Gabon

Gabon

Feedback welcome

Our aim is to use the best data to inform our analysis. See our Technical page for information on the IFs forecasting platform. We appreciate your help and references for improvements via our feedback form.

This page presents a comprehensive analysis of Gabon. The analysis outlines the nation’s socio-economic challenges and opportunities, examining various developmental paths through 2043. It explores eight sectoral scenarios, including demographic, governance, economic and infrastructure-related outcomes for Gabon up to 2043. The analysis aims to provide policymakers and researchers insights to guide Gabon towards a more prosperous future for all.

For more information about the International Futures modelling platform we use to develop the various scenarios, please see About this Site.

Summary

This page begins with an introductory assessment of the country’s context, looking at current population distribution, social structure, climate and topography.

- Gabon is an upper-middle-income country situated on the west coast of Central Africa. It has abundant petroleum resources and borders Equatorial Guinea to the northwest, Cameroon to the north, the Republic of the Congo to the east and south and the Gulf of Guinea to the west. Since independence from France in 1960, the country has primarily been ruled by the Bongo family. In August 2023, incumbent head of state, Ali Bongo, was removed in a military takeover. Despite Gabon’s upper-middle-income status, the country faces many development challenges and about a third of its population lives in absolute poverty. This large discrepancy between Gabon’s economic potential and its progress in human development reflects longstanding structural challenges, including constraints in strong governance, limited economic diversification, and barriers to inclusive growth and sustainable development.

This section is followed by an analysis of the Current Path for Gabon which informs the country’s likely current development trajectory to 2043. It is based on current geopolitical trends and assumes that no major shocks would occur in a ‘business-as-usual’ future.

- The population of Gabon is growing rapidly at about 2.3% a year. In 2023, the country's population was estimated at 2.5 million people, and on the Current Path, it will expand to approximately 3.7 million people by 2043. Gabon´s age structure is maturing slowly, and on the Current Path the country will reach replacement level fertility of 2.1 births per woman only by around 2068. With 90% of the population living in urban areas, Gabon is Africa’s most urbanised country. The rural exodus has been fuelled by the oil economy.

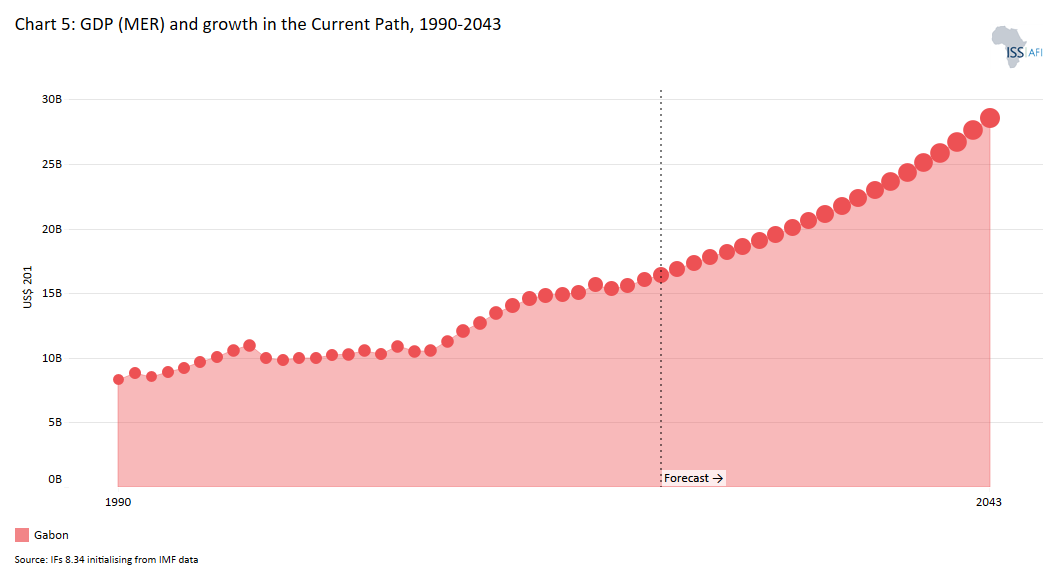

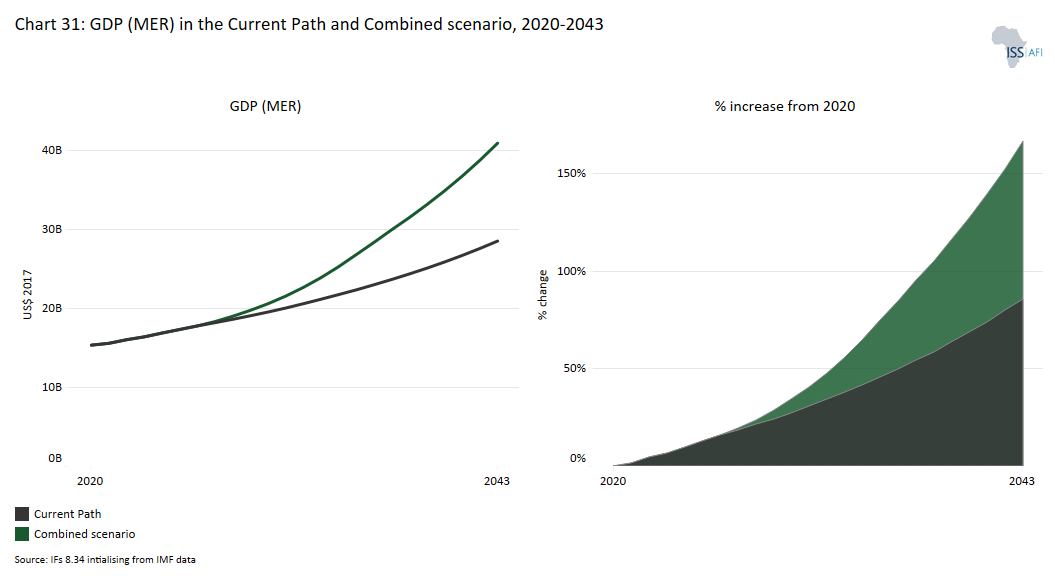

- Between 1990 and 2023, Gabon’s GDP (MER) essentially doubled from US$8.3 billion to US$16.4 billion. Gabon has the fifth-largest economy among the eight African upper-middle-income economies, with South Africa being in the lead, followed by Algeria, Libya and Botswana. On the Current Path, Gabon’s GDP will expand by almost 70% to US$28.5 billion in 2043. However, this optimistic trajectory hinges upon the ability to successfully manage the country’s political transition and sound macroeconomic management.

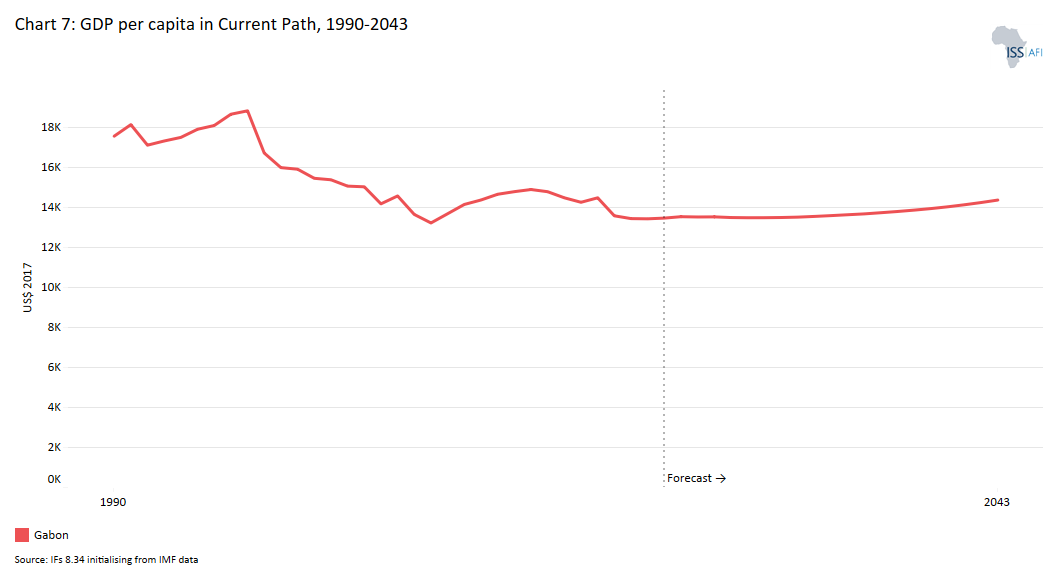

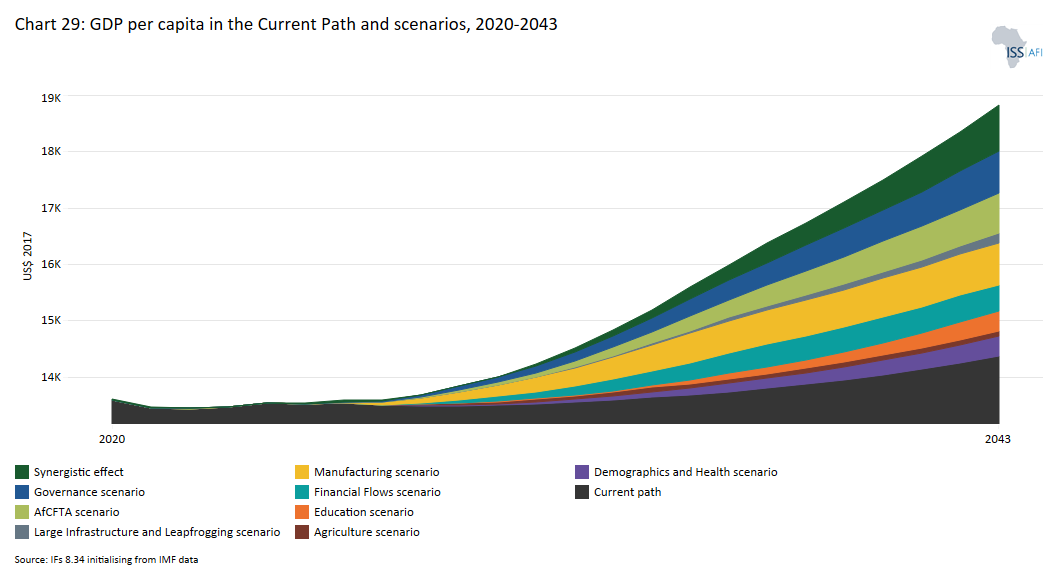

- Gabon’s GDP per capita (PPP constant 2017) evolution essentially mirrors fluctuations in global oil prices as well as domestic production dynamics in the context of significant population growth. Since the spectacular peak seen in 1976 when GDP per capita reached USD$31 090, average income has never again reached comparable levels. In 1990, GDP per capita stood at US$17 560, thereafter falling to US$16 000 in 2000 and dropping further to US$13 460 in 2023. Despite such negative GDP per capita growth, Gabon still performs above the group average of US$12 520 of Africa’s upper-middle-income economies. The country has the 4th-highest GDP per capita among its peers, following Mauritius (highest), Libya and Botswana. On the Current Path, Gabon's GDP per capita will rise to US$14 370 by 2043, now falling below the expected average of US$14 600 of its African income peer group.

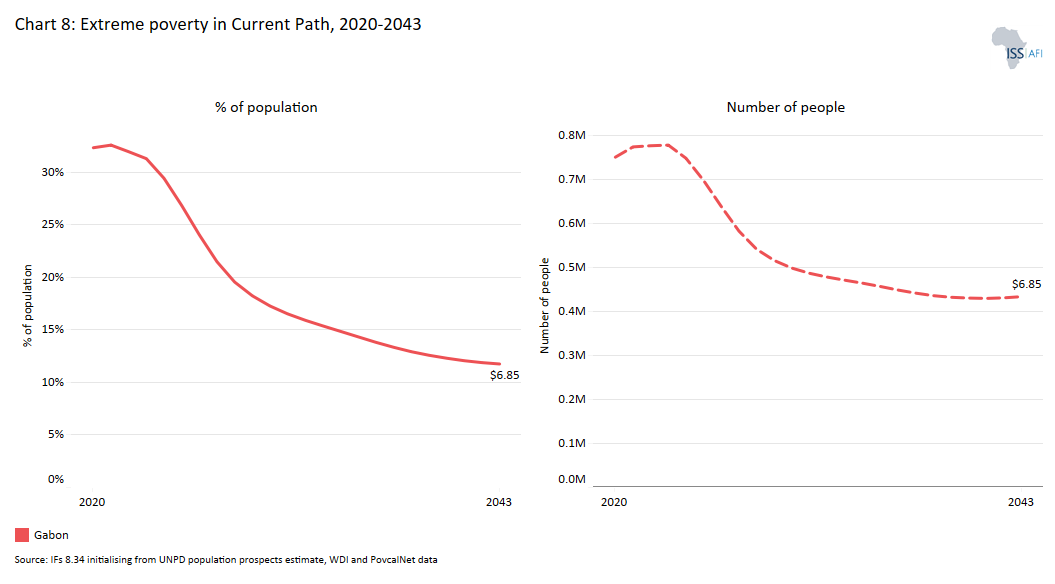

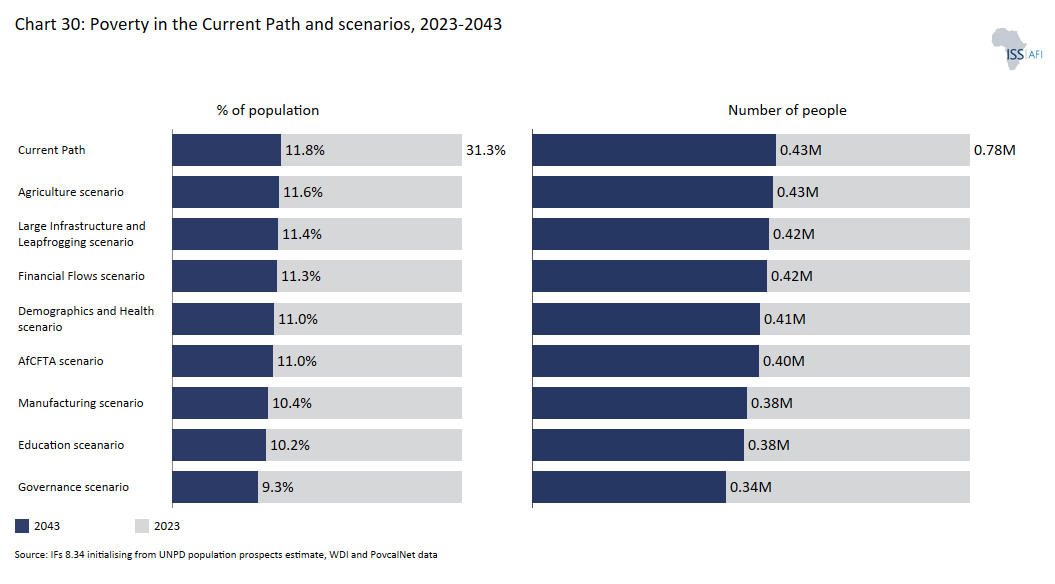

- In 2023, Gabon’s poverty rate measured at the international poverty line for upper-middle-income countries of US$6.85/day (per capita, 2017 PPP) was 31.3%, the equivalent of 778 810 people. This rate is, however, 8.4 percentage points lower than the average of 41% for Africa’s upper-middle-income countries but significantly above the average of 24% of the world´s upper-middle-income economies. On the Current Path, Gabon's poverty rate will decline to 17.3% in 2030 and to 11.8% by 2043, compared with the projected average of 11% for upper-middle-income Africa in the same year.

- Under the first Ali Bongo administration, the ‘Emerging Gabon 2025’ plan (PSGE) served as the central strategic document with three overarching goals: accelerate economic growth and economic diversification; reduce poverty and social inequalities; and sustainable resource management. In January 2024, the transition government released its own National Development Plan for the Transition (PNDT) that covers the period 2024-2026. The plan rests on five pillars: political and institutional reforms, development of strategic infrastructure, intensification of economic diversification, development of human capital and social inclusion, and environmental sustainability and climate change resilience.

