Advancing Inclusive Development: Policy options for Burkina Faso, Guinea, Gabon, Mali and Niger

In recent years, Africa has experienced an increase in the number of countries undergoing complex political transitions, particularly in West and Central Africa. These developments have strained regional cooperation, exacerbated security challenges and cast uncertainty over governance and development trajectories.

In response to these challenges, on 15 July 2023, the United Nations Development Programme (UNDP) and the African Union Commission (AUC) launched the Africa Facility to Support Inclusive Transitions (AFSIT). This initiative seeks to support African nations navigating complex political transitions by promoting a developmental approach that strengthens governance, fosters stability and enhances resilience. Rather than focusing solely on political interventions, AFSIT prioritises tackling the socio-economic drivers of political instability, ensuring that governance reforms are aligned with sustainable development.

This report, Advancing inclusive development: Policy options for Burkina Faso, Guinea, Gabon, Mali and Niger, builds on the insights of UNDP’s flagship report, Soldiers and Citizens: Military Coups and the Need for Democratic Renewal in Africa, which highlighted the necessity for enhanced people-centred governance and inclusive development as the basis for building state resilience against crisis. It moves beyond crisis response to explore long-term, development-oriented solutions that foster resilience and inclusivity as critical for sustaining peace and development.

By leveraging the International Futures (IFs) modelling platform, this report provides a forward-looking analysis of socio-economic and governance challenges, assessing policy options that can drive inclusive growth and sustainable governance. It synthesises five detailed country studies for Burkina Faso, Mali, Niger, Guinea and Gabon, each examining critical issues such as economic diversification, infrastructure development, governance reforms and social inclusion. Scenario-based analysis offers policymakers, regional bodies and international partners actionable pathways to achieve sustainable, inclusive growth and long-term stability.

A series of five detailed reports is available online (links are at the beginning of the report) and in French. These reports are envisioned to provide a platform from which UNDP and partners can begin discussions with national authorities of focal counties, regional organisations, and other key stakeholders on how to collectively realise the development opportunities identified by this research.

This report was commissioned by UNDP Regional Bureau for Africa in collaboration with the African Futures and Innovation Programme at the Institute for Security Studies, Pretoria, South Africa.

The layout print version is available for download here.

Summary

Cross-cutting policy recommendations

Economic diversification and industrialisation

- Promote economic diversification by investing in manufacturing, agro-processing, and adding value to raw materials.

- Develop industrial strategies that reduce dependency on a narrow range of commodities.

- Improve the business environment and attract foreign direct investment (FDI).

Infrastructure and energy development

- Expand infrastructure development, including roads, rail, ports and information and communication technology (ICT).

- Invest in renewable energy sources such as wind, solar, hydroelectric, and biomass.

- Improve electrification through mini-grids and hybrid energy systems, especially in rural areas.

Agriculture and food security

- Boost agricultural productivity through modern farming techniques, irrigation systems and climate-smart practices such as investments in high-yield, disease- and drought-resistant seeds, fertilisers and credit guarantees.

- Reduce food import dependency by increasing local production and strengthening supply chains.

- Improve rural infrastructure and market access, particularly by building all-weather roads that facilitate agriculture production and commercialisation.

Education and human capital development

- Expand education access, particularly for girls and women, improve quality and align curricula with labour market needs.

- Promote science, engineering and vocational training to support economic transformation.

- Advance a demographic transition by improving access to family planning, maternal healthcare and educational programmes.

Social inclusion and poverty reduction

- Implement social protection measures, including gender empowerment initiatives.

- Strengthen safety nets for vulnerable populations through social transfers that promote equitable development.

Security and regional cooperation

- Enhance regional security collaboration and promote diplomatic efforts to stabilise governance.

- Undertake community- and faith-based conflict resolution and reintegration programmes to address the root causes of instability.

- Strengthen cooperation with international organisations to secure development aid and financial support.

Governance and institutional capacity

- Ensure the return of constitutional governance through the development and implementation of credible, inclusive and legitimate transition roadmaps.

- Strengthen governance through anti-corruption measures, transparency, improvements in public sector efficiency, inclusive decision-making, and institutional capacity building.

Country-specific policy recommendations

Burkina Faso

- Fully implement the African Continental Free Trade Area (AfCFTA) Agreement to promote trade and regional integration.

- Improve climate resilience through early warning systems and disaster preparedness.

- Provide targeted support to vulnerable communities to prevent extremism and instability.

Guinea

- Strengthen linkages between the mining sector and the broader economy to ensure benefits are widely distributed.

- Implement water management strategies to address climate challenges and boost agricultural productivity.

- Diversify the economy away from primary and commodity products.

Gabon

- Address inefficiencies in resource management and ensure transparency in the use of revenues from crude oil and mining.

- Strengthen the healthcare system to address both the persistent burden of communicable and the growing burden of noncommunicable diseases.

- Continue to implement the agreed transition roadmap to the restoration of constitutional order, including through the holding of elections in April 2025.

Mali

- Implement comprehensive industrialization policies focused on low-end manufacturing.

- Expand apprenticeship and entrepreneurial programmes to tackle youth unemployment.

- Use diaspora bonds to encourage expatriate investment in the economy.

Niger

- Promote sustainable rural development through improved landuse policies and climate-adaptive infrastructure.

- Strengthen and implement regional security, trade and energy cooperation frameworks.

- Implement robust anti-corruption measures, enhance transparency and inclusive decision-making.

All charts for Advancing Inclusive Development: Policy options for Burkina Faso, Guinea, Gabon, Mali and Niger

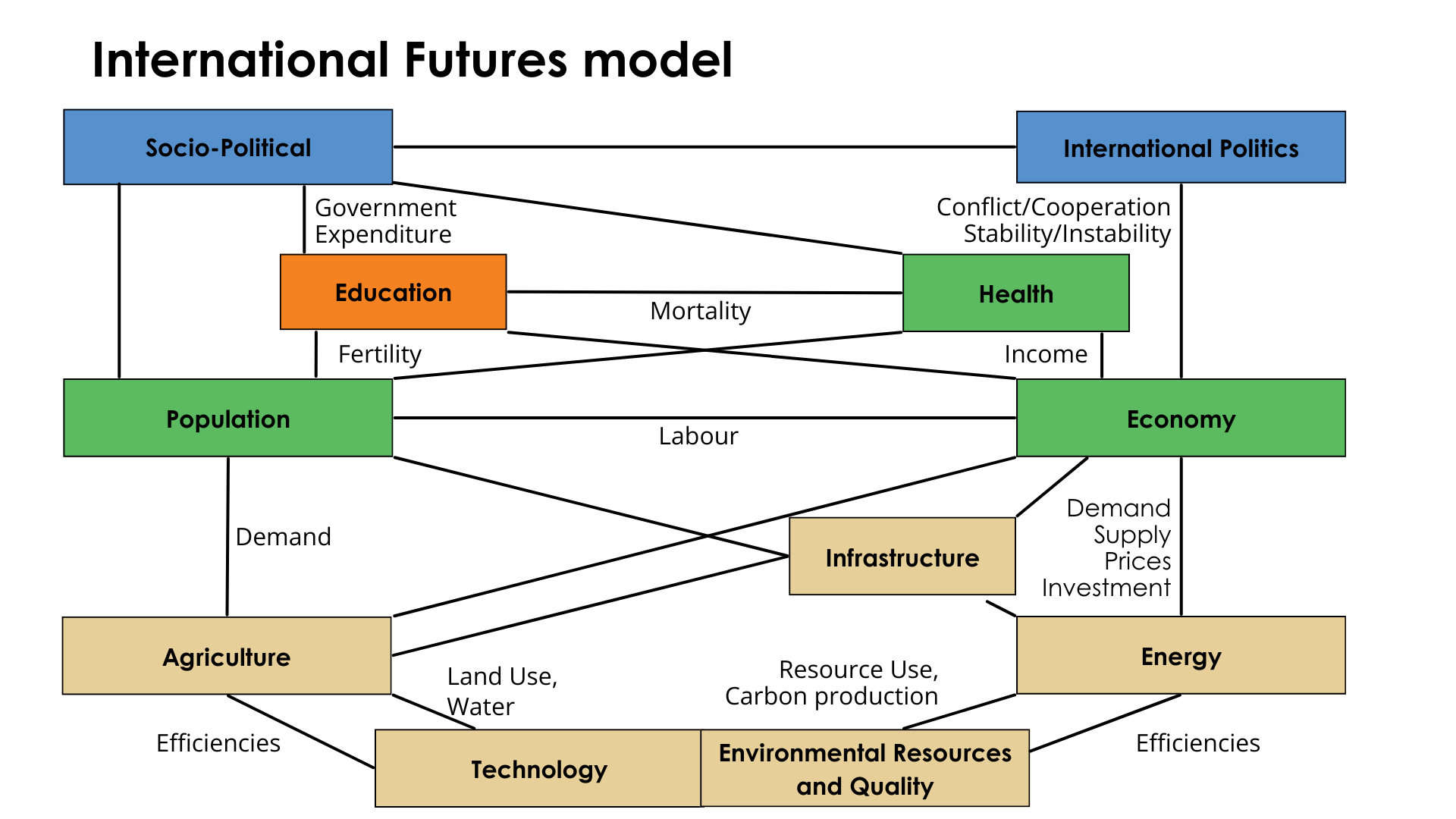

- Figure 1.1: Visual representation of the International Futures platform

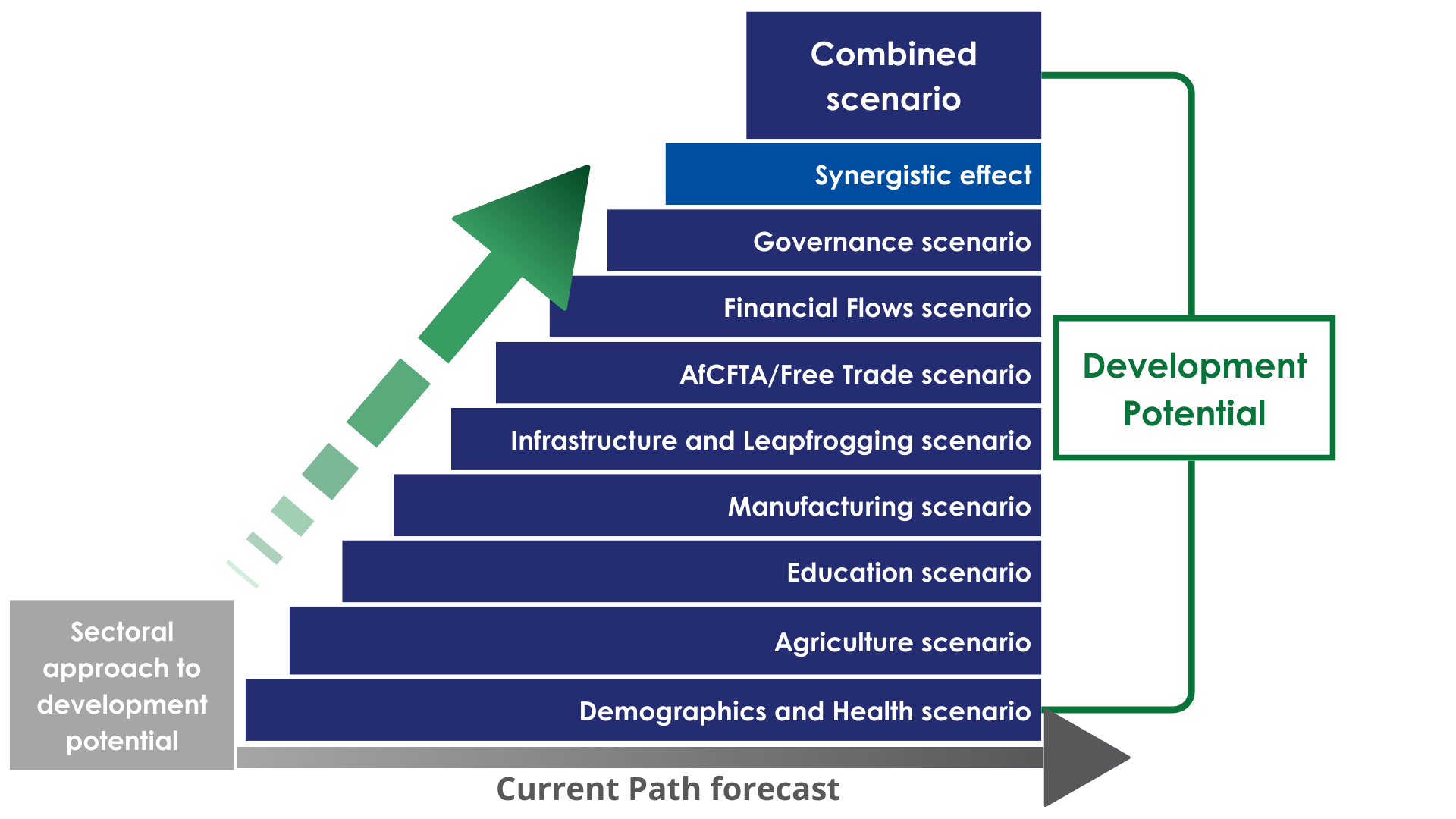

- Figure 1.2: A sectoral approach to the development potential

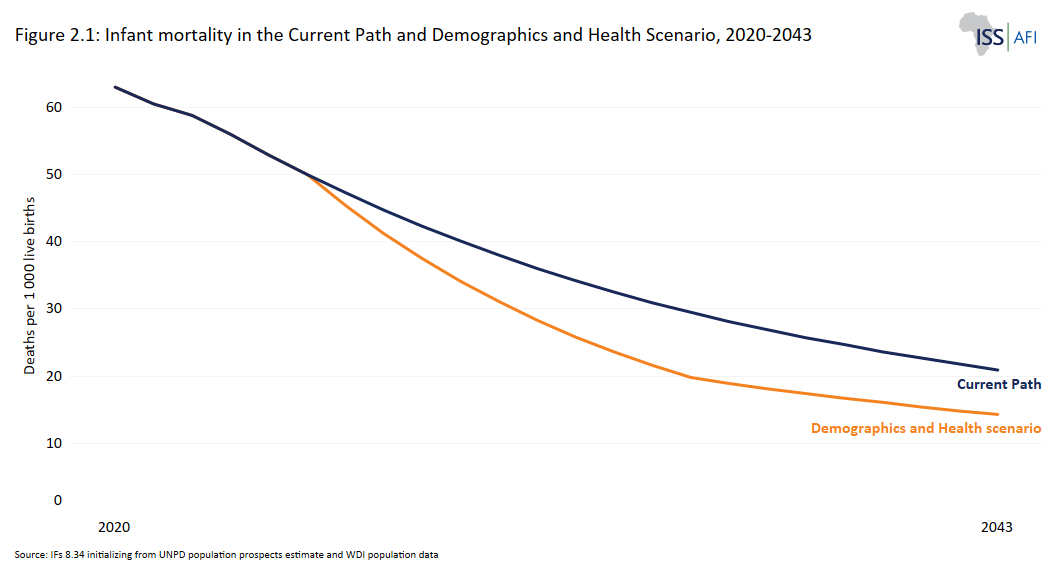

- Figure 2.1: Infant mortality in the Current Path and Demographics and Health Scenario, 2020-2043

