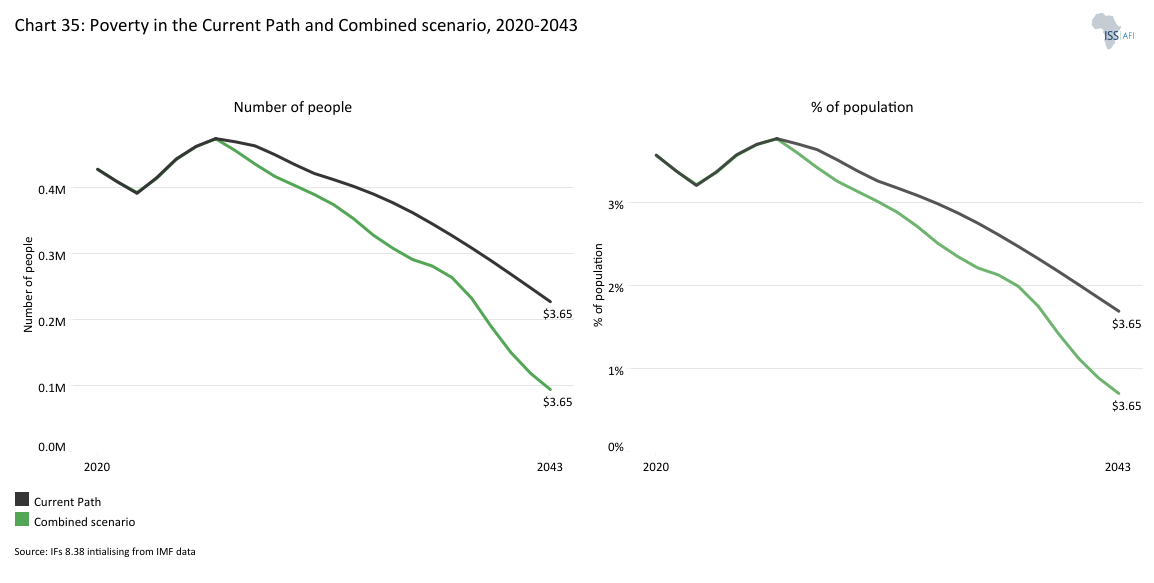

- Poverty levels, particularly at the US$3.65 per day threshold, will decline from 3.4% in 2023 to 1.7% in 2043. However, regional disparities and multidimensional poverty remain major concerns.

- Tunisia’s National Development Plan (NDP), anchored in Vision Tunisie 2035, outlines a strategic roadmap toward a high-income, inclusive and sustainable economy. It prioritises digital transformation, industrial diversification, regional equity and environmental resilience.

The next section compares progress on the Current Path with eight sectoral scenarios. These are Demographics and Health; Agriculture; Education; Manufacturing; the African Continental Free Trade Area (AfCFTA); Large Infrastructure and Leapfrogging; Financial Flows; and Governance. Each scenario is benchmarked to present an ambitious but reasonable aspiration in that sector, comparing Tunisia with other countries at similar levels of development and characteristics.

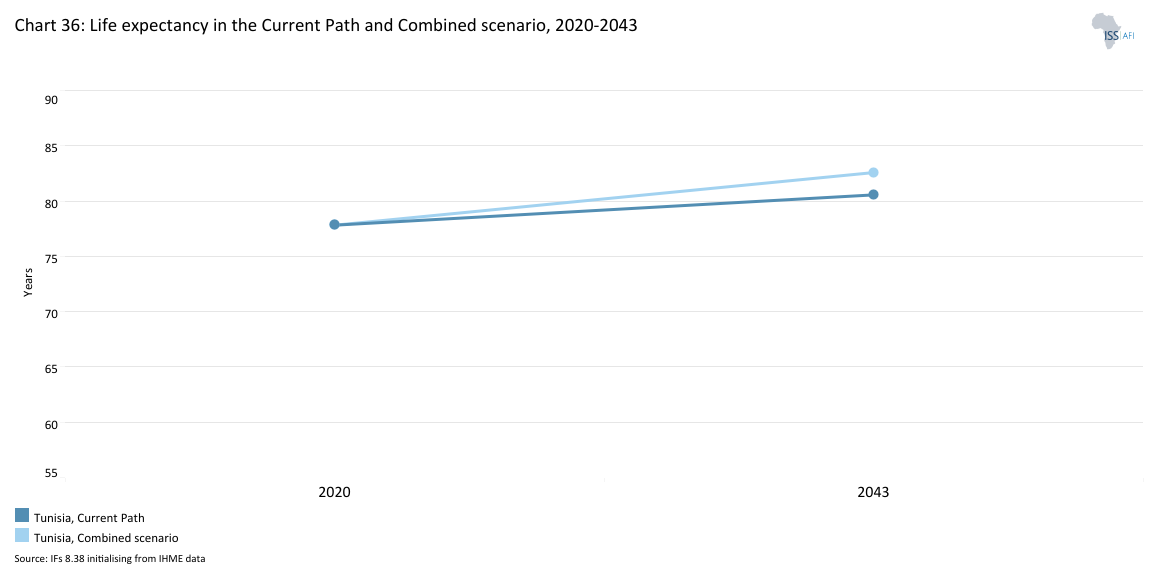

- The Demographics and Health scenario forecasts improved life expectancy and reduced infant mortality through investment in health infrastructure, WaSH services and prevention of non-communicable diseases (NCDs). Life expectancy rises to 82.2 years by 2043, 1.7 years above the Current Path.

- The Agriculture scenario increases food security by enhancing crop yields, expanding irrigation and adopting climate-smart techniques. By 2043, Tunisia transitions from a food deficit to a surplus, achieving full food self-sufficiency.

- The Education scenario enhances mean years of schooling to 11.9 years and improves quality scores across all levels. It narrows the gender gap and positions Tunisia to align human capital with labour market demands better.

- The Manufacturing scenario expands the industrial base and raises the manufacturing value-added share of GDP to 19.2% by 2043. It drives job creation, poverty reduction and higher fiscal revenues.

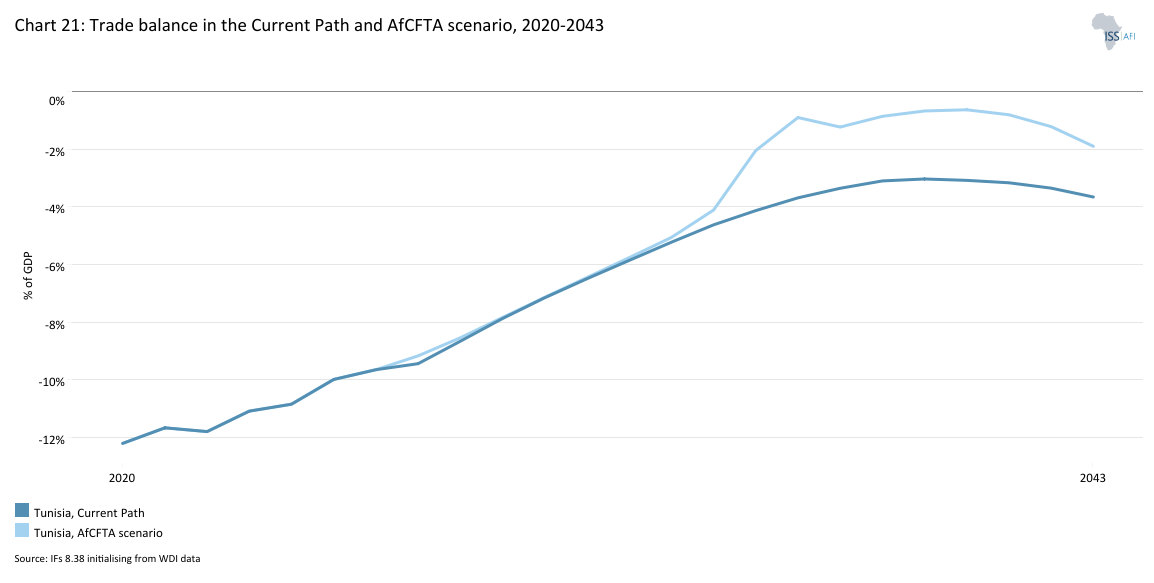

- The AfCFTA scenario increases trade openness and export diversification, lifting GDP per capita to US$13 500 by 2043. Tunisia's trade deficit shrinks as manufacturing and Information and Communication Technology (ICT) exports rise.

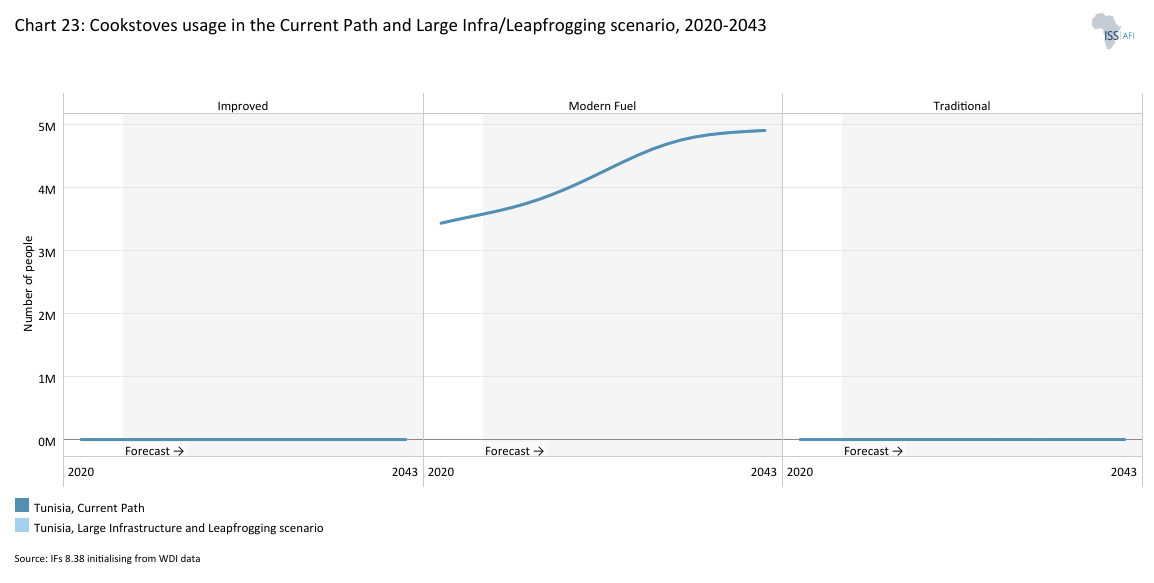

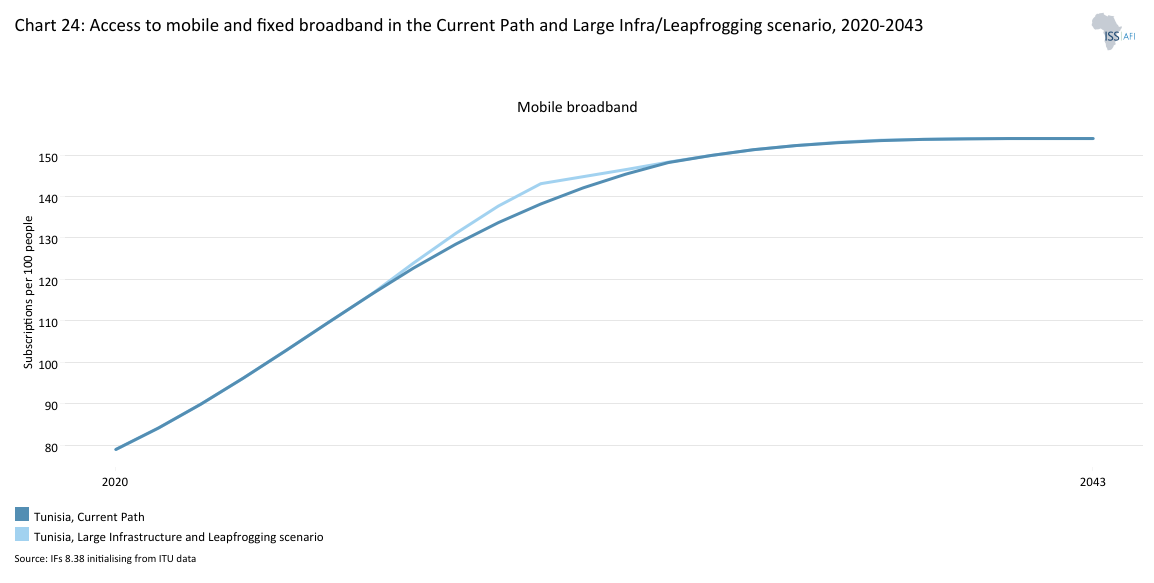

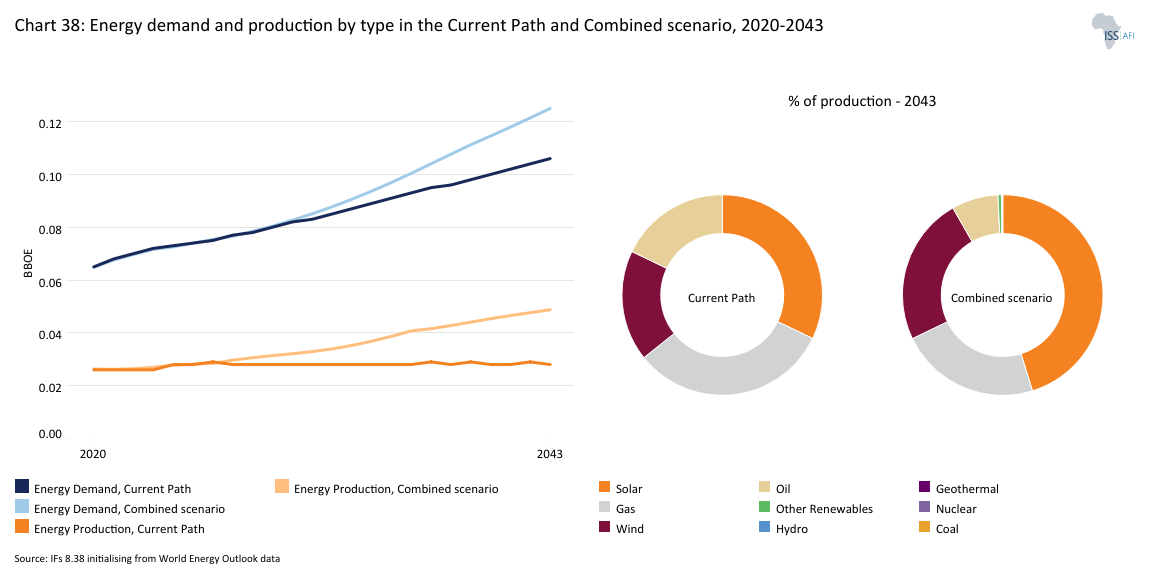

- The Large Infrastructure and Leapfrogging scenario boosts broadband connectivity and renewable energy production. It also supports growth in digital services and accelerates the green transition.

