Why is East Africa’s growth advancing, leaving Southern Africa behind?

Disparities due to regional variations in economic performance and resilience to global shocks challenge Africa’s overall growth.

Africa’s 55 countries are economically, geographically, culturally, and socially diverse. With its population of close to 1.5 billion people and a population growth of 2.36%, the continent houses just under a fifth of the world’s people. Next to Asia, Africa is the second fastest growing region in the world.

Furthermore, the current economic growth rate of 4.1% exceeds the population growth rate. In theory, that should mean advances in economic development, however, that is not the case in practice.

The continent remains highly susceptible to global and environmental shocks. Poverty remains widespread, and there are huge differences in performance between the five continental regions. This is influenced by factors including geographic location, structures of the individual economies, commodity dependence, regional political dynamics, and how the different economies respond to global shocks.

In the latest 2023 and 2024 African Development Bank Outlooks, it is the economic growth of two regions’ performance that catches the eye – namely East and Southern Africa. The chart below shows economic growth since 2021 and makes projections up to 2025.

Over this period, economic growth in Southern Africa has been the worst regional performer on the continent, while East Africa has excelled to be number one. In fact, the projected growth rates indicate that East Africa will accelerate while Southern Africa will continue to underperform.

How do these two regions compare? Of the 13 countries in Southern Africa, 69% are middle-income economies, whilst, in the case of East Africa’s 13 countries, only 38% hold middle-income status, with the majority still classified as low-income countries.

The general notion that low-income countries tend to grow faster than middle-income groups could favour East African economies in their growth trajectory, but it is not sufficient to fully explain the varied performance of the two regions.

The broad structures of the two regional economies differ. Ten countries in East Africa are non-resource intensive economies versus seven in Southern Africa. Both regions each have one oil-exporting country: South Sudan in East Africa and Angola in Southern Africa. Southern Africa dominates with five economies that are rich in non-oil resources, while East Africa has only two. The fact that East Africa is less exposed to global commodity booms and busts in their economic structure may benefit the region. This is evidenced by the 2023 Macroeconomic Performance and Outlook report, which indicates that, from 2021 to 2024, non-resource intensive economies tended to grow faster than the other categories.

Southern Africa contributes 22% to the African GDP, while East Africa’s contribution increased from 14% in 2018 to 17% in 2022. In a 2023 Euromonitor article, East Africa’s contribution to the continental GDP is projected to account for as much as 29% of Africa’s GDP by 2040. This projected increase in the region’s GDP is dependent on a continued sustainable high-growth path in this part of the continent.

Spillover Effects and External Shocks

Apart from the influence of global economic performances, shocks and geopolitical events, regional dynamics and the performance of neighbouring countries have strong spillover or knock-on effects. In the case of Southern Africa, South Africa and Angola together account for 75% of the region's output. In the case of East Africa, four economies – Ethiopia, Kenya, Tanzania and Uganda – account for around 84% of the region’s output.

Even though all the economies are exposed to global geopolitical shocks and a continued uncertain global economic environment, the countries in East Africa tend to be more resilient than those in Southern Africa in terms of growth

East Africa is resilient despite global uncertainties, with 84% of its output driven by Ethiopia, Kenya, Tanzania, and Uganda

Indicators of Underperformance

Underperformance in Southern Africa could predominantly be attributed to the stagnation of the South African economy and its broader impact on the region. The numerous political, structural, and macroeconomic challenges not only in South Africa but in a wider pool of countries in the region have an effect on physical and social infrastructure. This reduces productivity and constrains domestic demand. Despite Botswana and Mauritius's above-average long-term growth performances and higher growth expectations for Mozambique and Zambia, economic growth in Southern Africa is expected to be insufficient to carry the region forward significantly. Moreover, Southern Africa is plagued by high external debt burdens, poverty, inequality, and in particular youth unemployment.

In contrast, the strong economic performance in East Africa is driven by the strong economic performance of seven out of the 13 countries in the region. Rwanda, Ethiopia, Uganda, Tanzania, Djibouti, Kenya, and Seychelles are the highest performers. These countries enjoy average growth rates of more than 5%. Rwanda proved to be one of the key sustainable growth success stories with a growth rate exceeding 7% on average per annum. Impressive growth rates benefit the rest of the East Africa region despite the political instability in Somalia and Sudan.