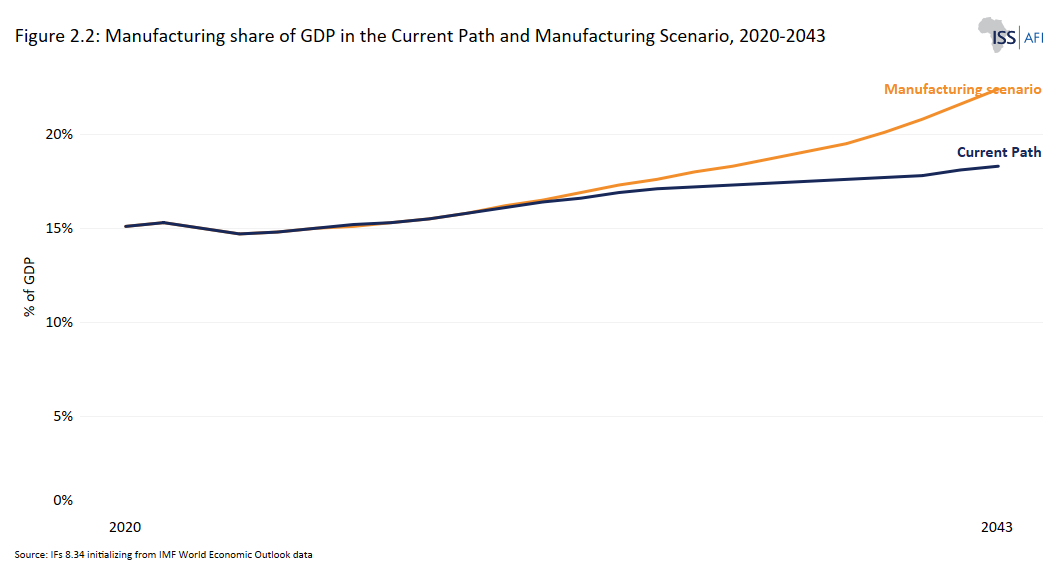

- Figure 2.2: Manufacturing share of GDP in the Current Path and Manufacturing Scenario, 2020-2043

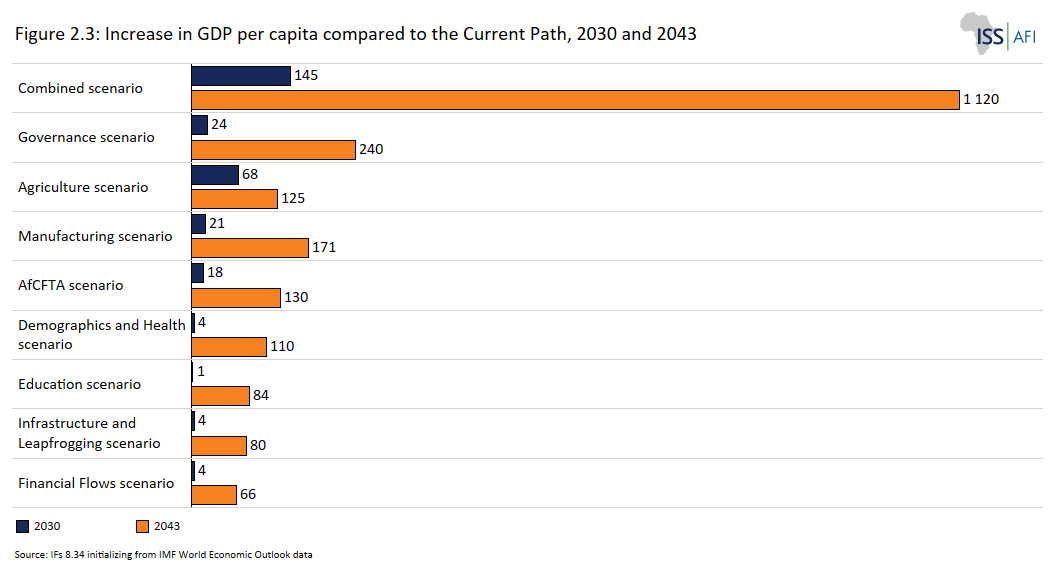

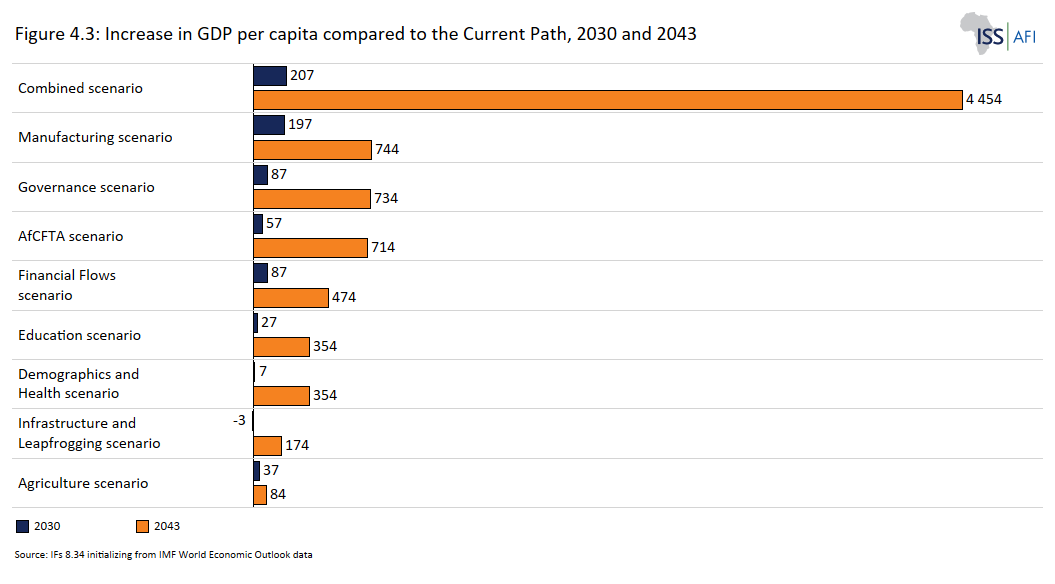

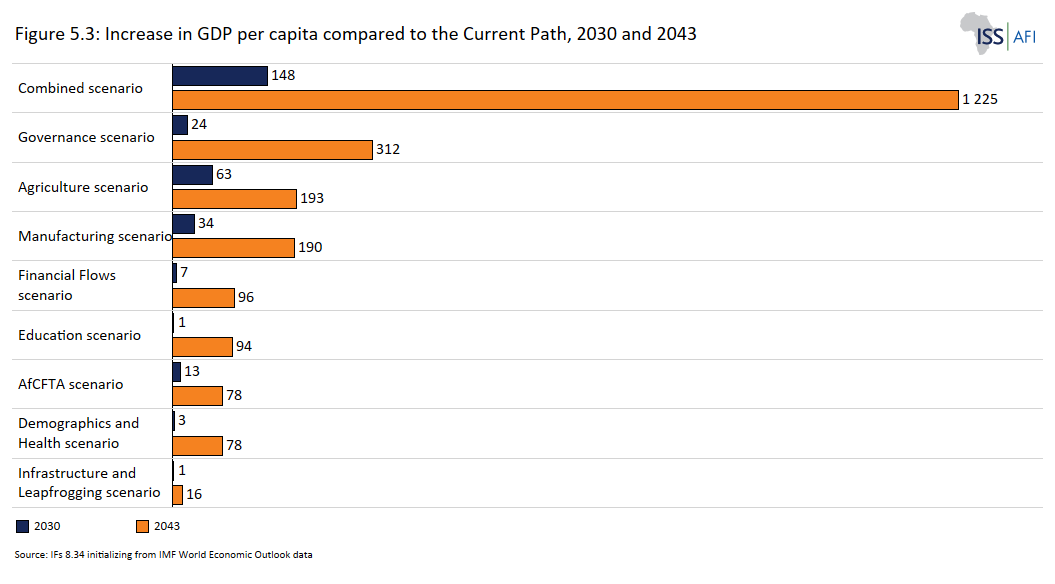

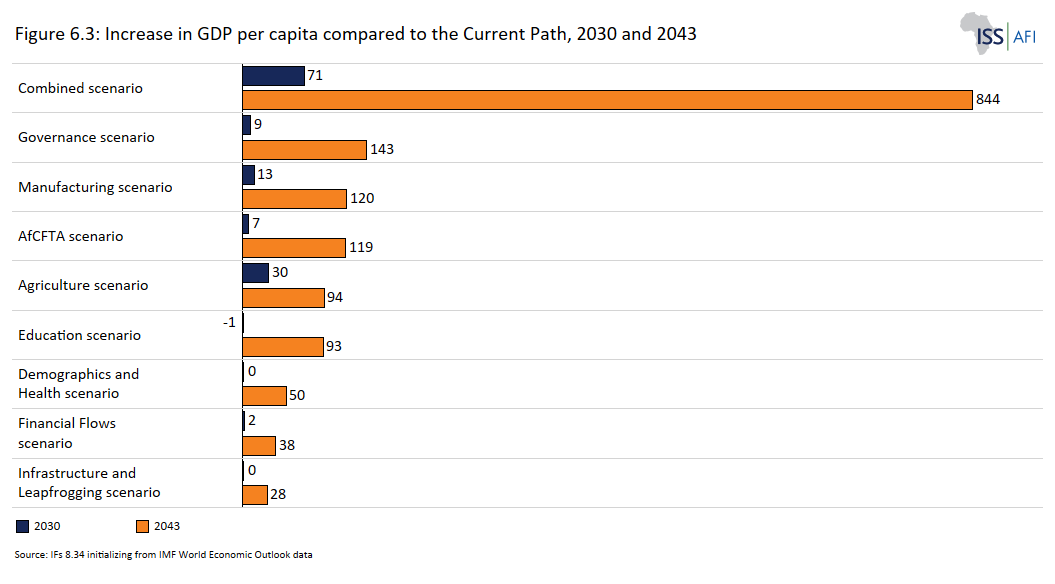

- Figure 2.3: Increase in GDP per capita compared to the Current Path, 2030 and 2043