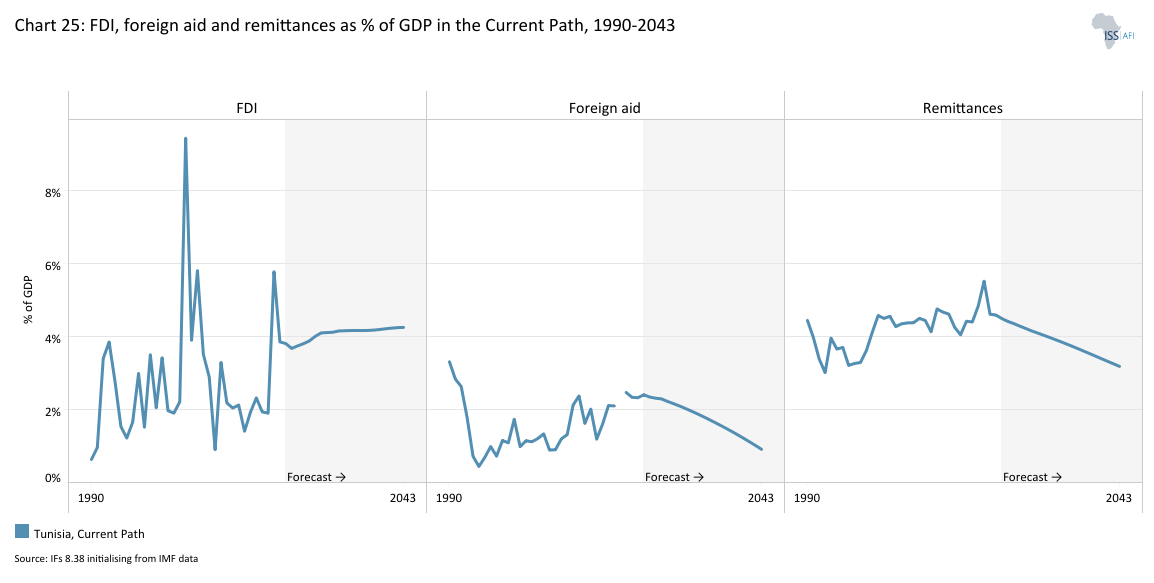

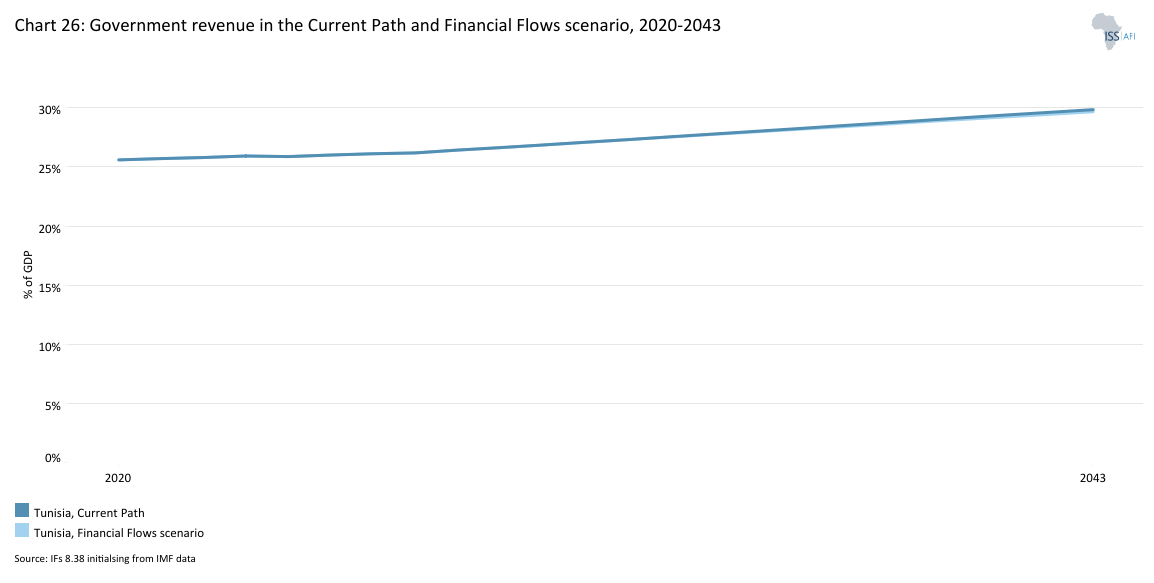

- The Financial Flows scenario increases FDI, slows remittance decline and reduces aid dependency. By 2043, GDP per capita rises to US$13 440, and government revenue grows by an additional US$1.35 billion above the Current Path.

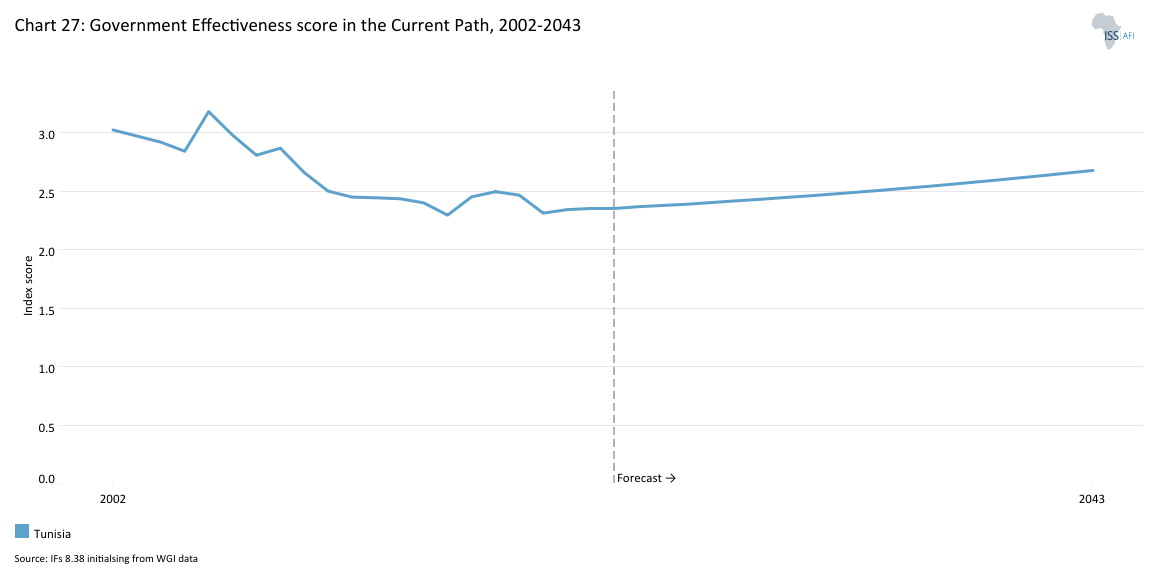

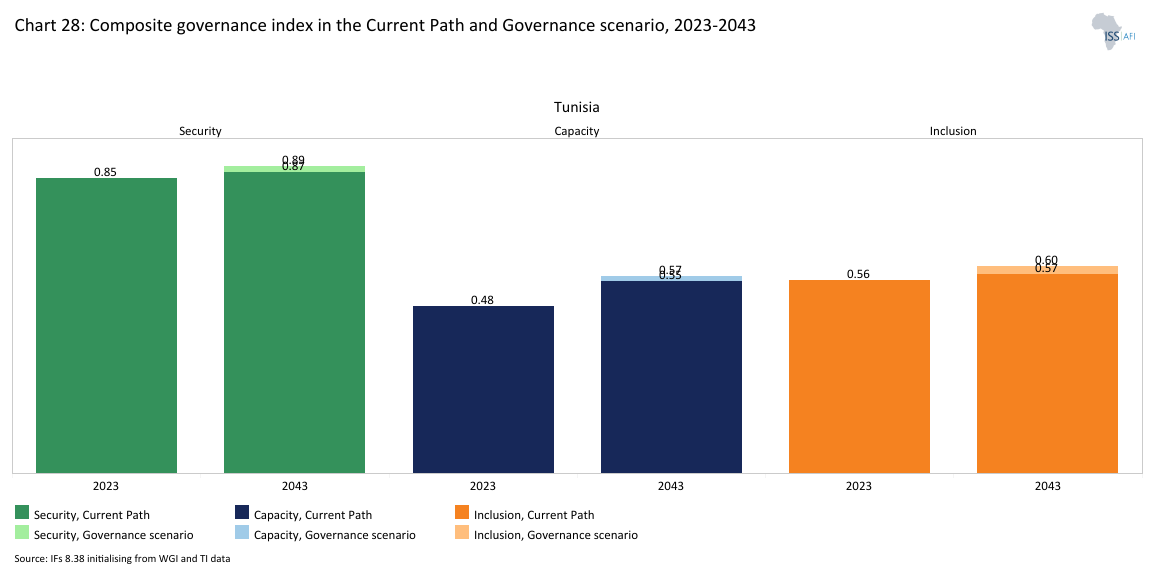

- The Governance scenario strengthens institutional effectiveness, public service delivery and social equity. Governance scores rise, poverty declines to 1.4%, and GDP grows to US$77.33 billion by 2043.

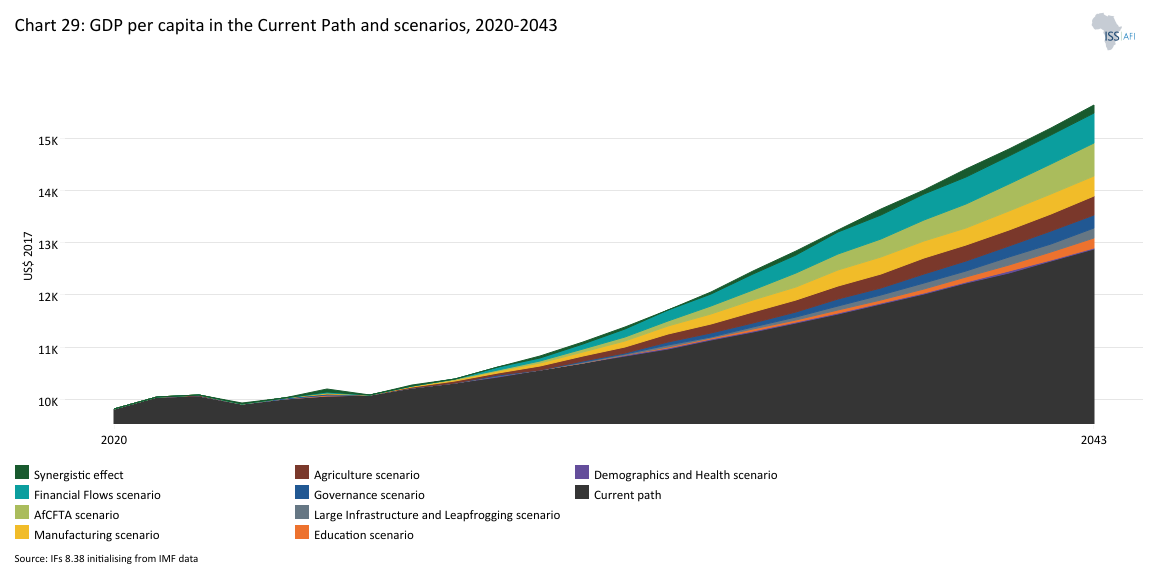

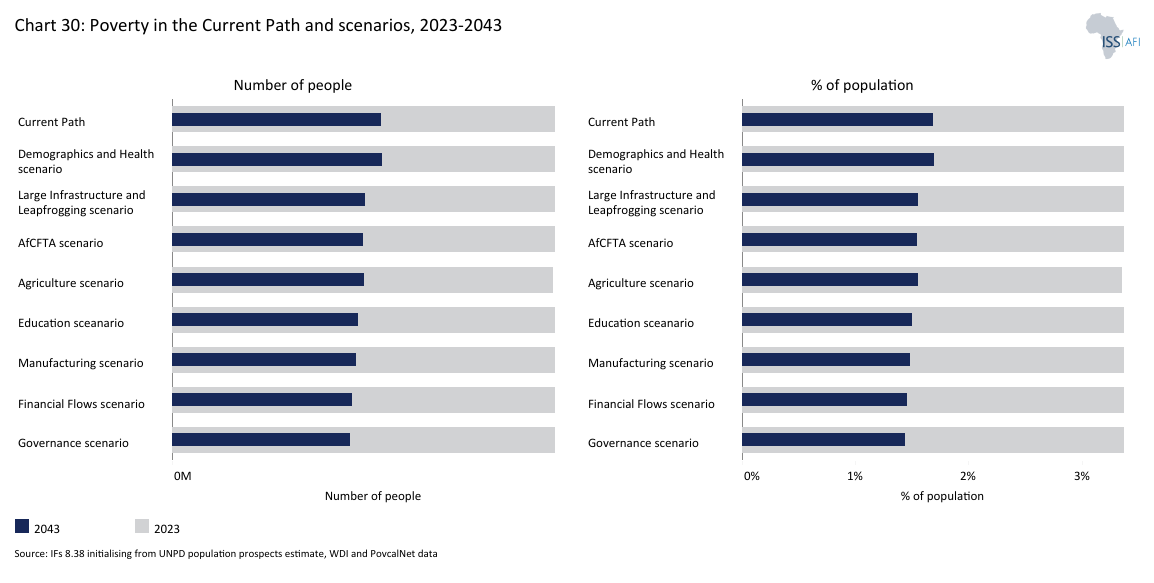

The fourth section compares the impact of each of these eight sectoral scenarios with one another and subsequently with a Combined scenario (the integrated effect of all eight scenarios). The forecasts measure progress on various dimensions such as economic size (in market exchange rates), gross domestic product (GDP) per capita (in purchasing power parity), extreme poverty, carbon emissions, the changes in the structure of the economy, and selected sectoral dimensions such as progress with mean years of education, life expectancy, the Gini coefficient or reductions in mortality rates.

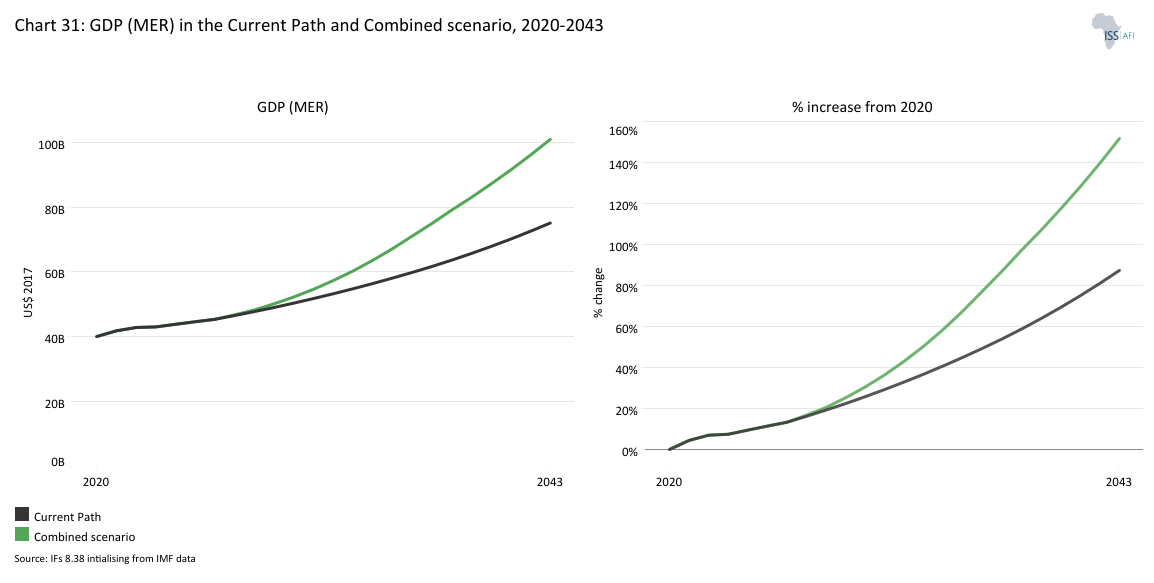

- The Combined scenario, which integrates all eight sectoral interventions, delivers the strongest development outcomes. It raises GDP (MER) to US$101 billion, boosts GDP per capita (PPP) to US$15 630, and reduces extreme poverty to 0.7% by 2043.

