Supporting growth while ensuring debt sustainability in Africa

African countries should explore their unmet domestic revenue mobilisation potential, spend efficiently, and conduct reforms to promote growth and stabilise debt.

African countries have been hit by a series of shocks in recent years. This includes COVID-19, which pushed most countries to increase spending to protect lives and livelihoods amid declining revenues. It also includes climate-related events and natural disasters, the inflationary shock following the Russia-Ukraine war, and the subsequent tightening in global financing conditions and exchange rate pressures.

The results are rising debt and limited fiscal space when many African countries need fiscal stimulus to reignite growth and secure a full recovery to accelerate progress towards the United Nations’ Sustainable Development Goals (SDGs).

The International Monetary Fund (IMF) forecasts that the average growth in Sub-Saharan Africa will decline from 4% in 2022 to 3.3% in 2023 before picking up to 4% in 2024. However, there is significant heterogeneity across countries as medium-term growth prospects remain too low for many countries.

Also, the region’s average interest payments-to-revenue ratio, an essential indicator for evaluating a country’s debt-servicing capacity and predicting the risk of a fiscal crisis, is now close to four times that of advanced economies. As of 2022, more than half of the low-income countries in Sub-Saharan Africa were considered to be at high risk or already in debt distress.

Countries must redouble their efforts to advance growth-enhancing reforms

Under the current fiscal policy, the average debt-to-GDP ratio in Sub-Saharan Africa, which stood at about 60% in 2022, will continue to rise by more than 10 percentage points over the next five years. These unfavourable debt dynamics have sparked concerns about a looming debt crisis in Africa.

To ensure debt sustainability, many African countries rely primarily on expenditure cuts, often sacrificing badly needed growth-enhancing spending such as public investment. Whereas Africa had 444 million people living in extreme poverty in 2019, in 2023 it has 482 million. This is 33.6% of its population and 38 million more poor people this year compared to its pre-pandemic level.

On its current development trajectory, the average poverty rate in Africa is forecast to reach 28.7% by 2030, a far cry from the SDG target of less than 3% by 2030. African countries need strong growth to reduce poverty significantly.

But how can they navigate this challenging balancing act of supporting economic growth while bringing their rising debt to a sustainable path? Raising more domestic revenue, spending efficiently and adopting growth-enhancing reforms can help ease this challenge.

Efforts to improve domestic revenue should go hand in hand with efficient spending by cutting down on wasteful spending