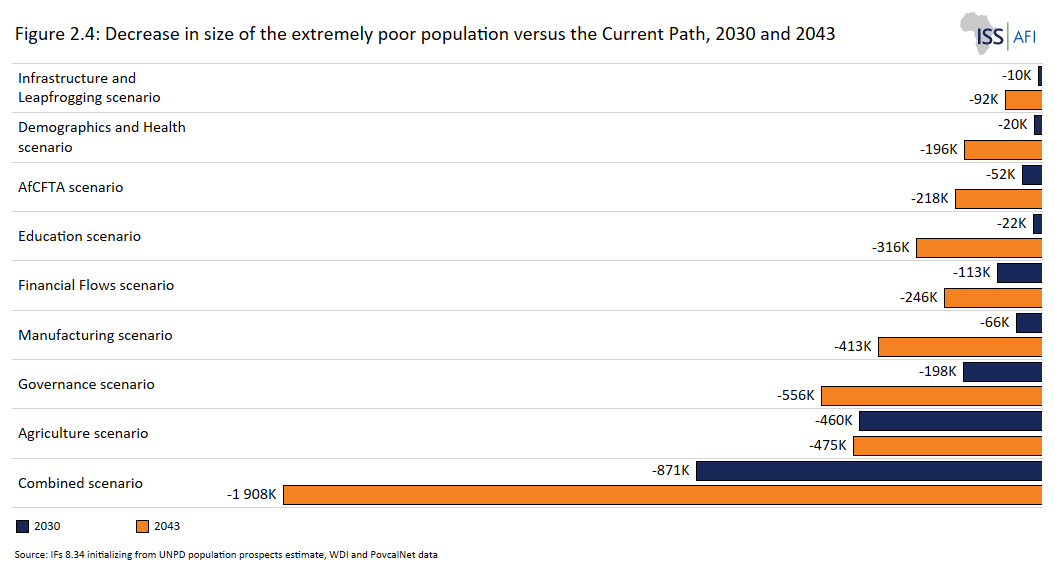

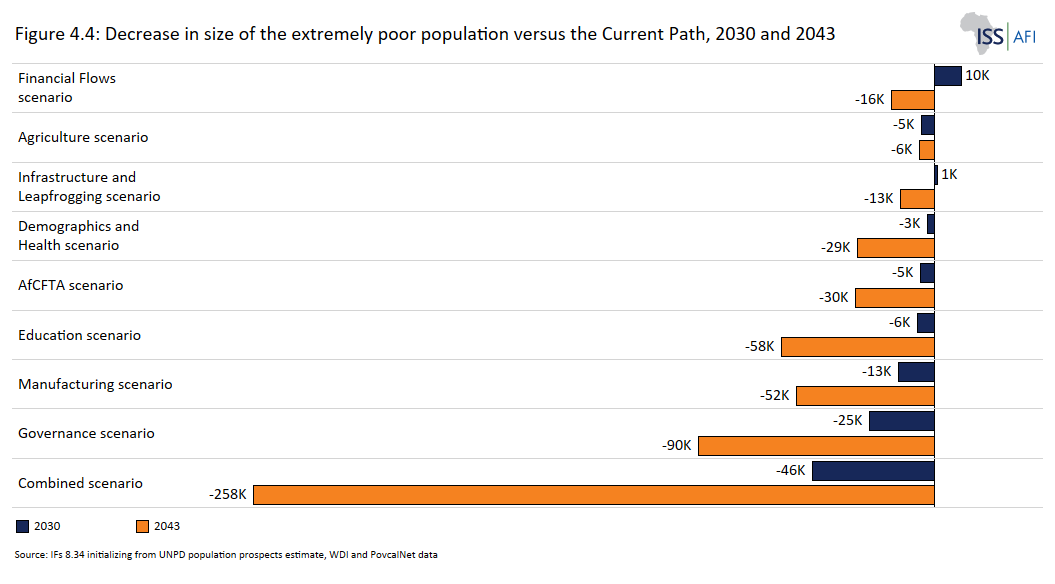

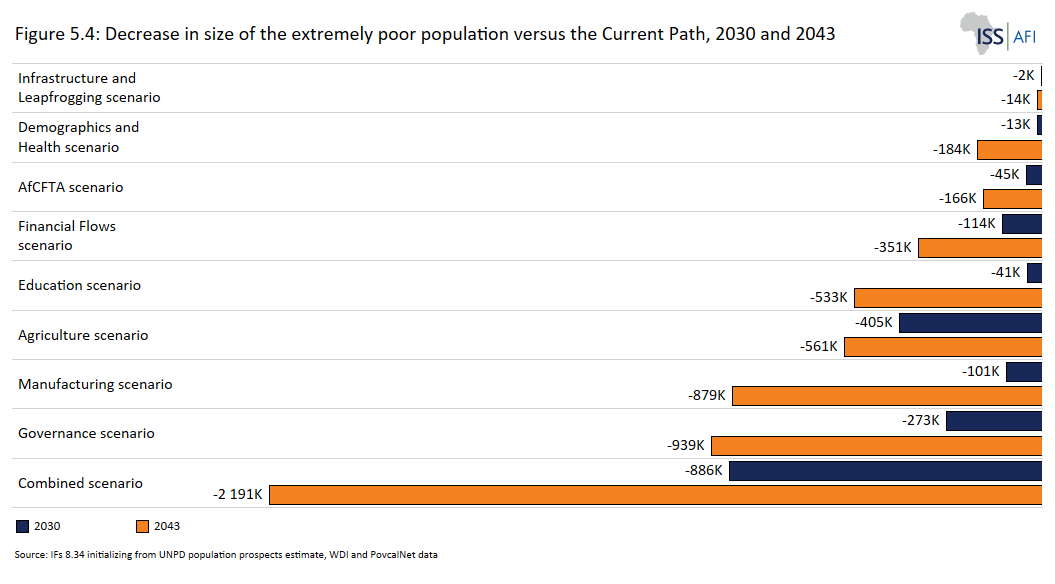

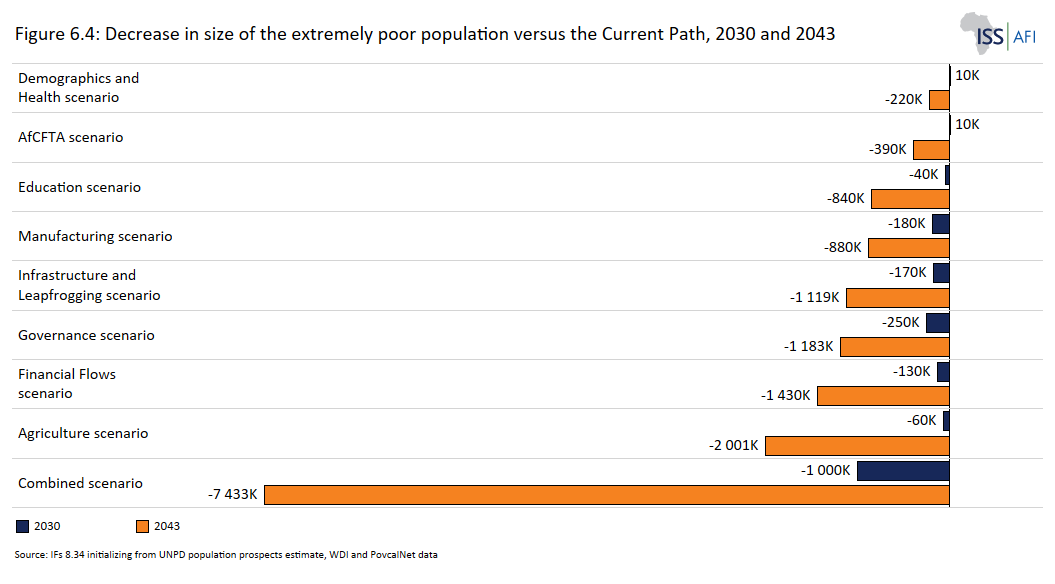

- Figure 2.4: Decrease in size of the extremely poor population versus the Current Path, 2030 and 2043

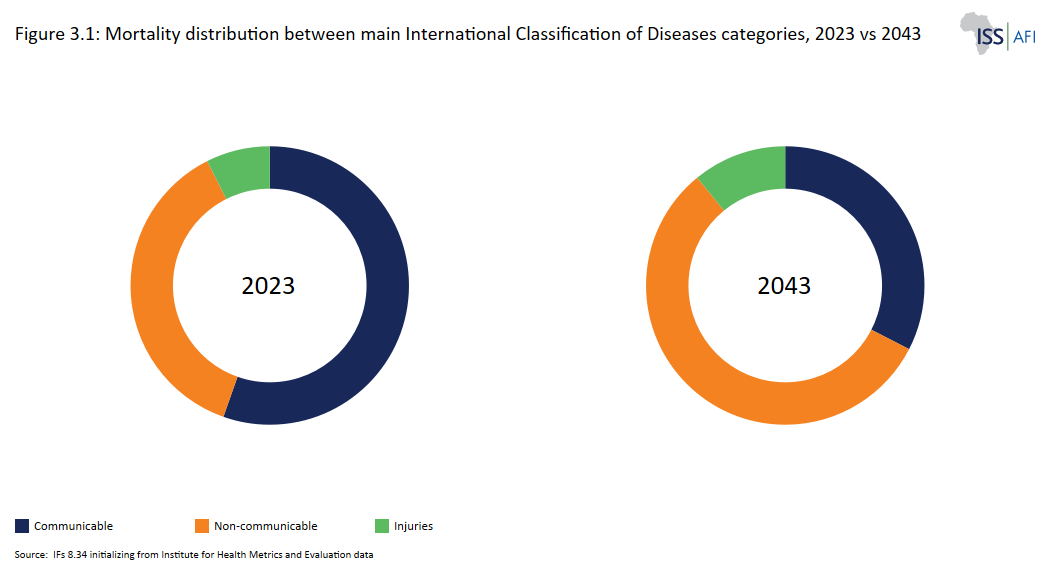

- Figure 3.1: Mortality distribution between three main International Classification of Diseases categories, 2023 vs 2043

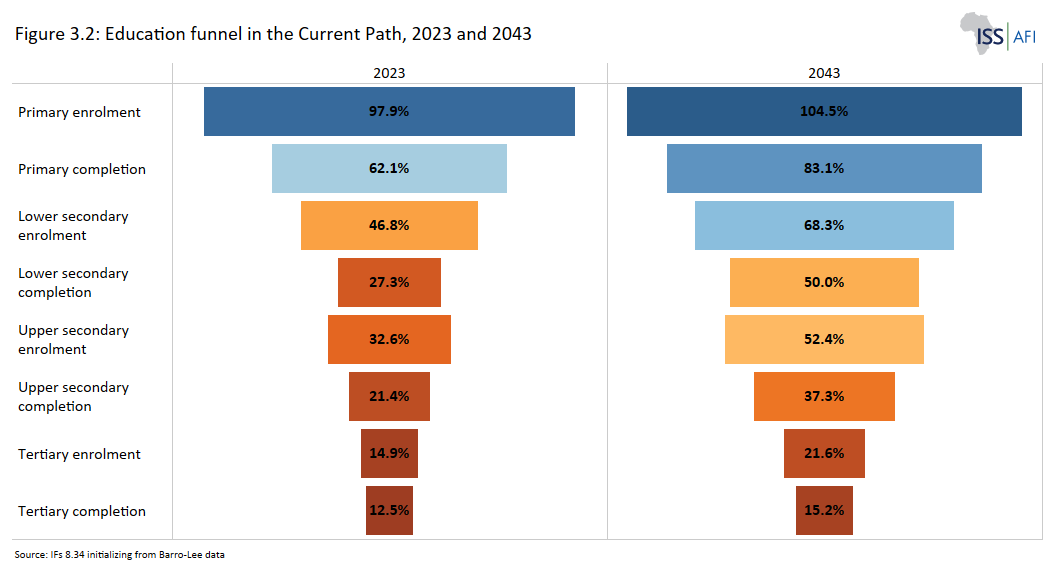

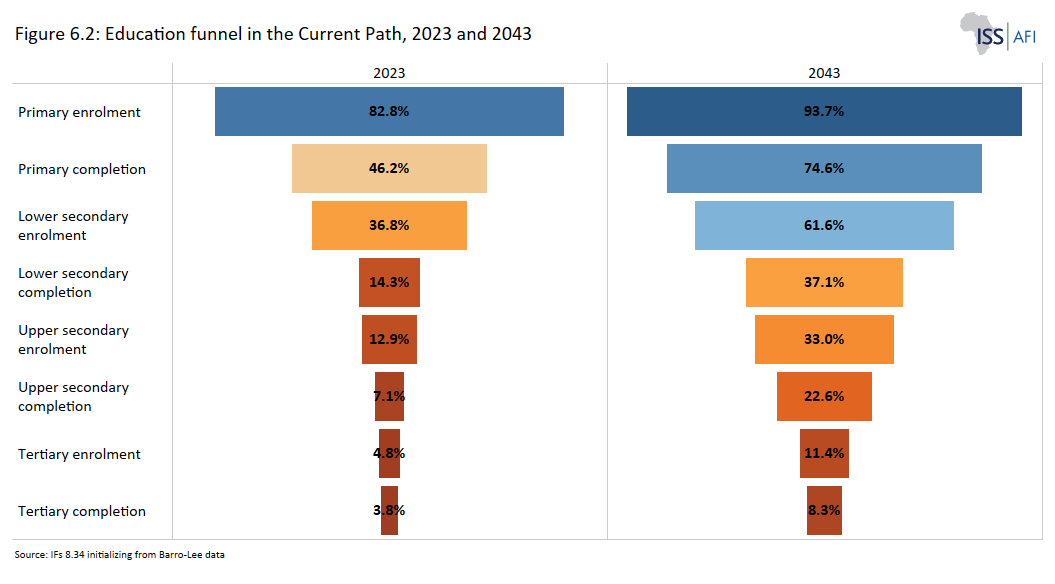

- Figure 3.2: Education funnel in the Current Path, 2023 and 2043

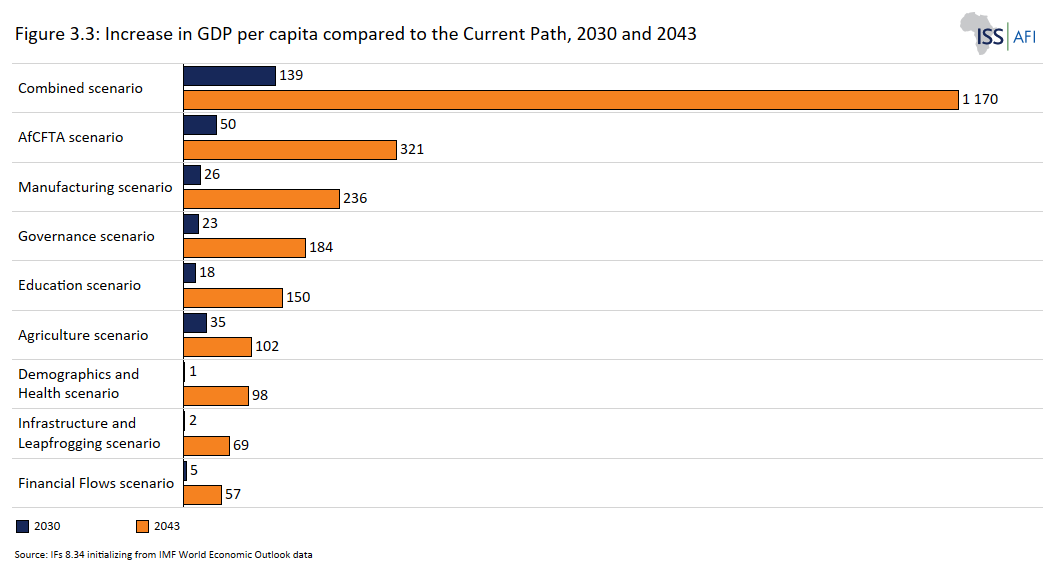

- Figure 3.3: Increase in GDP per capita compared to the Current Path, 2030 and 2043