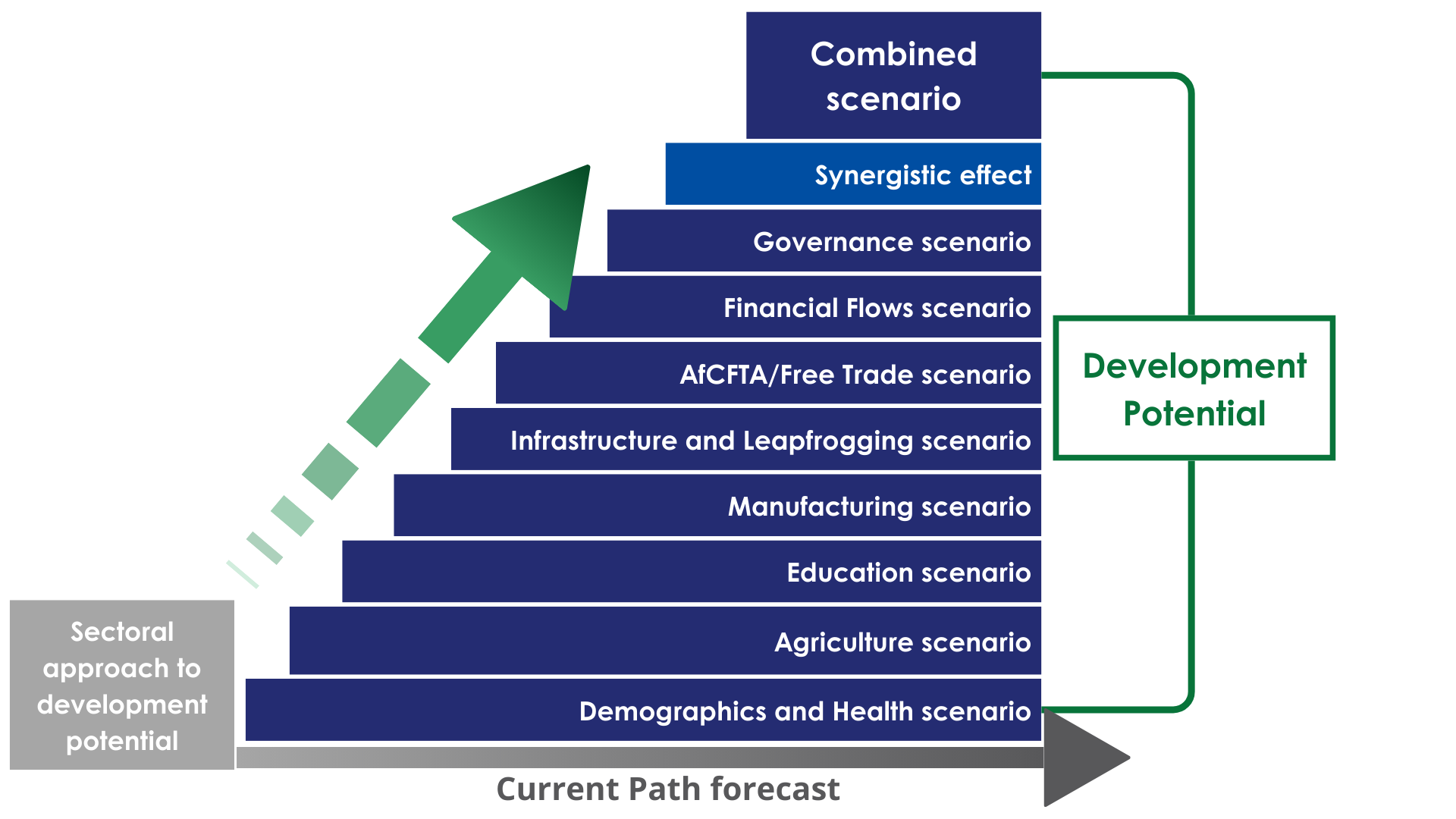

The next section compares progress on the Current Path with eight sectoral scenarios. These are Demographics and Health; Agriculture; Education; Manufacturing; the African Continental Free Trade Area (AfCFTA); Large Infrastructure and Leapfrogging; Financial Flows; and Governance. Each scenario is benchmarked to present an ambitious but reasonable aspiration in that sector compared to the historical progress made by other countries at similar levels of development.

- The implementation of the Demographics and Health scenario accelerates Gabon’s demographic transition. In this scenario, the ratio between working-age and dependant population will change more quickly and allow Gabon to enter the demographic “sweet spot” by 2038, with the potential to benefit from the large contribution that labour makes to economic growth. This is 17 years earlier than on the Current Path. Moreover, the population will see several health benefits flowing from the scenario. Infant mortality will drop by 40% to 13 deaths per 1 000 live births in 2043 compared to 19.7 in the Current Path. Life expectancy will increase to 73.6 years compared to 71.7 years in the Current Path by 2043.

- The Agriculture scenario vitally increases total agricultural production in the face of growing demand. Crop production, coming from a base of 1.8 million metric tons in 2032, will hit 2.7 million metric tons in 2043, 0.4 million metric tons above the expected production level in the Current Path. Increased production will reduce Gabon’s import dependence. By 2043, food imports will account for 35% of agricultural demand versus 46.7% on the Current Path trajectory. Further, the scenario promotes economic diversification by increasing the added value of the agricultural sector to 5.6% of GDP by 2043 compared to 4.8% of GDP in the Current Path.

- The interventions in the Education scenario improve human capital outcomes; a key driver of economic growth. The impact on mean years of education, however, is modest given that Gabon comes from a high base. Mean years of education increase by one year from 11.6 years in 2023 to 12.6 in 2043 in the Education scenario compared to the expected increase to 11.9 years in the Current Path. The share of science and engineering students among tertiary graduates will increase from 20.8% in 2023 to 25.3% in 2043 compared to the Current Path which will rise to 20.3%.

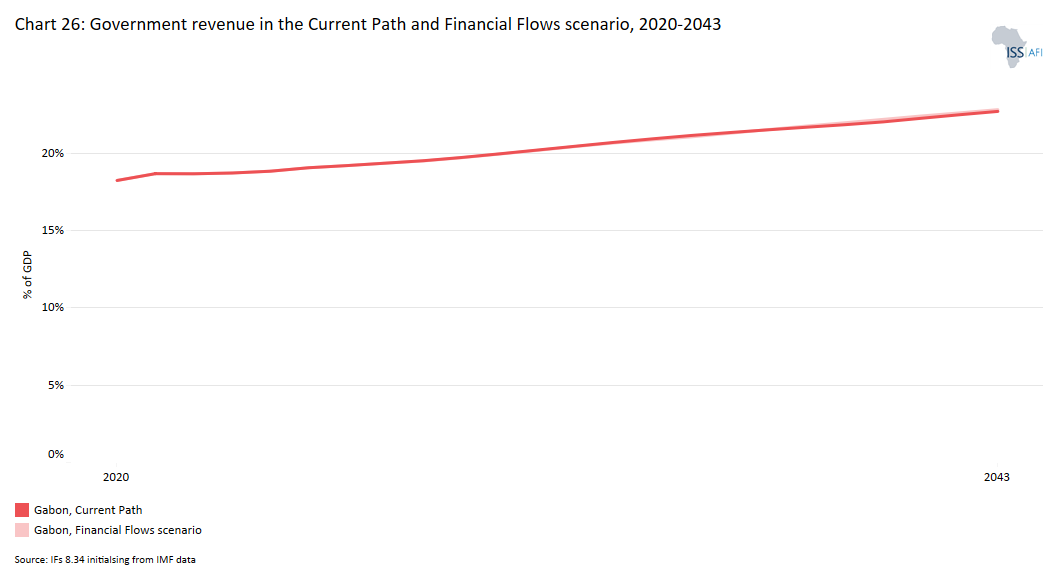

- In the Manufacturing scenario, efforts at economic diversification pay off and the economy grows the most with GDP (MER) reaching US$30.7 billion by 2043. Currently, Gabon’s industry is centred on petroleum, manganese mining and timber processing. In the Manufacturing scenario, by 2043 the sector’s share will rise to 22.1% of GDP compared to 18% in the Current Path. This will put Gabon slightly above the average of its global income peers. In 2043, government revenue will account for 23.1% of GDP compared to 22.7% in the Current Path.

- In the African Continental Free Trade Area (AfCFTA) scenario, GDP (MER) will reach US$30.6 billion in 2043 compared to US$28.5 billion in the Current Path. Over the same time horizon, GDP per capita will increase to US$15 080 compared to US$14 370 in the Current Path. By leveraging the AfCFTA’s benefits, Gabon can sustain trade-driven growth while reducing its vulnerability to external shocks and its overreliance on oil.

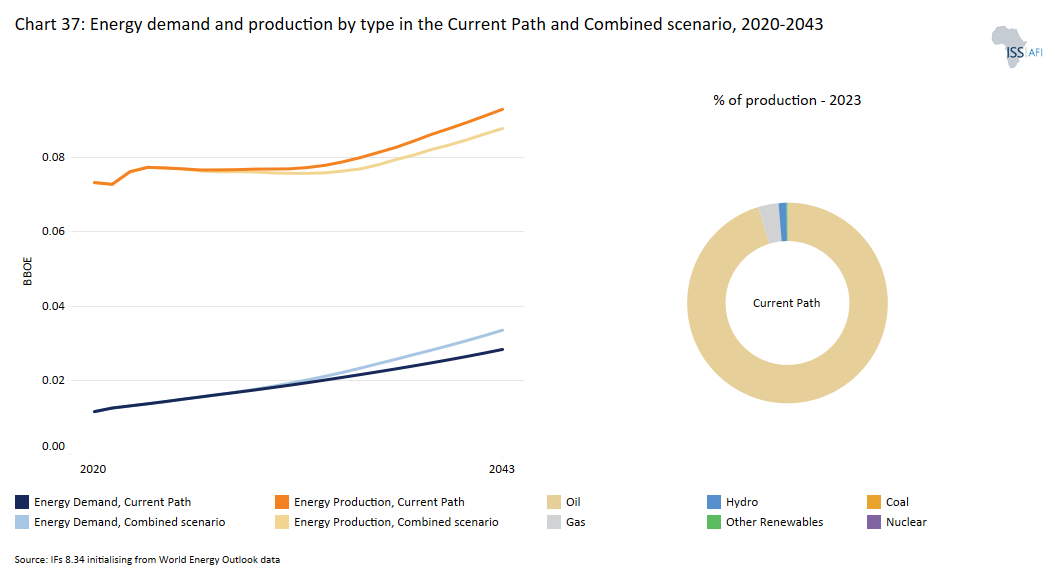

- In the Large Infrastructure and Leapfrogging scenario, the share of energy production from renewables increases significantly from accounting for hardly 1.4% of total energy production in 2023 to 3.3% in 2043. In the Current Path, energy production from renewables only increases to 1.8% of total energy production by 2043.

- In the Financial Flows scenario, foreign direct investment (FDI) as a percentage of GDP rises to 6.8% in 2035 and to 6.1% in 2043. On the Current Path, FDI will decline slightly, expected to reach only 5.2% in 2043 from a base of 5.4% of GDP in 2023. The economy will be worth US$29.9 billion by 2043 compared to US$28.5 billion on the Current Path.

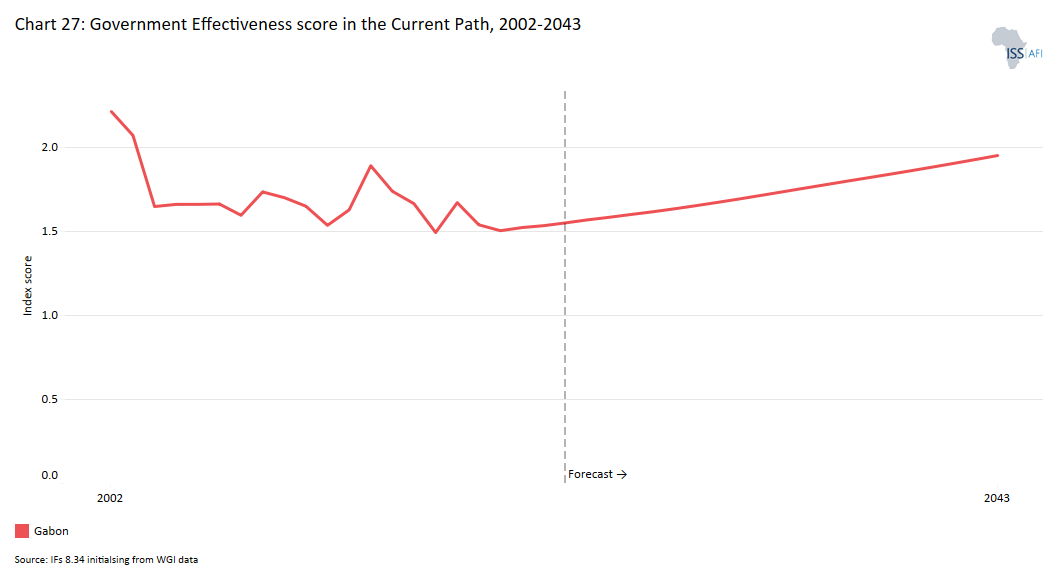

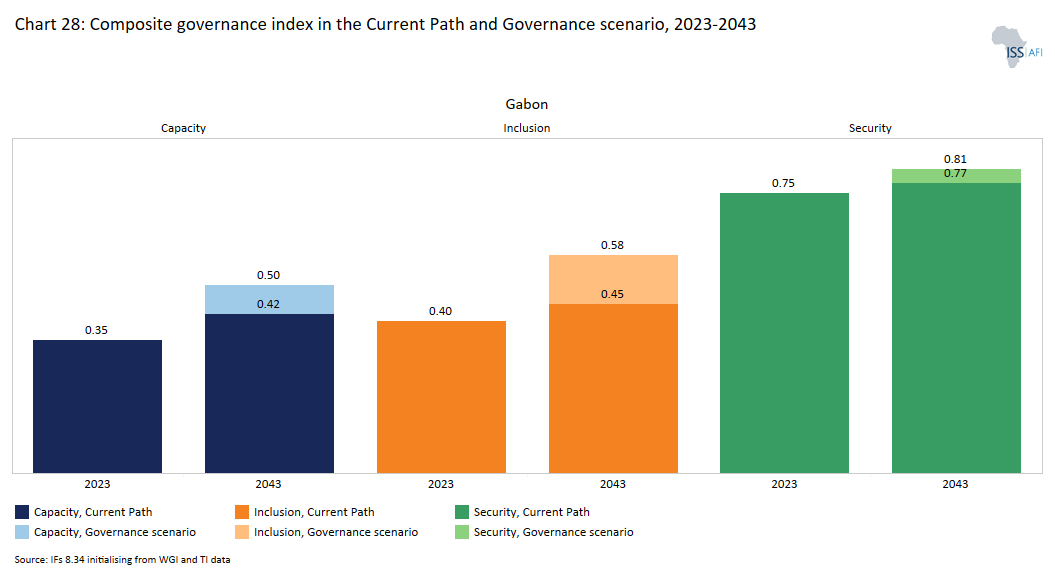

- In the Governance scenario, Gabon will increase its composite governance score by 6 points relative to the Current Path by 2043. This is mostly due to improvements in capacity and inclusion. If fully implemented, the Governance scenario will set the foundations for Gabon to transition to more inclusive economic growth and sustainable development and better align human development with the country’s upper-middle-income status. The Governance scenario is the most powerful in reducing poverty with the share of people living in poverty dropping from 31.3% in 2023 to 9.3% in 2043 versus 11.8% in the Current Path.

In the third section, we compare the impact of each of these eight sectoral scenarios with one another and subsequently with a Combined scenario (the integrated effect of all eight scenarios). In our forecasts, we measure progress on various dimensions such as economic size (in market exchange rates), gross domestic product per capita (in purchasing power parity), extreme poverty, carbon emissions, the changes in the structure of the economy, and selected sectoral dimensions such as progress with mean years of education, life expectancy, the Gini coefficient or reductions in mortality rates.

- Gabon experiences a boost to its GDP per capita in all eight sectoral scenarios. However, the Combined scenario has a much greater impact on GDP per capita compared to the individual scenarios. By 2035, the GDP per capita of Gabon (PPP) is US$1 910 larger than in the Current Path. In 2043, it will reach US$18 820 and surpass the Current Path projection by US$4 450, indicating that an integrated push across all sectors could significantly improve the living standard of the people of Gabon. Among the sectoral scenarios, the Manufacturing and the Governance scenarios increase GDP per capita the most with increases of US$730 and US$710 above the Current Path in 2043, respectively. The third and fourth most significant impact on Gabon’s GDP per capita is achieved in the AfCFTA and the Financial Flows scenarios, followed by the Demographics and Health scenario.

- Similarly, all scenario interventions contribute to poverty reduction in Gabon. However, the Governance scenario is the most powerful in reducing the extreme poverty rate by 2043, followed by the Education and Manufacturing scenarios. In the Combined scenario, by 2043, 5% of the population will be living in poverty compared to 11.8% in the Current Path. The results illustrate that poverty reduction in Gabon is best achieved via an integrated push across sectors with more inclusive governance and job creation playing a decisive role. The Combined scenario will put Gabon close to achieving the Sustainable Development Goal (SDG) on poverty and, by 2043, put the country 33.8 and 3.5 percentage points ahead of its African and global upper-middle-income peers, respectively.