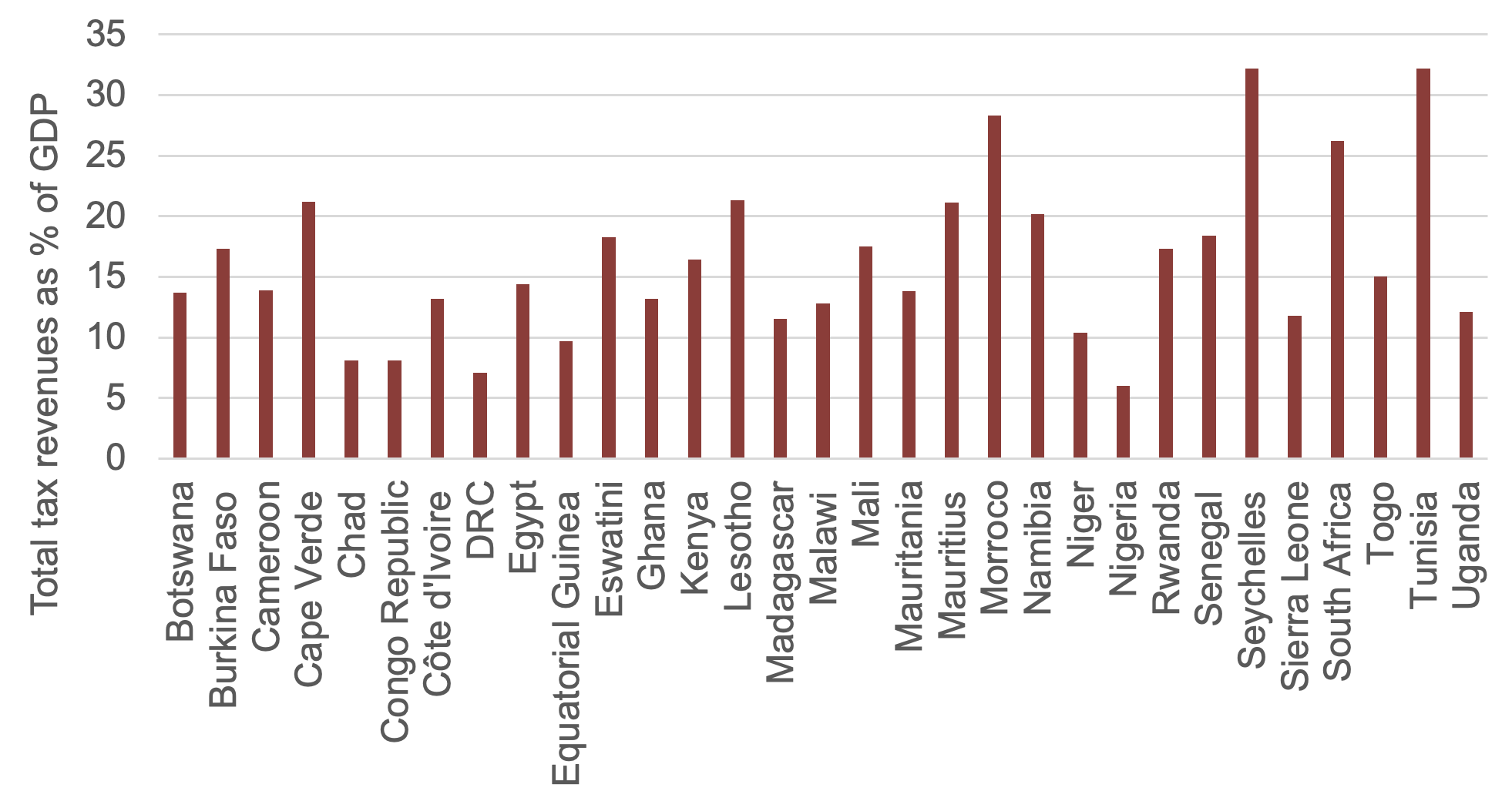

Although tax revenue mobilisation performance varies widely across African countries (Chart 1), Africa’s average tax-to-GDP ratio of 16.5% is lower than other regions such as Asia and the Pacific (19.1%), Latin America and the Caribbean (21.9%), and Organisation for Economic Co-operation and Development (OECD) countries (33.5%).

Chart 1: Total tax revenues as % of GDP in selected African countries, 2019

Source: OECD Tax Statistics, 2022

Tax revenue has progressed in African countries, but most remain below their tax potential

Tax revenue has progressed in African countries, but most remain below their tax potential (the maximum tax a country can collect given its economic structure and institutions). A new IMF study suggests that there is still a significant unmet tax potential, especially in low-income countries, implying that a further increase in domestic revenue is achievable with appropriate policies.

Higher domestic revenue will improve public finances and help reduce new borrowing while providing fiscal space for well-targeted spending to revive growth.

The adoption of a robust digitalised tax system holds the potential to bring about substantial improvements in domestic revenue collection in African nations. By implementing technologies like e-filing, e-invoicing, and e-accounting, the tax collection process can be streamlined, corruption minimised, and the overall tax base broadened. With one of the most advanced digital tax administration systems among emerging economies, Mexico reduced total tax evasion from 35.7% in 2012 to 16.1% in 2016, while the tax base has grown by around 150% since 2010.

Furthermore, the introduction of targeted taxes, such as those on carbon and sugary products, has the potential to increase revenue and reduce health and climate-related expenditures. Additionally, non-tax revenue sources, such as rents and royalties from sectors like oil and mining, should be optimised through improved contractual arrangements with multinational corporations.

The region’s average interest payments-to-revenue ratio is close to four times that of advanced economies

Combatting illicit financial flows, including tariff evasion and misreporting transactions, is also essential. The Kenya Revenue Authority, for example, plans to establish special partnerships with its international counterparts to ascertain the accurate value of imports from China.

Lastly, it is imperative for countries to periodically review and renegotiate their bilateral tax treaties to ensure fairness and prevent revenue loss. Recently, Burkina Faso’s Finance Minister Aboubakar Nacanabo stressed that the country was deprived of 40 to 50 billion FCFA (about US$80 million to US$100 million) annually owing to ‘unbalanced’ bilateral tax treaties with France.

Efforts to improve domestic revenue should go hand in hand with efficient spending by cutting down on wasteful spending. A comprehensive assessment of public investment programmes is crucial to ensure that limited resources genuinely serve economic growth.

In addition, countries must redouble their efforts to advance growth-enhancing reforms. To that end, reforms that improve governance and the business environment, reduce the cost of doing business, and strengthen institutions and regulatory quality, are key to attracting more foreign and domestic investment to boost growth. Higher growth rates will not only lower the debt-to-GDP ratio through the denominator effect, but will also strengthen government revenue and help reduce new borrowing and stabilise public debt.

In summary, efforts to improve domestic revenue through a well-designed and modernised tax system and policies to maximise non-tax revenue, coupled with increased spending efficiency and growth-enhancing reforms, can help many African countries improve their low growth prospects while stabilising their debt.

Image: IMF World Economic Outlook, October 2023