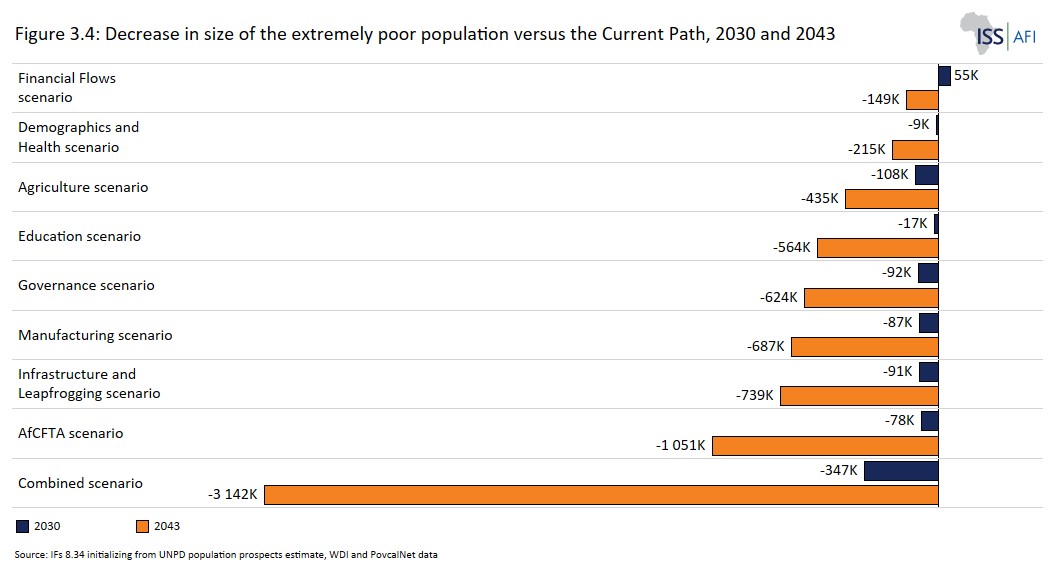

- Figure 3.4: Decrease in size of the extremely poor population versus the Current Path, 2030 and 2043

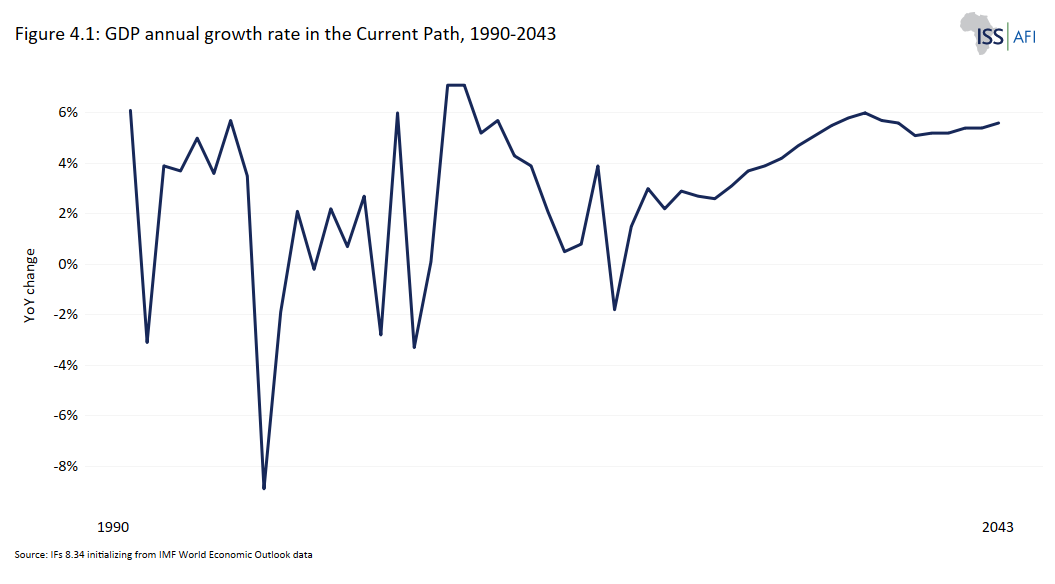

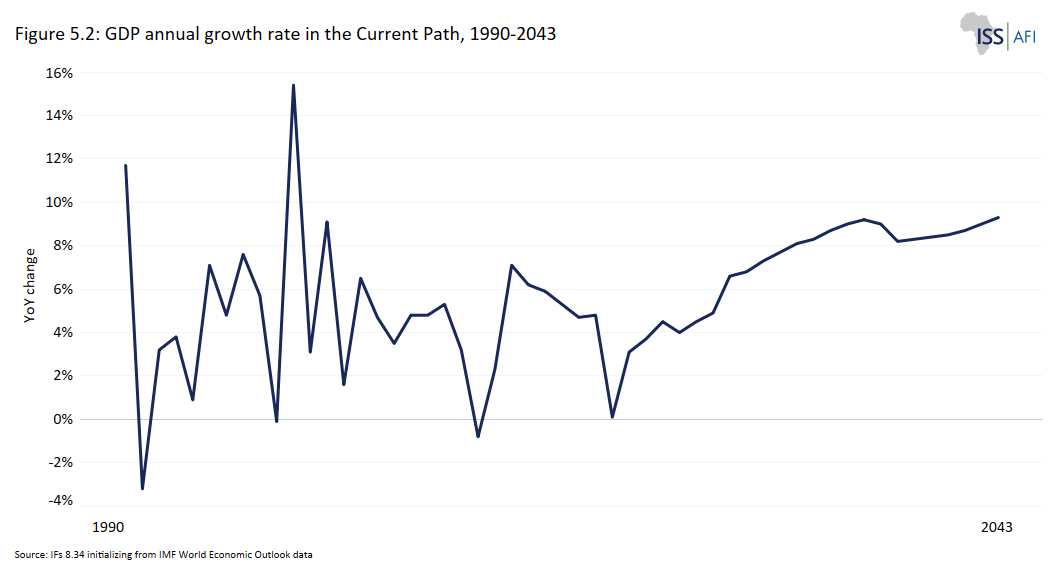

- Figure 4.1: GDP annual growth rate in the Current Path, 1990-2043

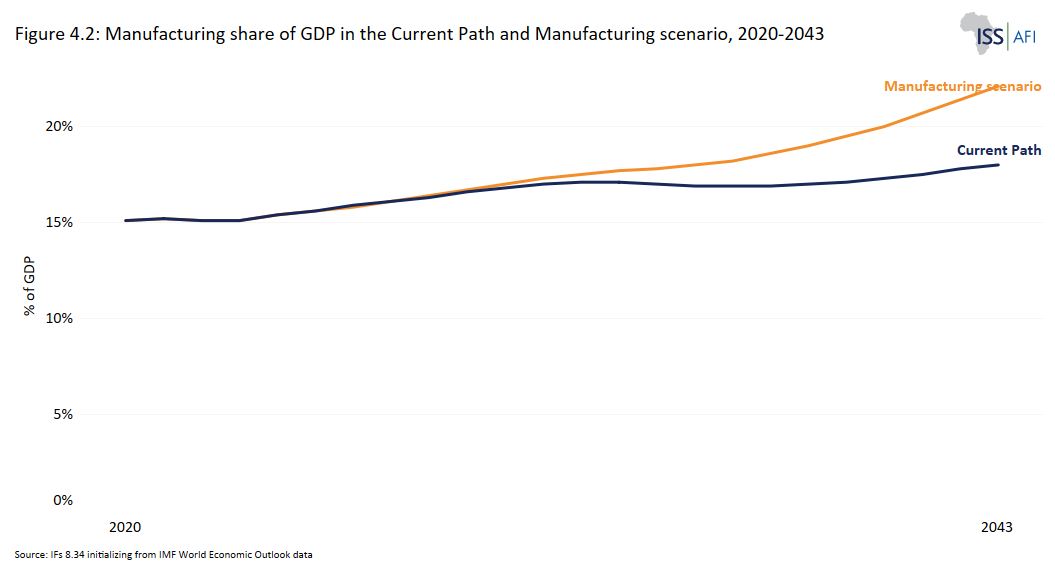

- Figure 4.2: Manufacturing share of GDP in the Current Path and Manufacturing Scenario, 2020-2043

- Figure 4.3: Increase in GDP per capita compared to the Current Path, 2030 and 2043

- Figure 4.4: Decrease in size of the extremely poor population versus the Current Path, 2030 and 2043

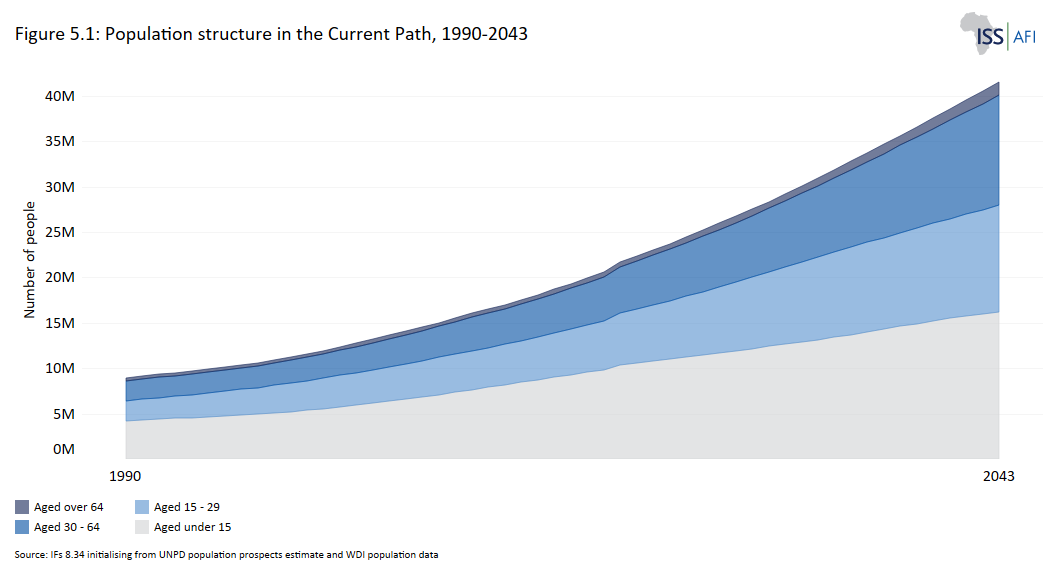

- Figure 5.1: Population structure in the Current Path, 1990-2043

- Figure 5.2: GDP annual growth rate in the Current Path, 1990-2043

- Figure 5.3: Increase in GDP per capita compared to the Current Path, 2030 and 2043

- Figure 5.4: Decrease in size of the extremely poor population versus the Current Path, 2030 and 2043

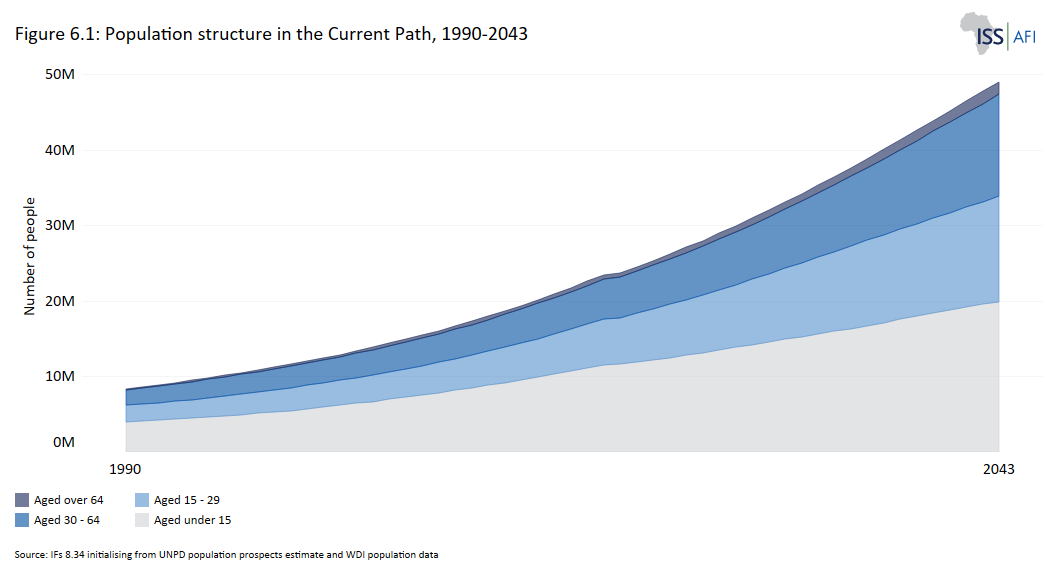

- Figure 6.1: Population structure in the Current Path, 1990-2043

- Figure 6.2: Education funnel in the Current Path, 2023 versus 2043

- Figure 6.3: Increase in GDP per capita compared to the Current Path, 2030 and 2040

- Figure 6.4: Decrease in size of the extremely poor population versus the Current Path, 2030 and 2043

Governance deficits, economic stagnation and increased insecurity in some parts of Africa have created conditions for a resurgence of unconstitutional changes of government (UCG), particularly in West and Central Africa. A key finding of the UNDP flagship report, Soldiers and Citizens: Military Coups and the Need for Democratic Renewal in Africa (2023), was that public perceptions of democratic governance failing to deliver inclusive development were a key driving factor behind many recent UCGs.