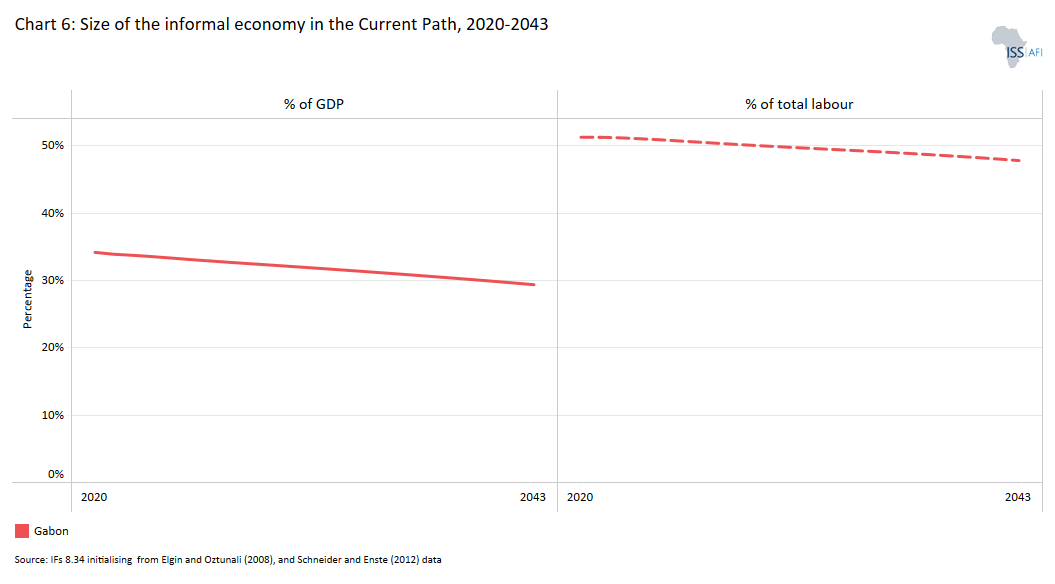

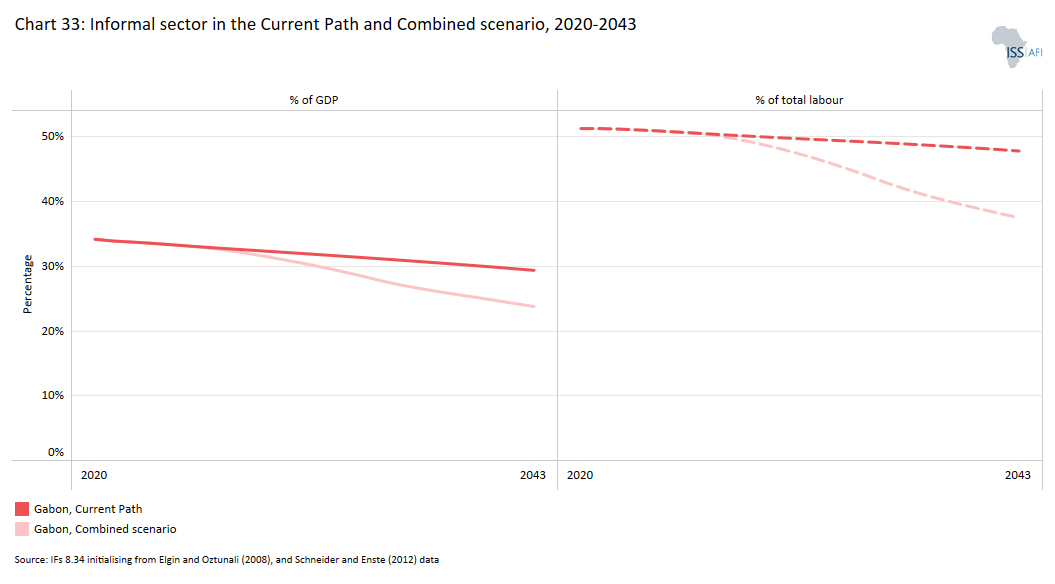

- The Combined scenario significantly improves Gabon’s economic growth outlook. In this scenario, the average growth rate between 2025 and 2043 is 4.7% versus 2.8% in the Current Path over the same period. The size of the economy measured in GDP at the market exchange rate (MER) will be US$40.9 billion and hence US$12.4 billion or 43.4% larger than in the Current Path in 2043. Moreover, Gabon makes greater progress in formalising its economy with the share of the informal sector dropping to 23.8% of GDP versus 29.4% in the Current Path by 2043.

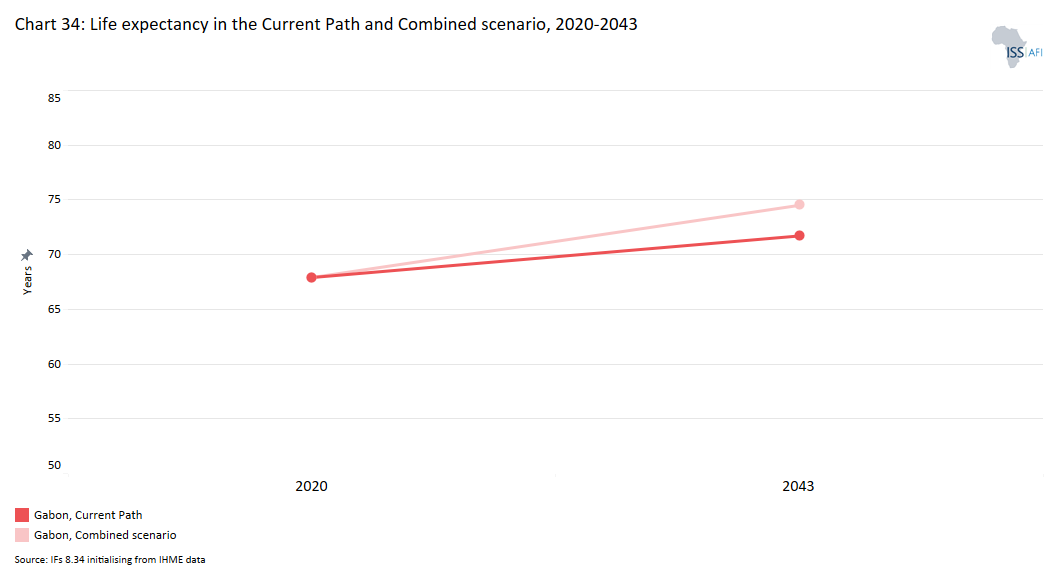

- In the Combined scenario, the average Gabonese can expect to live about 2.8 years longer at 74.5 years in 2043, compared with the Current Path for the same year. Infant mortality will stand at 10.7 deaths per 1 000 live births compared to 19.1 deaths in the Current Path in 2043.

We end this page with a summarising conclusion offering key recommendations for Gabon’s inclusive and sustainable development. Gabon stands at a critical juncture, with an opportunity to transform the trajectory shaped by the challenges of managing oil wealth, limited inclusion, declining incomes, and stagnant progress in human and social capital development. The return to constitutional rule via democratic elections, announced for April 2025, is crucial to set the foundation for a new government to engage in evidence-based planning and policy-making across sectors that can put Gabon on a path to shared prosperity. Addressing governance challenges is critical, with a focus on transparency, inclusive decision-making and institutional strengthening to establish legitimacy and ensure effective policy implementation. Economic diversification away from oil, particularly through investments in manufacturing, agriculture and renewable energy, alongside leveraging AfCFTA opportunities, can reduce dependence on resource exports and drive growth. Investments to overcome the infrastructure bottlenecks are imperative, and so is gaining investor confidence to attract foreign direct investment. Other than increasing education and health expenditure, human capital development must optimise resource allocation, focus on reducing drop-out and repetition rates, improve the gender balance, as well as enhance the quality and accessibility of science and technical education. Efforts to accelerate the country's demographic transition through improved healthcare and family planning will alleviate the pressure on service delivery and increase the economic growth potential.