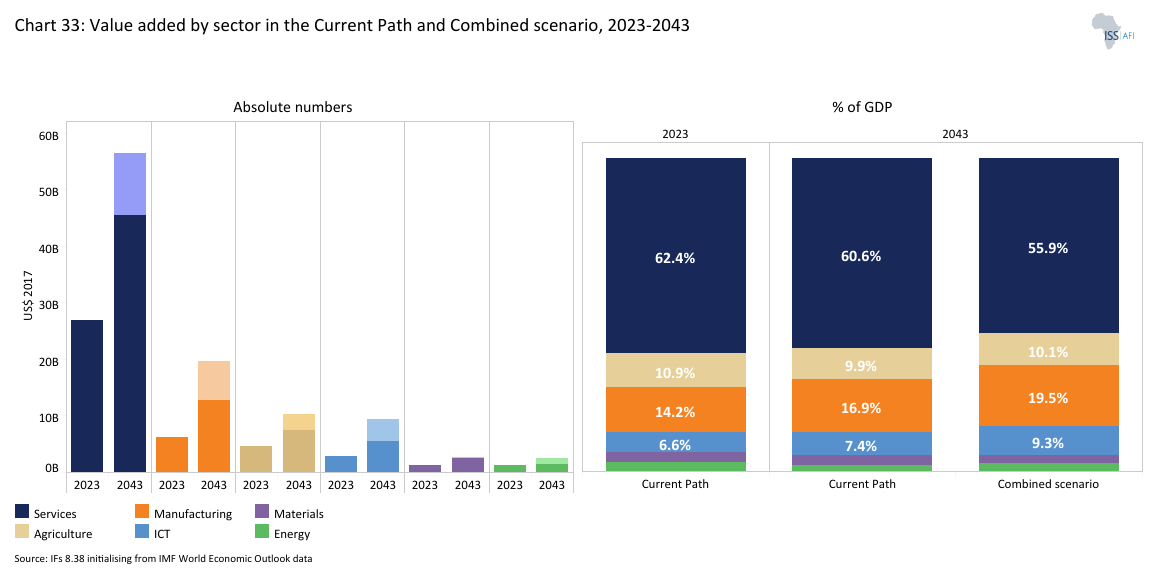

- Tunisia experiences significant structural transformation, with manufacturing, ICT and agriculture growth. The informal sector's role in GDP and employment shrinks notably, while the Gini coefficient declines to 0.3, signalling improved income equality.

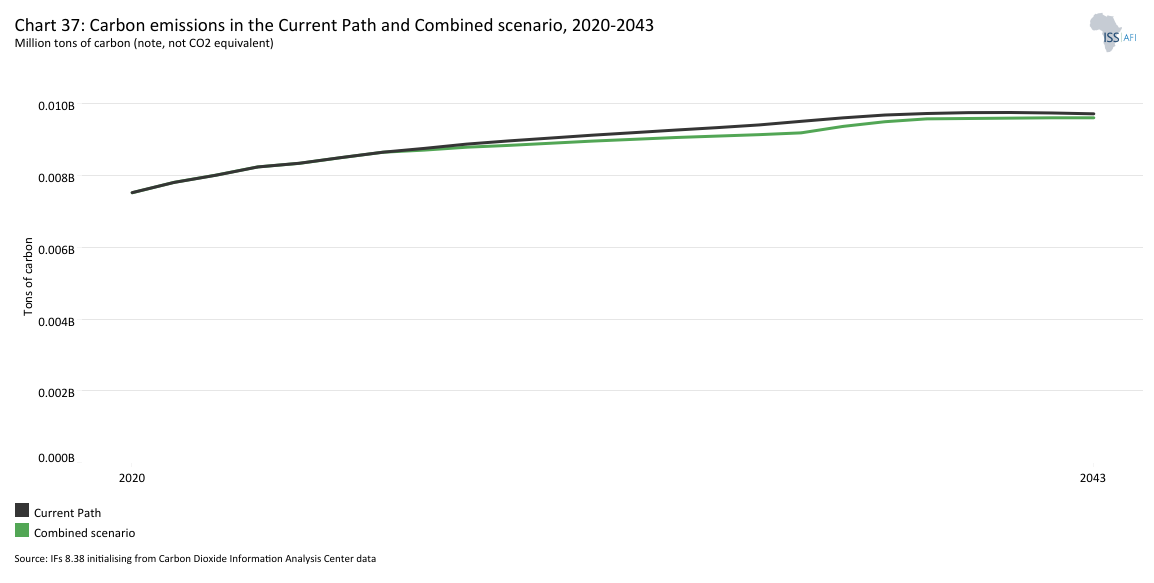

- Life expectancy increases to 82.6 years, and carbon emissions decline by 110 000 tons compared to the Current Path, affirming the sustainability of this growth path. However, an energy deficit persists, highlighting the need to diversify the renewable energy mix beyond solar and wind.

The analysis concludes with a summarising section offering recommendations. A coordinated and multi-sectoral approach can greatly enhance Tunisia’s development prospects. Key policy priorities emerging from the scenario analysis include strengthening governance to rebuild public trust and enhance institutional capacity; accelerating industrialisation and manufacturing-led growth to generate employment and boost value-added exports; and expanding agricultural productivity and food self-sufficiency through sustainable, climate-resilient practices. In parallel, scaling up investments in digital infrastructure and renewable energy will be crucial to support technological leapfrogging and a green transition. Reforming the education system to better align with labour market needs and improve the quality of learning outcomes is also essential. Tunisia should deepen trade integration, particularly through full participation in the AfCFTA, to diversify markets and stimulate private sector dynamism. Mobilising and managing financial flows more effectively will help reduce aid dependency while expanding fiscal space. Finally, sustained investment in health and social protection systems will be vital to reduce vulnerability, improve human capital outcomes, and foster social cohesion. With political will and strategic coordination, Tunisia can transition into a more inclusive, competitive and sustainable economy by 2043.