Recent coups have placed a strain on principles of regional and international cooperation. Six member states are currently suspended from the African Union (AU), more than at any time in its history. On 29 January 2025, the Alliance of Sahel States (AES) — Mali, Burkina Faso and Niger — formally withdrew from the Economic Community of West African States (ECOWAS), marking the most significant crisis in West Africa’s regional integration since the founding of ECOWAS in 1975. Disruption of regional cooperation structures and principles threatens hard-won development gains in Africa and risks exacerbating existing governance, development, and security challenges.

Against this backdrop, this report seeks to transcend these political challenges and begin a conversation on immediate, medium- and long-term development opportunities as a pathway for building state resilience and preventing crises. The report explores how to achieve development gains in complex political transition contexts and investigates the role of development as a strategic pathway to promote inclusive governance.

This report summarises the conclusions from five detailed country studies (available online), which aim to answer the following three key questions.

- What are the primary socio-economic and development challenges facing Burkina Faso, Guinea, Gabon, Mali and Niger?

- How do different policy interventions impact development trajectories in these countries, particularly in areas such as economic diversification, governance, infrastructure and social inclusion?

- What combination of policy strategies offers the most viable pathway for long-term stability, sustainable growth and inclusive governance?

The country studies aim to:

- Provide in-depth insights into the socio-economic and development dynamics of five countries undergoing complex political transitions;

- Assess the development trajectories of these states under a business-as-usual scenario (referred to as the “Current Path” in this report);

- Explore and model alternative policy options that could — through high-impact interventions — enable inclusive growth and governance stability (referred to as sectoral scenarios and a “Combined Scenario”) and

- Align the analysis with broader development goals by evaluating progress toward the Sustainable Development Goals (SDGs) by 2030 and the AU Agenda 2063 targets by 2043. The Current Path analysis and sectoral scenarios explicitly assess these timeframes, ensuring that policy recommendations support short-term and long-term development objectives.

Going beyond the dominance of political discourse, this report aims to help affected countries, regional organisations, and international partners identify strategies for inclusive development as a foundation for rebuilding trust, re-establishing regional cooperation and restoring constitutional governance and long-term stability.

By integrating sectoral modelling with real-world policy options, the analysis is structured to offer actionable pathways for national transitional governments, regional organisations and international partners seeking new and enhanced partnerships for governance and development in Africa. This report is a synthesis. The detailed country studies are available on the African Futures website at https://futures.issafrica.org/. The following section outlines the methodology used in this study, including the model, data sources and scenario-based approach that informs its findings.

This report relies on the International Futures (IFs) modelling platform developed by the Frederick S. Pardee Institute for International Futures at the University of Denver. The IFs is a global, long-term forecasting system that integrates country-specific, regional and global projections across multiple sectors, including demographics, economics, health, education, infrastructure, agriculture, energy, technology, governance, international politics, socio-political issues and the environment.

A key strength of the IFs is its dynamic and interconnected structure, allowing for simulations that demonstrate how changes in one system trigger shifts across others. This enables a comprehensive understanding of how policies or external shocks influence development outcomes. The scenario analysis capabilities allow users to explore the potential impact of policy interventions.

The IFs models development for 189 countries and their interaction, including 55 countries and territories in Africa, which can be combined to analyse and forecast the future of any group of countries. It blends different modelling techniques and models to form a series of relationships (Figure 1.1) based on academic literature to generate its forecasts. The IFs models use historical data from 1960 (where available) to identify trends and to produce a Current Path scenario from 2020 (the base year).

The Current Path is a dynamic scenario representing a continuation of current policy choices and technological advancements and assumes no significant shocks or catastrophes. It moves beyond a linear extrapolation of past and current trends by leveraging our available knowledge about how systems interact to produce a dynamic forecast. For this study, we adjusted the Current Path for each country to reflect recent developments, including adjustments in scores on stability and democracy.

Currently, the IFs model is one of the few global platforms capable of projecting SDG achievements at the country level and has been widely used in the analysis of African development.

Data availability remains a significant challenge in Africa, impacting the accuracy of forecasts and development planning. Despite these limitations, the IFs model integrates over 5,500 data series from African and internationally recognised sources. To overcome incomplete historical data (a common occurrence in many datasets), IFs include a powerful pre-processing function that:

- Estimates missing or outdated data points to create a more complete dataset;

- Initialises forecasts from the best available data, ensuring that gaps do not undermine long-term projections and

- Moves beyond simple trend extrapolation, making IFs projections historically comparable to the data that international organisations and national governments eventually release.

Where possible and when data is available and comparable — IFs is updated with national statistics sourced directly from national data providers.

As part of the study, the project team conducted three workshops with stakeholders. This included an inception workshop, a country expert meeting focused on validating the Current Path forecast, and a final country expert workshop aimed at validating the scenario forecasts.

The Current Path analysis provides a baseline against which more ambitious policy interventions can be assessed, representing a continuation of current policy choices and technological advancements and assuming no significant shocks or catastrophes. Each country study models the potential development impact of interventions in eight key sectors, followed by an integrated Combined Scenario that demonstrates their cumulative effect. The eight sectors cover all aspects relating to national development and have been carefully curated by sectoral experts. Details on each scenario, including a list of interventions, can be found online via the African Futures and Innovation website.

Each sectoral scenario is benchmarked against progress achieved by high-performing countries at similar levels of development in specific areas, such as improvements in net primary school completion rates (in the Education Scenario). The eight sectoral scenarios explored in this report and applied in each country study include:

- Demographics and Health

Envisions ambitious improvements in child and maternal mortality rates, enhanced access to modern contraception and decreased mortality from communicable diseases (e.g., AIDS, diarrhoea, malaria, respiratory infections) and noncommunicable diseases (e.g., diabetes), alongside advancements in safe water access and sanitation. This scenario accelerates the demographic and health transitions, supported by investments in health and water, sanitation and hygiene (WASH) infrastructure.

- Agriculture

Envisions an agricultural revolution that ensures food security through ambitious yet feasible increases in yields per hectare, thanks to improved management, seed, fertiliser technology and expanded irrigation. Efforts to reduce food loss and waste are emphasised, with increased calorie consumption as an indicator of self-sufficiency and prioritising it over food exports. Additionally, enhanced forest protection signifies a commitment to sustainable land use practices.

- Education

Represents reasonable but ambitious improvements in intake, transition and graduation rates from primary to tertiary levels and better quality of education at primary and secondary levels. It also models substantive progress towards gender parity at all levels, additional vocational training at the secondary school level and increases in the share of science and engineering graduates.

- Manufacturing

Reasonable but ambitious growth in manufacturing is envisaged through increased investment in the sector, research and development (R&D), enhance labour participation rates and improved government regulation of businesses.

- AfCFTA

Represents the impact of fully implementing the AfCFTA by 2034. The scenario increases exports in manufacturing, agriculture, services, ICT, materials and energy exports. It also includes improved multifactor productivity growth from trade and reduced tariffs for all sectors.

- Large Infrastructure and Leapfrogging

Involves ambitious investments in road and renewable energy infrastructure, improved electricity access and accelerated broadband connectivity. It emphasizes adopting modern technologies to enhance government efficiency and incorporates significant investments in major infrastructure projects like rail, ports and airports while highlighting the positive impacts of renewables and information and communication technology (ICT).

- Financial Flows

It represents a reasonable but ambitious increase in inward flows of worker remittances, aid to poor countries, and an increase in the stock of foreign direct investment (FDI) and additional portfolio investment inflows. We reduce outward financial flows to emulate a reduction in illicit financial outfiows.

- Governance

Better governance consists of stability, capacity and inclusion. It measures a state’s progress using the average of these three indices. To this end, it includes an index (0 to 1) for each dimension, with higher scores indicating improved outcomes. The Governance Scenario also includes additional welfare transfers that alleviate extreme poverty and reduce inequality.

The Combined Scenario integrates all eight sectoral scenarios to provide an optimistic (but realistic) view of that country’s development ceiling by 2043. The approach is presented in Figure 1.2. This approach:

- Offers a realistic yet ambitious projection of how structural reforms could accelerate development;

- Allows for comparisons between the Current Path (business-as-usual) and transformational development potential;

- Highlights preconditions for sustainable development, such as regional stability, trade facilitation, foreign investment, and

- Explores the costs of instability, showing how governance failures hinder long-term progress.

All monetary values referenced in these reports are expressed in constant 2017 US$, with GDP per capita in purchasing power parity (PPP) and GDP in market exchange rates (MER).

By applying this macro-level, scenario-based approach, the country reports provide policymakers with a strategic tool for decision-making, helping them visualise the long-term impact of different policy choices and assess realistic pathways for inclusive development.

The following executive summaries provide a focused analysis of Burkina Faso, Guinea, Gabon, Mali and Niger — five countries navigating complex political transitions. Each summary (extracted from the full online reports) explores the current socio-economic landscape, projected development pathways and the impact of sectoral interventions that could drive inclusive growth and resilience.

Burkina Faso is a landlocked country in West Africa, characterised by a dry, tropical climate. Its economy relies on agriculture and mining, particularly gold production. While extreme poverty has declined from 83 per cent in 1990 to 27.7 per cent in 2023, challenges remain, particularly in rural areas. With a population of 23 million in 2023, Burkina Faso’s population is growing at three per cent annually, although its total fertility rate of 4.2 births per woman is expected to decline to 2.8 by 2043. With investments in education, healthcare and employment, a demographic dividend could be realised by 2044. Until then, rapid population growth exacerbates pressures on infrastructure, public services and natural resources.

In recent years, security challenges from extremist groups have strained Burkina Faso’s development trajectory. The establishment of the Alliance of Sahel States (AES) with Mali and Niger in September 2023 underscores a shift toward different forms of regional security cooperation, now outside of ECOWAS.

As a low-income country whose economy is primarily reliant on subsistence farming and livestock raising, Burkina Faso faces persistent challenges. These include highly variable rainfall, poor soil quality, and inadequate communication networks and infrastructure. The country also depends heavily on mining, particularly gold, which accounts for approximately 16 per cent of its GDP and 80 per cent of its exports.

The country is classified as having low human development. According to the United Nations Development Programme’s Human Development Report 2023/2024, Burkina Faso ranked 185th out of 193 countries on the Human Development Index (HDI) and 149th out of 167 countries on the 2024 SDG Index, which assesses performance across the 17 Sustainable Development Goals (SDGs).

The government’s recent National Economic and Social Development Plan (PNDES-II, 2021–2025) emphasises restoring peace, strengthening resilience and promoting structural economic transformation. However, political uncertainty and limited fiscal resources jeopardise progress. Nonetheless, GDP grew sixfold from 1990 to 2023, reaching $18.3 billion, and is expected to rise to $58 billion by 2043. Whereas GDP per capita rose from $1,266 in 2000 to $2,119 in 2023, it will only increase to $2,494 in 2030 and $3,639 by 2043. Despite this income growth, poverty remains pervasive, especially in rural areas where reliance on subsistence agriculture limits income opportunities. Low diversification, weak infrastructure and governance challenges limit Burkina Faso’s potential.

Burkina Faso’s development outlook hinges on the security situation and the expected impacts of a full ECOWAS withdrawal. These include decreased trade with nonWest African Economic and Monetary Union (WAEMU) ECOWAS states, higher investors’ risk premiums and increased regional financing costs.

To address these challenges, this report analyses Burkina Faso’s development prospects along a Current Path (or business-as-usual forecast), eight sectoral scenarios and a combined, high-growth scenario. Each scenario highlights pathways to improve outcomes across critical sectors.

Demographics and Health

The Demographics and Health Scenario emulates investments in healthcare and water, sanitation and hygiene (WASH) infrastructure that are vital to reducing mortality rates and advancing Burkina Faso’s demographic transition. Under the Demographics and Health Scenario, maternal mortality would drop from 232 deaths per 100,000 live births in 2023 to 169 by 2030 and to 97 by 2043, exceeding the Current Path’s outcomes. Infant mortality would decline from 56 deaths per 1,000 live births in 2023 to 14 by 2043, below the SDG target of 25.

In the Demographics and Health Scenario, access to piped water would improve from 30 per cent in 2023 to 49 per cent by 2043, while improved sanitation coverage would rise from 24 to 50 per cent, outperforming the Current Path. These advancements would significantly reduce the prevalence of diarrhoeal diseases and malaria, the leading causes of child mortality.

Entering a potential demographic dividend will require lowering fertility rates through expanded family planning initiatives, modern contraception use and community-driven education campaigns.

In this scenario, efforts to address child malnutrition will include targeted nutritional programmes and cash transfers for vulnerable households. By 2043, the stunting rate among children under five would decline to 12.3 per cent, compared to 18.3 per cent in the Current Path. These interventions will enable the working-age population ratio of persons of working age to dependents to reach 1.7 to one by 2038, six years earlier than the Current Path.

Agriculture

Agriculture employs 71 per cent of Burkina Faso’s population but remains constrained by climatic shocks, low productivity and limited market access. Under the Agriculture Scenario, average crop yields would increase from 2.2 metric tonnes per hectare in 2023 to 4.1 metric tonnes by 2043, significantly surpassing the Current Path forecast of 2.6 tonnes. This would result in an additional 8.2 million metric tonnes of crop production by 2043, reducing food import dependency from 27.7 per cent in the Current Path to just 13 per cent.

Malnutrition rates would decline to 8.8 per cent by 2043, compared to 12 per cent in the Current Path, while rural livelihoods would improve through initiatives like FarmerManaged Natural Regeneration (FMNR).

Investments in transport and storage infrastructure would further bolster food security and market integration, enabling farmers to transition from subsistence to commercial agriculture.