All charts for Gabon

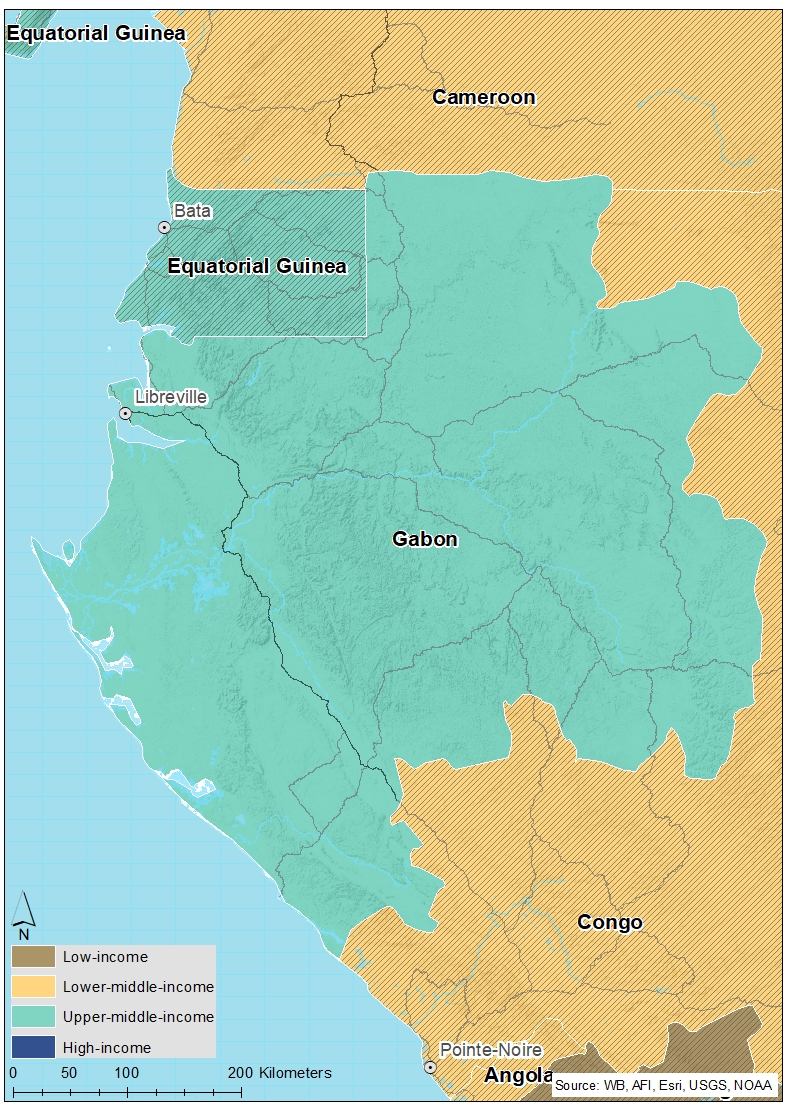

- Chart 1: Political map of Gabon

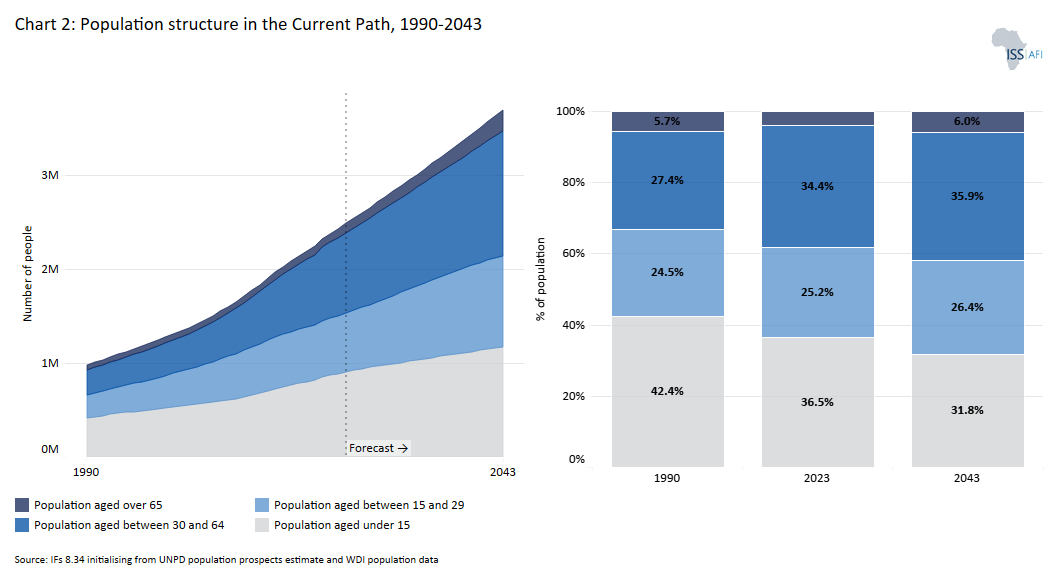

- Chart 2: Population structure in the Current Path, 2020–2043

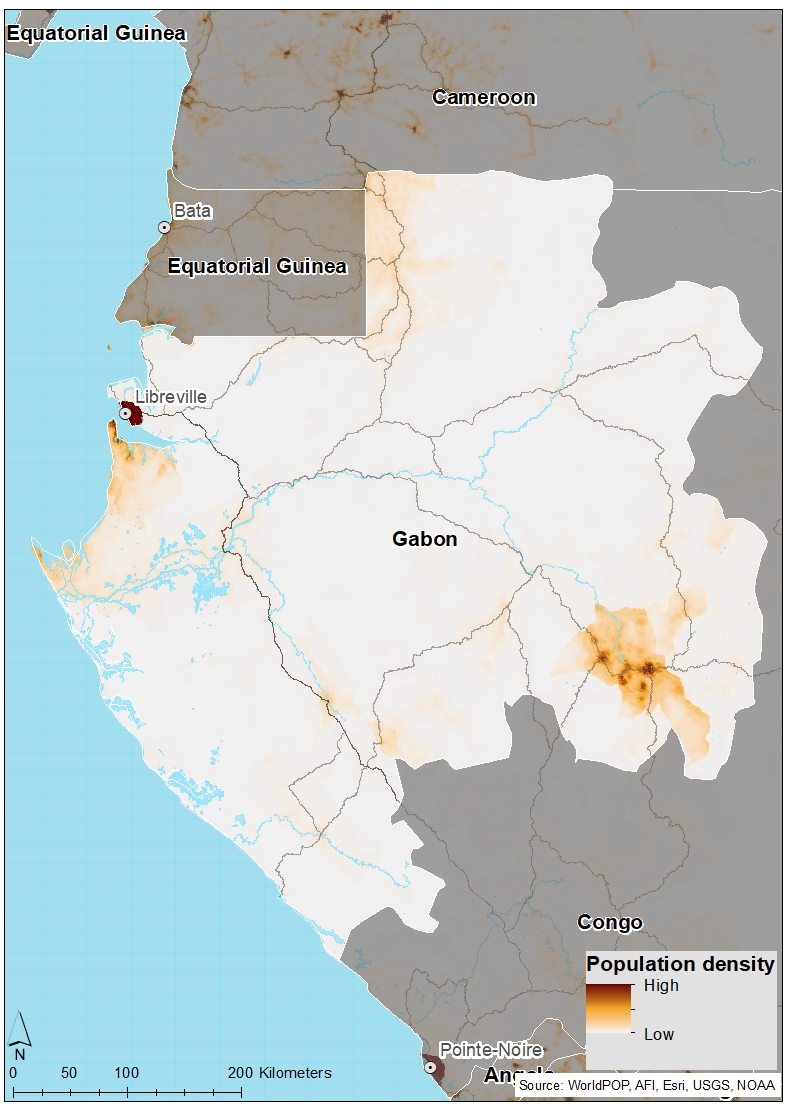

- Chart 3: Population distribution map, 2023

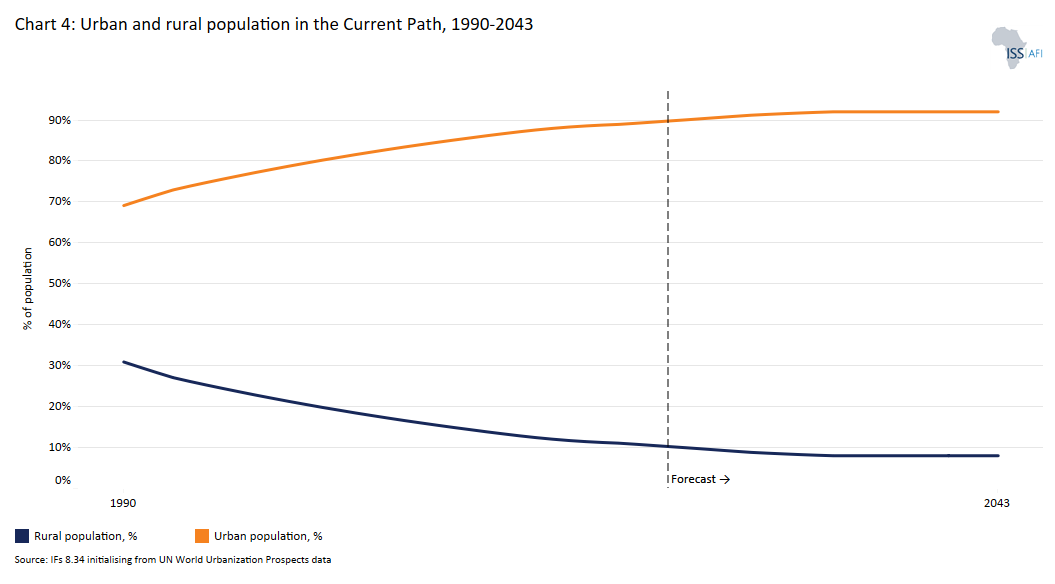

- Chart 4: Urban and rural population in the Current Path, 1990-2043

- Chart 5: GDP (MER) and growth rate in the Current Path, 1990–2043

- Chart 6: Size of the informal economy in the Current Path, 2020-2043

- Chart 7: GDP per capita in Current Path, 1990–2043

- Chart 8: Extreme poverty in the Current Path, 2020–2043

- Chart 9: National Development Plan of Gabon

- Chart 10: Relationship between Current Path and scenarios

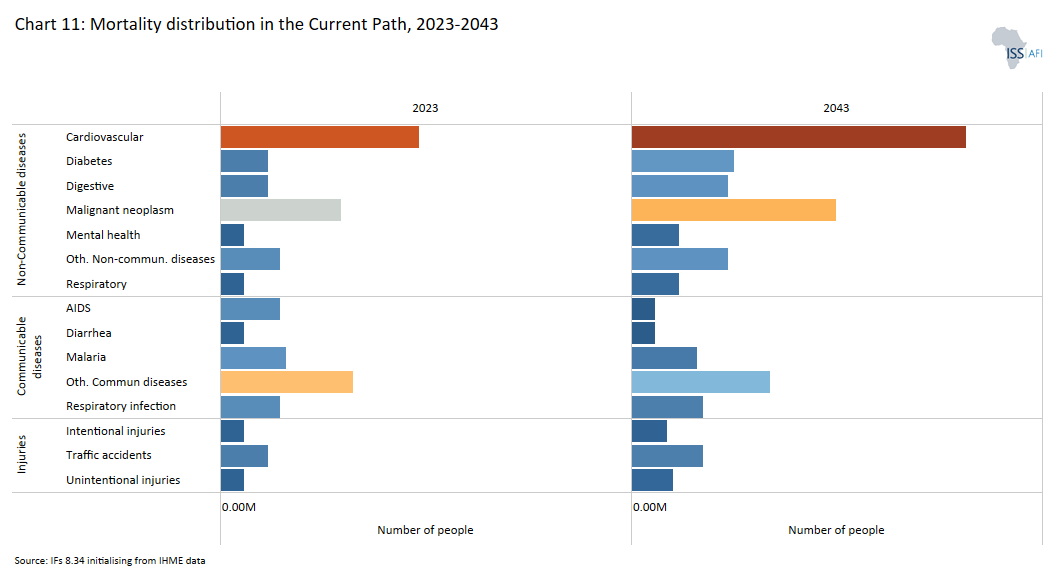

- Chart 11: Mortality distribution in the Current Path, 2023 and 2043

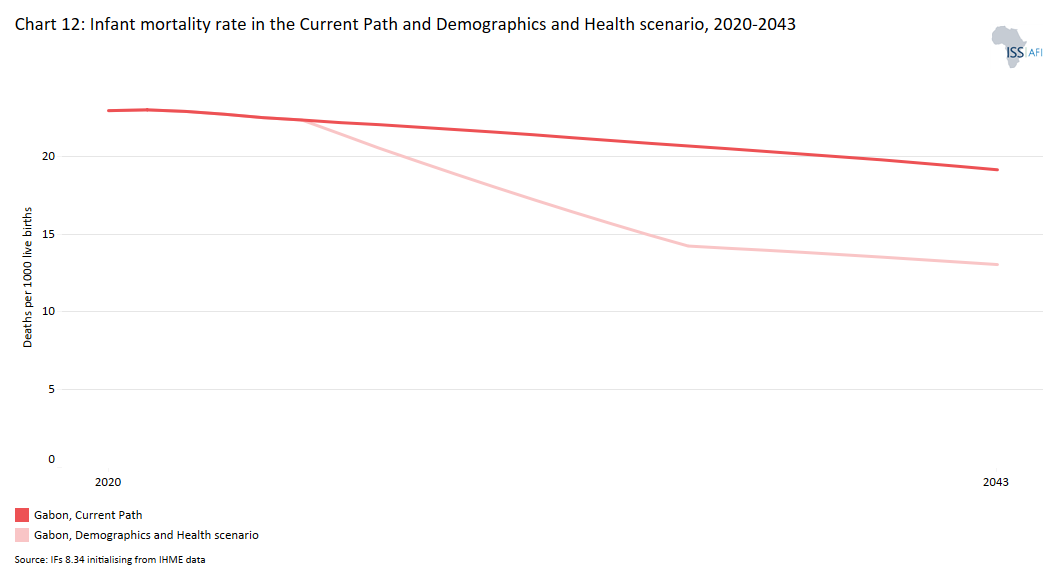

- Chart 12: Infant mortality rate in Current Path and Demographics and Health scenario, 2020–2043

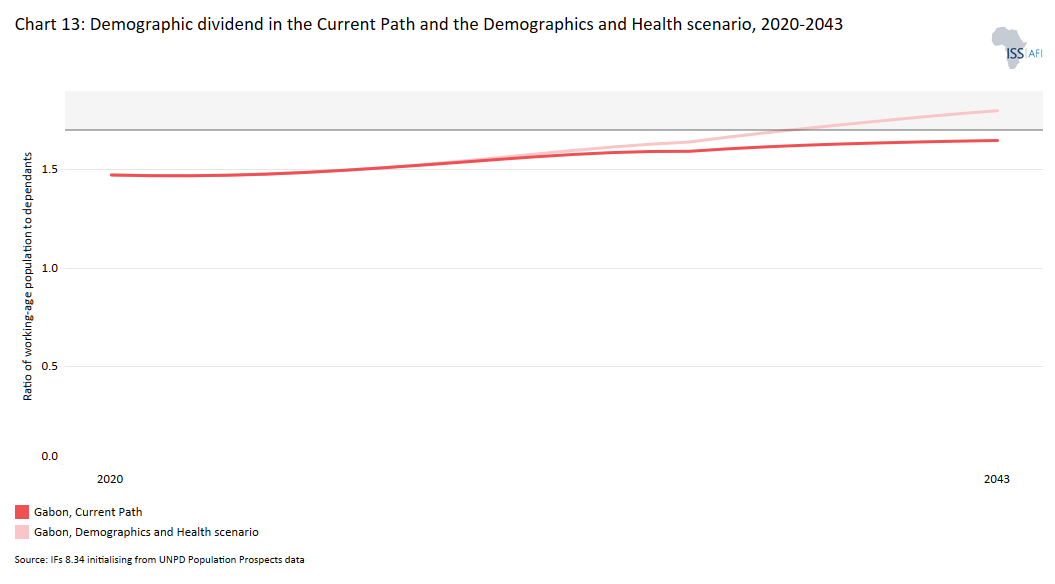

- Chart 13: Demographic dividend in the Current Path and the Demographics and Health scenario, 2020–2043

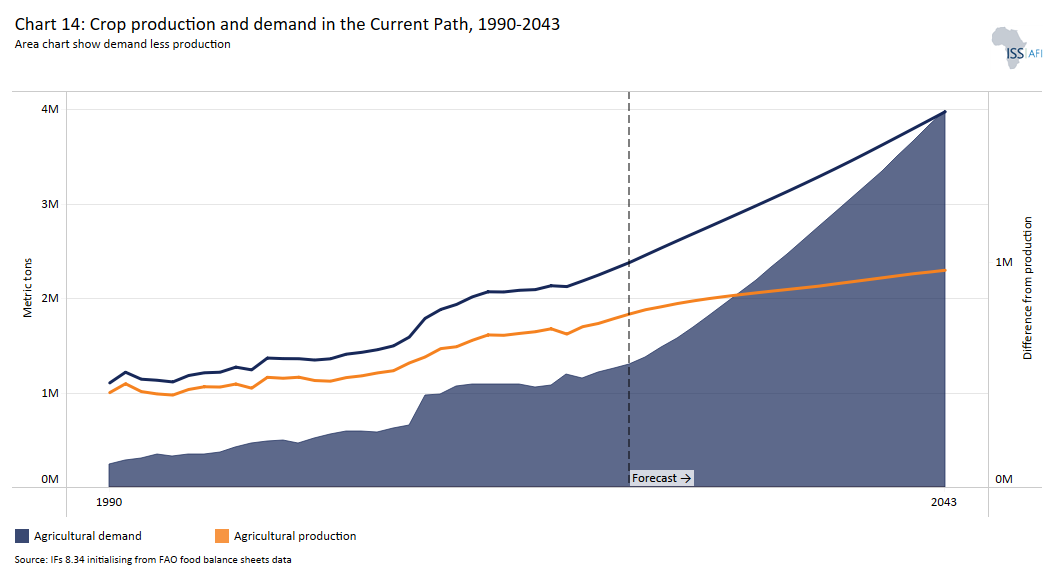

- Chart 14: Crop production and demand in the Current Path, 1990-2043

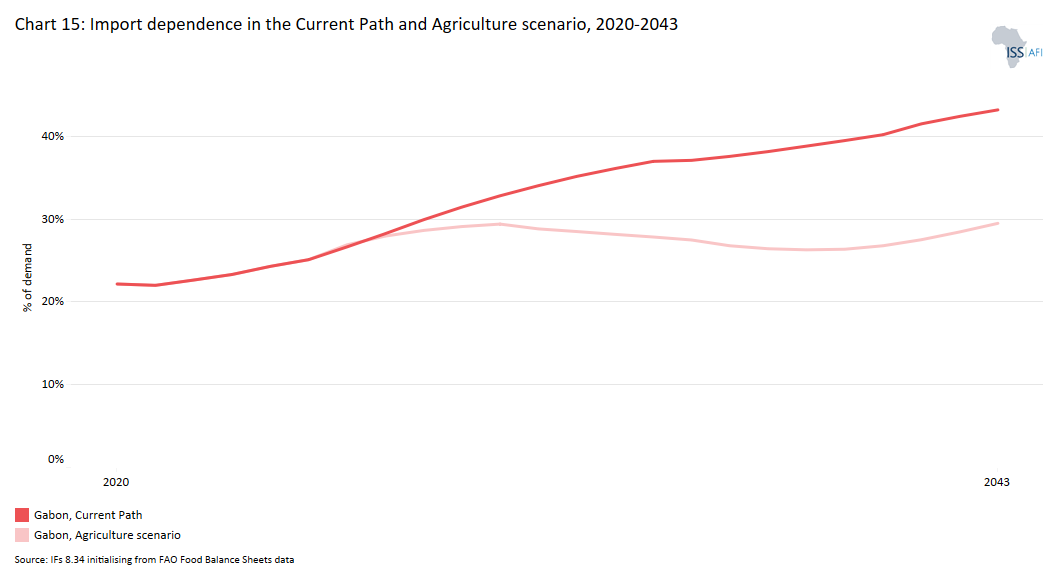

- Chart 15: Import dependence in the Current Path and Agriculture scenario, 2020–2043

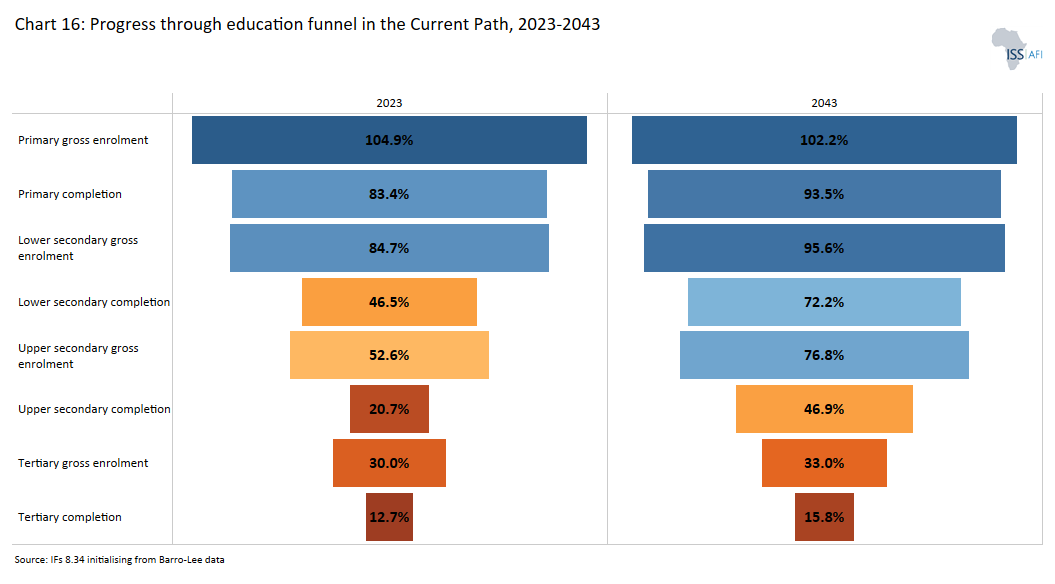

- Chart 16: Progress through the education funnel in the Current Path, 2023 and 2043

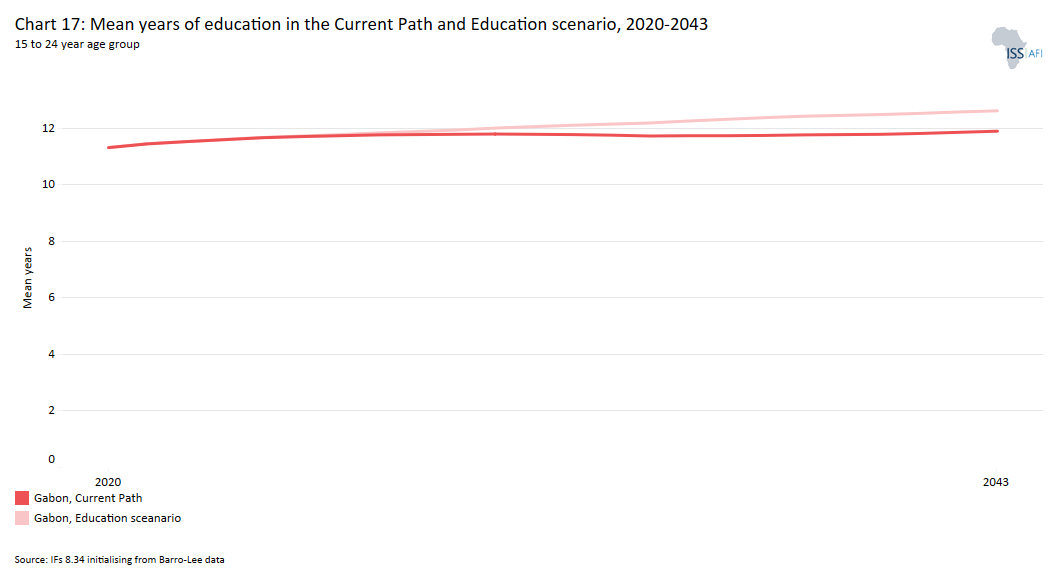

- Chart 17: Mean years of education in the Current Path and Education scenario, 2020–2043

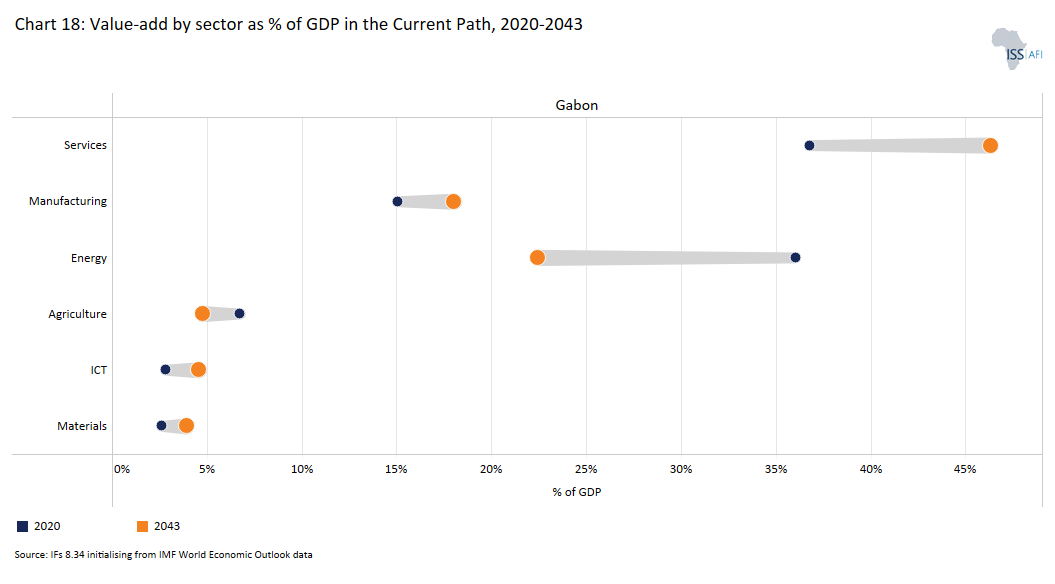

- Chart 18: Value-add by sector as % of GDP in the Current Path, 2023 and 2043

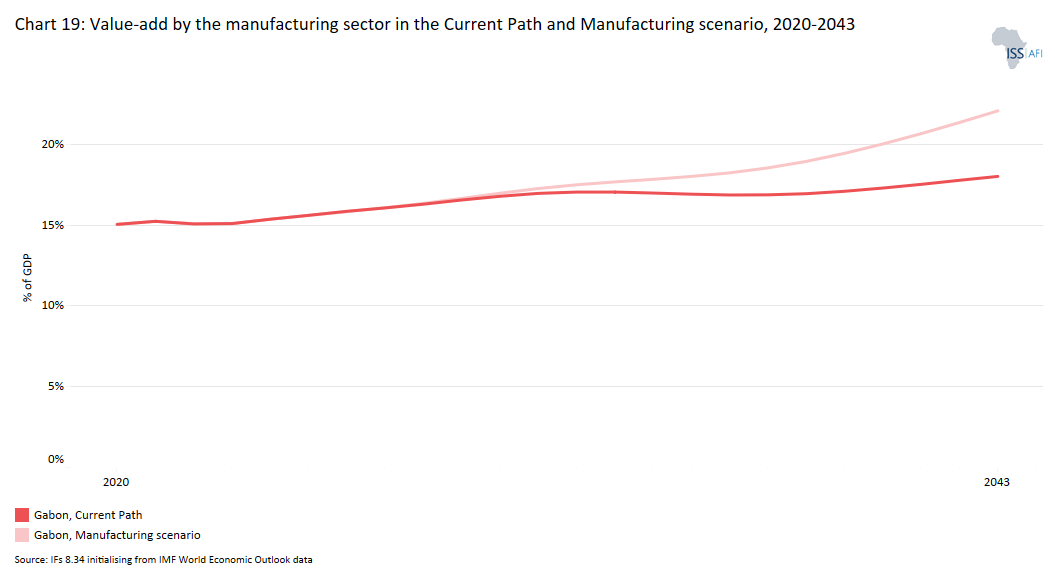

- Chart 19: Value-add by the manufacturing sector in the Current Path and Manufacturing scenario, 2020–2043