All charts for Tunisia

- Chart 1: Political map of Tunisia

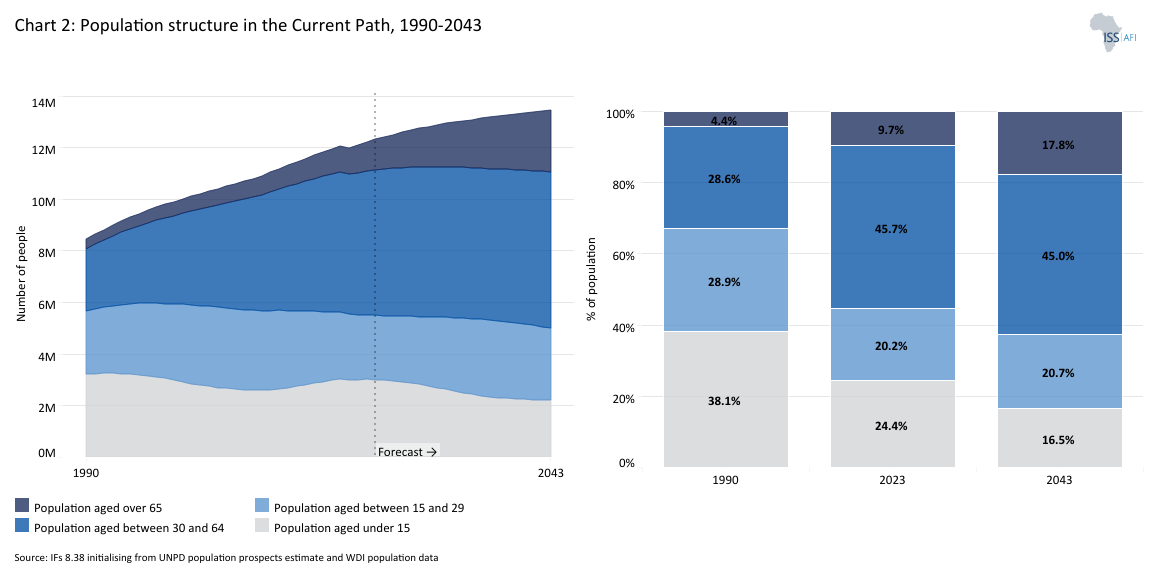

- Chart 2: Population structure in the Current Path, 1990–2043

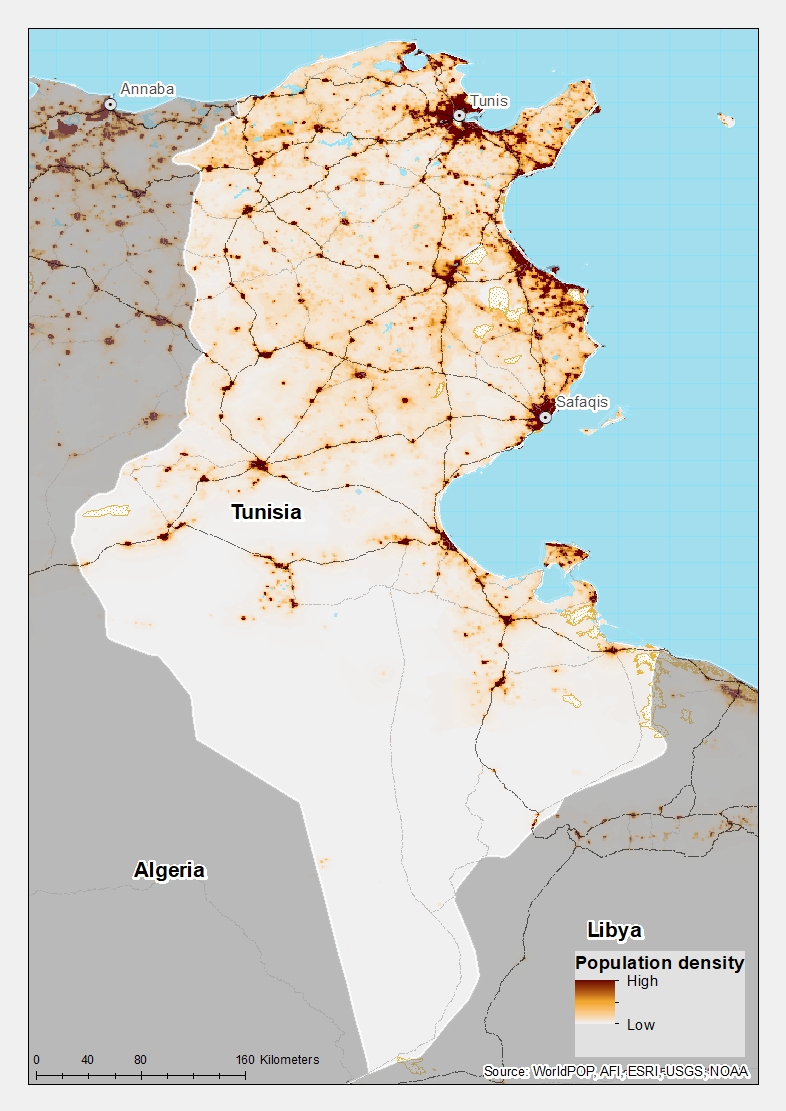

- Chart 3: Population distribution map, 2023

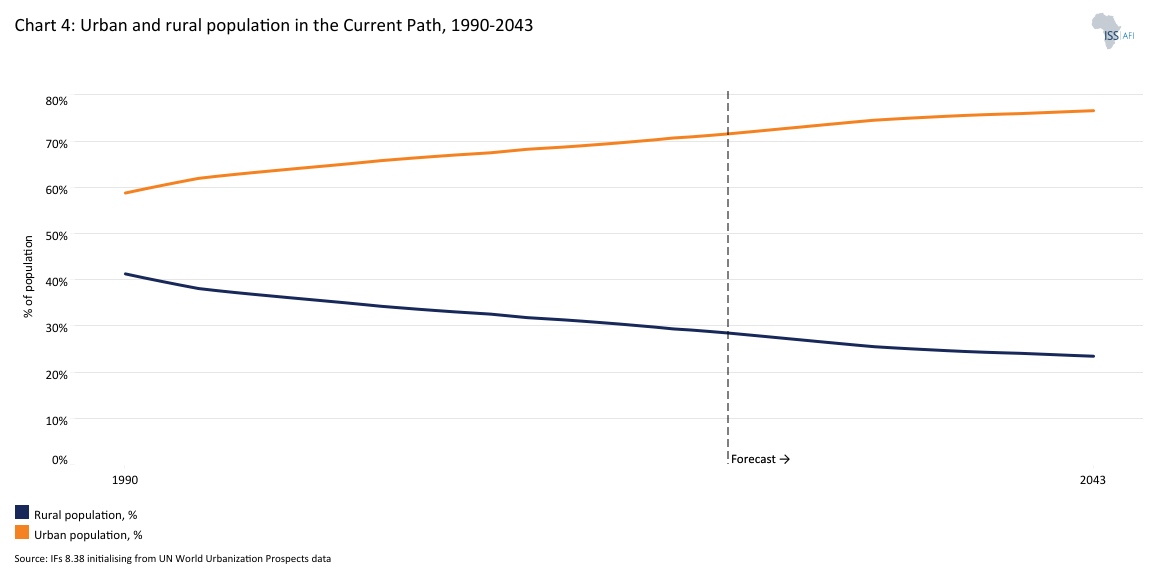

- Chart 4: Urban and rural population in the Current Path, 1990-2043

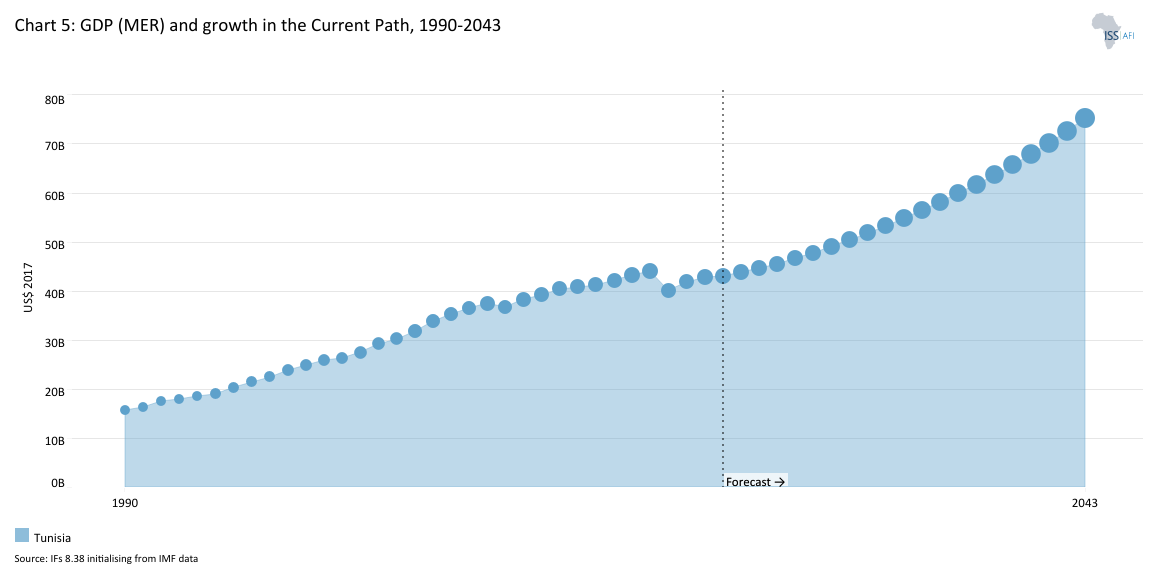

- Chart 5: GDP (MER) and growth rate in the Current Path, 1990–2043

- Chart 6: Size of the informal economy in the Current Path, 2020-2043

- Chart 7: GDP per capita in Current Path, 1990–2043

- Chart 8: Extreme poverty in the Current Path, 2020–2043

- Chart 9: National Development Plan of TUNISIA

- Chart 10: Relationship between Current Path and scenarios

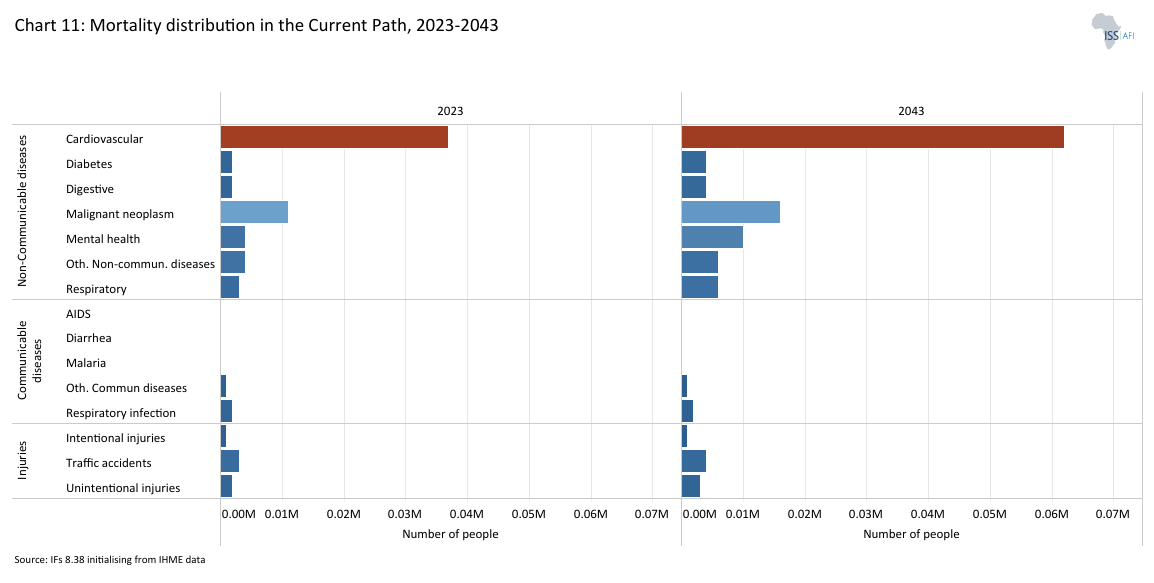

- Chart 11: Mortality distribution in the Current Path, 2023 and 2043

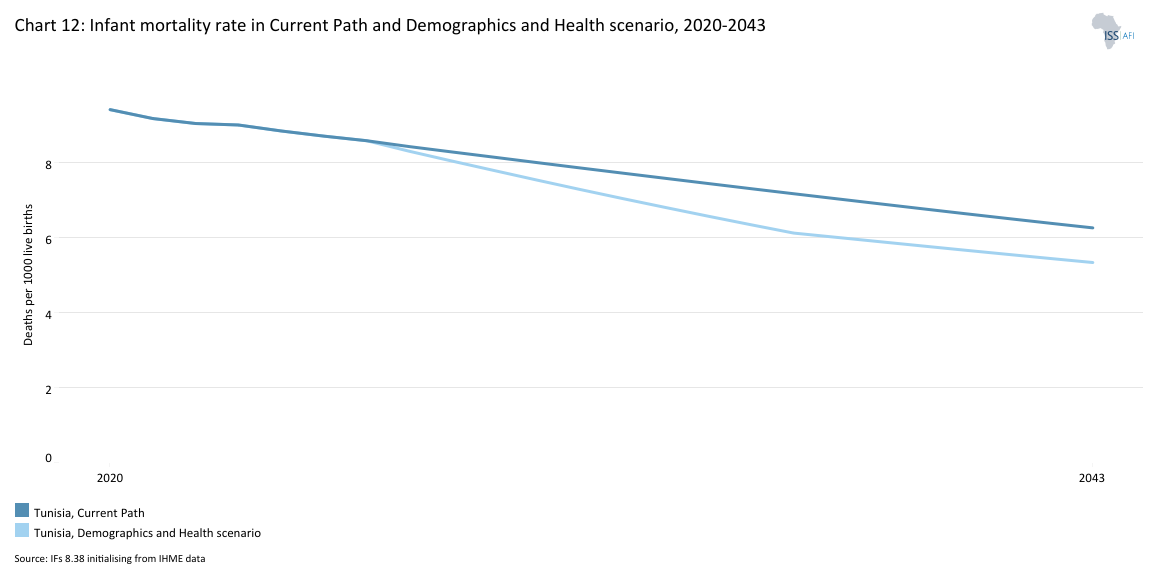

- Chart 12: Infant mortality rate in Current Path and Demographics and Health scenario, 2020–2043

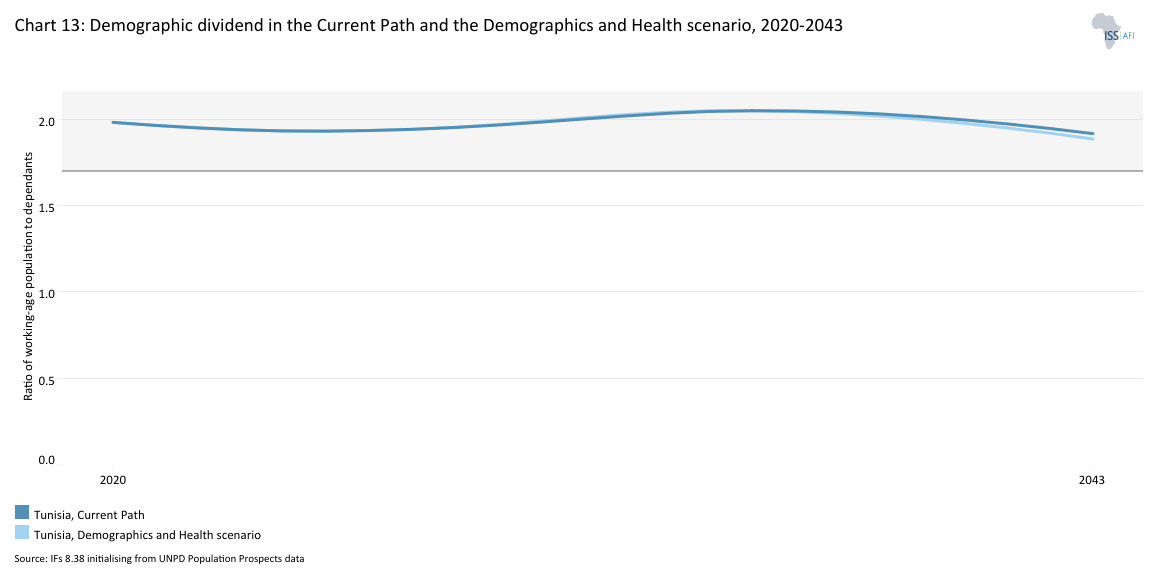

- Chart 13: Demographic dividend in the Current Path and the Demographics and Health scenario, 2020–2043

- Chart 14: Crop production and demand in the Current Path, 1990-2043

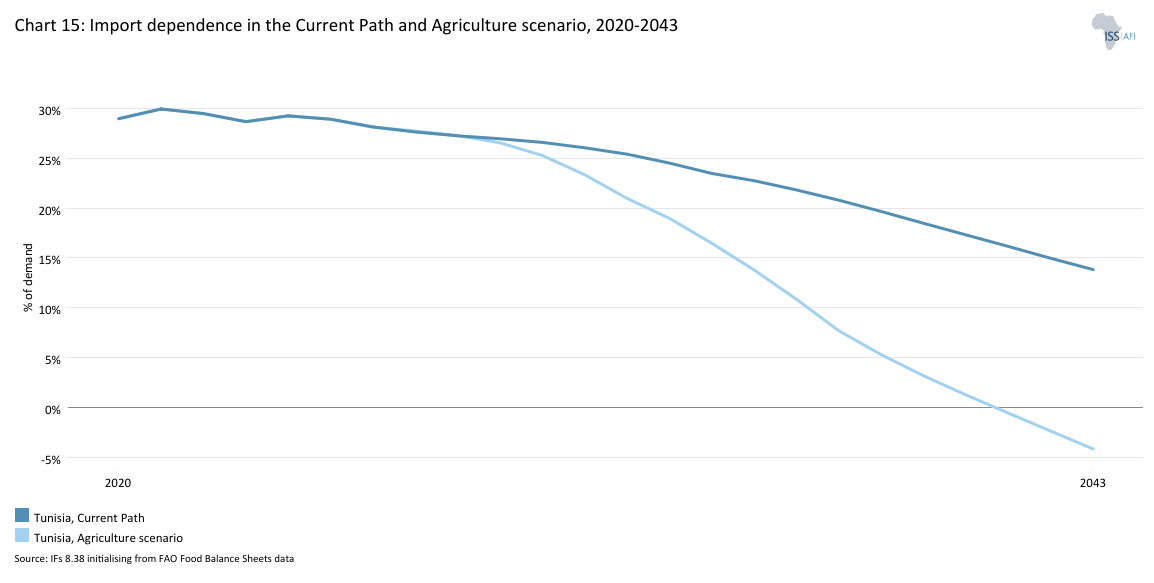

- Chart 15: Import dependence in the Current Path and Agriculture scenario, 2020–2043

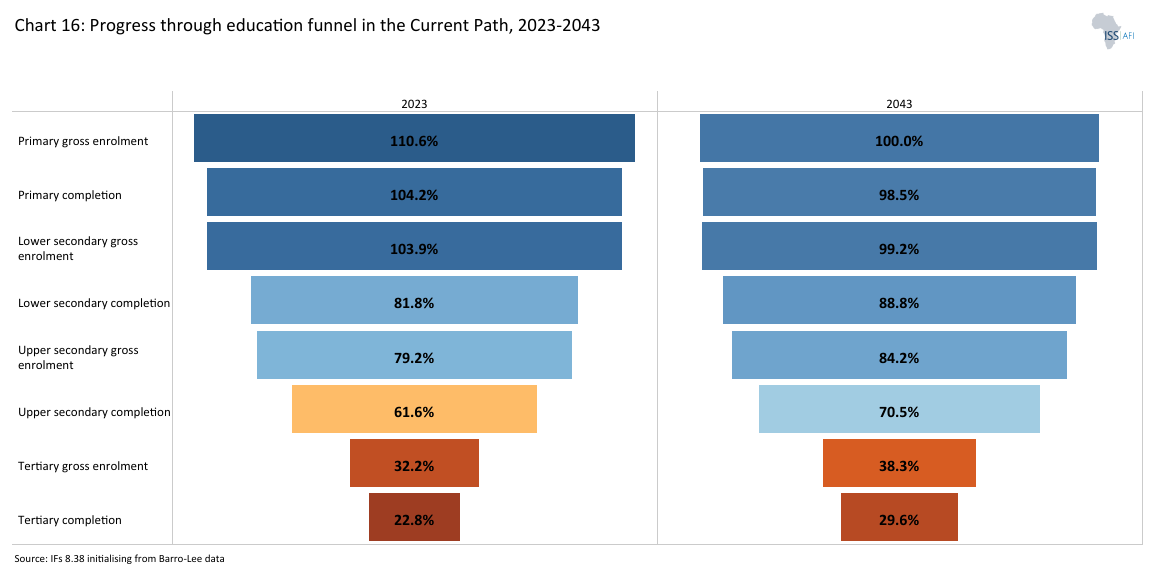

- Chart 16: Progress through the education funnel in the Current Path, 2023 and 2043

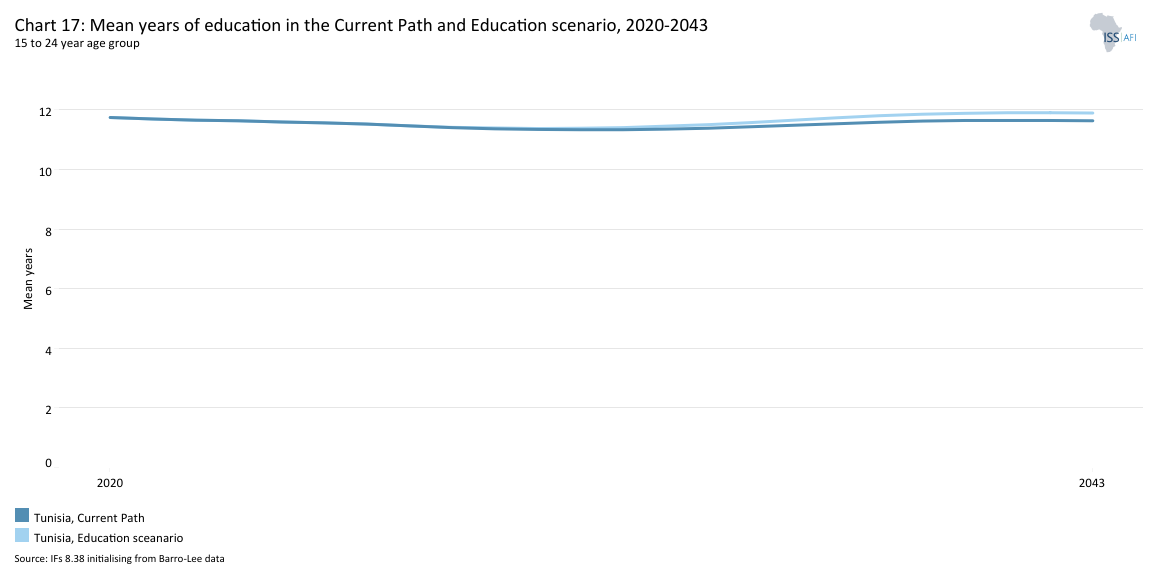

- Chart 17: Mean years of education in the Current Path and Education scenario, 2020–2043