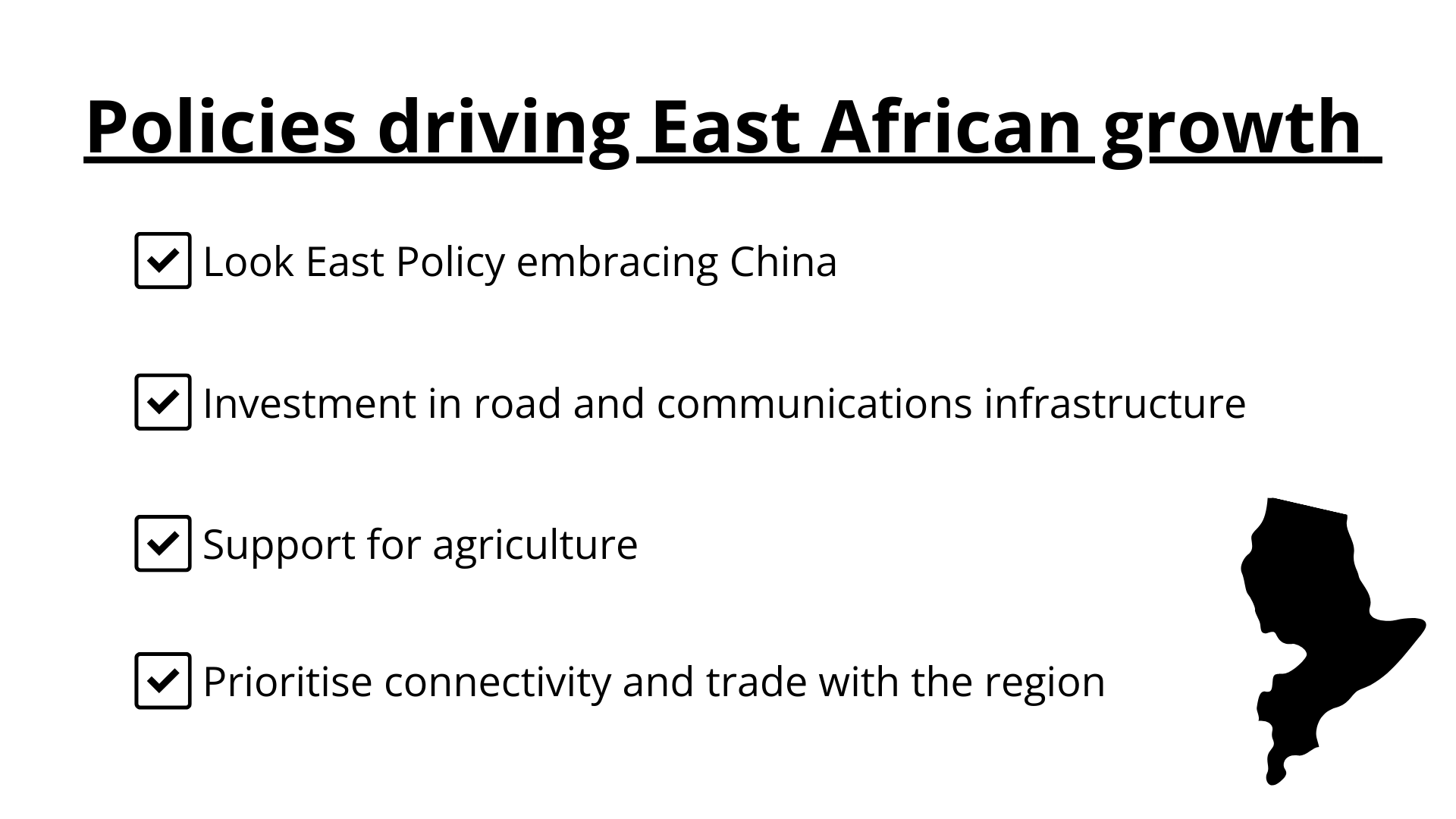

Several key policy decisions are contributing to the growth successes.

The investments in mega infrastructure projects include investments in roads, ports, airports, railway lines, dams, bridges, hydropower projects and crude oil pipelines. Examples are:

- The construction of the Standard Gauge Railway, stretching over 592km in Kenya;

- A railway line between Addis Ababa and Djibouti;

- The Karuma Hydropower Project in Uganda

- The newly planned Bagamoyo Port in Tanzania

- The Bugesera International Airport Expressway in Rwanda;

- The Juba International Airport in South Sudan.

The region is now reaping the benefits of these infrastructure projects, even though financial arrangements with China remain complex.

A large part of the growth in East Africa is also driven by the service sector. In this regard, government spending and strategic investments were made to support in-country connectivity and to deepen intraregional trade across the region. As a result of the rising middle class in the region, the demand for banking, insurance and healthcare is also on the rise. Since the region is known for its agricultural exports, initiatives to modernise agricultural production formed an important part of government spending. Djibouti, for instance, invested in improvements in its transport infrastructure to become an interregional logistics and trade hub. While both regions are exposed to the effects of climate change, skills shortages and persistent unemployment, the continued growth and development in both will depend on internal and regional growth dynamics.

East Africa's growth is fueled by the service sector, with strategic investments enhancing connectivity and boosting trade, catering to a burgeoning middle class

While East Africa is on a positive, sustainable growth trajectory, Southern Africa is stagnating. These regions remain vulnerable and continue to face macroeconomic challenges, destabilising environmental events, exposure to geopolitical shocks, skills shortages, persistent unemployment and poverty and inequality. However, regional dynamics, including the growth performances of neighbouring countries, have strong spillover effects.

The continued growth and development in these two regions depend on the extent to which the economies can individually and collectively navigate their growth trajectories. Southern Africa in general should focus on political and policy certainty, macroeconomic stability and enhanced regional cooperation to address its lagging growth performance.

Image: TheDigitalArtist/Pixabay