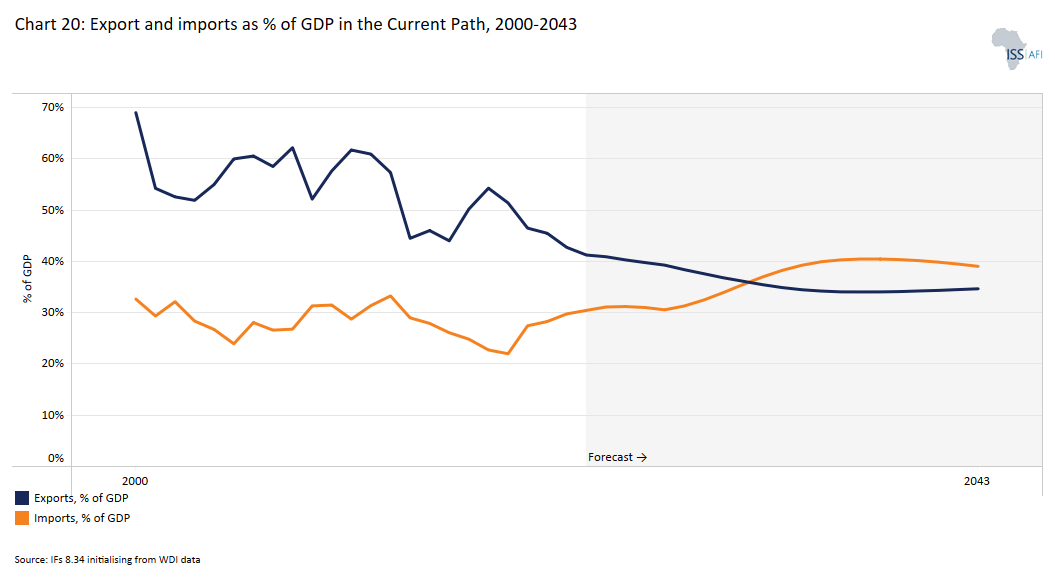

- Chart 20: Exports and imports as % of GDP in the Current Path, 2000-2043

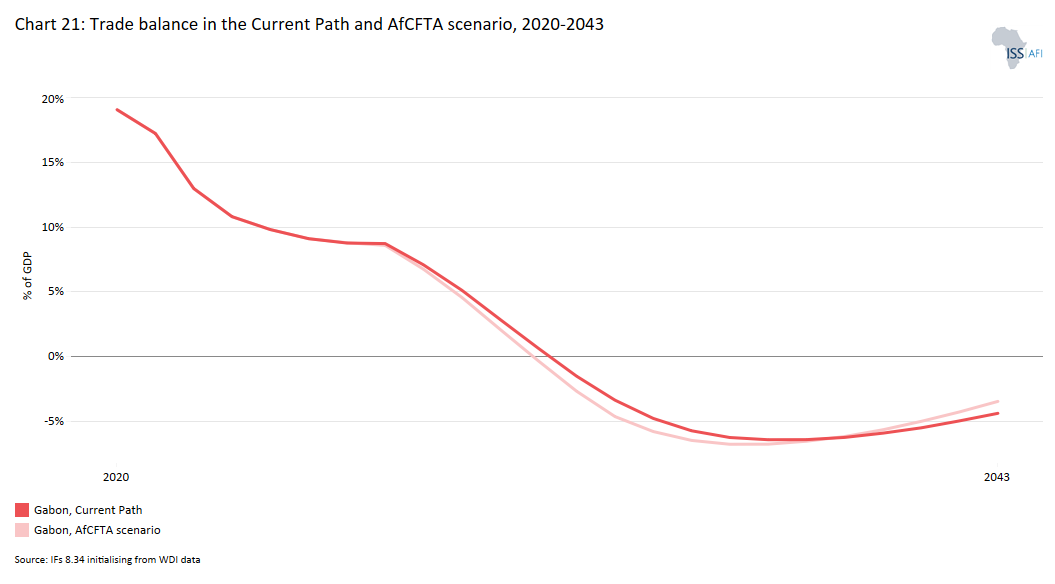

- Chart 21: Trade balance in the Current Path and AfCFTA scenario, 2020–2043

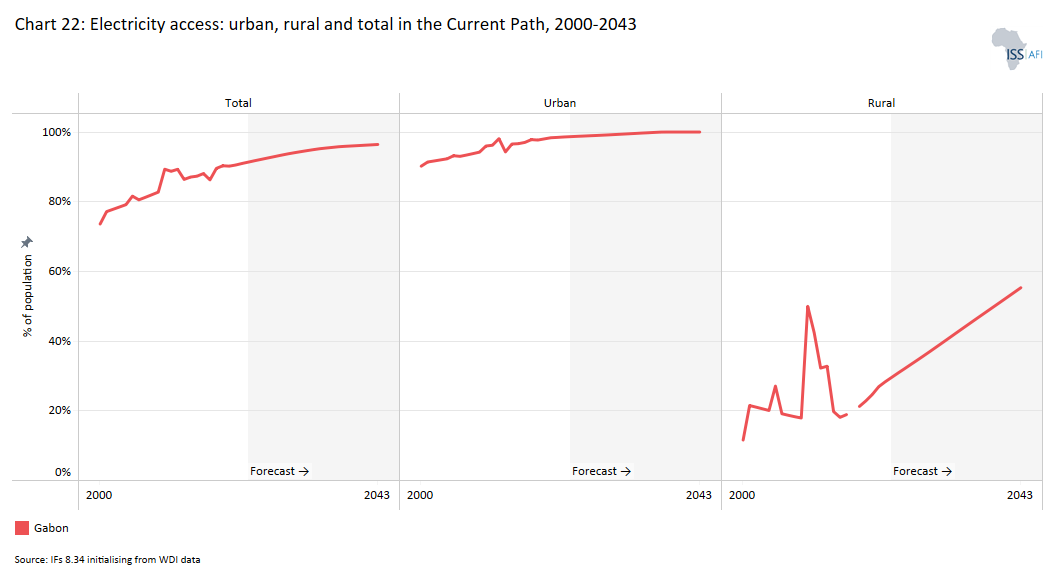

- Chart 22: Electricity access: urban, rural and total in the Current Path, 2000-2043

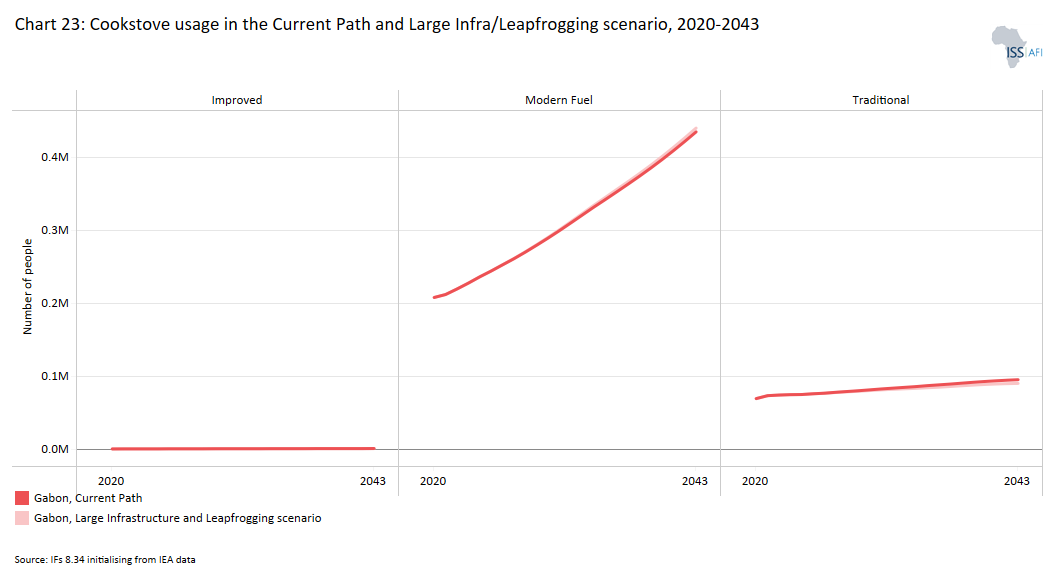

- Chart 23: Cookstove usage in the Current Path and Large Infra/Leapfrogging scenario, 2020–2043

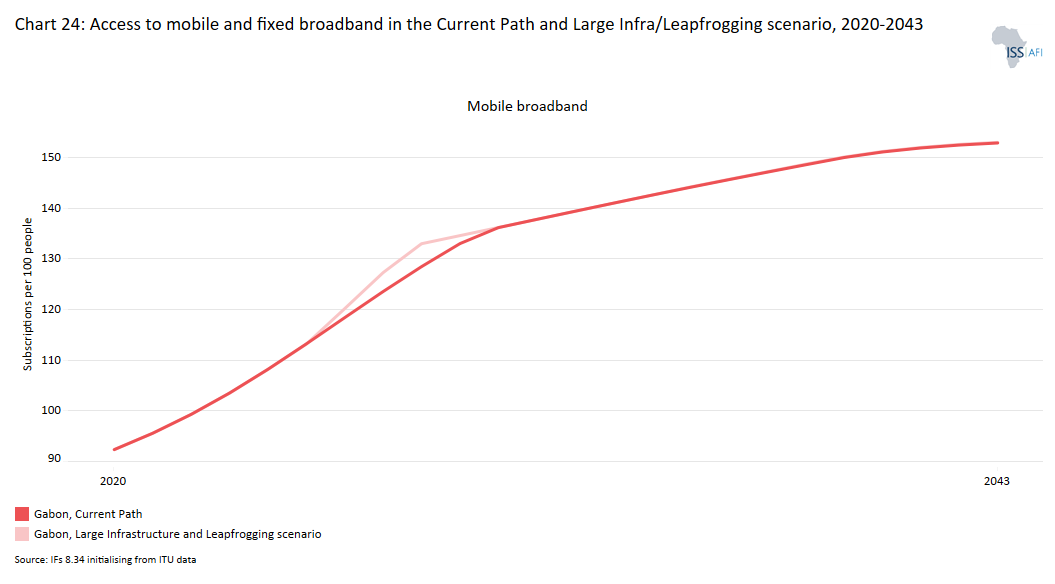

- Chart 24: Access to mobile and fixed broadband in the Current Path and the Large Infra/Leapfrogging scenario, 2020–2043

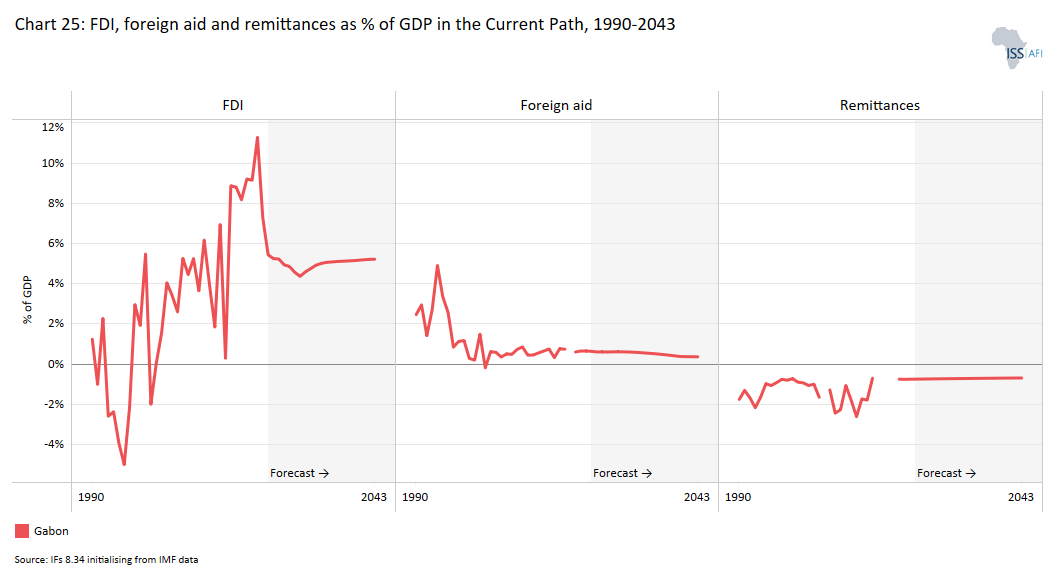

- Chart 25: FDI, foreign aid and remittances as % of GDP in the Current Path and in the Financial Flows scenario, 1990-2043

- Chart 26: Government revenue in the Current Path and Financial Flows scenario, 2020–2043

- Chart 27: Government effectiveness score in the Current Path, 2002-2043

- Chart 28: Composite governance index in the Current Path and Governance scenario, 2023 and 2043

- Chart 29: GDP per capita in the Current Path and scenarios, 2020–2043

- Chart 30: Poverty in the Current Path and scenarios, 2020–2043

- Chart 31: GDP (MER) in the Current Path and Combined scenario, 2020–2043

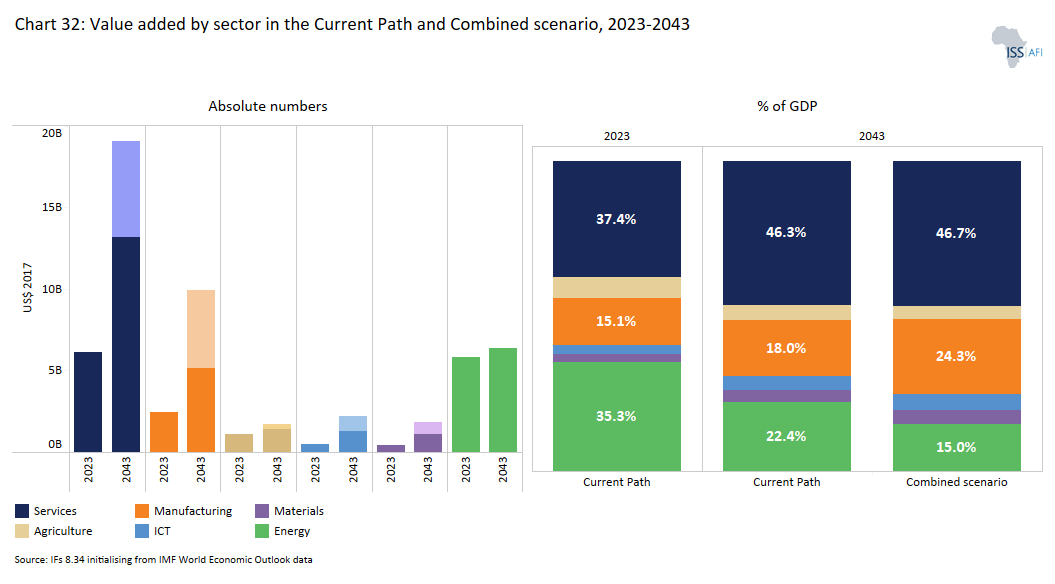

- Chart 32: Value added by sector in the Current Path and Combined scenario, 2023 and 2043

- Chart 33: Informal sector in the Current Path and Combined scenario, 2020–2043

- Chart 34: Life expectancy in the Current Path and Combined scenario, 2020–2043

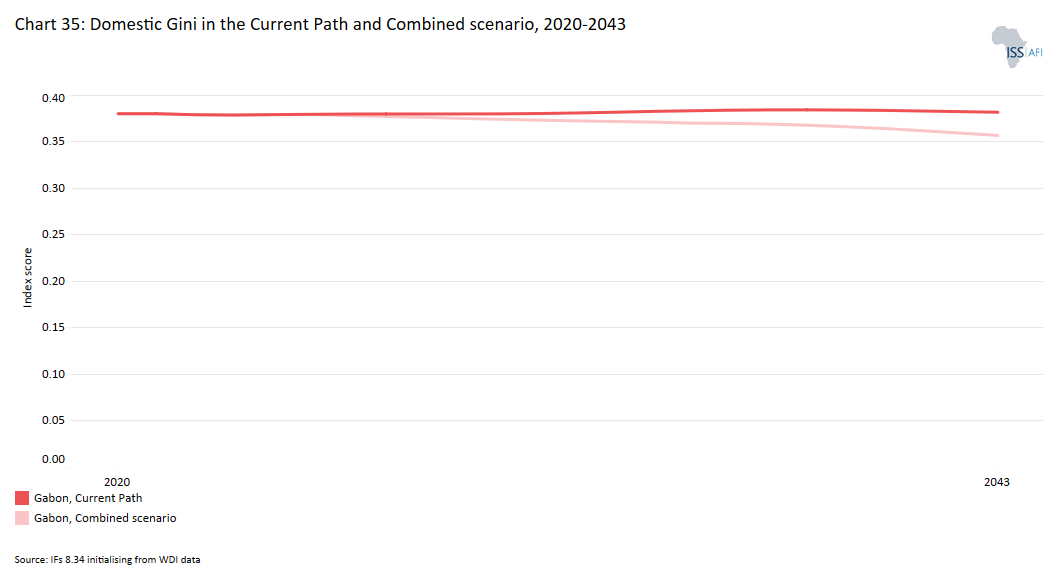

- Chart 35: Domestic Gini in the Current Path and Combined scenario, 2023 and 2043