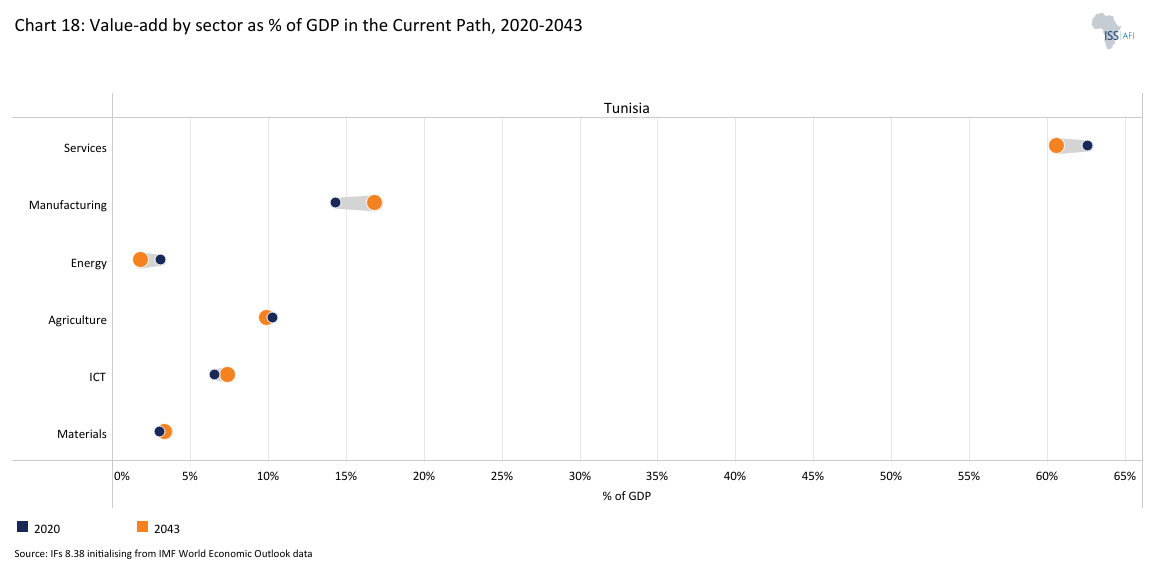

- Chart 18: Value-add by sector as % of GDP in the Current Path, 2023 and 2043

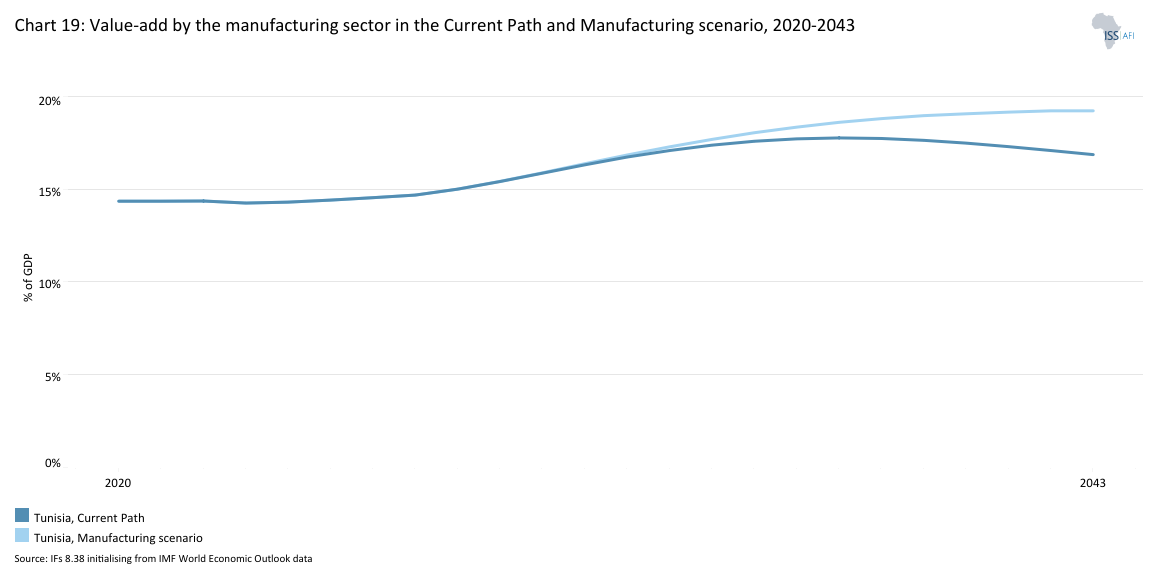

- Chart 19: Value-add by the manufacturing sector in the Current Path and Manufacturing scenario, 2020–2043

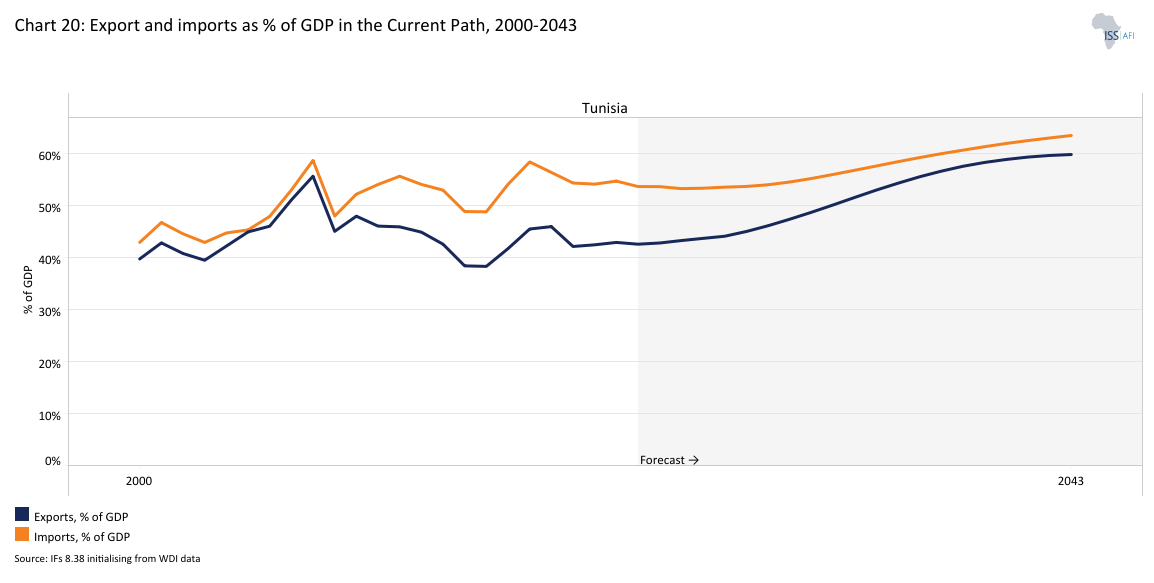

- Chart 20: Exports and imports as % of GDP in the Current Path, 2000-2043

- Chart 21: Trade balance in the Current Path and AfCFTA scenario, 2020–2043

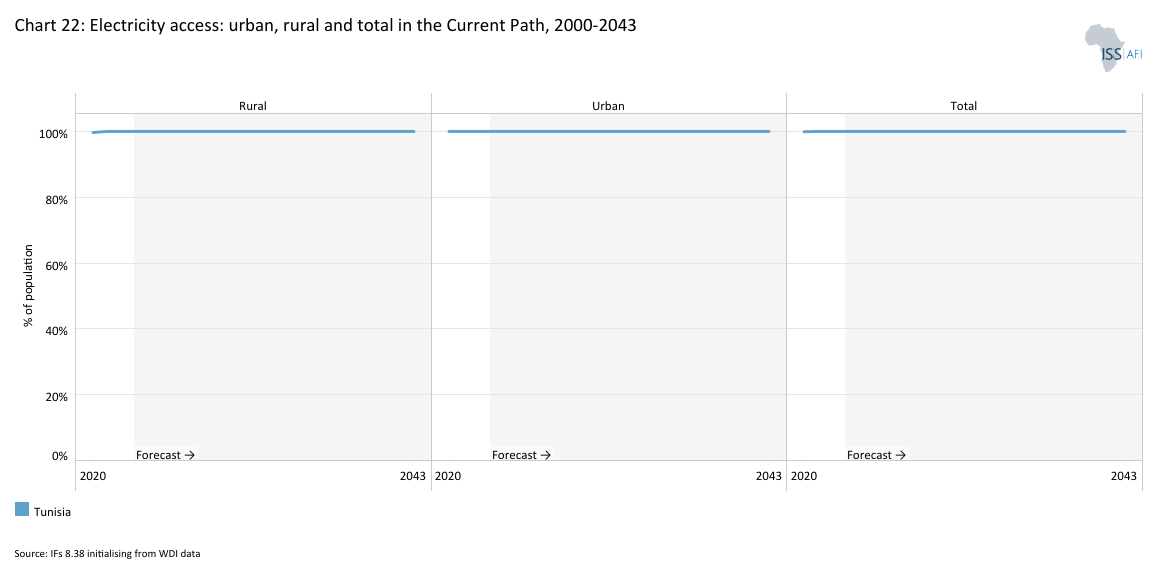

- Chart 22: Electricity access: urban, rural and total in the Current Path, 2000-2043

- Chart 23: Cookstove usage in the Current Path and Large Infra/Leapfrogging scenario, 2020–2043

- Chart 24: Access to mobile and fixed broadband in the Current Path and the Large Infra/Leapfrogging scenario, 2020–2043

- Chart 25: FDI, foreign aid and remittances as % of GDP in the Current Path and in the Financial Flows scenario, 1990-2043

- Chart 26: Government revenue in the Current Path and Financial Flows scenario, 2020–2043

- Chart 27: Government effectiveness score in the Current Path, 2002-2043

- Chart 28: Composite governance index in the Current Path and Governance scenario, 2023 and 2043

- Chart 29: GDP per capita in the Current Path and scenarios, 2020–2043

- Chart 30: Poverty in the Current Path and scenarios, 2020–2043

- Chart 31: GDP (MER) in the Current Path and Combined scenario, 2020–2043

- Chart 32: GDP per capita in the Current Path and Combined scenario, 2023-2043

- Chart 33: Value-add by sector in the Current Path and Combined scenario, 2023 and 2043

- Chart 34: Informal sector in the Current Path and Combined scenario, 2020–2043

- Chart 35: Poverty in the Current Path and Combined scenario, 2023 and 2043

- Chart 36: Life expectancy in the Current Path and Combined scenario, 2020–2043

- Chart 37: Carbon emissions in the Current Path and Combined scenario, 2020–2043

- Chart 38: Energy demand and production by type in the Current Path and Combined scenario, 2020-2043

- Chart 39: Policy recommendations

Chart 1 is a political map of Tunisia.

Tunisia is located in North Africa, bordered by Algeria to the west and south-west, Libya to the south-east, and the Mediterranean Sea to the north and east. The country spans an area of 163 610 km², with Tunis, situated along the north-eastern coastline, serving as the capital and largest city. The predominant languages are Tunisian Arabic, Berber and French, reflecting its historical and cultural diversity.

Tunisia gained independence from France in 1956 under the leadership of Habib Bourguiba, who later became the country’s first president. Bourguiba implemented an ambitious, state-led development strategy, emphasising social progress, secularism and gender equity, distinguishing Tunisia from many of its regional peers in North Africa and the Middle East. These early reforms contributed to positive education, healthcare and women’s rights outcomes.

However, despite these advances, Tunisia’s macroeconomic stability and improvements in human development masked deep-rooted structural issues. By the late 2000s, growing youth unemployment, regional inequality and entrenched corruption exacerbated a pervasive sense of exclusion and discontent, particularly among the educated but underemployed youth.

These underlying grievances culminated in the Freedom and Dignity Revolution of December 2010, which led to the ousting of long-time President Zine El Abidine Ben Ali in January 2011. Tunisia’s uprising catalysed for the broader Arab Spring, but it remains the only country in the region to have undergone a sustained, albeit turbulent, transition to democracy.

In the years following the revolution, Tunisia adopted a progressive constitution (2014) and held multiple rounds of competitive elections. Nevertheless, the post-revolutionary period has been marred by economic stagnation, political fragmentation and social unrest, with successive governments struggling to deliver on the promise of improved governance and living standards.

Since 2021, Tunisia has experienced a significant democratic regression. President Kaïs Saïed suspended parliament, dismissed the government and subsequently introduced a new constitution that significantly expanded presidential powers. These actions have drawn criticism from civil society, opposition groups and international observers, raising concerns about autocratic consolidation and the erosion of democratic institutions.

Economic conditions have also deteriorated. Public debt is rising, unemployment remains high, especially among the youth, and inflation has eroded household purchasing power. Talks with the International Monetary Fund (IMF) for financial support have stalled over disagreements concerning subsidy reform and fiscal austerity. These challenges are compounded by the spillover effects of regional instability and the impacts of climate change on agriculture and water security.

Although Tunisia possesses the foundations of an upper-middle-income country, including a relatively skilled labour force and a history of institutional reform, it continues to underperform economically. The persistent disconnect between human capital potential and economic output reflects structural weaknesses, limited investment and an underdeveloped private sector.

While Tunisia’s demographic and institutional profile positions it for long-term progress under stable conditions, current political and economic headwinds pose substantial risks. Without meaningful reforms to improve governance, unlock economic opportunity and rebuild public trust, the country’s development prospects may remain constrained in the decades ahead.

Chart 2 presents the Current Path of the population structure, from 1990 to 2043.

Tunisia’s population was estimated at 12.3 million in 2023 and will increase to approximately 13.4 million by 2043 on the Current Path. As illustrated in Chart 2, there was a notable surge in the working-age population (15–64 years) in the years leading up to the Freedom and Dignity Revolution in 2010. The substantial growth in this demographic cohort between 1980 and 2006 played a significant role in the socio-political dynamics that culminated in the ousting of President Zine El Abidine Ben Ali in January 2011.

Tunisia’s total fertility rate (TFR) declined below the replacement threshold of 2.1 children per woman in the early 2020s. This demographic shift will result in a marginal decrease in the proportion of the working-age population by 2043. Nevertheless, the country will maintain a substantial share of its population within the 15–64 age (working-age) bracket.

In 2023, the working-age population represented approximately 66% of the total population; by 2043, this proportion will decline slightly to 65.7% under the Current Path. Concurrently, Tunisia will experience a rise in the proportion of older adults. The Current Path suggests that the elderly population (65 and above) will constitute about 17.8% of the total population by 2043. This ageing trend will significantly affect economic productivity and the healthcare system, particularly given the increasing burden of non-communicable diseases (NCDs), which are generally more costly to diagnose and treat.