Education

Burkina Faso’s education system faces significant challenges, including low literacy rates (43.6 per cent in 2023), high dropout rates and gender disparities. In the Education Scenario, mean years of schooling for young adults (15–24 years) will increase from 5.8 years in 2023 to 8.6 years by 2043, compared to 7.8 years in the Current Path. Gross enrolment in lower-secondary, upper-secondary and tertiary education will rise to 70 per cent, 43 per cent and 16.6 per cent, respectively, by 2043. Gender parity in tertiary education would improve from 0.64 in 2023 to 0.94, closing gaps that hinder women’s participation in the labour force.

Curriculum reforms would align education with labour market demands, while vocational training and an increased focus on science and engineering will equip students with skills for an evolving economy.

Manufacturing

In the Manufacturing Scenario, the manufacturing sector’s contribution to GDP would rise from 9.6 per cent in 2023 to 22.4 per cent by 2043, exceeding the Current Path’s 18.3 per cent. Growth would be driven by agro-processing, textiles and construction materials, supported by investments in energy and transportation infrastructure.

Efforts to address high production costs, limited financing and outdated technology would improve the competitiveness of small and medium enterprises (SMEs).

AfCFTA

The African Continental Free Trade Area (AfCFTA) offers Burkina Faso opportunities to expand trade and reduce its trade deficit. In the AfCFTA Scenario, export growth in manufacturing, agriculture and services would increase exports to 44 per cent of GDP by 2043, up from 29.5 per cent in the Current Path. Improved productivity, reduced tariffs, and enhanced regional trade networks would strengthen Burkina Faso’s position in regional and global markets, fostering economic growth and resilience.

Financial Flows

In the Financial Flows Scenario, foreign direct investment (FDI) would increase to 2.8 per cent of GDP by 2043, compared to 1.8 per cent in the Current Path, while government revenue would increase to 24.7 per cent of GDP. Strengthening fiscal management and reducing illicit financial flows would create additional fiscal space for infrastructure and social spending.

Governance

Improved governance is central to Burkina Faso’s development. In the Governance Scenario, governance effectiveness would increase to 2.1 on the World Bank index by 2043, above the Current Path’s 2.0. Security, capacity and inclusivity scores would all improve, fostering stability and trust in public institutions. As a result of the inclusion of additional social welfare transfers, by 2043, the poverty rate will decline to 6.3 per cent, compared to 7.9 per cent in the Current Path.

The Combined Scenario integrates all eight sectoral scenarios above.

By 2043, the GDP per capita under the Combined Scenario would be $4 759, a 25 per cent increase compared to the Current Path forecast of $3, 638. This boost reflects accelerated economic diversification, improvements in productivity across key sectors, and expanded access to high-quality education and healthcare. The economy would grow to $82.6 billion, or $24.5 billion larger than the Current Path, with manufacturing, services and renewable energy taking on greater roles in the economic structure.

Extreme poverty in the Combined Scenario would decline significantly, with the per centage of people living below the international poverty line of $2.15 per day dropping to 2.6 per cent (1.1 million people) by 2043, compared to 7.9 per cent (3.5 million people) in the Current Path. This progress reflects targeted investments in rural development, education and agriculture, which directly improve income levels for vulnerable populations.

Burkina Faso faces complex and interlinked challenges, including insecurity, limited economic diversification, low agricultural productivity, poor infrastructure and constrained human capital development. While progress has been made, the country is not on track to achieve most SDGs by 2030. To overcome these barriers and foster inclusive, sustainable growth, the paragraphs below list key policy priorities that must be addressed.

Economic diversification is essential to reduce Burkina Faso’s reliance on agriculture and mining. Promoting industrialisation through investments in agro-processing and manufacturing will create formal jobs and stimulate local industries. Supporting small and medium enterprises with financial incentives, capacity-building, and market access will drive innovation and growth. Value addition to key exports, such as gold and cotton, can maximise economic returns while reducing vulnerability to external shocks.

Modernising agriculture is critical for food security and rural development. Access to improved farming techniques, irrigation and essential inputs like seeds and fertilisers will boost productivity. Climate-smart practices, coupled with investments in climate-resilient infrastructure, such as solar-powered irrigation and storage systems, will mitigate the impacts of droughts and unpredictable weather. Improved rural road networks will enhance market access and foster agricultural commercialisation, lifting incomes in rural areas.

Infrastructure development remains a key pillar for economic growth. Expanding renewable energy access, particularly in rural areas, can increase electrification while reducing reliance on costly imports. Upgrading transport networks and strengthening ICT infrastructure will facilitate connectivity, reduce costs and open new opportunities for businesses and education. Public-private partnerships can play a vital role in financing large-scale infrastructure projects.

Investing in education and health will strengthen human capital. Improving access to quality education, especially in rural areas, will raise literacy rates and better prepare students for the workforce. Expanding vocational training and focusing on science, technology, engineering, and mathematics will align skills with labour market needs. Efforts to reduce gender disparities, including targeted support for girls’ education, are vital. Healthcare investments should prioritise rural regions, with improved infrastructure, trained personnel and programmes to combat malnutrition and improve sanitation.

Social inclusion must be at the heart of development strategies. Strengthening social safety nets, such as cash transfers and food security initiatives, will protect vulnerable populations. Empowering women through improved access to credit, training, and economic opportunities will promote gender equality and inclusive growth.

Addressing systemic barriers, like gender-based discrimination, will ensure equitable participation in the economy. Good governance and institutional reforms are critical for stability and progress. Strengthening public sector efficiency, combating corruption and empowering local governments through decentralisation will improve public service delivery and enhance trust in institutions. Addressing insecurity, particularly in conflict-affected areas, is vital to fostering a stable environment for investment and growth. Enhanced governance will also enable Burkina Faso to attract foreign direct investment and regain donor confidence.

Climate resilience should be a national priority. Investments in early warning systems, sustainable land management and disaster preparedness can reduce vulnerability to extreme weather events. Policies to support climate adaptation in agriculture and water management protect livelihoods and ensure long-term sustainability.

Regional trade and integration through the AfCFTA offer significant opportunities. Expanding market access and fostering collaboration with regional partners will boost exports and reduce trade deficits. Reducing trade barriers and improving competitiveness will allow Burkina Faso to fully leverage its strategic position in regional value chains.

Lastly, international development aid remains crucial for Burkina Faso’s stability and growth. Cutting aid during a time of heightened insecurity risks exacerbating poverty and deepening instability. Continued donor support strengthens public services, mitigates economic shocks and prevents extremist groups from exploiting governance gaps. Aid also provides a platform for the international community to encourage constitutional governance and sustainable development.

By implementing these policies, Burkina Faso can build a foundation for sustained growth, reduce poverty and create equitable opportunities for its population. Coordinated efforts across sectors, supported by strong governance and international partnerships, can position the country as a resilient and prosperous nation by 2043.

The Republic of Guinea is a coastal country in West Africa, rich in natural resources, energy potential and arable land. Guinea has substantial deposits of gold, aluminium and iron ore, including the largest reserves of bauxite (aluminium ore) and the largest untapped deposits of high-grade iron ore in the world.

Economic diversification is limited, with agriculture and informal trade constituting large segments of the economy. Agriculture, the largest employer, is critical for poverty reduction and rural development. In addition to this sector, natural resources, processing industries, and services are Guinea's economic assets.

Guinea has a young and growing population. However, while the country has made some progress on its human capital development indicators, Guinea is not currently on track to meet most of its SDGs by 2030. Guinea’s economy relies heavily on mining, but this sector currently lacks sufficient linkages with the domestic economy. Since achieving independence in 1958, Guinea has alternated between civilian and military rule.

In 2023, Guinea transitioned to lower-middle-income status due to increases in its gross national income (GNI) and gross domestic product (GDP) per capita. This reclassification by the World Bank reflects its relatively high rates of economic growth, largely driven by the mining sector. On the Current Path, Guinea’s GDP per capita is projected to increase to US$2,988 in 2030 and $3,975 by 2043.

Guinea’s GDP reached $14 billion in 2023 with a growth rate of 5.7 per cent in that year. However, its growth rate has not been sufficiently inclusive and not accompanied by a structural transformation of the economy.

Therefore, achieving inclusive growth requires addressing its structural challenges while promoting equitable economic development. On the Current Path, Guinea’s GDP is projected to increase to $19.4 billion in 2030 and $28.4 billion by 2043.

Extreme poverty remains a significant challenge in Guinea. In 2023, about 11.9 percent of the population, equivalent to approximately 1.72 million people, lived on less than $2.15 per person per day. On the Current Path, the rate is expected to continue increasing until 2027, reaching 13.7 per cent. Thereafter, Guinea’s poverty rate is expected to gradually decrease, falling to 12.7 percent by 2030. By 2043, the poverty rate is expected to have declined to approximately 2.9 per cent.

The country’s population has been growing at 2.5 per cent annually since 2008. On the Current Path, it is projected to grow to 17.2 million by 2030 and 22.7 million by 2043. Fertility rates have declined from 6.5 births per woman in the 1980s to 4.2 in 2023. On the Current Path, the rate is projected to decline further to 3.9 by 2030 and 3.1 by 2043. Infant and maternal mortality rates have also significantly improved, with infant mortality decreasing from 65.2 deaths per 1,000 live births in 2014 to 50.9 in 2023 and are forecast to drop to 30 by 2030 and 25.2 by 2043. Maternal mortality, at 502 in 2023, is projected to reach 412 by 2030 and 236.8 by 2043.

Life expectancy has risen from 55 years in the early 2000s to 63 years in 2023, with projections of 66 years by 2030 and 70.5 years by 2043 on the Current Path. Guinea’s youthful population, with a median age of 19.1 years in 2023 and 41.1 percent of its population under 15 years, presents both opportunities and challenges, including high dependency ratios and pressure on resources.

If the workforce is skilled and employed, a working-age population-to-dependent ratio of 1.7 or higher can drive rapid growth, known as the demographic dividend. Guinea had a ratio of 1.2 working-age individuals for every dependent in 2023. On the Current Path, the country would, however, only enter a potential demographic window of opportunity in 2047.

The youth bulge, at 49.2 per cent in 2023, is expected to gradually decrease to 46.6 percent by 2030 and 41.9 per cent by 2043. This large youth population highlights the need for investments in education, healthcare and job creation to harness their potential while mitigating risks of sociopolitical instability.

To address these challenges, the report analyses Guinea’s development prospects along a Current Path, eight sectoral scenarios and a combined, high-growth scenario. Each scenario highlights pathways to improve outcomes across critical sectors. Sectoral scenarios

Demographics and Health

Guinea faces significant health and demographic challenges due to weak healthcare infrastructure and socio-economic conditions, as outlined in the National Health Development Plan 2015-2024. In 2023, 32.1 per cent of the population lacked access to safely managed water, and only 13.7 per cent had access to safely managed sanitation. By 2030, these figures are expected to rise modestly to 34.9 per cent and 18.9 per cent, respectively, far below the SDG targets. Child stunting rates decreased from 32.4 per cent in 2016 to 29.2 per cent in 2023. On the Current Path, Guinea’s stunting rate is projected to reach 24.7 per cent by 2030 (on track to meet the SDG target) and further reduce to 17.5 per cent by 2043. Infant mortality declined to 50.9 deaths per 1,000 live births in 2023, with projections on the Current Path of 40 deaths by 2030 and 25 by 2043, missing the SDG target.

Implementing the proposed Demographics and Health Scenario would accelerate progress, reducing infant mortality to 33.8 deaths by 2030 and 18.3 by 2043. This scenario also supports Guinea’s demographic transition, with the working-age population-to-dependents ratio forecast to reach the 1.7 threshold for a potential demographic dividend by 2043 instead of 2047. Realising this potential requires investment in skills development and economic integration for the growing labour force.

Agriculture

Agriculture is vital to Guinea’s economy, supporting food security, poverty reduction, employment and rural development. The sector provided employment for 52 per cent of the labour force, income for 57 per cent of rural households and accounted for 27.3 per cent of the country’s GDP in 2022. In 2023, Guinea’s agricultural crop yield was 3.6 tonnes per hectare, a 29.4 per cent improvement from 2.8 tonnes in 2016. Crop production reached 13.4 million metric tonnes, falling short of the 15.3 million metric tonne demand, creating a 1.9 million metric tonne deficit. By 2030, yields are expected to increase to 4 tonnes per hectare and 4.7 tonnes by 2043, with production rising to 15.9 million metric tonnes by 2030 and 19.9 million by 2043. However, demand is expected to outpace supply, leading to deficits of 2.8 million metric tonnes by 2030 and 5.5 million metric tonnes by 2043, increasing import dependency from 14.6 per cent in 2023 to 22.8 per cent by 2043.

The Agriculture Scenario would increase crop yield to 4.5 tonnes per hectare by 2030 and 5.9 tonnes by 2043. Import dependency would decrease significantly, dropping to 13.6 per cent by 2030 and just 1.4 per cent by 2043.

Education

The age structure of Guinea’s population, with a high proportion of youth, highlights the critical need for significant investments in quality education to drive economic growth and reduce poverty. Despite free and compulsory primary education, learning poverty remains a severe challenge, with 83 per cent of children unable to read and comprehend age-appropriate texts by age ten. Factors such as out-of-school children, low enrolment and poor quality of education exacerbate the crisis. In 2023, primary net enrolment was 80.9 per cent, below the average for African lower-middle-income countries. The Current Path shows limited improvement: by 2030, net primary enrolment is projected to reach 85.5 per cent, rising to 90.6 per cent by 2043 but still falling short of the SDG target.

Secondary education is projected to fare worse, with gross enrolment rates in 2023 at 46.8 per cent for lower secondary and 32.6 per cent for upper secondary education.

The forecast indicates gradual increases, but gender disparities remain. In 2023, Guinea’s adult population (15-24 years) had an average of only five years of education, among the lowest globally.