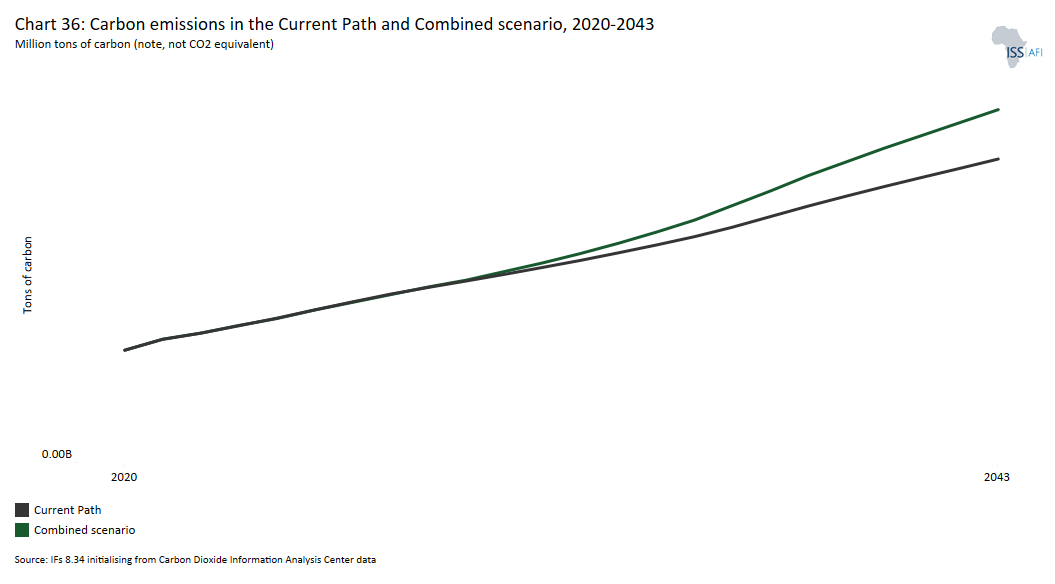

- Chart 36: Carbon emissions in the Current Path and Combined scenario, 2020–2043

- Chart 37: Energy demand and production by type in the Current Path and Combined scenario, 2020-2043

- Chart 38: Policy recommendations

Chart 1 is a political map of Gabon.

Gabon is an upper-middle-income country rich in natural resources that lies on the equator, along the west coast of Central Africa. The country covers an area of about 270 000 km2 with an estimated population of 2.5 million people in 2023. Gabon is bordered by Equatorial Guinea and Cameroon to the north, the Republic of the Congo to the east and south, and the Gulf of Guinea to the west. The islands of São Tomé and Príncipe are situated off the coast.

Gabon has a tropical climate, with year-round high temperatures and humidity. Precipitation is abundant and spread almost throughout the year, typically ranging from 1 500 mm to 3 500 mm per year. The country has a single wet season between October and May, with a mean monthly rainfall of 200 ‐ 250 mm. Gabon’s natural resource wealth includes timber, manganese, natural gas and crude oil. Forests cover 85% of the country’s landmass, making it the second-largest forest area in Africa. There are four ecoregions: the Atlantic Equatorial Coastal forest, Central African mangroves, the Gulf of Guinea central region and the northwestern Congolian lowland forest. Gabon's capital and largest city is Libreville located along the Atlantic coast in the northwest. The official language is French, and the currency in use is the Central African CFA franc.

The Kingdom of Orungu was formed in Gabon by the 18th century and became a powerful trading centre, mainly due to the slave trade. Since its independence from France in 1960, the sovereign state of Gabon has had four presidents. Elected in 1961, the first president, Léon Mba, was overthrown by a coup d'état in 1964 before being restored to power by France. In 1967, judged unfit to govern, he was replaced by Omar Bongo.

Despite the introduction of a multi-party system in the early 1990s, the organisation of elections and a new democratic constitution, Omar Bongo and his Parti Démocratique Gabonais (PDG) kept firm control over Gabon. At his death, the son, Ali Bongo, succeeded him as head of the country in 2009. In September 2023, after a contested election, the long reign of the Bongo family at the head of Gabon was interrupted by a coup d'état, setting up a transition government led by Brice Oligui Nguema, former head of the presidential guard.

Since the beginning of the transition, a national dialogue has been organised to rebuild institutions, lay the foundations for a new constitution, and set the framework for the 2025 presidential and legislative elections. The latter are due to take place on 12 April 2025, earlier than initially planned. The draft constitution was adopted by a popular referendum in November 2024. The constitutional revisions address dynastic rule by setting presidential term limits and banning family members of a sitting president from running for office. However, despite these advances, questions remain regarding the nature of the transition and its potential to deliver a definitive shift toward civilian rule in 2025. The president of the transition officially announced his intention not to run in the next elections, and this could pave the way for more open competition.

Although the military takeover enjoyed popular support locally, it was condemned by both the Economic Community of Central African States (ECCAS) and the African Union (AU) as a violation of the principles of both institutions. As a result, Gabon was suspended from both, before being reinstated by ECCAS in March 2024.

In December 2024, ECCAS announced that it would maintain Gabon’s suspension until constitutional order was restored. At the same time, the bloc sent a positive signal by referring to the “peaceful and inclusive” nature of the coup and by reversing its decision to move its headquarters to Malabo.

Abundant petroleum reserves and foreign direct investment in the oil sector turned Gabon into one of the most prosperous countries in sub-Saharan Africa in terms of GDP per capita.

Gabon’s oil industry started gaining attention even before independence. In 1931, several oil deposits were discovered in regions neighbouring the capital Libreville. In 1975, Gabon became a full member of the Organization of Petroleum Exporting Countries (OPEC). The country withdrew its membership in 1995 but rejoined the organisation in 2016. In 2021, Gabon also rejoined the Extractives Industries Transparency Initiative (EITI), from which it was not suspended despite the military coup.

Gabon is Africa’s seventh-largest oil producer and a net oil exporter although it only plays a minor role in global oil markets. In 2023, Gabon´s share of OPEC members’ crude oil exports stood at 1.04%, the second lowest after Equatorial Guinea.

Crude oil production in Gabon averaged 233.1 barrels per day (bpd) from 1973 until 2024. According to OPEC data, in 2023 it stood at 223 bpd. Due to the natural depletion of mature oil fields, the transition government is developing its offshore, deep-water resources to achieve a target of doubling oil production to 500 000 bpd by 2025. Offshore resources account for more than 70% of Gabon’s about 2 billion barrels of proven reserves, and recent offshore oil discoveries are expected to fuel production growth in the country.

In addition to the oil industry, Gabon possesses abundant primary materials and has potential for agricultural growth, developing the fishing industry and tourism sector development. Other notable exports aside from crude petroleum include manganese ore, sawn wood, veneer sheets and refined petroleum.

Gabon is currently classified as an upper-middle-income country by the World Bank. However, as is the case with several of its oil-producing peers, its resource wealth has not translated into inclusive growth and sustainable development for its population. Therefore, on many development indicators it is not aligned with the average of its income peer group. In the absence of economic diversification and inclusive economic governance, many development challenges persist. About one-third of the population still lives in poverty, inequality is entrenched and the dependence on food imports is growing. The economy is vulnerable to external shocks, and economic growth has yet to lead to sustainable job creation. Unemployment is high, in particular among young people, a problem that is compounded by the high level of informality. Moreover, infrastructure gaps, governance challenges and an unattractive business environment hold the country back.

Beyond guiding the return to civilian rule, the transition government must also lay the foundations for reversing longstanding challenges related to the management of oil wealth, limited inclusion and stagnant incomes, while advancing towards fiscal sustainability.

Chart 2 presents the Current Path of the population structure, from 2020 to 2043.

The demographic profile of a country is key in shaping its long-term social, economic and political path. It is hence a useful predictor for a nation’s development prospects.

Gabon’s demographic profile is misaligned with its upper-middle-income status and closer to the group average of its African lower-middle-income peers. Average total fertility is significantly higher than the global or African average for upper-middle-income countries although, between 1990 and 2023, it has declined from 5.5 to 3.7 births per woman of child-bearing age. In 2023, Gabon's population growth rate stood at 2.3%, roughly the median value for Africa and second highest among Africa’s upper-middle-income economies. From a baseline of hardly a million people in 1990, the country’s population more than doubled to about 2.5 million people in 2023 and is set to grow to 3.7 million people by 2043. Gabon is expected to reach replacement level fertility of 2.1 births per woman of childbearing age only by around 2068.

Relatively high levels of fertility and life expectancy mean that Gabon’s population is young with a demographic structure that is maturing only slowly. In other words, the country's population pyramid is large at the bottom, medium to slim in the middle and very slim at the top. In 2023, half of the population was younger than 22.5 years. More than a third (36.4%) were younger than 15, and only 4% of the population was older than 65. On the Current Path, the share of the population that is under 15 years old will drop to 31.8%, with the older age cohorts constituting a larger share of the overall population. By then, the median age will increase to just over 25 years, 7.7 years below the group average of Africa’s upper-middle-income economies and almost 19 years below the average for the world’s upper-middle-income countries.

A maturing age structure will benefit Gabon’s workforce. By 2043, its working-age population will account for about 62.3% of the overall population, up from 59.6% in 2023. The ratio of people of working age relative to the dependent population is improving slowly. Gabon is set to enter a potential demographic window of opportunity in 2043 with the ratio of working-age persons at 1.7 to one. The contribution of labour will improve economic growth if education and employment opportunities are provided.

In 2023, the average life expectancy in Gabon was 68.4 years with that for women significantly higher (71.7 years) than for men (65.2 years). On the Current Path, the average life expectancy of Gabonese citizens will increase to 71.7 years over the next two decades, 2.5 years below the expected average of 74.2 years for Africa’s upper-middle-income economies in 2043 and more in line with prospects for Africa's low-income economies. The gender gap in Gabon´s life expectancy will grow, reaching 7.1 years compared to 6.4 years in 2023.

Chart 3 presents a population distribution map for 2023.

According to the World Population Review, of the approximately 2.5 million people living in Gabon in 2023, more than a quarter or 578 000 inhabitants, are concentrated in the country’s capital, Libreville, which lies in the northwestern province of Estuaire. The second-largest city is Port-Gentil, with close to 110 000 residents, followed by Franceville with about 43 000 residents, and Oyem and Moanda with about 30 000 residents each. At 8.4 persons per square kilometre, population density in Gabon is low.

The country is characterised by exceptional ethnic diversity. The largest group are the Fang people, representing more than one-fourth of the country’s population. Other groups include the Myene (including the Mpongwe and Orungu), the Sira (including the Punu), the Nzebi and the Mbete. Together, the latter three account for about one-third of the population. Less numerous groups include the Benga and Seke, the Kota and Teke, and the Vili.

Due to its extractive economy as well as its relative political stability, Gabon has historically attracted migrants from neighbouring countries, both regular and irregular and mostly searching for economic opportunities. A recent survey carried out by the International Organisation of Migration reveals that the majority of migrants to Gabon originate from West or Central Africa, mainly Mali, Cameroon and Benin. For some, Gabon serves as a transit point on their journey to Europe.

Chart 4 presents the urban and rural population in the Current Path, from 1990 to 2043.

Mainly because of its oil-based economy, concentrated in urban areas, Gabon is the most urbanised country in Africa. In 2024, more than 90% of the country’s population lived in towns and cities. The average African upper-middle-income country has a ratio of 68.4% urban versus 31.6% rural citizens. Also, smaller countries are typically more urbanised than larger countries as there is less land to cultivate. Gabon’s rural exodus has been fuelled by the development of the oil economy to the detriment of agriculture and the quest for people to look for employment opportunities in urban areas. The rural sector is severely underdeveloped, and despite the availability of land and ideal climatic conditions, small-scale agriculture is mostly subsistence family farming.

Urbanisation has not translated into tangible improvements in the standard of living of most Gabonese, in particular those facing poverty. Two key reasons for this outcome are that the urban economy has not created sufficient jobs and that growth largely occurred in sectors with little connection to people facing poverty, such as oil production. Indeed, growth that does not benefit the poor tends to exacerbate existing inequalities.[1Wold Atlas, Ecological regions of Gabon.] For sustainable urban development to happen, the growing urban workforce needs productive employment opportunities. Low-wage jobs limit the tax base putting pressure on service delivery in urban areas. In Gabon, this is the case for the education sector, for example. Gabon is an example of what Freire et al. summarise, i.e. that ‘[i]f urbanisation occurs without a corresponding increase in economic opportunities and services, the resulting cities will be characterised by concentrations of relatively richer people purchasing low-level services from those migrating to cities, [with] slums and concentrations of basic infrastructure services catering to the higher income parts of the city’.

According to the World Bank, in Gabon poverty is highly concentrated in the country’s largest cities, in particular Libreville and Port Gentil. However, the poverty rate in rural areas is even more widespread and deeper, meaning that those households are far away from the poverty line and hence need more resources to be lifted out of poverty.

Chart 5 presents GDP in market exchange rates (MER) and growth rate in the Current Path, from 1990 to 2043.

Gabon’s GDP (MER) essentially doubled between 1990 and 2023, from US$8.3 billion to US$16.4 billion. The country ranks fifth out of the eight African upper-middle-income economies, with South Africa being the largest economy, followed by Algeria and Libya and Botswana in the fourth spot. On the Current Path, Gabon’s GDP will expand by almost 70% to US$28.5 billion by 2043.

According to the International Monetary Fund (IMF), Gabon's post-Covid economic recovery proved relatively resilient. Growth returned in 2021 after the recession induced by the pandemic and its broader fallouts and despite more recent shocks tied to the coup, logistical disruptions and high fuel prices for businesses. In 2021, the Gabonese economy grew by 1.5%, and 2022 and 2023 saw GDP expanding by 2.9% and 2.3%, respectively. The IMF growth forecast for 2025 is 3%. However, this optimistic outlook is contingent on progress in diversifying the economy as well as on consolidating Gabon’s precarious fiscal position to ensure fiscal sustainability in the future.

Key challenges that the transition government needs to address include:

- Ensuring transparency in managing public resources and improving the business climate,

- Consolidating the fiscal position with a view to ensuring fiscal sustainability,

- Incentivising economic growth, while making it more inclusive,

- Addressing fiscal imbalances to reduce liquidity risks and avoid unsustainable debt dynamics,

- Closing transparency and governance gaps.

The transition authorities are facing a balancing act. Social expectations for the regime change to set Gabon on a more positive development trajectory are high and underpinned by long-standing economic and social grievances. At the same time, the fiscal space is very limited and debt pressure is high. For example, fuel subsidies were expanded despite the significant fiscal cost. Given high fiscal and liquidity risks, the rating agency Moody’s and Fitch downgraded Gabon’s ratings, and the IMF’s May 2024 debt sustainability analysis underlined a high risk of debt distress, noting a significant deterioration in debt sustainability since the previous assessment in 2022. The gradual depletion of oil reserves is adding to the pressure.

Gabon faces US$27 million in arrears to the World Bank, which suspended disbursements in January 2025. The country also has US$700 million in Eurobonds maturing in June 2025 and US$1.8 billion due in 2031.

Chart 6 presents the size of the informal economy as per cent of GDP and per cent of total labour (non-agriculture), from 2020 to 2043. The data in our modelling are largely estimates and therefore may differ from other sources.

Countries with high informality typically encounter multiple development challenges connected to low revenue mobilisation. Further, high levels of informality tend to hold back economic growth.

In 2023, Gabon´s informal economy accounted for approximately 33.6% of GDP, by far the highest share among its upper-middle-income peer economies in Africa. In Botswana, which ranks second, the informal sector accounts for only 18.6% of GDP, and the group’s average is 14.9%. The share of Gabon´s informal sector is even higher than in the average African low-income economy where in 2023 the informal sector accounts for 29.3% of GDP.

On the Current Path, Gabon’s informal economy will decline relative to the formal economy, likely reflecting higher incomes as well as some improvements in overall state capacity, including for taxation. However, without targeted policy intervention progress will be very limited. In 2043, the informal sector will still account for 29.3% of the country's GDP. With limited formal sector opportunities, most of Gabon’s workforce is employed in the informal sector which adds little value to the economy overall other than often precarious employment. In 2023, informal labour accounted for more than half of total labour (51.1%). In the Current Path, this share will drop to 47.8% by 2043.

For oil-exporting economies, such as Gabon, persistently high levels of informality are not uncommon. The latter stem from economic structures that benefit exports of natural resources with limited diversification, hence constraining the tax base.