Tunisia reached its peak demographic dividend in the 2010-2011 period, with approximately 2.27 working-age individuals for every dependant (i.e., approximately 23 working individuals per 10 dependants). By 2023, this ratio had declined to approximately 1.94 and will rise slightly between 2025 and 2035 before gradually tapering off. Tunisia is among only eight African countries currently positioned to benefit from a demographic dividend, commonly associated with a dependency ratio of 1.7 or more working-age persons per dependant. However, despite this favourable demographic structure, the potential economic gains associated with labour-driven growth have not translated into corresponding increases in income.

Chart 3 presents a population distribution map for 2023.

As of 2023, Tunisia had an average population density of approximately 0.79 persons per hectare, based on its total land area of 163 610 km². However, this population is unevenly distributed, with significantly higher concentrations in urban coastal regions and major metropolitan centres.

The country is among the most urbanised countries in both Africa and the North African region, with an urbanisation rate of 70.5% in 2023, a figure that has continued to rise steadily since 2013. The country's three principal urban agglomerations, Greater Tunis, Sfax and Sousse, serve as the primary economic hubs, collectively contributing approximately 85% of the national GDP. These metropolitan regions attract most public and private investment, particularly in infrastructure, services and industrial activity.

Approximately 75% of Tunisia’s population resides in coastal areas, reflecting a historical pattern of development focused on maritime trade, tourism and export-oriented industries. In contrast, inland and southern regions remain underdeveloped, with limited access to quality infrastructure, healthcare and education. These regional disparities have contributed to significant socio-economic imbalances and continue to fuel internal migration toward urban centres.

Recent government development strategies, including those outlined in the National Development Plan and supported by international partners, have identified the reduction of regional inequality as a priority. Nonetheless, implementation has been uneven, and the gap between urban and rural areas remains a central challenge for inclusive and balanced national development.

Chart 4 presents the urban and rural population in the Current Path, from 1990 to 2043.

Tunisia has consistently maintained a higher level of urbanisation than regional and global benchmarks, with its urban population share exceeding the averages for Africa and lower-middle-income countries by approximately 20 percentage points. Unlike typical development trajectories, however, this relatively advanced urbanisation has not translated into more equitable income growth. Instead, its primary dividends have been improvements in educational attainment and enhanced access to basic infrastructure and public services.

The Current Path suggests that Tunisia’s urbanisation trend will continue to rise. By 2043, an estimated 76.6% of the population will reside in urban areas, while only 23.4% will remain in rural communities. The urban rate in 2023 was 72%. This shift underscores the need for policies to better harness urban growth for inclusive economic development, particularly in light of ongoing structural challenges and rising urban unemployment.

Chart 5 presents GDP in market exchange rates (MER) and growth rate in the Current Path, from 1990 to 2043.

Tunisia’s weak economic performance is fundamentally linked to a highly restrictive regulatory environment, the persistent dominance of state-owned enterprises, outdated legal frameworks, entrenched corruption, particularly within customs administration and limited market competition. In addition, rigid labour laws and a constrained socio-political space contribute to systemic exclusion and inequality. These structural impediments have stifled productivity, discouraged private investment and constrained long-term economic growth.

Relative to the averages for lower-middle-income countries, Tunisia derives the least growth contribution from labour and capital inputs. At the same time, multifactor productivity (or technology) accounts for the largest share of economic expansion. This reflects, in part, the country’s chronically low labour force participation rate, particularly among women, as well as subdued levels of capital formation. Tunisia’s female labour participation remains significantly below that of males, further reducing the potential of its human capital base.

Since the 2011 revolution, Tunisia’s development strategy has focused on promoting private sector-led growth, strengthening civil society and deepening international partnerships. However, progress has been limited. The country grapples with persistently high unemployment, rising public expenditure and debt levels, inflationary pressures, declining foreign reserves and fiscally unsustainable subsidies, especially in the energy sector.

The Current Path depicts modest economic growth over the next two decades, with Tunisia’s GDP expanding at an average annual rate of just over 2.8% between 2024 and 2043. From a baseline of US$43.05 billion in 2023, the economy will reach US$75.1 billion by 2043. This trajectory highlights the urgency of implementing deep structural reforms to unlock higher, more inclusive, and sustainable growth.

Chart 6 presents the size of the informal economy as a percentage of GDP and per cent of total labour (non-agriculture), from 2020 to 2043. The data in IFs is an estimate and therefore may differ from other sources.

Since the early 1990s, Tunisia’s informal sector has remained relatively small compared to regional and income-group peers. This reflects, in part, the country’s historically stronger institutional capacity, relatively better public service provision, and a more structured labour market than many of its African counterparts. However, the informal sector remains a critical source of employment, particularly in the aftermath of economic shocks, including the 2011 revolution and subsequent periods of fiscal stress and slow growth.

In 2023, the informal sector contributed 23.2% to Tunisia’s GDP, significantly below the average of 30.6% for lower-middle-income countries in Africa. By 2043, this share will decline modestly to 20.3% for Tunisia and 27% for the broader peer group, reflecting a gradual formalisation of economic activity.

Regarding employment, 36.5% of Tunisia’s labour force was engaged in the informal sector in 2023. This share will fall to 32.9% on the Current Path by 2043. Again, this is considerably lower than the average for lower-middle-income African countries, where informal employment stood at 57.5% in 2023 and will decline slightly to 54.2% over the same period.

Tunisia’s relatively lower levels of informality suggest a degree of institutional strength and regulatory control. However, it also reflects the limited absorptive capacity of the formal private sector and the persistence of structural unemployment. As the country seeks to boost inclusive growth, targeted reforms will be essential to expand decent work opportunities, strengthen the business environment and accelerate the transition from informal to formal employment.

Chart 7 presents GDP per capita in the Current Path, from 1990 to 2043, compared with the average for the Africa income group.

Tunisia’s GDP per capita has followed a trajectory of early promise, followed by recent stagnation. Since 1990, the country has experienced steady growth in per capita income, underpinned by investments in education, health and infrastructure, as well as a relatively diversified economy. This upward trend was particularly marked in the two decades leading up to 2010, during which per capita income increased significantly, placing Tunisia among the top ten African countries by income per person and well above the averages for lower-middle-income countries both globally and on the continent.

However, the post-2011 period ushered in a phase of economic uncertainty and stagnation. Political transitions, structural rigidities and declining competitiveness contributed to a slowdown in income growth. The COVID-19 pandemic further exacerbated these challenges, causing per capita income to fall from US$11 110 in 2019 to US$9 810 in 2020. Recovery has been slow, and the Current Path indicates that Tunisia is unlikely to regain its 2019 income levels before 2034.

Per capita income will rise gradually, reaching approximately US$12 870 by 2043. Despite this improvement, Tunisia’s income trajectory is increasingly aligning with the average for lower-middle-income countries, rather than diverging positively as might be expected given its substantial human capital endowment and early gains in socio-economic development.

This lack of convergence is a cause for concern. It suggests that Tunisia is not fully capitalising on its potential, particularly in areas such as labour productivity, innovation and private sector dynamism. Unlocking more robust and inclusive growth will require structural reforms to enhance economic competitiveness, reduce informality and generate higher-value employment, particularly for the country’s well-educated youth population.

Chart 8 presents the rate and number of extremely poor people in the Current Path from 2020 to 2043.

In 2022, the World Bank updated the poverty lines to 2017 constant dollar values as follows:

- The previous US$1.90 extreme poverty line is now set at US$2.15, also for use with low-income countries.

- US$3.20 for lower-middle-income countries, now US$3.65 in 2017 values.

- US$5.50 for upper-middle-income countries, now US$6.85 in 2017 values.

- US$22.70 for high-income countries. The Bank has not yet announced the new poverty line in 2017 US$ prices for high-income countries.

Monetary poverty only tells part of the story. In addition, the global Multidimensional Poverty Index (MPI) measures acute multidimensional poverty by measuring each person’s overlapping deprivations across ten indicators in three equally weighted dimensions: health, education and standard of living. The MPI complements the international US$2.15 a day poverty rate by identifying who is multidimensionally poor and also shows the composition of multidimensional poverty. The headcount or incidence of multidimensional poverty is often several percentage points higher than that of monetary poverty. This implies that individuals living above the monetary poverty line may still suffer deprivations in health, education and/or standard of living.[1]

Tunisia has made considerable progress in reducing poverty over the past three decades. Since 1990, the country has significantly lowered its poverty headcount, driven by sustained investments in human development, relatively inclusive social policies and broad access to basic services. As a result, Tunisia has already met the headline Sustainable Development Goal (SDG) of eradicating extreme poverty as defined by the international poverty line of US$2.15 per person per day (2017 PPP). Currently, less than 1% of the population lives below this threshold.

However, while eradicating extreme poverty represents a major milestone, other dimensions of poverty and inequality remain. Disparities persist across regions, particularly between urban coastal areas and the more impoverished interior and southern regions, as well as among various demographic groups. Poverty measured at higher thresholds, such as the World Bank’s US$3.65 per person per day poverty line for lower-middle-income countries, remains a challenge and will persist into the foreseeable future.

Although Tunisia’s long-standing universal subsidy system has contributed to mitigating poverty, it has also been fiscally burdensome and economically inefficient. The current system disproportionately benefits higher-income households and crowds out targeted social spending. As Tunisia navigates a constrained fiscal environment, reforming its subsidy framework toward more targeted and efficient social safety nets will be critical to achieving sustained poverty reduction and narrowing inequality.

The Current Path indicates that poverty, measured at the US$3.65 threshold, will rise slightly until around 2026 due to ongoing economic pressures, before resuming a gradual decline. By 2043, the proportion of Tunisians living below this line will fall to 1.7% (approximately 226 967 people), down from 3.4% (about 414 847 people) in 2023. This trajectory reflects continued, albeit modest, progress and underscores the need for deeper structural reforms to ensure a more equitable and inclusive growth path.

Chart 9 depicts the National Development Plan.

Tunisia’s long-term development agenda is anchored in Vision Tunisie 2035, a strategic framework launched in 2022 that outlines the country’s aspirations to become a high-income, inclusive and sustainable economy by 2035. This vision builds on Tunisia’s historical strengths, such as a well-educated population and relatively strong institutions, while addressing persistent structural weaknesses that have constrained economic transformation and social cohesion.

At the heart of Vision Tunisie 2035 is strongly emphasising human capital development. The government recognises that education, innovation and regional equity are essential to fostering a productive and inclusive society. The plan aims to enhance the quality and accessibility of education, emphasising digital literacy and skills that align with labour market needs. It also seeks to reduce regional disparities in education outcomes and healthcare access, particularly between coastal urban centres and the interior and southern regions.

A key pillar of the vision is the transition to a knowledge-based and digitally enabled economy. The plan prioritises investment in digital infrastructure and promoting digital transformation across public services and economic sectors. By fostering a conducive environment for digital entrepreneurship, the government hopes to create jobs, improve service delivery and boost Tunisia’s competitiveness in global markets.

Economic diversification and competitiveness represent another central theme of Vision 2035. Tunisia aims to shift from a low-value-added, consumption-driven economy to one export-oriented and integrated into global value chains. This involves modernising the industrial base, expanding the role of high-potential sectors such as ICT, pharmaceuticals, automotive components and agribusiness, and enhancing the productivity of small and medium-sized enterprises (SMEs). Structural reforms to improve the investment climate, reduce bureaucratic inefficiencies, and modernise financial markets are also planned to stimulate private sector growth and attract foreign direct investment.

Environmental sustainability is also a core priority. Tunisia aims to build a green economy that is resilient to climate change and anchored in the sustainable use of natural resources. Key objectives include expanding renewable energy generation (especially solar and wind), improving water resource management and promoting sustainable agriculture. Climate adaptation strategies, including strengthening coastal protections and promoting drought-resistant crops, are being developed in response to Tunisia’s growing vulnerability to environmental shocks.

The vision strongly emphasises social justice and inclusion. Policies are designed to improve living standards, reduce multidimensional poverty and expand access to social services. This includes reforming the subsidy system, which has been fiscally unsustainable and often regressive, in favour of more targeted social protection measures that directly benefit vulnerable populations. Measures to improve gender equality, especially in economic participation, are also being prioritised.

Another strategic focus is balanced regional development. Tunisia’s historical pattern of coastal-centric development has left large swathes of the country underdeveloped. The development plan seeks to rectify this by increasing public investment in lagging regions, promoting local economic development and decentralising public services to empower municipalities. Infrastructure investments, particularly in transport, water and energy, will be key in facilitating regional integration and economic opportunity.

The 2023–2025 Development Plan, which serves as the medium-term implementation framework for Vision 2035, sets more immediate priorities. It focuses on stabilising the macroeconomic environment by implementing fiscal and governance reforms, boosting revenue mobilisation and improving the efficiency of public spending. Given the pressures on public finances, the government plans to gradually reduce untargeted subsidies, especially in the energy sector, while strengthening social safety nets through direct cash transfers and better targeting mechanisms.

Sector-specific priorities under the 2023–2025 plan include revitalising agriculture through modernisation, climate-smart practices and improved rural infrastructure. The industrial sector is set to benefit from incentives for technological upgrading, cluster development and export promotion. Tourism focuses on diversifying offerings beyond traditional beach tourism to include cultural, ecological and medical tourism while improving service quality and infrastructure. Transport and logistics infrastructure, critical for boosting trade and regional development, is receiving significant public investment, with ongoing efforts to modernise port infrastructure and improve road and rail connectivity.

Energy policy is increasingly focused on renewable sources, with the government targeting a significant increase in solar and wind capacity as part of its energy transition strategy. Investment incentives, public-private partnerships,and regulatory reforms are being pursued to attract green financing and private investment in this sector.

To support implementation, Tunisia has mobilised public investment amounting to approximately US$12.3 billion for the current plan period, with allocations concentrated in infrastructure, education, healthcare and digital transformation. Strong international partnerships, including with the European Union, World Bank and African Development Bank, are being leveraged to finance development priorities and support structural reform efforts.

Although detailed frameworks for the period beyond 2025 have not yet been officially released, Tunisia is expected to continue to build upon Vision 2035 through successive medium-term plans. These are likely to focus on deepening the structural transformation of the economy, consolidating gains in human development, and adapting to the increasingly complex challenges posed by climate change, global economic shifts and domestic socio-political dynamics.

Chart 11 presents the mortality distribution in the Current Path for 2023 and 2043.

The Demographics and Health scenario envisions ambitious improvements in child and maternal mortality rates, enhanced access to modern contraception, and decreased mortality from communicable diseases (e.g., AIDS, diarrhoea, malaria, respiratory infections) and non-communicable diseases (e.g., diabetes), alongside advancements in safe water access and sanitation. This scenario assumes a swift demographic transition supported by heightened investments in health and water, sanitation and hygiene (WaSH) infrastructure.

Visit the themes on Demographics and Health/WaSH for more details on the scenario structure and interventions.

Tunisia introduced free healthcare on independence and has since made significant investments in the sector. Since then, the country's mortality profile has increasingly shifted toward non-communicable diseases (NCDs) since the late 60s, reflecting broader demographic and epidemiological transitions.

Currently, the country’s disease burden is dominated by NCDs such as cardiovascular conditions, malignant neoplasms (cancers), chronic respiratory diseases and mental health disorders. This trend aligns with changes in population structure, urbanisation and lifestyle factors, including dietary habits, physical inactivity, tobacco use and environmental pollution.