On the Current Path, average years of education are projected to improve to 6.5 years by 2030 and 7.5 years by 2043. The Education Scenario will boost it to 6.6 years by 2030 and 8.2 years by 2043, closing gender gaps. This scenario promotes higher proportions of science and engineering graduates, improving human capital for economic growth.

Manufacturing

Guinea’s manufacturing sector is underdeveloped, contributing only a small portion to GDP despite the country’s abundance of natural resources. The sector is dominated by small-scale industries focused on agro-processing, resource-based and light manufacturing, with limited competitiveness regionally and globally. In 2023, manufacturing accounted for just 11.7 per cent of GDP. The sector’s contribution to GDP has shown a gradual decline, dropping from 12.7 per cent in 2008 to 12.1 per cent in 2015. In terms of employment, the sector represents a small portion of the workforce, with its share decreasing from 3 per cent in 2009 to 2.5 per cent of total employment in 2019.

The Current Path shows modest growth, with manufacturing’s share of GDP expected to rise to 13.9 per cent by 2030 and 14.5 per cent by 2043. The Manufacturing Scenario suggests that targeted interventions could boost the economy significantly, increasing the size of the economy by 14 per cent (to $2.8 billion) in 2030 and by 17.1 per cent (to $7 billion) in 2043. To achieve sustainable economic growth, the scenario argues that Guinea must prioritise developing a more competitive and diversified manufacturing sector.

AfCFTA

Guinea is an open economy. However, its economy is highly vulnerable to fluctuations in global commodity prices due to its heavy reliance on primary and commodity exports. In 2022, exports accounted for 43.7 per cent of GDP (approximately $5.8 billion), with gold and aluminium ore constituting 95 per cent of total exports, while the top five commodities accounted for 97 per cent. The country will be ranked as the world’s largest exporter of aluminium ore in 2022. This heavy dependence on a narrow range of volatile commodities poses risks to sustainable economic growth and exposes the economy to external shocks.

It is crucial for Guinea to develop an industrial strategy that balances domestic and external markets by diversifying the economy while ensuring the basic needs of its population are met. Resource-rich countries like Guinea often face the risk of becoming overly reliant on the production and export of a limited range of primary goods. The diversification of its exports would be a crucial driver of economic development.

Guinea’s trade balance is structurally in deficit — a trend that is likely to persist over the forecast horizon. The AfCFTA Scenario offers potential benefits, increasing Guinea’s exports by $0.5 billion by 2030 and $4 billion by 2043. However, this scenario widens the trade deficit as imports outpace exports. To leverage opportunities from AfCFTA and achieve economic stability, Guinea must implement policies to ease trade barriers, reduce bureaucracy and promote industrial and export diversification. Guinea should leverage importing advanced industrial machinery under AfCFTA to enhance beneficiation and productivity.

Large Infrastructure and Leapfrogging

Political instability, corruption and governance challenges have disrupted infrastructure projects in Guinea, as many were dependent on international financing and partnerships that were paused or withdrawn, e.g., the Simandou iron-ore project. The Simandou iron ore project, which has been decades in the making and set to become one of the world’s largest and highest-grade iron ore mines, has faced delays due to two coups, legal disputes, corruption allegations and government-mandated modifications. One of the significant aspects of the project is the construction of a 600-kilometre railway to transport iron ore from the mines to a newly developed port on Guinea’s Atlantic coast.

In 2024, Guinea ranked 33rd out of 54 African countries on the African Infrastructure Development Index. Guinea faces significant infrastructure deficits, including poor roads, limited transportation systems, inadequate electricity, insufficient water and sanitation facilities and limited internet and mobile communication. These challenges hinder trade, discourage investment, reduce global competitiveness and slow economic growth and poverty reduction. Road infrastructure is particularly underdeveloped, with only eight per cent of roads paved in 2023. Rural areas are most affected, with only 17 per cent of the rural population having access to all-season roads within two kilometres, isolating over 60 per cent of the population and limiting their economic participation. Additionally, Guinea’s rail network is primarily focused on the mining sector, with minimal support for passenger or general freight transport. Addressing these infrastructure gaps is critical to unlocking Guinea’s economic potential and improving social well-being.

In 2023, only 46 per cent of the total population had access to grid electricity, with that per cent being 20.6 in rural areas. On the Current Path, national access is projected to increase to 52.7 per cent by 2030 and 64.4 per cent by 2043, with rural access reaching 27 per cent and 45 per cent, respectively. While fixed broadband offers faster internet speeds and more secure connections, fixed broadband penetration remains extremely low in Guinea at 0.07 subscriptions per 100 people in 2023, far below the 2.6 average for lower-middle-income African countries. In contrast, mobile broadband is expected to grow rapidly, with subscriptions rising from 74.2 per 100 people by 2030 to 143.5 by 2043. In the Large Infrastructure and Leapfrogging Scenario, these figures would improve slightly to 89 by 2030 and to 151.3 by 2043.

Financial Flows

Guinea attracts limited international capital flows due to its political instability and governance challenges. Much of the capital inflows are concentrated in the mining sector and do not extend to improve economic development. In 2023, FDI net inflows in Guinea were 3.9 per cent of GDP, down from 5.6 per cent in 2017. On the Current Path, FDI inflows are projected to increase to 4 per cent by 2030 and 4.3 per cent by 2043. In the Financial Flows Scenario, FDI would increase to 5 per cent by 2030 and 5.3 per cent by 2043. However, this optimistic forecast relies heavily on achieving enhanced political stability and substantial improvements in security.

With limited finances and FDI focused on mining, foreign aid is crucial for sustaining key infrastructure challenges in health and education facilities. Foreign aid represented 4.1 per cent of GDP in 2023. On the Current Path, foreign aid is expected to decline to 3.8 per cent of GDP by 2030 and 2.7 per cent by 2043, although absolute amounts would rise to $733 million in 2030 and $1 billion by 2043, in the Financial Flow. Scenario: foreign aid would reach $788 million (4 per cent of GDP) by 2030 and $1.2 billion (3 per cent of GDP) by 2043.

A separate scenario modelled in this study reveals that without foreign aid, an additional 53,100 Guineans could fall into extreme poverty by 2030 (with nearly 20,000 more by 2043), further undermining the country’s progress toward achieving the SDG poverty target. Moreover, Guinea’s GDP per capita is projected to decrease by US$11.25 in 2030 and by US$14.81 in 2043 in the absence of foreign aid.

Governance

There is evidence that governance has become less inclusive in Guinea since 2021. Guinea’s inclusion index score dropped from 0.48 in 2020 to 0.36 in 2023. The 2023 Ibrahim Index of African Governance (IIAG) report ranked Guinea 42nd out of 54 African countries, with an overall governance score of 41.9 out of 100. This falls below both the African average of 49.3 and the West African regional average of 52.6. Military spending increased from 1.4 per cent of GDP in 2020 to 2 per cent in 2022, above regional averages. On the IFF index, the country performs better in terms of security than in the other two dimensions of governance.

Governance challenges are further exacerbated by limited administrative capacity, centralised decision-making, low revenue and structural challenges such as poverty, ethnic diversity, climate change and civil conflicts. In terms of government effectiveness, Guinea scored 1.4 out of 5 in 2023, down from 1.9 in 2019, lagging behind comparable lower-middle-income African countries. On the Current Path, Guinea’s governance effectiveness score is projected to improve modestly to 1.6 by 2030 and 1.9 by 2043, while its governance index (capacity, inclusion and security) is expected to improve modestly from 0.39 in 2023 to 0.41 by 2030 and 0.46 by 2043. In the Governance Scenario, the index would increase significantly to 0.41 by 2030 and 0.48 by 2043, representing a 3.1 per cent and 4.5 per cent improvement over the Current Path, respectively.

The integrated development push across all the above sectors (the Combined Scenario) offers the most substantial improvements for Guinea. By 2030, GDP per capita would be 4.7 per cent higher than the Current Path, translating to an additional $139 per person. By 2043, this increase would reach 29.4 per cent, equivalent to $321 per person.

Economic growth would accelerate, with an average annual growth rate of 6.2 per cent (2026-2030) compared to 4.8 per cent on the Current Path. Over the long term (20262043), growth would average 7.3 per cent, significantly higher than 5.3 per cent on the Current Path. Guinea’s total GDP would be $1.4 billion larger by 2030 and $16.6 billion larger by 2043 compared to the Current Path.

However, economic growth would come with higher carbon emissions, which would increase by three million tonnes by 2030 and 5.9 million tonnes by 2043.

The Combined Scenario would also lead to a sharp reduction in extreme poverty, which would decline to 11.3 per cent by 2030, lifting 241,142 people out of extreme poverty. By 2043, extreme poverty would be eradicated at 0.1 per cent, equivalent to 572,589 fewer people living in poverty relative to the Current Path.

The study recommends ambitious yet feasible policy interventions across all sectors and highlights the importance of inclusive governance. Overall, it emphasises the need for comprehensive economic policy reforms and strategic investments to achieve meaningful growth. By addressing governance issues, enhancing infrastructure, improving agricultural productivity, and diversifying the economy, Guinea can pursue a pathway towards inclusive and sustainable development.

The government should prioritise policies that enhance transparency, accountability, inclusivity, institutional efficiency and adherence to the rule of law. Strengthening and empowering anti-corruption agencies to investigate and prosecute corruption is crucial for achieving these objectives.

Guinea’s economy relies heavily on mining, but weak links to other sectors limit job creation and poverty reduction. Promoting downstream beneficiation in the mining sector through mining processing and industrialisation could boost broader economic benefits. As noted earlier, Guinea derives most of its export revenues from mining, and its top five exports are primary or commodity products. These exports are characterised by highly volatile prices and lack both technological dynamism and local economic linkages. It is, therefore, crucial for the country to develop and invest in an industrial strategy that links the domestic and the external markets by diversifying its economy away from primary and commodities products.

Guinea must develop productive capacities and explore new sectors to reduce its reliance on a narrow range of activities and a limited set of commodities. It needs to maximise the opportunities under AfCFTA to expand market access and to import advanced industrial machinery to enhance downstream beneficiation (or value addition) and productivity.

The government of Guinea must invest in technologies that enhance productivity and provide farmers with access to high-yield, disease- and drought-resistant seeds, fertilisers and credit guarantees. Support is needed for research and development efforts to build resilience and boost agricultural productivity. Strengthening the transport infrastructure network, particularly in and with rural areas, by developing reliable, all-weather roads to facilitate agricultural production and commercialisation is critical. Not only roads should be upgraded, but railways and other networks should be upgraded to better connect rural areas with urban markets and reduce transportation costs. With such a large rural population, prioritising rural transport infrastructures would generate significant economic benefits, including higher rural incomes, increased agricultural productivity and greater economic participation.

In addition to transport infrastructure, Guinea should address all categories of infrastructure deficits that undermine regional value chains and private sector development in the country. Expanding energy access should be prioritised by increasing electrification, particularly in rural areas, preferably through investments in renewable energy sources like solar, which provide affordable and reliable power.

An abundant supply of skilled labour at a reasonable cost could serve as a key driver for attracting FDI and promoting industrialisation in Guinea in the coming years. To achieve this, the quality of education, healthcare and water and sanitation services must be significantly enhanced. The education curriculum should be reviewed in collaboration with the private sector and industry stakeholders to align it with labour market demands. Furthermore, efforts should be made to close the educational gender disparities to achieve sustainable development and meet global education goals.

The Gabonese Republic is an upper-middle-income country on the west coast of Central Africa with abundant petroleum resources. It borders Equatorial Guinea to the northwest, Cameroon to the north, the Republic of the Congo to the east and south and the Gulf of Guinea to the west. Despite Gabon’s upper-middle-income status, the country faces many development challenges, with about a third of its population living in absolute poverty.

Since independence from France in 1960, Gabon’s development has been hindered by decades of centralised rule under the Bongo family, exclusionary governance, and overreliance on oil exports. In August 2023, a military coup ousted incumbent president Ali Bongo. Elections are scheduled for 12 April 2025.

The large discrepancy between Gabon’s economic potential and its progress in human development is the result of decades of poor governance and the lack of economic diversification and inclusive growth. The transition government’s National Development Plan for the Transition (PNDT) 2024–2026 proposes to address Gabon’s structural challenges through five pillars: political and institutional reforms, infrastructure development, economic diversification, human capital development and environmental sustainability. In 2023, the country’s poverty rate of 31.3 per cent was significantly higher than the average for its global income peer group, although 8.4 percentage points below the average of its African income peers. On the Current Path, poverty is projected to decline to 11.8 per cent by 2043.

Gabon’s economy is heavily reliant on oil, which accounts for a significant share of GDP and government revenue. Between 1990 and 2023, GDP almost doubled from US$8.3 billion to $16.4 billion, with an expected increase to $28.5 billion by 2043. However, this optimistic trajectory hinges on the ability to successfully manage the country’s political transition, establish sound macroeconomic management and promote economic diversification. The latter remains limited, with manufacturing and agriculture contributing only 15 per cent and 6.7 per cent of GDP, respectively, in 2023.

Gabon’s key industries, besides petroleum, are minerals (mostly manganese) and timber processing, with the industry expanding into the manufacturing of furniture and plywood products. By 2043, manufacturing is projected to account for 18 per cent of GDP. The country’s industry faces a series of obstacles, including limited infrastructure, particularly transport networks and energy and port facilities, which limit local value addition. Moreover, Gabon’s industrial sector lacks competitiveness due to high energy costs and low productivity. Access to finance for local small- and medium-sized enterprises is a challenge.

Gabon has significant agricultural potential, but the agricultural sector remains underdeveloped, and productivity is severely limited. This is a result of the economy’s over-reliance on oil as well as other factors, including the land tenure system, the infrastructure deficit, etc. The country has more than five million hectares of arable land, of which less than 10 per cent is being used for agricultural production, mostly subsistence farming. In 2023, the agricultural sector accounted for 6.7 per cent of Gabon’s GDP, but its contribution is expected to decline to 4.8 per cent by 2043.