This explains that expected improvements are modest at best and misaligned with the country's upper-middle-income peer economies in which the informal sector will on average account for only 13.9% of GDP by 2043. Even in Africa´s low-income economies the informal economy will on average account for only 27% of GDP by 2043.

Addressing informality constructively is essential to promote inclusive wealth creation in Gabon and reduce inequalities. The sector is the only source of income for most people of working age. Improving access to quality education, job creation and financial inclusion are some policies that can reduce informality.

Chart 7 presents GDP per capita in the Current Path, from 1990 to 2043, compared with the average for the Africa income group.

In 2023, Gabon had a GDP per capita of US$13 460, US$1 000 above the African upper-middle-income group average of US$12 520. The country ranked 4th among its income peers on the continent. However, GDP per capita growth in Gabon has been extremely limited. In fact, in 2023 average incomes are lower than in 1990 when GDP per capita stood at US$18 000 or in 2000 when it was US$16 000. On the Current Path, Gabon’s per capita income will continue to stagnate and only increase by about 7% to US$14 370 in 2043.

Gabon’s GDP per capita evolution essentially mirrors fluctuations in global oil prices and domestic production dynamics in a context of relatively high population growth. Gabon's GDP per capita (PPP) peaked spectacularly following intense oil exploration and production activity during the 1960s and 1970s. In 1976, GDP per capita reached USD$31 090, but soon after dropped to levels between US$20 000 and US$18 000 during the 1980's and 1990's. The 2000s were characterised by even lower levels of GDP per capita, and in 2023, Gabon’s GDP per capita fell to US$13 460. Among its African upper-middle income peers, Gabon has the 4th-highest GDP per capita, following Mauritius (highest), Libya and Botswana. The group´s average in 2023 was US$12 520. On the Current Path, Gabon's GDP per capita will reach US$14 370 by 2043.

On the Human Development Report 2023/2024, Gabon scored 0.693 based on data from 2022 (higher scores mean higher human development). The country ranked 123 out of 191 countries and was among the top scorers of the medium human development category. However, it is worth noting that Gabon fell six ranks on the index between 2015 and 2022.

Chart 8 presents the rate and numbers of extremely poor people in the Current Path from 2020 to 2043.

In 2022, the World Bank updated the poverty lines to 2017 constant dollar values as follows:

- The previous US$1.90 extreme poverty line is now set at US$2.15, also for use with low-income countries.

- US$3.20 for lower-middle-income countries, now US$3.65 in 2017 values.

- US$5.50 for upper-middle-income countries, now US$6.85 in 2017 values.

- US$22.70 for high-income countries. The Bank has not yet announced the new poverty line in 2017 US$ prices for high-income countries.

As an upper-middle-income country, Gabon uses the US$6.85 benchmark to define poverty. The country’s poverty burden is high considering its GDP per capita. In the past, economic growth has not led to improved development outcomes for the overall population. In 2023, 31.3% of Gabonese were living below the poverty line, the equivalent of 778 810 people.

However, Gabon’s poverty rate lies 26.9 percentage points below the 58.3% average of its very heterogeneous African upper-middle-income peer group. South Africa, Botswana and Namibia are the countries with the highest poverty rates in that group. All three also are characterised by extremely high inequality that extends beyond income inequality. In South Africa, 62.9% of the population lived below the poverty line in 2023. Mauritius was the country with the smallest share of people living in poverty, i.e. 12.2%, and Gabon´s poverty rate was ranked third lowest in 2023. On the Current Path, Gabon’s poverty rate will decline to 11.8% by 2043.

Monetary poverty only tells part of the story, however. Therefore, the global Multidimensional Poverty Index (MPI) assesses acute multidimensional poverty by measuring each person’s overlapping deprivations across 10 indicators in three equally weighted dimensions: health, education and standard of living. The MPI complements the respective international monetary poverty thresholds by identifying who is multidimensionally poor and also shows the composition of multidimensional poverty. The headcount or incidence of multidimensional poverty is often several percentage points higher than that of monetary poverty. This implies that individuals living above the monetary poverty line may still suffer deprivations in health, education and/or standard of living. Gabon scores 0.037 on the Multidimensional Poverty Index 2024 with 8% of the population considered multidimensionally poor and with sanitation and nutrition being the most critical dimensions. For comparison, Botswana’s and Namibia’s scores are 0.073 and 0.175, respectively (higher is worse). The average score for sub-Saharan Africa is 0.254.

Chart 9 depicts the National Development Plan of Gabon.

Gabon has produced a series of development plans. Under the second Ali Bongo administration, the ‘Emerging Gabon 2025’ plan (PSGE) served as the central guiding document with implementation starting in 2012. The plan had three overarching goals: (i) acceleration of economic growth and economic diversification, (ii) reduction of poverty and social inequalities and (iii) sustainable management of the country's resources.

To achieve this, the plan identified three strategic paths:

- Strengthening the foundations to become a globally competitive country via investments in human capital, sustainable natural resource management, governance and infrastructure.

- Establishing three pillars that can accelerate sustainable development, namely Industrial Gabon, Green Gabon and Service Gabon.

- Facilitating inclusive growth and shared prosperity for all segments of the population through investments in health services, water and sanitation, housing and employment.

In July 2023, the Ali Bongo administration launched a Health Development Plan (Plan National du Développement National du Gabon) to accelerate progress towards universal health coverage.

In the aftermath of the coup, in January 2024, the transition government released its own development plan which, however, aligned with the priorities spelled out in the previous document. The Plan National de développement pour la Transition (PNDT) or National Development Plan for the Transition is a strategic document that sets out development priorities for the period 2024 to 2026. The plan reflects the vision of the Committee for the Transition and Restoration of Institutions (CRTI) and aims to promote sustainable and inclusive economic growth to improve the living conditions of the Gabonese people. To achieve this, the plan advocates the diversification of the Gabonese economy, by developing neglected sectors such as agriculture, tourism, industry and services.

The four strategic pillars of the PNDT are:

- The development of strategic infrastructure,

- Economic diversification,

- The promotion of a new social pact for inclusive development,

- The strengthening of environmental sustainability.

In addition, the plan envisions institutional reforms to ease the political transition. Priority projects to be financed include: the construction of new infrastructure, such as Libreville 2, adapted social housing, the creation of a Development Bank, as well as initiatives to strengthen sectors, such as aviation and road transport.

The eight sectoral scenarios as well as their relationship to the Current Path and the Combined scenario are explained in the About Page. Chart 10 summarises the approach.

Chart 11 presents the mortality distribution in the Current Path for 2023 and 2043.

Chart 12 presents the infant mortality rate in the Current Path and in the Demographics and Health scenario, from 2020 to 2043.

The infant mortality rate is the probability of a child born in a specific year losing their life before reaching the age of one. It measures the child-born survival rate and reflects the social, economic and environmental conditions in which children live, including their health care. It is measured as the number of infant deaths per 1 000 live births and is an important marker of the overall quality of the health system in a country.

The infant mortality rate is an important marker of the overall quality of a country’s health system. Gabon significantly reduced its infant mortality rate over the past decades from 55.6 deaths per 1 000 live births in 1990 to 22.7 deaths in 2023. In the Demographics and Health scenario, Gabon´s infant mortality rate will drop by 42.5% to 13 deaths by 2043. The Current Path forecasts 19.1 deaths per 1 000 live births in 2043. The scenario interventions will help Gabon outperform the expected African upper-middle-income group average of 19.2 deaths in 2043 and bring it very close to meeting the SDG infant mortality goal of 12 deaths per 1 000 live births. Globally, the average upper-middle-income country already reached this target in 2023 while upper-middle-income Africa still lags behind with 23.8 deaths per 1 000 live births in 2023.

Access to safe water in Gabon is close to universal. However, the country still performs poorly on access to improved sanitation, an important driver of improved health outcomes. In 2023, only 51.1% of the population had access to improved sanitation compared to the average of 81.2% in Africa’s upper-middle-income countries.

The Demographics and Health scenario envisions ambitious improvements in child and maternal mortality rates, enhanced access to family planning, and decreased mortality from communicable diseases (e.g., malaria, other communicable diseases) and non-communicable diseases (e.g., cardiovascular diseases, malignant neoplasms), alongside advancements in safe water access and sanitation. This scenario assumes a swift demographic transition supported by heightened investments in health and water, sanitation and hygiene (WaSH) infrastructure.

Visit the themes on Demographics and Health/WaSH for more detail on the scenario structure and interventions.

Chart 13 presents the demographic dividend in the Current Path and in the Demographics and Health scenario, from 2020 to 2043.

The dividend is the window of economic growth opportunity that opens when the ratio of working-age persons to dependants increases to 1.7 to 1 and higher, i.e. when the population structure changes. If for every dependant, there are 1.7 workers, there are fewer dependants to take care of, which frees up resources to invest in both physical and human capital formation. However, the improvement in the ratio between working-age persons relative to dependants does not automatically translate into rapid economic growth unless the labour force is sufficiently skilled and can be absorbed by the labour market. Failing improved education and employment generation to successfully harness their productive power, the growing labour force (especially those in urban areas) could increasingly become frustrated with the lack of job opportunities leading to social tension and even driving instability.

In 2023, the ratio of the working-age population to dependants in Gabon was 1.5 to 1. This means that, on average, for every dependant in Gabon, there were roughly 1.5 people of working age (15–64 years of age). This is significantly below the 1.8 to 1 average for African upper-middle-income countries but above the 1.4 to 1 average for lower-middle-income countries in Africa in the same year. On the Current Path, Gabon would enter the window of demographic opportunity only around 2050 versus in 2036 in the Demographics and Health scenario. By 2043, that ratio will reach 1.8 to 1, much closer to the average for Africa´s upper-middle-income economies (1.99-to-1) and 0.15 points above the ratio to be expected on Gabon´s Current Path (1.65-to-1).

Chart 14 presents crop production and demand in the Current Path from 1990 to 2043.

The Agriculture scenario envisions an agricultural revolution that ensures food security through ambitious yet feasible increases in yields per hectare, thanks to improved management, seed, fertiliser technology, and expanded irrigation and equipped land. Efforts to reduce food loss and waste are emphasised, with increased calorie consumption as an indicator of self-sufficiency and prioritising it over food exports. Additionally, enhanced forest protection signifies a commitment to sustainable land use practices.

Visit the theme on Agriculture for our conceptualisation and details on the scenario structure and interventions.

The data on agricultural production and demand in our modelling initialises from data provided on food balances by the Food and Agriculture Organization (FAO). Our model contains data on numerous types of agriculture but aggregates its forecast into crops, meat and fish, presented in million metric tons.

In 2023, Gabon’s total crop yield was approximately 1.8 million metric tons per hectare. Crop yields will increase by 25% to 2.3 million metric tons per hectare in 2043. However, crop production is outpaced by demand increasing the risk for excessive food import dependence. In 2023, 1.8 million metric tons were not enough to meet domestic demand, which stood at 2.4 million metric tons. Population growth combined with an unproductive agricultural sector means that the gap between demand and production has continuously been widening. The gap of almost 0.6 million metric tons observed in 2023 will widen to 1.6 million metric tons by 2043. A growing gap automatically translates into growing import dependence for food items, which in turn affects the current account balance.

Gabon has exceptional agricultural potential, but the agricultural sector remains underdeveloped and productivity is severely limited. This is a result of the economy’s over-reliance on oil as well as other factors, including the land tenure system, the infrastructure deficit, and more. The country has more than five million hectares of arable land, of which less than 10 per cent is being used for agricultural production, mostly subsistence farming. In 2023, the agricultural sector accounted for 6.7 per cent of Gabon's GDP, but its contribution will decline to 4.8 per cent by 2043.

However, in the pursuit of greater economic diversification for employment creation, poverty reduction and sustainable development overall, it is necessary to invest in agriculture. After all, Gabon boasts extremely favourable conditions for promoting agricultural development as land is available and easy to cultivate. In 2015, Gabon with the assistance of the UN Food and Agriculture Organisation (FAO), World Bank, Economic Community of Central African States and the New Partnership for Africa’s Development, had adopted a roadmap for the development of the sector with the explicit goal for it to account for 8.4% of GDP by 2020.

Some progress has been made since. In 2023, the agricultural sector accounted for 6.7% of Gabon's GDP (MER), up from 4.3% in 2015. The 2023 value lies just below the average for the world´s upper-middle-income economies at 7.1% which is significantly above the African upper-middle-income average of 4.5%. In relative terms, Gabon has the third-largest agricultural sector among its African upper-middle-income peers, following Namibia (ranked 2nd at 7.5%) and Algeria (ranked 1st at 10.2%). The remaining countries all have agricultural sectors that account for less than 4% of GDP. On the Current Path, however, the importance of Gabon´s agricultural sector will decline (4.8% by 2043). In the Agriculture scenario, the value added by the agricultural sector will account for 5.6% of GDP in 2043.

In 2023, Gabon’s crop production stood at 1.8 million metric tons. In the Current Path, it will increase by 25% to 2.3 million metric tons in 2043. Interventions in the Agriculture scenario create momentum and push crop production to 2.7 million metric tons; a nearly 50% increase.

This level of crop production is still not enough to meet the increasing demand of a growing population, but it will help to gradually reduce the gap. In 2023, demand for crops was estimated at 2.4 million metric tons. By 2043, it will have grown to 3.9 million metric tons. In 2023, the gap between production and demand was 0.6 million metric tons. In 2043, in the Current Path, production will fall 1.6 million metric tons short of demand in 2043. In the Agriculture scenario, the expected gap will be 1.2 million metric tons; smaller than on the projected Current Path trajectory yet larger than in 2023. This result illustrates that systems are interconnected and more importantly the need for holistic development planning.

Chart 15 presents the import dependence in the Current Path and the Agriculture scenario, from 2020 to 2043.

In the Agriculture scenario, total agricultural production will increase from 2 million metric tons in 2023 to about 3 million metric tons by 2043, 0.5 million tons more than in the Current Path. This helps to curb the growing level of import dependence that Gabon will experience on the Current Path as demand continues to grow due to population growth. In 2023, imports accounted for 28.6% of agricultural demand. With increased agricultural production in the Agriculture scenario, by 2043, imports will account for 35% of agricultural demand compared to 46.7% in the Current Path. This reflects a reduction in import dependence by 25%.

Chart 16 depicts the progress through the educational system in the Current Path, for 2023 and 2043.

The Education scenario represents reasonable but ambitious improvements in intake, transition and graduation rates from primary to tertiary levels and better quality of education at primary and secondary levels. It also models substantive progress towards gender parity at all levels, additional vocational training at the secondary school level, and increases in the share of science and engineering graduates.

Visit the theme on Education for our conceptualisation and details on the scenario structure and interventions.

Gabon’s education system is largely based on the French model, although efforts are underway to adapt the curriculum to better align with local needs. Education in Gabon is free and compulsory for all children between the ages of 6 and 16. Coming from a relatively high base, however, education in Gabon has deteriorated in recent years. The system is characterised by poor performance, evidenced in its high school dropout rates, and high repetition rates. Gabon’s general expenditure on education as a share of GDP is low. In 2022, education expenditure was estimated to account for 2.2% of GDP, 1.7 percentage points below the regional average of just under 4% of GDP. In fact, expenditure was at its peak in 2000 (3.8%) and has since experienced fluctuation with a significant drop since 2020 when it stood at 3.4% of GDP.

In primary education, the repetition rate stands at 37%, one of the highest globally, while in secondary education, the repetition rates are 26% for lower secondary and 23% in upper secondary. Currently, the share of the Gabonese population that has received no formal education at all stands at 17%. Among those over the age of 30, 9.7% have attained a higher level of education, 39.3% have completed secondary education, and 28% have finished only primary education.

Gabon has one of the highest primary enrollment rates in Africa, with gross primary enrolment above 90%. However, the high dropout rate means that only 57% of girls and 48% of boys successfully transition to secondary school. Primary enrolment rates are 104.9% in 2023, down from 139.9% in 2011. On the Current Path, primary enrolment rates will continue to drop, reaching 102.2% by 2030 and stagnate thereafter. In lower-secondary education, enrolment was 84.7% in 2023 and will increase to 90% by 2030 and reach 95.6 in 2043. Enrolment rates in upper-secondary education stood at 52.6% in 2023 and will increase to 64.9% and to 76.8% by 2030 and 2043, respectively. Tertiary education sees the lowest enrolment rate, with 30% in 2023, projected to increase to 32.1% by 2030 and to 33% by 2043.

A 2011 study by the Association for the Development of Education in Africa (ADEA) identified several issues contributing to Gabon’s high dropout and repetition rates. These included limited access to schools, particularly in the rural areas; inadequate funding and mismanagement of funds; shortages of qualified teachers and ineffective pedagogical supervision; as well as a lack of clear guidance for students in selecting suitable training programmes. The study also highlighted insufficient preparation of students for higher education, poorly defined transitions between secondary and higher education, and substandard quality of education at both secondary and higher levels.

Completion rates follow the same trend as gross enrolment rates, with the highest rates recorded at the primary level, followed by a sharp decline as students progress to higher education levels. In 2023, the primary completion rate was 83.4%, while lower-secondary rates saw a significant drop to 46.5%. Upper-secondary completion stood at 20.7%, with tertiary education having the lowest rate at just 12.7%.