The Current Path indicates that mortality from key NCDs will rise significantly over the next two decades. Cardiovascular-related deaths will increase from 37 080 in 2023 to 62 200 by 2043, while deaths from malignant neoplasms will increase from 10 780 to 16 480 over the same period. This sharp increase is largely driven by population ageing, rising prevalence of risk factors, and gaps in the prevention and early detection of chronic diseases.

In addition to cardiovascular disease and cancer, other NCDs, including mental health conditions, respiratory diseases and metabolic disorders, are becoming more pronounced. Deaths attributed to mental health-related conditions will rise from 3 740 in 2023 to 9 580 by 2043 under the Current Path. Similarly, fatalities from respiratory diseases will increase from 2 860 to 5 910, and other NCD-related deaths from 4 070 to 6 130 over the same period. These trends underline a growing and diversified NCD burden that poses significant challenges for Tunisia's health system.

Though relatively advanced by regional standards, Tunisia's health system faces critical challenges in responding to this evolving disease burden. These include underinvestment in preventive healthcare, uneven quality of services between urban and rural areas, limited integration of NCD management into primary care, and a shortage of specialised personnel and diagnostic infrastructure. The COVID-19 pandemic also exposed underlying vulnerabilities in the public health system, particularly concerning emergency preparedness, supply chain resilience and digital health infrastructure.

To effectively address the rising burden of NCDs, Tunisia will need to prioritise comprehensive health sector reforms. Key priorities include expanding access to early diagnosis and screening programs, integrating NCD care into primary healthcare delivery, and increasing investments in mental health services. Strengthening the country’s epidemiological surveillance and health information systems will also be essential for timely intervention and resource allocation. Moreover, public health campaigns focused on behavioural change, targeting tobacco use, physical inactivity and unhealthy diets, are critical to reducing the incidence of NCDs over the long term.

As the country prepares for an ageing population and rising healthcare demands, greater strategic planning, investment and intersectoral coordination will be required to build a resilient, equitable and sustainable health system.

Overall, Tunisia demonstrates strong performance across key health indicators. Life expectancy in the country is relatively high, reaching approximately 78.1 years in 2023. The Current Path suggests further improvement, with average life expectancy increasing to 80.6 years by 2043, nearly four years above the global average forecast.

Consistent with global trends, female life expectancy in Tunisia will remain higher than that of males. Between 2023 and 2043, female life expectancy will increase from 80.4 to 82.9 years, while male life expectancy will rise from 75.8 to 78.1 years under the Current Path. These trends reflect continued gains in healthcare access, disease prevention and general living standards, although gender disparities in health outcomes will persist.

Chart 12 presents the infant mortality rate in the Current Path and in the Demographics and Health scenario, from 2020 to 2043.

The infant mortality rate is the probability of a child born in a specific year dying before reaching the age of one. It measures the child-born survival rate and reflects the social, economic and environmental conditions in which children live, including their health care. It is measured as the number of infant deaths per 1 000 live births and is an important marker of the overall quality of the health system in a country.

Tunisia has already achieved the 2030 Sustainable Development Goal (SDG) target of reducing infant mortality to below 25 deaths per 1 000 live births, well ahead of schedule. It currently holds the lowest infant mortality rate among African lower-middle-income countries, a reflection of the country’s relatively strong healthcare infrastructure, effective immunisation programs and improvements in maternal and child health services.

Under the Demographics and Health scenario, Tunisia will make further gains in reducing infant mortality. The rate will decline from 9 deaths per 1 000 live births in 2023 to approximately 5.3 deaths by 2043. This compares favourably with the Current Path of 6.3 deaths per 1 000 live births over the same period. These improvements reflect the potential impact of continued maternal and child health investments, expanded access to quality prenatal and neonatal care and improved socio-economic conditions.

Moreover, the Demographics and Health scenario will be essential in improving life expectancy in Tunisia. Under this scenario, life expectancy will rise even further, reaching 1.67 years above the Current Path estimate of 80.56 years by 2043. This enhanced outcome benefits both women and men. Female life expectancy will exceed the Current Path of 82.94 years by an additional 1.46 years, while male life expectancy will rise 1.89 years above the Current Path estimate of 78.12 years. These gains reflect the positive impact of improved health services, better disease prevention and enhanced living conditions across the population.

Chart 13 presents the demographic dividend in the Current Path and in the Demographics and Health scenario, from 2020 to 2043.

The dividend is the window of economic growth opportunity that opens when the ratio of working-age persons to dependents increases to 1.7 to 1 and higher.

Demographers commonly distinguish between the first, second and even third demographic dividends. This analysis focuses on the first demographic dividend, which refers to the economic growth potential resulting from changes in the population’s age structure, specifically, an increase in the proportion of the working-age population (aged 15–64) relative to dependants (children under 15 and adults over 64). A demographic window of opportunity typically opens when this working-age to dependant ratio exceeds 1.7 to one, allowing for greater productivity, higher savings and increased per capita income.

Tunisia experienced a peak demographic window in 2010–2011, when the ratio of working-age individuals to dependants reached 2.3 to one. The country will undergo a second historical peak in the ratio around 2034–2036, reaching approximately 2.1 working-age persons per dependant under both the Current Path and the Demographics and Health scenario. Notably, the Demographics and Health scenario begins to exert a more positive impact from 2030 onward, as improvements in health and fertility outcomes contribute to a more favourable age structure. However, after this peak, the demographic dividend begins to decline. By 2043, the working-age to dependant ratio will decrease to 1.89 under the Demographics and Health scenario, slightly below the Current Path of 1.92.

This modest decline reflects several interrelated factors. First, population ageing becomes more pronounced in the years following the demographic peak, increasing the proportion of elderly dependants. Second, fertility rates, while reduced in earlier decades, may stabilise at lower levels (1.7 births per woman under both the Current Path and the Demographics and Health scenario), thereby slowing the growth of the working-age population. Third, labour force participation rates, particularly among women and youth, remain suboptimal, limiting the economic benefits that could otherwise be derived from the existing age structure. Finally, structural challenges in Tunisia’s economy, such as high unemployment, informality and underutilisation of skilled labour, also inhibit the full realisation of the demographic dividend.

These dynamics suggest that Tunisia's window of opportunity for maximising the first demographic dividend is finite and will begin to close in the late 2030s. To sustain and extend the benefits of this period, the country must accelerate investments in education, health and labour market reforms, particularly those that boost job creation, particularly for women, expand formal employment and improve productivity across sectors. Doing so will be essential for capturing the current dividend and laying the groundwork for a potential second demographic dividend driven by increased savings and capital accumulation in an ageing society.

Chart 14 presents crop production and demand in the Current Path from 1990 to 2043.

The Agriculture scenario envisions an agricultural revolution that ensures food security through ambitious yet feasible increases in yields per hectare, thanks to improved management, seed, fertiliser technology and expanded irrigation. Efforts to reduce food loss and waste are emphasised, with increased calorie consumption as an indicator of self-sufficiency and prioritising it over food exports. Additionally, enhanced forest protection signifies a commitment to sustainable land use practices.

Visit the theme on Agriculture for our conceptualisation and details on the scenario structure and interventions.

Agriculture remains a vital component of Tunisia’s economy and social fabric. The sector contributes approximately 11% to national GDP and employs around 16% of the labour force, which is particularly important in supporting rural livelihoods and ensuring food security. Tunisia is among the world’s leading producers and exporters of olive oil. It is one of the few African countries that has achieved self-sufficiency in dairy products, fruits and vegetables. However, the country remains heavily dependent on wheat imports, rendering its food system vulnerable to external price shocks and supply disruptions.

Between 1990 and 2023, both agricultural production and domestic demand have seen notable growth. Total agricultural output rose from 6.4 million metric tons in 1990 to 14.4 million metric tons in 2023, while demand increased from 8.2 to 19.8 million metric tons over the same period. This growing imbalance (demand is slowly outpacing production) has led to a widening food deficit, which stood at 4.8 million metric tons in 2023. Nevertheless, the Current Path indicates an improvement by 2043, with the food deficit narrowing to 2.5 million metric tons, as production and demand rise to 19.4 and 21.8 million metric tons, respectively.

As in many African economies, Tunisia's agriculture is predominantly crop-based. It plays a crucial role not only in economic output but also in providing food security and employment, especially in rural areas. Recent developments in the sector include increased investment in agro-export value chains, particularly olives, dates and citrus, as well as renewed policy focus on agricultural resilience and climate-smart farming practices.

Crop yields have improved moderately over the past three decades, increasing from 1.3 metric tons per hectare in 1990 to 2.6 metric tons in 2023. Variable climatic conditions, limited water availability and slow uptake of modern agricultural technologies have shaped this growth. While export-oriented crops such as olives and dates have performed relatively well, staple crops like wheat and barley are constrained by recurrent droughts, soil degradation and limited irrigation infrastructure.

Looking ahead, further improvements in agricultural productivity will depend on adopting sustainable water management practices, greater investment in agricultural research and innovation, and the broader application of modern farming techniques, including precision agriculture and climate-resilient seeds. Under the Current Path, crop yields will increase to 3.4 metric tons per hectare by 2043.

Within this period, total crop production will rise from 12.1 million metric tons in 2023 to 16.3 million metric tons by 2043, while demand will increase from 16.5 to 18.5 million metric tons. As a result, the crop deficit will decline significantly, from 4.4 million metric tons in 2023 to 1.9 million metric tons in 2043. This narrowing of the crop production and demand gap indicates that, with appropriate policy interventions and sustained investment, Tunisia has the potential to strengthen its food security and enhance the resilience of its agricultural sector.

Tunisia has made significant progress in expanding and modernising its irrigation infrastructure. The total land area equipped for irrigation increased from approximately 340 870 hectares in 1990 to 406 550 hectares in 2023, with a peak of 494 720 hectares in 2017. Despite this progress, water scarcity remains a critical constraint to agricultural productivity and sustainability. On the Current Path, the irrigated area will reach 442 100 hectares by 2043, an improvement from current levels, yet still below both the 2017 peak and the estimated national irrigation potential of 560 000 hectares. The Agriculture scenario increases total irrigated land to 483 000 hectares, an 18% improvement on the Current Path.

Among lower-middle-income countries in Africa, Tunisia currently ranks third after Egypt and Morocco in total irrigated land. However, further expansion and efficiency improvements in irrigation will require a strategic focus on sustainable water resource management. This includes greater investment in desalination technologies, rehabilitation of existing irrigation networks and the wider adoption of climate-smart practices such as drip and deficit irrigation. Ensuring sustainable water use will be essential to safeguarding Tunisia’s agricultural sector and securing long-term food and water security in the face of growing environmental and climate pressures.

Chart 15 presents the import dependence in the Current Path and the Agriculture scenario, from 2020 to 2043.

Improved agricultural yields directly affect food security and Tunisia’s dependence on food imports. Under the Agriculture scenario, crop production will rise significantly from 12.1 million metric tons in 2023 to 19.9 million metric tons by 2043. This represents a notable improvement over the Current Path, which forecasts production reaching only 16.3 million metric tons by the same year.

The successful implementation of the interventions outlined in the Agriculture scenario, which include enhanced input use, improved irrigation efficiency, adoption of climate-resilient practices and expansion of agricultural extension services, will be essential in closing the crop production gap.

These measures will eliminate the country’s crop deficit by the 2037/2038 season. By 2043, Tunisia could transition from a deficit of 4.4 million metric tons in 2023 to a surplus of 1.81 million metric tons. In contrast, remaining on the Current Path would still leave the country with a shortfall of approximately 1.9 million metric tons in 2043. This divergence highlights the transformative potential of targeted agricultural investments in achieving food security.

As of 2023, Tunisia imported approximately 26.7% of its total crop demand, making it vulnerable to global market volatility and external supply shocks. Critically, the Agriculture scenario enables Tunisia to eliminate its dependence on crop imports by 2040, achieving full self-sufficiency and surpassing domestic demand by approximately 6% by 2043, a milestone last achieved during the 1963–64 season. In comparison, the Current Path suggests a decrease in net agricultural import dependency to 13.6% by 2043.

From a food security perspective, this outcome would be significantly more favourable. Achieving self-sufficiency would shield the country from external price fluctuations, ensure greater resilience to supply chain disruptions, and enable Tunisia to more reliably meet the dietary and nutritional needs of its growing population. In the context of rising global food insecurity and supply chain vulnerabilities, exacerbated by climate change, geopolitical tensions and commodity price volatility, enhancing domestic agricultural capacity remains a strategic imperative for Tunisia’s long-term stability and development.

Chart 16 depicts the progress through the educational system in the Current Path, for 2023 and 2043.

The Education scenario represents reasonable but ambitious improvements in intake, transition, and graduation rates from primary to tertiary levels and better quality of education at primary and secondary levels. It also models substantive progress towards gender parity at all levels, additional vocational training at the secondary school level, and increases in the share of science and engineering graduates.

Visit the theme on Education for our conceptualisation and details on the scenario structure and interventions.

In 2024, Tunisia’s education system ranked 71st globally, a reflection of the country's sustained commitment to education as a national priority. Tunisia continues to allocate approximately 20% of its national budget to the education sector, highlighting one of the highest levels of public investment in education across Africa. The country ranks 49th globally for schooling expectancy and 51st for the student-to-teacher ratio at the primary level, underscoring its relatively strong emphasis on foundational education.

Since gaining independence in 1956, Tunisia has made remarkable strides in expanding educational access and improving outcomes. Landmark reforms have included significant investment in early childhood education and the introduction of free and compulsory education for children between the ages of six and sixteen. These reforms have resulted in Tunisia having one of the most educated populations in North Africa, ranking second after Libya within the region and ninth on the African continent overall, measured by the average number of years of schooling attained by adults aged 15 and older.

Despite these successes, challenges remain, particularly concerning the quality and inclusivity of education. The Current Path shows that the average number of years of schooling attained by youth aged 14 to 24 years, a key measure of future human capital, will remain stagnant at 11.6 years between 2023 and 2043. This stagnation is accompanied by a persistent and slightly widening gender gap favouring females. In 2023, the mean years of education for males trailed behind females by 0.38 years, and this gap will widen slightly to 0.41 years by 2043.

Regarding quality, Tunisia’s education system continues to improve, albeit gradually. The Current Path shows that the primary education quality score will rise from 36.7 in 2023 to 41.5 by 2043, while secondary education quality will increase modestly from 47 to approximately 50 over the same period. This positive trend places Tunisia above the average for lower-middle-income countries in Africa, demonstrating the impact of its sustained public investment in education. Nevertheless, the slow pace of improvement signals the need for renewed policy focus, especially to align educational quality with the demands of a modern economy.

A pressing concern is the widening gender gap in educational outcomes, increasingly favouring females. Between 2023 and 2043, the gender gap in primary education quality will increase from 1.5 points to 1.6 points, while the gap in secondary education quality will widen from 0.8 points to 1.01 points under the Current Path. While both boys and girls are benefiting from overall improvements, girls are progressing at a faster rate. These trends are corroborated by external assessments, including the World Economic Forum’s Global Gender Gap Report 2023, which ranked Tunisia 128th globally, a decline of eight places from the previous year. Although Tunisia has achieved near gender parity, or even a female advantage, in secondary and tertiary education enrolment, underlying disparities persist, particularly affecting male literacy and academic performance.