In the Current Path, crop yields are expected to increase by 25 per cent to 2.3 million metric tonnes per hectare in 2043, up from 1.8 million metric tonnes per hectare in 2023. However, crop production, which was 2.4 million metric tonnes per hectare in 2023, is being outpaced by domestic demand. Under the Current Path, the gap of almost 0.6 million metric tonnes observed in 2023 would widen to 1.6 million metric tonnes by 2043 and make Gabon more dependent on food imports.

The AfCFTA presents Gabon with an opportunity to enhance trade, diversify its economy and mitigate its dependence on oil exports. In 2023, Gabon maintained a trade surplus, with exports valued at $6.8 billion (41.3 per cent of GDP) and imports at $4.9 billion (30.5 per cent of GDP). However, this surplus is expected to decline due to resource depletion around 2040 and the global transition away from fossil fuels.

Population growth in Gabon is high, at about 2.3 per cent a year. In 2023, the population was estimated at 2.5 million people and is expected to reach about 3.7 million by 2043 in the Current Path. The combination of high fertility and life expectancy means that Gabon’s age structure is maturing slowly. In the Current Path, the country will reach replacement level fertility of 2.1 births per woman only by around 2068. In 2043, the average life expectancy in Gabon is projected to be 71.7 years, up from 68.4 years in 2023 and 2.5 years below the expected average of 74.2 years for Africa’s upper-middle-income economies in 2043.

The country’s epidemiological transition is characterised by a rapidly growing burden of non-communicable diseases alongside a persistently heavy infectious or communicable disease burden. Non-communicable diseases have replaced communicable diseases as the leading cause of death, with cardiovascular diseases being particularly widespread and deadly. Malaria is the leading cause of death among infectious diseases. Gabon has, however, made progress when it comes to universal health coverage and significantly improved its child survival rates between 1990 and 2023. The respective SDG targets are reachable within the next 20 years. Improved sanitation remains a challenge, with only 51.1 per cent of the population having access in 2023, well below the upper-middle-income African average of 81.2 per cent. Investments in sanitation infrastructure are hence crucial for improving overall health outcomes.

With 90 per cent of the population living in urban areas, Gabon is Africa’s most urbanised country. Nonetheless, urbanisation has not translated into tangible improvements in the standard of living of most Gabonese. Two key reasons for this outcome are that the urban economy has not created sufficient jobs and that growth largely occurred in sectors with little connection to the poor, such as oil production.

To address these challenges, the report analyses Gabon’s development prospects along a Current Path (or business-as-usual forecast), eight sectoral scenarios and a combined, high-growth scenario. Each scenario highlights pathways to improve outcomes across critical sectors.

Demographics and Health

The Demographics and Health Scenario would accelerate the demographic transition by reducing average total fertility to 2.5 births per woman in 2043, enabling Gabon to enter the demographic window of opportunity about 15 years earlier than in the Current Path. This shift presents an opportunity for increased labour force participation, driving economic growth.

Moreover, in this scenario, health outcomes would improve significantly. Infant mortality would drop by 40 per cent to 13 deaths per 1, 000 live births by 2043, compared to 19.7 in the Current Path. Life expectancy would increase to 73.6 years, outperforming the Current Path’s 71.7 years.

In 2023, non-communicable-related deaths were nearly twice as high as those from communicable diseases. This trend is expected to continue in the Current Path, putting the health system under additional stress and requiring increased spending as non-communicable diseases are typically more expensive to treat than communicable diseases.

Curbing the rise in non-communicable diseases requires addressing several different risk factors. Tackling negative changes in lifestyles linked to urbanization, such as unhealthy dietary habits, reduced physical activity and increased tobacco consumption, would be required to help boost productivity and prevent ongoing long-term treatment and care. Strengthening Gabon’s public health system and expanding preventive care would be key to sustaining long-term progress.

Agriculture

In the Agriculture Scenario, the value added by the agricultural sector would account for 5.6 per cent of GDP in 2043 compared to 4.8 per cent in the Current Path. The interventions under this scenario would push crop production to 2.7 million metric tonnes, 0.4 million metric tonnes above the expected production level in the Current Path. This would narrow the gap between production and demand, fueled by population growth, and help avoid excessive food import dependence.

In the Agriculture Scenario, in 2043, production would fall 1.2 million metric tonnes short of demand compared to a 1.6 million metric tonne shortfall in the Current Path. In 2023, imports represented 28.6 per cent of agricultural demand. With increased agricultural production, the Agriculture Scenario would achieve a reduction in import dependence by 25 per cent. By 2043, imports would account for 35 per cent of agricultural demand compared to 46.7 per cent in the Current Path.

Education

The interventions in the Education Scenario would improve human capital outcomes in Gabon as a key driver of economic growth and productivity. Given the relatively high baseline, the impact on mean years of education is modest yet important. In this scenario, mean years of education would increase by one year from 11.6 years in 2023 to 12.6, 0.7 years more than in the Current Path. The share of science and engineering students among tertiary graduates would increase from 20.8 per cent in 2023 to 25.3 per cent in 2043, compared to the Current Path of 20.3 per cent.

Moreover, the Education Scenario helps narrow the gender gap at the tertiary education level by bringing the female/male student ratio down to 1.3 in 2043 compared to the Current Path ratio of 2.5 female students per male student. This means that by 2043, male tertiary enrollment would reach 51.1 per cent, and female enrollment would be 66.5 per cent versus the projected 19.2 per cent and 47.6 per cent, respectively, on the Current Path. On the upper-secondary level, the gender gap would practically be closed, with enrolment rates of female and male students reaching 119.3 per cent and 122.2 per cent, respectively.

Improvements via the Education Scenario are key to fully capitalising on the impact of the Demographics and Health Scenario, as the demographic dividend can only materialise if the workforce is better educated to match the skills needed in the labour market.

Manufacturing

In the Manufacturing Scenario, efforts at economic diversification would pay off, and the economy would grow the most among the individual scenarios, with GDP (MER) reaching $30.7 billion in 2043. Currently, Gabon’s industry is centred on petroleum, manganese mining and timber processing. In the Manufacturing Scenario, the sector’s share would rise to 22.1 per cent of GDP in 2034, compared to 18 per cent in the Current Path. Relative to the 2023 baseline, this represents an increase of more than 22 per cent. Gabon would hence perform slightly above the average of its global income peers. In 2043, government revenue would account for 23.1 per cent of GDP, compared to 22.7 per cent in the Current Path.

Among the sectoral scenarios, the Manufacturing Scenario increases GDP per capita the most, with gains of $730 and $710 above the Current Path in 2043, respectively.

AfCFTA

In the AfCFTA Scenario, GDP would reach $30.6 billion, compared to $28.5 billion in the Current Path. GDP per capita would increase to $15,080, compared to $14,370 in the Current Path.

In the Current Path, Gabon’s trade balance will deteriorate from 10.8 per cent of GDP in 2023 to -4.4 per cent by 2043. By contrast, the AfCFTA Scenario would reduce this deficit to -3.5 per cent of GDP by 2043, supported by increased exports in manufacturing, agriculture, services, technology and processed materials.

Gabon exports crude petroleum, manganese ore and wood products primarily to China, Italy and South Korea. Its main imports, including poultry, machinery, and vehicles, come from China, France, and the United Arab Emirates. Within Africa, Gabon’s top export partners include Morocco and Benin. However, intra-regional trade remains low due to high tariffs (18.3 per cent), costly border procedures and a lack of economic complementarity within the Economic and Monetary Community of Central Africa (CEMAC).

The AfCFTA Scenario offers Gabon a path to greater economic resilience by reducing trade barriers, enhancing regional integration and fostering value addition in its resource-based industries. By leveraging AfCFTA’s benefits, Gabon could sustain trade-driven growth while reducing its vulnerability to external shocks and resource depletion.

Large Infrastructure and Leapfrogging

At the end of 2024, the transitional government unveiled an ambitious roadmap for 2025 to overcome the country’s infrastructure shortfalls. Three large infrastructure projects, the Mayumba deepwater port project, the Belinga-BouéeMayumba railroad line and the Booué hydroelectric dam, aim to boost trade, modernise infrastructure and meet the country’s energy needs.

In the Large Infrastructure and Leapfrogging Scenario, the share of energy production from renewables would increase significantly, from accounting for hardly 1.4 per cent of total energy production in 2023 to 3.3 per cent in 2043. In the Current Path, energy production from renewables is projected to only increase to 1.8 per cent of total energy production.

Gabon is already one of the top performers on the continent when it comes to mobile broadband, only being outperformed by Mauritius, South Africa, Egypt, Tunisia and Botswana. Fixed broadband subscriptions are low, however, and the scenario would increase the number of fixed broadband subscriptions from 4 subscriptions per 100 people in 2023 to 35.3, 12 more than in the Current Path, outperforming the expected average for upper-middle-income Africa in 2043. Moreover, by 2043, 67 per cent of the rural population would have access to electricity, compared to 55.3 in the Current Path.

Gabon needs to stay the course on growing its information technology capacity and continue to invest in the quantity and quality of services to transition to a modern economy.

Financial Flows

Restoring investor confidence to attract FDI is essential for Gabon’s fiscal stability. Under the Financial Flows Scenario, government revenue would increase to 22.8 per cent of GDP by 2043. The additional fiscal space would enable greater investments in infrastructure and services, helping Gabon address critical development challenges. The scenario envisions a recovery in FDI, improving a more modest evolution projected in the Current Path, where FDI could remain constrained due to the political context and broader governance challenges.

On the Current Path, FDI would decline slightly, expected to reach only 5.2 per cent in 2043 from a base of 5.4 per cent of GDP in 2023. In the Financial Flows Scenario, FDI as a share of GDP would rise to 6.8 per cent in 2035 and to 6.1 per cent in 2043, reflecting renewed investor confidence. This recovery would drive investment in key sectors like mining, renewable energy, and infrastructure, as well as increase economic growth and government revenues through improved tax compliance and natural resource royalties. In this scenario, the economy would be $29.9 billion in size by 2043, compared to $28.5 billion on the Current Path.

Moreover, efforts to reduce illicit financial outflows would further strengthen Gabo’s fiscal position, ensuring more capital remains in the economy and contributes to sustainable development.

Governance

Under the Governance Scenario, governance effectiveness improves significantly, with Gabon’s score on the associated World Bank index improving from 1.55 in 2023 to 1.96 by 2043. However, this would remain below the 2.56 average for upper-middle-income African countries, emphasising the need for continued reforms.

The 2023 coup, which removed President Ali Bongo, exposed deep political and economic governance failures. While disrupting stability, it also created an opportunity for reform. The transition government has since faced a dilemma between catering to the population’s expectations for higher standards of living by adopting expansionary fiscal policies and strengthening public financial management to ensure fiscal sustainability.

Gabon’s governance is assessed along the three dimensions of security, capacity and inclusion, which are measured on an index included in the IFs model. In 2023, Gabon ranked high in security (0.75 out of 1) but struggled with capacity (0.35) and inclusion (0.4), reflecting weak public service delivery and limited democratic participation. By 2043, governance reforms in the scenario proposed would improve these scores, with the composite governance index rising from 0.5 to 0.63. Capacity would increase to 0.45, as corruption would decline, fiscal management would strengthen, and government revenue would grow from 18.7 per cent to 24.2 per cent of GDP, enabling greater social spending. Inclusion would also improve, reaching 0.55, driven by enhanced democratic governance, increased female representation and ongoing legal reforms supporting gender equality.

Because the Governance Scenario includes additional social welfare transfers, it has the largest impact on poverty reduction, with the poverty rate projected to fall from 31.3 per cent in 2023 to 9.3 per cent by 2043, compared to 11.8 per cent under the Current Path. Stronger institutions, reduced corruption, and improved inclusivity would create a more stable and prosperous environment, positioning Gabon for sustained economic growth and governance outcomes comparable to Namibia’s 2023 levels by 2043.

Gabon would experience a boost to its GDP per capita in all eight sectoral scenarios. However, the Combined Scenario would have a much greater impact on GDP per capita compared to the individual scenarios. By 2035, in the Combined Scenario, the GDP per capita of Gabon (PPP) would be $1,910 larger than in the Current Path. In 2043, it would reach $18,820 and surpass the Current Path by $4,450, indicating that an integrated push across all sectors could significantly improve the living standard of the people of Gabon.

Similarly, in the Combined Scenario, only 5 per cent of the population would be living in poverty compared to 11.8 per cent in the Current Path. The results illustrate that poverty reduction in Gabon is best achieved via an integrated push across sectors, with more inclusive governance and job creation playing a decisive role. The Combined Scenario would take Gabon close to achieving the SDG on poverty and put the country 33.8 and 3.5 percentage points ahead of its African and global upper-middle-income peers, respectively.

The Combined Scenario would significantly improve Gabon’s economic growth outlook. The expected average growth rate between 2025 and 2043 would be 4.7 per cent versus 2.8 per cent in the Current Path over the same period. The size of the economy measured in GDP at the market exchange rate (MER) in 2043 would be $40.9 billion, hence $12.4 billion or 43.4 per cent larger than in the Current Path. Moreover, Gabon would make greater progress in formalising its economy, with the share of the informal sector dropping to 23.8 per cent of GDP in 2043 versus 29.4 per cent in the Current Path.

In the Combined Scenario, the average Gabonese could expect to live about 2.8 years longer at 74.5 years in 2043, compared with the Current Path for the same year. Infant mortality would be 10.7 deaths per 1,000 live births, compared to 19.1 deaths in the Current Path in 2043.