In 2023, the ratio of girls to boys for primary enrolment was 1, which reflects the expected trend where more boys than girls are enrolled in schooling. However, the ratio changes in favour of girls at higher education levels. At the lower-secondary level, the ratio increases to 1.07, to 1.06 at the upper-secondary level, and jumps to 3.9 at the tertiary level. This reflects a global trend as in many countries, secondary and even more so tertiary enrolment rates for females surpass those of their male peers.

However, the composition of Gabon’s labour force does not reflect such progress in educational gender parity as female participation stands at only 39.9% compared to 57.7% for men in 2023. This indicates that systemic barriers and gender inequalities prevent women from fully benefiting from their educational achievements on the labour market.

The Education scenario helps to narrow the gender gap at the tertiary education level by bringing the female/male student ratio down to 1.3 in 2043 compared to the projected Current Path ratio of 2.5 female students per one male student. This means that by 2043, male tertiary enrolment will reach 51.1% and female enrolment will be 66.5% compared to the projected 19.2% and 47.6%, respectively, on the Current Path. On the upper-secondary level, the gender gap will practically be closed with enrolment rates of female and male students reaching 119.3% and 122.2%, respectively.

Chart 17 presents the mean years of education in the Current Path and in the Education scenario, from 2020 to 2043, for the 15 to 24 age group.

The average years of education in the adult population aged 15 to 24 is a good first indicator of how the stock of knowledge in society is changing.

Gabon ranks third among Africa's 54 countries for the highest mean years of education, with an average of 11.6 years in 2023. Notably, the mean years of education were higher for girls at 12.4 years compared to 10.8 years for boys, highlighting a gender disparity in favour of female educational attainment. Given Gabon’s already high mean years of educational attainment, the implementation of the Education scenario yields modest improvements. By 2043, the mean years of education for boys will increase to 11.9 years, up from 11 years on the Current Path. Over the same time horizon, mean years of education for girls will rise to 13.4 years compared to 12.8 years on the Current Path. Overall, the mean years of education will reach 12.6 years, an improvement from the projected 11.9 years on the Current Path.

In 2022, only 13% of baccalaureate candidates in Gabon came from science majors, and of these, just 50% successfully graduated to pursue higher education. This highlights a shortage of science students and graduates in the country. Contributing factors include a lack of science teaching materials, infrequent practical training for teachers and inadequate infrastructure in schools, such as laboratories and microscience kits, which are important for fostering the necessary skills among students. In 2023, science and engineering students accounted for 20.8% of tertiary graduates in Gabon. On the Current Path, this share will decline to 20.3% by 2043. However, the Education scenario offers a more optimistic outlook, with the share of science and engineering students expected to increase to 25.3% by 2043.

Chart 18 presents the value-add by sector as share of GDP in the Current Path, for 2023 and 2043.

In the Manufacturing scenario, reasonable but ambitious growth in manufacturing is envisaged through increased investment in the sector, research and development (R&D), and improved government regulation of businesses. This aims to enhance total labour participation rates, particularly among females.

Visit the theme on Manufacturing for our conceptualisation and details on the scenario structure and interventions.

Gabon’s key industries besides petroleum are minerals (mostly manganese) and timber processing with the industry expanding into the manufacturing of furniture and plywood products.

The country’s industry faces a series of obstacles, such as insufficient infrastructure, in particular transport networks, energy and port facilities which limit local value addition. Moreover, Gabon's industrial sector lacks competitiveness due to high energy costs and low productivity, and access to finance for local small and medium-sized enterprises (SMEs) is a challenge.

In 2023, manufacturing accounted for about 15.1% of Gabon’s GDP (US$2.5 billion). The services sector accounted for 37.4% of GDP, the equivalent of US$6.1 billion, followed by energy which represented 35.2% of GDP (US$5.8 billion). Agriculture contributed US$1.1 billion, representing 6.7% of GDP. In the future, the services sector will continue to be the most important contributor to Gabon’s GDP, forecast to account for 46.3% of GDP by 2043 at a value of US$13.4 billion, followed by the energy sector that will account for 22.5% of GDP (US$6.4 billion). The manufacturing sector will account for 18% of GDP (the equivalent of US$5.1 billion) and the relative contribution of agriculture will decline to account for 4.8% of GDP (US$1.4 billion).

Chart 19 presents the contribution of the manufacturing sector to GDP in the Current Path and in the Manufacturing scenario, from 2020 to 2043. The data is in US$ and % of GDP.

In 2023, the value added by Gabon´s manufacturing sector accounted for 15.1% of GDP. This is in line with the average of the world´s lower-middle-income economies and more than 2 percentage points above the average of its African upper-middle-income peer group (12.7%). In the world´s upper-middle-income economies, in 2023 manufacturing accounted for on average 21.2% of GDP. On the Current Path, the value added to GDP by Gabon´s manufacturing sector will increase to 18% by 2043, again matching the expected average of the world´s lower-middle-income economies (18.1%) and outperforming the average of both its African lower-middle- (17.2%) and upper-middle-income economies (13.7%).

In the Manufacturing scenario, the value added by Gabon´s manufacturing sector will account for 22.1% of GDP in 2043, an increase of 4 percentage points compared to the Current Path and slightly ahead of the average of the world´s upper-middle-income economies (21.2%). Added value by manufacturing as per cent of GDP will increase by more than 22% relative to the 2023 baseline.

During the last 20 years Gabon's economy has become relatively less complex, moving from the 98th to the 112th position in the Economic Complexity Index (ECI) rank. The ECI measures an economy's capacity which can be inferred from data connecting locations to the activities that are present in them. It is a holistic measure of the productive capabilities of large economic systems, such as countries, cities or regions. Productive capabilities are all the inputs, technologies and ideas that, in combination, determine the frontiers of what an economy can produce. They include infrastructure, land, laws, machines, people, collective knowledge and more. Typically, economies with higher economic complexity exhibit faster economic growth.

Chart 20 depicts exports and imports as a percentage of GDP, from 2000 to 2043, in the Current Path and in the AfCFTA scenario.

The AfCFTA scenario represents the impact of fully implementing the African Continental Free Trade Agreement by 2034. The scenario increases exports in manufacturing, agriculture, services, ICT, materials and energy exports. It also includes improved multifactor productivity growth from trade and reduced tariffs for all sectors.

Visit the theme on AfCFTA for our conceptualisation and details on the scenario structure and interventions.

Gabon’s economy is largely dependent on its natural resource sector, primarily oil. Key exports include crude petroleum, manganese ore, sawn wood, veneer sheets and refined petroleum. Major trading partners are China, South Korea, Italy, India and Indonesia. At the continental level, Gabon’s major export partners in 2022 were Morocco, Benin, DR Congo, Algeria and the Republic of Congo.

The top imports are poultry meat, excavation machinery, packaged medicaments, cars and delivery trucks. Major trading partners are China, France, United Arab Emirates, United States and Belgium. At the continental level, Gabon’s key import partners included South Africa, Cameroon, Morocco, Senegal and Benin.

Gabon has a high level of specialisation in manganese ore, veneer sheets, sawn wood, plywood, and manganese oxides. Specialisation is measured using RCA, an index that takes the ratio between observed and expected exports in each product.

Gabon is a member of the Central African Economic and Monetary Community (CEMAC). Trade within CEMAC is notably lower compared to other African regional groupings. Trade in the region has been hindered by several challenges, including the limited complementarity of natural endowments, costly border procedures and the small size of regional markets. Moreover, the region's common external tariff, with an average rate of 18.3%, is relatively high, posing a significant barrier to competition. For Gabon, these challenges exacerbate its reliance on external markets and limit its ability to fully benefit from regional trade opportunities.

In 2023, Gabon’s total export value reached US$6.8 billion, accounting for 41.3% of its GDP while its total imports were valued at US$4.9 billion, constituting 30.5% of its GDP. This indicates that Gabon had a trade surplus, which is generally considered a positive economic indicator as the value of exports exceeded that of imports. However, this also indicates that Gabon has a heavy reliance on exports to generate revenue, while also relying on imports to fulfil domestic needs. This dependence on trade makes Gabon’s economy vulnerable to economic fluctuations.

Chart 21 presents the trade balance in the Current Path and in the AfCFTA scenario, from 2020 to 2043 as a percentage of GDP.

In 2023, Gabon recorded a trade balance equivalent to 10.8% of its GDP. This positive trade balance reflects a relatively stable economic position for the country. However, by 2030, the trade balance will decline to 2.9% of GDP—a 7.9 percentage point drop—and by 2043, it will reach a negative balance of 4.4% of GDP, meaning that imports will exceed exports. This downward trend can be attributed to Gabon’s dependency on its resources, particularly oil. With oil reserves depleting, outdated infrastructure and the imminent global energy transition towards renewable energy sources, Gabon’s revenues from oil are likely to decline. Furthermore, like many African countries, Gabon’s focus on raw material exports will limit its ability to capture more economic value. Therefore, it is imperative that Gabon prioritise economic diversification and invest in value-added processing industries to reduce its reliance on its natural resources and improve its long-term economic resilience.

Under the AfCFTA scenario, where trade barriers are reduced, Gabon’s trade balance will improve. By 2030, the trade balance will account for 2.1% of GDP, and by 2043, the deficit will account for -3.5% of GDP, an improvement compared to the projected -4.4% of GDP in the Current Path.

The scenario highlights the potential of AfCFTA to mitigate trade imbalances by fostering diversification, industrialisation and greater market access for Gabon’s exports. Local firms gain greater access to market intelligence and advice and increase their productivity, which ultimately leads to higher exports of higher value goods. Crucially, the impact of the AfCFTA scenario shows the positive impact of reducing imports tariffs and reducing non-tariff barriers to trade, as freer trade leads to local businesses having more access to the capital and intermediate goods they need to improve output.

Chart 22 presents the Current Path of access to electricity for urban, rural and the total population from 2000 to 2043.

At the end of 2024, the transitional government unveiled an ambitious roadmap for 2025 with the objective to transform Gabon's economic outlook. Three major infrastructure projects aim to boost trade, modernise infrastructure and meet the country's energy needs.

- The Mayumba deepwater port project aims to facilitate the export of natural resources and stimulate foreign trade and thereby boost Gabon’s trade and turn it into a regional logistics hub.

- The Belinga-Bouée-Mayumba railroad line consists of a 972-kilometre logistics corridor of track linking the Belinga mining site to the port of Mayumba. It is intended to facilitate the transport of minerals and other goods and transform Gabon into a regional hub for mining exports. The project, estimated at more than US$10 billion, will likely be implemented by a consortium led by the South African group Thelo, with the participation of the Egyptian company EGAAD. The aim is to transform Gabon into a regional hub for mining exports.

- The Booué hydroelectric dam is a key investment to meet the country’s growing energy needs and promote industrial development. A 600-megawatt hydroelectric dam worth US$2.5 billion is foreseen to be built at Booué to provide sufficient energy to power mining activities and meet the growing needs of the surrounding population. The Chinese group TBEA has signed a memorandum of understanding in preparation to implement this project.

According to the government, the projects are expected to create about 163 000 jobs to counter youth unemployment as well as boost priority sectors, such as agriculture, transport, tourism, digital technology and industry.

To promote a favourable environment for foreign investment it is key to ensure political stability, to strengthen the regulatory framework as well as emphasise reforms aimed at guaranteeing business transparency and legal certainty.

Gabon also aims to position itself as a leader in the green economy. Building on its pioneering role in forest preservation, the country plans to introduce a carbon tax on airlines and shipping companies crossing its territory. In the area of forest conservation, Gabon is investing to protect its rainforest, making it a net absorber of carbon. Since 2000, the country has created 13 national parks. Deforestation is a negligible risk, but there are several initiatives to limit deforestation and forest degradation.

Access to electricity in Gabon’s urban areas is universal. Rural electricity access in Gabon in 2023 was, however, 29.6%. On the Current Path, it will increase to 55.3% in 2043. In the Large Infrastructure and Leapfrogging scenario, access to electricity in rural areas improves more rapidly. By 2043, 67% of the rural population will have access to electricity. Given Gabon’s extremely high level of urbanisation, only a very small share of the population is affected by poor rural access rates.

Urban electricity access in 2023 is 98.7% and will reach 100% by 2037. There is no need for targeted interventions in this sector.

The interventions in the Large Infrastructure and Leapfrogging scenario involve (ambitious) investments in road, port and renewable energy infrastructure, improved rural electricity access and accelerated fixed broadband connectivity. The scenario models adopting modern technologies to improve government efficiency and investing in major infrastructure projects, such as rail, ports, and airports while highlighting the positive impacts of renewables and ICT.

Visit the themes on Large Infrastructure and Leapfrogging for our conceptualisation and details on the scenario structure and interventions.

Chart 23 presents the number of people using cookstoves in the Current Path and in the Large Infrastructure and Leapfrogging scenario, from 2020 to 2043.

In Gabon, 24.8% of households still rely on traditional cookstoves; the equivalent of 80 000 households. This usage is moderate in the broader African context, but more than twice as high as the average use in Africa´s upper-middle-income economies in 2023, which stands at 10.8%.

This modest yet significant reliance on biomass fuels contributes to deforestation and environmental degradation and bears significant health risks, in particular for women and children. In 2023, 74.7% of Gabonese households used modern fuels and only 0.5% relied on improved cookstoves.

On the Current Path, the reliance on traditional cookstoves will decline in relative but not in absolute terms. This means that by 2043, only 18% of the population will make use of such cookstoves, but this equals 96 020 households representing an increase by 16 020 households. In the Large Infrastructure and Leapfrogging scenario, the usage rate will drop to 17.1% (90 950 households) compared to the average of 6% for Africa´s upper-middle-income economies. However, 90 950 households will still depend on traditional cookstoves, 15 360 more than in 2023.

Chart 24 presents the percentage of the population and number of people with access to mobile and fixed broadband in the Current Path and in the Large Infrastructure and Leapfrogging scenario, from 2020 to 2043. The user can toggle between mobile and fixed broadband.

Over the past decade, Gabon has made great progress when it comes to internet access. In the United Nations ICT Development Index 2023, Gabon scores 73.7 out of 100, which places the country ahead of the global average of 72.8 and close to the average for the world´s upper-middle-income economies of 80.1. Gabon is one of the top performers on the continent, outperformed only by Mauritius, South Africa, Egypt, Tunisia and Botswana. Gabon outperforms the average score for Africa of 47 by 26.7 points.

Between 2012 and 2020, Gabon has greatly improved its network coverage and roll-out of high-speed fiber optics through the Central African Backbone (CAB) project.

As a result, mobile broadband coverage in Gabon is high. In 2023, Gabon had a mobile broadband subscription rate of 104 subscriptions per 100 people, which is however below the average subscription rate of 122 in Africa´s upper-middle-income countries. On the Current Path, Gabon’s mobile broadband subscription rate will increase to 153 and have more than caught up with its peer group average of 152 subscriptions per 100 people. Because of its rapid progress in recent years, Gabon is coming from a high base, and the Large Infrastructure and Leapfrogging scenario has little impact.

However, the scenario does have a positive impact on the evolution of fixed broadband subscriptions. In 2023, the number of fixed broadband subscriptions in Gabon was estimated at about 4 subscriptions per hundred people. This lies below the average for Africa’s upper-middle-income economies of 7.1 subscriptions per 100 people. In the Large Infrastructure and Leapfrogging scenario, subscriptions in Gabon will rise to 35.3 subscriptions per 100 people, 12 more than in the Current Path and outperforming the expected average for upper-middle-income Africa in 2043 at 26 subscriptions per 100 people.

Gabon needs to stay the course in growing its ICT capacity and continue to invest in the quantity and quality of services to transition to a modern economy.

In November 2024, the transition government officially launched the program Gabon Digital, a project supported by the World Bank that aims to digitalise public administration and position the country as a technology hub in Central Africa. This entails modernising digital infrastructures, strengthening data security and improving access to public services.

Chart 25 presents the trends in FDI, aid and remittances in the Current Path and in the Financial Flows scenario as a percentage of GDP, from 1990 to 2043.

Foreign Direct Investment (FDI) as per cent of GDP accounted for 5.4% of GDP in 2023. The negative impact of the coup on the investment climate is reflected in the data as FDI inflows had stood at 11.3% of GDP in 2021. On the Current Path, Gabon does not attract significantly more FDI inflows (5.2% in 2043), but under the Financial Flows scenario such inflows will account for 6.8% in 2030 and for 6.1% in 2043, reflecting renewed investor confidence. This recovery would drive investment in key sectors like mining, renewable energy and infrastructure, increasing economic growth and government revenues through improved tax compliance and natural resource royalties. In this scenario, the economy will be worth US$29.9 billion by 2043, compared to US$28.5 billion on the Current Path.

Gabon’s transitional President, General Brice Oligui Nguema, has engaged in an active diplomatic outreach effort, participating in global summits such as COP28 and the Saudi Arabia–Africa Summit. He has also hosted representatives from France, the United Kingdom, and the United States, and held meetings with neighbouring presidents and leaders of African regional organisations. These efforts can be seen as part of a broader strategy to restore investor confidence and attract foreign direct investment.

According to the latest United Nations Conference on Trade and Development (UNCTAD) report on foreign direct investment, Gabon escaped the slowdown in FDI inflows to the continent in general and to Central Africa in particular. The country, buoyed by oil, gas, timber and the mining sector, took the lead in the CEMAC ranking occupying 15th place on the continent.