Recent evidence shows that female students outperform male students in critical subjects such as reading literacy, mathematics and science. However, this educational success among females has yet to translate into proportional labour market gains. Despite their higher educational attainment, Tunisian women face significant barriers to economic participation. Female labour force participation remains 43.6 percentage points lower than that of males under the Current Path, highlighting a major disconnect between educational advancement and employment outcomes. This mismatch limits the contribution of women’s educational achievements to overall economic growth and points to broader societal and structural constraints.

Moreover, the steady decline in boys' academic performance, combined with their disengagement from education, has broader implications for Tunisia’s workforce competitiveness and social cohesion. If unaddressed, these trends risk entrenching gender imbalances not only in education but also across the labour market and wider society. Therefore, there is an urgent need for targeted interventions to support male educational achievement while continuing to promote female economic empowerment.

At the same time, Tunisia faces significant structural challenges at the upper-secondary and tertiary levels. High dropout rates, curriculum-job market mismatches and limited capacity in technical and vocational education persist, undermining the ability of the education system to meet evolving labour market demands. Many of Tunisia’s educated youth, particularly university graduates, struggle to access meaningful economic opportunities, leading to heightened frustration and social unrest. This disconnect between educational attainment and economic integration was a critical driver behind the 2011 Freedom and Dignity Revolution and remains a potent source of socio-political tension today.

Addressing these interconnected challenges requires a holistic approach that focuses on improving educational quality, narrowing gender disparities, enhancing the relevance of education to labour market needs, and dismantling barriers to female labour force participation. Only through such comprehensive reforms can Tunisia fully realise the transformative potential of its substantial investments in education.

Chart 17 presents the mean years of education in the Current Path and in the Education scenario, from 2020 to 2043, for the 15 to 24-year age group.

The average years of education in the adult population aged 15 to 24 are a good first indicator of changes in society's stock of knowledge.

Under the Education scenario, Tunisia will achieve notable improvements in both the quantity and quality of education. By 2043, the average years of educational attainment for individuals aged 14 to 24 will increase to 11.9 years, 0.3 years higher than the Current Path of 11.6 years. This would reverse the stagnation observed in recent years and surpass Tunisia’s previous peak of 11.7 years, recorded in 2020.

Importantly, the scenario also narrows the gender gap in educational attainment for this age group, reducing the difference between females and males from 0.38 years in 2023 to 0.23 years by 2043. In contrast, the gap will widen slightly to 0.41 years on the Current Path, highlighting the scenario's potential to promote greater gender equity in education.

Significant gains are also apparent in educational quality. Tunisia’s primary education quality score will rise to approximately 47.5 by 2043, representing an improvement of around 6 points above the Current Path. This outcome would surpass the country's previous peak score of 43.9, achieved in 1995, and mark a meaningful reversal of the long-term decline in primary education performance. Furthermore, the Education scenario contributes to narrowing gender disparities: the gender gap in primary education quality will shrink dramatically from 1.5 points in 2023 to just 0.3 points by 2043, compared to a widening gap of 1.6 points under the Current Path.

At the secondary level, quality scores also improve substantially. The Education scenario raises Tunisia’s secondary education quality score to 55.5 by 2043, again approximately 6 points higher than the Current Path. Importantly, gender equity advances alongside quality improvements. The gender gap in secondary education quality will decline significantly, from 0.8 points in 2023 to 0.2 points by 2043, compared to a widening gap of 1.04 points under the Current Path.

These outcomes suggest that targeted educational reforms not only elevate overall performance but also meaningfully contribute to reducing gender disparities across primary and secondary education levels. The improvements reflect the scenario's emphasis on targeted interventions, including teacher training, curriculum reform, expanded access to digital learning tools and enhanced learning environments, particularly in underserved and rural areas.

Recent developments in Tunisia’s education sector further reinforce the relevance of this scenario. Ongoing reforms have focused on modernising curricula, reducing dropout rates and aligning educational outcomes with labour market demands. There is a growing national dialogue around bridging the skills gap and expanding access to technical and vocational education, which is essential to enhancing employability and driving inclusive economic growth. If effectively implemented, the Education scenario offers a pathway to revitalising Tunisia’s education system and unlocking its human capital potential.

Chart 18 presents the value-add by sector as a share of GDP in the Current Path, for 2023 and 2043.

In the Manufacturing scenario, reasonable but ambitious growth in manufacturing is envisaged through increased investment in the sector, research and development (R&D) and improved government regulation of businesses.

Visit the theme on Manufacturing for our conceptualisation and details on the scenario structure and interventions.

Similar to the situation in most African countries, Tunisia’s economy is dominated by the service sector, which contributes significantly more to GDP than other sectors. In 2023, the service sector accounted for approximately 62.4% of GDP, followed by manufacturing, agriculture, ICT, materials and energy. However, under the Current Path, the contribution of services will decline slightly, reaching 60.6% by 2043, suggesting a modest rebalancing in the economy's sectoral composition.

According to the classical theory of structural economic transformation, also known as the three-sector hypothesis, countries tend to shift from an agriculture-based economy toward industrialisation, and eventually toward a service-dominated economy as they ascend the income ladder. For a lower-middle-income country like Tunisia, this would typically imply a robust expansion of the manufacturing sector, driven by declining agricultural employment and productivity growth in industry. However, Tunisia’s Current Path reflects a pattern of distorted structural transformation, where the growth of the service sector has not been accompanied by sustained industrial dynamism.

The Current Path illustrates a modest increase in the share of manufacturing value added to GDP, from 14.3% in 2023 to 16.9% by 2043. This limited growth suggests that the industrial base remains underdeveloped and that the country has yet to harness the full potential of manufacturing-led development. At the same time, the share of agriculture in GDP will decline slightly, from 10.9% in 2023 to 9.9% by 2043, consistent with broader patterns of agricultural decline during economic transformation.

Given the country’s urgent need to generate employment, especially for youth and educated graduates, Tunisia's limited industrial performance is particularly concerning. Industrialisation is critical not only for creating direct employment in manufacturing but also for generating indirect jobs and productivity gains in related sectors such as logistics, ICT, services and construction. Current government initiatives, including the National Industrial Strategy 2035, seek to revitalise key manufacturing sectors such as pharmaceuticals, automotive components, agri-processing and electronics. These efforts are supported by investment promotion reforms and international cooperation agreements to integrate Tunisia into regional and global value chains.

Despite recent policy shifts aimed at revitalising the industrial sector, Tunisia continues to face various structural challenges that constrain its manufacturing potential. Weak infrastructure, particularly in interior regions, limited innovation capacity, bureaucratic inefficiencies and restricted access to finance for small and medium-sized enterprises (SMEs) remain persistent obstacles. Compounding these issues is that, although Tunisia’s education system has expanded significantly, it remains largely oriented toward general academic training rather than equipping students with the technical and vocational skills needed to support higher value-added manufacturing. Efforts to strengthen vocational education have been limited, resulting in a persistent mismatch between workforce capabilities and industry demands. Moreover, the chronic lack of regional trade integration across North Africa severely restricts Tunisia’s ability to climb the manufacturing value-added ladder. Fragmented markets and weak cross-border industrial linkages undermine opportunities for economies of scale, innovation and supply chain development, leaving Tunisia heavily reliant on the European Union (EU) as its primary trading partner. Addressing these interconnected constraints will be critical for unlocking higher levels of inclusive growth and achieving a more balanced and sustainable structural transformation.

Chart 19 presents the contribution of the manufacturing sector to GDP in the Current Path and in the Manufacturing scenario, from 2020 to 2043. The data is in US$ and % of GDP.

Under the Manufacturing scenario, Tunisia will experience a significant expansion in its industrial base, with the manufacturing value-added share of GDP rising from 14.3% in 2023 to 19.2% by 2043. This would surpass the country’s historical peak of almost 19%, recorded in 1995, and notably outperform the Current Path of 16.9% for the same year. This upward trajectory reflects the scenario’s emphasis on industrial revitalisation through targeted investments, improved infrastructure, value chain integration and enhanced competitiveness in strategic sectors such as agro-processing, automotive components, textiles and electronics.

While the relative contribution of other sectors to GDP, particularly services and agriculture, will decline slightly, their absolute growth continues, indicating positive spillover effects from the manufacturing sector. These intersectoral linkages, particularly through increased demand for logistics, ICT, business services and agricultural inputs, are critical for sustaining a broader economic transformation. As a result, government revenue also benefits, with increased tax collection from a more dynamic and diversified economic base.

In this scenario, Tunisia’s government revenue as a share of GDP will rise from 25.9% (US$11.16 billion) in 2023 to 30.2% (US$23.73 billion) by 2043. This represents a modest improvement over the Current Path, which forecasts government revenue at 29.8% (US$22.41 billion) by the same year. However, despite these gains, the 2043 revenue share remains below the country's previous peak of 35.6%, recorded in 2017. This suggests that while industrial growth contributes to fiscal recovery, further tax policy and revenue administration reforms may be necessary to fully restore Tunisia’s fiscal capacity.

The Manufacturing scenario also drives broader economic growth. By 2043, Tunisia’s GDP will reach US$78.54 billion—US$3.43 billion higher than the Current Path. This translates into an increase in GDP per capita to US$13 270, approximately US$400 above the Current Path. These improvements underscore the potential of manufacturing-led growth to generate higher incomes and enhance economic resilience.

Crucially, the scenario also contributes to poverty reduction. The share of the population living in extreme poverty, defined as living on less than US$3.65 per day, will fall from 3.4% in 2023 to 1.5% by 2043. This is a more substantial decline than under the Current Path, which estimates extreme poverty at 1.7% by 2043. The reduction is attributed to stronger economic growth, greater job creation in the manufacturing and allied sectors, and the inclusion of targeted social transfers for unskilled workers.

Overall, the Manufacturing scenario illustrates a more robust and inclusive development pathway for Tunisia, marked by deeper structural transformation, improved fiscal space and enhanced social outcomes. Policy coherence, investment in industrial infrastructure, support for SMEs and greater integration into regional and global value chains will be essential to realise this potential.

Chart 20 depicts exports and imports as a percentage of GDP, from 2000 to 2043, in the Current Path and in the AfCFTA scenario.

The AfCFTA scenario represents the impact of fully implementing the African Continental Free Trade Agreement by 2034. The scenario increases exports in manufacturing, agriculture, services, ICT, materials and energy exports. It also includes improved multifactor productivity growth from trade and reduced tariffs for all sectors.

Visit the theme on AfCFTA for our conceptualisation and details on the scenario structure and interventions.

Given the historically low levels of intra-regional trade in North Africa, it is unsurprising that, in 2023, nearly 72% of Tunisia’s exports were destined for the EU, while 44% of its imports originated from the EU, rather than from neighbouring countries. This heavy reliance on the EU market underscores the chronic lack of regional economic integration within North Africa, a region often described as one of the most politically and economically fragmented on the continent. Persistent divisions among North African states, exacerbated by long-standing political tensions (such as the closed borders between Algeria and Morocco) and limited institutional cooperation, have constrained the potential for trade-led growth, cross-border investment and broader economic collaboration across the region. Despite numerous initiatives, such as the Arab Maghreb Union, intra-regional trade in North Africa remains stagnant at less than 5% of total trade, far below levels seen in other African regions like East or West Africa.

Given these regional constraints, Tunisia has strategically pursued closer ties with the EU to drive its economic development. Efforts to deepen Tunisia’s integration with the EU formally began with the launch of negotiations for a Deep and Comprehensive Free Trade Area (DCFTA) on 13 October 2015. The DCFTA aims to expand Tunisia’s preferential access to the EU single market by including sensitive sectors such as agriculture, services and investment, areas that were excluded from the earlier 1995 EU-Tunisia Association Agreement. By doing so, the DCFTA seeks to foster new trade and investment opportunities, enhance Tunisia’s competitiveness and further integrate Tunisian firms into European value chains, particularly in sectors such as manufacturing, agribusiness and information technology.

While the DCFTA offers significant opportunities, including the potential for technology transfer, improved standards and increased foreign direct investment, it also presents substantial challenges. Domestically, the agreement remains controversial. Critics argue that the DCFTA could disproportionately benefit large export-oriented firms while marginalising smallholder farmers, local producers, and small and medium-sized enterprises (SMEs), ill-prepared to compete with European firms. There are also concerns that liberalising sensitive sectors such as agriculture could expose Tunisia’s agricultural sector to unfair competition, threatening rural livelihoods. Furthermore, opponents warn that aligning regulatory frameworks too closely with EU standards could erode Tunisia’s regulatory sovereignty, limiting the country’s ability to pursue independent development policies tailored to national priorities.

Current developments indicate that negotiations have stalled intermittently due to these domestic concerns and broader political uncertainty. Rising socio-economic frustrations, high unemployment and fears over economic dependence on Europe have made the DCFTA a politically sensitive topic in Tunisia. Moreover, the European Union’s own evolving trade and sustainability policies, such as the Green Deal and Carbon Border Adjustment Mechanism, add further layers of complexity to Tunisia’s future integration into the European economic space.

Nevertheless, if negotiated carefully, with adequate safeguards for vulnerable sectors and comprehensive support for economic modernisation and diversification, Tunisia’s deeper integration with the EU could offer a powerful engine for growth and structural transformation. Achieving this, however, will require balancing the benefits of greater access to European markets with the need to protect national interests, foster inclusive development and strengthen resilience against external shocks.

At the same time, Tunisia faces significant internal trade challenges. It is estimated that nearly one-third of goods sold in the domestic market are imported illegally, a trend driven by high import tariffs, outdated trade regulations and corrupt customs practices. These barriers deter formal trade activity and undermine state revenue collection. A comprehensive overhaul of trade regulations, customs enforcement and currency exchange rules is urgently needed to reduce informality and restore confidence in the formal economic system.

In this context, the AfCFTA scenario presents a more optimistic trajectory. It envisions a Tunisia that is more deeply integrated into regional markets. The AfCFTA offers Tunisia a strategic opportunity to diversify its export markets, reduce its dependence on Europe and position itself as a gateway to African markets. With its geographic proximity, well-educated labour force, industrial base and investment potential, especially in pharmaceuticals, textiles and automotive components, Tunisia is well-placed to serve as a regional manufacturing and logistics hub.

Tunisia’s global trade openness, measured as the sum of exports and imports as a percentage of GDP, will grow from 96.2% in 2023 to 130.6% by 2043 under the AfCFTA scenario, compared to 123.3% under the Current Path. This signals a marked improvement in Tunisia’s integration into global and regional value chains.

Moreover, the AfCFTA scenario anticipates a structural transformation of the economy, shifting from a reliance on agriculture, raw materials and low-productivity services to a stronger focus on manufacturing and ICT. By 2043, the manufacturing sector’s contribution to GDP will rise from 14.3% in 2023 to 18.3%, compared to 16.9% on the Current Path. ICT will also expand, driven by digital infrastructure investments, policy reforms and greater regional demand.